The World Bank Group in the Kyrgyz Republic

Chapter 3 | Operationalization and Performance of World Bank Group–Supported Strategies

Highlights

The Country Partnership Strategy and the Country Partnership Framework programs were implemented largely as planned; however, they deviated from plans by pausing budget support through development policy financing and supporting the COVID-19 pandemic response. The pause in development policy financing was appropriate and demonstrated learning from experience.

The shift to private sector–led growth was operationalized in the agriculture sector and in the approach to large infrastructure (that is, national roads) and infrastructure in urban areas. However, some reforms needed to improve conditions for firm-level growth and quality assurance were not implemented on the scale conveyed at the Performance and Learning Review stage. Substantial results were achieved in basic education and health over the evaluation period. World Bank Group–supported projects have had less success with improving services for which responsibility rests mainly at the local level.

Dropping the judicial sector reform project reduced the potential effectiveness of the World Bank Group’s work, as improving the rule of law is needed to substantially increase private sector–led growth in the Kyrgyz Republic. The approach to improving predictability in the business environment was focused at a low level on technical approaches rather than systemic reforms. The approach to essential local public services was heavily weighted toward infrastructure funding rather than addressing binding constraints in service delivery. These will be discussed in chapters 4 through 6.

The Country Partnership Strategy and the Country Partnership Framework had noted that opportunities for the International Finance Corporation and the Multilateral Investment Guarantee Agency may be constrained given the investment climate and institutional capacity, and that was borne out in practice. The International Finance Corporation did make substantial contributions through investment in financial institutions (discussed in chapter 5).

