Evaluating for People and the Planet

Learning through Evaluation

In fiscal year (FY)23, the Independent Evaluation Group (IEG) submitted eight corporate, thematic, or sectoral evaluations; five Country Program Evaluations (CPEs); the 2022 Management Action Record validation; and the Results and Performance of the World Bank Group 2022 to the Committee on Development Effectiveness of the Board of Executive Directors.

Corporate, Thematic, and Sectoral Evaluations

Every year, IEG completes several long-term evaluations to assess the performance of the World Bank Group’s institutions and identify lessons for improving operations related to a particular theme, sector, or corporate process. These reports

- Rely on robust mixed methods designs that usually combine synthetic analyses at the overall portfolio level with in-depth analyses at the country, project, or other levels;

- Use a range of methodological approaches, such as portfolio analyses, structured literature reviews, surveys, and case study analyses; and

- Draw on internal and external data sets, internal and external documentation, and interviews with different groups of stakeholders.

Evaluation design, including issues of scope, delimitation, sampling, and other data collection, and analysis issues are discussed in peer-reviewed Approach Papers.

The eight evaluations submitted in FY23 cover a range of themes critical to development. Read about the findings and recommendations and refer to the reports for full details.

The World Bank’s Early Support to Addressing COVID-19: Health and Social Response—An Early-Stage Evaluation

Credit: Shutterstock / nelic.

The World Bank delivered a response of unprecedented scale and speed in the early months of the COVID-19 pandemic. In The World Bank’s Early Support to Addressing COVID-19: Health and Social Response—An Early-Stage Evaluation, IEG assesses how well the World Bank responded to the immediate health threat and how well it focused on protecting vulnerable groups against human capital losses. The evaluation recommends that, to ensure stronger future crisis preparedness, the World Bank use crisis recovery efforts to strengthen the resilience of essential health and education services to protect human capital, apply a gender equality lens to health and social response actions across sectors, help countries strengthen regional cooperation and response capacities for public health preparedness, and build on the COVID-19 experience to strengthen the World Bank’s internal preparedness to respond in future emergencies. Because the response is ongoing, the evaluation does not assess effectiveness but considers early results and pathways that are expected to lead to outcomes.

To learn more, check out the blog, “What the COVID-19 Response Reveals about the Future of Public Health Surveillance Systems: The Good, the Not Yet Known and the Absent”; listen to the podcast, “Lessons for Future Crises from the World Bank Group’s Response to the COVID-19 Pandemic”; and read the report.

World Bank Group Support to Demand-Side Energy Efficiency

Credit: Shutterstock / alphaspirit.it.

The World Bank’s Climate Change Action Plan recognizes energy efficiency as one of the most cost-effective ways to combat climate change and to support countries’ aims of achieving net-zero carbon dioxide emissions through decarbonization. The World Bank Group Support to Demand-Side Energy Efficiency evaluation assesses the effectiveness and coherence of the World Bank’s support to clients on demand-side energy efficiency projects and the opportunities to scale them up. The evaluation recommends intensifying decarbonization support to middle-income countries, developing sector-specific approaches in lower-middle-income countries, incorporating reduction of indirect emissions in project design, and helping clients develop innovative approaches that adopt and adapt digital and financial solutions from developed countries.

To learn more, check out the blog, “Untapped Potential for Decarbonization: Scaling Up Energy Efficiency”; listen to the podcast, “Boosting Energy Efficiency to Power a Green Future”; and read the report.

International Finance Corporation Additionality in Middle-Income Countries

Credit: Shutterstock / valiantsin suprunovich.

Additionality is the unique contribution of a multilateral bank to a private investment project that is not offered by commercial sources of finance. The goal is for the multilateral development bank to add value without crowding out private sector activity. This is particularly important in middle-income countries because their financial markets are more developed and private investment far exceeds official development assistance. The International Finance Corporation Additionality in Middle-Income Countries evaluation focuses on additionality of International Finance Corporation (IFC) interventions at the project level but also considers whether additionality can occur beyond this, at the country and sector levels. IFC is generally successful at realizing financial additionality (such as through features of the financing structure) but is less successful at delivering nonfinancial additionality (such as deployment of knowledge and standards). The evaluation recommends that IFC address gaps in internal systems related to monitoring, supervision, and reporting of additionality; bring its strategy for additionality and its pattern of activity in middle-income countries into closer alignment; and incorporate its additionality approach into its country strategies and sector deep dives.

To learn more, check out the blog, “Exploring How and Why the International Finance Corporation Investment Projects Make a Unique Contribution in Middle-Income Countries”; listen to the podcast, “Additionality in the Private Sector and the Experience of the International Finance Corporation”; and read the report.

