The World Bank Group in Chad, 2010 to 2020

Chapter 2 | World Bank Group–Supported Strategy

This chapter reviews Bank Group–supported strategies between FY10 and FY20 as reflected in the ISN (FY10–12)1 and CPF (FY16–20)2 and assesses the extent to which they addressed Chad’s main development constraints, including those also identified as major drivers of conflict and fragility.

Bank Group engagement with Chad over the period of this CPE was heavily influenced by a previously challenging relationship. In 2006, the World Bank suspended disbursements on its portfolio in response to the government not upholding revenue management arrangements agreed to under the Chad-Cameroon pipeline project as a condition for the World Bank to support the pipeline (World Bank 2010a). In response, the World Bank and the Chadian government negotiated a transitional memorandum of understanding for 2007 stipulating that the government would spend 70 percent of all oil revenues on priority development sectors. Disbursements for some projects resumed, although by late 2007, it became clear that the government was not upholding the agreement (World Bank 2010a).

In February 2008, a rebel attack on the capital prompted the closure of the World Bank office in N’Djamena, the evacuation of staff, and the suspension of mission travel. Because the agreements on oil revenues had not been respected, World Bank management decided to keep the office closed until a solution was found (World Bank 2010a). In September 2008, the government repaid the balance of pipeline-related credits, ending World Bank engagement in the Chadian petroleum sector. In 2008–09, no new lending was approved. However, in January 2009, the World Bank office reopened and resumed dialogue with authorities and stakeholders toward an inclusive development program to improve the inferior social and economic conditions in Chad. The chronology of World Bank engagement in Chad between 2003 and 2020 is described in appendix A.

