World Bank Support for Domestic Revenue Mobilization

Chapter 2 | World Bank Interventions in Support of Domestic Revenue Mobilization

The World Bank increased its support for domestic revenue mobilization (DRM) between 2016 and 2019, especially since 2018 and to International Development Association–eligible countries and to countries in Sub-Saharan Africa. The increase was greatest in countries with lower ratios of revenue to GDP. DRM-related investment projects in middle-income countries were scaled up significantly in the evaluation period. The World Bank made greater use of development policy operations to support DRM during the evaluation period compared with the previous three-year period, placing increased emphasis on tax policy reforms while improving its collaboration with development partners through the Platform for Collaboration on Tax.

World Bank interventions and priorities in support of DRM at the country level were generally well grounded in analytical and diagnostic work that identified major country-specific constraints to DRM. The number of diagnostic tools on DRM has increased recently. Each has potentially important value added in informing policy dialogue, operational design, and priority setting, but their proliferation may present challenges for task team leaders (many of whom are not tax experts) in identifying and prioritizing reforms at the country level and within operations systematically and efficiently.

Green and health taxes received greater attention in the evaluation period, though from a low level. Much of this attention was due to the work of the Global Tobacco Control Program, which drew experts together from across Global Practices and external development partners to influence operations design and prepare assessments on many countries, including with respect to tobacco taxes.

Analytical work on the distributional implications of tax policy increased compared with the previous three-year period. Attention on the expected distributional implications of DRM interventions increased in low-income countries. Less attention has been given to the distributional impact of DRM support to middle-income countries. However, reporting on the ex post impact of tax reform in Implementation Completion and Results Reports was infrequent, particularly in development policy operations.

Portfolio of Domestic Revenue Mobilization–Related Interventions

During the evaluation period, FY16–19, the World Bank supported 116 countries to improve DRM through lending operations and projects and through advisory services and analytics (ASA; table 2.1). Half of the countries were IDA eligible, one-third were borrowers from the International Bank for Reconstruction and Development only, and the remainder were blend borrowers. Countries with revenue-to-GDP ratios below 15 percent tended to receive higher levels of World Bank support for DRM than those above this threshold.

Table 2.1. Source and Volume of World Bank Support to Domestic Revenue Mobilization

|

Instrument |

Commitments Approved during FY12–15 |

Active Portfolio at the Start of the Evaluation Period |

Commitments Approved during FY16–19 |

|||

|

(no.) |

(US$, millions) |

(no.) |

(US$, millions) |

(no.) |

(US$, millions) |

|

|

Investment projects focused on DRM |

20 |

1,020 |

15 |

616.4 |

31 |

1,488 |

|

Development policy operations with at least one prior action focused on DRM |

65 |

n.a. |

17 |

n.a. |

84 |

n.a. |

|

Trust-funded projects |

8 |

128 |

5 |

47.7 |

9 |

68.5 |

|

Advisory services and analytics |

425 |

47 |

425 |

47 |

322 |

88 |

Source: World Bank Business Intelligence database, May 2021.

Note: Trust-funded projects presented do not include those under the Global Tax Program. DRM = domestic revenue mobilization; FY = fiscal year; n.a. = not applicable.

