Averting the Housing Gap - What Can Countries Do?

What can countries, the World Bank Group and other stakeholders do to help address the housing gap in developing countries?

What can countries, the World Bank Group and other stakeholders do to help address the housing gap in developing countries?

By: Caroline HeiderMaria Elena Pinglo

By 2020, the number of people living in slums around the world will rise to 900 million if nothing is done.

By 2020, the number of people living in slums around the world will rise to 900 million if nothing is done, according to recent estimates by UN Habitat. This lack of access to adequate housing will exacerbate problems associated with rapid urbanization and population growth in Africa, Asia, and Latin America. The significance of this issue is reflected by Sustainable Development Goal 11, which highlights universal access to affordable housing as a condition to making cities inclusive, safe, resilient, and sustainable.

The benefits of affordable housing are manifold. Research has shown that more and better housing increases the welfare of occupants, stability, and even civic engagement. Improvements in housing also have important benefits to the economy, including the generation of demand for different categories of labor and business. However, housing continues to be a large investment that most individuals cannot afford to pay for all at once, a fact that highlights the central role of housing finance in the functioning of housing markets.

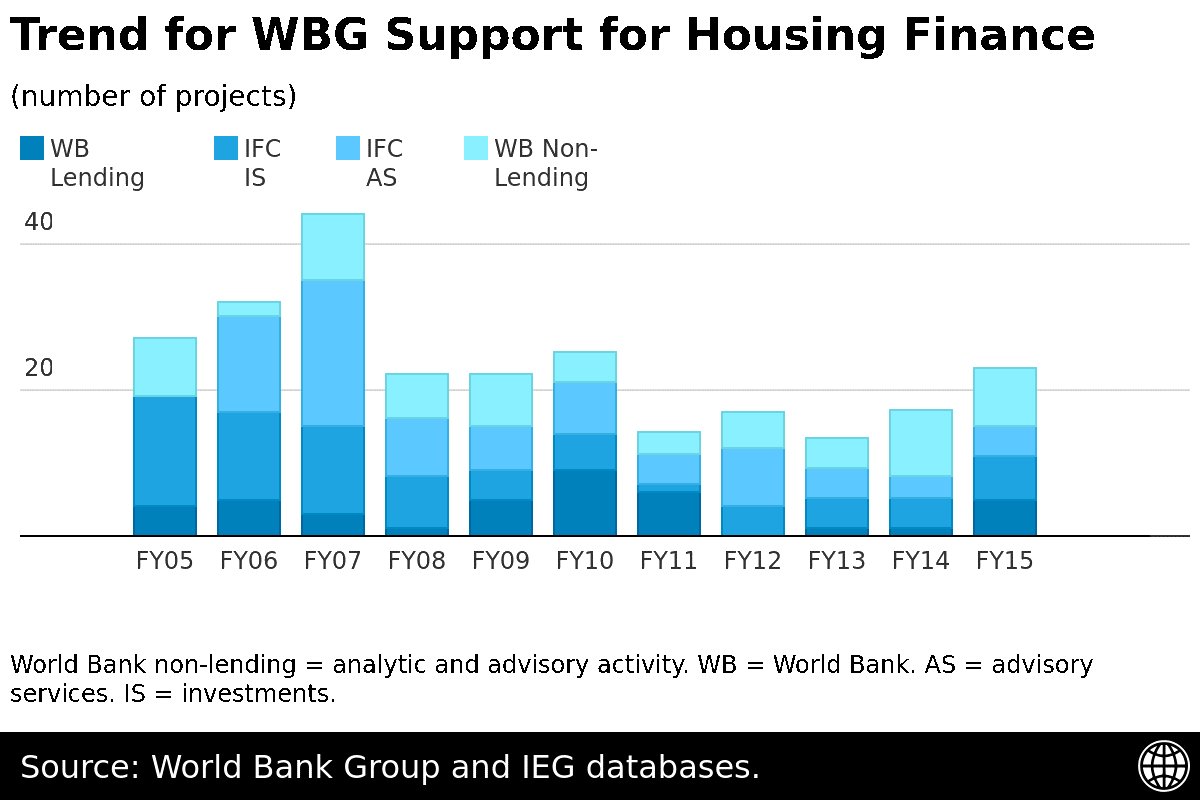

Between 2005 and 2015, the World Bank Group invested over $5 billion to support housing finance projects in 73 developing countries, mostly in the Latin America and Caribbean and the Middle East and North Africa regions. Even with these interventions, demand for housing finance remains huge. Mortgage markets in many developing countries remain weak and underfunded, with mortgage-to-gross-domestic product ratios below 10 percent.