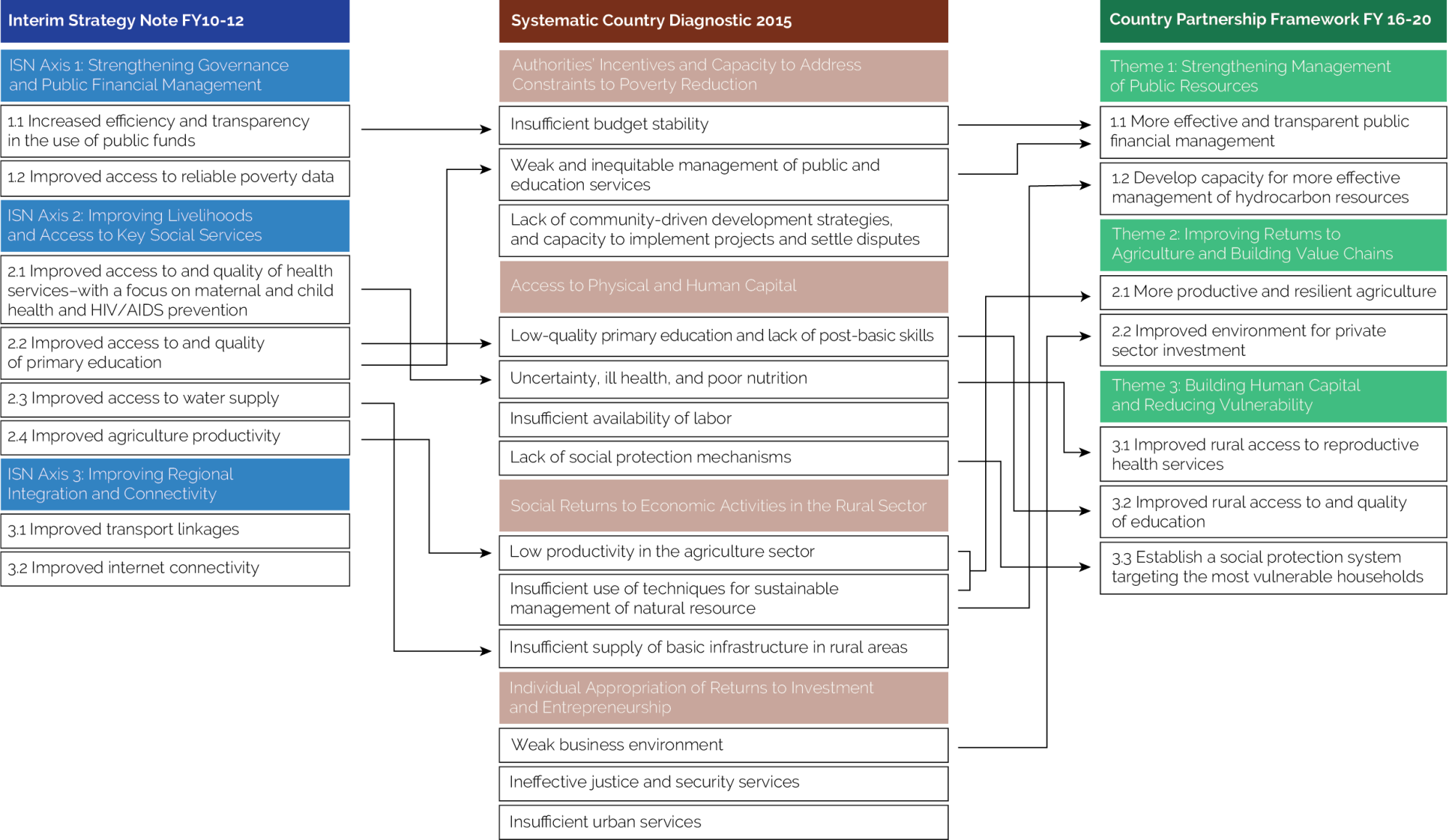

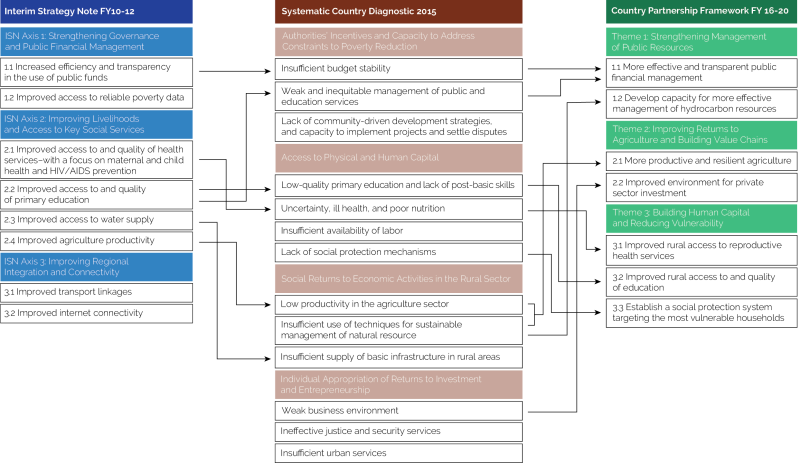

This evaluation finds that Bank Group support to Chad was consistent with government priorities and the findings of World Bank diagnostics and that it focused on the main critical constraints to growth and poverty reduction. The World Bank identified the main development constraints, including conflict drivers in Chad, and made a deliberate effort to address these in the design of the CPF. The overarching development objectives of Bank Group engagement in Chad did not change significantly during the evaluation period or across strategies. All engagement areas under the ISN were sustained under the CPF (figure 2.1). The assessment of development priorities presented in the Systematic Country Diagnostic anchored the design of the CPF, which had elements clustered in relation to three strategic engagement areas: (i) strengthening management of public resources; (ii) improving returns to agriculture and building value chains; and (iii) building human capital and reducing vulnerability for households. Promoting gender equality was emphasized in all World Bank strategies as a precondition for economic development. The social protection portfolio became prominent only during the CPF period, aligning with the government’s first National Social Protection Strategy in 2015.

Figure 2.1. Links among the ISN (FY10–12), SCD (2015), and CPF (FY16–20)

Source: World Bank 2010a, 2015b, 2015a.

Note: CPF = Country Partnership Framework; FY = fiscal year; ISN = Interim Strategy Note; SCD = Systematic Country Diagnostic.

The preparation of the ISN (FY10–12) signaled the Bank Group’s formal reengagement with Chad. A major objective of the Bank Group during the ISN period was to improve its knowledge of the political economy and rebuild trust with the government. In the ISN, the World Bank outlined plans to support strengthening public financial management, improve livelihoods and access to key social services, and improve regional integration. Reflecting the fragile environment, the ISN adopted a limited and gradualist approach, initially focusing on the efficient and transparent use of public resources and improving access to reliable poverty data. The ISN expired in June 2012 and was not formally extended. From that point until the adoption of the 2016 CPF, Bank Group engagement was largely guided by the requirements for receiving large-scale debt relief at the Heavily Indebted Poor Countries (HIPC) completion point (box 2.1).

Box 2.1. Reforms and Objectives Supported by the World Bank to Be Achieved before the HIPC Completion Point

Poverty Reduction Strategy Paper

- Prepare a fully participatory Poverty Reduction Strategy Paper and satisfactorily implement it for at least one year.

Governance

- Make satisfactory progress in strengthening public expenditure management to identify and track poverty-related spending.

