World Bank Support for Domestic Revenue Mobilization

Chapter 1 | Background and Context

Domestic revenue mobilization has become increasingly important to the development policy agenda. In many developing economies, revenue mobilization is below the minimum required to finance basic government functions. As such, it is an explicit part of two Sustainable Development Goals and had become a priority for World Bank client countries facing rising fiscal deficits and debt burdens even before the COVID-19 pandemic.

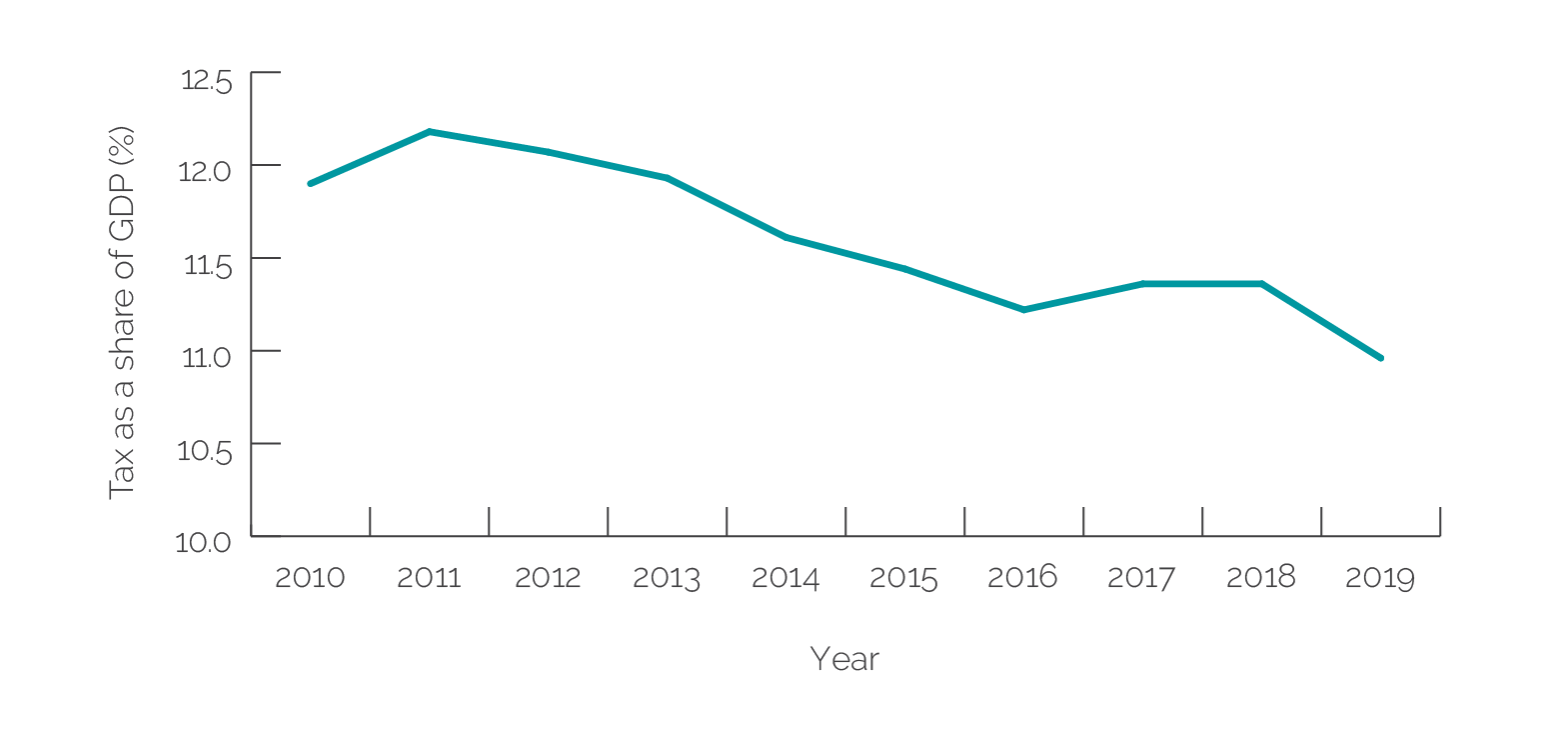

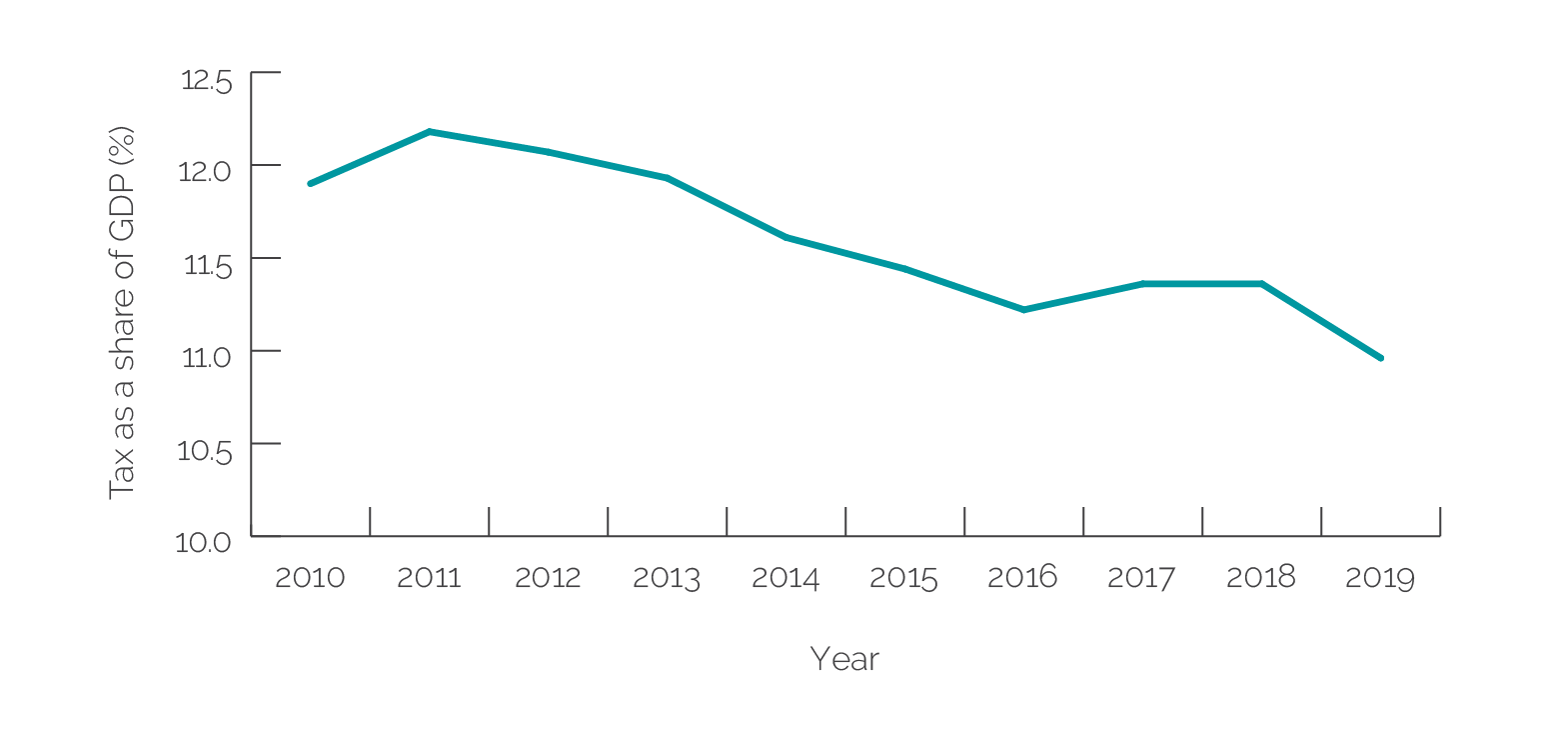

Domestic revenue mobilization has received increased attention from the international community. But despite this attention, the ratio of tax to GDP for low- and middle-income countries has been on a declining trend over the past decade, falling by almost 1 percent of GDP between 2010 and 2019 to reach its lowest level since 2005.

