Delphi Technique: Predicting Emerging Opportunities and Challenges in Renewable Energy

6 | Formulating Conclusions

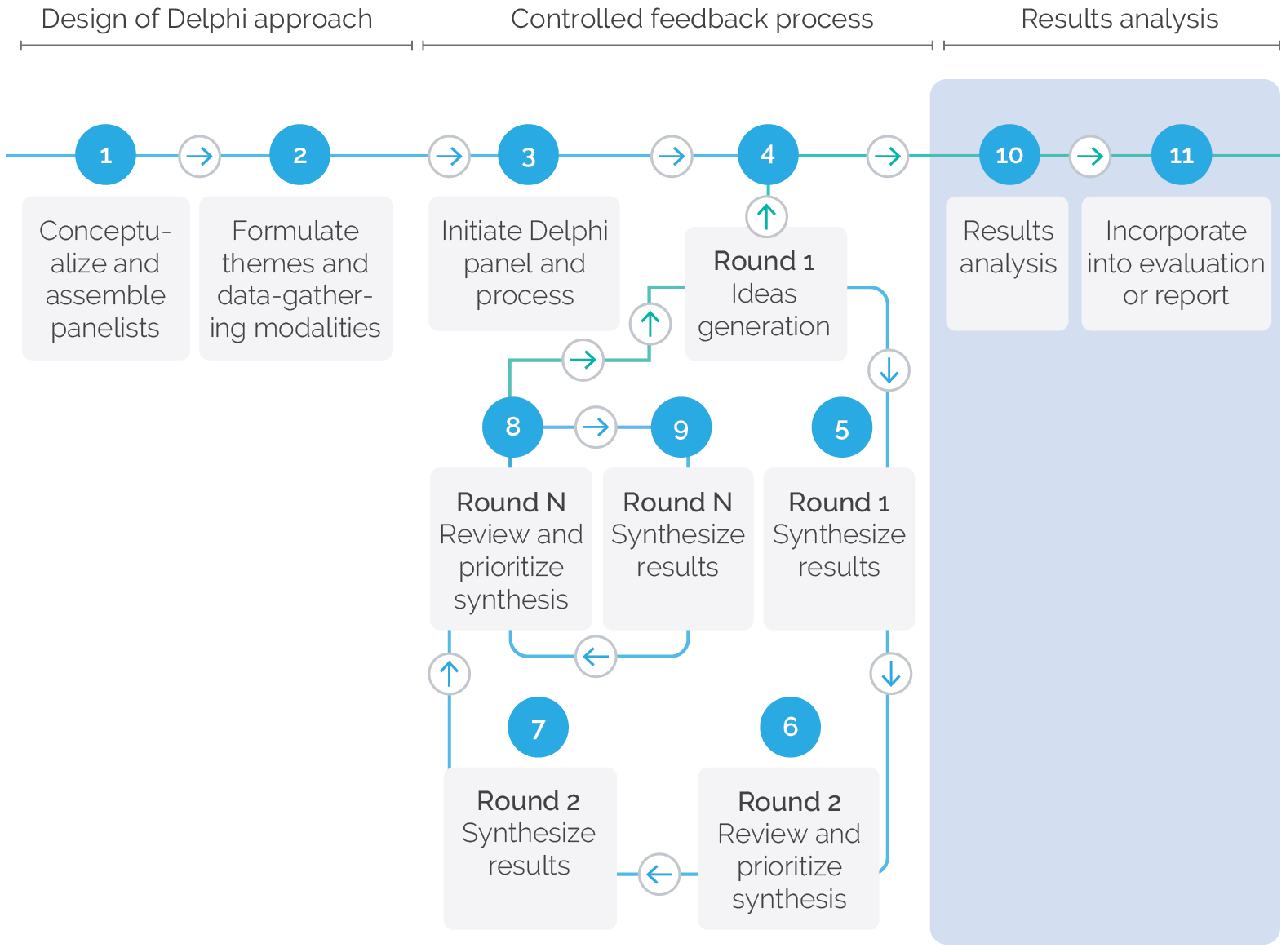

This chapter continues with the third and final stage, focusing on the major conclusions drawn from the Delphi exercise and how they were integrated into the broader RE evaluation. It is based on the results analyzed in chapter 5 and continues to apply a subject matter perspective, but it triangulates the conclusions from the Delphi process with findings from other methods to formulate conclusions. The Delphi process step covered in this chapter is marked 11 within the blue-highlighted area in figure 6.1.

