The World Bank Group in Madagascar

Chapter 4 | World Bank Group Support for Addressing Madagascar’s Governance Challenges

Highlights

The World Bank contributed to enhancing transparency and accountability. However, progress with budget transparency has been reversed amid the coronavirus (COVID-19) crisis.

World Bank support for domestic resource mobilization contributed to improved tax and customs revenue collection, as well as increased generation of local revenues, but was not able to reduce high (and regressive) tax expenditures.

World Bank support to public expenditure management contributed to modest reductions in transfers and subsidies to nonpriority expenditures and improved corporate governance in some state-owned enterprises, but strong resistance prevented greater progress, particularly within the electricity company, Jiro sy Rano Malagasy.

World Bank contributions to decentralization were substantial but largely limited to the intergovernmental fiscal transfer system. Local governments experienced increased fiscal autonomy thanks to grants from the Local Development Fund (Fonds de Développement Local), and fiscal transfers are now quicker and more transparent.

Results were sometimes hampered by project design that may not have adequately taken into account strong vested interests, rent seeking, and the use of funds from government institutions to benefit a few high-status individuals. This can be seen in local projects and reversals of prior actions in the face of vested interests, with well-connected private sector actors using accountability institutions for their own benefit.

The World Bank contributed to tangible, albeit limited, results in domestic resource mobilization, expenditure management, transparency, accountability, participation, and, to a lesser extent, fiscal and administrative decentralization. This chapter describes these interventions and their effectiveness.

The World Bank supported improved governance through a mix of investment financing, analytical work (particularly during the political crisis), and, since 2014, policy-based lending. Lending centered on three flagship governance projects: the Governance and Institutional Development Project (FY04–09), the Governance and Institutional Development Project II (FY08–15), and the Public Sector Performance Project (FY15–21; see box 4.1). Several DPOs contained governance-related prior actions: the Reengagement DPO (FY15–16), the Resilience DPO (FY16–17), the Public Finance Sustainability and Investment I and II DPOs (FY17–19), the Inclusive and Resilient Growth I and II DPOs (FY18–20), the Fiscal Sustainability and Energy DPO (FY19–21), and the COVID-19 Response DPO (FY21). The IFC supported governance indirectly, through limited support to improving the economy for private sector investment; its 2021 Country Private Sector Diagnostic (World Bank Group 2021a) identified and analyzed deep-rooted governance issues hampering private sector growth and proposed ways to even the country’s playing field, in which certain sectors are historically dominated by a few politically connected economic operators.

Box 4.1. Public Sector Performance Project

In fiscal year 2016, the World Bank approved the US$40 million Public Sector Performance Project with a development objective to improve revenue management and local service delivery nationwide and in the education sector in selected regions. The project, which closed in December 2021, consisted of four components:

- Revenue management (US$16.8 million)

- Service delivery capacity of local governments (US$12.0 million)

- Governance mechanisms in the education sector (US$7.8 million)

- Controls and performance monitoring (US$3.4 million)

Project design was directly influenced by lessons learned from the two previous flagship governance projects in Madagascar. Governance and Institutional Development Projects I and II were evaluated by the Independent Evaluation Group and found to be overly ambitious and characterized by limited commitment by the government, weaknesses in the monitoring and evaluation system (including reliance on the government’s undeveloped system and unclear accountability for data collection), and an undefined project implementation unit.

The Public Sector Performance Project incorporated these lessons. Project interventions were focused on the local level, results-based financing (through performance-based conditions) was incorporated into the project to overcome political opposition and incentivize interministerial cooperation, and a project implementation unit was anchored in the Office of the President to support increased political leadership and other reforms.

Sources: World Bank 2015d, 2016a.

Transparency, Accountability, and Participation

The World Bank contributed to improvements in transparency, accountability, and citizen participation, particularly after the political crisis. Madagascar has seen improvements in transparency, accountability, and participation since their steep deterioration during the political crisis of 2009–14 (figure 4.1). The World Bank contributed to these outcomes by building capacity for the timely publication of quality public finance information—for example, budget execution reports, tax expenditures, SOE financial operations, and transfers to local governments; scaling up social accountability mechanisms at the local level; strengthening the capacity of the supreme audit institution to audit national accounts (as well as to conduct high risk audits); supporting reforms to encourage greater transparency of companies benefiting from mining laws; and assisting in drafting legislation for, and enforcement of, asset declaration requirements.

Figure 4.1. Madagascar’s Voice and Accountability Score: Rebounding to Precrisis Levels

Source: Worldwide Governance Indicators.

Note: The Worldwide Governance Indicators’ Voice and Accountability score captures perceptions of the extent to which a country’s citizens are able to participate in selecting their government, as well as perceptions of freedom of expression, freedom of association, and a free media. This is an aggregate score based on a number of existing data sources, with higher values corresponding to better governance. Please see note to table 1.2 on the nature of the Worldwide Governance Indicators.