- Adopt law and application decrees on public procurement; publish a quarterly public procurement bulletin; complete audits by internationally reputed firms for the five largest contracts in 2001; adopt Budget Settlement Law for 2000 before adoption of Budget Law for 2002; adopt Budget Settlement Law for 2001 before adoption of Budget Law for 2003; nominate judges for commercial courts in the five largest cities.

- Implement for one year a governance action plan in consultation with the International Development Association and International Monetary Fund.

Health

- Ensure at least 75 percent of health districts and centers are operational, up from 68 percent in 1999.

- Achieve a three-dose diphtheria, pertussis, and tetanus vaccination rate of at least 40 percent in 1999 and an assisted birth rate of at least 20 percent.

- Increase availability of condoms through the social marketing project by at least 25 percent relative to 2000.

Source: IMF and IDA 2001.

Note: HIPC = heavily indebted poor countries.

The ISN listed six major development challenges for Chad: (i) climate and environmental challenges that made agriculture unproductive; (ii) instability, conflict, and a large inflow of refugees; (iii) heavy dependence on oil revenue for fiscal management; (iv) low quality of budget spending; (v) lagging indicators in health and education; and (vi) an unfavorable business environment. The ISN noted that development progress was undermined by internal conflict, weak governance, and a lack of government commitment to reform (World Bank 2010a, 2).

The ISN drew significantly on analytics produced by development partners (mainly the African Development Bank and European Union). This was necessary given shortcomings in institutional memory because a number of World Bank staff who had previously worked on Chad had moved on, some to work on other countries. During the five years of the ISN, a relatively small amount of Chad-specific analytical work was undertaken, despite the steepness of the learning curve associated with World Bank reengagement in a complex and volatile conflict-affected situation. That said, analytical work to underpin operations and guide strategy was ramped up during the CPF period.

The Bank Group–supported strategy (CPF) starting in 2016 was aligned with Chad’s National Development Plan (2017–21). The National Development Plan stressed the importance of women’s empowerment and the need to improve the quality of life for women and female adolescents by strengthening their access to high-quality health services, improved nutrition, and property rights, themes that also featured in the ISN. The CPF (FY16–20) was prepared against the backdrop of regional security threats and large numbers of refugees, oil commodity price shocks (2015–18), and the growing impact of climate change. It focused on agriculture, social protection, education, health, the energy sector, public financial management, and the development of local capacity for hydrocarbon resource management.

Reflecting the findings of the 2015 Systematic Country Diagnostic, the CPF supported efforts to improve Chad’s business environment. These efforts were most evident in the telecom sector, where the International Finance Corporation has been using Millicom investments and advisory services to enhance mobile network connectivity in Chad. IFC commissioned a digital financial survey to explore innovative ways to support connectivity in Chad. The survey assisted the International Finance Corporation with addressing challenges with the country’s tax structure and other business constraints. The International Finance Corporation also supported the government in developing a public-private partnership law, enacted in 2017.

As with the ISN, the CPF (FY16–20) drew on lessons from IEG’s evaluation on the Chad-Cameroon Petroleum Development and Pipeline Project (World Bank 2009). These lessons included the need to improve dissemination of the World Bank’s lending and nonlending reports to support greater government commitment and the need to focus more on community-based projects to reach vulnerable groups. The ISN noted that the World Bank’s project portfolio was too complex and ambitious. The World Bank experienced a high rotation of task managers and therefore needed greater and more consistent supervision support. Increased support to implementation teams was also necessary to ensure financial management and procurement procedures were well understood and adhered to and to support the development and implementation of appropriate monitoring and evaluation frameworks and tools.

COVID-19 Response

At the request of the Chadian government, World Bank financing was shifted in 2020 to respond to the COVID-19 pandemic. Mother and Child Health Services Strengthening Project resources were used to procure key supplies and equipment for infection control and prevention, including personal protective equipment at the health facilities in project-supported provinces. Because of the COVID-19 pandemic, the World Bank agreed to keep the project active until all remaining funds were fully disbursed. The pandemic also paused community-based activities (for example, reproductive health education and school-based activities) supported under the Sahel Women Empowerment and Demographic Dividend (SWEDD) project. Some resources were shifted to support the national quality control laboratory in Chad to produce hydroalcoholic gels, under the supervision of the World Health Organization. In April 2020, the World Bank approved $55 million for COVID-19 response, which included support to improve vaccination access for women.