Investment Project Financing

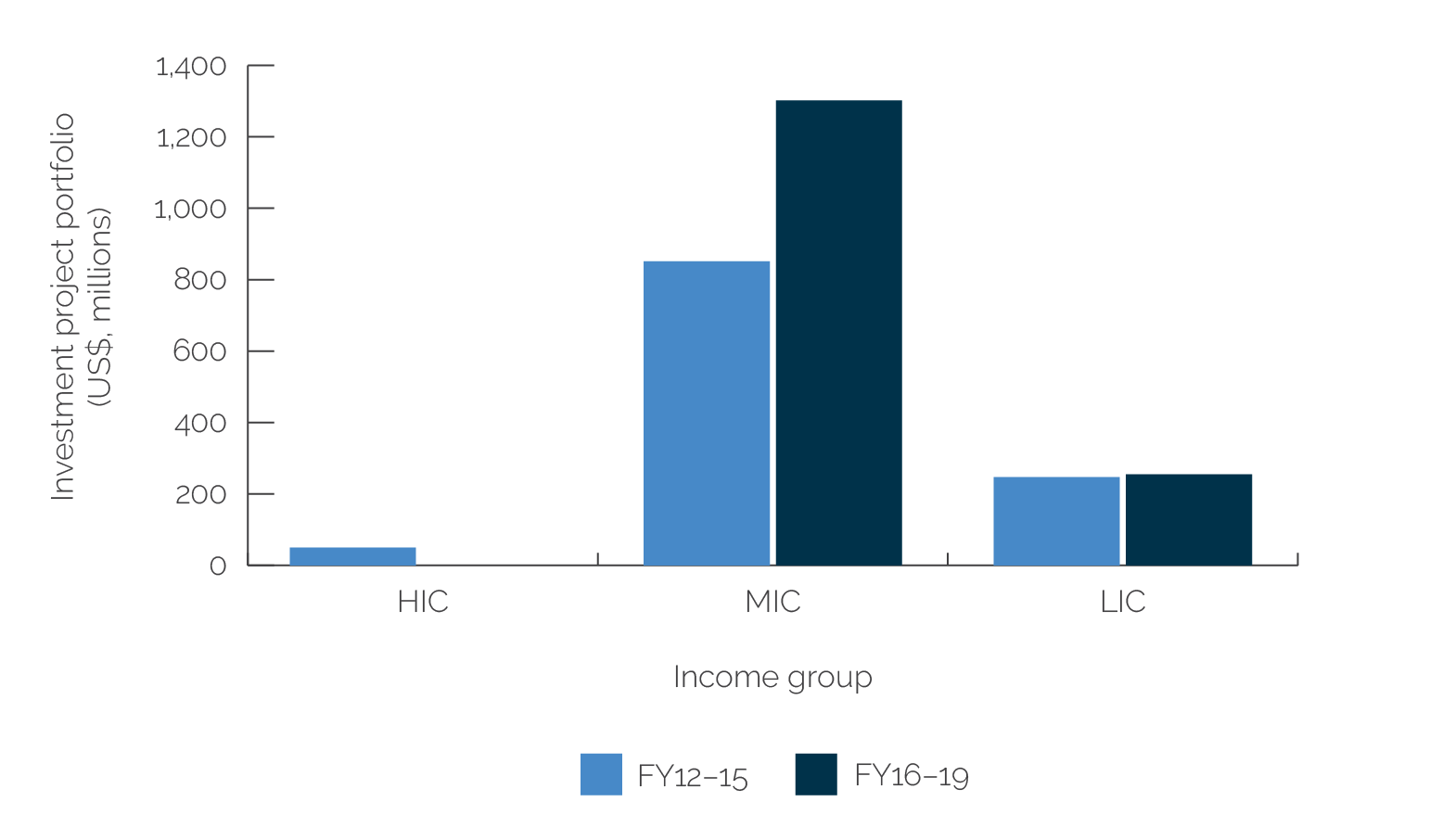

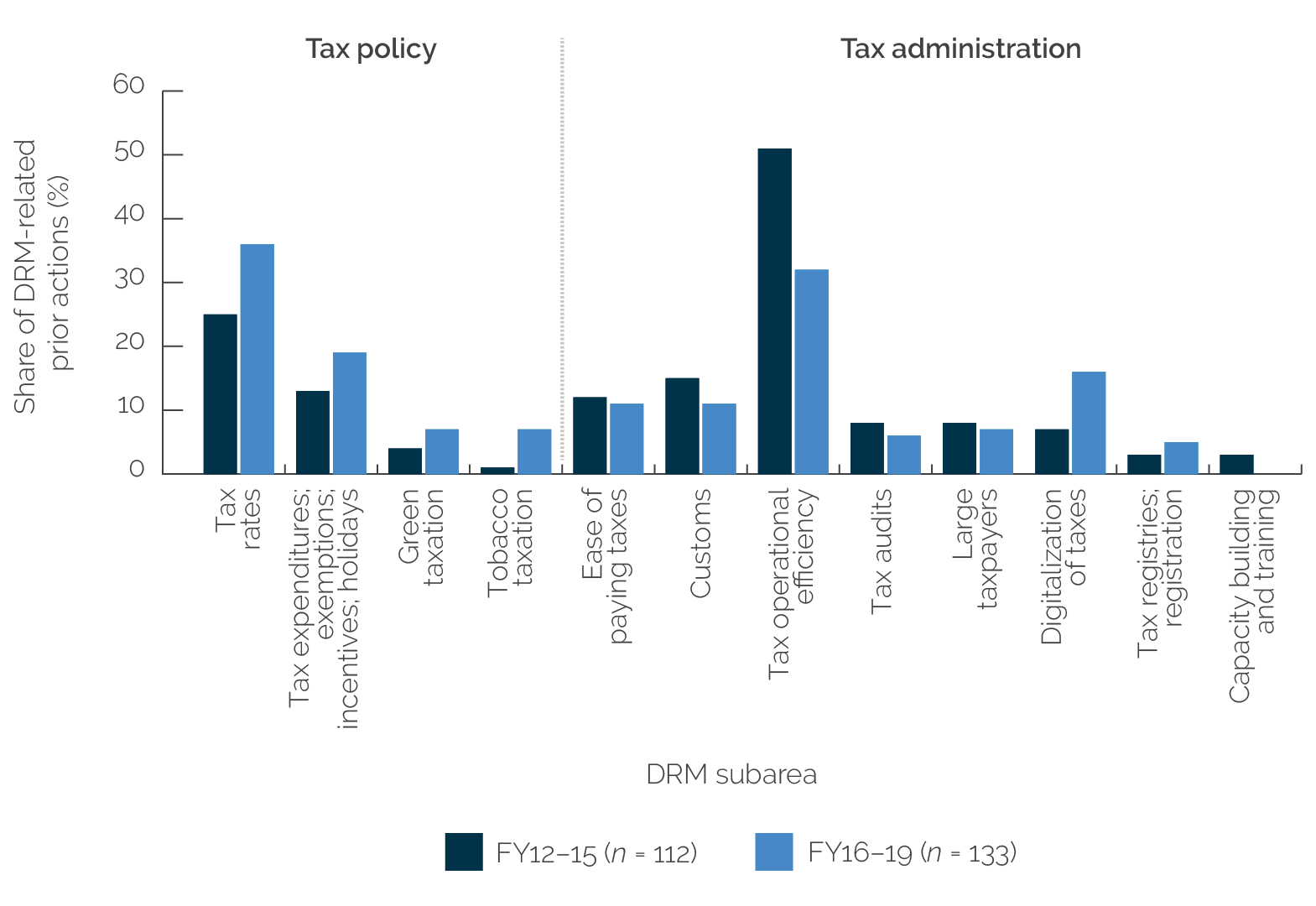

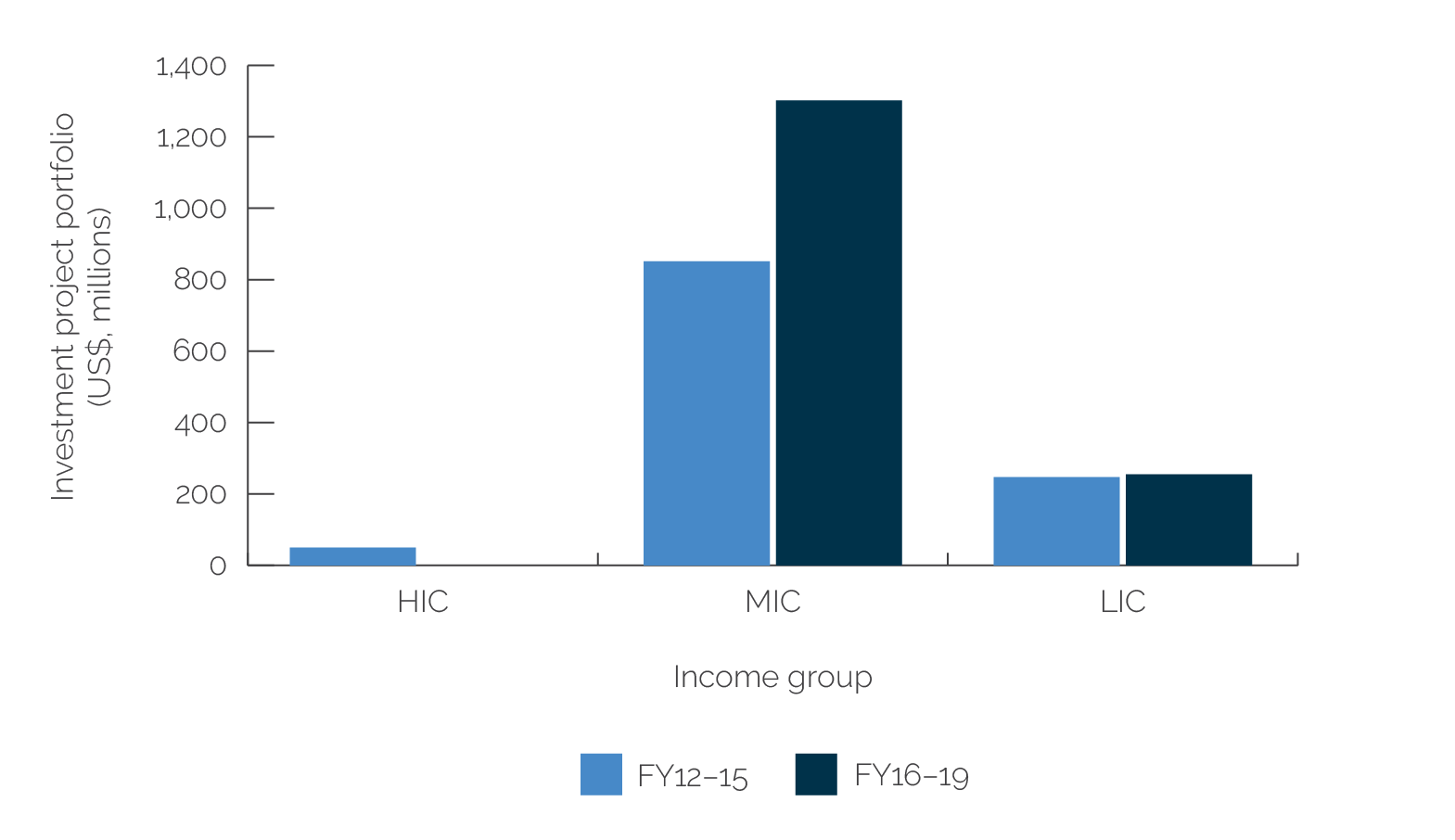

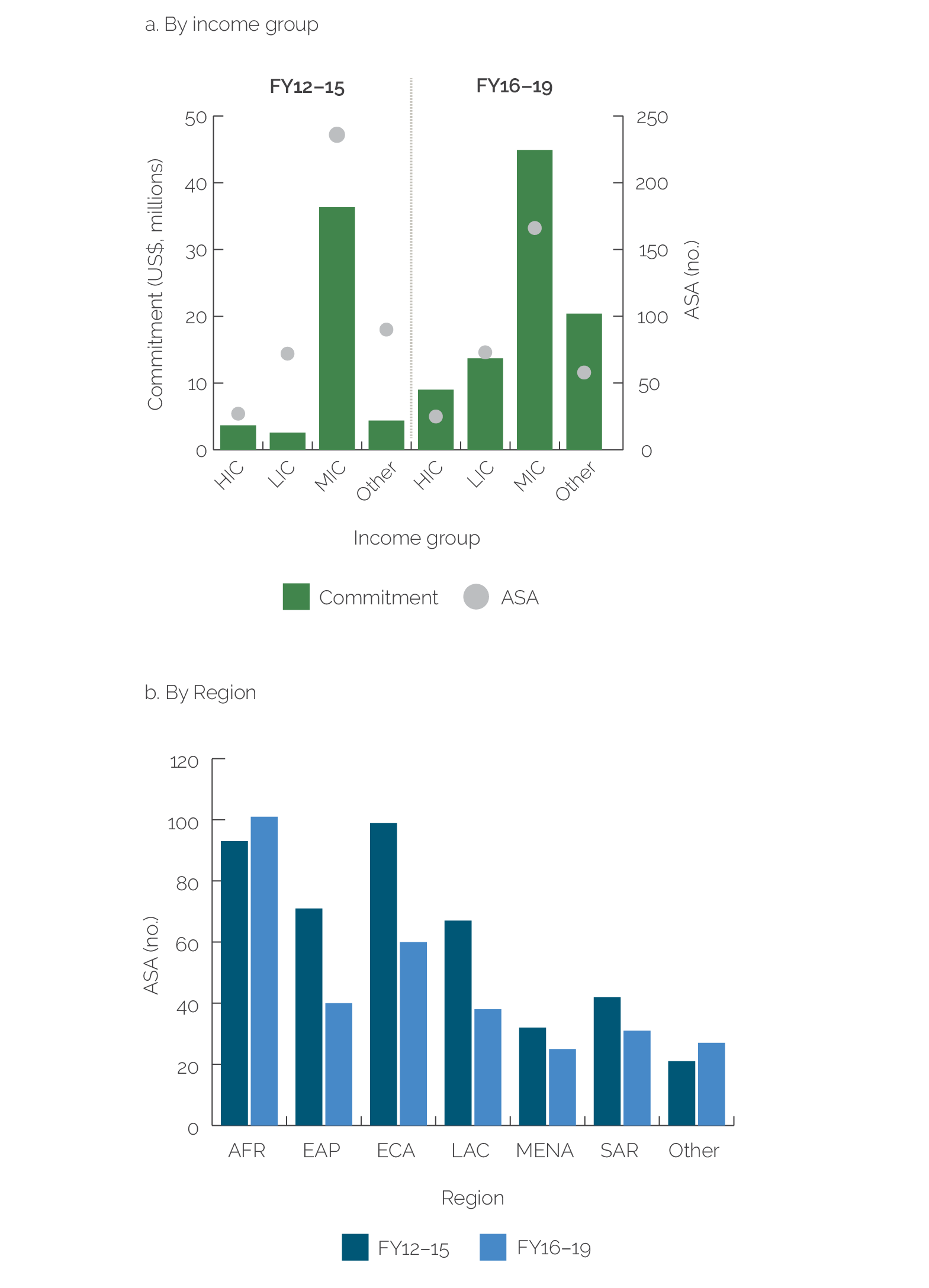

DRM-related investment projects in middle-income countries and in Africa and South Asia were scaled up significantly in the evaluation period (figure 2.1).1 The World Bank approved $1.5 billion to support 40 DRM-related investment projects in FY16–19, covering 28 countries, an increase from $1.1 billion in FY12–15 for 28 projects in 25 countries (with the average project size about the same between periods). The typical project was a tax administration project with objectives focused on improving or increasing efficiency and effectiveness of revenue management, taxpayer compliance, and modernization of the tax system. South Asian countries received the largest share of commitments for DRM-related investment projects during the evaluation period (table 2.2). This was concentrated in large projects in India (5) and Pakistan (5).

Figure 2.1. Investment Project Portfolio by Income Level, FY12–15 and FY16–19

Source: World Bank Business Intelligence database, May 2021.

Note: FY = fiscal year; HIC = high-income country; LIC = low-income country; MIC = middle-income country.

Table 2.2. Regional Breakdown of Domestic Revenue Mobilization–Related Investment Projects Approved, FY16–19

|

Region |

DRM-Related Investment Projects (no.) |

Value of DRM-Related Investment Projects (US$, millions) |

Average Value of DRM-Related Investment Projects per Country (US$, millions) |

|

AFR |

17 |

652 |

38 |

|

SAR |

12 |

727 |

61 |

|

ECA |

4 |

88 |

22 |

|

EAP |

4 |

20 |

5 |

|

LAC |

1 |

55 |

55 |

|

MENA |

1 |

15 |

15 |

|

Total |

39 |

1,557 |

196 |

Source: Independent Evaluation Group.

Note: Total value includes trust-funded projects. AFR = Africa; DRM = domestic revenue mobilization; EAP = East Asia and Pacific; ECA = Europe and Central Asia; FY = fiscal year; LAC = Latin America and the Caribbean; MENA = Middle East and North Africa; SAR = South Asia.