The World Bank contributed to modest progress on budget transparency, although recent backtracking has drawn into question the sustainability of these gains. Technical assistance from the Public Sector Performance Project contributed to marginal improvements in budget transparency, which can be seen in the increase in Madagascar’s Open Budget Index score between 2017 and 2019. However, budget transparency remains in the “minimal” category, and public participation in the national budget process remains low. With encouragement from the World Bank and other development partners, the Ministry of Finance published open format budget documentation and budget expenditure data in 2020 as part of its “COVID-19 report,”1 earning praise from the International Monetary Fund, although some CSOs expressed dissatisfaction with the ambition of the report (STEF 2021). However, there has been significant backsliding since the beginning of the pandemic, as the availability of fiscal data has declined. Internews, an international NGO, notes that the government intimidation of journalists and restrictions on the media have increased in the past several years (Chapoy 2021). Transparency International—Initiative Madagascar noted a similar deterioration in terms of the government’s treatment of civil society (Transparency International—Initiative Madagascar 2021b).

The World Bank was an early supporter of social accountability mechanisms in Madagascar. This support was strengthened during and after the political crisis, contributing to the institutionalization of mechanisms such as participatory budgeting in some municipalities. World Bank support came primarily through the provision of grant funding and technical assistance to local governments and CSOs. At the start of the evaluation period, the World Bank provided technical assistance to municipal governments and community associations to enhance community participation in the management of mineral resources through the Mineral Resources Governance Project (2003–12), which piloted participatory budgeting in mining communities and led to the funding of local development subprojects using local tax revenues.

Financial and technical support for participatory budgeting was scaled up through a number of World Bank–funded projects. This was part of an integrated approach to supporting social accountability, revenue mobilization, and decentralized land management at the municipal level (Communal Operation of Integrated Support). The approach, piloted under the Governance and Institutional Development Project II, provided small grants to municipalities through the Local Development Fund (Fonds de Développement Local) to increase social accountability mechanisms, such as participatory budgeting, citizen engagement, and community scorecards, and to improve revenue management and local public service delivery. This resulted in over 500 social accountability initiatives implemented at the local level that were rolled out to 50 municipalities by the end of the project in 2014. Since then, the World Bank has adopted the Communal Operation of Integrated Support approach in other World Bank–funded projects, including through the GPSA, continuing to provide grants and training to local officials to build capacity for and institutionalize participatory planning and budgeting processes in targeted municipalities.

World Bank support strengthened the capacity of civil society to monitor service delivery and open budgets. The World Bank’s financial and technical support provided through the GPSA and implemented by the NGO Soa Afafy Hampahomby ny ho Avy (SAHA) has been crucial to building the capacity of CSOs at the regional and national levels and in coordinating CSOs to better channel their advocacy to enhance citizen participation in and accountability of the government’s public financial management.2 SAHA is now one of the country’s premier sources of external oversight over, and citizen participation in, the elaboration of local action plans, the implementation of participatory budgeting, and the transparency of resource allocations to communes. Civil society interlocutors noted that through GPSA-funded operations, the World Bank helped establish a constructive relationship between CSOs and the government by encouraging state bodies to work with CSOs.