Between 2005 and 2015, the World Bank Group invested over $5 billion to support housing finance projects in 73 developing countries, mostly in the Latin America and Caribbean and the Middle East and North Africa regions. Even with these interventions, demand for housing finance remains huge. Mortgage markets in many developing countries remain weak and underfunded, with mortgage-to-gross-domestic product ratios below 10 percent.

So what can countries, the World Bank Group and other stakeholders do to help address the housing gap in developing countries? A recent review by the Independent Evaluation Group (IEG) looked at the World Bank Group's Support to Housing Finance and provides a number of insights on how countries can work to expand housing finance. The review draws on lessons learned from looking the World Bank Group's activities over the last decade.

Sequencing is key: A well-functioning housing finance sector typically evolves in three stages. Countries often start by strengthening the enabling environment, then progress to initiating the primary market, before finally getting to a stage where they can sustain mortgage funding through tapping the capital markets. Getting the sequence right is often critical. For example, securitization or the use of mortgage-backed securities is only likely to succeed where housing finance markets have benchmark yield curves, experienced institutional investors, and sufficient market liquidity, to name a few of the enablers.

Critical for Success: Understanding Market Conditions. Governments, financial institutions, and other actors need to take the time to develop a deep understanding of the needs of specific markets in which they seek to expand housing finance. In India, the housing finance sector was able to thrive in the last decade, despite the lack of foreclosure legislation and enforcement. This was possible because industry players understood local conditions and used highly selective criteria and personal guarantees to reduce risk.

The importance of stakeholder commitment: As much as timing and sequencing matter, particularly on the policy side, often conditions on the ground may not allow for this. In such cases, having committed sponsors support the passage of key reforms can prove crucial. Gaining the commitment of key players is also vital. In Morocco, for example, the government and World Bank succeeded in sustaining a low-income housing program, primarily because there was strong, sustained commitment on the part of key actors, particularly in government.

IEG's review of the World Bank Group's support to housing finance complements other IEG studies on the World Bank Groupâs activities in the financial sector. An earlier evaluation looked at financial inclusion, while an upcoming evaluation due to be released in July this year will review the World Bank Group's role in promoting capital markets development.

Later this month, IEG will host a learning event with top housing finance experts from within and outside the World Bank Group to discuss the report and share its insights with stakeholders. Speakers will explore how best the World Bank Group and other development practitioners can contribute to bridging the housing gap in developing countries. The upcoming event is part of a broader effort by IEG to share lessons from its evaluative work in ways that emphasize the learning value and promote knowledge sharing among stakeholders.

Lack of safe and affordable housing is a major development challenge - impacting over 330 million households globally. Watch a replay of an IEG LIVE event exploring how the World Bank Group is working to meet the Sustainable Development Goals, in particular the target of ensuring access for all to adequate, safe, and affordable housing. This learning event is jointly hosted by the Independent Evaluation Group, the World Bank's Finance & Markets Global Practice, and the International Finance Corporation's Financial Institutions Group, and will feature the findings and lessons of the recent IEG learning product World Bank Support to Housing Finance.

Lack of safe and affordable housing is a major development challenge - impacting over 330 million households globally. Watch a replay of an IEG LIVE event exploring how the World Bank Group is working to meet the Sustainable Development Goals, in particular the target of ensuring access for all to adequate, safe, and affordable housing. This learning event is jointly hosted by the Independent Evaluation Group, the World Bank's Finance & Markets Global Practice, and the International Finance Corporation's Financial Institutions Group, and will feature the findings and lessons of the recent IEG learning product World Bank Support to Housing Finance.

Comments

Add new comment