Development Policy Financing

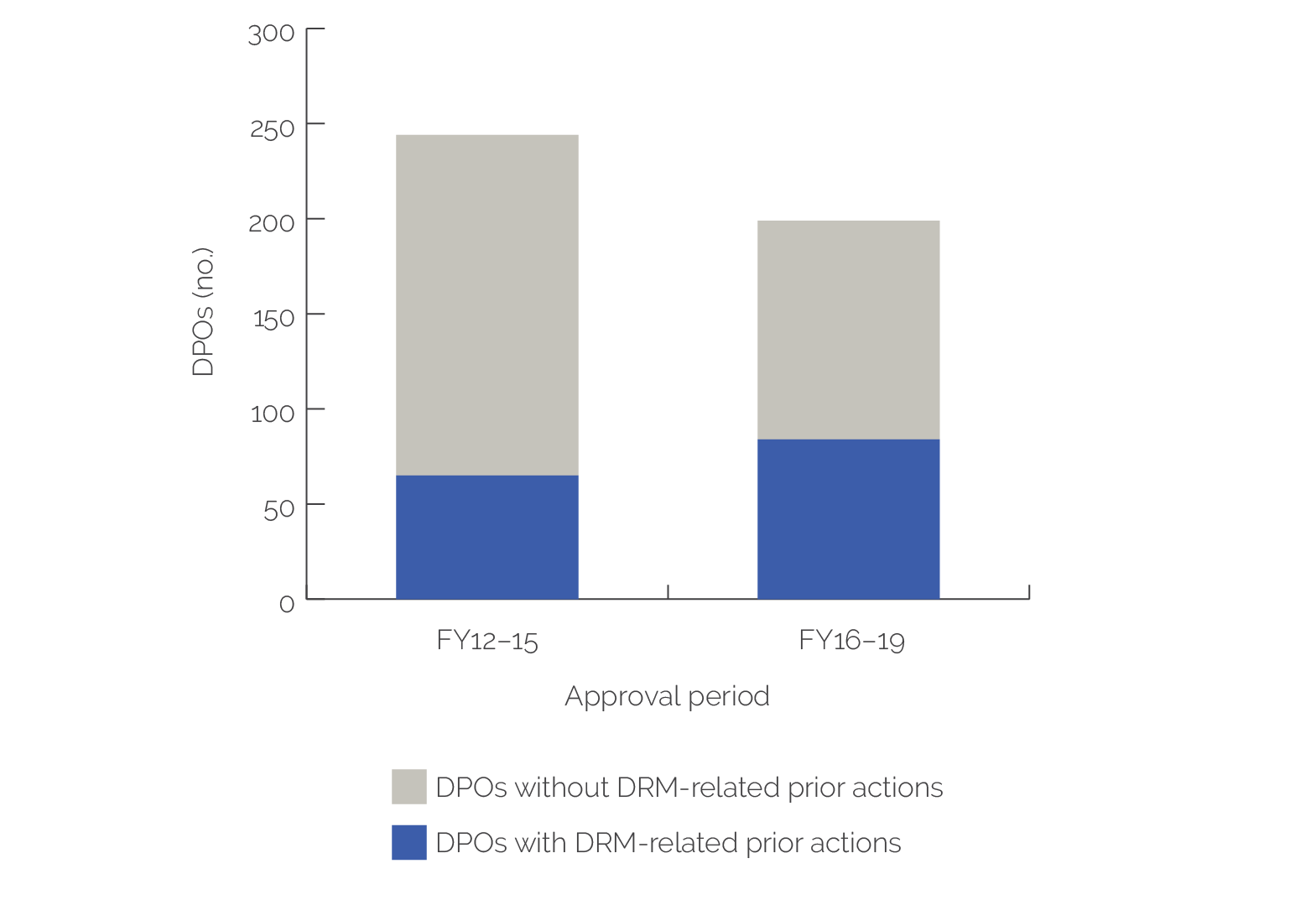

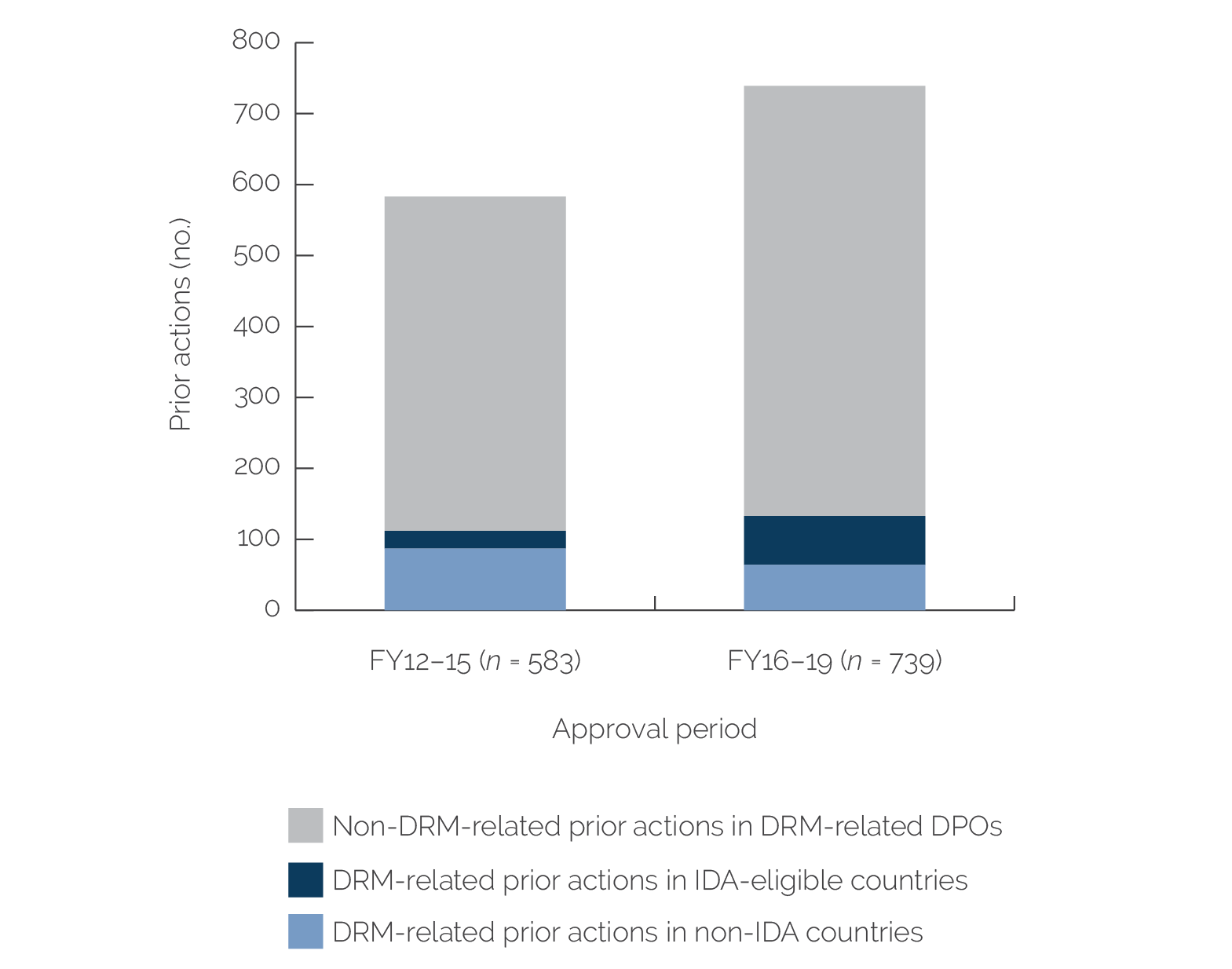

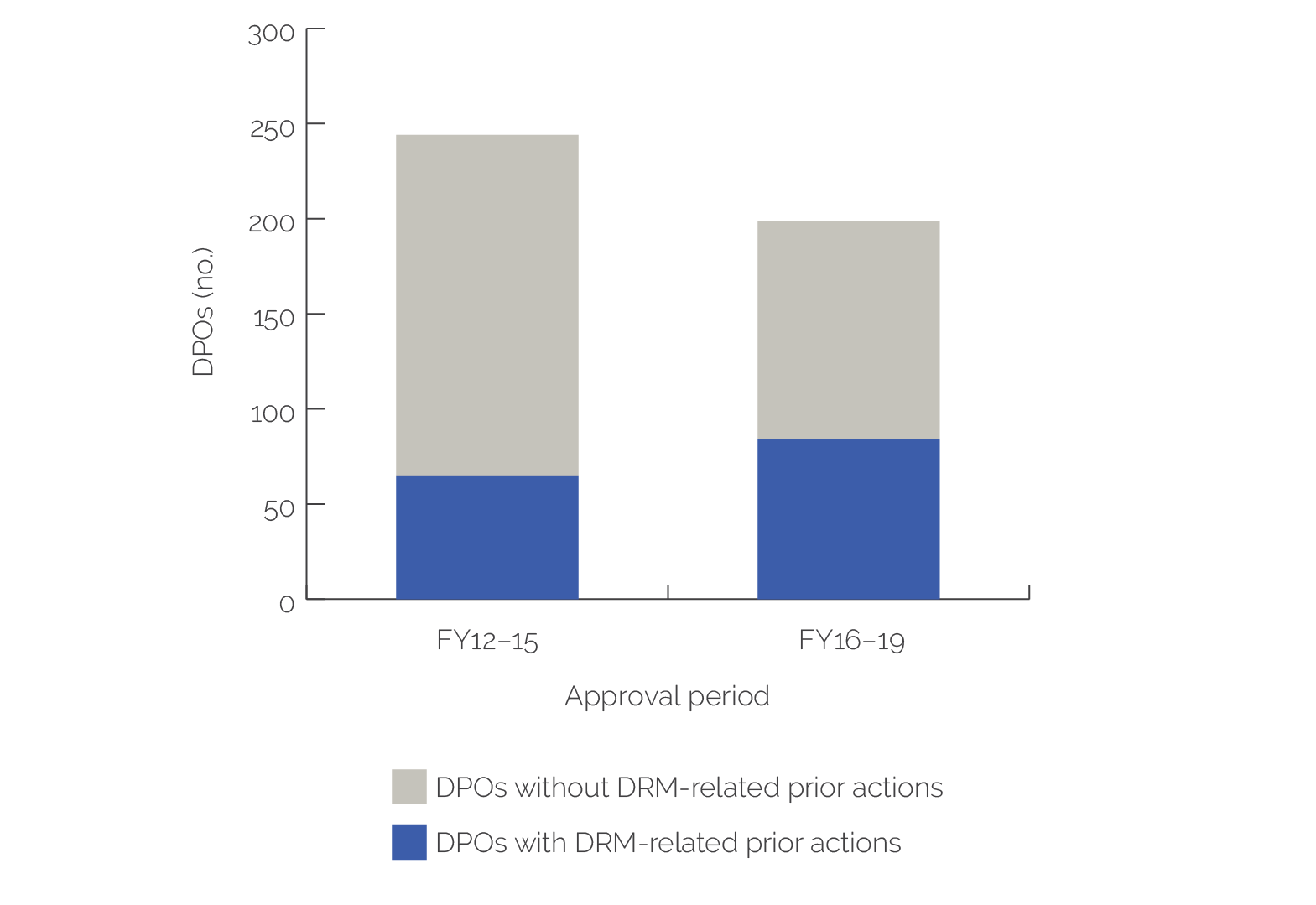

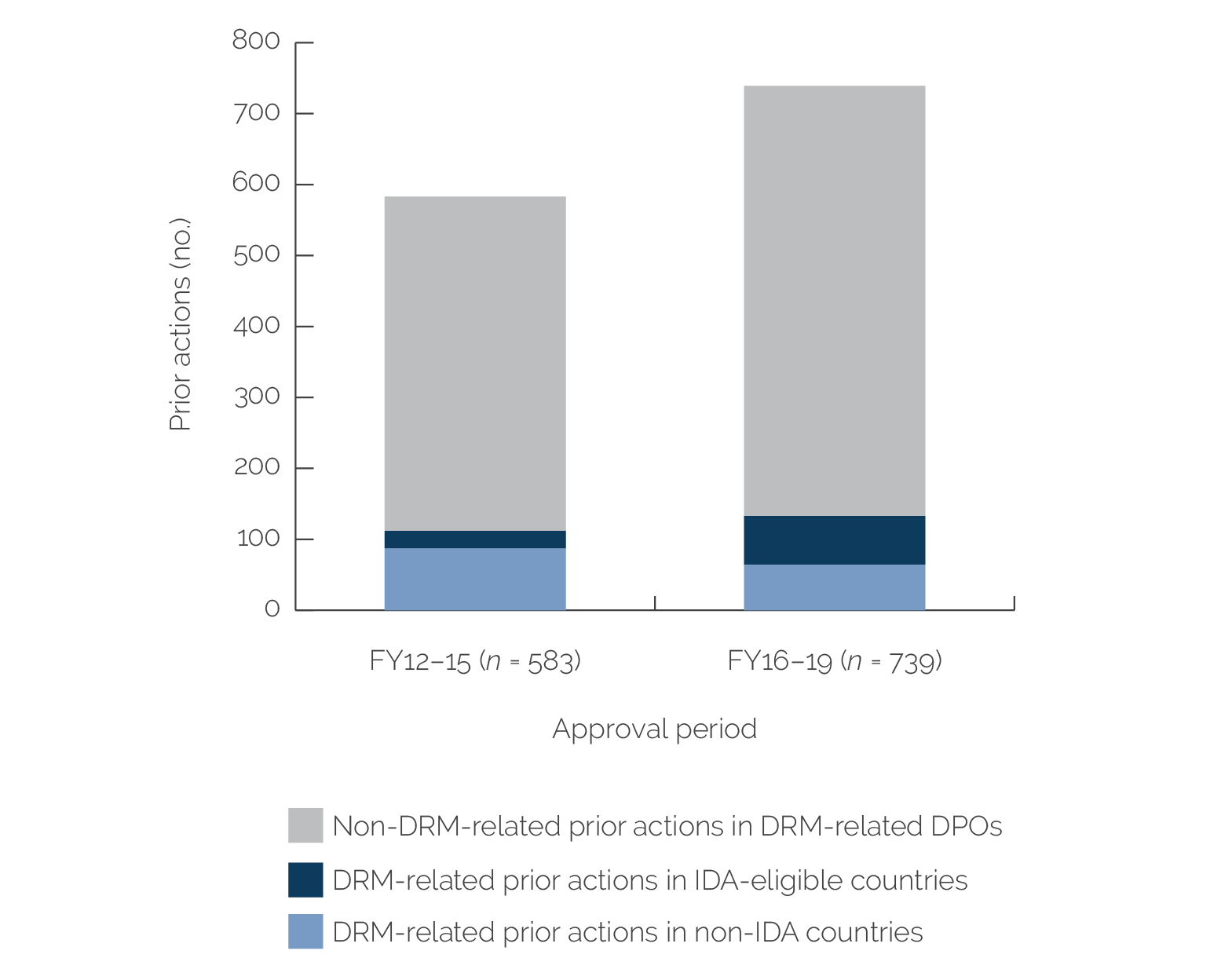

DRM played a larger role in development policy financing (DPF) in the evaluation period than in the previous three-year period. The number of development policy operations (DPOs) approved with at least one DRM-related prior action increased from 65 to 84 between FY12–15 and FY16–19, and the number also increased as a share of DPOs from 27 percent to 42 percent. This pattern was more pronounced in IDA-eligible countries (figures 2.2 and 2.3). In total, there were 133 DRM-related budget support operations across 54 countries. In the previous period, there were 112 DRM-related budget support operations across 36 countries.

Figure 2.2. Development Policy Operations with Domestic Revenue Mobilization–Related Prior Actions

Sources: World Bank Business Intelligence database; Operations Policy and Country Services Prior Actions database, World Bank, Washington, DC, April 2021.

Note: DPO = development policy operation; DRM = domestic revenue mobilization; FY = fiscal year.

Figure 2.3. DRM-Related Prior Actions in DPOs with at Least One DRM-Related Prior Action, by Borrowing Group, FY12–15 and FY16–19

Source: Independent Evaluation Group.

Note: DPO = development policy operation; DRM = domestic revenue mobilization; FY = fiscal year; IDA = International Development Association.