Domestic Resource Mobilization

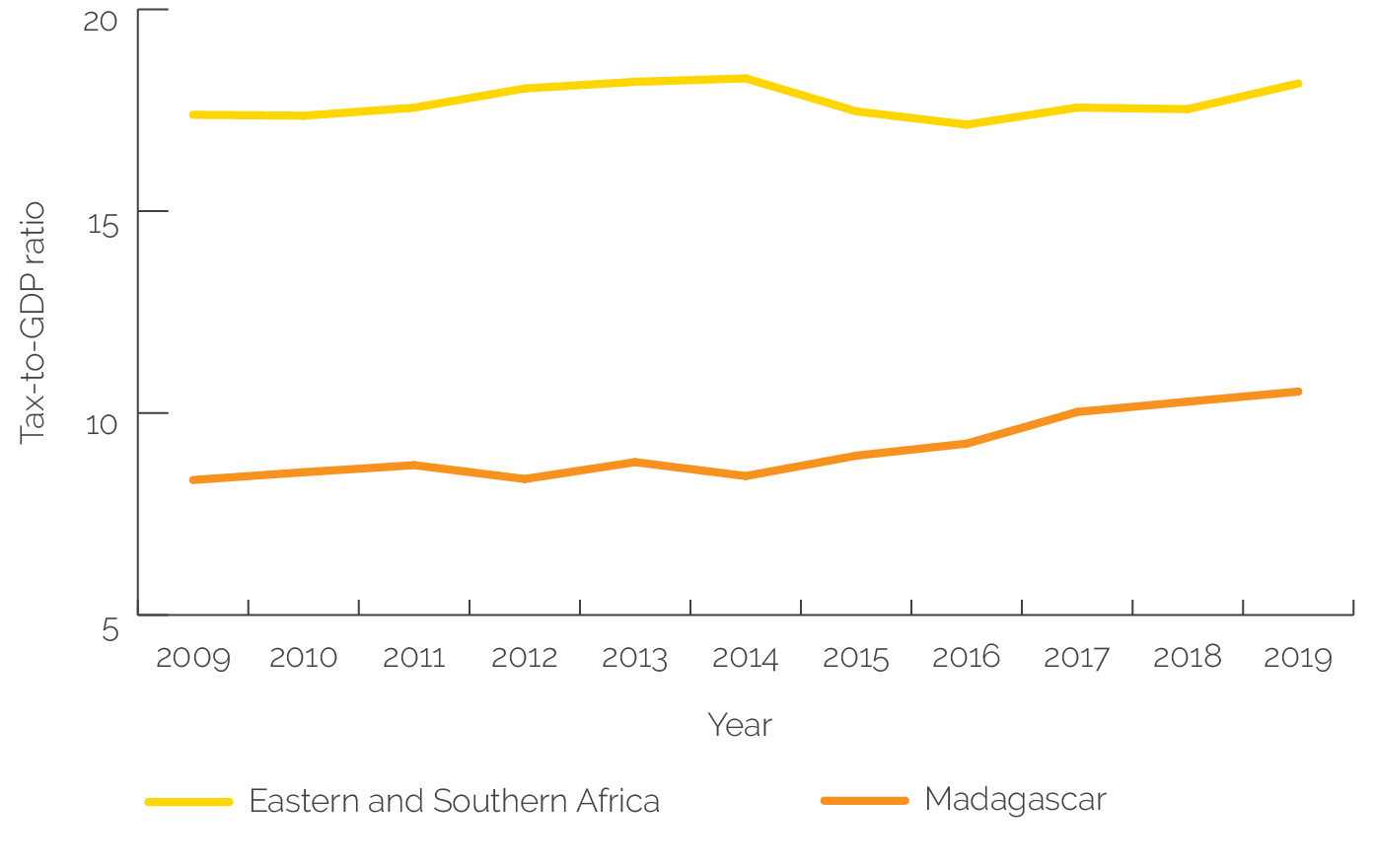

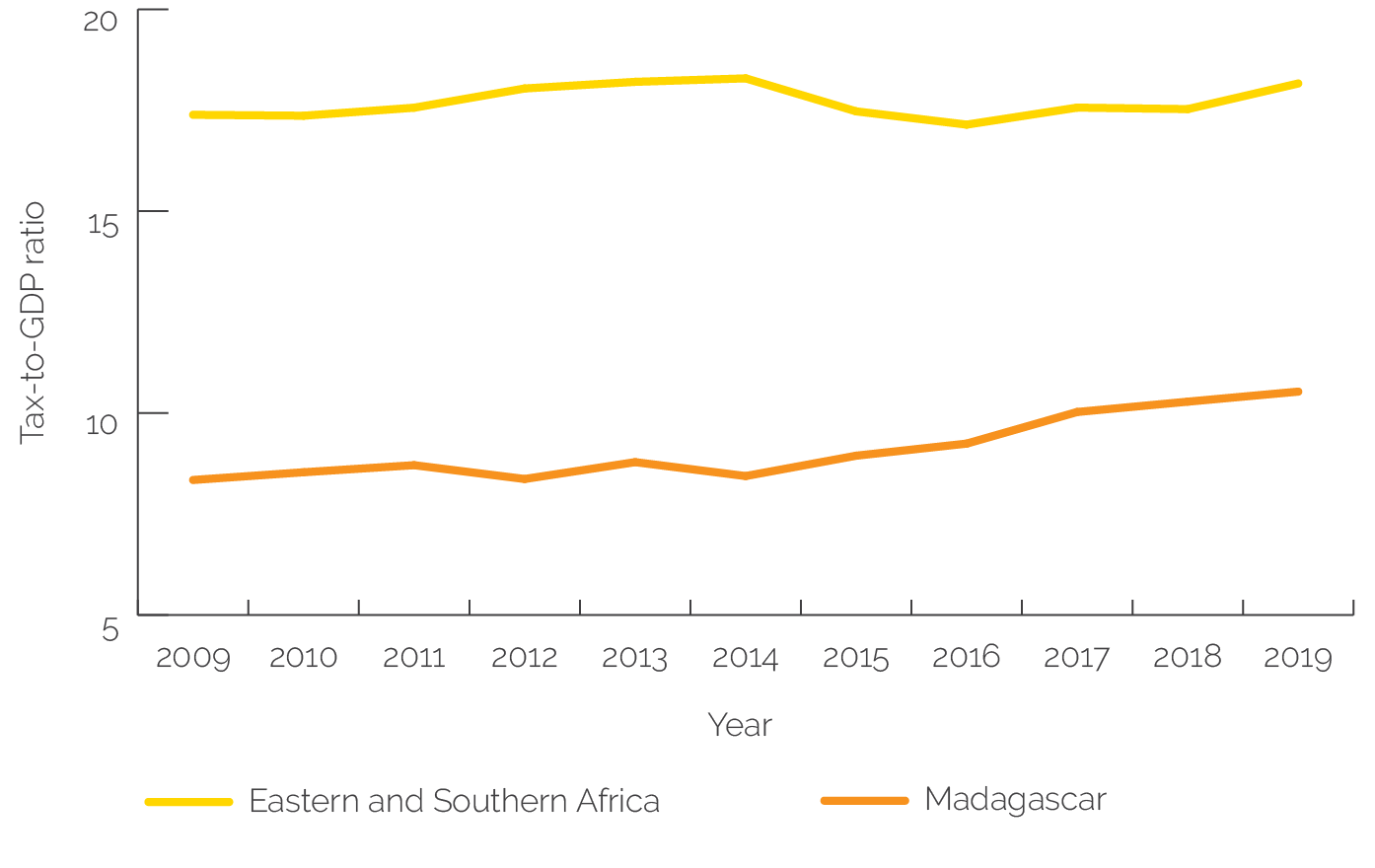

World Bank support to domestic revenue mobilization contributed to boosting tax and customs revenues, although the tax-to-GDP ratio remains below the potential of 15 percent (IMF 2020b), and regressive tax exemptions remain high. Following the political crisis and the sharp decline in tax as a percentage of GDP—from 11.4 percent in 2008 to 8.3 percent in 2009—Madagascar’s tax-to-GDP ratio climbed steadily back to 11.0 percent in 2021. However, the ratio is still significantly below the average for countries in Eastern and Southern Africa (figure 4.2). Furthermore, this increase has since been dampened by the COVID-19–related economic contraction, with the ratio estimated at 9.3 percent of GDP in 2021. Customs revenue has grown significantly in recent years and registered a 60 percent increase from 2016 to 2019 (World Bank 2021b).

The World Bank supported domestic revenue mobilization through a mix of investment projects, support for policy reforms, and nonlending interventions. The Governance and Institutional Development Project II, approved in FY08, which was rated unsatisfactory by IEG, included support to improve the performance of tax and revenue agencies by modernizing customs offices, integrating the customs management system with the country’s integrated financial management information system, and providing training. The Public Sector Performance Project (approved in FY16 and closed in FY22) included support to improve and consolidate taxpayer registration and identification, modernize the country’s integrated tax administration system, strengthen risk-based audit function and controls, introduce performance-based management to the tax and revenue agencies, and improve revenue collection in the mining sector. The three DPO programmatic series supported fiscal transparency through prior actions to (i) disclose the list of enterprises granted tax benefits under the Free Zone regime, (ii) publish planned and executed fiscal transfers (that is, revenue sharing) to local governments, and (iii) tighten the scope of customs exemptions and boost customs administration by expediting the customs clearance process and establishing performance contracts for customs inspectors at Toamasina port.3 Nonlending support included a Domestic Revenue Mobilization Policy Note (2014), support for two Tax Administration Diagnostic Assessment Tools (2015 and 2021), and influential ASA on combating corruption and tariff evasion (2019).

