The private sector in low income and fragile countries needs more than credit

Lessons from the early implementation of the IDA Private Sector Window (PSW)

Lessons from the early implementation of the IDA Private Sector Window (PSW)

By:

Private sector investment is a key ingredient to support the 2030 Sustainable Development Goals agenda and foster economic growth in all IDA countries, including those experiencing fragile and conflict-affected situations (FCS).

|

The Private Sector Window (PSW) contributes to sustainable development, the Sustainable Development Goals, and Mobilizing Finance for Development objectives. The PSW supports IFC 3.0, which aims to tackle difficult development challenges by creating markets and mobilizing private investment. The PSW reflects MIGA strategic priorities, which focus on scaling up investments in low-income IDA and FCS countries. The PSW also supports the implementation of the first Bank Group Fragility Conflict and Violence strategy, which emphasizes the importance of the private sector. |

Supporting the private sector in both conflict-affected and the least developed countries, however, is extremely challenging and requires constant innovation, experimentation, and learning. The Private Sector Window (PSW) is one such innovation. Launched in 2017 by IDA, the World Bank Group’s fund for the world’s poorest countries, the PSW aims at catalyzing private sector investments in high-risk countries. At the Independent Evaluation Group (IEG) of the World Bank Group, we recently conducted an assessment of the early implementation of the PSW to gather insights on how well the instrument is working, and what might be needed to boost its relevance and impact.

The PSW is the most recent, and IDA’s first, blended finance instrument that aims to use non-commercial, development funds to mobilize private sector investments in underserved sectors and markets by reducing their financial risk. It was set up to address the challenges posed by risks and unpredictability in IDA-FCS countries that deter private sector investment. Specifically, the PSW seeks to make projects commercially viable by de-risking an investment or by limiting IFC’s and MIGA’s own exposure to project risk. It does so by using concessional finance, or a subsidy, in the project or guarantee structure to enhance credit and mitigate the risk of possible losses.

|

|

Objective |

By Offering |

Results In |

Leads To |

|

Use of concessional funds (subsidies) |

Improve the risk-reward profile of private investments (with IFC and MIGA involvement) that are unable to proceed on strictly commercial terms |

|

Credit enhancement through:

|

|

Source: Independent Evaluation Group.

Note: IFC = International Finance Corporation; MIGA = Multilateral Investment Guarantee Agency.

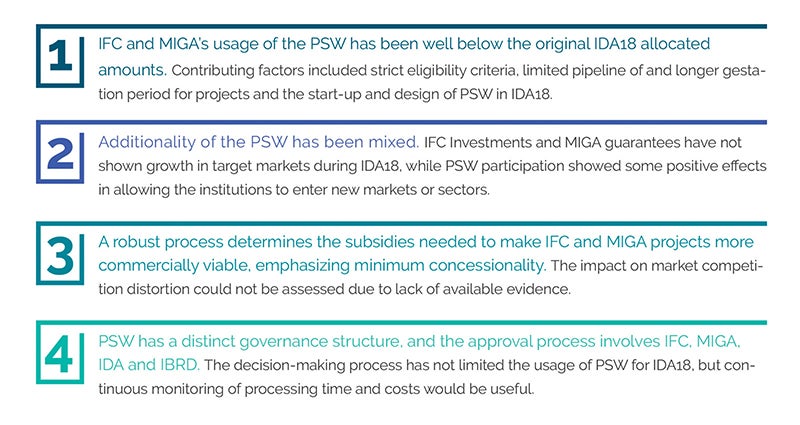

We looked at the early implementation of the PSW in IDA18, from financial years 2018 to 2020, and focused on four features: usage of the PSW, its additionality (relating to the growth of IFC and MIGA investments and guarantees in PSW-eligible countries, and IFC’s and MIGA’s entry in new markets or sectors) , the level of concessionality (the determination of subsidies to make IFC and MIGA investments commercially viable), and its governance. We did not assess the impact of PSW-supported projects on the ground as it is too early to evaluate their development outcomes.

We concluded that the risk mitigation the PSW provides addresses only one of the factors deterring private sector investment in eligible countries. The PSW is designed with a focus on de-risking IFC and MIGA financial risks but it is not designed to address other risks and constraints limiting the supply of bankable projects in high-risk markets. Non-financial risks often pose as big a constraint for private sector investments as financial risks. The poor quality of the business climate in IDA countries and especially in FCS (such as the quality of the macro and fiscal policies, quality of public sector governance, regulatory barriers to trade); reputational risks related to weak environmental, social and governance (ESG) standards; and issues related to integrity and due diligence are all examples of non-financial risks present in PSW-eligible countries.

Our findings and conclusions invite a reflection on the trade-offs related to the PSW’s limited deployment in IDA18, and course corrections and complementary efforts to support private sector investment in FCS, where needed:

The findings from our assessment have informed current discussions around the twentieth replenishment of IDA, which was launched early to support ongoing efforts to help the world’s poorest countries contain the impacts of the pandemic and lay the groundwork for recovery. The private sector, as an engine of jobs and growth, has a vital role to play in the recovery. The PSW can help unlock that potential, which we hope to strengthen by contributing with our insights to the cycle of innovation, experimentation, and learning.

Jack Glen is an independent consultant and adjunct professor at The Johns Hopkins University. He is a former staff of the IFC, including as Chief Portfolio Officer in the Portfolio Management Department.

Mitko Grigorov is a Consultant (ETC) with IEG. He works on macro-evaluations, covering fragile and conflict affected states and co-leads an evaluation on disruptive and transformative technologies. Prior to IEG, Mitko worked on the World Economic Outlook at the IMF for four years and as a journalist, in both print and TV, in New York.

Daniel Palazov is a Consultant (STC) with IEG. He works on macro-evaluations, covering Private Sector Development (PSD) and has worked on several evaluations on fragile and conflict affected states.

Stephan Wegner is a senior evaluation officer. He coordinates IEG’s work on fragility, conflict and violence.

Add new comment