The World Bank’s Role in and Use of the Low-Income Country Debt Sustainability Framework

Credit: Shutterstock / Smileus.

The joint World Bank–International Monetary Fund Low-Income Country Debt Sustainability Framework (LIC-DSF), introduced in 2005 and most recently updated in 2017, has been a cornerstone of debt sustainability analysis in countries eligible for International Development Association lending. The World Bank’s Role in and Use of the Low-Income Country Debt Sustainability Framework evaluation assesses the World Bank’s inputs into the LIC-DSF and how the World Bank uses LIC-DSF outputs to inform various corporate and country-level decisions. The evaluation recommends clarifying expectations of the World Bank in taking the lead on long-term growth prospects, sustaining and extending attention to debt data coverage, using debt sustainability analysis to directly inform priorities for the identification of fiscally oriented reforms for development policy operations and for the Sustainable Development Finance Policy, and continuing to increase attention in the LIC-DSF to the growth and fiscal implications of climate change.

To learn more, check out the blog, “Moving from Numbers to Facts: Improving Data Quality in Debt Sustainability Analyses,” and read the report.

World Bank Support for Domestic Revenue Mobilization

Credit: Shutterstock / gooddesign10.

Domestic revenue mobilization has become increasingly important to the development policy agenda. The World Bank Support for Domestic Revenue Mobilization evaluation assesses the relevance and effectiveness of World Bank–supported strategies and interventions to help client countries enhance domestic revenue mobilization after the World Conference on Financing for Development in 2015 in Addis Ababa. The evaluation recommends more systematic use of the findings of tax diagnostics and instruments to set tax reform priorities, regular assessment of the effectiveness and efficiency of tax exemptions in achieving country-specific policy objectives, prioritization of reforms that strengthen the governance framework for granting new tax exemptions, and provision of clearer guidance on choosing results indicators to measure the impact of support for domestic revenue mobilization.

To learn more, check out the blog, “Why Is It So Hard to Raise Taxes in Developing Economies? Lessons from World Bank Experience with Domestic Revenue Mobilization”; access the “Evaluation Insight Note: Domestic Revenue Mobilization”; listen to the two-part podcast series, “Taxes, the Social Contract, and Financing Development” (Part 1 and Part 2); and read the report.

Addressing Gender Inequalities in Countries Affected by Fragility, Conflict, and Violence: An Evaluation of the World Bank Group’s Support

Credit: Adapted from Shutterstock / FerroRubini.

Conflict and fragility increase the exposure of women and girls to gender-based violence and make it more difficult for them to access social services, including sexual and reproductive health services. Fragility, conflict, and violence (FCV) also exacerbate their vulnerability to poverty. Addressing Gender Inequalities in Countries Affected by Fragility, Conflict, and Violence: An Evaluation of the World Bank Group’s Support analyzes the factors that enable and constrain meaningful and lasting results in addressing gender inequalities in FCV contexts. The evaluation recommends that the Bank Group transition from a project-centric approach to a country engagement approach in FCV countries, which can enable the systemic changes that are needed to address gender inequalities; support long-term, integrated, and multisectoral interventions; and simultaneously meet immediate humanitarian needs and longer-term development needs. This would require the Bank Group to strengthen its strategic focus on gender inequalities and mobilize resources at a level commensurate with the Bank Group’s stated commitments to the gender agenda in FCV contexts.

To learn more, read the report.

Financial Inclusion: Lessons from World Bank Group Experience, Fiscal Years 2014–22

Credit: Shutterstock / PhotoBankIndia.

Financial inclusion encompasses financial access—owning an account—and the use of financial services by individuals and firms. Globally, both of these remain major challenges for microenterprises, poor households, women, and other excluded groups. The Financial Inclusion: Lessons from World Bank Group Experience, Fiscal Years 2014–22 evaluation includes a retrospective look at the drive for universal financial access and examines progress on and challenges for Bank Group support for women’s access to financial services, digital financial services, and COVID-19 response. The evaluation recommends that the World Bank and IFC further encourage account use by underserved groups, design and implement more comprehensive approaches that address constraints in the enabling environment for digital financial services to reach underserved and excluded groups, and collect outcome data across a variety of such groups.

To learn more, check out the blog, “Can the World Bank Shed More Light on the Outcomes of Its Support for Financial Inclusion?” and read the report.

Results and Performance of the World Bank Group

Credit: Shutterstock / balinskaya.

