Albania Country Program Evaluation

Chapter 3 | Developments and World Bank Group Contributions in Specific Areas

This chapter reviews developments and Bank Group contributions under the four evaluation pillars. Each section describes (i) specific Bank Group objectives and their relevance, including results framework quality; (ii) instruments deployed and design quality; and (iii) program implementation and contribution to results sought, concluding with an outcome rating. The basis for outcome assessment is progress made toward relevant CPS, CPSPR, CPF, and PLR objectives as measured against indicators in the combined results framework (appendix D).

Strengthening Macrofinancial Management and Public Service Delivery

Fiscal Management and Public Service Delivery

Under this area, the Bank Group sought to (i) improve public financial management, (ii) promote fiscal consolidation with the aim of reducing public debt and creating fiscal space, and (iii) improve access to and delivery of public services for citizens. The relative emphasis on these objectives varied over the evaluation period. In 2010–11, weaknesses in public financial management were pronounced. Growing fiscal pressures were increasingly managed through discretionary midyear expenditure cuts, which led to payment arrears of 0.7 percent of GDP to the private sector. The CPS correctly sought to address weaknesses in budget formulation and implementation but did not directly promote fiscal consolidation, despite emerging signs of distress. As the macroeconomic situation deteriorated, the Bank Group appropriately revised its objectives in the CPSPR to instill fiscal discipline and control the deficit.1 The fiscal stance remained a central concern in the CPF program, along with public investment management in the roads sector. The CPF also sought to improve transparency and convenience for citizens in accessing key public administrative services, an important element in the agenda of the new government that took office in late 2013.

In support of the first two of these areas, the World Bank used an appropriate mix of lending and technical assistance, strengthened by relevant analytical work. Development policy operations—the FY14 Public Finance DPL and the FY15 Public Finance Development Policy Grant—supported the government’s fiscal consolidation efforts, including reforms in the pension system and the power sector. IPF complemented DPF in key related sectors that had been important contributors to fiscal imbalances (such as power, roads, and pensions). A technical assistance program that spanned the entire evaluation period supported improved public financial management, including two rounds of the Integrated Planning System Multi-Donor Trust Fund and technical assistance on pensions. Relevant analytics, including the FY14 policy notes and the FY14 PFR, helped orient government reform priorities and World Bank support.

The World Bank’s program was flexible, responsive to the country’s needs, and calibrated to government reform commitments. When government commitment to reform was seen to be wavering, the World Bank scaled back its lending; conversely, when the government showed commitment, it expanded the program. Thus, when fiscal discipline was at risk in 2012 and the government appeared unwilling to take corrective measures, the World Bank canceled planned growth DPLs. However, when the new government showed commitment to reform (for example, beginning in FY14), the World Bank–supported program was scaled up substantially. The World Bank’s willingness to convert a planned public finance DPL into a policy-based guarantee demonstrated its flexibility in the choice of instruments to best meet the government’s needs.

World Bank support strengthened the medium-term budget process and financial management information system. The World Bank supported the rollout of the treasury single account and the initiation of tax e-filing and e-procurement. Efforts were also made to strengthen institutional capacity for investment planning in the road sector. Toward fiscal consolidation, the World Bank supported design and implementation of an arrears clearance and prevention strategy, reforms in taxation to boost revenues,2 pension reforms to improve the system’s financial sustainability, and energy sector reforms to improve financial viability, including adjustment of tariffs toward cost recovery levels. Much of this work served as inputs to or complemented the three-year IMF-supported arrangement approved in 2014.

Progress in reforms has stalled to some extent since 2017, so overall results under public financial management and fiscal consolidation are mixed. Public financial management still suffers from considerable weaknesses, as seen from the persistently large divergence between planned and actual spending. Progress in strengthening the public investment program in the road sector was minimal. Significant fiscal consolidation equivalent to 4 percentage points of GDP was implemented between 2014 and 2017, and the growth of public debt moderated but remained more than 70 percent of GDP. After 2017, payment arrears began to accumulate again, though more slowly. New areas of concern emerged that could undermine fiscal stability, including increased reliance on inadequately regulated off-budget PPPs (notably in roads) that give rise to opaque contingent liabilities. The World Bank supported the government to monitor PPPs through a public financial management technical assistance project (FY18–20) and helped publish its first PPP monitoring report in December 2019.3

Important gains were achieved in improving the efficiency of delivery of some public services, although this remains a work in progress. The World Bank supported this area through its ongoing FY16 Citizen-Centric Service Delivery Project, which sought to overhaul facilities and processes to allow quicker and more convenient access to key public services (such as motor vehicle registration, health insurance cards, and processing of old-age pensions), including improved access to government services in remote areas for vulnerable groups such as the Roma. The project supported the establishment of one-stop service centers, citizen feedback mechanisms, improved information provision, and online service provision. Through the project, rapid progress was achieved in shortening steps and procedures for 100 business processes and in the development of online services—all services are now available online through the e-Albania portal. Preliminary survey results cited in the PLR suggest that citizens have already benefited in convenience and time saved.

The extent to which the World Bank achieved its fiscal management and public service delivery objectives is rated moderately satisfactory. The World Bank supported progress toward significant fiscal consolidation after 2014, but the situation remains fragile, and public debt remains high. Important reforms to improve public financial management are progressing more slowly than expected. Good progress is being made toward improving the delivery of public services, though it is too early to assess results because the World Bank project is still under implementation.

The Financial Sector

The Bank Group program’s initial focus on credit expansion to the private sector shifted to safeguarding financial stability. The twin objectives in the financial sector were to strengthen the banking system’s capacity to increase credit to the private sector—especially to micro, small, and medium enterprises— and to bolster the capacity of financial institutions (bank and nonbank) to withstand the stresses arising from deleveraging and contagion from foreign banks, and the growing volume of NPLs. The CPS (FY11–14) emphasized the first of these objectives, and the focus shifted to the second objective, starting with the FY13 CPSPR as conditions in the financial sector deteriorated.

These objectives, including the shift in focus, were well aligned with prevailing conditions and reflected government priorities. The growth of credit to the private sector had slumped from 32 percent in 2008 to 10 percent by 2011, posing a threat to economic recovery. Financial stability was a less prominent concern on the eve of the CPS period, even though the volume of NPLs had grown from 6.7 percent of total loans in 2008 to 14 percent by the end of 2010. The CPS arguably understated emerging risks. As balance sheets deteriorated further,4 objectives in the CPSPR were revised to address risks to financial stability.