Figure 4.2. Tax–to–Gross Domestic Product Ratio in Madagascar versus Neighbors

Source: World Development Indicators.

Note: GDP = gross domestic product.

These interventions contributed to tangible improvements in tax administration, including a more than doubling in the number of registered taxpayers. World Bank financing and technical assistance contributed to the successful rollout of an e-payment module within an integrated tax administration system, simplifying and systematizing tax payments. World Bank support to improve taxpayer registration and rationalize the registry through the establishment of a single administrative identification number helped broaden the tax base, from 200,000 registered taxpayers in 2016 to nearly 515,000 at the end of December 2021. It also significantly contributed to the registration of over 31,000 small and individual businesses over the same period.

The World Bank contributed to tangible improvements in customs administration. Prior actions (through the Public Finance Sustainability and Investment DPO series) supported (i) greater restrictions on the scope of the customs exemption regime through revisions to the Customs Code, (ii) adoption of an expedited custom clearance process, (iii) adoption of a risk-based approach to verifying tax payments at customs offices, and (iv) establishment of performance-based management contracts for customs inspectors at Toamasina port. The resulting reforms contributed to a reduction in the time it takes to clear customs by half and better verification of declared values for imports, including through the signing of externally evaluated performance contracts for eight revenue offices (Chalendard, Raballand, and Rakotoarisoa 2019; World Bank 2020a). Thanks in large part to performance contracts, Toamasina port has witnessed a more than 400 percent increase (2016–21) in the rate of confirmed suspicious customs transactions (World Bank 2021b).

