The World Bank’s Role in and Use of the Low-Income Country Debt Sustainability Framework

Chapter 6 | Collaboration of World Bank and International Monetary Fund Staff in Preparing Debt Sustainability Analyses

Highlights

Despite the inherent difficulties in coordinating across institutions, collaboration in preparing Debt Sustainability Analyses (DSAs) between International Monetary Fund (IMF) and World Bank staff was strong. At the same time, almost half of surveyed World Bank country economists had some level of disagreement on underlying assumptions, most often for short- and medium-term macroeconomic forecasts (over which the IMF has the lead responsibility).

Disagreements are to be expected as part of a robust preparation process for a complex, cross-institution analysis, and almost all were resolved at the technical or managerial level. Long-term International Development Association financing projections were periodically contested and needed to be resolved at a managerial level.

More than two-thirds of surveyed World Bank economists indicated that the new DSA clearance procedures either significantly or moderately improved several aspects of the World Bank’s participation and inputs into DSAs. However, over half of respondents indicated that the new processes either moderately or significantly slowed DSA processing and approvals within the World Bank. A number of World Bank respondents considered the new processes to be overly bureaucratic, requiring substantial additional time to review a DSA, with negative implications for collaboration with the IMF.

The LIC-DSF guidelines indicate that all LIC-DSAs should be produced jointly by IMF and World Bank staff and submitted to both the IMF and the IDA Executive Boards (IDA and IMF 2017a). Guidelines call on World Bank and IMF staff to build in sufficient time for consultation and review between the two institutions to avoid last-minute disagreements and requests for changes. As part of this process, the teams should hold a preliminary meeting during preparation to discuss the macroeconomic assumptions and coverage of the DSA. Where disagreements cannot be resolved at the technical level, a dispute settlement mechanism has been articulated that requires the involvement of the managements of the two institutions.

IMF and World Bank staff should coordinate closely in producing DSAs, based on their respective areas of expertise . . . . Bank and Fund country teams should agree on the broad parameters and projections of the DSA, including growth and new borrowing, prior to producing the DSA draft. In the case of large deviations between IMF and World Bank projections, teams are to revert to the dispute resolution mechanism. (IDA and IMF 2017a, 18)

IEG sought to assess the extent to which the de facto role of World Bank staff in the preparation of country-specific LIC-DSAs was consistent with the agreed 2017 guidelines. IEG carried out a survey from June to August 2022 of all current World Bank country economists who participated in the preparation of the most recent LIC-DSAs. Responses were received from economists working on over 85 percent of LIC-DSA countries (see appendix D).

Despite the inherent difficulties in coordinating across institutions, a majority of World Bank respondents considered that cooperation with IMF counterparts in preparation of DSAs was strong. Approximately 90 percent of country economists rated the quality of collaboration between IMF and World Bank staff in the preparation of LIC-DSAs as “very good” or “good.” The guidelines indicate that IMF and World Bank teams should begin to jointly prepare a draft DSA and hold a preliminary meeting to discuss the macroeconomic assumptions and coverage of the DSA. This appears to hold in practice in two-thirds of cases: in the survey of World Bank country economists, 65 percent responded “yes” that the World Bank and IMF teams discuss and agree on the LIC-DSA’s underlying macroeconomic framework and assumptions at the pre-mission stage of preparation. Just under a third of respondents considered this to be the case only “somewhat.”