Results and Performance of the World Bank Group 2022 (also known as RAP 2022)—IEG’s annual review of the Bank Group’s performance—analyzed the achievement of project and program objectives in FY22 through validated ratings. Analysis of effectiveness at the country program level found an overall favorable trend. However, that trend was tempered by the following findings: (i) the Country Partnership Frameworks (CPFs) and their results frameworks relied overwhelmingly on the World Bank lending portfolio, and they insufficiently integrated and leveraged advisory services and analytics and the support provided by IFC and the Multilateral Investment Guarantee Agency; (ii) the CPFs did not always adapt sufficiently and quickly enough to changes in context, such as when government commitment or Bank Group priorities changed, implementation capacity was weaker than expected, or planned lending failed to materialize; and (iii) a historical lack of advisory services and analytics monitoring raises questions about the Bank Group’s ambitions to be a “Knowledge Bank” and its ability to use advisory services and analytics strategically to improve country-level impact. RAP 2022 offers suggestions for continued growth, including enhancing the effectiveness of Bank Group support at the country program level, strengthening risk identification and mitigation, and monitoring the use and influence of advisory services and analytics.

To learn more, check out the blog, “World Bank—a ‘Knowledge Bank’ or a ‘Report Bank’?” and read the report.

Country Program Evaluations

Country Program Evaluations (CPEs) are long-term evaluations that look at how well the Bank Group achieved its objectives in a specific country over a period of up to 10 years. CPEs use similar methods as IEG’s thematic, sector, and corporate evaluations. CPEs

- Assess Bank Group performance primarily on the basis of contributory actions directly controlled by the Bank Group;

- Evaluate the relevance of each main objective, the relevance of the Bank Group’s strategy toward meeting the objective (including the balance between lending and nonlending instruments), the efficacy with which the strategy was implemented, and the results achieved; and

- Determine the degree of country ownership of international development priorities, such as the Sustainable Development Goals, and Bank Group corporate advocacy priorities, such as safeguards.

