Enhancing the Effectiveness of the World Bank’s Global Footprint

Chapter 1 | Introduction

The World Bank is embarking on new efforts to expand and adjust its global footprint by the mid-2020s. These reforms were motivated by the International Bank for Reconstruction and Development’s capital increase package and International Development Association (IDA) commitments to support clients, especially in low-income countries (LICs) and lower-middle-income countries (LMICs), and countries affected by fragility, conflict, and violence (FCV). This is not a new effort. The World Bank has been continuously decentralizing its staff and decision-making over the past two decades and already has a sizable presence in the field. However, there is not much data and evaluative evidence on these past efforts and whether they delivered their anticipated results. Therefore, this evaluation takes a critical look back at the more recent decentralization efforts to benefit the new expansion of the World Bank’s global footprint. These efforts focus on the decentralization of professional staff in operations and their managers. The evaluation only marginally considers the decentralization of country directors, country managers, and their staff.

The purpose of this evaluation is to assess the effectiveness of the World Bank’s decentralization efforts. These are the World Bank’s efforts to expand its global footprint by moving more staff and decision-making to the field. The evaluation examines the benefits and challenges of this process and proposes measures to improve it. This evaluation collected data over two major periods. First, it examined the broader staffing patterns over the past two decades to get a sense of decentralization’s longer-term impacts. Second, it carried out interviews, a task team leader (TTL) survey, and country case studies from fiscal years (FY)13–21 to understand decentralization’s most recent impacts. For some analyses, the coverage period varies based on data availability. This report does not evaluate the International Finance Corporation’s (IFC) decentralization efforts but synthesizes and uses lessons learned from IFC’s experience to better understand the World Bank’s experience. To account for the effects of the coronavirus (COVID-19) pandemic, the team added a small line of inquiry to the evaluation to provide partial evidence on how the World Bank’s field presence influenced its early COVID-19 response. Most World Bank staff have strong prior opinions on decentralization, and the evaluation team worked carefully to steer clear of biases and triangulate evidence from different sources.

The cost of decentralization is not part of the evaluation’s scope. Although the efficiency of decentralization is critical, the cost of decentralization, such as the mobility benefits for field assignments, and the costs of global footprint in FCV locations compared with other locations have been reformed several times in the period of this evaluation in FY15 and FY18–19, and the assessment of past decentralization costs would not be meaningful to inform the current context.

The evaluation finds that decentralization helped the World Bank build a strong presence in client countries, delivering many anticipated benefits. These benefits, mainly unveiled through substantial qualitative evidence, include greater responsiveness to clients, more regular operational support for projects, increased trust between World Bank staff and government counterparts, enhanced collaboration with partners in the field, and several other important benefits. However, the link between decentralization and project performance—as measured by available quantitative indicators—is less clear, with qualitative and quantitative metrics yielding inconsistent findings. The World Bank’s decentralization model also carries with it some structural inefficiencies, poses risks to knowledge flow and global collaboration, and entails certain disincentives related to career development for staff and managers in the field. Some of these inefficiencies are anticipated trade-offs from having a decentralized system; others were not anticipated but resulted from having several disparate, uncoordinated decentralization and reorganization reforms over the years. The evaluation suggests that the World Bank adopt a more nuanced approach to managing its global footprint and mitigating decentralization’s challenges and inefficiencies.

Methods

The evaluation questions guiding this evaluation are the following:

- What are the links between decentralization and World Bank country program performance?

- How did staffing and decision-making authority in the field improve client responsiveness and enhance performance? (i) How does this vary for different types of client countries? (ii) What factors explain the variation in decentralization’s benefits and downsides? (iii) How did the World Bank staffing and decision-making authority in the field affect the World Bank’s early response and support to its clients to fight COVID-19?

- What are the lessons on how to balance the potential benefits and downsides of different decentralization configurations?

- How can the potential benefits and downsides of decentralization be measured to strengthen the World Bank’s global footprint?