The Bank Group’s response combined financing and guarantees, technical assistance, and analytics in a coherent package. Two development policy operations in FY14 and FY17 addressed policy reforms targeting fundamental weakness in the financial sector, including the resolution of NPLs. These interventions were complemented by diagnostic analytical work and substantial technical assistance to strengthen financial institutions and the legal and regulatory framework.

ASA were a crucial part of the support. Advisory services included technical assistance to (i) the Bank of Albania to help develop a road map for expediting the resolution of NPLs and for resolving distressed banks in accordance with international best practice; (ii) the Albanian Financial Supervisory Authority to bolster its operational and financial autonomy to regulate nonbank financial institutions, especially investment funds; (iii) improve the framework for deposit insurance, extend its coverage to all legal entities, and augment the capacity of the deposit insurance agency; and (iv) strengthen the regulatory and supervisory framework for savings and credit associations. Additionally, commercial banks received IFC technical assistance to strengthen governance and improve their ability to lend prudently. Analytical work, including the Financial Sector Assessment Program Update (FY14), identified problem areas in the financial sector and mapped out needed reforms, including those implemented through the development policy operations.

IFC support to enhance bank capacity to lend to the private sector was insufficiently geared to the binding constraints to private sector borrowing. IFC provided lines of credit and trade finance to selected banks to increase their capacity to lend to micro, small, and medium enterprises, and MIGA provided guarantees to selected foreign banks against expropriation of mandatory reserves to encourage greater lending by their local subsidiaries. However, the assumption in the CPS that providing additional liquidity to banks would automatically boost their lending proved faulty. Binding constraints on bank lending to micro, small, and medium enterprises (such as the difficulty of finding bankable projects) were insufficiently addressed. In addition, in the view of one bank, permissible borrower risk profiles under an IFC credit line were overly conservative, given the growing number of NPLs and a very liquid banking system.

With Bank Group support, significant progress was made in strengthening the legal and regulatory framework governing bank and nonbank financial institutions. The capacity of key regulatory and supervisory institutions was strengthened. Parliament adopted a bank resolution law providing a framework for resolving distressed banks in accordance with international good practice. Technical assistance from the World Bank helped establish a dedicated resolution unit in the Bank of Albania to implement the law. The framework for deposit insurance was enhanced and coverage extended to all legal entities, including small enterprises. The adoption of a new law on savings and credit associations strengthened the legal, regulatory, and supervisory framework, resulting in consolidation of the savings and credit associations sector from 106 to 13 entities by December 2017. Several measures were implemented to deal with NPLs, including amending tax laws to enable NPL write-offs (which mandated write-offs after a fixed period in the lost category of NPLs) and amending the regulatory framework for private bailiffs to align their incentives with successful collateral execution. A new bankruptcy law strengthened the insolvency regime.

Bank Group–supported reforms and initiatives led to improved financial system soundness and stability. The volume of NPLs declined from a peak of 23 percent of total loans in 2014 to 8.3 percent in January 2020. The net open position in foreign exchange as a percent of regulatory capital and the return on equity have both improved by about 3 percentage points. Although credit to the private sector has improved in recent years (at 1.7 percent in 2018), it remains tepid, and credit as a share of GDP remains well below its level of 10 years ago.

The achievement of objectives in the financial sector is rated satisfactory. The financial system is clearly in better shape and institutionally more empowered to deal with emerging stress.

Improving the Conditions for Private Sector Development

Business Climate and Developing Sustainable Tourism

Bank Group objectives displayed continuity over the evaluation period, and they began explicitly encompassing sustainable tourism development under the CPF. Four distinct objectives can be discerned, with emphasis shifting over the evaluation period. The first two—to increase satisfaction with quality of regulations and to improve private sector compliance with selected EU and international requirements—were pursued during the CPS period. The latter two were CPF objectives: to contribute to an improved business environment and to support sustainable tourism development.

Bank Group objectives were highly relevant to the country context and aligned with the priorities set out in Albania’s development strategies. Economic growth had slowed after the global crisis and during the ensuing euro area crisis, placing renewed focus on the need to enhance competitiveness through an improved business environment and on tourism’s potential as an engine of sustainable development and economic integration. The 2007–13 NSDI 1 identified an improved business environment as one of its strategic priorities. Equally, a key goal under the 2014–20 NSDI 2 was to enhance competitiveness in key growth sectors, notably agriculture and tourism. Business environment improvement objectives were well aligned with key Bank Group diagnostics, including the SCD and Enterprise Surveys, and with the EU accession agenda. Result frameworks were adequate, but results indicators focused primarily on tracking outputs and insufficiently reflected private sector activity.

