The World Bank Group in Ukraine, 2012–20

Chapter 1 | Background

This Country Program Evaluation (CPE) reviews the relevance and effectiveness of the World Bank Group partnership with Ukraine between 2012 and 2020. It responds to the following evaluation questions: (i) To what extent were the Bank Group’s strategic positioning and engagement relevant to and aligned with the country’s main development challenges and evolving political economy? (ii) To what extent did Bank Group engagement contribute to development results in Ukraine, including helping to deal with crises and their aftermath? (iii) How effectively did the Bank Group leverage internal synergies and collaborate with major development partners? The CPE also draws lessons for future engagement in Ukraine.

Country Context

Ukraine has significant economic potential, but economic and social developments have been slow and highly volatile over the past decade. A lower-middle-income country with a population of 43 million and a gross national income per capita of $3,540 in 2020 (Atlas method), Ukraine is endowed with a well-educated and entrepreneurial population, vast areas of fertile land, sizable energy and other natural resources, and a geographic location at the crossroads of Europe and Asia. However, Ukraine’s gross national income per capita remains far below that of its neighbors and comparator countries.1 Although some indicators of human development have returned to pretransition levels, life expectancy at birth (72 years in 2019) has changed little over the past 20 years and lags the European Union (EU) and Organisation for Economic Co-operation and Development averages by more than 10 years. The poverty rate (at the international poverty rate of $5.50 a day, 2011 purchasing power parity) increased from 3.4 percent in 2012 to a peak of 6.3 percent in 2015 and declined to 3.4 percent in 2018. During the same period, inequality increased slightly.2

Ukraine’s uneven economic performance was a result of both internal factors and exogenous shocks. The country was hit hard by the 2008–09 global economic and financial crisis, with gross domestic product (GDP) shrinking by almost 15 percent in 2009. After a period of recovery, the country faced two shocks in 2014 and 2015: an armed conflict in Eastern Ukraine and a drop in global commodity prices (particularly for metals and agricultural goods). As a result, real GDP contracted by 6.6 percent in 2014 and 9.8 percent in 2015 (table 1.1). The national currency (hryvnia) depreciated 47 percent in 2014 and a further 33 percent in 2015, while the consolidated fiscal deficit reached 10.1 percent of GDP in 2014 and the public debt burden more than doubled to 70 percent of GDP in 2015 (World Bank 2017f).3 Many of the country’s development challenges have persisted over the past three decades in the face of stop-and-go reform efforts. These challenges include corruption and weak governance; energy inefficiency, affordability, and supply insecurity; ineffective public services and poorly targeted social assistance; and conflicts and shocks (World Bank 2017a, 2017c, and 2018d).

Table 1.1. Key Economic and Social Indicators

|

Indicators |

Ukraine, by Year |

Average during 2012–19 |

||||

|

2012 |

2015 |

2019 |

Ukraine |

ECA |

World |

|

|

GDP growth (annual %) |

0.2 |

–9.8 |

3.2 |

–0.6 |

1.7 |

2.8 |

|

GNI per capita (current dollars) |

3,500 |

2,700 |

3,370 |

3,060 |

24,714 |

10,834 |

|

Inflation, consumer prices (annual %) |

0.6 |

48.7 |

7.9 |

13.5 |

1.4 |

2.3 |

|

Life expectancy at birth, total (years) |

70.9 |

71.2 |

71.8 |

71.3 |

77.3 |

71.9 |

|

Infant mortality (per 1,000 live births) |

9.2 |

8.1 |

7.2 |

8.1 |

8.2 |

31.2 |

Sources: International Monetary Fund World Economic Outlook database; World Bank World Development Indicators database.

Note: ECA = Europe and Central Asia; GDP = gross domestic product; GNI = gross national income.