Figure 6.1. The Delphi Process—Results Analysis Stage

Source: Independent Evaluation Group.

Incorporate Results into the Evaluation or Report

Once the results from the Delphi panel are analyzed, the key findings can be triangulated with the results from other methods to formulate the overall conclusions on the subject matter being evaluated (figure 6.1, step 11). These conclusions can form the basis of recommendations made to effect change.

In the RE evaluation, the Delphi exercise with IEG’s global expert panel on RE provided useful insights and helped established the key emerging challenges and opportunities facing the scale-up of RE as envisaged in the clean energy transition. The RE evaluation was able to triangulate findings with the results drawn from other previous methods and come to several key conclusions (box 2.1). These conclusions reflect the emerging direction of RE markets and also where the Bank Group may be best placed to support clients in navigating the sector. This section summarizes the major conclusions that were reached from the multiple methods used in the RE evaluation, to which the Delphi results contributed.

- Addressing existing interests, especially from fossil fuel generators and power utilities, will create headwinds for scaling up RE, and require a comprehensive approach to addressing their concerns so that investments in RE can advance. Although some RE-specific reforms are necessary to improve the investment climate for developing the sector, a more comprehensive and sustained approach is needed to address challenges that may be posed by competing and complementary sectors. Fossil fuel–powered generators, along with electricity utilities, have at times displayed resistance to expanding RE, because of potential business losses, technical challenges to integration, or concerns about higher power system costs, especially when assimilating VRE. There may also be pushback from local communities and other concerned stakeholders if RE technologies such as hydropower adversely affect the environment and those who may be displaced are inadequately compensated.1 These vested interests can manifest in some of the barriers identified in the ToC in box 3.1. Case studies and portfolio reviews of the Bank Group RE engagements found them to be more effective in achieving development outcomes when the institution takes a more comprehensive and sustained approach to addressing barriers to sector expansion.

- Although the overarching global impetus for scaling up RE is to mitigate adverse climate impacts, local considerations such as increasing electricity access and avoiding local air pollution may be a greater motivator for developing the sector. However, the panel did not perceive the Bank Group to be well positioned to help clients capitalize on these aspects. Increasing electricity access through RE to nearly a billion people around the world was the top-ranked opportunity. However, the Bank Group’s capacity to support such efforts was perceived to be modest by the Delphi panel, although a review of the institution’s RE portfolio found increasing access an objective in 22 percent of the 465 projects, with nearly 80 percent of these investments achieving their access goals. The Delphi panel had a similar perception about another high-priority opportunity: that the Bank Group was not well positioned to help clients address local pollution. This conclusion is consistent with the RE portfolio review, which found few investments that aimed to avoid local air pollution. A recent IEG evaluation on pollution found that local environmental issues were underresourced within the institution, further corroborating the Delphi panel’s view (World Bank 2017). The Bank Group may want to strengthen its support to local energy considerations as a way of scaling up RE, since a review of country investment strategies as a part of the RE evaluation found them to be the primary country-level motivator for developing the sector, over global considerations.

- The Bank Group has a comparative advantage in disseminating global knowledge, which can significantly contribute to clients’ efforts to successfully scale up RE. The Delphi panel saw the Bank Group as very well positioned to share lessons from its extensive global experience, to inform clients about and help them successfully navigate the emerging RE landscape. This conclusion was further validated by a review of the RE portfolio, which found that the Bank Group shared global knowledge and international experiences with 78 countries in their design and approach to RE development. In addition, the institution operates several global platforms that disseminate knowledge and development experiences related to RE, such as the Energy Sector Management Assistance Program, the Carbon Finance Group, and the Asia Sustainable and Alternative Energy Program.2

The conclusions drawn regarding the major barriers to scaling up RE, as identified by the Delphi panel and corroborated with findings from other methodological sources, are detailed below:

- A key pathway to scaling up RE, particularly through private participation, identified three major barriers to overcome: inadequate policies and regulations, integration of RE into power systems, and addressing any residual risks through specific mitigation measures. As previously noted, the Delphi panel identified these three barriers as the top challenges to address in scaling up RE in developing countries (along with capacity building). A QCA carried out for the RE evaluation also independently confirmed overcoming the three-barrier combination as a key pathway to mobilizing investments in RE for achieving energy supply and global environmental objectives. A subsequent separate analysis by the International Energy Agency identified the same set of barriers as “the three main challenges” that need to be addressed to “accelerate significantly” RE growth for meeting the long-term goals established under the SDGs and the Paris Agreement (IEA 2019).