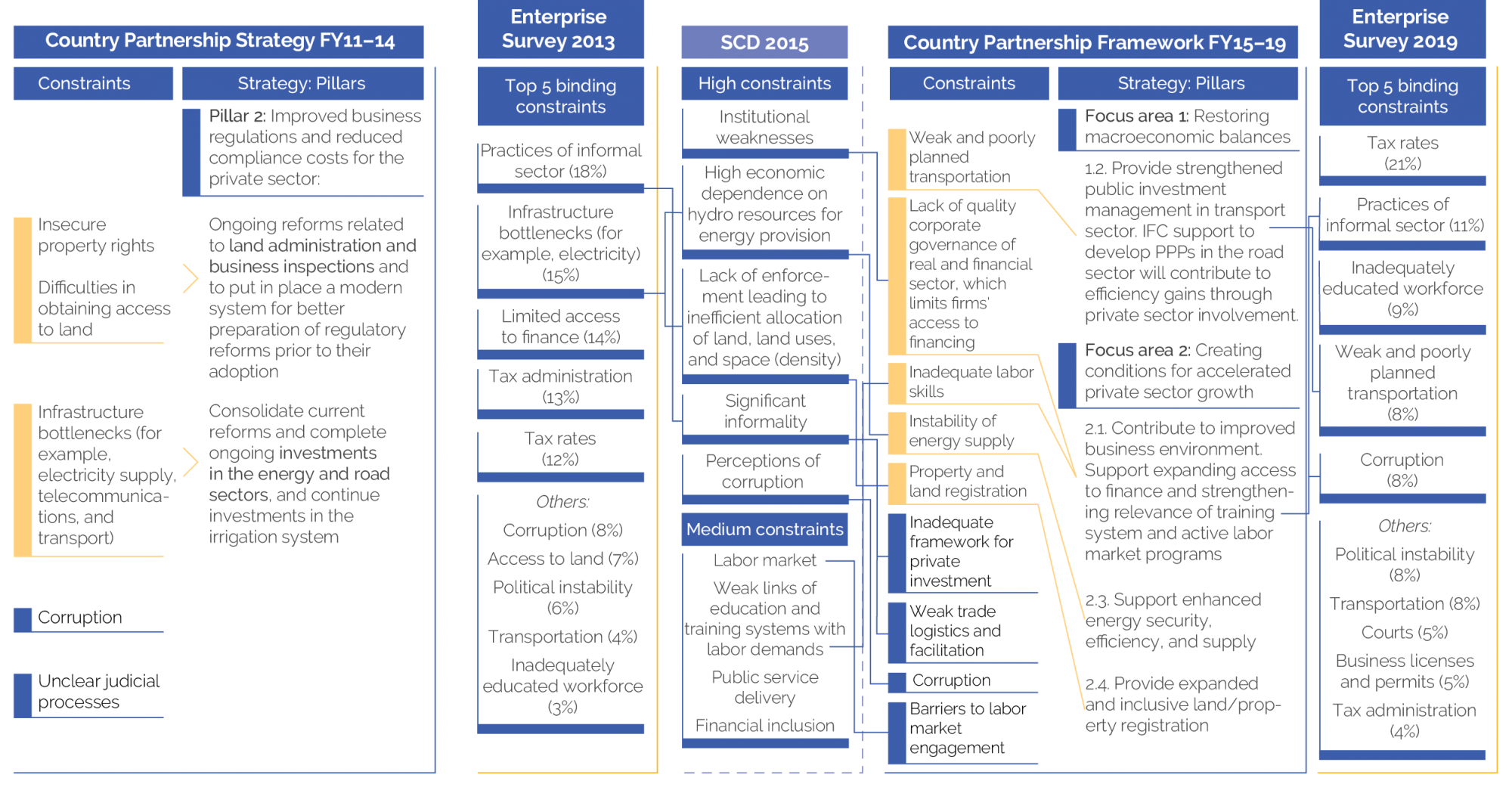

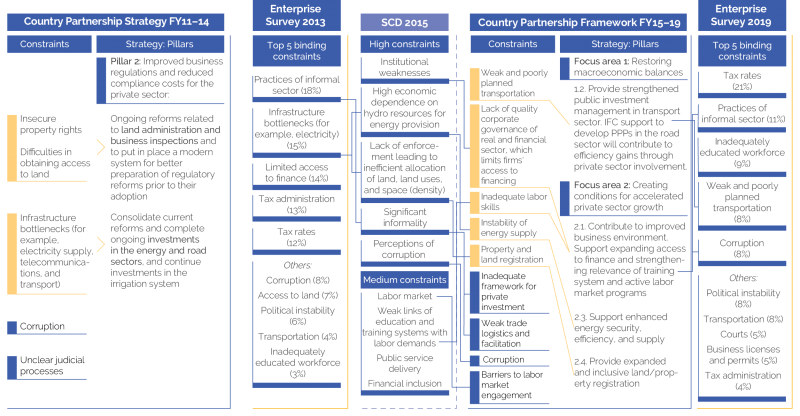

The most critical constraints to private sector development identified in the Enterprise Surveys and the SCD were reflected in the FY11–14 CPS and the FY15–19 CPF (figure 3.1). Both the Enterprise Survey 2013 and SCD identified practices of the informal sector and poor infrastructure as major constraints to firms operating in Albania. These were reflected in CPF attention to the framework for private investment, corruption, property and land registration, transport (public investment management), and energy. The CPF’s emphasis on labor skills did not respond to a significant constraint that was identified in the Enterprise Survey 2013 and the SCD. However, the World Bank’s 2014 regional report, Back to Work: Growing with Jobs in Europe and Central Asia, noted that about 30 percent of the interviewed firms in Albania reported skills as a major constraint, after infrastructure and corruption (Arias et al. 2014). The report argued that the education and training systems have not adapted well to the changes in skills demand. This was reflected in the Enterprise Survey 2019, in which about 1 in 10 firms identified inadequate labor skills as among the most binding constraints (although high tax rates [21 percent] and practices of the informal sector [11 percent] were identified most often as among the most binding constraints).

Figure 3.1. Critical Constraints to Private Sector Development in Albania

Source: World Bank 2015a, 2015b, 2015d; Enterprise Survey results for 2013 and 2019.

Note: FY = fiscal year; IFC = International Finance Corporation; PPP = public-private partnership; SCD = Systematic Country Diagnostic.

Bank Group support for business climate improvements blended several instruments into a credible package that capitalized on World Bank–IFC complementarity. World Bank IPF (the Business Environment Reform and Institutional Strengthening Project) active early in the evaluation period helped strengthen institutions to promote exports, while DPF later in the period supported reforms in the regulatory environment to enhance competitiveness. The World Bank also delivered technical assistance in several related areas. World Bank efforts were complemented by IFC advisory services, notably the International Standards and Technical Regulations Project, which helped operationalize reforms in the field. A more recent FY17 regional IFC advisory services project for the Western Balkans seeks to enhance investment policies and promotion in a harmonized manner, helping to lay the groundwork for EU accession. Nine IFC investments in the early years of the evaluation period also directly supported private sector development. However, IFC made no direct investments during the CPF period, partly because of lack of demand. Analytical work under World Bank and IFC advisory activities helped identify issues in the business environment and inform government policy and Bank Group support. Policy dialogue was facilitated through ad hoc participation in the relevant development partner working group. In all, Bank Group support was packaged adequately, given the primary focus on the regulatory framework and institutions, complementarities between World Bank IPF and DPF and IFC advisory services projects, and the results sought.