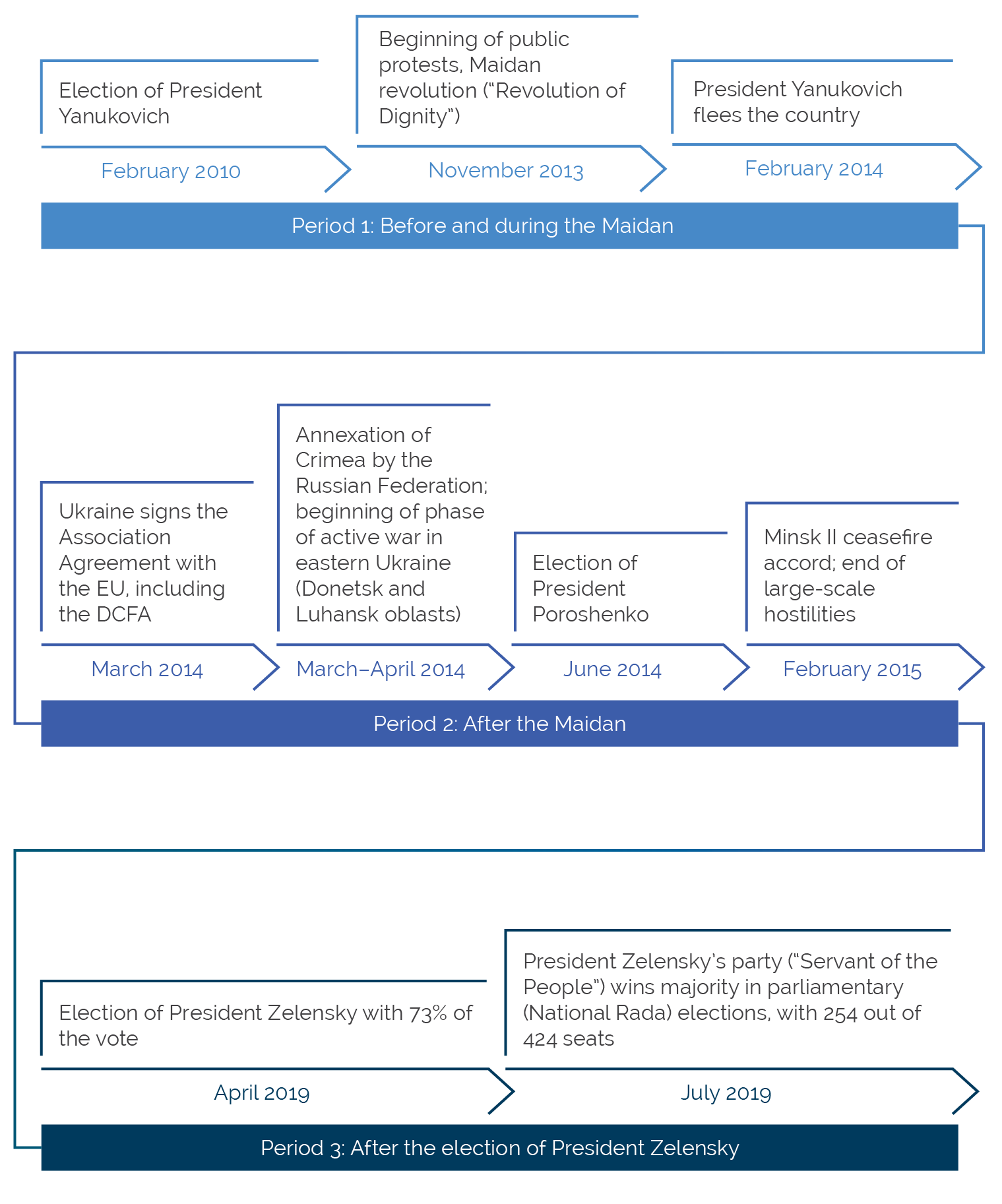

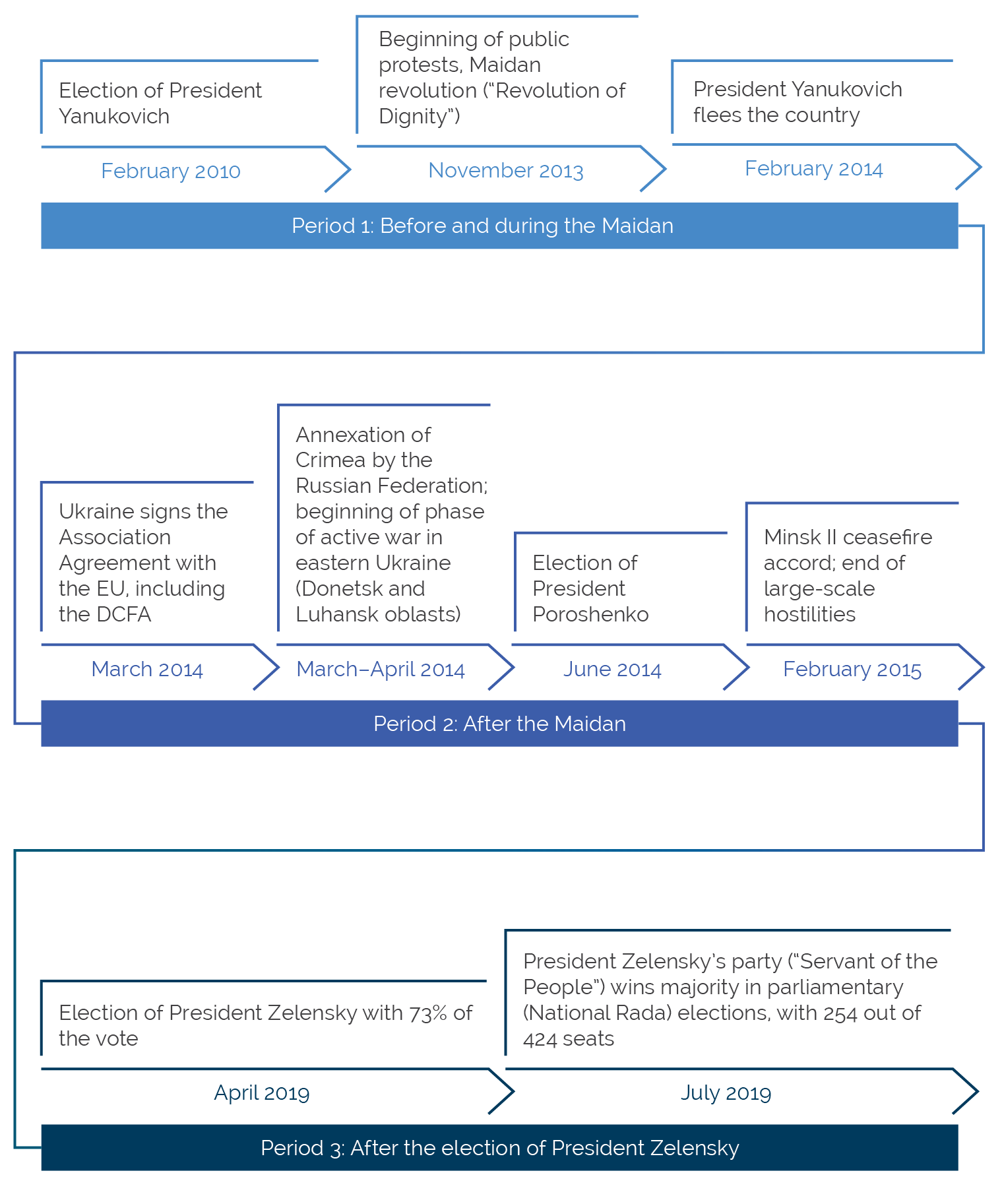

The period covered by this CPE can be divided into three distinct subperiods, defined by political developments and corresponding adjustments in Bank Group engagement: (i) 2012–13 was a period of stagnant engagement with the government of President Yanukovych amid low demand for reform; (ii) 2014–19, after the so-called Euromaidan revolution (also known as the “Revolution of Dignity”), included a major economic and financial crisis, during which the Bank Group focused on stabilizing the economy and supporting institutional reforms; and (iii) the election of President Zelensky in April 2019 (with an unprecedented majority)4 led to closer dialogue in areas previously considered too politically sensitive (such as land reform), amid continued opposition from vested interests (figure 1.1). This CPE also covers the beginning of the negative impact of the COVID-19 pandemic.

Figure 1.1. Major Political Milestones

Source: Independent Evaluation Group.

Note: DCFTA = Deep and Comprehensive Free Trade Agreement; EU = European Union.

