World Bank Results and Performance

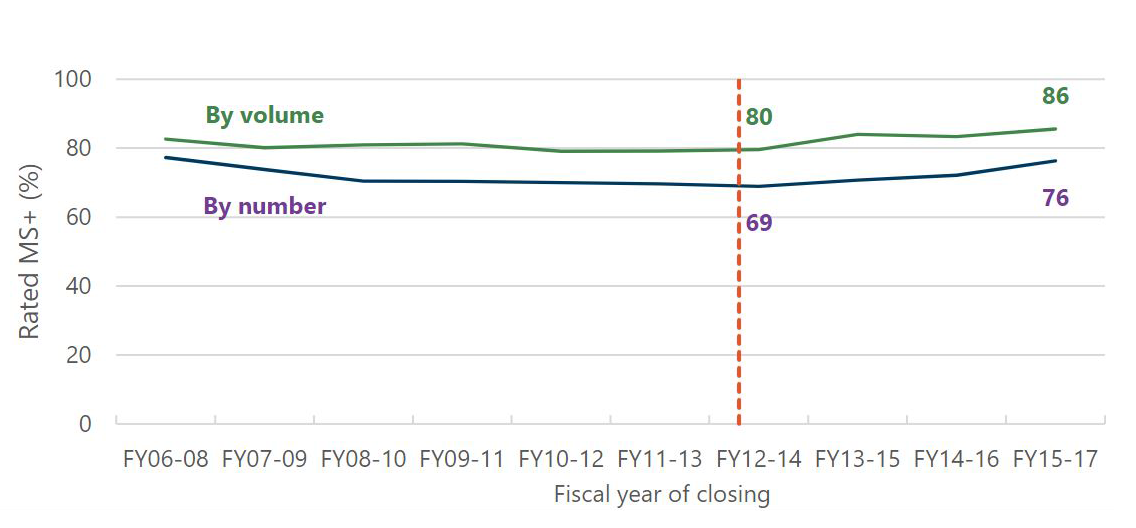

Outcome ratings for World Bank lending have continued on an upward trajectory.

-

The share of closed projects rated moderately satisfactory or above (MS+) on outcome was 76 percent in FY15-17 compared with 69 percent in FY12-14.

-

Measured by lending volume, the share of MS+ projects was 86 percent in FY15-17 compared with 80 percent in FY12-14.

-

Bank performance ratings rose in tandem, from 70 percent MS+ for projects closed in FY12-14 to 76 percent for projects closed in FY15-17.

-

Project performance trends are generally positive. Further analysis undertaken for this report indicates, however, that strong results and growing portfolios in a number of countries with relatively high capacity, account for a good share of the observed improvement (the delta) in project outcomes between FY12-14 and FY15-17.

-

Beyond the project level, ratings for country strategy outcomes for FY14-18 increased to 69 percent MS+, just below the FY17 corporate target of 70 percent. Country strategy outcomes in countries affected by fragility, conflict, and violence (FCS) were rated far lower, however, at 46 percent MS+. Ratings for Bank Group performance in country strategies were 62 percent good or above for all country strategies reviewed in FY14-18. This rating was particularly low in Africa and in FCS countries, at 54 percent good or above.

More findings related to World Bank Results and Performance (Chapter 1)

IFC Results and Performance

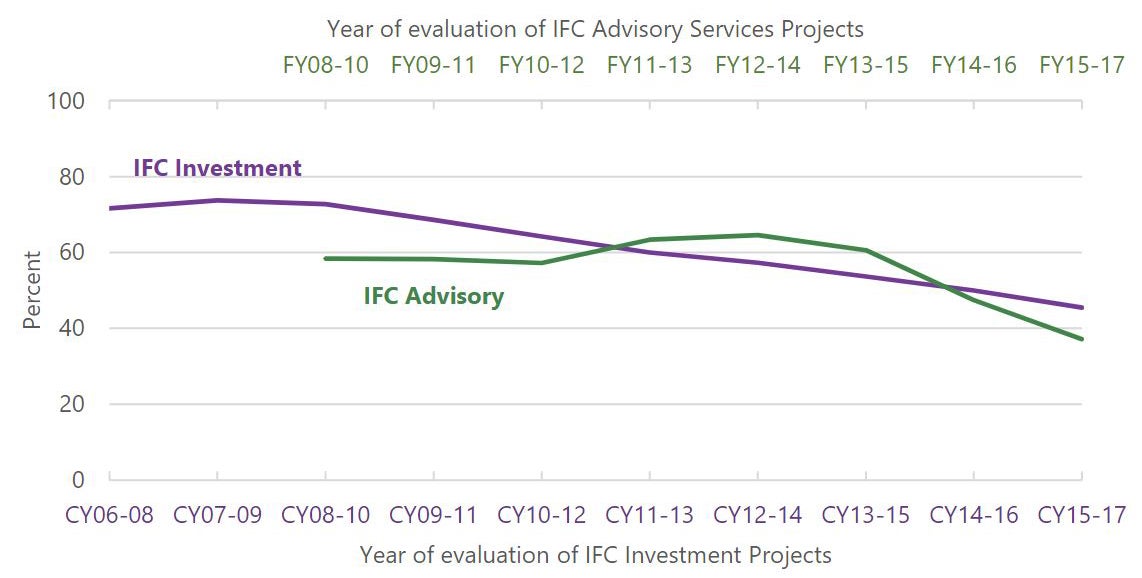

The most recent cohort of evaluated IFC investment projects continues the downward trend in development outcome ratings that began in calendar year (CY)08-10.

