Results and Performance of the World Bank Group 2021

Chapter 4 | Multilateral Investment Guarantee Agency Results and Performance

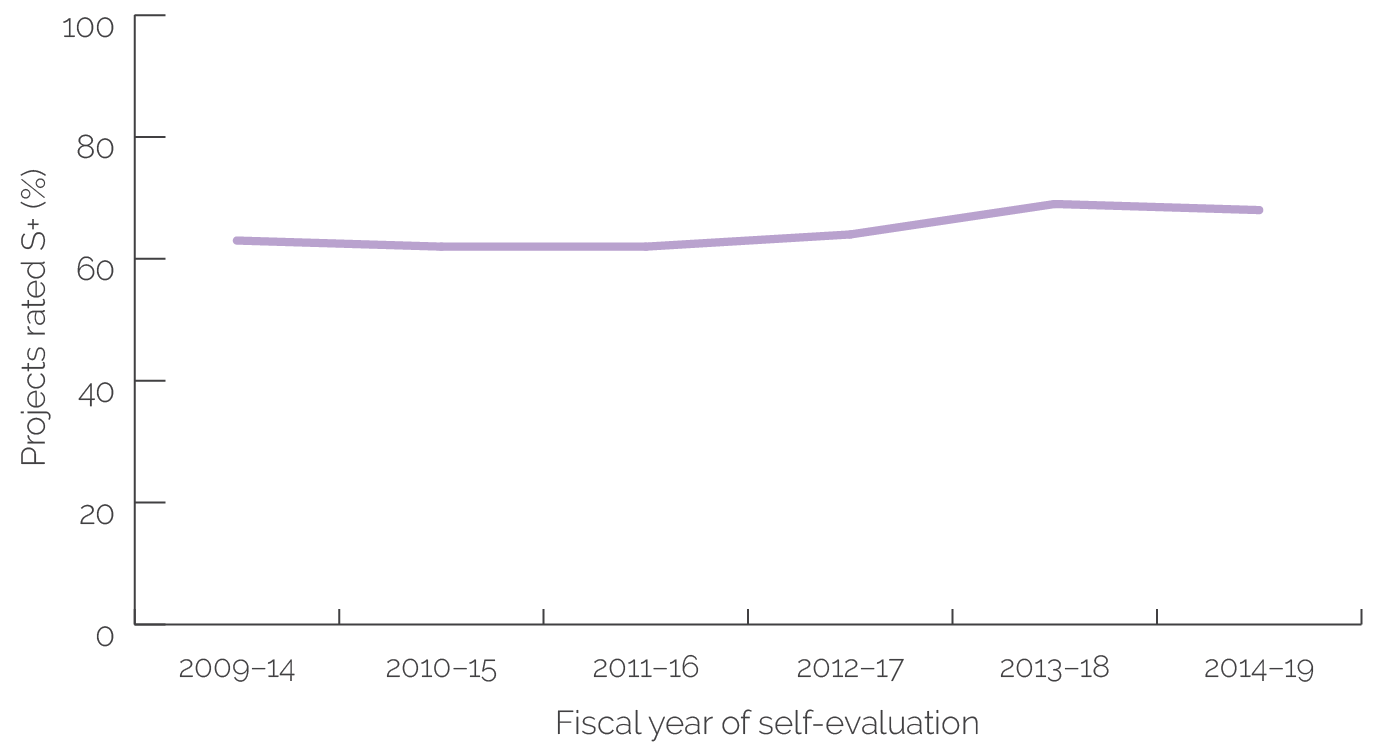

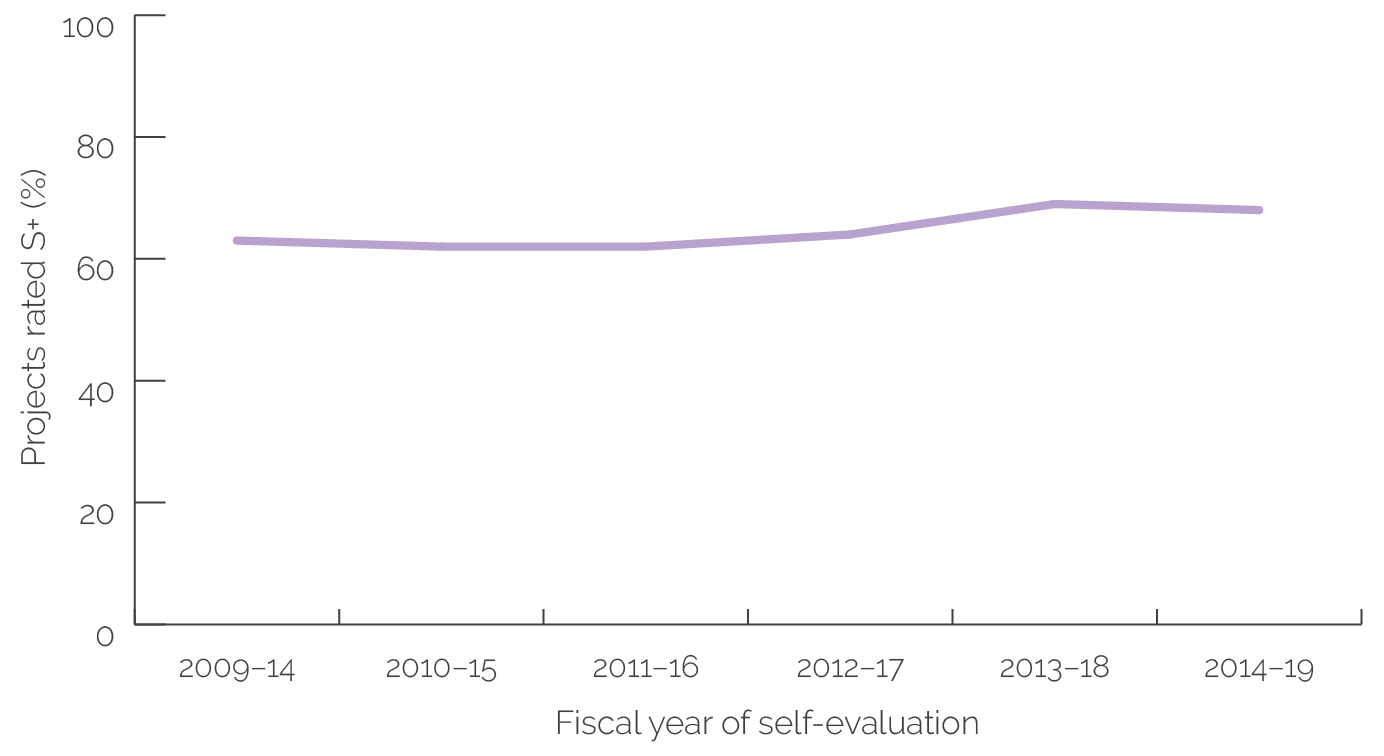

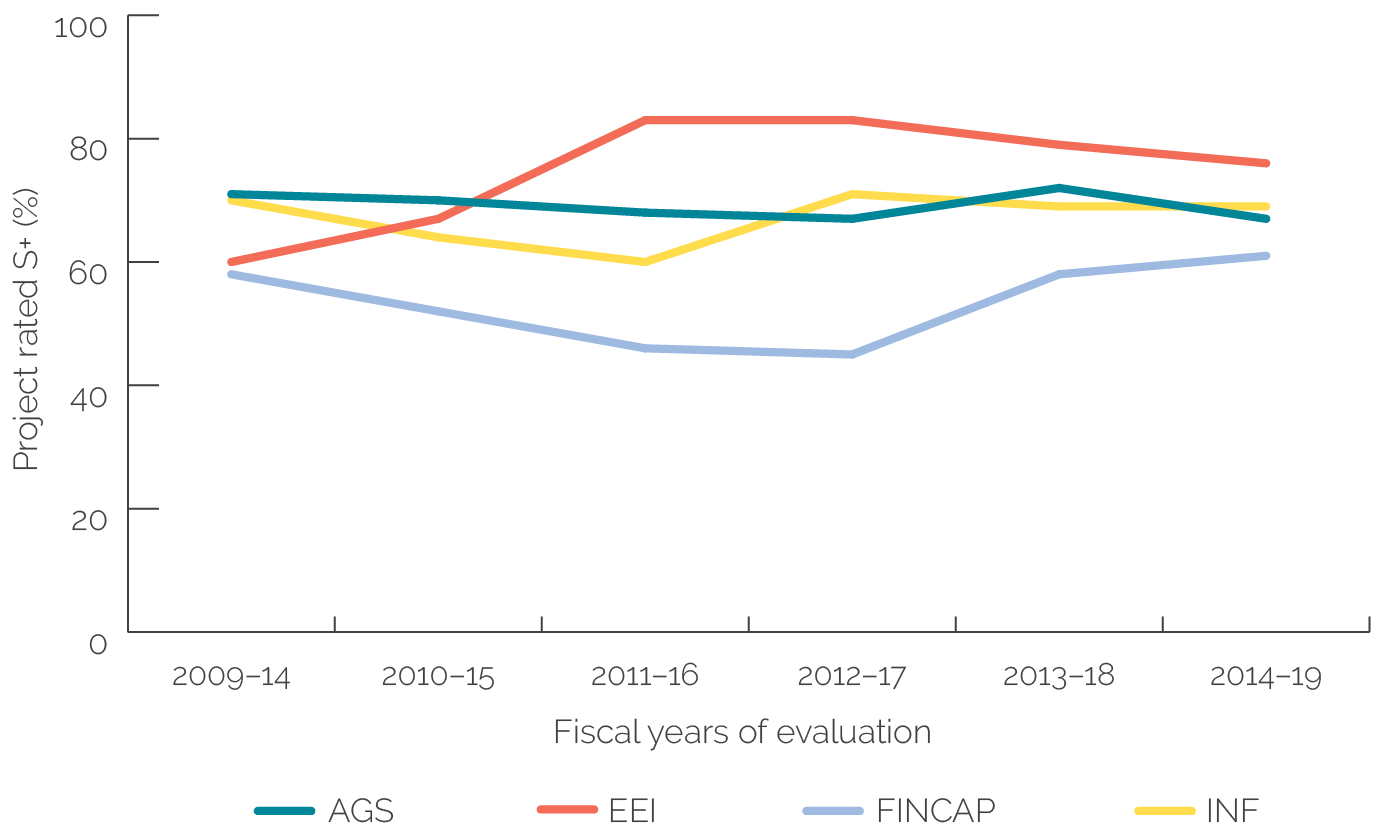

MIGA’s project development outcome ratings have been increasing over the past 10 years. More specifically, MIGA’s development outcome ratings increased from 62 percent S+ in FY11–16 to 68 percent S+ in FY14–19 (figure 4.1). When calculating ratings by gross issuance amounts, MIGA’s development outcome ratings increased from 59 to 74 percent S+ over the same time frame.

Figure 4.1. MIGA Project Development Outcome Ratings

Source: Independent Evaluation Group.

Note: MIGA = Multilateral Investment Guarantee Agency; S+ = satisfactory or above.