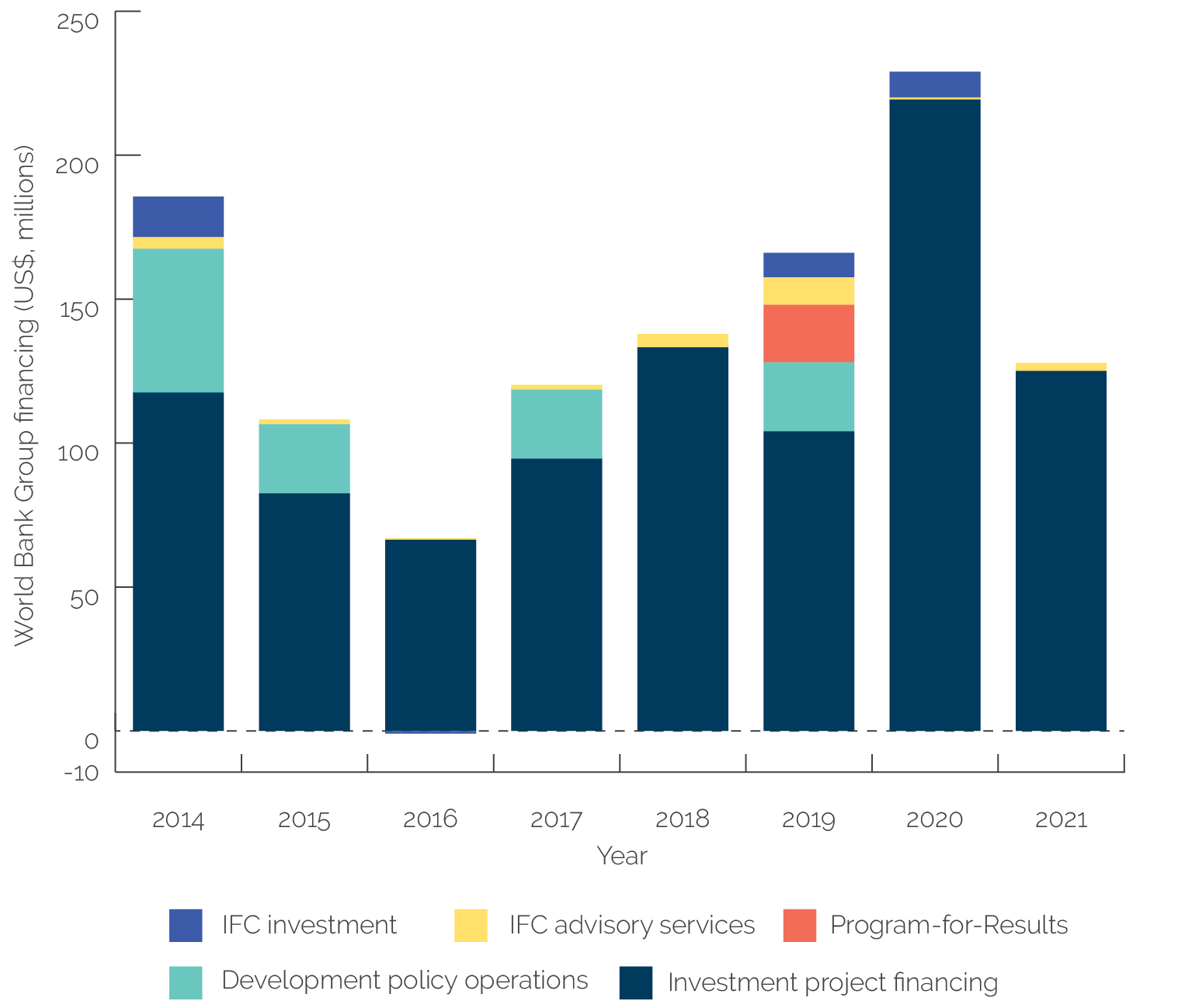

The Bank Group–supported portfolio grew substantially over the evaluation period. From $503 million in active investment projects in FY14, the World Bank portfolio grew steadily to $1,063 million by FY21. Figure 3.1 shows the Bank Group support approved throughout the evaluation period.

Figure 3.1. World Bank Group Financing Approved by Type and Fiscal Year

Figure 3.1. World Bank Group Financing Approved by Type and Fiscal Year

Source: World Bank Business Intelligence database.

Note: IFC = International Finance Corporation.

Country Partnership Strategy Implementation and Performance

The CPS objective to establish a robust system of public administration and reform the judiciary was implemented with heavy reliance on development policy operations (DPOs). A series of two DPOs in FY14 contained prior actions related to the adoption of the anticorruption program, its action plan, and the Law on Conflict of Interest; budget discipline and transparency; transparency in public procurement; improving energy sector transparency, governance, and accountability; and judicial reform. A Governance and Competitiveness DPO in FY17 (expected to be the first in a series of two; the second operation was canceled) supported many of the same areas in addition to tax administration reform.

There was significant advisory services and analytics (ASA) and technical assistance through small (trust-funded) investment projects on aspects of PFM, public sector reform, public procurement, and statistics. IFC advisory services contributed to tax administration reform. The planned Judicial Development Project was dropped, which reduced the potential effectiveness of the World Bank Group’s work, as improving the rule of law is needed to substantially increase private sector–led growth in the Kyrgyz Republic. The details of the work under this objective are discussed in chapter 4 on governance.

The CPS objective to expand access to and increase the efficiency and quality of education, health, and other public services was supported by a large lending program. Health, social protection, and education are discussed in this chapter, whereas rural water supply and sanitation and village infrastructure are discussed in chapter 6 on essential local public services.

Operations showed good results on health but weaker results on social protection. The Health and Social Protection Project (FY05–15) supported strengthening the targeting of social benefits and mitigating the impact of food price shocks on health and nutrition. However, the Independent Evaluation Group (IEG) rated it moderately unsatisfactory for overall outcome because of modest contributions to improving performance of the health sector and strengthening the targeting of social benefits (World Bank 2016d). The Second Health and Social Protection Project (FY13–20) performed better after the project was restructured to narrow the focus on mother and child health care, as the initial project development objective was considered too ambitious, and client capacity was insufficient to cover all four originally planned service areas (World Bank 2020b). The Results-Based Health project (FY13–17) piloted performance-based payments and enhanced supervision for maternal and neonatal care in selected hospitals and strengthened the recipient and health care provider capacity in performance-based contracting and monitoring and evaluation for results. IEG found that the project successfully implemented the pilot as planned (World Bank 2020c).