The COVID-19 pandemic had a negative impact on economic activity in many countries, and thus on tax revenues, at the same time as needs have increased. This has heightened the importance of strengthening domestic revenue mobilization to contribute to building fiscal space and resilience.

Financing to reach global development goals, such as the Sustainable Development Goals (SDGs), derives from several sources: public sector borrowing, private capital and investment, official development assistance, and domestic revenue mobilization (DRM). The Independent Evaluation Group (IEG) has recently undertaken evaluations of the World Bank Group’s support for the first two sources: public sector borrowing (the 2021 evaluations World Bank Support for Public Financial and Debt Management in IDA-Eligible Countries and The International Development Association’s Sustainable Development Finance Policy: An Early-Stage Evaluation and the 2023 evaluation The World Bank’s Role in and Use of the Low-Income Country Debt Sustainability Framework) and private capital and investment (the 2020 evaluation World Bank Group Approaches to Mobilize Private Capital for Development and the 2019 evaluation "Creating Markets" to Leverage the Private Sector for Sustainable Development and Growth: An Evaluation of the World Bank Group’s Experience through 16 Case Studies). This evaluation assesses the World Bank’s support for DRM.

DRM has become an increasingly important part of international and country-level policy agendas. Since the 2015 International Conference on Financing for Development in Addis Ababa, DRM has risen in importance in the international development policy agenda, forming part of 2 out of the 17 SDGs and figuring prominently in successive International Development Association (IDA) replenishments. In the years leading up to the COVID-19 pandemic, high fiscal deficits and already high and rising debt levels made enhancing DRM a significant priority for developing economies. The challenge has been particularly pressing for lower-income countries, given their weak capacity in tax administration. Since the onset of the pandemic, tax revenues have dropped by 12 percent in real terms, and the ratios of tax to GDP in many countries have fallen below 15 percent (considered the minimum necessary to finance a state’s basic functions).

DRM has also become increasingly important in the context of successive IDA replenishments. The evaluation period includes the 18th Replenishment of IDA (July 2017 to June 2020), which committed to a shift to more ambitious and broader policy, institutional, and financing initiatives to help low-income countries achieve their development goals. Subsequently, the 19th Replenishment of IDA placed greater emphasis on DRM, with the IDA Results Measurement System tracking the number of countries that have raised their revenue-to-GDP ratios above 15 percent and the number of IDA countries that have had substantial World Bank tax engagements and have achieved an increase in the number of registered taxpayers. The 20th Replenishment of IDA, which falls outside of this evaluation period, maintained and refocused attention on DRM, introducing a more explicit mandate to promote progressivity in tax systems.

Despite the increasing attention on DRM, tax yields have been on a declining trend over the past decade. This trend began to reverse in 2016, but the improvement was short lived, peaking in 2018 at 11.4 percent of GDP, declining sharply to 10.9 percent in 2019, and falling further to 10.7 percent in 2020 with the onset of COVID-19 (figure 1.1).

Figure 1.1. Tax as a Share of Gross Domestic Product in Low- and Middle-Income Countries

Source: World Development Indicators database.

Note: GDP = gross domestic product.

In 2016, World Bank management produced Strengthening Domestic Resource Mobilization: Moving from Theory to Practice in Low- and Middle-Income Countries (Junquera-Varela et al. 2017). This report, prepared by the Governance Global Practice, was intended to support the role of the World Bank in the context of the Addis Tax Initiative and the SDGs. Additionally, it intended to help the Bank Group find new entry points and reinforce its commitment to tax reform to enhance and expand its tax agenda.

The importance of acknowledging the multidimensional nature of tax issues (and, by implication, the importance of collaboration within the Bank Group) was recognized in an internal 2016 position paper that called for a holistic approach to support to DRM, with clear links between tax and expenditure. The paper indicated that revenue and expenditure reforms should be embedded in broader public financial management reforms. This would ensure that DRM becomes a development tool to generate revenues for sustained and inclusive development.

