World Bank Support for Public Financial and Debt Management in IDA-Eligible Countries

Chapter 3 | World Bank Support for Public Expenditure Management

This chapter analyzes World Bank support to help IDA-eligible countries improve their PEM to ensure that public resources are spent in accordance with an approved budget and that the government receives value for money. Support is analyzed for three subareas of PEM: (i) budget preparation and execution (including payment arrears management), (ii) expenditure data management, and (iii) public sector accounting. Budget preparation and execution are the backbone of PEM, although data management and financial accounting are cross-cutting themes. While procurement plays a critical role in ensuring the efficiency of public expenditure, it was not analyzed here given IEG’s freestanding evaluation of public procurement (World Bank 2014a). The availability of cross-country data on the quality of PEM is limited owing to difficulties in measuring results and a lack of accurate and regular data collection. This analysis therefore relies, to a large extent, on PEFA data.1

Budget Preparation and Execution

Over the evaluation period, 78 of 85 IDA-eligible countries collectively had 108 investment projects, 221 DPOs, and 345 nonlending activities with a focus on PEM. Support involved a mix of technical assistance and investments focused on capacity building of, among other themes, aspects of budget strategy development; strengthening of procedures, systems, and capacity to formulate medium-term budget frameworks; introduction of program-based budgeting; and training to improve expenditure forecasting (box 3.1 contains a detailed country example). For DPOs, support involved prior actions on the submission of budget statements to parliament, the establishment of budget preparation timetables, the operationalization of budget oversight and verification units in line ministries, and improvement in the quality of budget commitment plans (that is, boosting the ability of governments to develop credible plans of liabilities, or reservations or allotments of appropriation). Nonlending support included the preparation of policy notes to help enhance the effectiveness and efficiency of budget execution processes, public finance reviews to estimate medium-term expenditure pressures on the budget, and public expenditure tracking surveys.

Box 3.1. An Example of World Bank Support for Public Expenditure Management: Strengthening Sierra Leone’s Budget Cycle

The World Bank and its partners supported public expenditure management in Sierra Leone through the $28.5 million Public Financial Management Improvement and Consolidation Project, which received additional financing of $10 million from the World Bank in 2017. The project, which is set to close in March 2021, has as one of its components “enhancing budget planning and credibility,” which aims to strengthen the macrofiscal forecasting and public investment functions of government and thereby improve overall budget planning, strengthen systems and procedures for budget formulation, and build capacity for managing contingent liabilities. Activities include the following:

- Capacity building for the Economic Policy Research Unit to further develop its modeling capacity;

- Training and consultancies to build the capacity of the Budget Bureau in developing a training model and training relevant staff in line ministries and local councils in planning and executing their budgets;

- Technical assistance on integrating budget planning and execution and using the planning and execution modules of integrated financial management information systems performance budgeting software; and

- Assistance in planning and implementing the government’s migration to a medium-term budget framework.

The project has so far succeeded in decreasing the average time of quarterly budget releases to ministries, departments, and agencies within the start of the quarter; increasing the number of nonstate actors taking part in annual budget discussions; and decreasing the ratio between actual primary expenditure and original budgeted primary expenditure. The ongoing project’s progress toward the achievement of project development objectives and its overall implementation progress were both rated satisfactory in the latest Implementation Status and Results Report, from June 15, 2020.

Source: World Bank 2013c, 2020f.

Despite significant World Bank support for capacity building on the budget cycle, improvements in IDA-eligible countries were mostly limited. For the 38 IDA-eligible countries that benefited from World Bank PEM support (investment project financing and DPOs) and had at least two PEFA scores for PEFA indicator (PI)-1 (aggregate expenditure outturn compared with original approved budget) and PI-2 (composition of expenditure outturn compared with original approved budget) during the evaluation period, there was little change, on average, in either score: a 0.1 increase (out of 4.0) in the score for PI-1, and a 0.1 decrease for PI-2. However, although adequate technical capacity is a necessary condition for budget credibility, the credibility of the budget—like much of the rest of PEM (and PFDM, for that matter)—can also be strongly influenced by idiosyncratic, country-specific factors, like whether political leaders choose to defer to approved budgets and revenue forecasts and allow staff in PEM institutions to perform their duties and follow procedures, or whether they resist pressure to overspend during election years.2