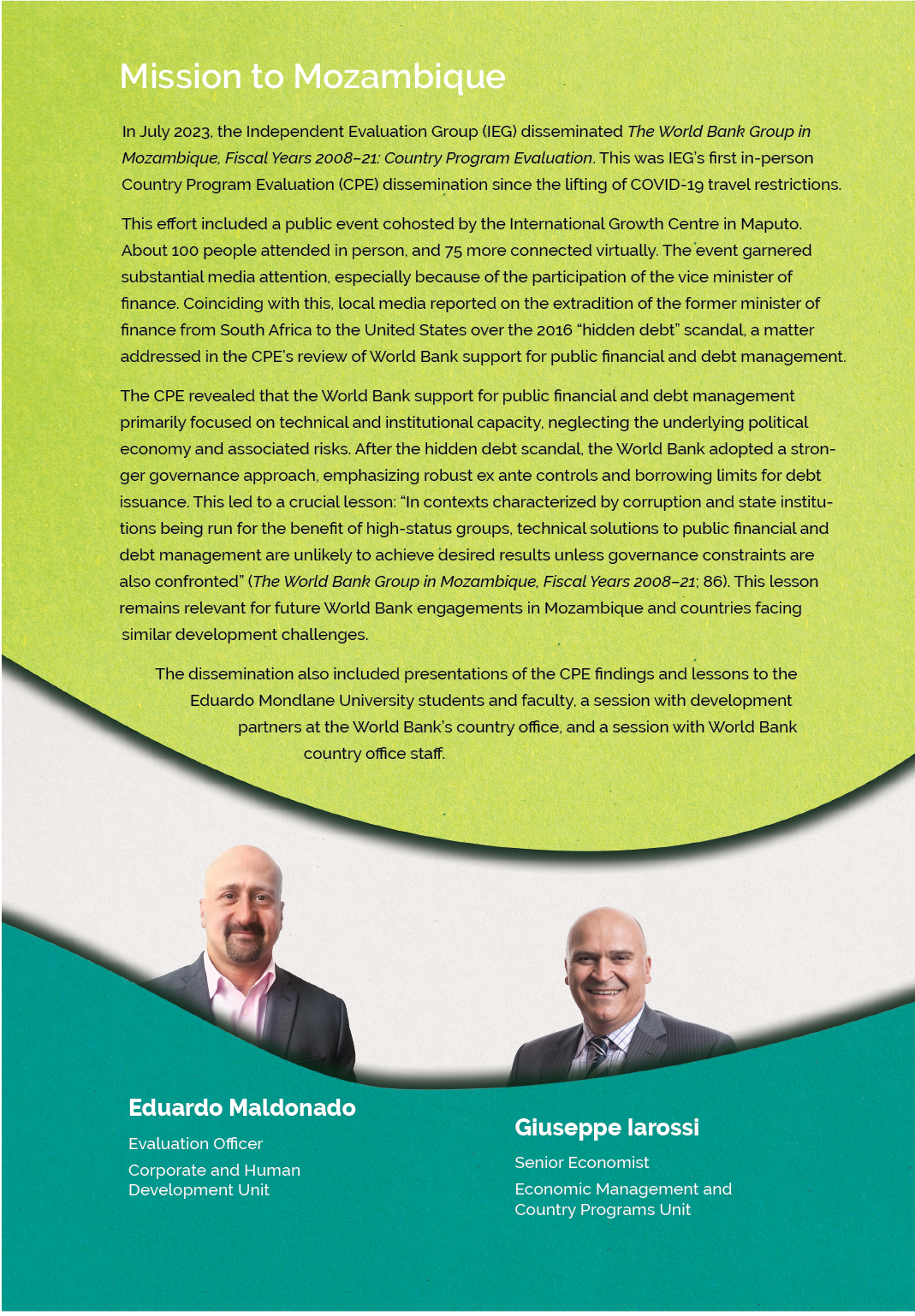

In FY23, IEG submitted CPEs for the Kyrgyz Republic, Madagascar, Morocco, Mozambique, and Ukraine.

Credits: Adobe Stock / pikoso.kz (background); Adapted from shutterstock / Photoestetica (top left) ; Adobe Stock / maksym (top right); shutterstock/sunsinger (bottom left); shutterstock / Yury Birukov (bottom right).

Project Performance Assessment Reports

At the project level, IEG conducts Project Performance Assessment Reports (PPARs) for approximately 20 percent of the World Bank’s project portfolio based on the review of self-evaluation reports—Implementation Completion and Results Reports (ICRs)—prepared by World Bank staff. PPARs

- Are an independent field-based project evaluation and may be conducted at any point after a self-evaluation (ICR) has been completed;

- Rely on a mixed methods approach, including literature reviews, portfolio analyses, and a country mission involving site visits and semistructured interviews with different stakeholders; and

- Assess projects to identify lessons from experience, ensure the integrity of the World Bank’s self-evaluation process, and verify that the World Bank’s work is producing the expected results.

In FY23, IEG submitted PPARs on projects in Albania, Bhutan, Brazil, Côte d’Ivoire, and Rwanda.

The Albania Competitiveness Development Policy Loan (P155605) was designed to increase Albania’s competitiveness by improving the investment policy framework, which would facilitate business practices and trade. IEG gleaned many lessons from its evaluation, including that prior actions must address the key binding constraints to achieving the development policy loan’s objective, that IFC must determine at implementation of reforms that the client is fully committed, and that responsibility for particular data needs to be clear from the beginning.

The Sustainable Production in Areas Previously Converted to Agricultural Use (P143184) project in Brazil focused on the Cerrado biome, a savanna-forest mosaic located in central Brazil. The project sought to shed light on the best way to provide private landholders on midsize farms with the knowledge and skills needed to adopt low-carbon technologies. IEG’s evaluation offers five lessons, including that agencies delivering training and technical assistance need to have a strong decentralized presence and well-established outreach to producers, that farmers persuaded of the profitability of adopting improved farming practices are more likely to pay for technical assistance, and that technology transfer depends on effective collaboration between research and extension agencies.

The First and Second Development Policy Credits for Fiscal Sustainability and Investment Climate (P147806 and P157469) in Bhutan aimed to promote fiscal discipline, improve access to finance for enterprises, and improve the climate for business entry and investment. IEG’s assessment determined three lessons: development policy credits should be more selective and focus on fewer and better-sequenced reforms, development policy credits in Bhutan need to assess technical capacity and implementation risks more thoroughly, and coordination among ministries and agencies needs to be encouraged.

The Agriculture Sector Support Project (P119308) in Côte d’Ivoire aimed to support government reforms to achieve a more competitive, sustainable, and private sector–led cash crop sector and to ensure sustained increases in producers’ incomes. Lessons from IEG’s assessment include that project relevance and efficacy are enhanced by aligning projects with national strategies, that projects with short timelines need to have realistic goals, and that an array of productivity enhancement interventions can overcome many challenges.

The Transformation of Agriculture Sector Program Phase 3 Program-for-Results (PforR; P148927) in Rwanda supported the government in implementing the agricultural transformation program. The third phase aimed to enhance food security and nutrition to help reduce poverty and increase inclusive economic growth. IEG’s evaluation of the PforR offered three lessons: PforR projects should start with mature and implementation-ready activities, stakeholders should internalize the added value of PforRs for incentivizing institutional reforms, and gaps in capacity and eligibility to request and execute budgets need to be addressed at the beginning.