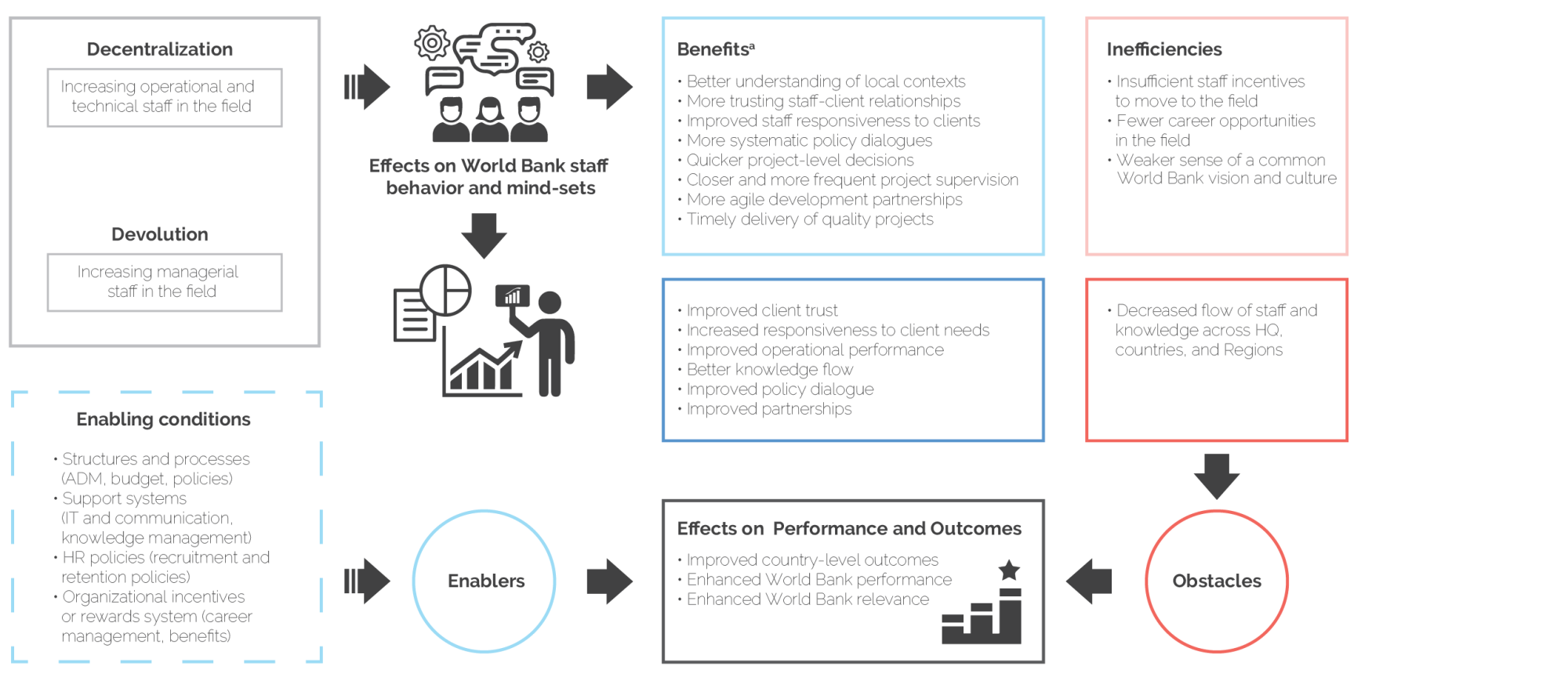

To answer these questions, the evaluation team developed a conceptual framework (figure 1.1) that unpacks the key elements of decentralization’s processes and impacts. The current wave of decentralization lacks an explicit objective against which the evaluation team could measure decentralization’s results; therefore, the evaluation team constructed a framework based on a structured literature review of the drivers of organizational effectiveness, the effects of decentralized organizational delivery models, and the World Bank’s past decentralization documents. To inform the conceptual framework, the evaluation team interviewed a cross-section of World Bank staff and managers and reviewed senior management’s communications related to the World Bank’s global footprint.