PEM support to arrears management in IDA-eligible countries was associated with improved performance. Just over half of IDA-eligible countries that received World Bank PEM support (and had at least two PEFA scores) recorded reductions in their stock of expenditure payment arrears. Box 3.2 details why government arrears accumulate and how the World Bank has supported governments in preventing this. On average, the stock, monitoring, and prevention of payment arrears improved for more than half (58 percent) of IDA-eligible countries. Of the 40 IDA-eligible countries that received World Bank PEM support and had more than one PEFA score for PI-4 (stock and monitoring of expenditure payment arrears) during the evaluation period, the same share recorded reductions in their stock of expenditure payment arrears; 8 countries (Guinea-Bissau, Kenya, Kosovo, Madagascar, Mozambique, the Solomon Islands, Timor-Leste, and Zimbabwe) saw an increase, as well as deterioration in the availability of data for monitoring arrears; 9 countries saw no change in scores. On average, there was a modest improvement in PEFA PI-4 scores, from C (2.1) to C+ (2.6), which is a reflection not only of World Bank support but also of support from other development partners and, of course, the work of client governments themselves.

Box 3.2. World Bank Support for Arrears Prevention in International Development Association–Eligible Countries

The prevention, control, and regularization of arrears require sound expenditure and commitment management. The most common causes of expenditure arrears are unrealistic budgeting, lack of control over expenditure commitments, poor cash management, delays in the processing of payments, deliberate postponement of payments, and insufficient sanctions against officials or institutions that do not adhere to systems of control.

The World Bank has supported International Development Association–eligible countries in their efforts to control the accumulation of arrears by strengthening systems through arrears regularization or prevention strategies. A review of World Bank support in this area found the following measures to control the accumulation of, and support the reduction of, arrears:

- Strengthening the legal and regulatory framework for reporting and clearing arrears;

- Improving the credibility and realism of the budget, particularly on revenue forecasts;

- Enhancing the management of arrears, through arrears accounting and the publication of data, including data resulting from BOOST (see the Expenditure Data Management section for an explanation of BOOST);

- Increasing control of expenditure commitments;

- Strengthening cash and debt management;

- Reinforcing the supervision of subnational governments and public enterprises; and

- Modernizing information systems related to the financial management of general government functions.

Source: Independent Evaluation Group.

Expenditure Data Management

To help improve the quality of, and access to, expenditure data used to inform PEM work, the World Bank launched the BOOST initiative in 2010 (box 3.3). This nonlending activity—most of which was delivered as stand-alone, trust-funded technical assistance but has evolved and is now supported alongside public expenditure reviews—involves supporting clients to collect data on the public expenditure accounts from a government’s IFMIS (see chapter 5 for more on IFMIS) or budget documents and then using the Excel-based BOOST platform to develop disaggregated public expenditure databases. These data can support budget analysis and decision-making within a government and, when publicly disclosed, can also be a tool to improve citizen understanding of public policies and enhance budget transparency. To date, a BOOST platform has been established in over 70 countries. Two noteworthy examples of successful use of these data are Mali and Moldova:

- In Mali, the Ministry of Education combined BOOST data on spending with data on student performance. The availability of such disaggregated expenditure data, coupled with tangible human development results, motivated critical discussions on efficiency and how best to leverage limited resources to improve development outcomes in education. For example, the analysis determined that the city of Sikasso had better completion rates than the city of Kayes, even though Sikasso was spending significantly less on education.

- In Moldova, the Ministry of Finance has long maintained a BOOST expenditure database that combines disaggregated expenditure data with nonfinancial indicators to determine the relationship between sectoral spending and results. One outcome of this database has been to illustrate the lack of correlation between spending on schools and education test results. These findings were then used by the Ministry of Education to help justify a comprehensive school reform program that led to improved expenditure efficiency in the sector (Mills and Wescott 2016).