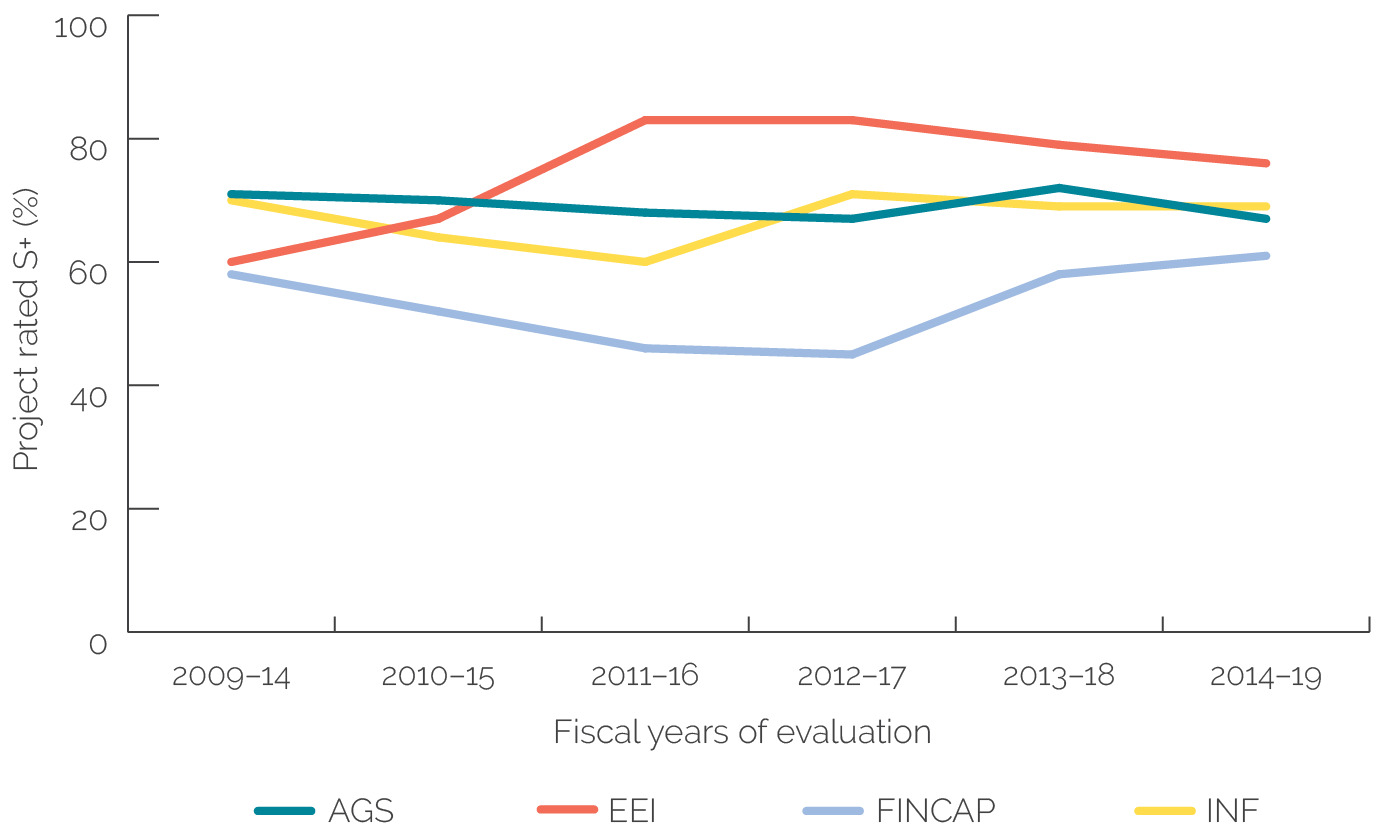

MIGA’s financial sector had the lowest performance, although this has been converging with the performance of other sectors. Among MIGA’s four sectors, the Energy and Extractive Industries sector had the highest success rate, with 75 percent of development outcome ratings being S+, although this rate has declined recently. Part of the reason for this decline is that several power projects were unable to produce as much electricity as expected because of technical issues and increased competition with other energy sources. Meanwhile, MIGA supported several first-of-a-kind power projects in countries with the potential to achieve a demonstration effect. In MIGA’s Infrastructure sector, there were several successful water and sanitation projects and urban transport projects, but telecom projects were less successful. MIGA’s Agribusiness and General Services sector’s performance was stable, although agribusiness projects, which are a majority of the sector’s projects, had lower performance than other subsectors. MIGA’s Finance and Capital Markets sector’s performance improved in 2018 and 2019 after its portfolio shifted from shareholder loans from parent companies supporting their subsidiaries to capital optimization projects and state-owned enterprise projects. See figure 4.2 for sector ratings trends.

Figure 4.2. MIGA Project Development Outcome Ratings by Sector

Source: Independent Evaluation Group.

Note: AGS = Agribusiness, General Services; EEI = Energy and Extractive Industries, FINCAP = Finance and Capital Markets; INF = Infrastructure; MIGA = Multilateral Investment Guarantee Agency.

MIGA has enhanced its self-evaluation efforts. MIGA’s ability to collect information and track development results is inherently limited by its role as a provider of guarantees. However, MIGA has minimized these challenges by having teams visit nearly all projects that are subject to self-evaluation. MIGA has made efforts to self-evaluate all of its projects, with IEG only doing validations. MIGA has been deferring the evaluations for projects that are not yet fully operational and projects with political risks until those issues are resolved and its criteria for determining which projects are eligible for evaluation have become firmer.1

Access to goods and services for customers and market development are prominent outcome types for MIGA. To assess longer-term investment rating trends, we carried out an outcome type analysis, which differs from the analysis we carried out for IFC in that it could not rely on retroactively applied Impact Measurement and Project Assessment Comparison Tool data (box 4.1). MIGA’s outcome types can be divided among project-level outcomes and foreign investment–level outcomes. Among outcome types, “access to goods and services for customers” and “market development” are the most common, accounting for 70 and 47 percent of projects (appendix C, table C.8). Both of those outcome types are typical for large infrastructure projects that promote foreign investment. MIGA has an increasing share of foreign investment outcome types, such as “improved business and sector practices” and “signaling effects.” These outcome types are expected to have demonstration effects.

