Addressing Country-Level Fiscal and Financial Sector Vulnerabilities

Chapter 2 | Identifying Vulnerabilities

Highlights

The World Bank Group carried out timely and relevant analyses to better understand emerging risks and sources of fiscal and financial sector vulnerabilities. The World Bank’s diagnostic work on the financial sector was particularly frank, whereas its assessment of fiscal vulnerabilities was sometimes more restrained to accommodate client sensitivities.

The identification of fiscal vulnerabilities did not always take a whole-of-government perspective, thereby missing important links among vulnerabilities (for example, state-owned enterprises, state-owned banks, and contingent liabilities, including from large public investment projects).

At the country level, the Bank Group, on its own and in collaboration with the International Monetary Fund, provided significant, relevant, and timely diagnostic assessments and technical assistance that were appreciated by clients, although limitations on data quality and availability were sometimes problematic.

Monitoring and identification of debt and quasi-fiscal vulnerabilities has been variable. This has been due, in part, to a lack of quality data and data transparency, particularly concerning bilateral debt. Debt Sustainability Analyses have proven useful, but they have not always consistently and adequately captured idiosyncratic, compound, or country-specific shocks. In some cases, this led to underestimation of risks.

The Bank Group made considerable effort to monitor, analyze, and identify fiscal and financial sector vulnerabilities in client countries throughout the evaluation period (2010–19). Some 570 advisory services and analytics (ASA) products were produced with direct relevance to fiscal and financial sector vulnerabilities, with a notable increase over time in financial sector products and technical assistance engagements, as well as debt-focused products such as Debt Management Performance Assessments (DeMPAs), Debt Sustainability Analyses (DSAs), and technical assistance, and the introduction of a global flagship specifically focused on macrofinancial issues (box 2.1). (Also see World Bank [2021], an evaluation of World Bank support for public financial and debt management.)

Box 2.1. Macro-Financial Review and Identification of Vulnerabilities

Since 2017, the Macro-Financial Review (MFR), a semiannual report, has provided integrated analysis of global-, regional-, and country-level risks and vulnerabilities, addressing a key weakness of earlier global reports that were less rooted in the regional- and country-level perspectives. The Independent Evaluation Group reviewed each report published and interviewed the task manager and internal clients. The report also launched a new index of macrofinancial vulnerabilities. Successive semiannual reports have also addressed special topics, such as cross-border banking, blockchain technology, and climate change. There is a confidential version of the MFR that includes country ratings and an internal version without ratings.

The report provides value added to identification of fiscal and financial vulnerabilities in three respects: integration, granularity, and analyses of special topics. First, global-regional-country integration of macrofinancial monitoring and more granular analysis of financial sector vulnerabilities that permits the World Bank to see ahead of the curve is the main value added. The MFR currently covers 44 countries, mostly larger and regionally important economies for which requisite data are available. Second, the report provides a granular analysis with more in-depth analysis than is usually the case in flagship or regional reports. Third, the report provides useful analyses of special topics that shed new light on links among vulnerabilities. However, many smaller, low-income countries are not covered, in large part because of a lack of reliable data.

Source: Independent Evaluation Group.

Country-Level Diagnostics

Major country diagnostics, such as Systematic Country Diagnostics (SCDs), Country Economic Memorandums (CEMs), Public Expenditure Reviews, Public Finance Reviews, Financial Sector Assessment Programs (FSAPs), DeMPAs, and other ASA activities, are the cornerstone of country-level analysis of fiscal and financial vulnerabilities (for examples within the country cases studied, see box 2.2).

Box 2.2. Integrative Diagnostics Identifying Key Vulnerabilities: Morocco and Ukraine

The Ukraine Country Economic Memorandum (2010) was an example of a timely and relevant country diagnostic that identified key fiscal and financial vulnerabilities. On the fiscal side, it highlighted significant threats to fiscal sustainability: pension reform and producer subsidies. On the financial sector, it identified “mounting vulnerabilities in the banking sector due to lax credit analysis in the context of fast credit growth fueled by external borrowing.” It also noted that “supervision and regulation [were] not ready to prevent another crisis” (World Bank 2010b). Indeed, this diagnostic, as well as other analyses, such as the 2011 Public Expenditure Review, correctly identified vulnerabilities that contributed to the crisis to come.