The World Bank also helped support an increase in the collection of local revenues (that is, land taxes and mining royalties). The World Bank supported local government revenue mobilization through revision of the legal framework and strategies guiding revenue mobilization for local governments, the use of mobile payments for revenue collection, and piloting and scaling up of innovative approaches to secure revenue collection. This contributed to recovery of revenue by local governments from 30 percent in 2016 to over 42 percent in December 2021. Furthermore, World Bank support to the revision of the Mining Code and regulations related to large- and small-scale mining contributed to the collection of tax revenue from natural resources: the decentralized tax collection rate of mining royalties increased from 10 percent to 97 percent during the first third of the evaluation period (World Bank 2014b). Finally, World Bank financial and technical support (in coordination with the International Monetary Fund) contributed to the design and establishment of a tax policy unit within the Ministry of Finance, tasked with conducting a priori and ex post analysis of current and potential tax reductions and exemptions; the unit now produces yearly reports. A decree making such analysis mandatory was expected to be sent to the Council of Ministers at the time of writing.

Several domestic revenue mobilization interventions, however, were not successful. Although the World Bank supported disclosure of a summary of all tax expenditures in the annual budget law (see the “Expenditure Management” section), this did not contribute to a significant increase in revenue. Far from supporting the government to meet its targeted reduction of approximately $24.8 million in tax exemptions, tax expenditures eliminated during the Public Finance Sustainability and Investment DPO series (2016–18) were less than $0.4 million, and in 2017 the government approved additional tax benefits for special economic, industrial, and agriculture zones (World Bank 2019). Additionally, support for the establishment of a single administrative identification number to inform revenue mobilization was dropped by the World Bank because of lack of progress on the client side.

Expenditure Management

World Bank support for public expenditure management focused on reducing subsidies and transfers to the pension fund and SOEs as well as improving transparency and efficiency in the energy sector. Although expenditure management was a core focus of the World Bank under the CAS, expenditure management objectives became more targeted in subsequent strategies, reflecting agreement with the EU on an informal division of labor with respect to revenue and expenditure support. With the return to constitutional order in 2014, World Bank attention was targeted to reducing regressive transfers and subsidies. This was supported through prior actions in several DPOs and through technical assistance within the Public Sector Performance Project.4 Relevant prior actions included publishing an annual tax expenditure statement, eliminating the fuel subsidy, and removing ineligible beneficiaries from the pension roster to reduce transfers to the pension fund. However, these prior actions were not effective in meeting the World Bank’s targets, which were only partially achieved.5

Recognizing the inadequate performance of the national electricity and water utility, the World Bank devoted considerable attention to improving the financial and operational performance of JIRAMA. Given the associated fiscal burden, the World Bank included seven prior actions to reform JIRAMA in various DPOs. In parallel, the Electricity Sector Operations and Governance Improvement Project supported the adoption of a performance improvement plan for JIRAMA, which has contributed to a reduction in total electricity losses per year in the project area from a baseline of 35 percent to 25 percent and a reduction in interruptions in electricity service per year in the project area from 870 to 600 as of 2022 (progress to achieving the project development objective was rated satisfactory in February 2022; the project is expected to close in June 2023). The World Bank also provided technical assistance to reduce the cost of power generation and fuel subsidies (for example, by enabling substitution of diesel in existing power generation plans and shifting toward hydro and solar power).6