MIGA projects have a higher probability of achieving project-level outcomes than foreign investment–level outcomes. As described in chapter 3, the achievement of project-level outcomes tends to be under the direct control of projects. Our analysis shows that the project-level outcome types of “access to goods and services for customers,” “quality and affordability of goods and services,” and “increased employment” have the highest probabilities of success. From FY12–14 to FY17–19, project-level outcome achievement rates increased (table 4.1). MIGA’s inherent limitations as a guarantee provider in collecting data on the development results of projects means that many projects lack sufficient evidence to rate project outcomes. This suggests that MIGA’s improved development outcome ratings are due to both increased evidence collection in recent years and actual improvement in performance.

Box 4.1. MIGA Outcome Type Analysis Methodology

Chapter 4 analyzes the influence certain outcome types have on the performance of Multilateral Investment Guarantee Agency (MIGA) projects.. The outcome typology includes 13 outcome types that were adapted from MIGA’s Impact Measurement and Project Assessment Comparison Tool (IMPACT) framework. The analysis reviewed all MIGA projects that were evaluated during fiscal year (FY)12–14 and FY17–19 and validated by the end of calendar year 2020. The Results and Performance of the World Bank Group 2021 team coded each outcome claim from the Board proposal (President’s Report) and assessed outcome claim achievement by reviewing Project Evaluation Reports and Validation Notes. The way claim achievement was assessed was different from the approach of IMPACT and more streamlined. The intention in this chapter was to analyze outcome types in a similar manner to chapters 2 and 3, but this was constrained by the fact that the President’s Report included a large number of outcome claims without specific indicators to verify those claims. Moreover, MIGA did not backfill project information with IMPACT data, unlike the International Finance Corporation, so there were certain difficulties in specifying intended outcome claims and seeing the claim rating change. This created a risk that outcome types would not be assigned objectively by this analysis team. Hence, the results of MIGA’s outcome type analysis should be interpreted cautiously. Appendixes A and B provide further details on the methodology.

Source: Independent Evaluation Group.