World Bank Group–Supported Program

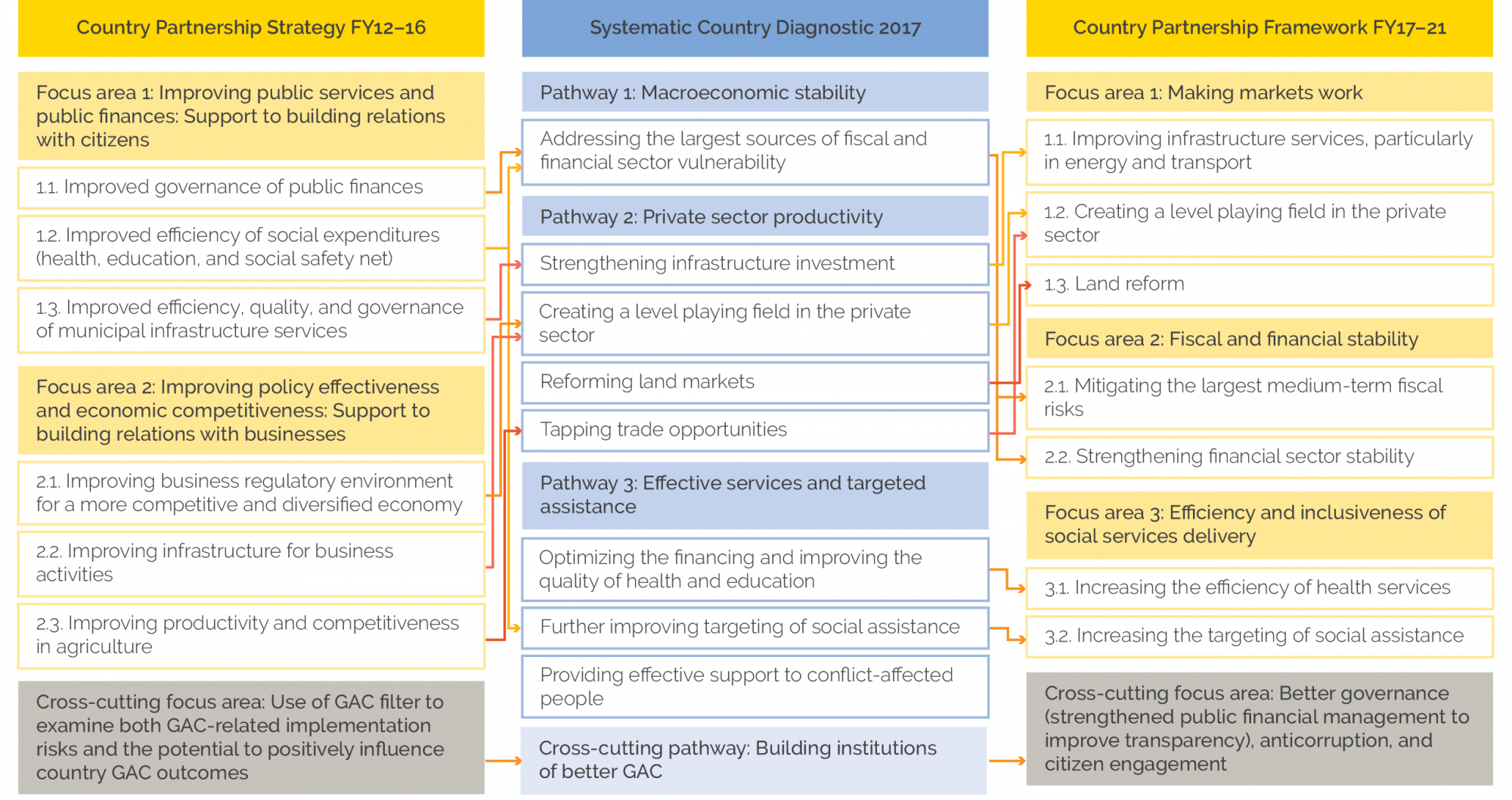

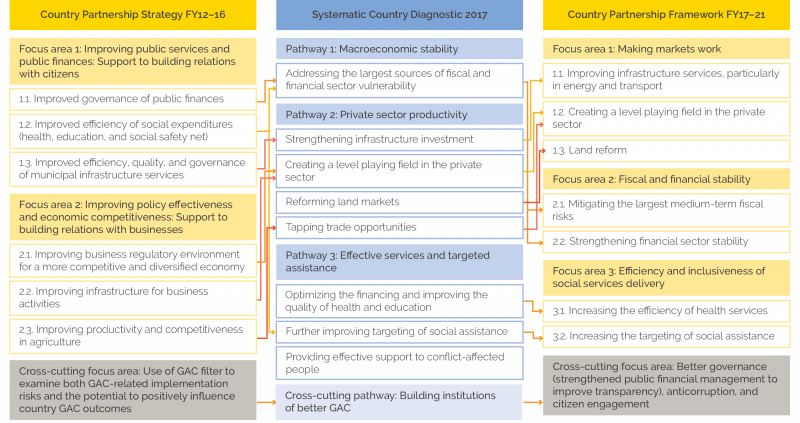

During the period under review, the Bank Group engagement with Ukraine was guided by two strategies, with the latter informed by the 2017 Systematic Country Diagnostic (figure 1.5). The fiscal year (FY)12–16 Country Partnership Strategy (CPS; World Bank 2012b) covered the period before and after the 2014 events and was based on two pillars: (i) state capacity for service delivery and government accountability, and (ii) growth and competitiveness through a better regulatory and investment climate and improved business infrastructure. The FY17–21 Country Partnership Framework (CPF; World Bank 2017c) placed greater emphasis on governance-related issues and citizen engagement and focused on four areas: (i) better governance, anticorruption, and citizen engagement; (ii) making markets work; (iii) fiscal and financial sustainability; and (iv) efficient, effective, and inclusive service delivery. Because of the COVID-19 pandemic, the CPF was extended by one year until June 30, 2022.5 The new CPF for FY23–27 has been postponed indefinitely given the ongoing armed conflict (since February 2022).6