Renewable electricity growth still needs to accelerate significantly to meet long-term sustainable energy goals

This growth is possible if governments address the three main challenges to faster deployment: policy and regulatory uncertainty; high investment risks in many developing economies; and system integration of wind and solar PV in some countries.

IEA 2019

- An adequate policy and regulatory environment for RE is an essential factor for mobilizing investments in the sector—an area where the Bank Group has considerable experience, although there is a need to continually adapt to evolving market conditions. The Delphi panel ranked an unstable policy and regulatory framework as the second-most significant challenge facing the expansion of RE. The QCA identified addressing the same barrier as a requisite (near-necessary) one to overcome in scaling up RE. The Delphi panel also assessed that the Bank Group has high or near high capacity to help client countries with several of the key reforms needed to improve policy frameworks. This finding was underscored by a portfolio review, where a third of the Bank Group’s 217 public sector interventions included support to policy and regulatory reforms.3

- The integration of RE, in particular VRE technologies such as solar PV and wind power, is emerging as a major barrier to achieving the clean energy transition, yet the Bank Group has limited project-level experience in this area. This is among the top three challenges for scaling up RE identified by the Delphi panel. The QCA found integration to be the other essential (near-necessary) barrier (along with policies and regulations) to be addressed to mobilize investments in RE. Despite its significance, the Delphi panel found the Bank Group to have only moderate capacity to help with most related actions or solutions. This assessment is reinforced by a portfolio review, which found that less than 7 percent of the institution’s RE projects included activities to address this barrier.4 The limited experience with integrating RE also reflects the circumstance that many developing countries are only beginning to reach high shares of VRE, which is sure to exacerbate the integration challenge in the future. Among the solutions suggested by the Delphi panel in this regard, two emerging ones stand out:

- Energy storage is becoming an increasingly important approach to balancing power for integrating VRE. The need for storage underscores the immediate importance of hydropower, especially pumped storage, and there was consensus that battery storage will progressively become an economical solution. Although battery storage technologies continue to advance, with steadily declining costs, there was acknowledgment that hydropower, especially pumped-storage technology, is presently economically viable and should be considered when developed to industry and international standards. The Delphi panel also identified a clear trend and predicted that battery storage technologies will continue to innovate and scale up in the near to medium term as they become more economically viable at utility scale. An in-depth review of hydropower undertaken in the RE evaluation found the Bank Group to have extensive experience helping clients deploy the technology, since it makes up nearly 40 percent of its RE portfolio. Although 90 percent of evaluated hydropower projects complied with environment and social policies, the institution could more consistently implement best practices in these policies and development of local communities that extend beyond minimal safeguard requirements. Nevertheless, the review found substantial direct economic benefits from its hydropower portfolio as a result of avoided costs from alternative generation and sizable climate benefits from avoided CO2. Although the Bank Group is more recently supporting clients in deploying utility-scale battery storage, most of its experience during the evaluation period was confined to household-level solutions in projects aiming to increase electricity access. It validates the more moderate ratings by the Delphi panel for the institution’s capabilities in this regard.

- DG from RE resources is a rapidly emerging approach to scaling up RE while addressing transmission bottlenecks, but there was a divergence of views within the Delphi panel on its significance. Panelists did not reach consensus regarding this emerging trend to have more dispersed generation nodes that can help scale up RE by directly supplying distribution grids, bypassing potential transmission constraints. They were divided; half viewed RE DG as important or highly important and the other half thought its significance was moderate or low. This could be due to rapid expansion of VRE from RE DG (mostly from solar PV) progressively exacerbating the integration challenge as the share of intermittent electricity increases. The Delphi panel’s view contrasted with the perspectives of Bank Group energy sector staff surveyed for the RE evaluation, where 80 percent placed high importance on RE DG. It would be prudent to carefully consider the institution’s presently expanding activities in RE DG and its implications for power systems so that potential unintended adverse consequences can be avoided.