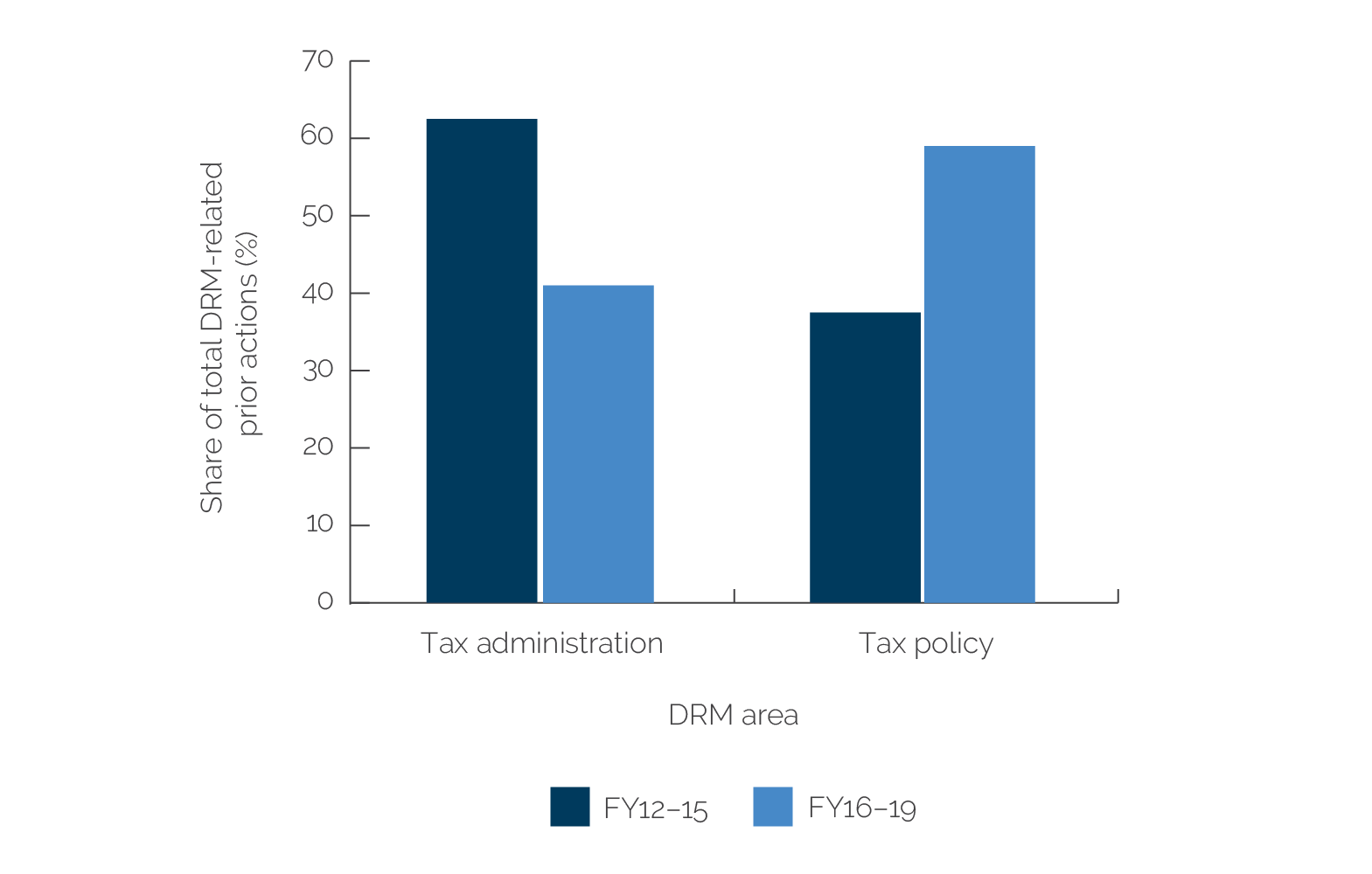

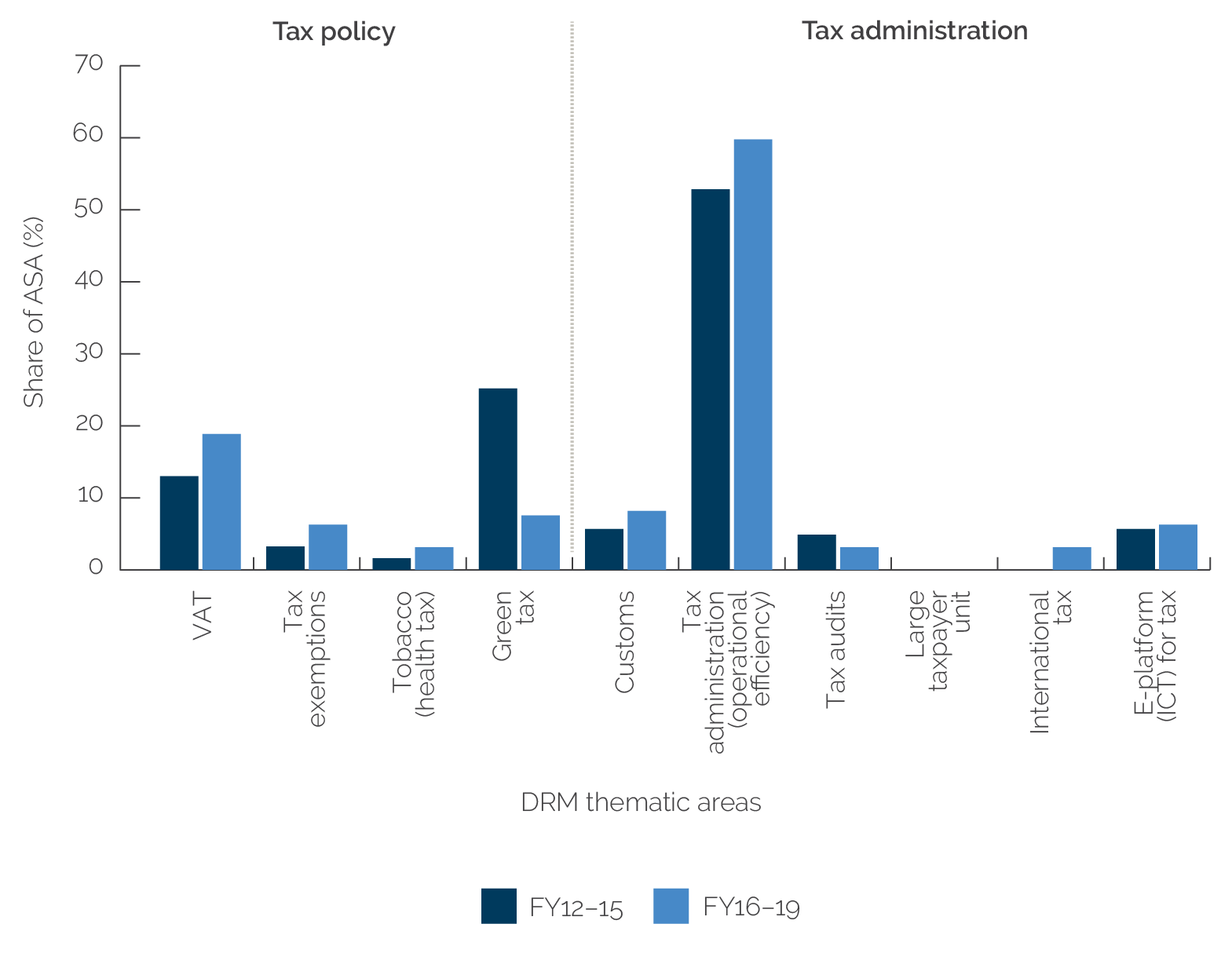

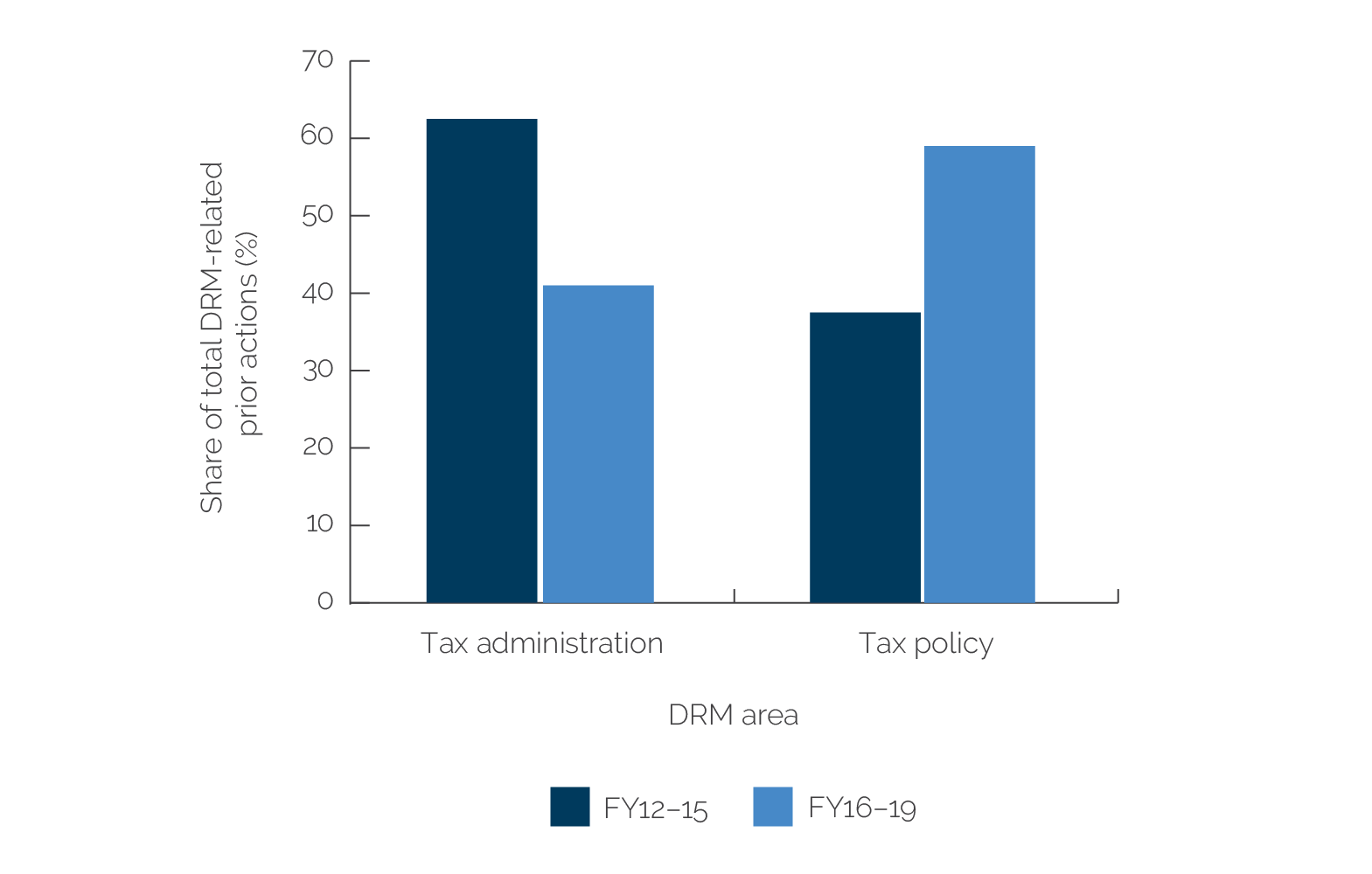

Domestic Revenue Mobilization–Related Prior Actions

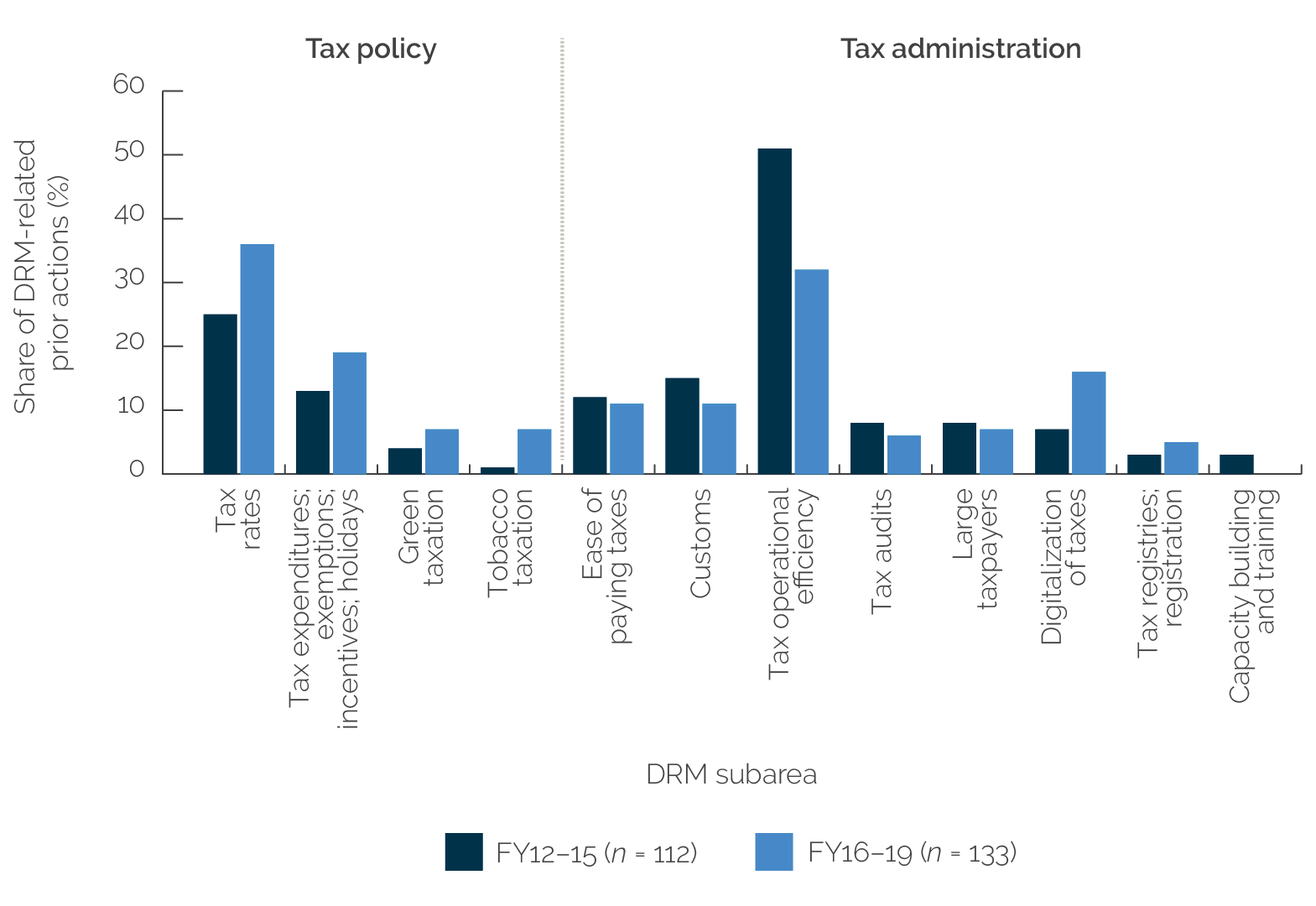

DRM-related prior actions have been shifting toward greater focus on tax policy (figure 2.4). In FY12–15, prior actions were focused on tax administration, particularly to improve operational efficiency. In FY16–19, the focus of DPOs shifted to tax policy, particularly reforms related to changes in tax rates (for example, value-added taxes [VATs], corporate income tax, and personal income tax). Given the increased use of DPOs relative to the earlier period, this implies an increase in attention to tax policy in World Bank operations.

Figure 2.4. Domestic Revenue Mobilization–Related Prior Actions by Area

Source: World Bank Operations Policy and Country Services Prior Actions database, April 2021.

Note: DRM = domestic revenue mobilization; FY = fiscal year.

Most DRM-related prior actions were one of three types: changes in tax rates, reductions in tax expenditures, and improvements in the ease of paying taxes.2 The share of these three types rose from a little more than half in the FY12–15 period to two-thirds in the evaluation period. Prior actions supported green and health taxes more frequently in the evaluation period, though from a negligible base, and digitalization of taxes rose significantly as a share of the total. Prior actions intended to improve operational efficiency of tax administration became less important between the two periods (figure 2.5).

A little less than one-quarter of DRM-related prior actions in the evaluation period sought to address tax expenditures or tax exemptions.3 Of these, 30 percent required the publication of the inventory of tax exemptions and expenditures (ostensibly to strengthen accountability in granting tax exemptions) or a tax expenditure statement, and 40 percent required an outright reduction or elimination of tax exemptions and expenditures. Most of the rest required changes to the governance framework for granting new exemptions. Program documents rarely explained the motivation for the approach chosen to reduce inefficient and regressive tax exemptions.