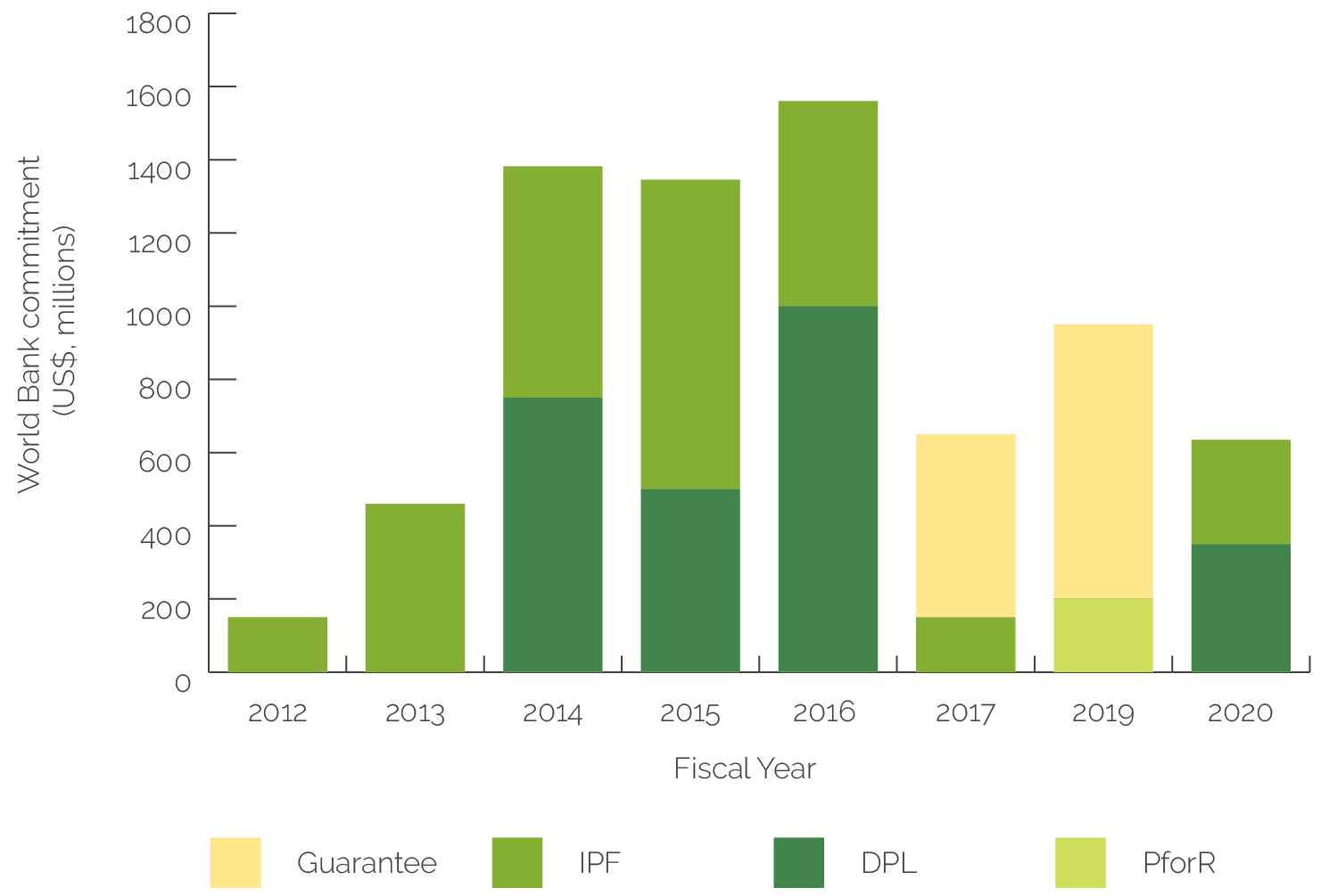

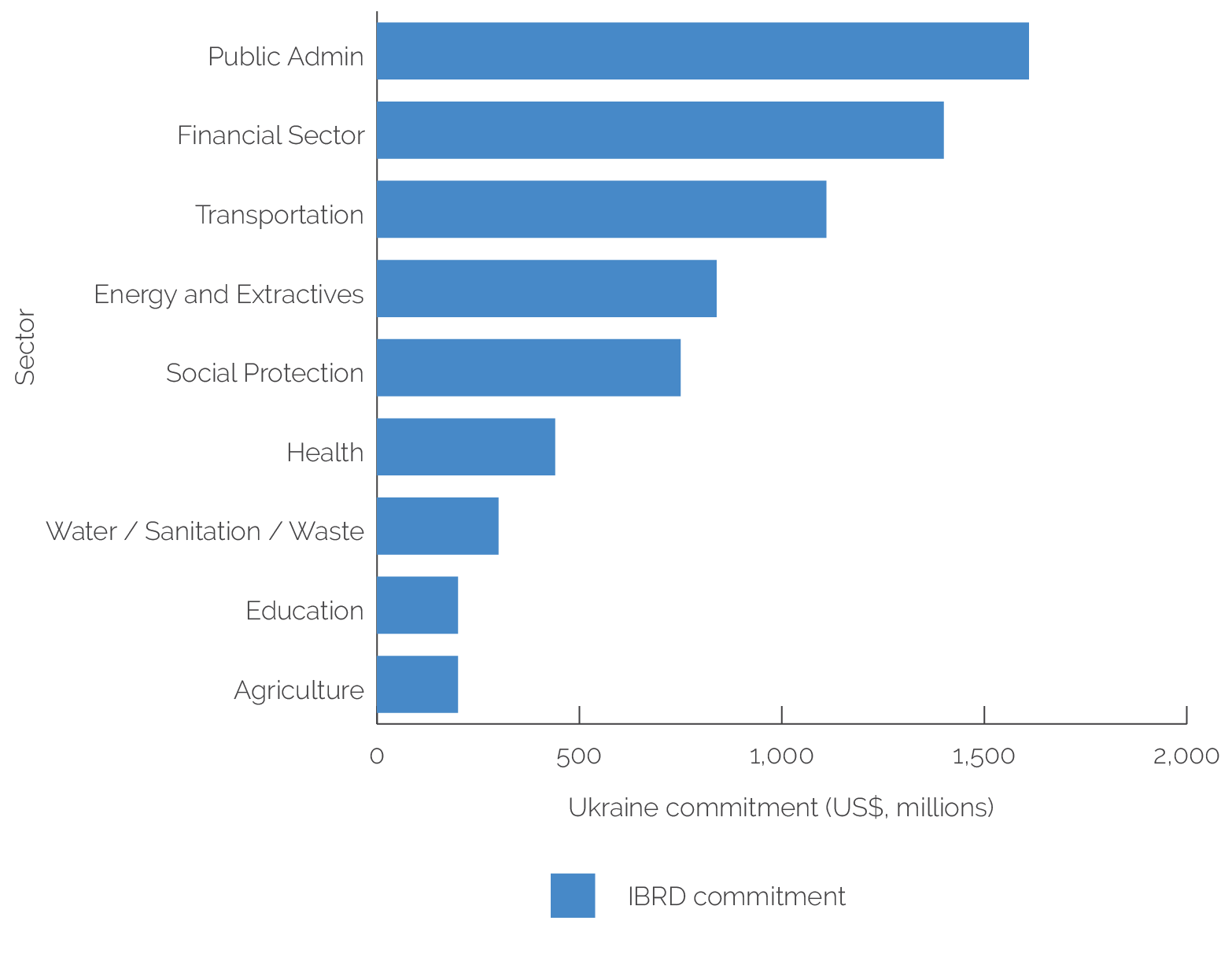

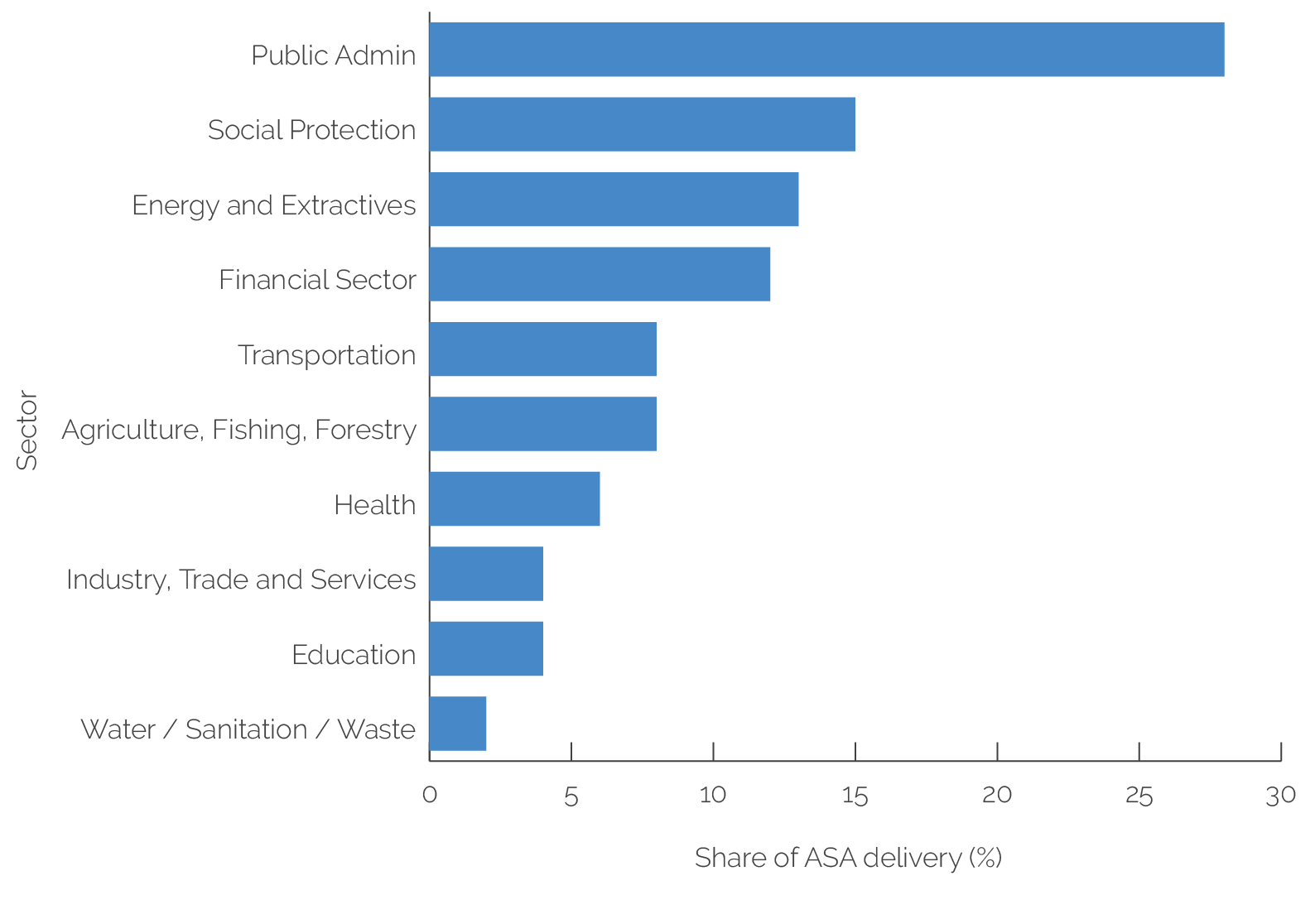

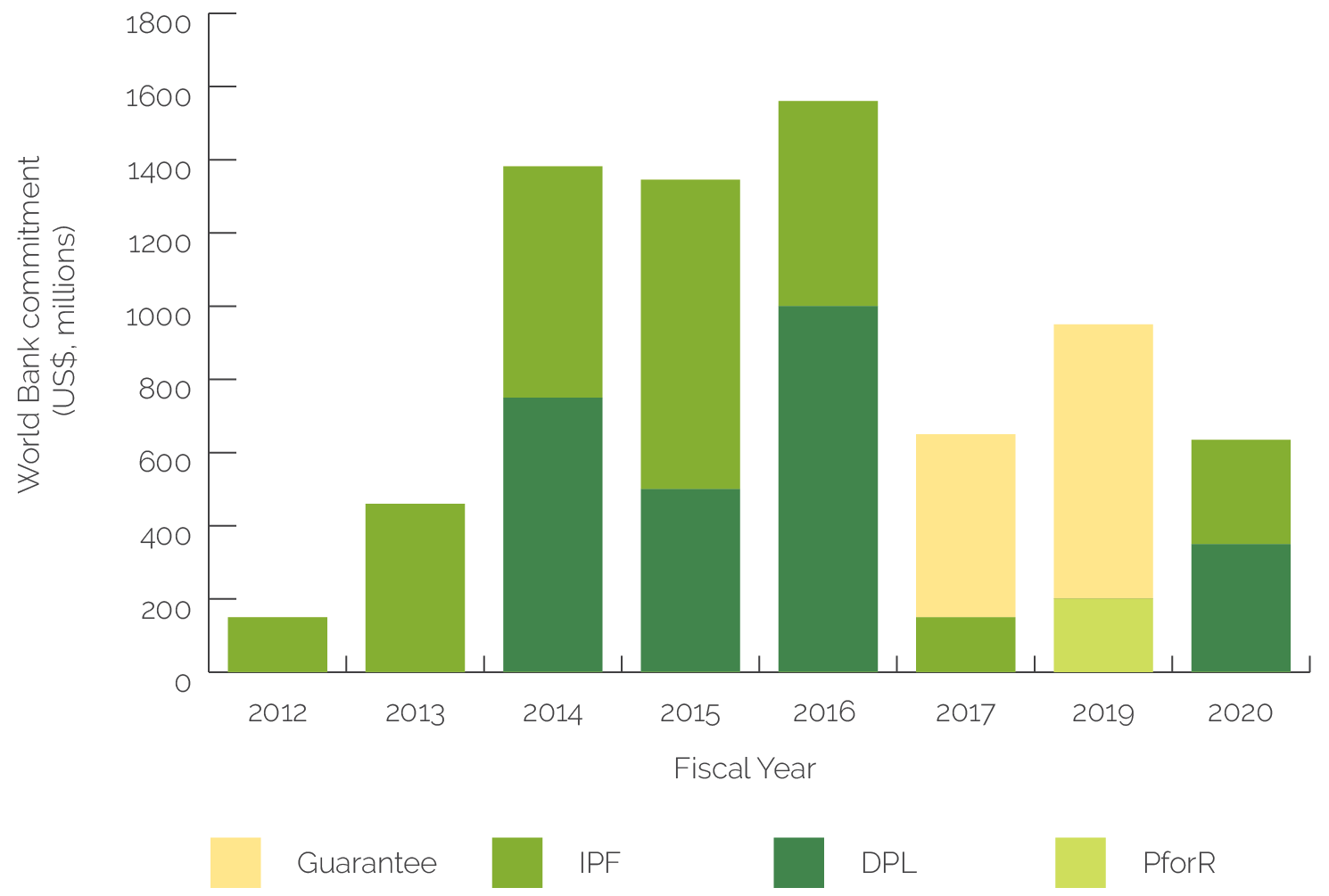

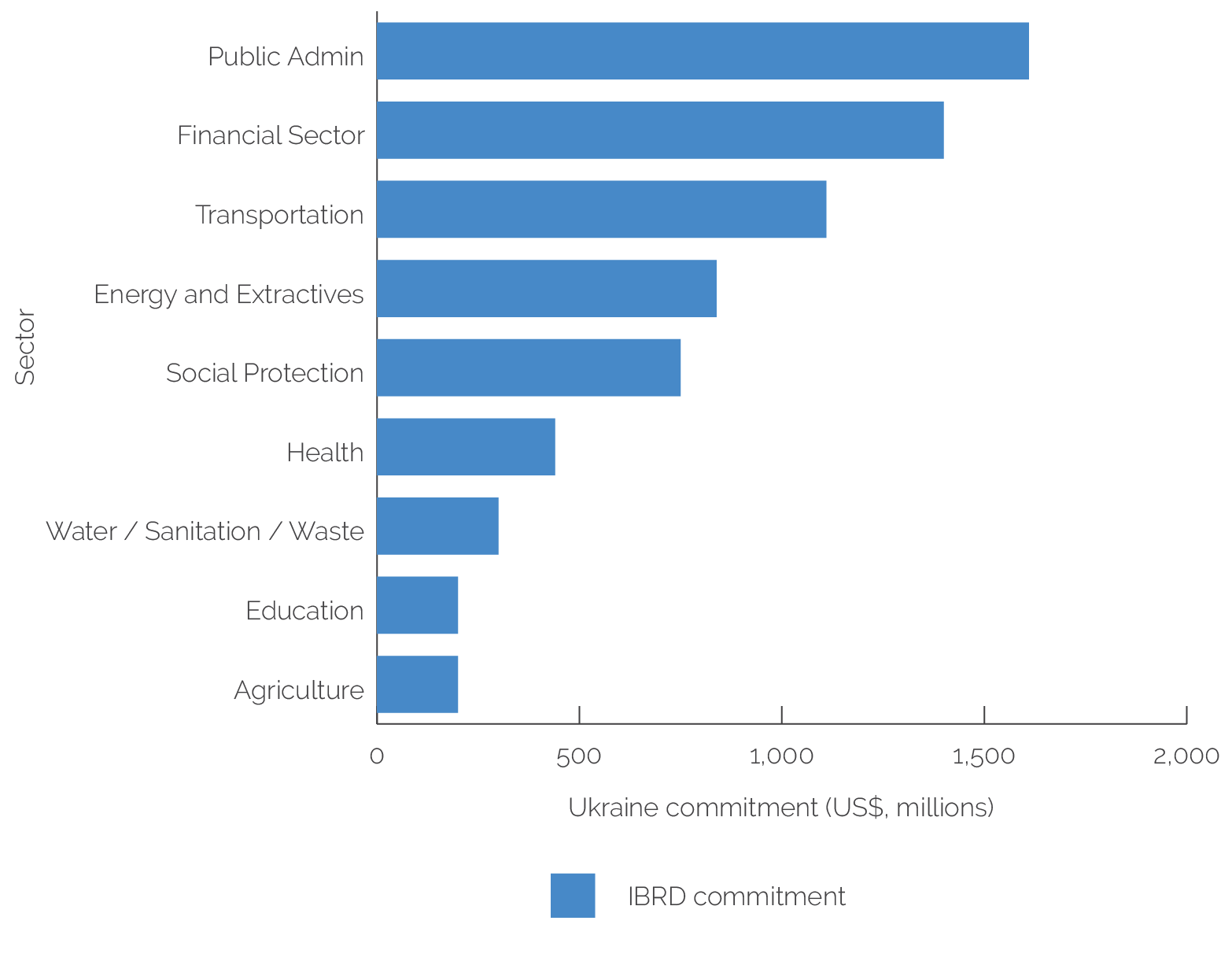

Bank Group support evolved in response to crises and political developments. Before 2014, engagement was characterized by slow-moving investment projects (mainly in energy and infrastructure), no budget support operations, and limited advisory services and analytics (ASA). Beginning in 2014, and in response to crises and political changes, the Bank Group drastically ramped up financial support to the government (figure 1.2), with the majority of financing in the form of development policy loans (DPLs) linked to policy reforms related to crisis response and better governance (figure 1.3). In addition, the Bank Group continued to support the infrastructure sector through new projects in energy (2016 Power Transmission Project, $330 million, and 2021 Power System Resilience project, $177 million) and