World Bank IPF supported objectives related to sustainable tourism development, given tourism’s economic potential. The NSDI 2 identified tourism as one of the key drivers of growth, job creation, and investment in Albania. The Bank Group has a track record of supporting environmental cleanup and land management, two areas with important links to sustainable coastal tourism. Two IPF operations sought to help develop tourism by supporting the development of related infrastructure. However, the FY05 ICZMCP (which closed in FY15) and the more recent FY17 Project for Integrated Urban and Tourism Development extended well beyond tourism.

Bank Group contributions substantially enhanced the quality of business regulations. The regulatory framework for business inspections and systems adopted under the Business Environment Reform and Institutional Strengthening Project has been used across the country. Substantial capacity on EU technical regulations and standards was built with IFC support under the International Standards and Technical Regulations Project.5 Joint World Bank–IFC support helped strengthen the regulatory framework, notably through the preparation of a best practice bankruptcy law. Improvements in the quality of regulations have been evidenced in Business Environment and Enterprise Performance Surveys and customized surveys (World Bank 2015b).

However, challenges remain in implementing these regulations, and consequently private investment has yet to expand significantly. Stakeholder interviews and the recent Foreign Investors Association of Albania White Book highlight continuing problems, including frequent changes in the legal and regulatory framework, an ineffective judicial system, and inconsistencies between laws and the corresponding guidance notes (FIAA 2018). Compared with the 2015 baseline score of 66, the Doing Business distance to frontier indicator was 68.9 in 2017, below the CPF target of 74.

Higher-order outcomes related to private sector development illustrate weak private sector response to ongoing reforms. A few large, one-off projects, notably the Trans Adriatic Pipeline Project and the Devoll Hydropower Project, have driven investment and growth in recent years. Exports as a share of GDP increased modestly from 29 percent in 2011 to 32 percent in 2018. Foreign direct investment inflows were broadly stable over the evaluation period—at 8.1 percent of GDP in 2011, 7.8 percent in 2017, and 8.0 percent in 2018. Foreign direct investment inflows have been concentrated in the energy sector (gas pipeline and hydropower) and mining sector and are limited in other tradable sectors. More troubling, however, is that private investment as a share of GDP has declined steadily, from 27.7 of GDP in 2011 to 19.4 percent in 2017 and an estimated 18.4 percent in 2018 (IMF 2016, 2018). Regarding sustainable tourism development, investments in the Saranda port undertaken under the ICZMCP project contributed to increased tourist arrivals,6 though tourism was not an explicit objective at the time. However, it is too early to assess the Bank Group’s contribution under the CPF because the ongoing project, which has focused on infrastructure development so far, was approved only recently.

The achievement of objectives in relation to business environment and tourism development is rated moderately unsatisfactory. The objectives were well aligned with the country context and government strategies. However, despite Bank Group support, the conditions for accelerated private sector growth—an explicit higher-order objective under the CPF—are not yet in place.

Land and Property Registration

The Bank Group sought to improve land and property registration throughout the evaluation period, but it grappled with an underlying constraint. The CPS sought to strengthen the business climate by reducing the time for registering immovable property transactions. The CPF elevated land administration to a distinct strategic objective, under which it sought to provide expanded and inclusive land and property registration. The high gender gap in land ownership justified this additional focus on gender and inclusion dimensions in land registration. Progress in this area was also important on the path to EU accession.7 Results framework quality was generally adequate, with results indicators reflecting progress toward objectives. The Bank Group’s objectives were of high relevance, though with a major caveat. Albania’s investment climate was undoubtedly undermined by severe weaknesses in the land sector, including in property registration and in the sustainable and productive use of land for investments. However, numerous competing claims to land and property—a very sensitive area in which the World Bank has not been directly involved—have remained unresolved, and this has been a key impediment to improving land administration. Until the government adopts a legal framework that provides definitive solutions to informal settlements and property restitution and compensation claims, it is difficult to see how investment and economic growth can be promoted effectively.

Bank Group projects in this area proved too complex. The FY07 LAMP was the principal lending instrument. There were also land registration components in the FY05 ICZMCP and in the ongoing FY15 Environmental Services Project. However, the two earlier IPF operations had multiple components across sectors and thus were too complex, as recognized by project restructurings and Implementation Completion and Results Report findings. Together with other factors,8 this complexity led to implementation difficulties and a need to restructure the projects significantly. In the ICZMCP, the land registration component was dropped entirely. LAMP was initially designed with both urban planning and land registration components based on the reasoning that improving land registration would create an environment for more effective urban land use planning. Although the project underwent major restructuring,9 the land registration component was retained and focused on introducing computerized data management at the Immovable Property Registration Office (IPRO) and its branches, technical capacity building for IPRO staff, and digitizing and updating property registration records.

Insufficient consideration of land rights data accuracy and institutional issues detracted from the relevance of design of initial World Bank lending. The Security of Tenure and Registration of Immovable Property Rights LAMP component did not pay enough attention to the quality of the land rights data obtained from previous EU, Organization for Security and Co-operation in Europe, and US Agency for International Development projects. Fragmented institutional arrangements in the land sector compounded the data problems further.10 Subsequently, the World Bank chose not to develop a second phase of the LAMP adaptable program loan and instead coordinated with the government of Albania and development partners (principally the EU and the German Agency for International Cooperation) to provide ASA that responded to the government’s need for guidance on land administration reform strategies and policies.

World Bank support helped increase property registration, but with major caveats concerning records quality and coverage. Through LAMP, more than 370,000 titles (of a target of 400,000) were registered at IPRO. As of early 2019, there were about 2.4 million properties registered, representing 60 percent of the estimated 4 million properties in Albania. An estimated 75 percent of cadastral zones have been registered. However, the reliability of the underlying mapping data on which registrations are based continues to be a serious constraint, and IPRO is far from achieving fully digitized operations. Most initial registration is still performed manually, and records are subsequently entered digitally. The scarcity of digitization increases the potential for human error or manipulation in the manual registration forms. Additionally, most of the sensitive southern coastal zone remains unregistered partly because of political and governance issues related to the considerable tourism development potential in this region. The lack of progress on property registration here is a significant constraint to economic development in the area.