In the 2016 Morocco Financial Sector Stability Assessment, the World Bank Group pointed out that although the financial system was broadly resilient, well managed, and free of major vulnerabilities, certain institutional and procedural aspects of the system needed to be strengthened to improve robustness in the face of increasing risks in a volatile international economic environment. In particular, the assessment identified vulnerabilities that required attention: large cross-border exposure to markets in Sub-Saharan Africa, high concentration and limited competition in the banking system, and the nonperforming loans taken out by small and medium-size enterprises.

Source: Independent Evaluation Group.

Country policy notes were often prepared by the World Bank for a new government coming to power. These notes synthesized key findings of policy research and diagnostics, including with respect to fiscal and financial vulnerabilities. The 2016 Benin Policy Notes, for example, highlighted challenges to maintaining fiscal discipline and domestic revenue mobilization, and the need to ensure grants and low-cost financing in the budget. Similarly, policy notes for the new government of Ukraine in 2014 laid out a comprehensive view of key fiscal and financial sector issues and an agenda that could serve as a basis for more intensified engagement.

The SCD identifies the key constraints to achieving progress toward the twin goals of ending extreme poverty and promoting shared prosperity (World Bank 2019a). The SCD is prepared once every four to six years and is used to prioritize areas for Bank Group support. The scope of the SCD is not limited to areas where the Bank Group is currently active or where the Bank Group expects immediate country demand. A such, SCDs often include a discussion of fiscal and financial vulnerabilities when these are significant enough to constrain development progress.

The World Bank’s assessment of, and outlook for, country-specific macroeconomic risks and vulnerabilities can also be found in the semiannual Macro Poverty Outlook.1 The Macro Poverty Outlook consists of individual country notes that provide an overview of recent developments and medium-term forecasts of major macroeconomic variables and discuss risks to growth and macroeconomic stability. Case studies reveal varying degrees of consistency and candor in highlighting critical risks, particularly on the fiscal front. This was the case for assessments of fiscal risks in both Bangladesh and Tajikistan, where after 2016, the World Bank downplayed growing weaknesses in the macroeconomic framework related to contingent liabilities, including those related to state-owned enterprises (SOEs).

World Bank Support for Identifying Fiscal and Financial Sector Vulnerabilities

The World Bank’s diagnostic work identified various types of fiscal and financial sector vulnerabilities (table 2.1). On the fiscal side, some of the vulnerabilities identified in the case studies included those related to debt sustainability, fiscal space and debt management capacity, contingent liabilities, and the robustness of domestic revenue mobilization. On the financial sector side, vulnerabilities often manifest in relation to supervision and regulation, nonperforming loans (NPLs), commercial bank resolution frameworks, and the capacity of financial stability agencies such as central banks, financial stability committees, and deposit insurance agencies. In addition, fiscal and financial exposures are often intertwined, especially in commercial bank lending to SOEs or the government, commercial bank holdings of sovereign debt, and state-owned bank capitalization. A review of World Bank identification of fiscal and financial sector vulnerabilities for individual case study countries is summarized in appendix C.

Table 2.1. Typology of Fiscal and Financial Vulnerabilities Identified in the World Bank’s Country-Level Diagnostics for Case Study Countries

|

Fiscal |

Fiscal-Financial |

Financial |

|

Unsustainable debt (Benin, Mozambique, Ukraine) Fiscal space (Jamaica, Tajikistan) Energy subsidies (Tajikistan, Ukraine) Debt management capacity (Mozambique, Tajikistan) Quality of data and transparency (Mozambique, Tajikistan) Low domestic revenue mobilization (Bangladesh, Benin, Mozambique, Tajikistan) |

Bank lending to state-owned enterprises (Tajikistan) Bank holdings of sovereign debt (Jamaica) State-owned banks lending and capitalization needs (Bangladesh, Tajikistan, Ukraine) |

Supervision and regulation (Tajikistan, Ukraine) Nonperforming loans (all countries) Commercial bank resolution frameworks (all countries) Connected lending and corruption (Bangladesh, Tajikistan, Ukraine) Capacity of financial stability agencies (all countries) Loan classification (Bangladesh) Commercial bank exposure to foreign markets, cross-border exposure, limited access to banking system and capital market (Morocco) |

Source: Independent Evaluation Group.