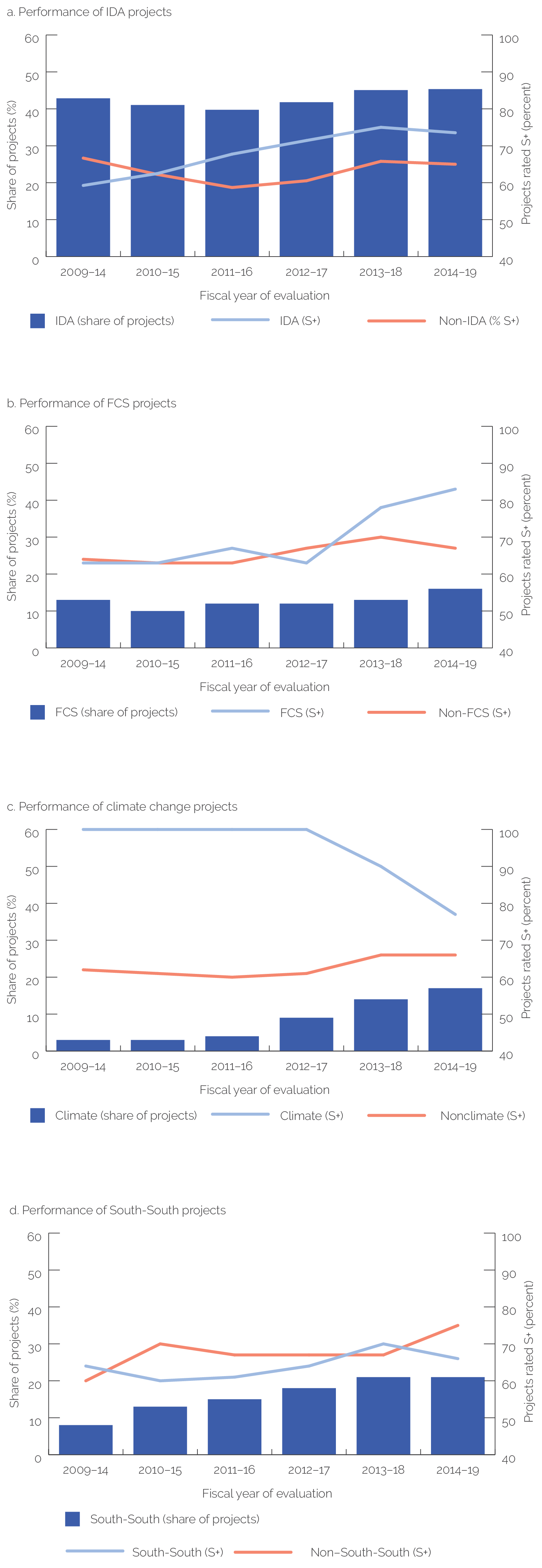

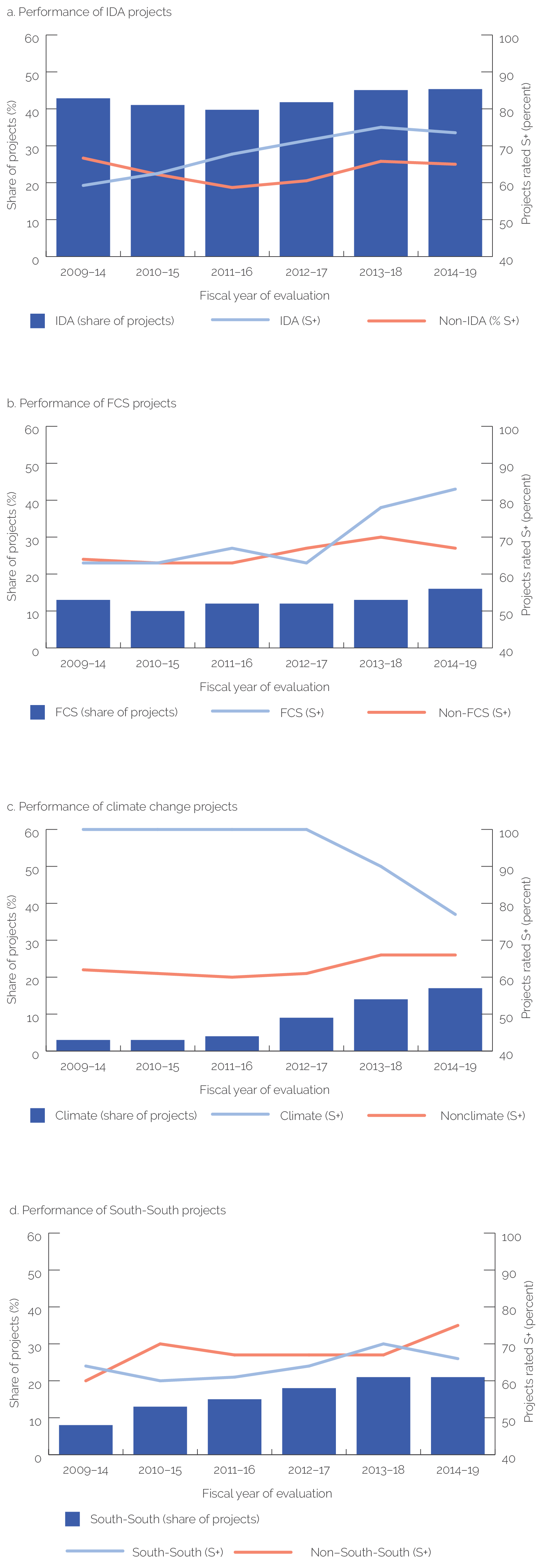

Aligning projects with certain corporate priorities had an inconclusive impact on ratings. The RAP 2020 identified several factors associated with MIGA’s relatively higher ratings. These factors include larger multilateral investors, larger project sizes, and beginning MIGA’s involvement in projects once the projects are more advanced. We used Project Evaluation Report ratings to analyze the performance of projects that feature corporate priorities. In addition to MIGA’s mandate of promoting foreign investment, MIGA’s three-year rolling strategies have identified four prominent corporate strategies, including IDA, FCS, climate change, and South-South investments (see box 4.2 for more details on MIGA’s corporate priorities). Figure 4.3 shows that the performance of projects with and without a focus on corporate priorities is not obviously different over the past decade. Considering the small number of MIGA projects, the quantitative analysis would need to be complemented by qualitative analysis to shed further light on these findings.