World Bank support helped reduce transaction times (and thus business compliance costs) and strengthen the institutional setup (with other partners). IPRO now has nine fast-track services with a 48-hour turnaround service standard for transactions like transfer of property, obtaining a property certificate, and providing documentation for loan collateral (registration of immovable property transactions reportedly required 30 days in 2009). However, initial registration of unregistered property still takes a minimum of 25 days. The World Bank has worked effectively as the focal development partner, coordinating with several other partners to improve and unify geospatial data, improve gender equity in property transactions, support legislative reforms, and develop strategies for capacity building and implementation. Key among the World Bank’s inputs is the recent completion of an integrated land administration road map, which lays out options for a land reform implementation strategy. The government is currently considering two legislative reforms recommended under the road map, involving consolidation of agencies and resolution of competing claims on land.

The achievement of objectives under land registration is rated moderately unsatisfactory. The World Bank correctly remained engaged with the government on land issues despite the very challenging and politically charged environment, gradually shifting support from lending to ASA. Since 2014, the World Bank has assessed the obstacles to its previous efforts to support land administration, developed new approaches, and generally shown flexibility and analytical rigor in refining its approach. However, despite the World Bank’s intense engagement, results in improved quality and reliability of land registration records through digitization and capacity building at IPRO are below expectations, largely because of lack of political will and vested interests.

Access to and Quality of Infrastructure Services: Energy

Bank Group energy sector objectives displayed broad continuity and reflected Albania’s needs and plans. CPS objectives covered improvements in domestic energy supply, safety and operational efficiency of hydropower dams, transmission system operation, energy efficiency, and use of cleaner energy. The CPS also sought to improve cost recovery in electricity distribution. The objectives under the CPF focused on enhanced energy security, efficiency, and supply. CPS and CPF objectives were appropriate given the country’s dependence on hydropower, low financial viability of the electricity sector, and growing household electricity consumption. Bank Group energy sector objectives were aligned with those of NSDI 1 and 2. Results framework quality was adequate, although results indicators were excessively output and process oriented.

The Bank Group deployed a wide range of instruments that built on World Bank–IFC complementarities. Activities complemented each other, were logically sequenced, and were an appropriate blend of investment, policy reform, and technical and advisory support. Among other initiatives, the World Bank provided major investment support for rehabilitating the country’s hydropower facilities through the FY08 Energy Community of South East Europe Program Adaptable Program Loan 5 Dam Safety Project. Subsequently, it provided a combination of IPF (the FY15 Power Sector Recovery Project) and DPF to help promote reforms in the energy sector and improve financial viability. IFC provided early and timely support to help address legacy environmental issues in the oil and gas sector. It also complemented World Bank efforts to improve electricity production in large hydro facilities by catalyzing investment in the small hydropower producer segment through its regional renewable energy advisory program (Balkan Renewable Energy Program). In addition, IFC sought to help local commercial banks improve their lending practices and risk assessment for renewable energy and energy efficiency project financing and to supplement banks’ resources for this purpose.

Bank Group support for improving electricity production has had mixed results. The development of the Vlore thermal plant under a World Bank–supported project that closed early in the evaluation period failed to bring the plant online for technical and environmental reasons that could not have been fully anticipated. World Bank and KfW support to improve the safety of Albania’s largest hydro facilities (and thus their capacity and efficiency) has seen slow implementation, and expected results have yet to be realized. IFC contributed to the growth of small hydropower producers and helped embed environmental and social safeguards in projects within its purview amid growing safeguard concerns in the wider small hydropower producer space.

Progress in improving the efficiency of supply and cost recovery has been mixed. IFC helped strengthen local bank capacity to screen lending for residential energy efficiency improvements. Albania has realized significant energy savings and a corresponding reduction in greenhouse gases, although the contribution of IFC financing was minor.11 World Bank support contributed to a reduction in technical and commercial losses (though below target). Distribution losses have steadily improved from 43.0 percent in 2013 to 24.3 percent in 2018, but losses remain significantly above the 2019 target of 19 percent and higher than in regional comparator countries. Collection rates have improved steadily, reaching 99 percent in 2019 (January–August) from 84 percent in 2012. However, intercompany arrears, though reduced, remained higher than targeted by June 2019. Overall, the electricity sector remains financially unsustainable, with low cost recovery and high system losses.

World Bank analytical work informed tariff reform and helped mitigate the impact of electricity tariff increases on the most vulnerable households. The World Bank undertook a high-quality diagnostic study on the distributional impact of electricity reform. The study was an example of good practice in collaboration between the World Bank’s Energy Global Practice and its Social Protection Team. The government endorsed its recommendations and is now using the Unified Scoring Formula to determine poor households’ eligibility for energy cash benefits to mitigate the impact of the electricity tariff increase.

Progress on institutional reform provided the basis for integrating Albania with the larger European electricity market, but further market liberalization has been delayed. With the European Bank for Reconstruction and Development, IFC contributed to the successful opening of Albania’s oil sector and, by addressing its legacy environmental issues, helped bring it in line with the EU acquis. More generally, several requirements under the acquis are in place, including the Power Sector Law (2015) and the Law on Renewable Energy Sources (2017), partly because of Bank Group and other partner support. Electricity generation, transmission, and distribution activities are now separated into independent companies, and an independent regulator has been established. These developments brought the sector into compliance with the southeast Europe Energy Community Treaty. However, despite extensive technical assistance, advice, and support for policy reforms and investment support from the Bank Group in coordination with other partners (including the EU, the European Bank for Reconstruction and Development, KfW, and the US Agency for International Development), the government has not made the expected progress toward liberalizing the electricity market and setting up a functioning Albania power exchange to integrate with regional and European markets. There has been little progress in achieving compliance with unbundling requirements of the distribution system operator and in putting cross-border exchanges in place between the transmission system operator and neighboring transmission system operators. In energy, after the failed privatization of the distribution entity, engagement by the Bank Group stagnated as government and stakeholders assessed, deliberated and agreed on mitigating reform options.12

On balance, the extent to which objectives in the energy sector were met is rated moderately unsatisfactory. Despite modest progress in some areas, results have been slow to materialize and have fallen short of expectations. Some stakeholders have suggested that the Bank Group could show greater initiative in helping to prepare and monitor implementation of a comprehensive reform blueprint for the sector to serve as a platform for coordinated development partner engagement.