The Sector Support for Education Reform project (FY13–19) created conditions for improved learning outcomes in basic education, and the IEG validation found it to be well designed and implemented. The project “created favorable conditions for improved learning in basic education, as it improved pedagogical practices, teacher skills, curricula, availability of textbooks and teaching-learning materials, and applied a Classroom Assessment Scoring System. It established conditions for efficient allocation of resources by supporting a nationwide rollout of Per Capita Financing. It promoted school capacities in budgeting and resource management and transparent school reporting on performance and expenditures” (World Bank 2020d, 8).

Promotion of financial and private sector development was supported by a wide range of World Bank and IFC interventions. Details of the work under this objective are discussed and assessed in chapter 5 on private sector development. IFC increased its investment in domestic financial institutions but did not find investment opportunities in other sectors that were mentioned as possibilities in the CPS. This was due to several factors: (i) expected reforms that were not enacted in the health and education sectors to improve the enabling business environment, (ii) low capacity of the government to implement public-private partnerships, (iii) ongoing concerns related to corporate governance and corruption, and (iv) the continued dominant role of the public sector in the economy and unrealized privatization plans.

CPS support to the agriculture sector was adjusted to focus on export-oriented growth after the PLR stage. After the PLR stage, an effort to link agriculture with export value chains in the dairy sector was pursued jointly by the World Bank and IFC, making the program more relevant to supporting sources of economic growth. Kyrgyz Republic: Developing Agri-Food Value Chains (World Bank Group 2018) contributed to this shift. The Completion and Learning Review (CLR) Review rated these objectives as only partially achieved (World Bank 2018d).

The World Bank supported increasing transparency, accountability, and governance arrangements for main energy companies (largely state-owned enterprises). This change was attempted primarily through the FY14 DPO programmatic series and the FY15 Energy sector DPO. Prior actions in the FY17 Governance and Competitiveness DPO supported the revision of the tariff-setting methodology for district heating companies and the introduction of a performance reporting and monitoring framework for the heating sector. Reforms in the heating subsector were prioritized because of its major performance failure during the preceding winter, which had serious political implications. The governance component of the FY15 Electricity Supply Accountability and Reliability Improvement Project was aimed at strengthening metering, procurement, and financial management practices at the major power distribution company. The lack of progress in energy sector reform, including increased tariffs, was a major driver of the World Bank’s decision to pause development policy lending after FY17 (although a stand-alone operation was approved in FY19).

The World Bank’s approach to enhancing governance in the energy sector under the CPS failed to adequately reflect the government’s anxieties over the reliability of the power supply in winter months and the affordability of electricity consumption. In contrast with the experience of other countries in the region, the push for higher tariffs in the Kyrgyz Republic was not accompanied by reform of the national social protection system (introduction of means-tested poverty benefits) as a mitigation measure.

Country Partnership Framework Implementation and Performance

The core of the FY19–22 CPF program (through FY21) was implemented largely as planned but with a pause in development policy lending and the inclusion of support for the COVID-19 pandemic response.

The objective to strengthen institutions for improved macroeconomic management focused on PFM and debt management and has had modest results. It was supported mainly by ASA and the FY19 Economic Governance DPO with prior actions supporting budget discipline in transparency, transparency in public procurement, and improvements in tax administration. Implementation was off-track “because of political uncertainty, lack of ownership, and poor implementation and coordination” (World Bank 2022e, 5).

The objectives to enhance conditions for private investment and diversification had mixed results. The program design omitted important aspects of the business-enabling environment and access to finance. The FY19 Economic Governance DPO supported a prior action to submit the draft law on food safety to parliament (which was not adopted) and to adopt procedures for dispute resolution among private operators in the telecommunications sector (which is still not effective). The financial sector development program made contributions to transforming microfinance institutions into banks and shifting banking supervision to a risk-based framework, but the support to expand access to financial services through the KPO had limited relevance and effectiveness.