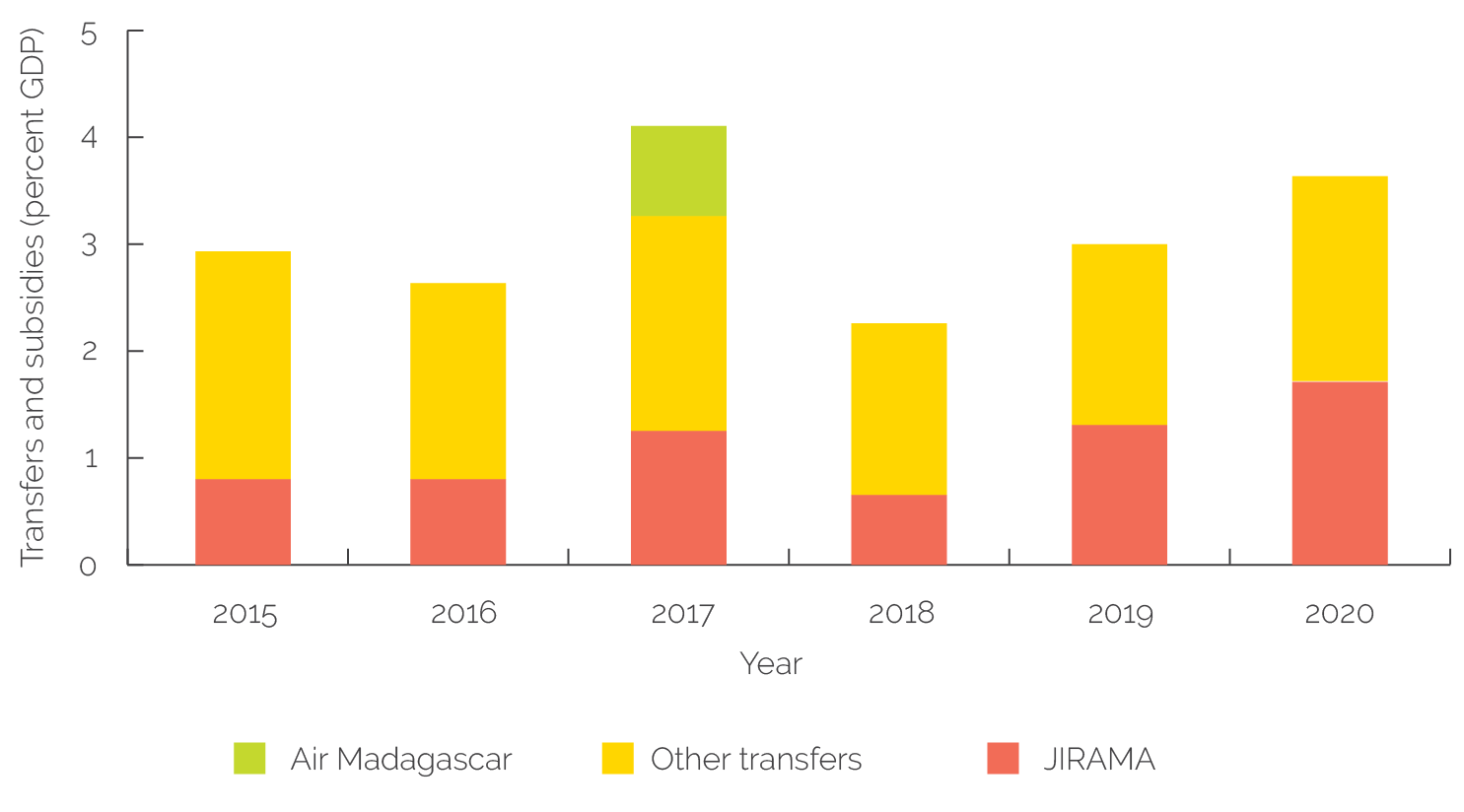

Although the World Bank supported a reduction in transfers and subsidies to nonpriority expenditures, progress fell short of targets. Through the Public Finance Sustainability and Investment DPO series, the World Bank helped reduce selected fiscal transfers (including transfers to the pension fund, and fuel and SOE subsidies) as a share of total expenditures from 13 percent in 2015 to 6.4 percent in 2019;7 however, this fell short of the target of 3 percent by 2019. Reforms to eliminate fuel subsidies were not sustained, and transfers to the pension fund and SOEs (JIRAMA and Air Madagascar) were only partially reduced (World Bank 2019). Efforts were complicated by the costs of responding to the COVID-19 crisis in 2020 and rapidly increasing oil prices in 2021, which contributed to losses at SOEs and led to an increase in transfers to JIRAMA in 2020 and 2021 (figure 4.3; IMF 2021).

Although the World Bank’s efforts to improve JIRAMA’s performance contributed to a reduction of electricity losses and interruptions in electricity service, JIRAMA’s costs have continued to rise. The World Bank supported, through the Electricity Sector Operations and Governance Improvement Project and the Fiscal Sustainability and Energy DPO, a reduction in electricity losses through reforms to incentivize energy efficiency and investment in the rehabilitation and upgrade of facilities for electricity supply. However, although addressing technical issues has led to important achievements, efforts to improve the corporate governance of JIRAMA have achieved only modest results. As of 2021, a financial recovery plan for JIRAMA had not been approved by JIRAMA’s Supervisory Board, and the publication of JIRAMA’s financial statements on the Ministry of Economy and Finance’s website was delayed and produced without the auditor’s opinion (World Bank 2021a). JIRAMA’s operating losses and arrears to suppliers continue to be elevated, and the variable cost of electricity production—a CPF supplementary progress indicator—rose between 2015 and 2021, rather than fell (World Bank Group 2021b).

Figure 4.3. Madagascar: Transfers and Subsidies to State-Owned Enterprises

Source: International Monetary Fund 2021.

Note: GDP = gross domestic product; JIRAMA = Jiro sy Rano Malagasy.