Table 4.1. Outcome Type Performance, Evaluation Stage, 2012–14 and 2017–19

|

Outcome Type Performance |

2012–14 |

2017–19 |

||

|

Outcome Claims |

Outcome Claims |

|||

|

(% achieved) |

(no.) |

(% achieved) |

(no.) |

|

|

Project-level outcome |

||||

|

1.1 Access (1.1.1–1.1.3) |

33 |

27 |

56 |

54 |

|

1.1.1 Access to goods and services (MSME) |

11 |

9 |

56 |

9 |

|

1.1.2 Access to goods and services (female) |

0 |

2 |

— |

0 |

|

1.1.3 Access to goods and services (customers) |

42 |

19 |

57 |

46 |

|

1.2 Quality/affordability of goods and services |

46 |

13 |

52 |

29 |

|

1.3 Enhanced capacity of final beneficiaries |

33 |

9 |

50 |

2 |

|

1.4 Improved living standards (earnings) of individuals |

— |

0 |

100 |

2 |

|

2.1 Suppliers/distributors reached |

0 |

2 |

100 |

2 |

|

2.3 Improved sales/profitability of suppliers/distributors |

0 |

5 |

33 |

9 |

|

3.1 Increased employment |

54 |

13 |

38 |

21 |

|

4.1 Increased transfers to the government |

30 |

10 |

33 |

18 |

|

6.2 GHG reduction |

— |

0 |

57 |

7 |

|

6.3 Efficient use of resources |

40 |

5 |

71 |

7 |

|

Foreign investment–level outcome |

||||

|

9. Business & sector practices |

40 |

5 |

40 |

15 |

|

10. Market development |

39 |

23 |

29 |

24 |

|

13. Signaling effects |

— |

0 |

100 |

1 |

Source: Independent Evaluation Group.

Note: Outcome type estimation by Independent Evaluation Group based on the approval documents and confirmed cases at the evaluation. Of the outcome claims considered not achieved, 51 percent were considered not achieved because their results could not be verified. Broken down by outcome types, foreign investment–level outcome claims had higher share of unverified claims (61 percent) than project-level outcome claims (50 percent). The level is relatively high, particularly for foreign investment–level outcome claims, and it would be expected that the tracking of outcome claim results is strengthened under the newly introduced Impact Measurement and Project Assessment Comparison Tool framework. — = not applicable; GHG = greenhouse gas; MSME = micro, small, and medium enterprise.

Figure 4.3. MIGA Projects with Development Outcomes Rated S+, with and without Corporate Priority Objectives

Source: Independent Evaluation Group.

Note: FCS = fragile and conflict-affected situation; IDA = International Development Association; MIGA = Multilateral Investment Guarantee Agency; S+ = satisfactory or above.

Box 4.2. MIGA’s Select Corporate Priorities

International Development Association countries. The Multilateral Investment Guarantee Agency (MIGA) introduced International Development Association (IDA) countries as a strategic priority area for in 2005; this has continued to be a priority area ever since.

Fragile and conflict-affected situations. Fragile and conflict-affected situation (FCS) countries have been a strategic priority for MIGA since 2005, and MIGA’s current strategy reinforces this focus. MIGA’s fiscal year (FY)21–23 strategy aims to increase the share of MIGA guarantees in IDA and FCS countries to an average of 30 to 33 percent during FY21–23.

Climate change. The World Bank Group launched its first Climate Change Action Plan in 2016 and has published a second plan for 2021–25. In the second plan, MIGA, as part of the Bank Group, is committed to aligning all new operations with Paris Agreement goals by 2025.

South-South investment. MIGA supports South-South investments by promoting foreign investments from developing countries. MIGA made this a strategic focus area in its FY09–11 and FY12–14 strategies (the FY15–17 strategy mentioned it as an area of support).

Methodology. To assess the relationship between projects that integrate corporate priorities and their Project Evaluation Report ratings, we classified all the projects evaluated since the FY09 cycle using climate change flags provided by MIGA, South-South flags provided by the Independent Evaluation Group, and FCS classification at the time of evaluation.a A project can have multiple corporate priorities.

Source: Independent Evaluation Group.

Note: MIGA = Multilateral Investment Guarantee Agency.a. Subject to the availability of data at the time of assessment. For country classification for IDA and FCS, historical country classification based on the Bank Group’s classification was applied for evaluation year of projects. For example, for a project in the 2016 evaluation year, IDA and FCS country classifications of the Bank Group in 2016 were applied.

- The point in time at which the criteria for evaluation have been met is called “early operating maturity.”