Identifying Fiscal Vulnerabilities

The World Bank’s depth, quality, and timeliness of fiscal monitoring, policy dialogue, and analytical work identifying vulnerabilities has been strong in most countries and situations. Over the evaluation period, fiscal vulnerabilities increased in most case study countries with ratios of public debt to gross domestic product (GDP) rising significantly, as did the burden of budgetary interest payments relative to domestic revenues (figures 2.1 and 2.2). Assessments of Jamaica accurately flagged major weaknesses coming from the high and unsustainable public debt, the associated lack of fiscal space to finance basic services, and the link between fiscal management and constraints to growth.2 In Ukraine, the 2010 CEM correctly argued that “the current fiscal model has proven unsustainable and that urgent fiscal reform is necessary” (World Bank 2010b, 63). The World Bank warned that fiscal policies were exacerbating broader macroeconomic risks and that they could have dire macroeconomic consequences, such as the 2014 full-blown currency, banking, and political crisis. Also, the 2011 Public Expenditure and Financial Accountability assessment gave low scores for budget credibility (measured by the difference between budgeted expenditures and outturns), budgetary transparency and comprehensiveness (measured by the extent of unreported government operations and oversight over SOEs), and payroll control and internal and external audit effectiveness (World Bank 2011b, 5–6).

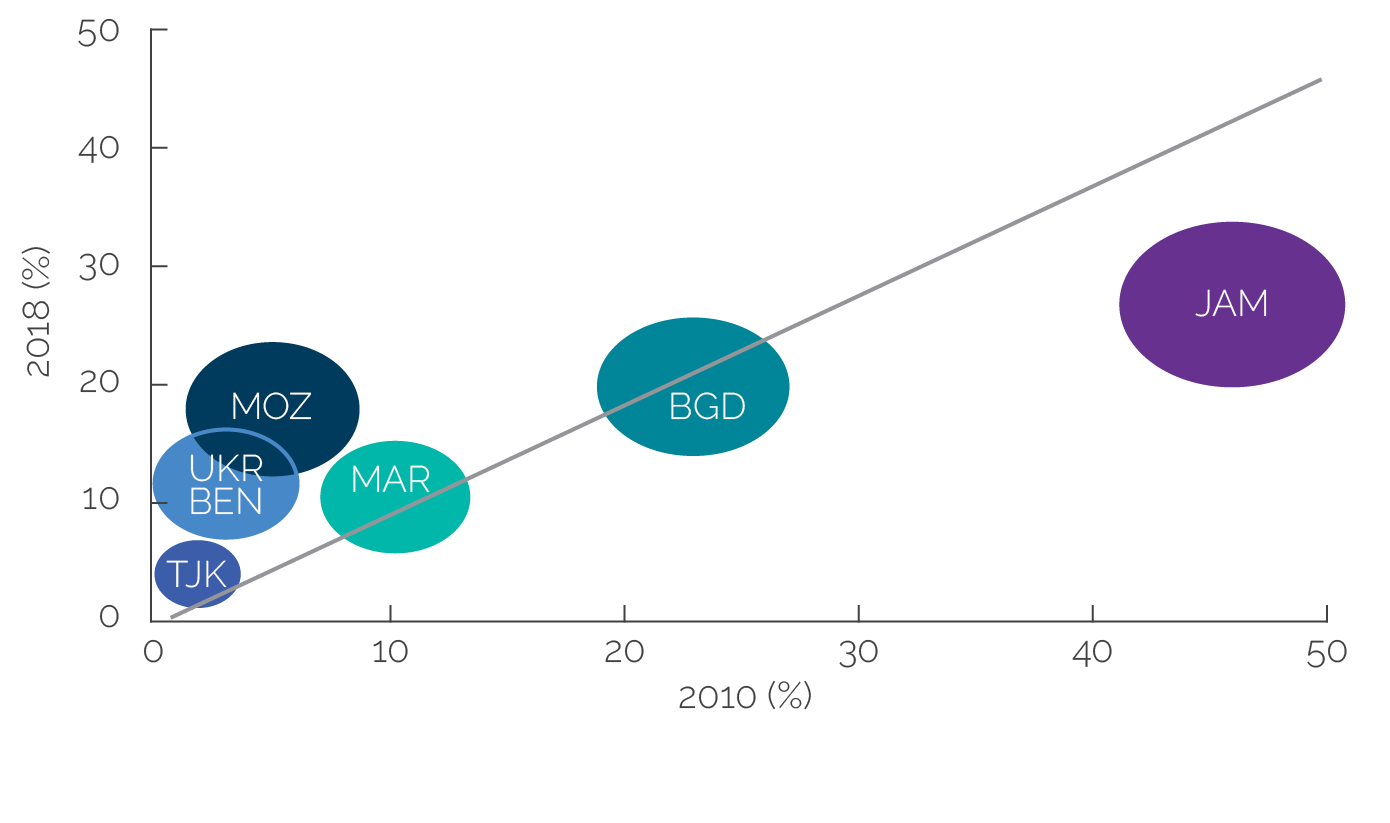

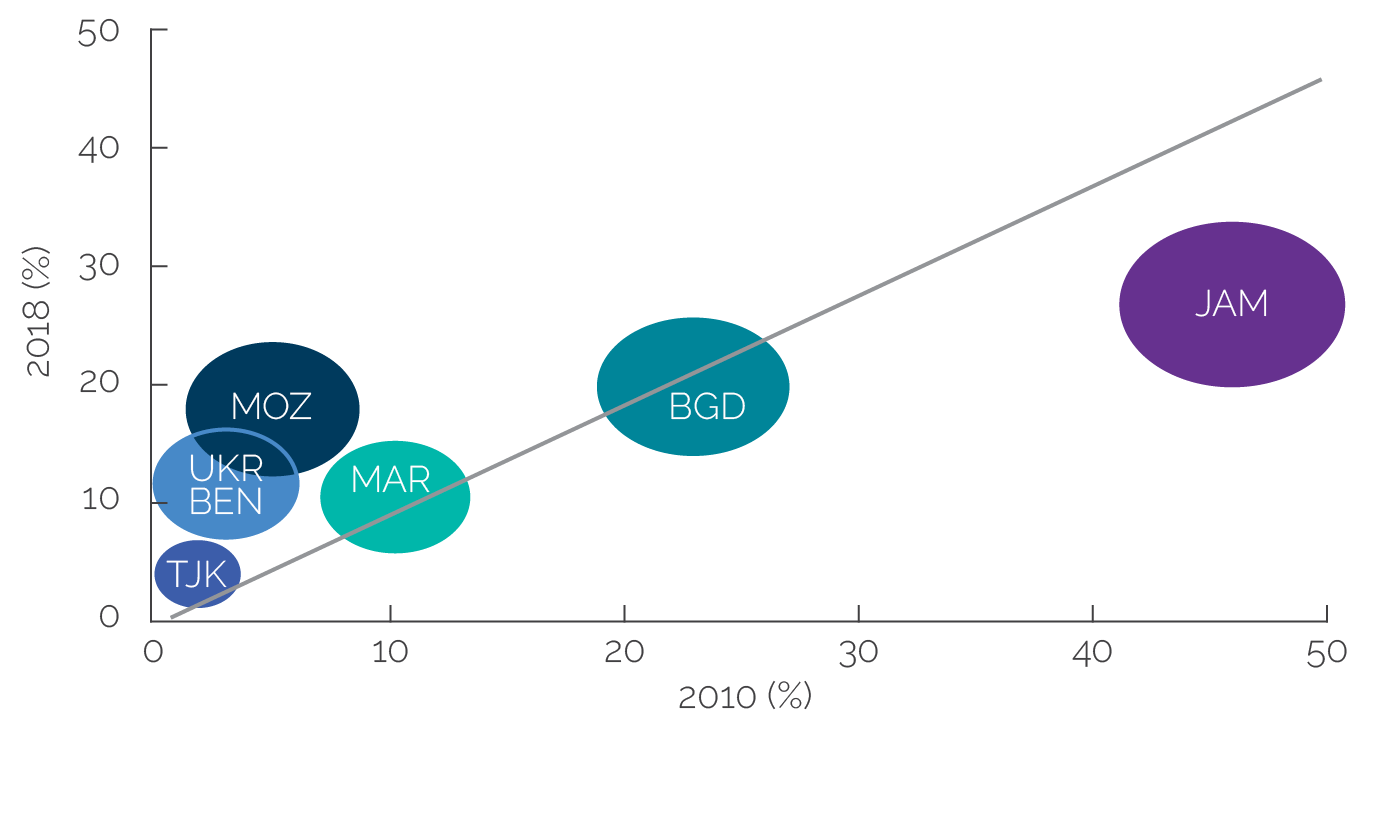

Figure 2.1. Indicators of Fiscal Vulnerability: Ratio of Interest Payments to Tax Revenue (percentage)

Source: International Monetary Fund Article IV consultation.

Note: Area of circles represents the percentage of interest to tax for 2018. BEN = Benin; BGD = Bangladesh; JAM = Jamaica; MAR = Morocco; MOZ = Mozambique; TJK = Tajikistan; UKR = Ukraine.