However, case studies and other evidence show frequent reintroduction of significant new exemptions. This suggests a benefit in giving greater attention to measures to strengthen the governance framework for granting exemptions. In Pakistan, after initially declining starting in 2014, tax exemptions were reintroduced in advance of 2018 elections, increasing from 1.6 to 2.5 percent of GDP between 2017 and 2019. As a result, tax collection deteriorated from 12.9 to 11.6 percent of GDP. In Panama, elimination of tax exemptions proved more difficult than envisioned amid strong political headwinds in domestic tax reform outside the executive branch of government. In Madagascar, the World Bank supported disclosure of a summary of all tax expenditures in the annual budget law, but this did not contribute to a significant increase in revenue. Far from a targeted reduction of about $24.8 million in tax exemptions, tax expenditures eliminated during the Public Finance Sustainability and Investment DPO series (2016–18) were less than $0.4 million, and in 2017, the government approved additional tax benefits for special economic, industrial, and agriculture zones.

Attention to the establishment and functioning of large taxpayer units in DPOs was modest, and outcomes were weak. Although large taxpayer units are often seen as potentially effective in improving taxpayer compliance and raising revenue, their establishment received little attention in World Bank–supported operations.4 In each period, nine DPOs with at least one DRM-related prior action sought to establish or strengthen large taxpayer units. However, only about half of the targets for results indicators related to them were achieved for DPOs approved between FY16 and FY19. Only about half of the DPOs approved during the evaluation period with prior actions related to these units have closed. For those that have, three-quarters of targets for the associated results indicators have been achieved.