The evaluation’s conceptual framework has five elements and some underlying assumptions about the links between decentralization and the World Bank’s performance. These five elements include the following: (i) the World Bank’s decentralization reforms, (ii) the enabling conditions that make decentralization work and can influence results, (iii) the reform’s intended changes to staff’s behaviors and mind-sets, (iv) the model’s expected effects on client responsiveness and operational performance and the model’s inefficiencies, and (v) the model’s desired long-term effects on the World Bank’s country-level performance and outcomes. The framework assumes that increasing technical, operational, and managerial staff in the field would lead to better performance of the World Bank at the country level. It posits that staff in the field are more likely to form trusting relationships with clients and development partners, deepen policy dialogues, and tailor knowledge and lending services to local contexts. These changes would contribute to changes in staff’s behaviors and mind-sets and would thereby improve the World Bank’s client responsiveness, operational performance, and eventually, country program results. The framework also posits that decentralization could create certain obstacles for both staff and the institution in achieving expected outcomes.

Within the conceptual framework, the evaluation focuses on expected changes in World Bank staff’s behaviors and mind-sets, anticipated effects on client responsiveness and operational performance (blue boxes in figure 1.1), and the model’s inefficiencies (pink boxes in figure 1.1). The evaluation analyzes decentralization’s project-level effects only in a limited way, when data are available, and tackles the enabling conditions (such as human resources policies) to the extent they contribute to or constrain decentralization’s benefits.

The conceptual framework, which evolved during the evaluation, serves multiple purposes. At the design stage, the evaluation team used it to delineate the scope of the evaluation by gaining a general sense of how decentralization might affect the World Bank’s performance at the country level. The evaluation team also used the conceptual framework to design case study templates, identify survey and interview instruments, and interpret data and evidence. The authors of this evaluation also used the conceptual framework as a structure around which to organize this report.

The evaluation team undertook the following data collection and analysis activities:

- Desk review. The evaluation team reviewed World Bank and IFC strategy documents, human resource and budget documents, and analytical and self-evaluation reports. These reports relate to the World Bank’s past and current decentralization waves and commitments, such as those presented to the Board of Executive Directors. The desk review also included country strategies, project documents, and other operational documents for the selected country case studies.

- Case studies. The evaluation carried out case studies on decentralization’s impacts on 20 client countries. These countries represented different types of decentralization configurations and captured a diverse set of the World Bank’s country engagements. The evaluation team prioritized the selection of LICs, LMICs, and countries in a fragile and conflict-affected situation (FCS) because these countries were prioritized in International Bank for Reconstruction and Development and IDA commitments. Four of these case studies were deeper in scope than the others; however, the evaluation team could not visit these four countries as originally planned because of the COVID-19 pandemic. Case study authors relied on virtual interviews and a review of country- and project-level documents.

- Key informant interviews. The evaluation carried out 227 interviews with (i) World Bank staff, managers, and clients for the 20 country case studies; (ii) IFC staff and managers; and (iii) managers in Global Practices (GPs), and the Human Resources and Budget, Performance Review, and Strategic Planning Vice Presidential Units. The evaluation used NVivo software to code and analyze all case study interviews, which helped triangulate and validate findings from the other data sources.

- A TTL survey. The evaluation carried out a survey for TTLs to compare the perspectives of TTLs based in headquarters with those of TTLs based in the field. Of the 2,432 staff who led or co-led a project or analytical and advisory services in 2020, 790 (33 percent) provided valid responses to the survey.

- Multivariate statistical analysis. The team conducted a multivariate statistical analysis to explore the association between the field presence of different types of World Bank staff and project-level performance and project outcomes ratings for 2002–18. The analysis tested several hypotheses based on the World Bank’s decentralization plans. The analysis also included a review of academic literature and interviews and focus groups with managers and TTLs.