Strong resistance and lack of political will have prevented further progress in reforming JIRAMA. Although the World Bank continued to support and encourage reforms in the challenging energy sector, it has had limited impact largely due to resistance from the utility’s supervisory board and upper management. The Reengagement and Resilience stand-alone DPOs, the Public Finance and Sustainability DPOs, and the Fiscal Sustainability and Energy DPO attempted to reform the governance and improve the efficiency of JIRAMA and reduce the transfers and subsidies it receives through prior actions. These prior actions included coloring diesel delivered to JIRAMA to reduce leakages; publishing monthly statistics on the delivery of diesel to, and generation of, electricity at electricity generator centers; reviewing a priori contracts exceeding a prespecified value and for noncompetitive procurements; and publishing the terms of all new power generation contracts on its website. However, just 57 percent of the seven prior actions supporting reforms to the SOE were sustained.8 These issues will likely continue until the electricity regulatory agency gains full independence from the Ministry of Energy (Transparency International—Initiative Madagascar 2021c).

Fiscal and Administrative Decentralization

World Bank support for Madagascar’s decentralization agenda was concentrated in the latter half of the evaluation period due to initially weak government buy-in. The World Bank only relatively recently began to actively support the country’s decentralization agenda, including the delivery of services at the subnational level (for instance, through the Citizen Involvement in Municipal Service Improvement, Resilient Livelihoods, and PRODIGY projects), support to local revenue mobilization and strategic urban planning, and revision of a standardized index measuring local governance. More recently, there have been high-level discussions between the Ministry of the Interior and the World Bank on a potential project that would, among other things, revise the allocation formula for the Equalization Fund and increase investment grants to communes from the Local Development Fund (Fonds de Développement Local; created with World Bank support in 2007).

The World Bank did contribute to improvements in subnational public financial management and the intergovernmental fiscal transfer system. Early support improved public financial management at the communal level, including through (i) the rollout of the integrated financial management information system to regional capitals, streamlining communal taxation (which led to increased tax collection), and (ii) improved decentralized management of natural resources and land certificates (Demetriou 2019). The World Bank directly supported the increased fiscal autonomy of local governments, with grants to rural communities of up to $5,000 per commune through the Local Development Fund (Fonds de Développement Local) increasing by 100 percent in 2021. Through the Public Sector Performance Project, performance-based conditions incentivized more timely fiscal transfers to local governments. Prior actions through the Inclusive and Resilient Growth DPO programmatic series supported greater transparency in relation to planned and executed fiscal transfers to local governments (for instance, by amending the statute to require publication of planned transfers, executed expenditures for the year prior, and an explanation of the prioritization guidelines regarding the distribution of expenditures across regions). The World Bank also supported full operationalization of the National Equalization Fund (Fonds National de Péréquation), established in 2016 (with support from the Public Sector Performance Project), which integrated a pro-poor equalization formula into the country’s intergovernmental fiscal transfer system, thus channeling greater resources to the most underprivileged communes. Transfers through the National Equalization Fund (Fonds National de Péréquation) have been significantly delayed, calling into question the efficacy of the World Bank’s DPO support, which was aimed at enhancing budget transfers to local governments (World Bank 2020a). However, overall, increased fiscal transfers are on the rise: Madagascar’s government increased operating fiscal transfers to subnational governments by 20 percent in 2022.

Managing and Mitigating Political Risks

World Bank interventions in the governance space were sometimes undermined by elite capture and weak rule of law, suggesting the need for the World Bank to better mitigate political economy risks identified ex ante. Elite capture of project benefits, reversals of prior actions, or vested interests undermining accountability institutions were frequent problems. In one case, customs reforms to improve the identification of fraud at ports backfired: rent seekers succeeded in getting the reform champion—the General Director for Customs—imprisoned on what some have claimed are politically motivated charges. In the Third Environment Program Support Project (EP3), local elites influenced the selection of village households that were eligible for safeguard compensation. As a result, households with higher socioeconomic and food security status, better access to markets, and membership in local forest management associations were more likely to be identified as project affected, potentially exacerbating rather than addressing social inequities (World Bank 2021d). Relatedly, the Extended Governance and Anticorruption Review (World Bank 2015a) found that illegal logging has persisted, in part due to EP3’s omission of key stakeholders.

The Bank Group’s support for the protection of rosewood may have also been negatively affected by less-than-adequate political economy risk mitigation efforts. As part of the World Bank’s stand-alone Reengagement DPO, a prior action requiring the creation of an interministerial committee for securing and disposing of seized stocks of precious woods was viewed as high risk, given strong vested interests and lack of rule of law in this area. Some World Bank staff raised concerns that members of the committee had ties to the illegal rosewood trade and that budget support may not have been an appropriate instrument, given the risks of elite capture and corruption. Although efforts were made to mitigate the risk by revising the composition and reporting structure of the committee, progress fell short of the target (a viable use plan for the seized stockpiles of precious wood agreed with the Convention on International Trade in Endangered Species of Wild Fauna and Flora) in part due to insufficient political economy analysis being undertaken during project preparation (World Bank 2017b).