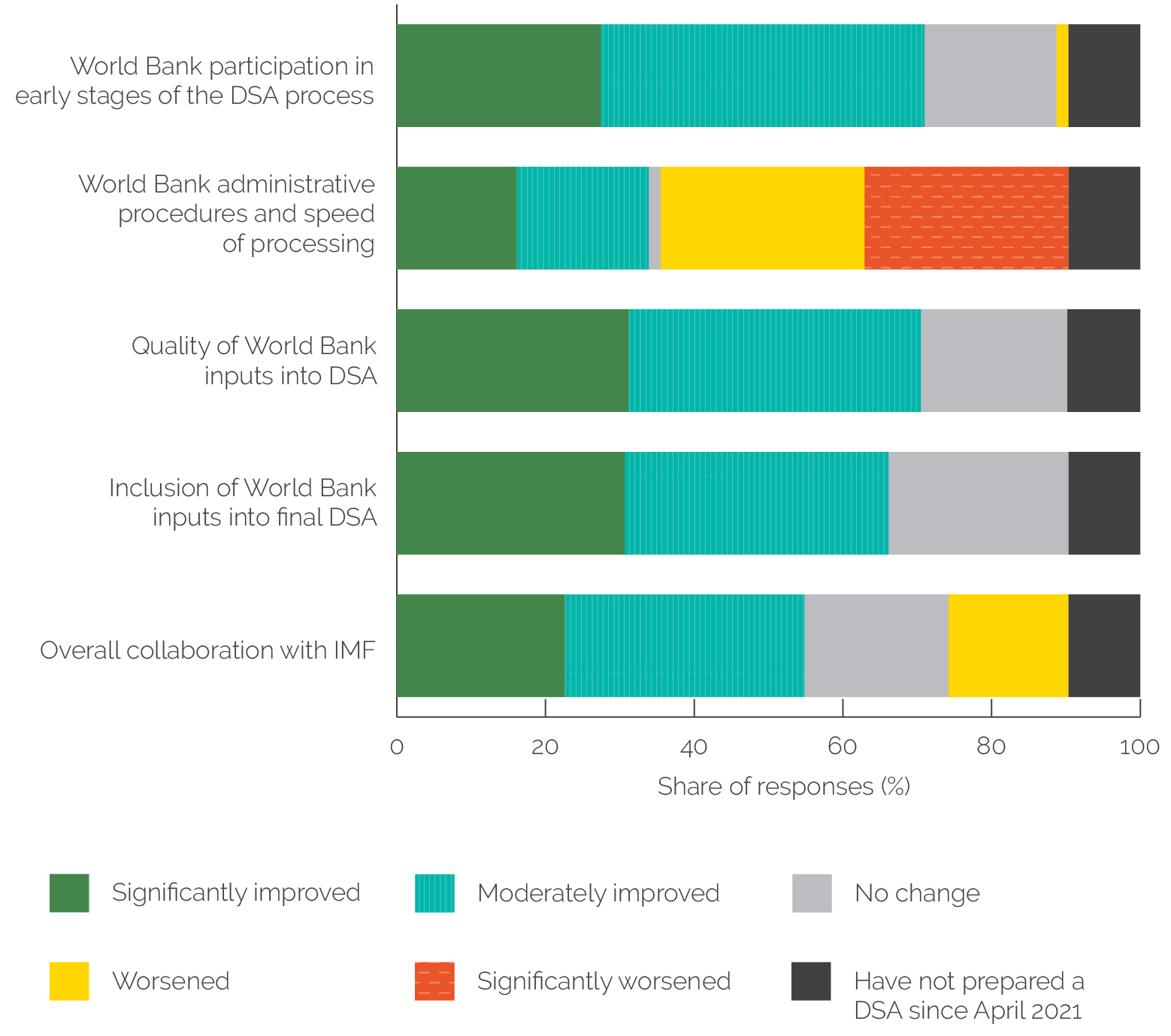

In terms of World Bank inputs to the DSA, about one-third of World Bank respondents indicated that they made “significant contributions or had shared responsibility with the IMF” for short-, medium-, and long-term macroeconomic, fiscal, and debt forecasts (figure 6.1). Ten percent of World Bank respondents indicated that they led preparation of the long-term macroeconomic projections, and 5 percent led preparation of the long-term fiscal and debt projections. The majority (about two-thirds) indicated that they “provided comments and some revisions” to these projections. On the other hand, about three-quarters indicated that they had led the preparation of both short- and long-term IDA financing assumptions.