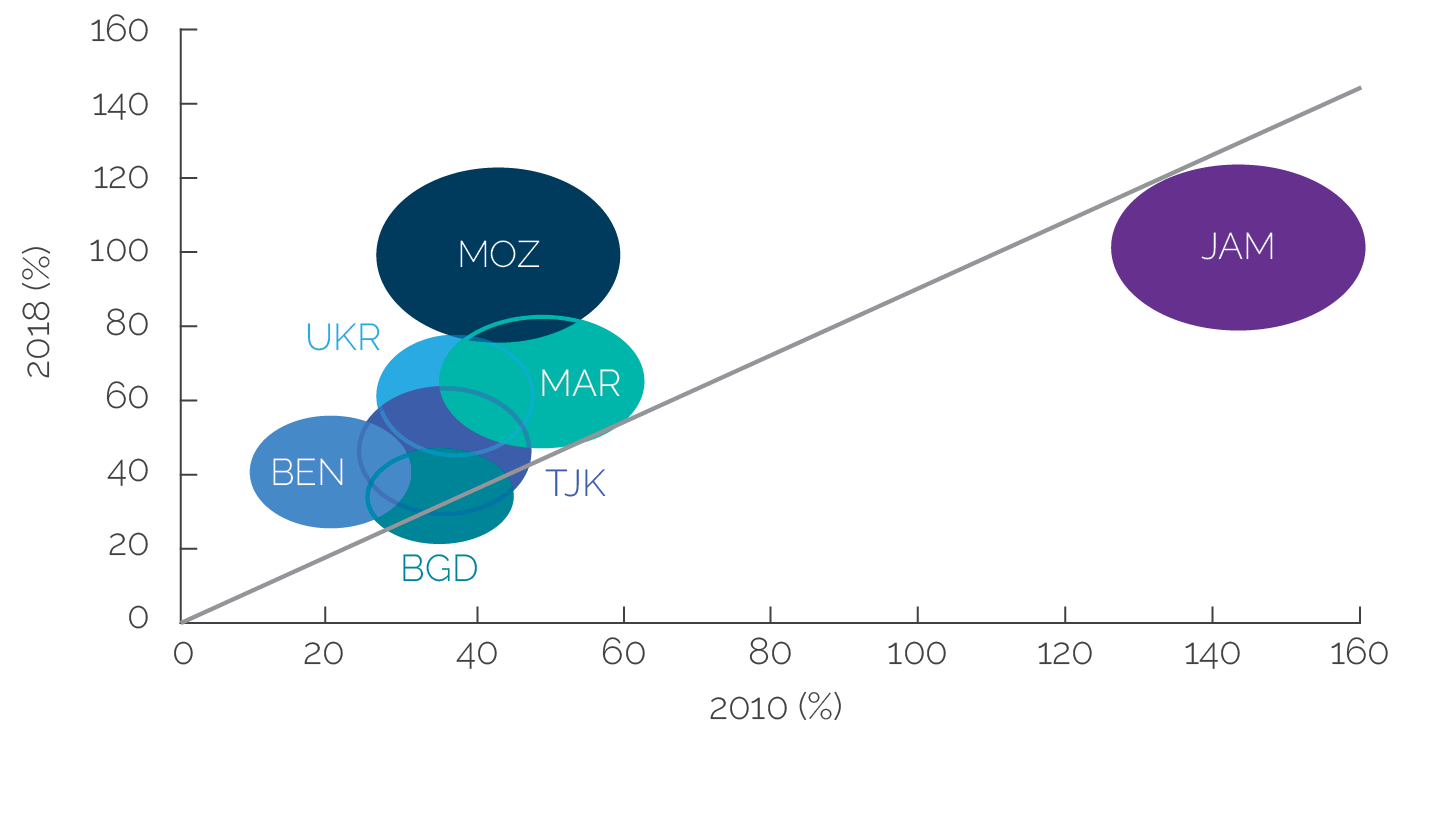

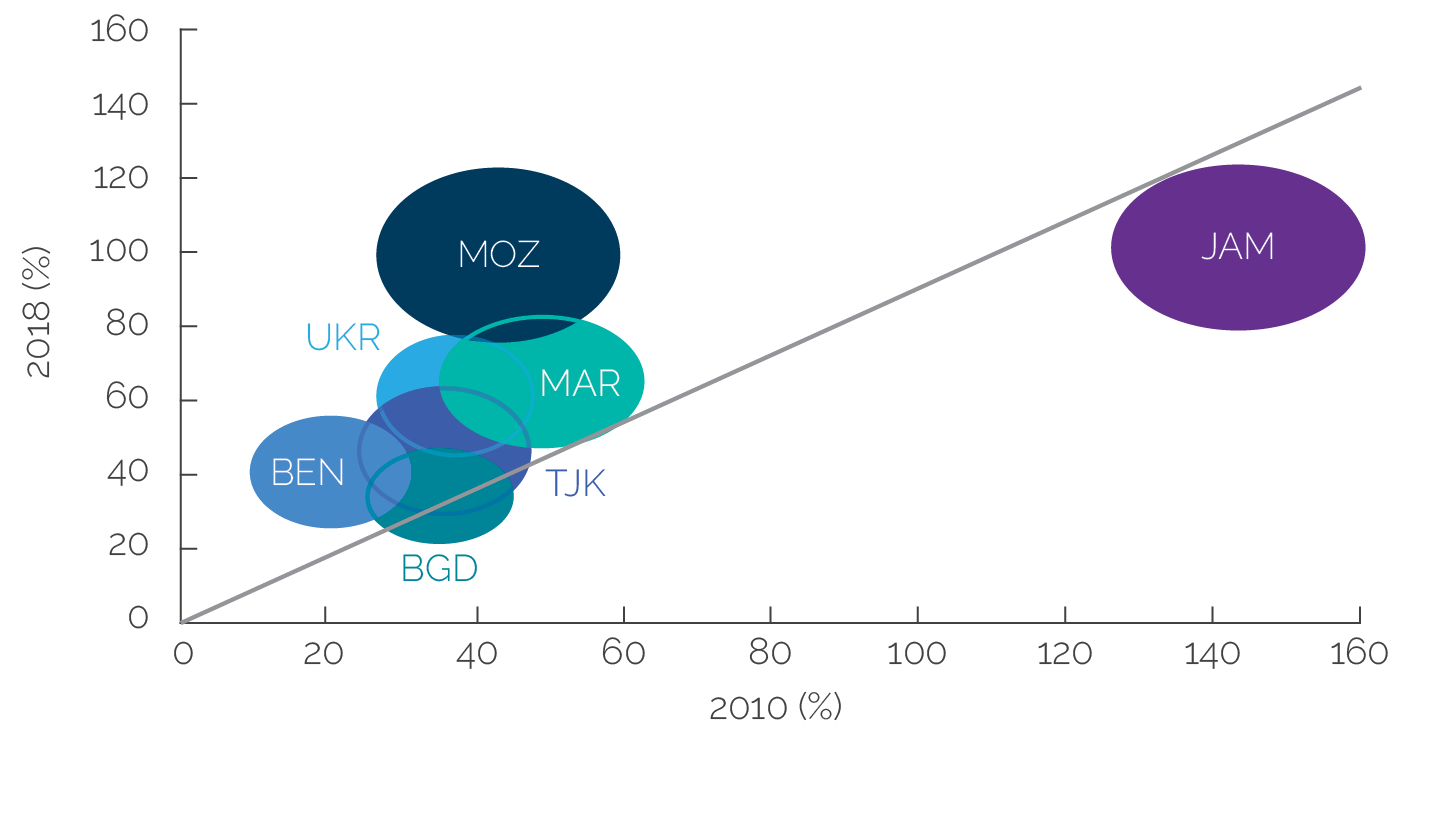

Figure 2.2. Indicators of Fiscal Vulnerability: Ratio of Gross Government Debt to Gross Domestic Product (percentage)

Source: International Monetary Fund 2019.

Note: Area of circles represents the percentage of debt to gross domestic product for 2018. BEN = Benin; BGD = Bangladesh; JAM = Jamaica; MAR = Morocco; MOZ = Mozambique; TJK = Tajikistan; UKR = Ukraine.

Even when country ownership of economic reform was weak and engagement with the World Bank and the IMF was limited, the World Bank kept abreast of economic developments and flagged emerging vulnerabilities. In Tajikistan, it raised concerns with emerging pressures on liquidity and the government’s budget from a potential drop in remittances. It also consistently warned the authorities of the need to build fiscal buffers and international reserves (World Bank 2012a).

Monitoring and the identification of debt vulnerabilities improved over the evaluation period, resulting in important “red flags” that anticipated debt problems, but key vulnerabilities did not always inform other work. In IDA-eligible countries, the World Bank uses the DeMPA diagnostic to flag risks associated with the quality of debt management. This was the case in Mozambique, where weaknesses in public debt reporting and recording were identified several years before the “hidden debt” crisis erupted in 2016. Elsewhere, the World Bank did not always clearly and consistently raise concerns with rising quasi-fiscal risks. This was the case for Bangladesh, for which the World Bank’s overarching assessment of fiscal stability was dominated by a DSA that did not take full account of underlying explicit and implicit contingent liabilities and that instead concluded that Bangladesh was at “low risk of debt distress” (World Bank 2018a).