Access to and Quality of Infrastructure Services: Roads

There was a justified shift in emphasis in Bank Group road sector objectives. The CPS sought to improve road conditions and sustainability of road investments, a highly relevant objective given the poor state of secondary and local roads in the country. This was recognized in NSDI 1 and 2, and the five-year Strategy for Rural and Agriculture Development (2015–20). In the CPF, the focus shifted toward strengthening public investment management in the transport sector, seeking to improve controls on expenditure and its efficiency while emphasizing maintenance over new construction. This change in emphasis was informed by the FY14 PFR, which drew attention to the need for better investment spending controls to underpin fiscal consolidation, and the SCD, which indicated a need for relatively greater emphasis on road maintenance.

World Bank support was appropriate and logically sequenced. World Bank IPF, supported by ASA and IFC advisory services, evolved from an initial focus on road construction to maintenance, regional trade facilitation, and sector policy. The World Bank supported the government’s programmatic Secondary and Local Roads Improvement Program through the FY08 Secondary and Local Roads Project, responding to the government’s priorities and resource needs for road rehabilitation to improve access for rural areas. Two new IPF operations followed, replacing previous plans to use DPF to support transport reforms. The FY15 Results-Based Road Maintenance and Safety Project seeks to maintain the condition and improve the safety of primary and primary-secondary road networks and strengthen road asset management and safety practices. The FY18 Regional and Local Roads Connectivity Project addresses a wider range of issues covering physical investment, institutional development, road safety and resilience, and links to markets. Starting in FY12, IFC advised on structuring a transaction for the operation and maintenance of the Milot-Morine highway, which was successfully completed in FY17. Analytical work focused notably on improving logistics in the Durres-Tirana corridor. An assessment of road assets conducted in FY16 highlighted the need to use a RED for determining the economic viability of road rehabilitation and upgrading projects and programs and to allocate medium-term budget resources clearly and transparently. Albania will be part of phase 1 of the proposed Regional Trade and Transport Facilitation project, which will support Western Balkan countries in advancing the goal of regional economic integration and integration with the EU, as laid out in the Berlin Process (appendix F).

World Bank support for secondary and local roads has helped improve access for communities. Under the Secondary and Local Roads Project, 118.9 kilometers of secondary and local roads were rehabilitated (exceeding the target of 108 kilometers), providing improved access to markets, social services, and administrative centers for 86 communities (113,608 persons), above the project’s target of 81 communities. The World Bank’s convening role also helped crowd in $386 million in financing from international financial institutions for the broader Secondary and Local Roads Improvement Program, which improved 1,200 kilometers of rural roads in 12 regions and 61 municipalities, improving mobility for more than 2 million people.

However, World Bank efforts to improve management capacity, including through performance-based maintenance contracts, have not yet produced significant results. The RED was developed under the FY08–13 Secondary and Local Roads Project to improve planning, prioritization, and resource allocation for road management activities. Although RED was introduced in 2016, it requires adjustments after territorial reform and changes in municipality jurisdiction after the June 2019 elections, and needs adequate incentives and capacity to make it function effectively. Similarly, efforts to align road sector investments with the medium-term budget framework have yet to show results. The Albanian Road Authority, the main contributor to arrears, has not yet rolled out multiyear commitment control (IMF 2018). The FY14 ASA activity on assessment of road assets, updated in December 2014, highlighted the need to use a simple RED and informed the ongoing FY15 Results-Based Road Maintenance and Safety Project. Building on the Secondary and Local Roads Project, a new approach for prioritizing road investments was developed under the FY18 Regional and Local Roads Connectivity Project. However, the introduction of these simple management systems to improve maintenance planning and resource allocation, along with the development of service-level agreements setting performance criteria, face hurdles because of organizational and behavioral inertia.

IFC support resulted in a PPP transaction, though it has yet to influence policy. The IFC advisory services helped conclude a concession contract for the operation and maintenance of the 114-kilometer Milot-Morine highway in September 2017, the first highway PPP and toll road in Albania. This was expected to pave the way for additional toll highways in the country. However, there is no indication of a longer-term commitment to expanded use of competitively bid PPPs in the road sector. On the contrary, there has been widespread use recently of noncompetitive, unsolicited PPPs in roads, as discussed in the Fiscal Management and Public Service Delivery section.

The World Bank’s analytical work to improve logistics performance has had limited impact so far. The study developed the idea of improving logistics performance in the Durres-Tirana corridor through a collaboration platform for user entities. However, the volume of transactions through the platform has been low so far because of limited interest from users.

Based on results so far, the achievement of objectives in the roads sector is rated moderately satisfactory. Road sector projects were appropriately sequenced, first addressing the relatively greater need for secondary and local roads while increasingly emphasizing financially sustainable road asset management and laying the basis for private participation in road operation and maintenance. World Bank support also contributed to improving the quality of the public investment program in the road sector and to increasing capacity for road sector institutions, road safety, and resilience issues, although significant results have not yet materialized in some areas.

Improving the Management of Land, Water, and the Environment

Focus shifted over the evaluation period from reducing climate change vulnerability to increasing the productivity and sustainability of land use. In the CPS (after some modifications in the FY13 progress report), the focus was on reducing upstream risks of erosion through improved management of wetlands, forest and pasture resources, and water catchments; improving the framework for managing water resources (including irrigation use); and strengthening solid waste disposal. These objectives were cast as contributing to a broader goal of reducing vulnerability to climate change. Because the government has access to substantial grant financing for climate change mitigation, particularly from the EU, the CPF shifted from climate change toward improving the adoption of sustainable land management practices and improved irrigation and drainage and improving conditions for private sector development. Objectives during both periods were highly relevant to Albania’s development goals, and they align explicitly with pillar 4 of the current NSDI 2 (to spur economic growth through sustainable use of resources and territorial development). The outcomes sought and indicators used were broadly adequate, although during the CPS period, they arguably did not fully reflect the extent of the World Bank’s work on improving and expanding irrigated agriculture and developing integrated water resources management policies and strategies.