Figure 6.1. Responsibility for LIC-DSA Inputs Reported by World Bank Country Economists

Source: Independent Evaluation Group.

Note: IDA = International Development Association; IMF = International Monetary Fund; LIC-DSA = Low-Income Country Debt Sustainability Analysis.

A large majority of World Bank staff reported no significant disagreements with risk ratings. Some 89 percent of country economists surveyed did not have significant disagreements with the risk ratings assigned to countries, with a further 8 percent disagreeing “somewhat” with the ratings. However, some disagreement over underlying assumptions is an inherent part of a robust process to produce a complex analysis across institutions. Almost half of surveyed World Bank country economists had some level of disagreement with projections and assumptions for key variables. Although few respondents reported “significant disagreements,” 40 percent indicated that they had “somewhat” significant disagreements. Of those who disagreed on assumptions or projections, the most frequent disagreements (45 percent) were over (short-, medium-, and long-term) macroeconomic forecasts, followed by 28 percent indicating disagreement over short- and medium-term IDA financing assumptions. In addition, 24 percent of respondents had disagreements with IMF counterparts over short- and medium-term fiscal and debt assumptions, whereas 17 percent had disagreements over long-term fiscal and debt assumptions. Almost all disagreements were resolved at the technical level (76 percent of respondents) or managerial level (10 percent). Only 7 percent went to the director level or above. In one-third of case studies, there was at least one issue related to an assumption that was resolved at the managerial level. For two of the cases, the issue was related to macroeconomic forecasts, and for another, it was with respect to IDA financing assumptions.

