Chapter 1: Managing for Results

Highlights:

- The World Bank Group has taken several important steps over more than a decade to address the principles of managing for development results; progress is notable on instituting a structure and process for measurement and less so on adaptive management and learning.

- World Bank Group management for results is affected by weaknesses in measurement of outcomes, adaptive management based on evidence, and generally weak client systems that generate results data.

- The World Bank Group is addressing client capacity to manage for results through various instruments and approaches; the effectiveness and results of these efforts have not yet been assessed.

- The World Bank Group is at a good point to take stock of its progress and systematically plan for and address the now well-known constraints to strengthening both measurement and adaptive management and learning.

For more information, see Chapter 1: Managing for Results

Chapter 2: Recent Performance of World Bank Group Operations

Highlights: World Bank

At 72 percent moderately satisfactory or above, World Bank project outcome ratings remained stable overall. Only a few projects with very large volume drove an increase in volume-weighted outcome ratings from 81 percent in FY10-12 to 87 percent in FY13-15.

At 72 percent moderately satisfactory or above, World Bank project outcome ratings remained stable overall. Only a few projects with very large volume drove an increase in volume-weighted outcome ratings from 81 percent in FY10-12 to 87 percent in FY13-15.

- The South Asia Region and the Social Protection Global Practice had higher outcome ratings, compared with other regions and global practices.

- At 66 percent moderately satisfactory or above, country development outcome ratings in

FY13–16 remained below the FY17 target of 70 percent. At 65 percent moderately satisfactory or above, country-level World Bank performance ratings also remained below the FY17 target of 75 percent.

- In regions other than Africa, most countries that had cycled through at least two country strategies during FY07–16 maintained a satisfactory development outcome rating, or improved from unsatisfactory to satisfactory. However, ratings remained unsatisfactory, or declined from satisfactory to unsatisfactory across country strategy cycles for a large group in Africa.

For more information, see World Bank Project Performance

Highlights: IFC

Development outcome success rates of IFC investment projects continued the broader downward trend in outcomes since the financial crisis in 2008. Financial Institutions Group performance had a slight uptick from prior years, but other industry groups saw drops in success rates.

Development outcome success rates of IFC investment projects continued the broader downward trend in outcomes since the financial crisis in 2008. Financial Institutions Group performance had a slight uptick from prior years, but other industry groups saw drops in success rates.

- IFC work quality and IFC net commitments to projects are the primary drivers of development outcome ratings in the evaluated period, but limited data capture and insights on beneficiary-level results highlight a strand of weakness.

- Advisory services projects' success rate was below the corporate target for the review period,

FY13-15.

For more information, see Trends in Outcome Ratings for IFC Investment and Advisory Projects

Highlights: MIGA

On a six-year rolling average basis, excluding projects rated “no opinion possible” from the total evaluated, development outcomes of MIGA projects remained nearly steady at 61 percent.

On a six-year rolling average basis, excluding projects rated “no opinion possible” from the total evaluated, development outcomes of MIGA projects remained nearly steady at 61 percent.

- One consistent finding is that the underwriting methods, monitoring and supervision of the project credit risk, obligor risk profile, and overall performance reporting in self-evaluations need strengthening.

- Furthermore, IEG suggests that MIGA assess the risk to development outcome at underwriting stage and in self-evaluations explicitly.

For more information, see Trends in Outcome Ratings for MIGA Projects

Chapter 3: Management Action Record

Highlights

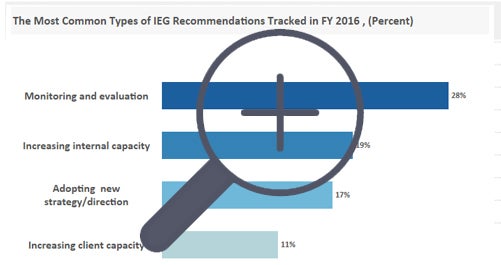

Of the 277 IEG recommendations adopted since 2008, 34 percent had an M4R dimension that related to either capacity development or M&E. Sixty-eight percent of these recommendations were rated as substantial, high, or completed in terms of implementation, lower than the 77 percent implementation rate for all other recommendations.

Of the 277 IEG recommendations adopted since 2008, 34 percent had an M4R dimension that related to either capacity development or M&E. Sixty-eight percent of these recommendations were rated as substantial, high, or completed in terms of implementation, lower than the 77 percent implementation rate for all other recommendations.

- The most common management actions in response to M4R recommendations were improving country statistical capacity, introducing core sector indicators, strengthening World Bank Group M&E, and incorporating evidence-based knowledge work into project design. However, more attention to this area is warranted to address IEG recommendations focused on M4R, including M&E, particularly as the World Bank Group aims to better integrate results data in its decision-making processes.

For more information, see Chapter 3: Management Action Record

Keywords

DOI

10.1596/IEG113868

Evaluation Reports Collection