Chad’s Participation in the Heavily Indebted Poor Countries Initiative

During the evaluation period, the World Bank worked with the International Monetary Fund (IMF) to help Chad reach the Enhanced HIPC Initiative completion point. At the end of 2000, Chad’s external public and publicly guaranteed debt amounted to $1.06 billion, equivalent to 75 percent of its GDP. Of the total debt, approximately 84 percent was owed to multilateral institutions and 16 percent to official bilateral creditors. In May 2001, the International Development Association (IDA) and IMF agreed that Chad had reached the completion point under the HIPC Initiative. The total amount of debt relief committed at that time (but not yet delivered) implied a 30 percent reduction in the net present value of Chad’s public and publicly guaranteed external debt as of the end of December 2000 (IMF 2015b). The World Bank provided direct technical assistance to the government to progress through the HIPC Initiative. This assistance included the Second Population and AIDS Project and the Education Sector Reform Project (PARSET). In education, the World Bank–supported reforms aimed to improve access to and quality of education. Reforms and objectives to be achieved by the completion points are described in box 2.1.

The government had intended to reach the HIPC completion point in 2004, but internal and regional conflicts prevented the implementation of national development plans. It was not until April 2015 that the boards of IDA and the IMF agreed that Chad had made satisfactory progress in implementing its commitments under the HIPC Initiative. Chad fully met 11 of the 15 triggers, including participatory preparation of a Poverty Reduction Strategy Paper and its satisfactory implementation for at least one year. Debt relief under the HIPC Initiative from all of Chad’s creditors was estimated at $170.1 million in present value terms at the end of 2000. After reaching the HIPC completion point, Chad also benefited from further nominal debt service reduction from IDA ($509 million) and the African Development Fund ($236 million) under the Multilateral Debt Relief Initiative. The combined effect of the HIPC Initiative, the Multilateral Debt Relief Initiative, and additional bilateral assistance was to reduce the present value of the debt-to-exports ratio from 55.1 percent at the end of 2013 to 31.3 percent at the end of 2015 (IMF 2015b).

More recently, to improve debt sustainability and as part of the World Bank’s Sustainable Development Finance Policy, Chad agreed to start publishing a quarterly bulletin (within three months of the end of the quarter) covering all central government debt (excluding state-owned enterprises and publicly guaranteed debt) and agreed not to enter into any contractual obligations for new external public and publicly guaranteed nonconcessional debt in FY21, unless the nonconcessional debt limit was adjusted by the World Bank to reflect any material change of circumstances or in coordination with the IMF and adjustments in the IMF Debt Limits Policy.

Despite significant debt relief, Chad continues to face debt challenges related to its domestic and private external debt. In 2019, the IMF recommended that Chad focus on strengthening debt management and refrain from contracting nonconcessional debt. In April 2020, the IMF projected that the net present value of public and publicly guaranteed external debt–to-exports would increase from 60.6 percent in 2019 to 88.1 percent in 2021. Public and publicly guaranteed debt service–to-revenue was projected to increase from 10.9 percent in 2019 to 17.9 percent by 2021. By 2021, Chad was at high risk of external debt distress largely because of more than $1 billion in debt owed to Glencore and a syndicate of private lenders.

- The World Bank reported gross national income per capita in purchasing power parity (current international dollars) of $1,620 for Chad.

- See also the World Inequality Database, https://wid.world/country/chad/.

- Constraints to development identified by the World Bank Group are consistent with those identified by development partners. The African Development Bank’s strategy (2015–20) noted that Chad was plagued by a difficult climatic environment, economic and financial vulnerabilities, infrastructural constraints, and an unattractive business environment. The World Food Programme (2019–23) identified the high prevalence of food insecurity and malnutrition, gender inequalities, climate and weather-related crises, and conflicts and insecurity-driven displacements as major development constraints. Similar constraints were identified by the United Nations Children’s Fund and United Nations Population Fund.

- See labor force participation data at https://data.worldbank.org/indicator/SL.TLF.CACT.FE.ZS.

- According to the most recent Demographic and Health Survey (2014–15); see https://dhsprogram.com/publications/publication-FR317-DHS-Final-Reports.cfm.

- See fertility data at https://data.worldbank.org/indicator/SP.DYN.TFRT.IN?locations=TD.

- World Development Indicators database, https://datatopics.worldbank.org/world-development-indicators.

- According to Ngatia et al. (2020), 3 in 10 women report experiencing physical violence at home since the age of 15.

- See the Notre Dame Global Adaptation Initiative Country Index at https://gain.nd.edu/our-work/country-index/ (accessed March 2022).

- An Interim Strategy Note provides a framework for the World Bank’s engagement in a country until a full-fledged strategy can be adopted. Interim Strategy Notes are developed in consultation with the government and a range of stakeholders, discussed by the Bank Group’s Board of Executive Directors, and then publicly disclosed.

- The onset of the coronavirus (COVID-19) pandemic led the Bank Group to extend the Country Partnership Framework through fiscal year 2021.