The CPF noted that opportunities for IFC and MIGA were constrained by the investment climate and institutional capacity. IFC investment and MIGA guarantees remain constrained by the small market, the dominance of the public sector, and lack of transparency in aspects of the regulatory environment. IFC’s advisory services were implemented as planned during the CPF period, focusing on the investment climate, agribusiness sector, and financial sector development and advising on a public-private partnership transaction for Manas International Airport (see chapter 5).

Development policy lending was paused, driven by a lack of progress and reversals in some reforms supported under previous DPOs. The World Bank canceled the second operation in the Governance and Competitiveness DPO series (slated for FY18) and paused future DPOs because of lack of progress on energy sector reform and attempts to backtrack on public procurement reforms supported in the FY14 DPO series. The World Bank approved a stand-alone Economic Governance DPO in FY19 that was driven by a desire to stop further backtracking on public procurement reform—through two prior actions supporting implementation of the Public Procurement Law (establishing Independent Complaint Review Commission enhancements and adopting standard bidding documents in two key public procurement areas). There has been no development policy lending since FY19.

Relevant lessons from the CPS did not adequately inform implementation of the CPF. The CLR of the CPS highlighted the following as important for reducing corruption and improving governance: (i) strengthening the demand for good governance to generate sustained political commitment to reduce corruption and (ii) implementing a long-term approach spanning several CPF periods and mainstreaming governance considerations throughout the entire Bank Group program. The CPF stated that the Bank Group program would use citizen engagement mechanisms to achieve this. However, the implementation of citizen engagement was not appropriately matched to the governance challenge. Citizen engagement mechanisms were mostly applied in projects at the local level to prioritize local micro infrastructure projects. These engagement mechanisms did not focus on accountability mechanisms at the central government level.

COVID-19 Pandemic Response

The World Bank responded quickly to support the health, private sector, and livelihood impacts of the COVID-19 pandemic. The response included the following:

- A $12.2 million Emergency COVID-19 Project and $20 million in additional financing to strengthen disease surveillance systems, public health laboratories, and epidemiological capacity for early detection and confirmation of cases; combine detection of new cases with active contact tracing; support epidemiological investigation; strengthen risk assessment; and provide on-time data and information for guiding decision-making and response and mitigation activities. It also financed essential medical goods, such as medicines, medical supplies, and equipment. Its implementation progress was strong from late 2020 through early 2022. The original project, approved in April 2020, was one of the first COVID-19 response projects approved by the World Bank.

- A $50 million Emergency Support for Micro, Small, and Medium Enterprises Project approved in July 2020 with $50 million in cofinancing from the Asian Infrastructure Investment Bank and another $50 million in additional financing in FY22. The project sought to address potential risk aversion and decreased lending by financial institutions that would deny firms critical financing during the pandemic. The project experienced considerable delays in implementation as a result of the change in government in 2020–21. Disbursement accelerated in early 2022.

- A total of $17 million in additional financing for the Third Village Investment Project and $20 million in additional financing for the CASA-1000 Community Support Project to reach all rural subdistricts with support for social infrastructure investments and to support reestablishment of livelihoods affected by COVID-19.

- A $50 million Social Protection Emergency Response and Delivery Systems Project that did not become effective and was canceled as per the client’s request.