This evaluation assesses the relevance and effectiveness of World Bank strategies and interventions between fiscal year (FY)16 and FY19 to help client countries enhance DRM.1 The period of analysis, though relatively short, covers a major elevation in the importance the international community assigned to DRM. After the 2015 deadline for attainment of the Millennium Development Goals, the Bank Group and the development community recognized that official development assistance was unlikely to be adequate to achieve the newly articulated and more ambitious SDGs. The realization that achieving the SDGs would require a more concerted effort on DRM was reflected in several major reports and documents. These include the World Bank’s Financing for Development Post-2015; the United Nations’ Transforming Our World: The 2030 Agenda for Sustainable Development; a joint publication, “From Billions to Trillions: Transforming Development Finance Post-2015 Financing for Development: Multilateral Development Finance,” by the African Development Bank, the Asian Development Bank, the European Bank for Reconstruction and Development, the European Investment Bank, the Inter-American Development Bank, the International Monetary Fund (IMF), and the Bank Group; and the United Nations’ “Addis Ababa Action Agenda of the Third International Conference on Financing for Development.”

The COVID-19 pandemic has had a negative impact on economic activity in many countries, and thus on tax revenues, at the same time as needs have increased, both from the standpoint of demands on health systems and in the need to undertake countercyclical spending to preserve jobs and save lives. Together, this has heightened the importance of strengthening DRM to contribute to building fiscal space and resilience. The challenge for most developing economies is to strengthen DRM without creating regressive or growth-impeding distortions to tax systems. This will require action on both the tax policy and administration fronts, improving the efficiency of tax administration, reducing inefficient and regressive tax expenditures, adapting tax policies to reinforce climate change and health objectives, and expanding the generation of revenue from fast-growing digital activities. Governments will also need to recognize the close link between taxpayer compliance and the quality of government spending (and especially the provision of adequate and good-quality public services). Without the latter, the public will have little incentive to pay taxes.

Reflecting the importance that the Board of Executive Directors assigns to improving DRM, in June 2021 World Bank management presented to the Board “IBRD/IDA Board Briefing on Domestic Resource Mobilization (DRM): Supporting Green, Resilient and Inclusive Development (GRID).” This presentation recognized that, with the pandemic exacerbating preexisting DRM challenges, the World Bank needed to take a leading role in representing developing economy views on international tax issues at the global level and to increase human and financial resources dedicated to DRM. The presentation expressed World Bank management’s intention to

- Scale up country support to reshape fairer, equitable, and greener tax systems based on country priorities and demands[;]

- More actively advocate for developing countries at the global level to ensure that their interests and challenges are addressed, including at the G20 and G7 [Group of Twenty and Group of Seven] level; and

- Continue fostering international cooperation to address current and new challenges to support inclusive and greener growth, help reduce inequality and eradicate poverty. (World Bank 2021b)

To achieve this, management’s presentation identified potential interventions to improve the scope of success, which included the following:

- Introducing DRM-related activities into [World] Bank operations, from the CPFs [Country Partnership Frameworks] and SCDs [Systematic Country Diagnostics] to lending operations and TA [technical assistance], and

- Increasing [World] Bank’s human and financial resources to timely respond to greater demands from countries for support to address current revenue challenges, as well as to help them prepare ahead for future challenges. This could involve mainstreaming DRM experts in regional EFI [Equitable Growth, Finance, and Institutions] units. (World Bank 2021b)

Evaluation Scope

This evaluation addresses three evaluation questions:

- How relevant were World Bank strategies, activities, and interventions to enhance DRM in World Bank client countries?

- To what extent has the World Bank been effective in supporting client country efforts to broaden tax bases, improve tax structures and equity, and strengthen tax administration? In achieving results at the country and intervention levels, what worked, what did not work, and why?

- Were World Bank interventions to support client DRM complementary? Was complementarity with development partners pursued and achieved?

Appendix A contains a detailed description of the methodology and data sources underpinning this evaluation.

- The Independent Evaluation Group has assessed World Bank support for tax reform on several occasions. Appendix B summarizes some of the past findings and lessons.