transport (2016 Road Sector Development Project, $560 million). Analytical work continued to focus on institution building, including support for anticorruption reforms (figure 1.4).

In response to the COVID-19 pandemic and conflict in Eastern Ukraine, the Bank Group approved over $1.1 billion of support in 2020–21. This support included additional financing for a health project ($135 million), two additional financings for the Social Safety Nets Modernization Project ($150 million and $300 million), a public health and vaccines project ($90 million), and a budget support operation to assist with economic recovery ($350 million).7 In November 2020, the World Bank approved a $100 million loan to support conflict-affected areas in the east (“Eastern Ukraine: Reconnect, Recover, Revitalize”) and support government efforts to promote the recovery, reintegration, and inclusion of the conflict-affected population.

Figure 1.2. World Bank Commitments to Ukraine by Financing Instrument, Fiscal Years 2012–20

Source: World Bank Business Intelligence (January 29, 2021).

Note: DPL = development policy loan; IPF = investment project financing; PforR = Program-for-Results.

The Bank Group supported private sector development (most notably agribusiness) mainly through International Finance Corporation (IFC) investments and Bank lending operations. IFC committed $751 million through 38 investments, the bulk of which (21 investments totaling $494 million) were in the agribusiness sector. A 2019 Program-for-Results operation (“Accelerating Private Investment in Agriculture”) aimed to eliminate constraints on private sector participation in the agriculture input and output markets. A programmatic development policy financing series included prior actions to strengthen the business regulatory framework and address distortions in the agricultural land market. The Multilateral Investment Guarantee Agency had six project exposures in Ukraine, amounting to $204 million. Table 1.2 presents outcome and Bank performance ratings for