Program documents often discussed the expected progressive distributional impact of DRM measures, but Implementation Completion and Results Reports rarely reported ex post impact. The time frame of a stand-alone DPO may not allow for such reporting because of data availability, but it is unclear if and at what point the World Bank intends to assess the distributional impact at the country level of the tax reform it supports.

Figure 2.5. Domestic Revenue Mobilization–Related Prior Actions by Domestic Revenue Mobilization Subcategory, FY12–19

Source: World Bank Operations Policy and Country Services Prior Actions database, April 2021.

Note: Tax operational efficiency refers to prior actions supporting activities that aim to improve tax administration processes and effectiveness. Percentages add up to more than 100 percent because some prior actions fit into more than one category. DRM = domestic revenue mobilization; FY = fiscal year.

An assessment of the relevance of results indicators in DPOs to measure progress in improving DRM suggests room for improvement.5 Results frameworks tracking progress with DRM have often proved problematic, undermining opportunities for course correction and learning from experience. Close to half of all DRM-related results indicators in DPOs were overall and tax-specific revenue-to-GDP indicators, and more than 40 percent were tax inspection–related indicators. The DRM-related indicators were often too high level or too weakly related to prior actions (for example, use of the revenue-to-GDP ratio to capture the impact of an increase in corporate tax rates), and the tax inspection–related indicators were often too output oriented to measure impact. These findings are consistent with those of IEG’s Evaluation Insight Note on domestic revenue mobilization, which observed that the quality of DRM-related indicators was often an issue, limiting the ability to monitor the impact of a project or operation (World Bank 2023). Some results indicators had little or no link to the operation’s specific DRM components (such as in Liberia and Pakistan or in Croatia, which also had no baselines or targets).

Green and Health Taxation

Prior actions to encourage green and health taxation emerged in the FY16–19 period as the third largest group of tax policy actions supported by budget support operations (table 2.3). For green taxes,6 prior actions included measures to increase VAT collection for land, sea, and air vehicles and services and for mining. For health taxation, prior actions focused on increasing general sales and excise taxes for alcohol, sugary drinks, and tobacco.

- Green taxes. Compared with the previous period, the evaluation documented a slight increase in the share of prior actions supporting green taxation. The total number of relevant prior actions increased from 4 out of 112 in FY12–15 to 9 out of 133 in FY16–19. Despite this increase, there was only one associated results indicator (which measured an improvement in revenue from petroleum taxes during the later period; table 2.3). Its target was achieved.

- Health taxes. Health taxes gained attention in the evaluation period with the help of initiatives such as the Global Tobacco Control Program: nine DRM-related prior actions (7 percent) supported increases in health taxes.7 Results indicators measuring the impact from health tax prior actions were more prominent in FY16–19, including measures of excise tax collection from alcohol and tobacco. Four of five targets for these results indicators in closed operations were achieved. During the earlier period, only 1 out of 107 indicators measured an increase in excises from tobacco (Philippines Third DPF, approved in FY15).

Table 2.3. Domestic Revenue Mobilization–Related Indicators for Green and Health Taxation

|

Period |

DRM-Related Prior Actions (no.) |

DRM-Related Results Indicators (no.) |

Green Tax |

Health Taxes |

||||

|

Green tax prior actions (no.) |

Green tax–related results indicators (no.) |

Results indicator achievement rating |

Health tax prior actions (no.) |

Health tax–related results indicators (no.) |

Results indicator achievement rating |

|||

|

FY12–15 |

112 |

107 |

4 |

0 |

0 |

1 |

1 |

Achieved |

|

FY16–19 |

133 |

124 |

9 |

1 |

Achieved |

9 |

5 |

1 = not achieved 4 = ongoing operations, thus not yet rated |

Source: World Bank Business Intelligence database, April 2021.

Note: DRM = domestic revenue mobilization; FY = fiscal year.

Nonlending Portfolio

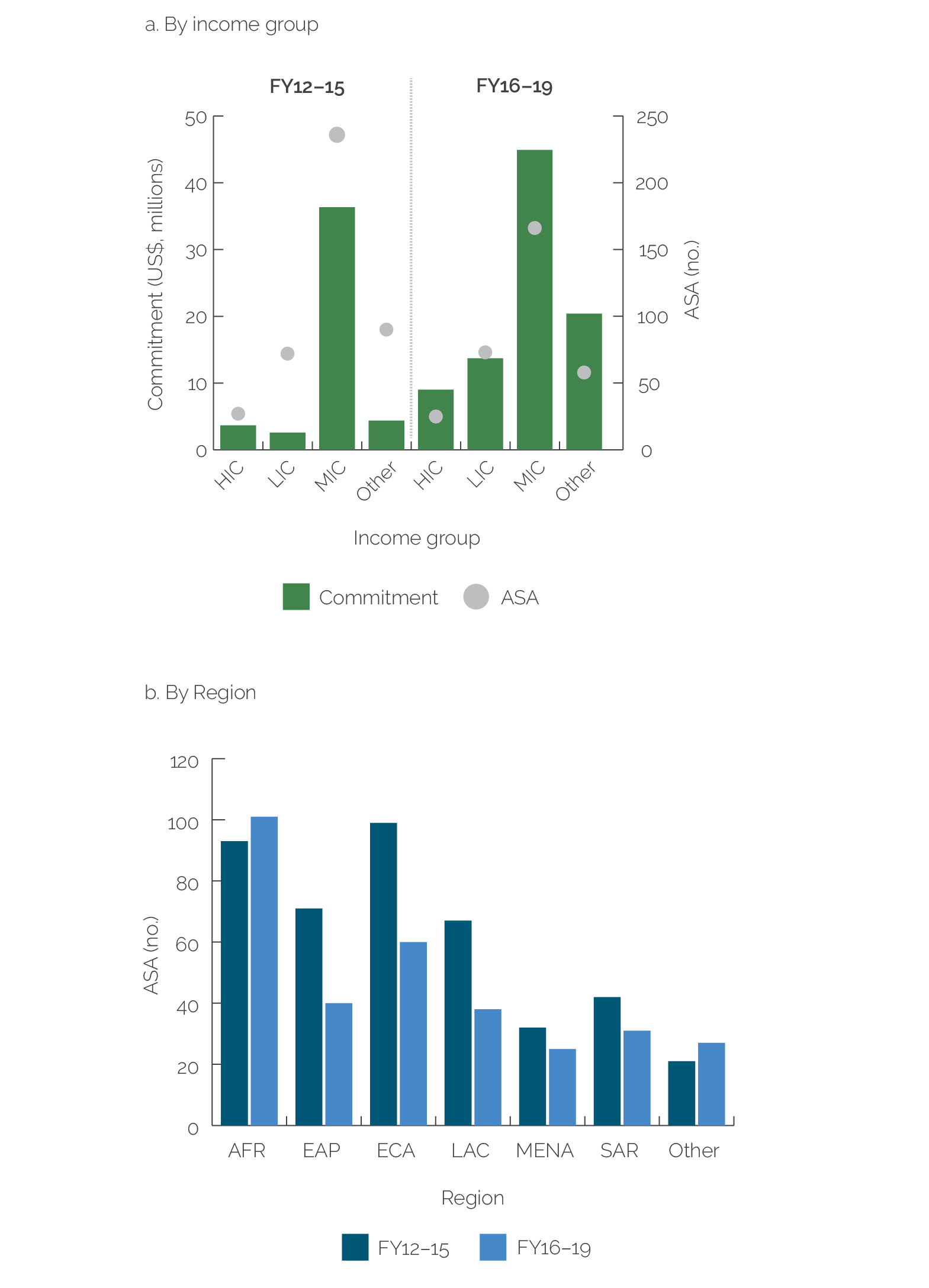

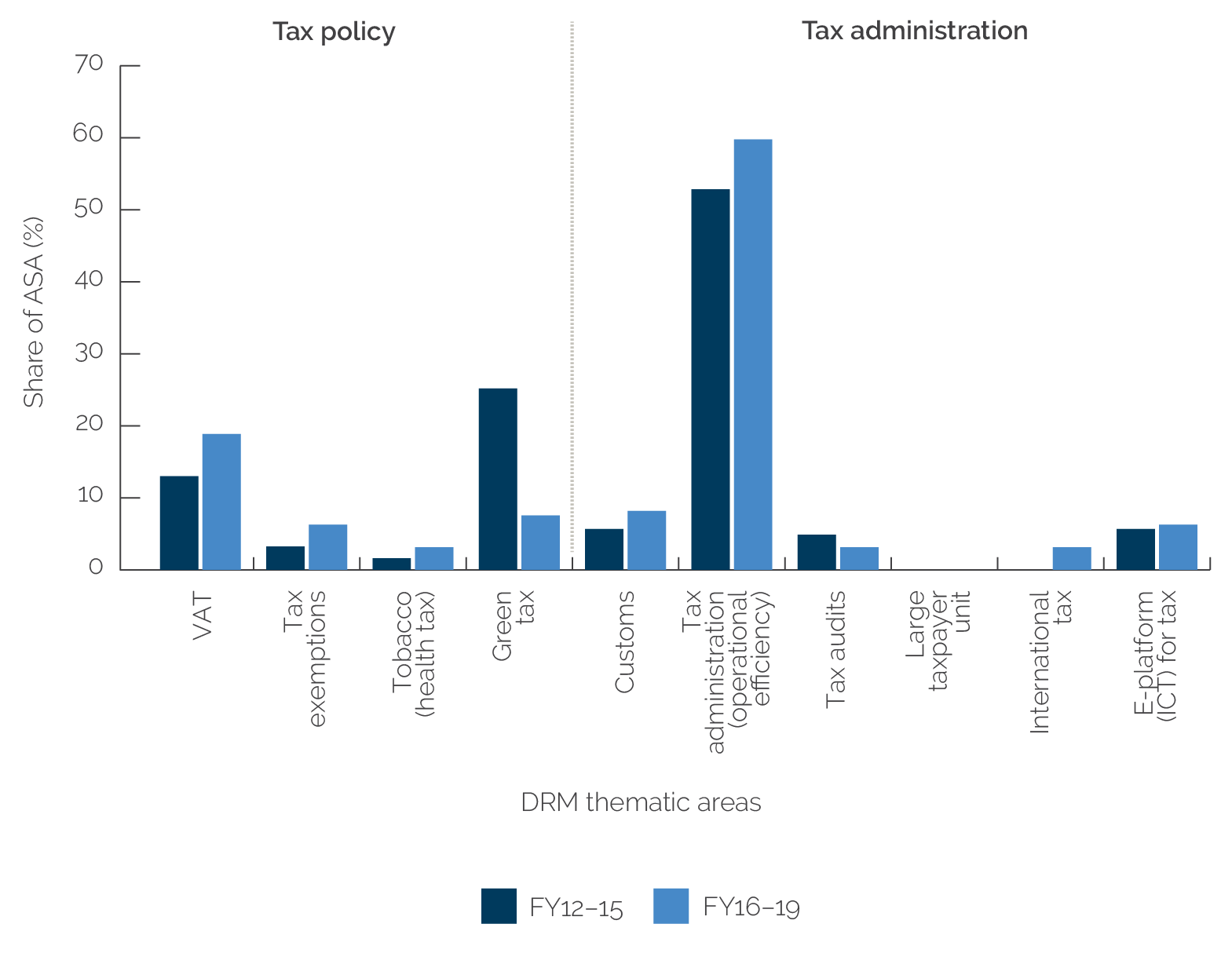

The total number of DRM-related nonlending activities declined over FY16–19, from 425 to 322, but the average size increased significantly. Total spending doubled from $47 million in FY12–15 to $88 million for 117 countries, including multicountry activities (figures 2.6 and 2.7). This was part of an effort to increase selectivity, strategic use, and resourcing of ASA. During both periods, 60 percent of activities were delivered to middle-income countries. By thematic area, DRM-related ASA was focused on tax administration, particularly improving tax operations and services (figure 2.7). About 8 percent of ASA in the evaluation period included some discussion of green taxation, compared with 25 percent in the previous period. Relatively few ASA were undertaken on tax expenditures and exemptions or the use of large taxpayer units. Medium-term revenue strategies were introduced in 2016 and are intended to be a government-led comprehensive approach to tax system reform over the medium term through a whole-of-government approach. Although not a World Bank product, the World Bank—along with the IMF, the Organisation for Economic Co-operation and Development (OECD), and other development partners—is a contributor to this promising initiative. However, as of the end of February 2023, only five countries had completed a medium-term revenue strategy and were implementing it.8