Project Performance across the Evaluation Period

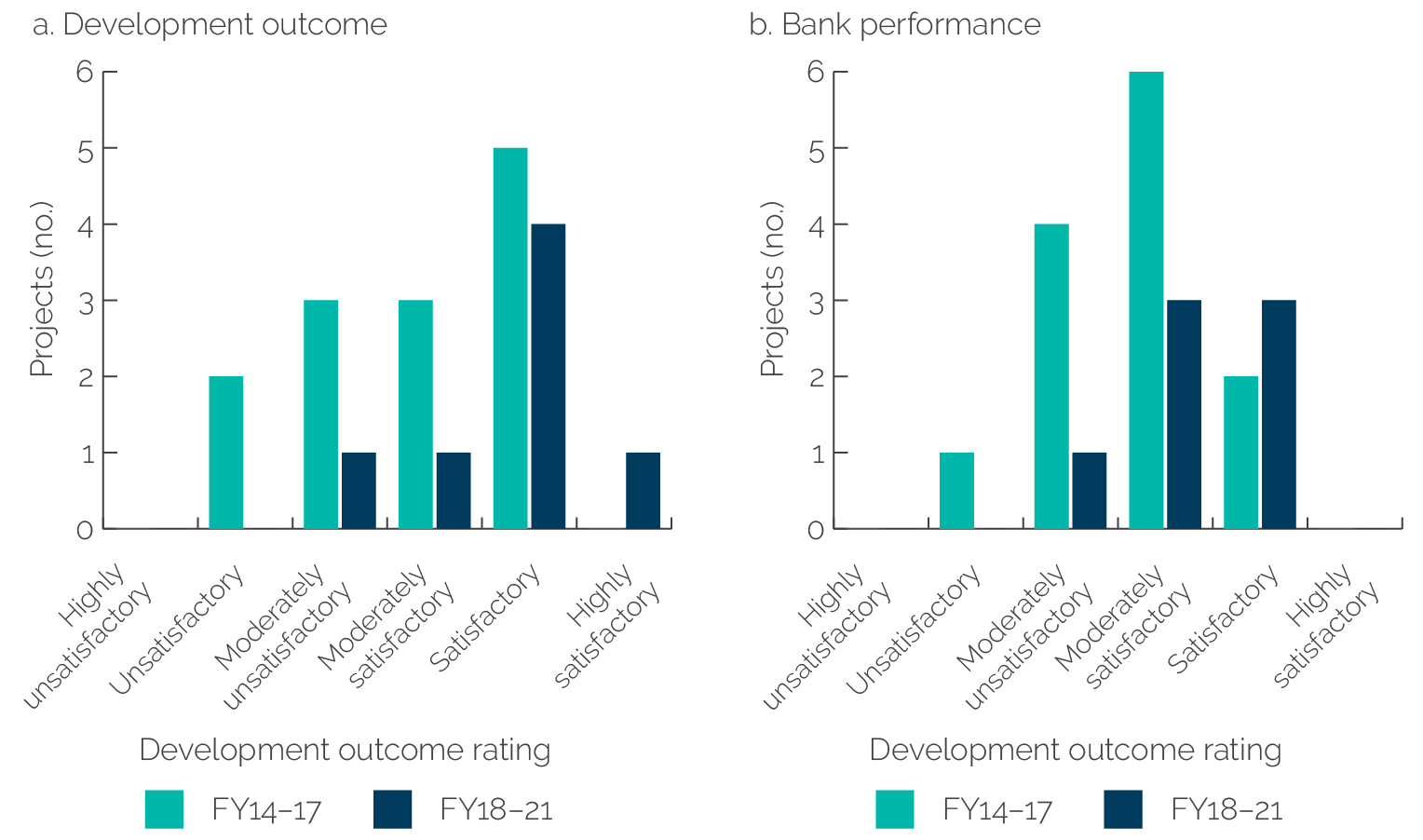

Results from DPOs over the evaluation period were disappointing. During the evaluation period, the World Bank used DPOs to support improvements in governance and competitiveness and the financial viability and governance of the energy sector. Development outcomes were rated moderately unsatisfactory or lower and Bank performance was rated moderately unsatisfactory, reflecting weaknesses in both design and implementation. The energy sector DPO was somewhat more successful with both its development outcome and Bank performance rated moderately satisfactory. Chapter 4 on governance and chapter 5 on private sector development discuss the specific reforms that were supported by these operations.

Results from investment project financing were more positive (figure 3.2). Appendix C presents the portfolio, including project ratings.

Figure 3.2. Development Outcome and Bank Performance Ratings for Investment Project Financing Projects

Figure 3.2. Development Outcome and Bank Performance Ratings for Investment Project Financing Projects

Source: Independent Evaluation Group.

Note: FY = fiscal year.