World Bank support was adequately geared to its objectives, supporting both investments and policy development. The World Bank executed seven lending operations and a much larger number of technical assistance activities, most of which were conducted in close coordination with specific lending operations. Initiatives focusing on pollution abatement, restoring and increasing agricultural and forestry productivity, improving water resources management, and climate change impact mitigation formed major parts of the World Bank’s portfolio during the evaluation period. Much of the work on environment during the CPS period was undertaken through regional initiatives, such as the FY09 Global Environment Facility Lake Shkoder Ecosystem Project and efforts to support Albania’s development of a climate change and disaster mitigation strategy. The World Bank had a sustained focus on rehabilitating and expanding irrigated farming and sustainable forestry and pastureland usage through the FY05 Natural Resources Development Project and its successor, the FY15 Environmental Services Project, which allowed for adaptation based on lessons learned and responsiveness to Albania’s evolving priorities and needs. The FY13 Water Resources and Irrigation Project and linked technical assistance provided a vehicle for expanding irrigated agriculture and leading advisory support for water resources policy and regulatory reform.13 The package was appropriate for influencing development policies and strategies that were being formulated for overall water sector reforms and for directly investing in productivity and was well aligned with the strategic objectives.

Much of the work was performed in close coordination with other partners. The World Bank worked closely and extensively with other donors to support the evolution of integrated water resources management and sustainable forestry. Through trust funds, the Swedish International Development Cooperation Authority financed much of the World Bank’s advisory and technical assistance work on river basin management, integrated water resources management, forest management, and institutional capacity building. Coordination with other donor partners (principally the EU) for urban waste management investments typically involved parallel financing initiatives, with the World Bank financing portions of infrastructure that depended on coordinated investments by other donors and the government to be fully functional.

The World Bank has been broadly successful in achieving environmental sustainability objectives. Through the 2005–11 Natural Resources Development Project, erosion was reduced by 220,000 tons, and 129,000 tons of carbon were sequestered, significantly exceeding the original project targets. Forest incomes rose by 8 percent in the 251 communes in the project area, and agricultural incomes from pasturelands climbed 28 percent as a result of adopting more sustainable land use practices. Albania was a pioneer in carbon sequestration, being one of the first to do so on eroded lands. The current Environmental Services Project is on track to further increase upland incomes and expand sustainable forestry and pastureland management.

Much of the World Bank’s successful support for disaster mitigation was reactive. The World Bank responded well to emergency requests from natural disasters. After severe flooding in 2013, the LAMP was restructured to reallocate funds for emergency flood relief. However, World Bank efforts to support disaster risk management have had limited impact. The government ultimately did not adopt the disaster risk management strategy that was prepared with World Bank support,14 but building codes were updated to improve resistance to the effects of natural disasters. The EU, which has a large climate change grant program, has assumed leadership in advising the government on disaster risk management.

Productivity improvements through irrigation were also achieved, though with delays caused by institutional changes. These changes include decentralization and shifts in responsibilities for water resources management between the Ministry of Environment and the Ministry of Agriculture and Rural Development. Municipalities have limited institutional capacity to take on the management of irrigation infrastructure, and shifts in ministerial mandates required time to be completed, which hampered the execution of contracts for infrastructure and capacity building. Incomplete or inadequate land registration in some areas has also delayed the completion of some irrigation infrastructure. The Water Resources and Irrigation Project is now on track to expand irrigated area by about 40,000 hectares in six irrigation programs (the revised project target under additional financing), but there are concerns about small farmers’ access to irrigated water.15

World Bank support for the policy framework has seen significant success. Important progress was made with the preparation of the national integrated water resources management strategy and World Bank–managed technical assistance for developing a national water cadaster, irrigation regulations, and two river basin management plans. A new law on irrigation is under preparation with World Bank support, informed by the new draft Irrigation, Drainage, and Flood Protection Strategy (also prepared with World Bank support). Agreeing on strategies and enacting legislation is a long process, and the World Bank stayed the course over the evaluation period, earning credibility with the government and development partners.

Expected results in solid waste management were achieved but with extended delays. Urban environmental achievements included hazardous waste hot spot remediation at Porto Romano, which was successfully completed and continues to be managed in accordance with end-of-project plans. The World Bank invested in a regional solid waste management operation in Himara. Inadequate land registration increased the costs and delayed completion of this latter initiative.

The extent to which the objectives under this pillar were achieved is rated moderately satisfactory. Results sought were substantially achieved, though with delays in many cases, and the World Bank provided valuable support at the policy and strategy level.

Improving the Quality of Service Provision in the Social Sectors

Access to and Quality of Education Services and Understanding Labor Market Constraints

Bank Group strategy shifted during the evaluation period from supporting country education reform strategies to focusing on skills and the labor market. In the CPS, the World Bank continued the previous Country Assistance Strategy and sought to broaden access to education, particularly at the secondary and higher levels, and to improve quality at all levels. The objectives were highly relevant to country conditions and supported the implementation of the first phase of the country’s education reform strategies. World Bank work provided an overall framework, in essence attempting to shift the education system from a focus on inputs to education outcomes, where efficiency and accountability measures would lead to enhanced performance and greater equity. A significant improvement in Albania’s human capital is imperative for the country to become more competitive within the region and is a key factor for poverty reduction.16 Employers viewed school leavers as ill equipped for the needs of the workplace in a market economy. The poor were the most affected. In the CPF, the Bank Group ended its support to the education sector based on the priorities established by the SCD and the government’s view that it no longer required World Bank funding for education (figure 2.1). The CPF indicated that the World Bank would “support an analytic program that will seek an evidence-based understanding of the labor market and the constraints faced by women and the bottom 40 percent to labor force participation” (World Bank 2015a, 30) which is unquestionably relevant work given the policy challenges in Albania. However, it offered no specific outcomes in its results framework.

During the CPS period, and in collaboration with other partners, the World Bank carried out a balanced mix of lending and ASA highlighting key sector challenges. World Bank financing approved under the previous Country Assistance Strategy sought to help improve the quality of teaching and learning, expand secondary school enrollment, and initiate higher education reform, including compliance with the EU’s Bologna Process.17 To boost performance incentives, it also sought to strengthen management, leadership, and governance and accountability through decentralized service delivery and increased school responsibility. However, given the implementing agencies’ weak institutional and fiduciary capacity, the World Bank’s project was too ambitious and complex in design. Moreover, design failed to include new school construction, a government priority, which was added later, in addition to renovation of existing school buildings. World Bank ASA focused on education governance and accountability as essential to improving the education system’s performance and on key factors to improve quality and relevance of education.