Over the evaluation period, there was increasing analytical work on green and tobacco taxation (although from a low base). The Global Tobacco Control Program supported analytical work at both the global and country levels on tobacco taxation and provided technical assistance and analytical inputs into tobacco tax policy reforms that were adopted in at least 13 countries.9

Figure 2.6. Advisory Services and Analytics

Source: World Bank Business Intelligence database, April 2021.

Note: Other refers to regional or multicountry ASA. AFR = Africa; ASA = advisory services and analytics; EAP = East Asia and Pacific; ECA = Europe and Central Asia; FY = fiscal year; HIC = high-income country; LAC = Latin America and the Caribbean; LIC = low-income country; MENA = Middle East and North Africa; MIC = middle-income country; SAR = South Asia.

Figure 2.7. Advisory Services and Analytics Activities by Theme, FY12–19

Sources: World Bank Business Intelligence database, April 2021; Independent Evaluation Group calculations.

Note: Shares add up to more than 100 percent because some ASA activities addressed more than one theme. ASA = advisory services and analytics; DRM = domestic revenue mobilization; FY = fiscal year; ICT = information and communication technology; VAT = value-added tax.

A considerable range of DRM-related tools, diagnostics, and analytical work has been developed since 2015, both from within and outside the World Bank. These include the Tax Administration Diagnostic Assessment Tool (TADAT), the Tax Policy Assessment Framework, three new tool kits on international tax, tax treaty explorers, the Innovations in Tax Compliance Conceptual Framework, Commitment to Equity Assessment Diagnostic Framework tools, Tax DIAMOND, microsimulation models, tax gap models, and tax incentive analyses. Each one focuses on a distinct dimension of DRM and has potentially important value added in informing policy dialogue, operational design, and priority setting, but their proliferation presents challenges for task team leaders (many of whom are not tax experts) to identify and prioritize reforms effectively at the country level. To date, there is no consolidated assessment that provides a framework to prioritize tax reforms and capacity-building efforts across tax objectives that can be updated and easily drawn on to inform priorities in CPFs, CPF updates, and the identification of prior actions in DPOs.

The World Bank is a partner for TADAT, which evaluates a country’s tax administration systems in nine performance outcome areas based on 26 indicators (box 2.1).

Box 2.1. The Tax Administration Diagnostic Assessment Tool

The Tax Administration Diagnostic Assessment Tool (TADAT), introduced in 2015, is a diagnostic tool for country tax administrations. TADAT was introduced by development partners, including the International Monetary Fund; the World Bank; and bilateral development aid agencies of France, Germany, Japan, the Netherlands, Norway, Switzerland, and the United Kingdom, in response to the 2015 Addis Ababa commitments to improve domestic revenue mobilization in developing countries. The European Commission provided initial financial support to the TADAT trust fund in agreement with the International Monetary Fund and the World Bank. TADAT assessments are usually commissioned by international agencies, such as a multilateral development bank or the International Monetary Fund. The report is finalized after securing the country’s feedback.

TADAT indicators are scored to identify a country’s strengths and weaknesses to help country tax administrations identify areas that need improvement. As of August 2022, 135 assessments have been prepared, including 33 subnational assessments, not all of which have been made public. The World Bank has jointly led or participated in 31 TADAT assessments. TADAT assessments are carried out by teams of accredited assessors. Issues addressed include emerging issues, such as digital taxation, green taxes, and gender imbalances in tax administration. The field guide was updated in 2019, learning from stakeholders’ experience and feedback.

Evidence from case studies for this evaluation indicates that TADAT assessments have been influential in shaping World Bank operations and government reforms in tax administration during the evaluation period in Chad, Madagascar, Rwanda, and, to a lesser extent, Guatemala (see chapter 4 and appendix C).

Sources: BrightScreenProds 2021; World Bank 2021a; evidence from this evaluation’s case studies and semistructured interviews of stakeholders.

Note: The World Customs Organization has developed a parallel diagnostic process for customs. For more information about TADAT, see https://www.tadat.org/home#overview.

The Global Tax Program, launched in June 2018 with funding from development partners, supports advisory services and technical assistance to improve and strengthen tax institutions and revenue mobilization (box 2.2). The program represented a significant expansion of World Bank engagement in DRM, with about 81 percent of its resources supporting expansion of and improvement in the quality of DRM country-level work, with the remaining resources supporting development of diagnostic tax tools, assessment frameworks, and research. As of October 2022, the Global Tax Program has funded engagements in 69 countries, two-thirds of which were IDA eligible.

The FY21 annual progress report of the Global Tax Umbrella Program provides an update on the progress of the activities undertaken by the Global Tax Program between July 2020 and June 2021. An important outcome indicator is the number of reform recommendations endorsed by the respective governments. Of the 201 recommendations made since inception, 73 have already been endorsed, 28 of which were endorsed in FY21. Another outcome indicator—number of reform recommendations (to improve procedures, practices, and standards) endorsed—achieved 11 recommendations against a target of 17 (World Bank 2021a).

Box 2.2. Global Tax Program

The Global Tax Program, established in 2018, helps support, leverage, and coordinate domestic revenue mobilization–related World Bank work, including lending and advisory services and analytics, at the international and country levels. It is organized in relation to four pillars:

- The global tax activities and global public goods pillar supports development and application of tax diagnostic tools, such as tax policy assessment frameworks and Tax DIAMOND, which identify weaknesses and recommendations for improvements.

- The country-level work pillar supports countries in improving revenue collection through medium-term revenue strategies based on prior tax diagnostic work, mainly using the Tax Administration Diagnostic Assessment Tool, tax policy assessment frameworks, or Tax DIAMOND.

- The third pillar (actionable research, data, knowledge, and learning) supports domestic revenue mobilization–focused research and data work with the potential to yield operational actions leading to domestic revenue mobilization improvements.

- Pillar four (program implementation and supervision) administers the program and manages single and multidonor trust funds supporting Global Tax Program activities.

The Global Tax Program secretariat is housed in the World Bank’s Global Tax Unit. The number of tax experts varies over time, and the program relies significantly on the use of consultants. It has contributed to high-profile, flagship, and other research of the World Bank, including the recent World Development Report on digital taxation and work on digital services taxation.

Source: Independent Evaluation Group.

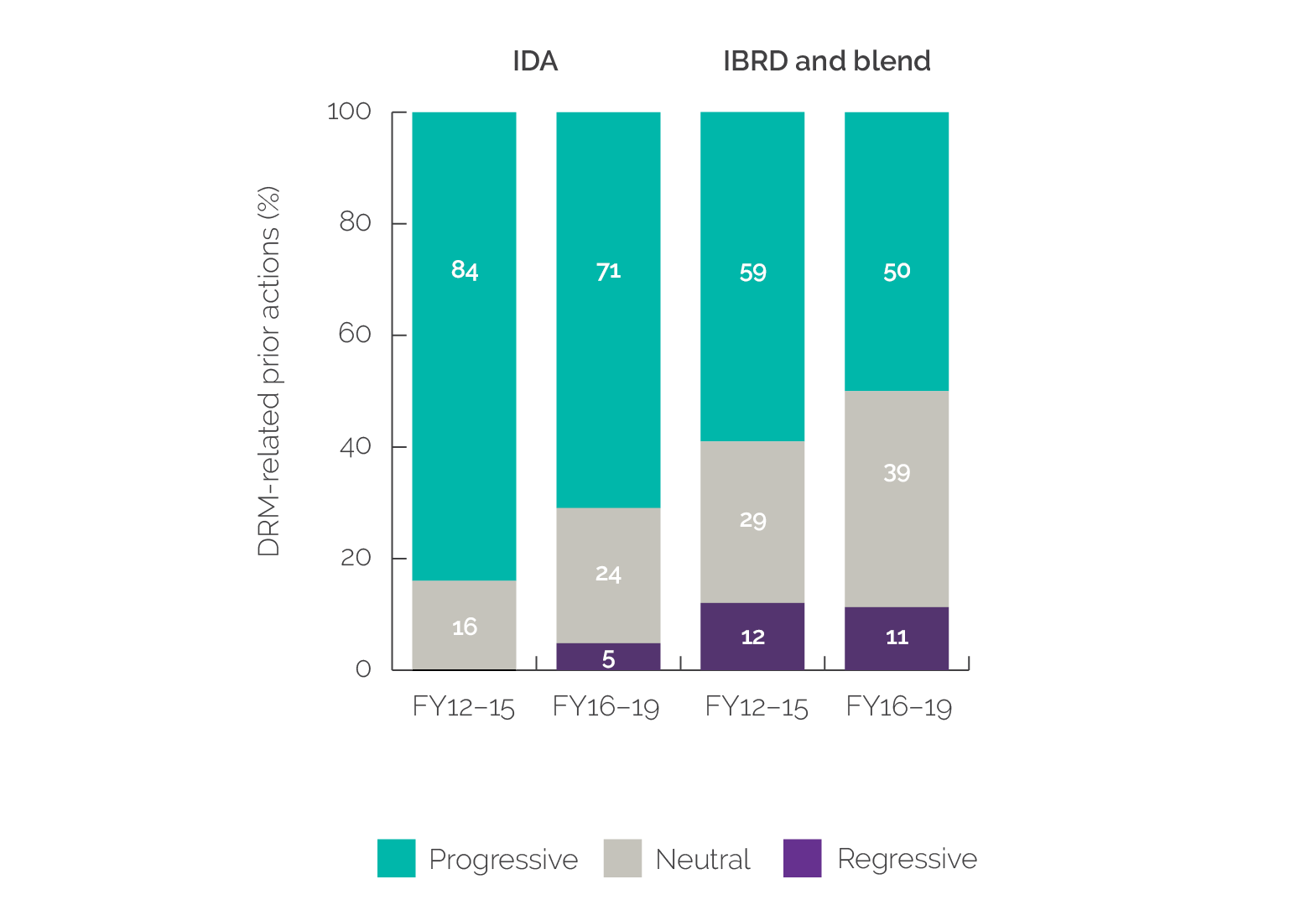

Domestic Revenue Mobilization and Equity

The World Bank has increased its attention to equity considerations in its DRM work. Building on the 20th Replenishment of IDA (IDA20) commitment to support IDA-eligible countries “to bolster their domestic resource mobilization capacity through equitable (fair and progressive) revenue policies” (World Bank 2022a, x, para. xx.b), World Bank staff are in the process of articulating a set of progressivity metrics to encourage assessment of “equitable (fair and progressive)” policies at the country level, which could potentially result in operations giving greater attention to promoting tax equity. This issue received considerable attention in the June 2021 Executive Board briefing on DRM (World Bank 2021b).