Although 16 percent of IFC projects evaluated in CY15-17 achieved strong positive outcomes, 33 percent were rated as unsuccessful and, of that, 12 percent were highly unsuccessful compared with 5 percent in CY12-14. It is important to note that the latest cohort of projects were approved and evaluated during a period of sustained decrease in commodity prices, volatile macroeconomic conditions, and difficult private sector environments in many countries, as well as internal changes within IFC.

Development outcome performance was better in non-International Development Association (IDA) countries and for the environmental and social effects of investment projects. Ratings for project business success and economic sustainability saw a drop in CY15-17, as did private sector development, but from a higher base. Performance was weaker in IDA countries; Sub-Saharan Africa; commercial banking; oil, gas and mining sectors; and infrastructure investments.

Performance of IFC advisory services showed a more rapid decline. The share of IFC advisory services projects rated mostly successful or better dropped from 65 percent in FY12-14 to 37 percent in FY15-17. Advisory projects in IDA countries performed well below average, at 31 percent mostly successful or better.

Development outcome ratings are strongly associated with IFC’s work quality, especially its front-end work. IFC is actively addressing work quality issues to reverse the trend and improve its future performance.

More findings related to IFC Results and Performance (Chapter 2)

MIGA Results and Performance

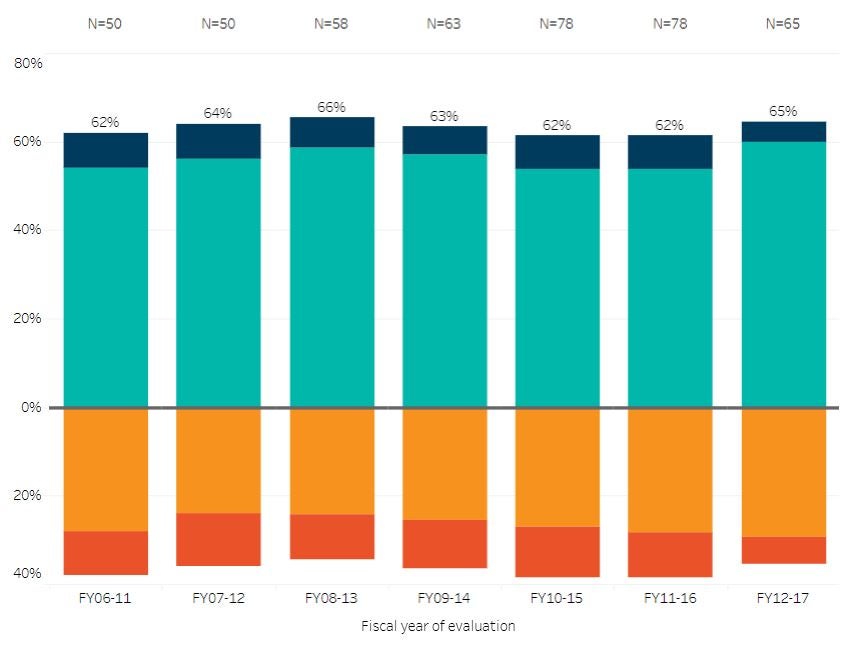

Development outcome ratings for MIGA operations increased from 62 percent of projects rated satisfactory or better in FY06-11 to 65 percent in FY12-17. MIGA had strong performance in the energy and extractive industries and infrastructure sectors and in IDA countries, where performance for FY12-17 reached 70 percent satisfactory or better, above the performance of operations in non-IDA countries (61 percent).

Of the four outcome indicators used to assess development outcome ratings, there was strong performance between FY06-11 and FY12-17 on environmental and social effects, but a decline in ratings for project business success, economic sustainability and, notably, for private sector development—where the rating dropped from 84 percent satisfactory or better to 65 percent.

More findings related to MIGA Results and Performance (Chapter 3)

World Bank Group Management's Follow-Up to IEG Major Evaluations

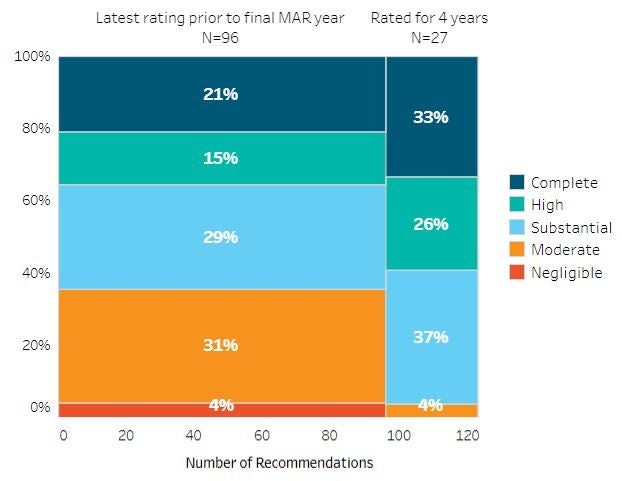

Progress in implementing action plans created in response to recommendations from IEG’s major evaluations has been slow. IEG rates a little over half of the action plans as highly or completely implemented after four years. Tracking and reporting on action plans does not work well, and significant delays occur during the formulation of action plans. Reform of the process is now being considered by IEG and Bank Group management.