projects in Ukraine that closed during the evaluation period, and appendix D provides additional details on the Bank Group portfolio. Building on the assessment of private sector development constraints contained in the 2017 Systematic Country Diagnostic, the Bank Group produced in 2020 a Country Private Sector Diagnostic (IFC 2020) that examined ways to unleash private sector potential. These included improving agricultural productivity, integration into manufacturing global value chains, and health care. The report identified persistent cross-cutting constraints, such as weak competition landscape, limited access to finance, inadequate infrastructure, and energy market distortions.

Figure 1.3. Ukraine Commitments by Sector, Fiscal Years 2012–21

Source: World Bank Business Intelligence (December 14, 2021).

Note: IBRD = International Bank for Reconstruction and Development.

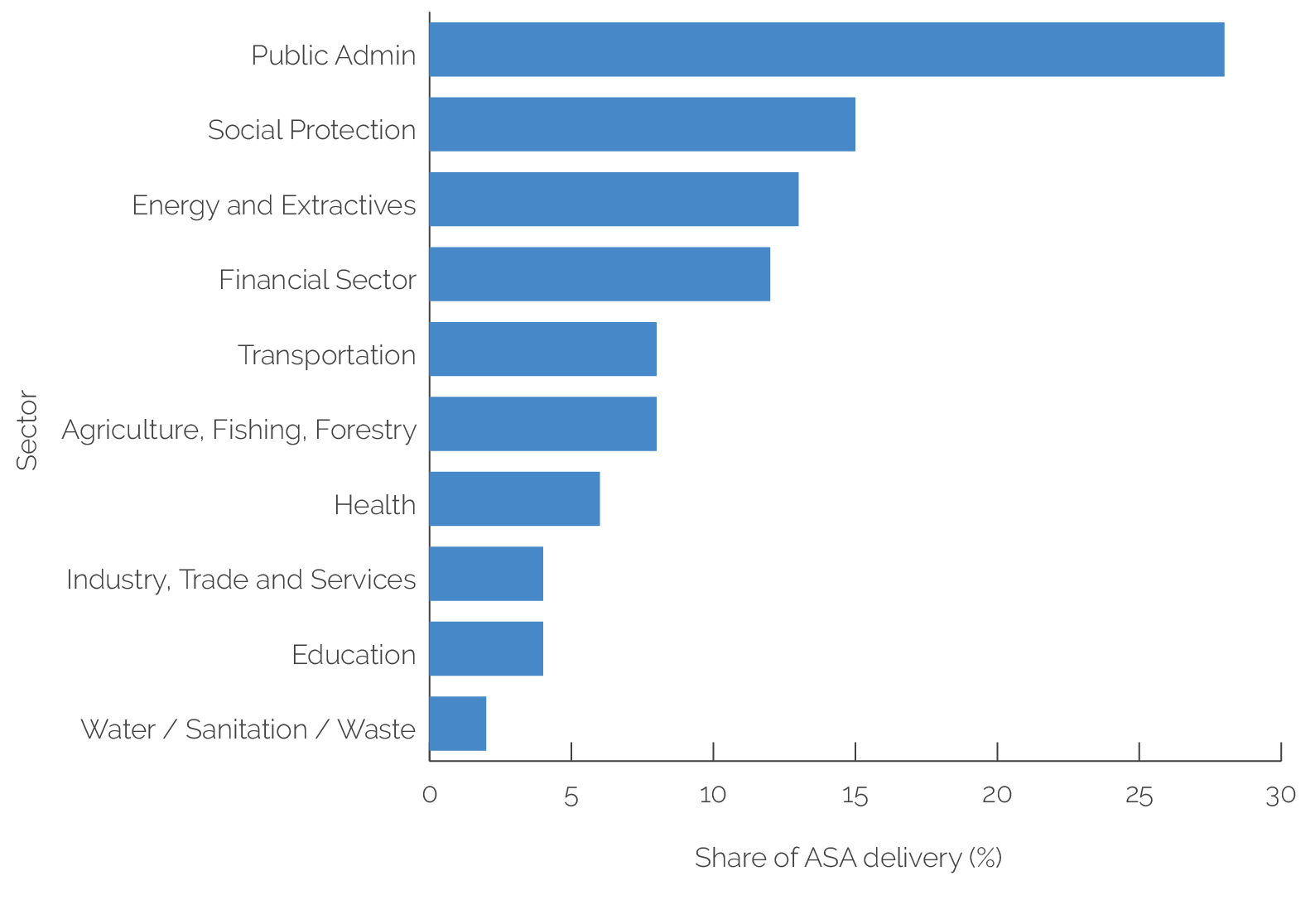

Figure 1.4. Ukraine Advisory Services and Analytics Delivery by Sector, Fiscal Years 2012–21