Box 3.3. Using BOOST for Public Expenditure Management

The World Bank–developed BOOST helps governments organize existing budgetary data by economic, functional, administrative, and programmatic classifications to allow for data management at a highly disaggregated level of analysis. This is useful as data limitations are a notable handicap for country-level analysis and planning, as well as for broader cross-country analysis. Some of the main data constraints that BOOST can help address include that a number of countries use idiosyncratic budget classification systems that do not follow Government Finance Statistics classification principles and that government budgetary publications often provide data at a high level of aggregation that limits the scope for analysis.

By sharing data on a widely available Excel platform, BOOST has facilitated greater use of disaggregated budget data for fiduciary and accountability purposes in many International Development Association–eligible countries. With BOOST expenditure databases, country budgets can be analyzed by government economists and external analysts at a higher degree of disaggregation than was previously possible with official budgetary publications.

Source: World Bank BOOST Data Lab, https://www.worldbank.org/en/programs/boost-portal/boost-data-lab.

The World Bank has provided only limited capacity-building support for the use of BOOST by IDA-eligible clients, which is one reason that such data are generally not used regularly by governments. Despite BOOST’s potential to enhance the efficiency and effectiveness of government spending—and although BOOST data are regularly used by development partners—such data are not systematically used by client countries, largely because of the limited support for its use. For instance, BOOST-specific ASA activities for both the Democratic Republic of Congo and Sierra Leone focused on supporting ministries of finance with the coding of public expenditure, not on capacity building to encourage the use of these data.3 Besides the lack of World Bank support for regular use of BOOST expenditure data, other factors that limited the use of BOOST by client countries included weak data management and archiving capacity within ministries of finance and a lack of ownership of data sets (with the tool being considered a World Bank resource, not a client government one).

Public Sector Accounting

The World Bank provided lending and nonlending support to improve public sector accounting to 24 IDA-eligible countries to support implementation of international public sector accounting standards (IPSAS). This support generally took the form of lending: 23 investment project financings (sometimes with trust fund support from the Swiss State Secretariat for Economic Affairs), 2 Programs-for-Results (in Kenya and Pakistan), and 56 prior actions in 52 separate DPOs. Box 3.4 details one example of such support.

Box 3.4. World Bank Support for Public Sector Accounting in Maldives

The Public Financial Management Systems Strengthening Project is an $18.5 million investment project financing that became effective in October 2014 and is expected to close in July 2022. The project aims to strengthen the public accounting system in Maldives by improving financial reporting practices to include timely production of financial statements, budget execution reports, financial reports for donor-financed projects, and other management reports (such as those providing relevant information on arrears and commitments). The project includes:

- Development of a public accounting system based on an array of modules from an integrated business management software package. The project is procuring the hardware, software, and licenses; training Ministry of Finance officials on the use of the system; and rolling the system out to line ministries and agencies.

- Reform of public accounting to align internal audit practices with international standards.

- Implementation of international public sector accounting standards–based modified accrual basis accounting to issue whole-of-government financial statements.

As of February 2020, the project was performing well, with a satisfactory rating for progress toward achievement of the project development objectives. The government’s 2018 annual financial statements were prepared according to the International Public Sector Accounting Standards and successfully submitted to the Auditor General’s office within four months from fiscal year-end; however, statements are not yet directly system generated. This progress is a substantial improvement from the prior situation, in which the government’s accounting systems were not computerized or integrated with other public financial management systems (such as its revenue management and debt recording and management systems).

Source: World Bank 2014b, 2018b, 2020b.