- Energy storage is becoming an increasingly important approach to balancing power for integrating VRE. The need for storage underscores the immediate importance of hydropower, especially pumped storage, and there was consensus that battery storage will progressively become an economical solution. Although battery storage technologies continue to advance, with steadily declining costs, there was acknowledgment that hydropower, especially pumped-storage technology, is presently economically viable and should be considered when developed to industry and international standards. The Delphi panel also identified a clear trend and predicted that battery storage technologies will continue to innovate and scale up in the near to medium term as they become more economically viable at utility scale. An in-depth review of hydropower undertaken in the RE evaluation found the Bank Group to have extensive experience helping clients deploy the technology, since it makes up nearly 40 percent of its RE portfolio. Although 90 percent of evaluated hydropower projects complied with environment and social policies, the institution could more consistently implement best practices in these policies and development of local communities that extend beyond minimal safeguard requirements. Nevertheless, the review found substantial direct economic benefits from its hydropower portfolio as a result of avoided costs from alternative generation and sizable climate benefits from avoided CO2. Although the Bank Group is more recently supporting clients in deploying utility-scale battery storage, most of its experience during the evaluation period was confined to household-level solutions in projects aiming to increase electricity access. It validates the more moderate ratings by the Delphi panel for the institution’s capabilities in this regard.

- Mitigating RE and country-specific risks can be vital, especially for mobilizing private investments, and the Bank Group has a suite of options to support clients in this regard. There was considerable consensus within the Delphi panel regarding the high importance of minimizing counterparty risks as a way of mobilizing investments in RE. The significance of this barrier also highlights the need to improve the policy and regulatory environment, which can be a source of uncertainty for investors, and the need to use other approaches to minimize any residual risks. Mitigating RE risks was rated by the Delphi panel as the barrier the Bank Group is best placed to address. The panel’s high level of confidence may reflect the suite of instruments that the institution can deploy to help clients mitigate investment risks, including guarantees, political risk insurance, concessional financing, and the ability to mobilize grant funds. It likely indicates why the Bank Group was perceived to be very well positioned to mobilize financing in small countries and markets, where risks can be high.

- Inadequate human capacity for designing, developing, and operating RE is an important barrier to overcome, but it can often be augmented through external support. Nearly 90 percent of the Delphi panel placed high importance on developing institutional capacity for developing RE, particularly within government agencies. The QCA also found a causal link between adequate capacity and the realization of RE investments, although it was not found to be a near-necessary condition for expanding RE. This potential contradiction between the Delphi panel and the QCA results may exist because, although developing long-term internal capacity in RE is important, shortfalls can also be augmented with external support on a transitional basis. The Bank Group plays a key role in this regard, since nearly half of the investments in its RE portfolio included activities to strengthen client capabilities.5 The Delphi panel opined that the institution has high capacity for training various officials on RE, although it was perceived to have less capability in helping clients negotiate with the private sector.

- The World Commission on Dams (2000) recommended that hydropower be implemented with a broader development objective as a goal rather than narrowly focusing only on its energy benefits. The World Bank Group has adopted most of these recommendations, and the RE evaluation found that when projects adhered to these principles, they had more successful development outcomes.

- The Asia Sustainable and Alternative Energy Program was a stand-alone multidonor-supported program that operated within the World Bank during the evaluation period, although it has since merged with and now operates as a part of the Energy Sector Management Assistance Program.

- Nearly all investment interventions to support policy and regulatory reforms within the World Bank Group portfolio were understandably undertaken through public sector projects supported by the International Development Association and the International Bank for Reconstruction and Development.

- The World Bank Group has a long history and sizable portfolio supporting transmission and distribution of electricity, which is a key part of integrating generation into power systems. Many of these investments are not classified as renewable energy projects, although some could directly or indirectly facilitate the integration of renewable energy.

- The public sector projects aimed to improve technical design and implementation capacity (including strengthening governance and fiduciary capabilities), and private sector investments primarily helped comply with environmental and social requirements.