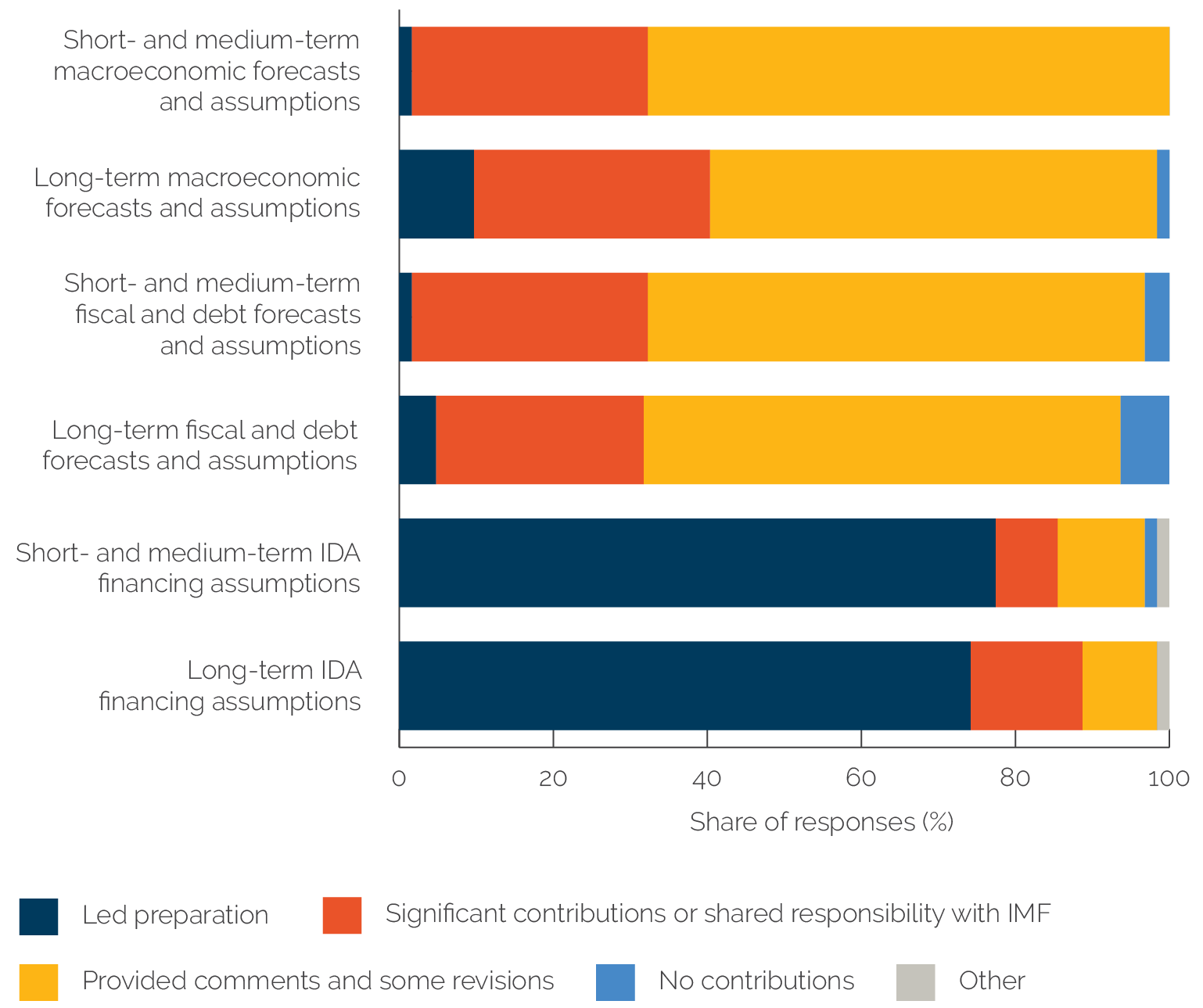

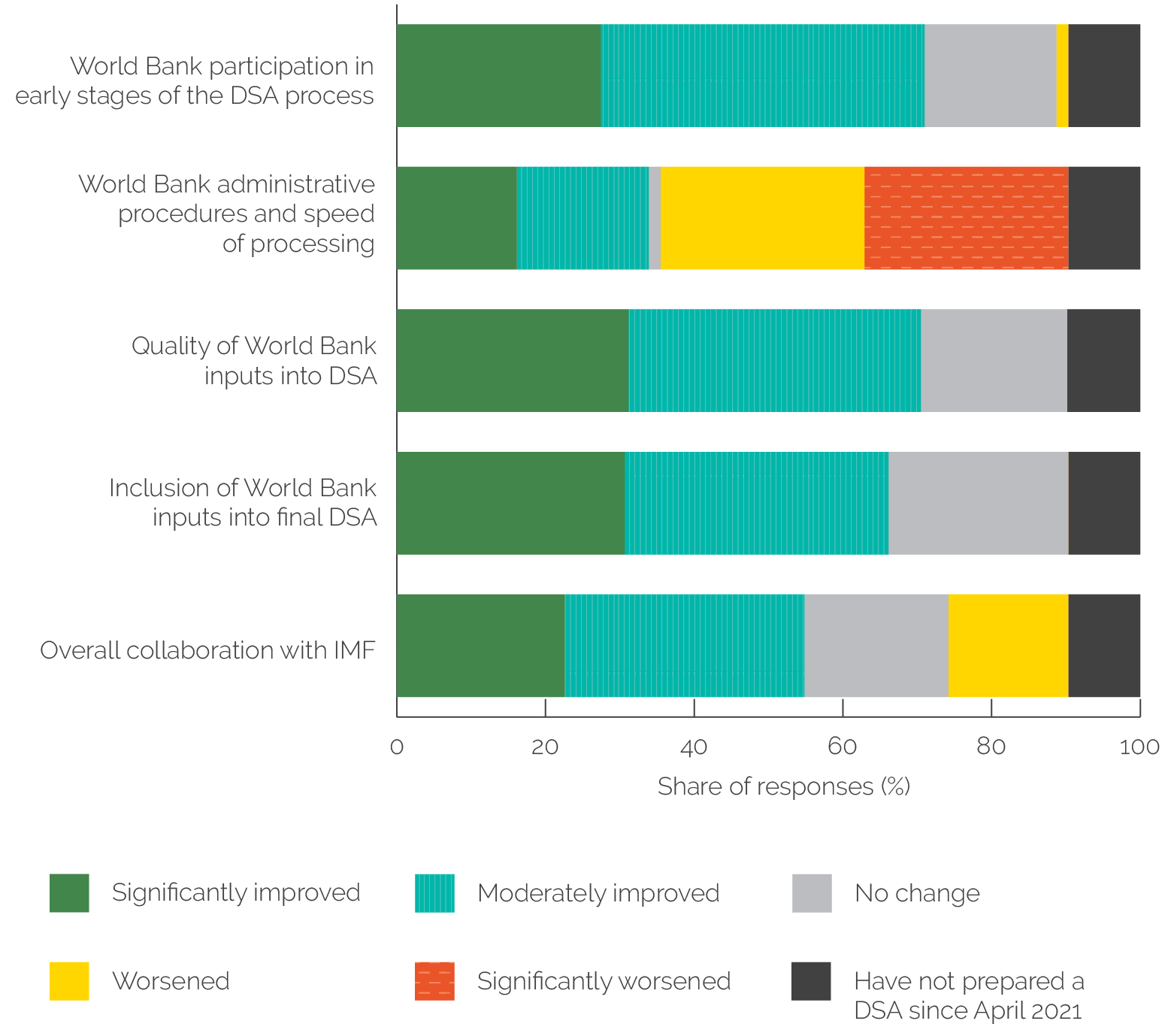

Respondents from the World Bank reported that, while the changes introduced in the World Bank’s internal processes for DSA review and clearance in April 2021 (see chapter 2) had improved several aspects of World Bank participation in the DSA process, the new procedures had slowed DSA preparation and were administratively burdensome, negatively affecting collaboration with the IMF. The survey was carried out from June 30 to August 18, 2022, with 78 percent of responses discussing DSAs processed in FY22, which was the first year of the new ADM’s implementation when the new processes were first being implemented. More than two-thirds of surveyed World Bank economists indicated that the new ADM either significantly or moderately improved several aspects of World Bank participation in the DSA, including World Bank participation in the early stages of the DSA process, the quality of World Bank inputs into the DSA, and inclusion of World Bank inputs into the final DSA (figure 6.2). However, just over half (55 percent) of respondents indicated that the new processes either significantly or moderately worsened World Bank administrative procedures and the speed of processing. Some concern was also expressed that the new internal processes had had a negative impact on collaboration with the IMF: whereas 55 percent found that the new ADM significantly or moderately improved collaboration with the IMF, 16 percent signaled that it had worsened it.

Figure 6.2. World Bank Economist Views on Impact of April 2021 Debt Sustainability Analysis Review Processes

Source: Independent Evaluation Group.

Note: DSA = Debt Sustainability Analysis; IMF = International Monetary Fund.

The question on the updated ADM received more written comments from World Bank economists than any other question on the survey (about one-third of respondents included written comments). There were a few positive views; for example, “the new ADM procedures have gradually improved our IMF colleagues’ estimation of the World Bank to junior partner from procedural annoyance (if not outright obstacle)” or simply “improved the quality of DSAs.” However, more than half of the written responses reflected frustration with overly bureaucratic procedures and the substantial time required under the new ADM to process and review a DSA, negatively impacting interactions with the IMF. Some comments noted that the new World Bank processes were not well aligned with IMF preparation schedules and clearance processes, creating additional frustration for both sides, and that there was a need for a more concerted effort to communicate and coordinate World Bank and IMF clearance processes. Similar results were reflected in case study interviews. Of the nine case study countries, seven described the new ADM as a significant administrative burden, often straining relations with the IMF. However, most economists who were interviewed agreed that it had improved the World Bank’s quality of inputs and participation in the process.