More findings related to IEG Evaluations' Follow-Up (Chapter 4)

Visualizations of IEG Data on Regional Results and Performance

Click on any Region below to explore regional data:

Project outcome ratings rose in five Regions but declined in Latin America and the Caribbean. Comparing FY15-17 with FY12-14, IEG finds that

The Africa Region boosted project outcome ratings, by number, from 61 percent to 71 percent MS+ and from 63 percent to 77 percent by volume, becoming the fourth most successful Region in FY15-17.

- The East Asia and Pacific Region saw the largest upward movement in ratings, with MS+ ratings increasing from 67 percent to 88 percent, by number of projects.

- In the Europe and Central Asia Region, outcome ratings increased from 76 percent to 85 percent MS+ by number and from 88 percent to 95 percent by volume.

- In the Middle East and North Africa Region, outcome ratings increased modestly from 63 percent to 67 percent MS+ by number, but by a much larger amount by volume—from 61 percent to 80 percent.

- Outcome ratings in South Asia increased from 77 percent to 82 percent MS+ by number and from 86 percent to 91 percent by volume.

- Outcome ratings in Latin America and the Caribbean continued to decline in FY15-17, falling from 76 percent MS+ in FY12-14 to 69 percent MS+ in FY15-17 by number, and from 90 percent to 73 percent MS+ by volume. More findings related to Regions

Visualizations of IEG Data on Practice Group Results and Performance

Click on any Practice Group below to explore data visualizations:

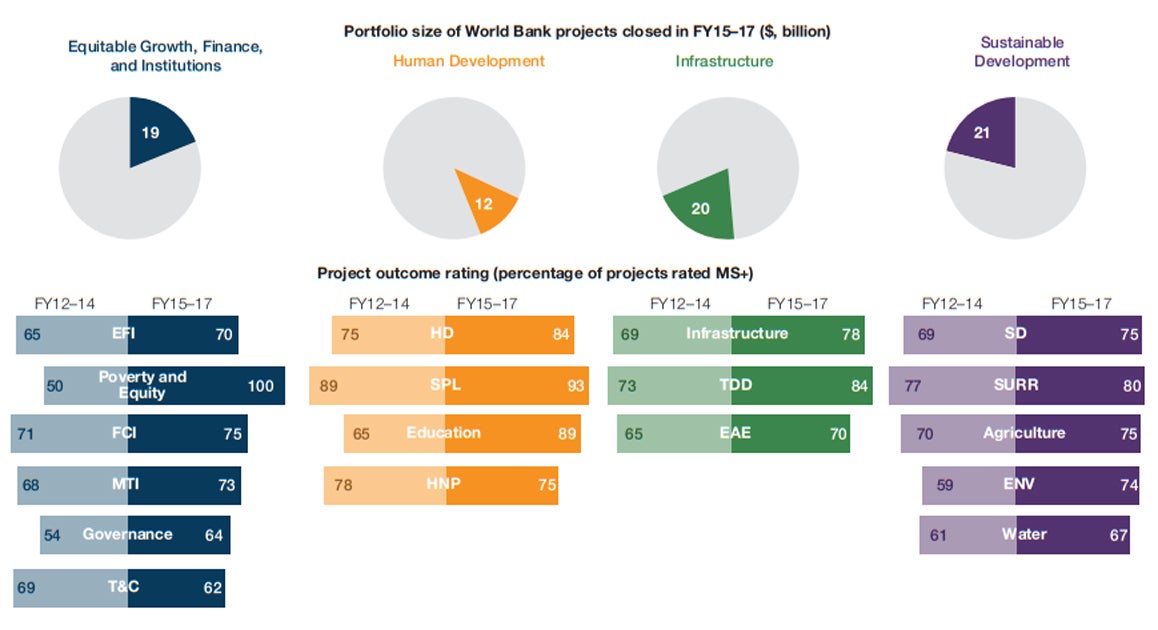

Across sectors, outcome ratings improved almost everywhere. Ratings improved for both investment projects and development policy financing and for all Practice Groups, with standout improvements in the Human Development Practice Group. Within Human Development, the Education Global Practice saw a 24 percentage point jump in the share of its projects achieving MS+. In the Equitable Growth, Finance, and Institutions Practice Group, where overall project performance lags behind the other Practice Groups, all five rated projects in the Poverty Global Practice for FY15-17 were rated MS+. More findings related to Practice Groups