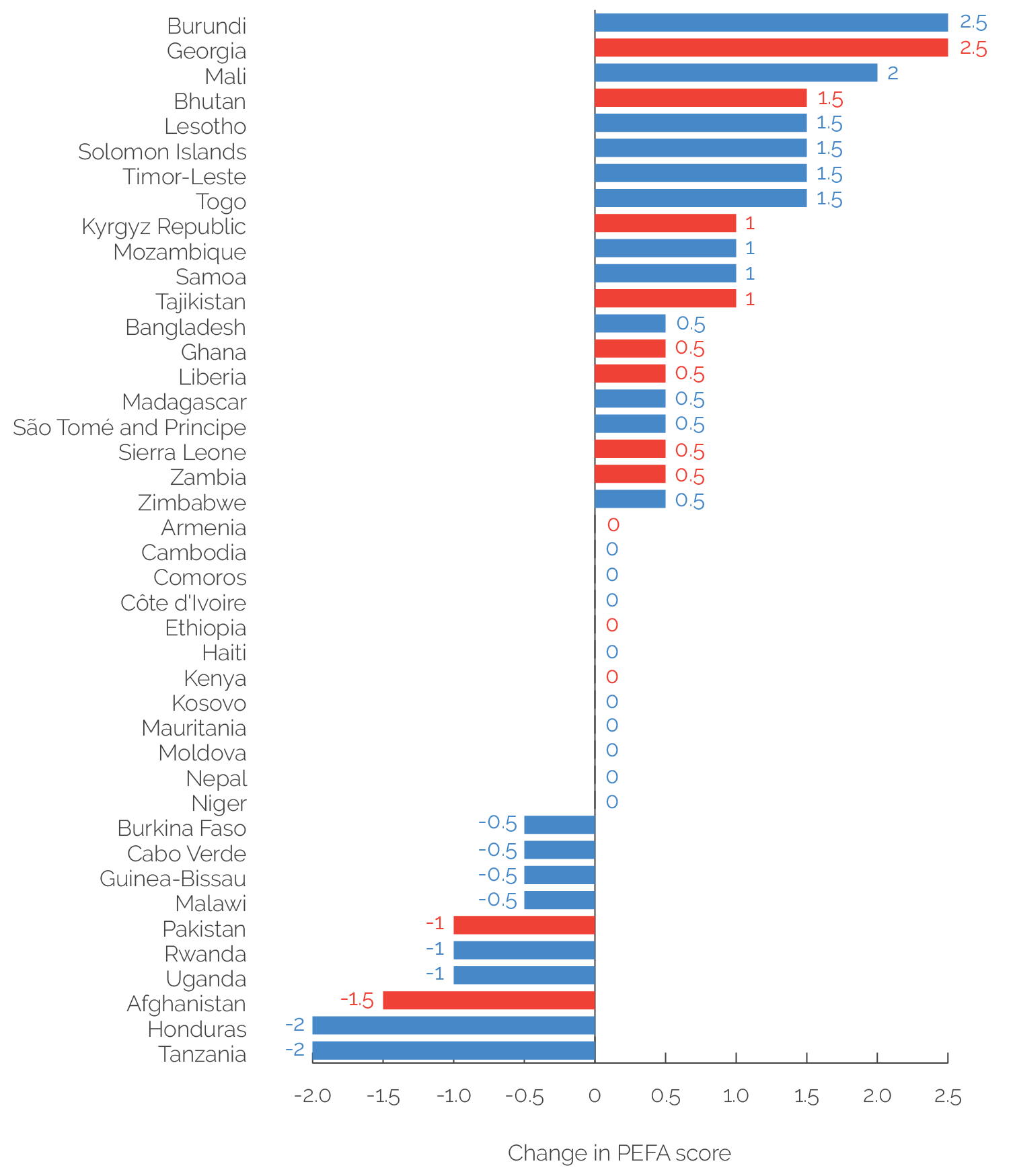

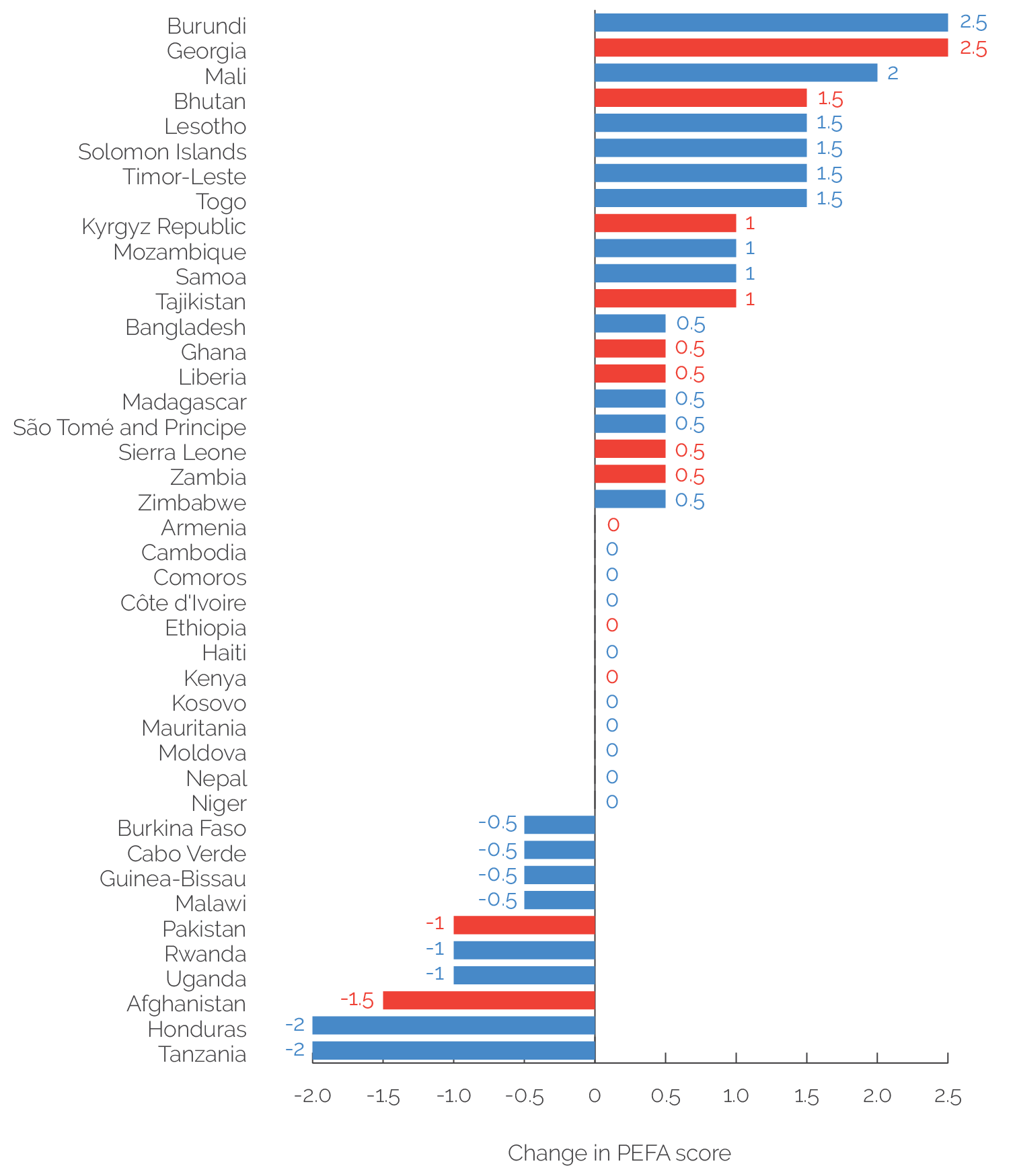

Although limited, World Bank support to improve public sector accounting has been associated with positive results. Twenty-four IDA-eligible countries received support for public sector accounting during the evaluation period. Of these, 14 had more than one PEFA score for question 25, a composite indicator encompassing (i) completeness of financial statements, (ii) timeliness of submission of financial statements, and (iii) accounting standards used and timeliness of annual financial statements. On average, those 14 countries saw their financial accounting capacity score increase more than those that did not receive World Bank support: an average of 0.32 for countries receiving World Bank support versus 0.22 for those that did not (figure 3.1).4

An example of successful World Bank support in the area of public sector accounting can be found in Georgia. A 2018 IEG evaluation of Georgia’s Public Sector Financial Management Reform Support Project (World Bank 2018d) concluded that the project helped increase the transparency and credibility of state finances through the adoption of accrual basis IPSAS. The completeness of financial statements improved between its two PEFA assessments on the relevant indicator, from C in 2013 to B in 2018. That being said, at project closure, only 22 standards recognized in IPSAS had been adopted, and the government required an extension to its time frame to align national accounting standards with IPSAS. The main reason, according to government officials consulted by IEG, was the lack of qualified accountants and the limited internal capacity, especially in line ministries, to adopt accrual basis accounting.