During the evaluation period, the World Bank increased analytical work on the distributional impact of tax reform. This was spearheaded partly by the Commitment to Equity Institute in close collaboration with the World Bank. A finding that emerged from many of these studies is that poor people get taxed more and receive less in public services so that fiscal systems (overall) often show very limited or no progressivity. These findings are increasingly reflected in World Bank analytical and diagnostic work (particularly for low-income countries), which often advocate for more progressive tax policies. However, the progressivity of tax systems is taken up to a lesser extent in middle-income countries and in World Bank DRM-related operations than the number of studies of distributional impact would suggest.

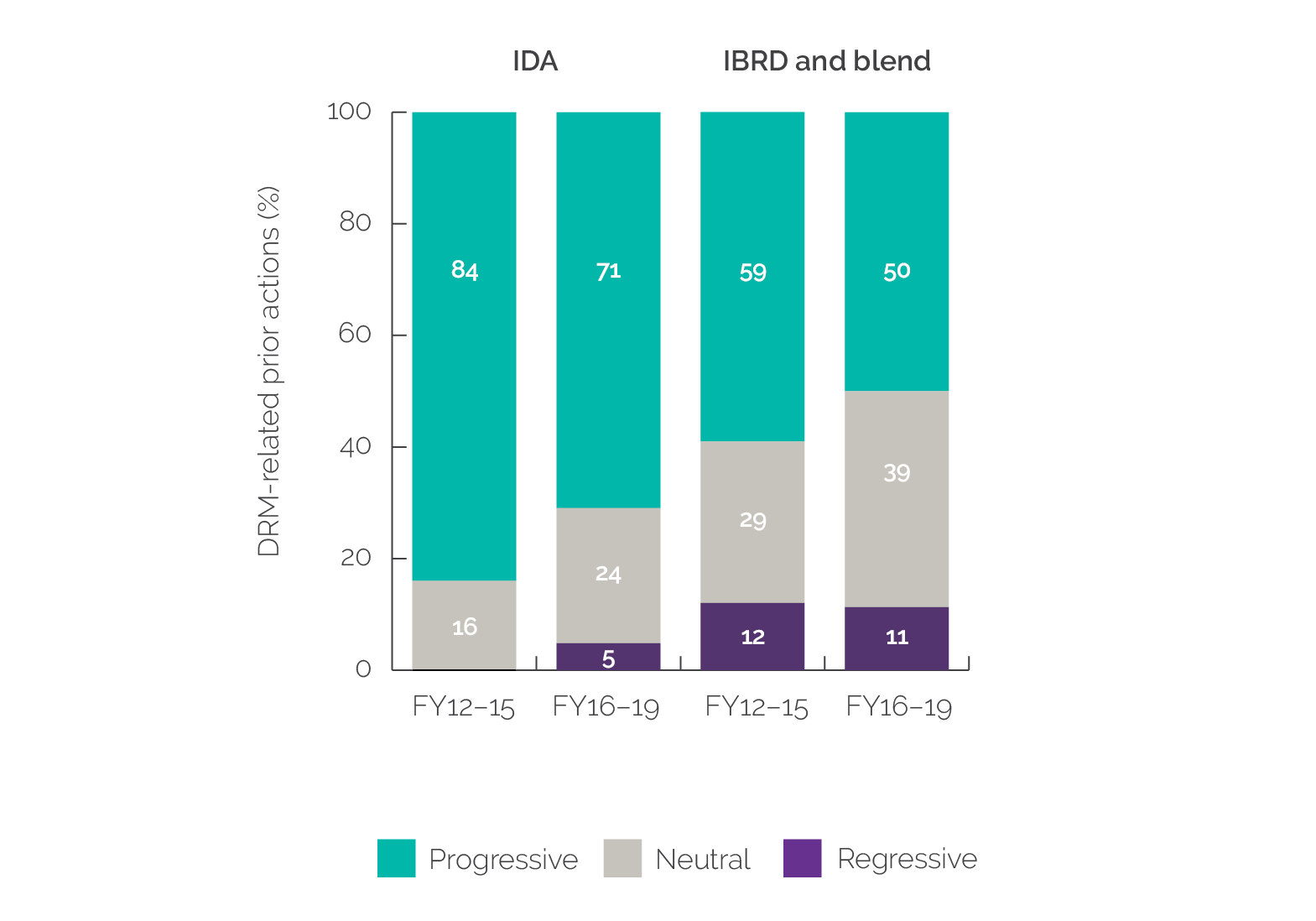

Most DPO program documents discuss the expected distributional implications of DRM-related reforms, but actual impact was discussed infrequently in Implementation Completion and Results Reports.10Evidence was collected from poverty and social impact analyses in program documents and ex post poverty and social impacts identified in Implementation Completion and Results Reports and Implementation Completion and Results Report Reviews. The expected distributional impact of reform supported by DRM-related prior actions was discussed in more than 90 percent of cases.

Most tax-related prior actions in DPOs over the evaluation period were expected to have either a neutral or a progressive distributional impact (figure 2.8). This result was similar to that of the previous three-year period. In both periods, about 1 in 10 DRM-related prior actions in International Bank for Reconstruction and Development countries was expected to have a regressive impact. Relatively few potentially regressive tax measures were supported through DPO prior actions in IDA-eligible countries in the evaluation period. Regressive tax measures supported through DPO prior actions included increased fuel excise tax and increased excise tax on tobacco and alcohol. From an equity standpoint, this finding is not particularly problematic. In most cases where expected DRM-related impact was regressive, targeted actions were identified on the spending side to protect poor people, implying the need for caution in assessing the expected distributional impact of World Bank–supported tax reforms in isolation from the broader fiscal system.

Figure 2.8. Expected Impact on Equity of Tax-Related Prior Actions by Income Group, in FY12–15 and FY16–19 Periods

Sources: World Bank Operations Policy and Country Services Development Policy Financing Prior Actions database, April 2021; Independent Evaluation Group Implementation Completion and Results Report Review database, August 2022.

Note: DRM = domestic revenue mobilization; FY = fiscal year; IBRD = International Bank for Reconstruction and Development; IDA = International Development Association.

Collaboration with Development Partners

Collaboration with development partners over the evaluation period improved considerably, driven largely by the Platform for Collaboration on Tax (PCT),11 established in April 2016 at the start of the evaluation period. The PCT is a joint initiative of the IMF, the OECD, the United Nations, and the World Bank to strengthen collaboration on DRM.12

The quality of collaboration on DRM between the World Bank and the IMF was very good. Interviews and case studies pointed to strong collaboration on DRM issues at the country level (facilitated by the PCT and annual reports on interagency collaboration). There was cross-attendance in meetings of the governing bodies of the respective DRM trust funds (the World Bank’s Global Tax Program and the IMF’s Revenue Mobilization Trust Fund). Information sharing between staff working at the two institutions was good, benefiting from the preexisting agreement between the IMF and World Bank on information sharing that gives World Bank staff access to IMF technical assistance reports on request.

The World Bank’s relationship with the OECD on tax issues is evolving. The OECD has been ramping up its engagement in the tax space over the past decade, and it has been particularly noticeable in terms of its work on global taxation. The World Bank has engaged actively with the OECD through the PCT and international forums, such as the Group of Twenty. Much of this engagement has been to bring the perspective of developing countries into discussions with the OECD in its role as a global standard setter. More recently, the OECD has begun to move beyond that role to one of de facto provider of technical assistance to many World Bank clients. It will be important to ensure that this work benefits from existing arrangements on collaboration and coordination.

- “Investment projects” include investment project financing and trust-funded projects. Domestic revenue mobilization–related investment projects are those defined using standard World Bank theme codes and are tagged with at least one of two theme codes: tax policy or domestic revenue administration. Projects with significant domestic revenue mobilization content were defined as those with more than 6 percent tax content based on independently assigned World Bank theme codes. The objectives of the operations, pillars and components, and prior actions implemented (in development policy operations) were reviewed to ensure that enough material on taxation was available to be evaluated.

- “Payment of taxes” includes simplification of tax payments, tax compliance, amalgamation of taxes, tax returns, and tax payment schedules and procedures.

- Tax expenditures are the revenue losses from exclusions, exemptions, deductions, tax credits, preferential tax rates, and deferrals. Although tax expenditures can have positive effects on inclusive growth when they are targeted appropriately, they are frequently used to benefit well-connected or politically influential individuals and entities. For this reason, it is important that the granting of tax exemptions is accompanied by rigorous analysis of their costs, benefits, and distributional impact.

- See Baer (2002) for a summary of the uses and benefits of large taxpayer units.

- The “relevance” of results indicators in a development policy operation is defined as the extent to which an indicator tracks progress to the associated objective as a result of the prior action or prior actions.

- “Green taxes” as used in this evaluation is synonymous with “environmental taxes” and refers to taxes designed to tax behavior that is harmful to the environment. They include taxes on pollution, energy, carbon emissions, fuel consumption, waste production and disposal, use of natural resources, and motor vehicles and other transport.

- Including tobacco taxation policy reforms as prior actions in development policy operations for Armenia, Colombia, Gabon, Moldova, Mongolia, and Montenegro.

- A list of countries in the medium-term revenue strategy process can be found here: https://www.tax-platform.org/medium-term-revenue-strategy/countries.

- The 13 countries are Azerbaijan, Belarus, Ethiopia, Indonesia, Lesotho, Moldova, Nigeria, the Philippines, Senegal, Sierra Leone, Tonga, Ukraine, and Uzbekistan (World Bank 2019b), with 30 World Bank Support for Domestic Revenue Mobilization Chapter 2 technical assessments provided to an additional 9 countries plus the Organisation of Eastern Caribbean States.

- Distributional impact is largely a policy issue and as such is infrequently relevant to investment projects. This discussion therefore focuses on development policy financing.

- For more information about the Platform for Collaboration on Tax, please see https://www.tax-platform.org.

- The governments of France, Japan, the Netherlands, Norway, Switzerland, and the United Kingdom also support the Platform for Collaboration on Tax.