Source: World Bank Business Intelligence (December 14, 2021).

Note: ASA = advisory services and analytics.

Table 1.2. Independent Evaluation Group Performance Ratings for Ukraine, Fiscal Years 2012–19

|

Exit FY |

Project Name |

Amount (US$, millions) |

IEG Outcome Rating |

Bank Performance Rating |

|

2012 |

State Tax Service Modernization Project |

40 |

Moderately satisfactory |

Moderately satisfactory |

|

2013 |

Rural Land Titling and Cadastre Development Project |

82 |

Moderately satisfactory |

Moderately satisfactory |

|

2013 |

Social Assistance System Modernization Project |

93 |

Unsatisfactory |

Moderately unsatisfactory |

|

2014 |

Development of State Statistics System |

41 |

Moderately satisfactory |

Moderately satisfactory |

|

2015 |

Public Finance Modernization Project |

4 |

Unsatisfactory |

Unsatisfactory |

|

2015 |

Second Export Development Project |

305 |

Satisfactory |

Satisfactory |

|

2015 |

Urban Infrastructure |

137 |

Moderately satisfactory |

Moderately satisfactory |

|

2015 |

Roads and Safety Improvement |

380 |

Moderately satisfactory |

Moderately satisfactory |

|

2015 |

DPL 1 |

750 |

Satisfactory |

Satisfactory |

|

2015 |

Programmatic Financial Sector DPL 1 |

500 |

Satisfactory |

Satisfactory |

|

2016 |

Hydropower Rehabilitation |

138 |

Moderately satisfactory |

Moderately satisfactory |

|

2016 |

Power Transmission |

194 |

Moderately unsatisfactory |

Moderately satisfactory |

|

2016 |

DPL 2 |

500 |

Satisfactory |

Satisfactory |

|

2016 |

Programmatic Financial Sector DPL 2 |

500 |

Satisfactory |

Satisfactory |

|

2017 |

Energy Efficiency |

200 |

Satisfactory |

Satisfactory |

Source: World Bank Business Intelligence (January 31, 2021).

Note: DPL = development policy loan; FY = fiscal year; IEG = Independent Evaluation Group.

Figure 1.5. Evolution of the World Bank Group Strategy, Fiscal Years 2012–21

Source: Independent Evaluation Group.

Note: FY = fiscal year; GAC = governance and anticorruption.

Country Program Evaluation Scope and Coverage

The CPE includes three special themes that reflect important challenges Ukraine faced during the evaluation period. These themes were identified in discussions with the Bank Group Ukraine country team and the Ukrainian authorities during the early stages of this evaluation and through review of the country strategy and analytic documents.

- Governance and anticorruption. Weak governance and high levels of corruption have been perennial challenges for Ukraine, permeating most sectors of the economy. Anticorruption was an overarching theme in all Bank Group programs and government of Ukraine strategies. The CPE examines the relevance and efficacy of Bank Group support to achieving better transparency, accountability, and associated institutional reforms (chapter 2).

- Crisis response and economic resilience. Ukraine went through several severe political and economic crises during the evaluation period, and the Bank Group was a key partner in supporting economic stabilization and in helping to address underlying fiscal and financial sector vulnerabilities. The CPE assesses how well the Bank Group contributed to stabilizing the economy and building the foundation for economic resilience (chapter 3).

- Energy security and efficiency. A well-functioning energy sector, with a secure supply, is vital for Ukraine’s economic competitiveness and fiscal sustainability and the well-being of its people. Although the country is endowed with sizable energy resources and has an advantageous geographic location, it is also one of the most energy-intensive economies in the world, with high energy consumption perpetuated by aging and inefficient infrastructure and high and poorly targeted subsidies. The development of Ukraine’s energy sector has been challenged by geopolitical contestation and market capture. These factors have made effective management of the sector extremely challenging, contributing to frequent political and economic crises and the high incidence of corruption. The CPE takes an in-depth look at the effectiveness of Bank Group support in helping the country manage these complex challenges (chapter 4).

- $15,000 for Poland, $12,000 for Romania, and $9,000 for Turkey (World Bank Data, GNI [gross national income] per capita, Atlas method [current US$]; see https://data.worldbank.org/indicator/NY.GNP.PCAP.CD).

- See https://data.worldbank.org.

- A detailed discussion of the series of crises and efforts to address Ukraine’s fiscal and financial sector vulnerabilities can be found in appendix D.

- President Zelensky was elected in April 2019 with 73 percent of the vote. In July 2019, his party (“Servant of the People”) won 60 percent of seats in parliament (the Verkhovna Rada).

- Some areas, such as education and subnational service delivery, were assigned a criticality rating of “medium” and downscaled.

- At the time of the Country Program Evaluation submission (April 2022), the World Bank Group management was in close dialogue with the Ukrainian authorities to provide immediate support and be ready to move toward reconstruction when conditions allowed. See also the Joint International Monetary Fund–World Bank Group Statement on the War in Ukraine (March 1, 2022): https://www.worldbank.org/en/news/statement/2022/03/01/joint-imf-wbg-statement-on-the-war-in-ukraine.

- An additional financing for a health project ($135 million, approved in April 2020), two additional financings for the Social Safety Nets Modernization Project ($150 million, approved in April 2020, and $300 million, approved in November 2020), and a public health and vaccines project ($90 million, approved in May 2021).