The World Bank has increasingly supported the adoption of accrual basis accounting by IDA-eligible countries because pure cash accounting has weaknesses in financial transparency, integrity, and accountability. To date, the adoption of accrual basis accounting in the public sector has been concentrated in Organisation for Economic Co-operation and Development countries. Lower-income countries have had less success because the transition and adoption require extensive public sector capacity that such countries rarely have. Nevertheless, the World Bank has provided increased support to IDA-eligible countries to shift to accrual basis accounting. This support reflects (i) a growing recognition of shortcomings in pure cash accounting and of advantages in accrual basis accounting; (ii) the development of accrual basis international standards for government fiscal and financial reporting, as in the Government Financial Statistics Manual and IPSAS; (iii) the professionalization of the government accounting cadre and the associated introduction of private sector accounting techniques to the public sector; and (iv) the advent of IFMIS, which greatly reduces the transaction costs of collecting and consolidating accrual basis information (Cavanagh, Flynn, and Moretti 2016).

Figure 3.1. Change in PEFA Financial Accounting Scores for IDA-Eligible Countries with More Than One PEFA Score (2008–17)

Source: Independent Evaluation Group, Public Expenditure and Financial Accountability Secretariat.

Note: Countries in red received accrual basis accounting support from the World Bank during the evaluation period. The y-axis refers to the change in question 25 score for countries with at least two PEFA assessments during the evaluation period. IDA = International Development Association; PEFA = Public Expenditure and Financial Accountability.

World Bank support for public sector accounting has led to limited adoption of accrual basis accounting in IDA-eligible countries. Of the 24 IDA-eligible countries that received support for accrual basis accounting from the World Bank during the evaluation period, three fully adopted it (Democratic Republic of Congo, Honduras, and Mongolia) and four are transitioning to accrual basis accounting (Ghana, Rwanda, Senegal, and Uzbekistan), according to data from the International Federation of Accountants. Nine additional IDA-eligible countries adopted accrual basis accounting thanks in part to technical assistance support from other development partners, including the African Development Bank, the Inter-American Development Bank, and the Asian Development Bank (Bergmann and Horni 2019).

- Public Expenditure and Financial Accountability (PEFA) has both upstream and downstream aspects of public financial management. Pillars 1, 2, 3.11, and 4.16–4.18 cover upstream aspects, such as budget formulation and public investment management (in other words, public expenditure management); pillars 5.21–5.26, 6, and 7 cover downstream aspects and whether budgetary resources are used for intended purposes through effective systems for accounting, control, reporting, auditing, and oversight.

- For example, World Bank public expenditure management support to Cambodia helped modestly improve budget credibility, thanks to sufficient revenue performance and credible expenditure outturns compared with the original budget. Even so, variance in budgeted and actual expenditure remained excessively high for political reasons, particularly for certain ministries such as Rural Development. Similarly, World Bank support to improve the credibility of Sierra Leone’s budget was not achieved because, although substantial technical assistance was provided—for instance, the development of a budget framework paper; the establishment of budget committees in government entities and local councils; and training for ministries, departments, and agencies on preparing their budgets in accordance with the Medium-Term Expenditure Framework guidelines—the investment project financing on its own could not address the policy constraints to enhanced credibility (World Bank 2016b, 2018a).

- In general, most country-level BOOST support was categorized within the World Bank system as a global activity, so it cannot be individually assessed.

- Conversion from alphabetical to numerical scores was done according to the PEFA Secretariat’s crosswalk (https://www.pefa.org/sites/default/files/Transfer%20of%20PEFA%20Scores%20into%20numerical%20values-for%20the%20Website-Final-Nov19.pdf).).