DSAs are central to gauging a low-income country’s risk of debt distress. However, a review of DSAs for the seven case studies for the evaluation period and related field interviews revealed that some of the key assumptions that underpinned the DSA baseline and alternative scenarios were overly optimistic. This was especially true with respect to growth and export revenue projections. Also, explicit and implicit contingent liabilities of SOEs were not fully reflected in any of the case studies during the review period. In Bangladesh and Tajikistan, for example, contingent liabilities arising from SOEs did not feature in the debt sustainability analysis, leading to the underestimation of fiscal risks. The DSA for Bangladesh also did not recognize the implications for debt sustainability of potential overestimation of GDP. In Tajikistan, fiscal vulnerabilities due to the budgetary costs of the Rogun Hydro-Power Project, commercial bank capitalization, and the interconnectedness between commercial bank lending and borrowing from SOEs were identified in World Bank analytical notes. However, inadequate data and transparency, including with respect to bilateral and nonconcessional borrowing, diminished their usefulness to the policy dialogue and policy advice. Debt data transparency is a broader problem, particularly for low-income countries and lower-middle-income countries, that has begun to receive enhanced attention, including as part of the recently adopted Sustainable Development Finance Policy (IDA 2020). Furthermore, the revised IMF–World Bank Debt Sustainability Framework for Low-Income Countries, introduced in 2018, places greater emphasis on contingent liabilities and aims at greater public and publicly guaranteed debt coverage, including with respect to risks from SOEs, extrabudgetary funds, and subnational governments. Where data availability is limited, omissions are flagged and trigger a contingent liability stress test, which is adjusted by the user to fit the country-specific circumstances.

Identifying Financial Sector Vulnerabilities

Financial sector vulnerabilities are monitored through a wide variety of qualitative and quantitative diagnostic assessments, the most comprehensive of which are FSAPs and financial sector assessments or Financial Sector Stability Assessment (FSSAs). Bank staff collaborate with IMF staff on FSAPs, following a modular approach, with the World Bank having the ability to conduct stand-alone FSAP “development” modules without IMF involvement.3 However, the World Bank does not conduct stress testing, which is instead conducted by the IMF.

In the financial sector, reflecting lessons from the global economic and financial crisis, diagnostic analyses for case study countries were generally timely and focused on the right issues, especially in Jamaica, Morocco, and Ukraine. In each of these countries, the Bank Group monitored key vulnerability indicators and undertook regular analytical work, even when clients were not committed to significant reform. The 2010 Ukraine CEM noted that “mounting vulnerabilities in the banking sector due to lax credit analysis in the context of fast credit growth fueled by external borrowing were accentuated by the [global financial] crisis” and highlighted currency and maturity risks and underprovisioning for bad loans (World Bank 2010b). It also stated that “supervision and regulation [were] not ready to prevent another crisis.” Even outside of a formal FSAP, the World Bank provided extensive and high-quality monitoring, analytical, and advisory work to Ukraine, which proved critical to a timely response to the financial crises and shocks that started in 2014.

In Morocco, the Bank Group—in a series of diagnostics and policy discussions in the context of financial sector development policy loans (DPLs) and an FSA/FSSA conducted jointly by the World Bank and the IMF in 2016—pointed out that, although relatively resilient and without major vulnerabilities, institutional and procedural aspects of the system could be strengthened to improve the robustness of the system, especially in the face of increasing risks in a volatile international economic environment. The World Bank identified weaknesses in cross-border lending from Morocco to some Sub-Saharan African countries, large single-borrower exposure, and risks from NPLs, although the Moroccan financial system remained deep and broadly well managed. Also, access to the banking system and capital markets remain limited, and with most firms in Morocco being small and medium size, this could contribute to macroeconomic volatility. The FSSA also noted that the supervision of capital markets and financial market infrastructures needed upgrading.

In Jamaica, in 2010, in the context of a policy dialogue undertaken in close collaboration with the IMF, the World Bank highlighted risks to the financial system from large holdings of sovereign debt, which threatened the liquidity and solvency of the banking system given the high risk of sovereign default. Subsequently, the 2015 FSA/FSSA correctly identified the rise of persistent risks to the financial sector from, among other things, (i) complex financial conglomerates dominating the financial sector and operating in multiple jurisdictions, with the headquarters of some large groups based in jurisdictions with different oversight practices; (ii) the concentrated ownership structure of the financial sector; (iii) related-party and large group exposures; and (iv) large off-balance sheet positions. The 2018 FSAP found the financial system in a stronger position, with a substantial reduction in NPLs, albeit with continued interconnectedness in the repurchase agreement market, a large value payment system, and significant counterparty exposures in the financial sector.