- Quantitative analyses of projects, country programs, and human resource data. A number of additional analyses informed this evaluation, including (i) an analysis of staff proactivity and project preparation times, (ii) an analysis of human resources data on internationally recruited staff (IRS) grade level changes and the frequency of geographical staffing movements during FY13–21, (iii) a correlation analysis of the association between a country director’s presence and country program outcome ratings, (iv) an analysis of operational support data from the World Bank’s time recording system, and (v) a correlation analysis of the staff’s field presence and selected World Bank Country Opinion Survey variables.

Figure 1.1. Conceptual Framework of the Evaluation

Source: Independent Evaluation Group.

Note: ADM = accountability and decision-making; FCS = fragile and conflict-affected situation; HQ = headquarters; HR = human resources; IT = information technology; LIC = low-income country; LMIC = lower-middle-income country; UMIC = upper-middle-income country.

a. These expected benefits can vary for different client groups, FCS countries, LICs, LMICs, and UMICs.

The evaluation had some notable limitations. First, the team could not undertake planned field visits because of the COVID-19 pandemic. This resulted in fewer interviews with clients and created some selection bias because the team interviewed clients who were recommended by staff rather than pursuing a wider set of clients during field visits. Second, the multivariate statistical analysis builds on existing literature and combines different data sources. However, the analysis lacked data and variables capable of fully analyzing decentralization’s direct effect on performance or that could control for all other, possibly important, causal explanatory factors. Third, the evaluation assessed the World Bank’s satellite, or “hub,” offices in country case studies primarily from a client support perspective, and only when the nature and quality of hub support emerged as a significant issue in those countries (for more details on limitation of different methods, see appendix A). That said, the evaluation did review in detail the Center on Conflict, Security, and Development in Nairobi, Kenya (appendix C).

The evaluation team was not able to fully answer the evaluation question 1 because existing data are not comprehensive or adequate for explaining the links between decentralization and the World Bank’s country program performance. However, the survey, interviews, and case studies thoroughly examine many aspects of this relationship, as conceptualized in figure 1.1. The team was able to answer evaluation question 4 only partially. The evaluation suggests actions and mechanisms for the World Bank to strengthen decentralization’s benefits and mitigate key inefficiencies. The team uncovered these benefits and challenges during the evaluation, but the decision on what to monitor would depend on the specific objectives of decentralization that need to be defined by management.

The evaluation team collaborated with World Bank staff and units to collect and validate data. The team engaged closely and systematically with the Human Resources and the Budget, Performance Review, and Strategic Planning Vice Presidential Units, which shared extensive data with the team, including sensitive human resources and staff time-use data, and provided timely updates on the forthcoming human resource policy changes. The evaluation’s design, methods, data collection, and emerging findings were internally and externally validated through consultations with Board members and focused discussions with relevant staff, managers, and technical counterparts in Operations Policy and Country Services. The evaluation triangulated findings through several data sources and analyses. As a result, all findings are generally supported by at least three data sources.

Road map. The report comprises five chapters, including this introduction. Chapter 2 reviews the global footprint reforms and staffing and decision-making trends since decentralization began more than two decades ago. Chapter 2 sets the stage to answer the evaluation questions in subsequent chapters. Chapter 3 uncovers decentralization’s benefits to clients and to the World Bank across different Regions and country types and discusses the links between field presence and operational performance. Chapter 4 unpacks some of decentralization’s challenges and inefficiencies and describes how these undermine decentralization’s expected impacts. Both chapters 3 and 4 answer evaluation question 2 and inform evaluation question 3. Chapter 5 answers evaluation question 3 and contributes to evaluation question 4 by providing recommendations on how to maximize the benefits of decentralization and mitigate its inefficiencies. All chapters contribute to evaluation question 1—an overarching question to assess the links between decentralization and project and program performance. The evaluation’s appendixes present several of the original documents and background analyses that informed the evaluation’s findings.