Several DPO prior actions were reversed in the face of strong vested interests. The Bank Group’s 2021 Performance and Learning Review for Madagascar noted that DPOs “were important vehicles for supporting integrated reform packages but suffered from persistent implementation gaps and faced some policy reversals” (World Bank Group 2021b, 17). A review of Implementation Completion and Results Reports and Implementation Completion and Results Report Reviews reveals that this situation was attributed not only to limited institutional capacity, a lack of strong political commitment, and changes in government personnel but also, critically, to strong vested interests in politically sensitive sectors, such as energy. For example, several reforms supported by the Public Finance Sustainability DPOs were reversed; transfers for fuel subsidies were eliminated in 2019, but they were reinstated in part due to the collapse in international oil prices.

Despite lessons from previous DPOs, there were systematic shortcomings in the World Bank’s assessment of political and governance risks and fiduciary and stakeholder risks. According to the World Bank’s self-evaluation of the Fiscal Sustainability and Energy DPO (World Bank 2021a), “the mitigation strategy planned in the program document of conducting stakeholder consultations backed with communication outreach activities appears relatively weak, as evidenced particularly by the failure to achieve most agreed targets,” particularly related to efforts to reform JIRAMA and improve governance of the energy sector. The result is that inefficient fuel subsidies and transfers, as well as enduring tax expenditures, that benefit the country’s elite continue to crowd out higher-priority investments and social spending.

Some interventions directly or indirectly supported by the World Bank may have unintentionally weakened accountability institutions. One prominent form of support was using the financial incentive of the TAA to encourage the strengthening of democratic institutions. One such effort in pursuit of this milestone came in the form of the 2018 establishment of the High Court of Justice (Demetriou 2019), which, to be sure, was achieved without direct support from the World Bank.9 This court was given the exclusive mandate to try high-level politicians, but parliamentary authorization is required to pursue high-scale corruption cases. This has led to de facto immunity of corrupt parliamentarians and the politicians connected to them. The establishment of the new court may have unintentionally weakened the anticorruption court (Pôles Anti-Corruption), which no longer has exclusive responsibility for trying corruption and money laundering cases (Schatz 2019). World Bank support for the establishment of a special tribunal for the trafficking of rosewood to help Madagascar meet its commitments to the Convention on International Trade in Endangered Species of Wild Fauna and Flora and to combat collusion between economic operators and high public officials has been praised by many experts. However, some have expressed concerns about a fragmenting of anticorruption efforts led by the Committee to Safeguard Integrity (Comité pour la Sauvegarde de l’Intégrité), which has been tasked with ensuring the coordination, monitoring, and evaluation of the country’s anticorruption system.

- See http://www.mef.gov.mg/reportingcovid.

- Soa Afafy Hampahomby ny ho Avy was established in 2011 and provides support to local governments and civil society organizations on participatory budgeting, local taxation, economic local development, intercommunity planning, land management, strategic alliances with ministries, and policy dialogue with the government and donors.

- The development policy operation (DPO) programmatic series comprised the Resilience DPO, the Inclusive and Resilient Growth I and II DPOs, and the Public Finance Sustainability and Investment I and II DPOs.

- The DPOs were the Investing in Human Capital development policy financing, the Fiscal Sustainability and Energy DPO, the Public Finance Sustainability and Investment DPO series, the Resilience DPO, and the Reengagement DPO.

- Although an annual report on tax expenditures has been published as an appendix to the budget since 2017, this has not led to a significant reduction in tax expenditures, with only 1.3 billion ariary eliminated by 2019, compared with a target of 70 billion ariary. DPO prior actions succeeded in removing ineligible beneficiaries from the pension roster, leading to a reduction in transfers to the pension fund as a share of total expenditures from 5.8 percent to 3.8 percent, but this did not meet the target of 1.6 percent because some wage beneficiaries were shifted to pension beneficiaries in parallel. Although the government revised the structure of retail fuel prices in 2018 and 2019 as part of its strategy to eliminate fuel subsidies, reforms were not sustained as an automatic price adjustment mechanism had not been put in place as of 2020 (World Bank 2019).

- Through the Power Sector Financial Sustainability advisory services and analytics, the World Bank supported the development of an energy subsidy reform program to be implemented with the support of the Fiscal Sustainability and Energy DPO. This analytical work helped raise awareness of Jiro sy Rano Malagasy’s finances and of options to address the fiscal situation.

- Relevant prior actions included establishing an automatic adjustment mechanism of fuel prices and passing a decree to eliminate the fuel subsidy, completing a verification of pension beneficiaries, publishing quarterly statistics on the cost of electricity for each power supply contract, and adopting standard contracts for all power generation agreements by Jiro sy Rano Malagasy.

- The World Bank (2020a) noted that “a more diligent analysis of JIRAMA’s [Jiro sy Rano Malagasy’s] political economy including the clientelist networks that need to be dismantled within and around the utility would have helped to more closely and effectively supervise implementation of reforms through additional measures including more robust monitoring provisions and independent auditors.”

- Establishment of the High Court, including most justice reforms, was led by the European Union.