Client Feedback, World Bank–IMF Collaboration, and Data Issues

Interviews with government agencies in case study countries frequently noted appreciation for the quality of the World Bank’s technical analysis and fiscal and financial sector diagnostics and of IMF–World Bank collaboration, including on DSAs (box 2.3). Interviewees provided many examples of how these diagnostics and technical assistance informed subsequent institutional reforms: Ukraine CEM 2011, Morocco FSA 2016, Jamaica CEM 2011, and Mozambique DeMPA 2015/16 and Public Expenditure Review 2014. In some cases, however, when there was disagreement over the conclusions of the diagnostics and what were perceived as overly critical findings, governments were reluctant to publish the findings. This was the case with the Public Expenditure and Financial Accountability analysis in Tajikistan, where the government acknowledged the usefulness of the analysis but decided to delay its publication for internal reasons, and with the financial sector assessments in Bangladesh. Nevertheless, clients frequently indicated that they valued the World Bank’s analytical work, even when they disagreed with its findings.

World Bank–IMF collaboration in identifying fiscal and financial vulnerabilities has been generally strong, often in the context of joint diagnostics (for example, FSAPs and DSAs), and the quality was generally high. IMF–World Bank DSAs include scenario and shock analyses, with shock scenarios taking into account different assumptions for growth, interest rates, and exchange rates. Country-specific shocks such as to remittances were occasionally included, but shocks associated with quasi-fiscal operations and contingent liabilities were not always well captured by the assessments, often because of a lack of data. Debt transparency on private and bilateral debt has also been an issue.

The World Bank and the IMF conduct joint FSAPs with an agreed division of labor, whereby the IMF focuses on financial stability and the World Bank on financial development issues. Of the seven case studies, FSAPs have been completed in four countries during the evaluation period: Bangladesh, Jamaica, Morocco, and Tajikistan. (There were no FSAPs completed in Benin, Mozambique, or Ukraine during the evaluation period, although the World Bank did undertake considerable financial sector monitoring, analysis, and technical assistance in Ukraine). World Bank and IMF staff report generally good collaboration in their preparation. Itinerant technical visits helped maintain monitoring and policy dialogue. However, in the case of Bangladesh, World Bank staff sought to undertake a full FSAP in the latter part of the evaluation period as financial sector vulnerabilities began to increase. Conversely, IMF staff did not consider Bangladesh to be a priority for scarce FSAP resources, resulting in delays in undertaking a comprehensive analysis of conditions in the financial sector. World Bank staff proceeded with a stand-alone “development” module in 2019.

Shortcomings in data quality and transparency often hindered the World Bank’s ability to analyze, identify, and monitor vulnerabilities, as in the case of bilateral debt in Tajikistan, for example (table 2.2). This evaluation finds that the quality of data needed to adequately monitor and analyze vulnerabilities is low in three out of seven case study countries. Even in countries with significant Bank Group engagement, such as Bangladesh and Ukraine, the quality of data was deemed moderate, especially with respect to contingent liabilities. Data quality was found to be generally high only in Jamaica and Morocco. The situation is similar with respect to the availability, transparency, and timeliness of data.

Table 2.2. Quality of Data on Fiscal and Financial Vulnerabilities

|

Country |

Quality of Data |

Transparency |

Timeliness |

|

Bangladesh |

Moderate |

Moderate |

Moderate |

|

Benin |

Low |

Moderate |

Moderate |

|

Jamaica |

High |

High |

High |

|

Morocco |

High |

Moderate |

Moderate |

|

Mozambique |

Low |

Low |

Moderate |

|

Tajikistan |

Low |

Low |

Low |

|

Ukraine |

Moderate |

High |

Moderate |

Source: Independent Evaluation Group assessment based on Public Expenditure and Financial Accountability, Public Expenditure Review, Financial Sector Assessment Program, and country reports.

- https://www.worldbank.org/en/publication/macro-poverty-outlook. .

- The subsequent Jamaica Public Expenditure and Financial Accountability Review expounded on institutional vulnerabilities in budget planning, monitoring, and management (Jamaica PEMFAR 2012).

- The World Bank Group performed a development module for Bangladesh in 2019 and for Jamaica in 2015. Publication of the report on the development module for Bangladesh had not been authorized as of April 2021.