ASA activities on highly relevant education topics relating to skills and the labor market were delivered under the CPF. Various tasks generated knowledge on early childhood development and quality of education, including an assessment of trends in student learning using the Program for International Student Assessment results during 2000–15 and Albania case studies on out-of-work and out-of-school youth and on Roma exclusion.18 Under the CPF, the World Bank examined links between labor supply and demand and labor market regulation and institutions, including how these help explain labor market outcomes. Regarding skills development, special attention was paid to understanding the issues affecting youth, women, and the bottom 40 percent of the population. The recent policy notes, which proposed reform options to stimulate job creation and growth, provided substantial inputs to the preparation of a government action plan. They included specific measures to improve the education system’s quality and efficiency, foster job-relevant skills development by the training system, and remove labor market barriers.

There were significant improvements in access to secondary, higher,19 and preprimary education, although services for rural areas and the poor remain a challenge. Despite rapid expansion of the education system, the quality of pre-university education improved as proxied by student learning outcomes in standardized tests, with more students reaching basic proficiency in the Program for International Student Assessment tests between 2000 and 2012 and again in 2015. Still, overall quality remains low, as about half of 15-year-olds are functionally illiterate and lack basic numeracy skills.20 The huge expansion of higher education led to a decline in quality, along with stagnant resources, no change in curricula or teaching methods, and accreditation of universities that did not meet criteria or standards. The World Bank and other partners’ financing contributed to broader secondary education access and improved learning outcomes by supporting investments that directly improved teaching and learning conditions, even though difficult implementation led to a 2.5-year extension of the World Bank’s project.

Implementation of reforms to strengthen performance incentives has lagged. Higher education reform objectives were only partially achieved. Although the legal and regulatory frameworks and mechanisms for results-based financing and quality assurance were developed, implementation was insufficient. Overall, despite financing and strong ASA, key systemic reform goals to transform incentives in the formal education system to focus on performance were not achieved.

The achievement of objectives in education is rated moderately satisfactory. Objectives under the CPS were and continue to be highly relevant, and progress was made, although more remains to be done. The World Bank sought no specific education-related outcomes under the CPF, but it did respond to government requests for work on skills development and jobs. This work was well received and useful to the government, but it is too early to assess its possible impact.

Access to and Quality of Health Services

Bank Group objectives in health supported government priorities. Two key objectives were maintained throughout the evaluation period: improving access to quality health care services (including reducing out-of-pocket spending) and improving the efficiency of the health care system. Both were relevant to country conditions and reflected key issues in the health sector. Although several health outcomes in Albania had improved, the quality of health care was poor, service delivery suffered from inefficiency at all levels (because of a lack of incentives and accountability for performance for providers), and households’ financial protection against health care costs was weak.21 These factors disproportionately affected the poor—high out-of-pocket costs represented about 10 percent of total expenditure for the lowest income quintile. The World Bank emphasized primary health care during the CPS period. It emphasized hospitals, which dominated public health spending, during the CPF period (57 percent versus less than 40 percent on average in Organisation for Economic Co-operation and Development countries). Nevertheless, in both periods, the World Bank sought to shift the health system from input-based financing toward output-based approaches to improve systemwide performance in efficiency, equity, and quality of services.

World Bank interventions did not sufficiently factor in the capacity and political economy constraints. Through FY14, the focus was on primary health care improvements and development of performance-based resource allocation mechanisms at the primary health care level. From FY15 on, with the Swiss Agency for Development and Cooperation providing financing for primary health care, the World Bank’s focus turned to hospital management improvements and performance-based resource allocation, sectorwide health management information systems, and further improvement in financial access to health care. However, health project designs seem to have been too optimistic regarding absorptive capacity in the implementing agencies and stability of health sector leadership, and it seems to have overestimated the government’s commitment to health sector reform.

Results were mixed regarding improved access to and quality of health services. During the evaluation period, some important health outcomes improved, including reduced infant mortality, under-five mortality, and child stunting.22 At the same time, the Demographic and Health Survey 2017–18 reports a mixed picture on trends in access to and quality of primary health care services. Coverage of antenatal care reportedly declined between 2008–09 and 2017–18,23 but the provision of antenatal and postnatal services followed World Health Organization standard protocols more closely, suggesting quality improvements for those with access.24 However, the contribution of World Bank projects to these results is likely to have been limited. Recently, the government took steps to address noncommunicable diseases by providing free access to family doctors for 600,000 uninsured people, including reimbursement for drugs, a free checkup program for all 35–70 year olds, regardless of insurance status, and a breast cancer screening program for women. Still, lack of required household survey data since 2012 and delays in establishing the health management information system hinder an in-depth assessment of the impact of these changes.

Efficiency improvements have also lagged, partly because of a volatile institutional environment that has hindered smooth implementation of major reforms. The World Bank’s Social Sector Reform DPL supported key building blocks for an effective health system. A single payer for all public health services was established; the capacity of the Ministry of Health and the Health Insurance Institute (now the Health Insurance Fund) to formulate financing policy and performance management contracts with primary health care facilities was built up; and a master plan to rationalize hospitals was developed. However, most objectives have not been achieved. Household out-of-pocket spending remains high. During the CPS, the rate of insurance coverage rose to about 60 percent compared with a target of 70 percent, but more recent data are not available (administrative data suggest it has continued to increase, although there have been consistency issues between administrative and household survey data in the past). The implementation of performance-based primary health care financing, which the World Bank supported, and the integration of performance into hospital financing, have seen very limited progress.

The achievement of objectives in health is rated moderately unsatisfactory. Implementation of World Bank support has been less than satisfactory because project design was too ambitious and political economy factors intervened. Frequent changes in the Ministry of Health (six during the implementation of a project that covered the initial years of the evaluation period), followed by senior staff changes, led to implementation delays, project restructurings, and very limited progress on key reforms supported. Factors such as the administrative and territorial reforms and the ministry restructuring have further stressed the sector’s limited institutional capacity.

Coverage, Targeting, and Efficiency of Social Protection Services

Throughout the evaluation period, the World Bank sought to help improve access to and the equity and efficiency of Albania’s social protection system. Social protection covers both social assistance and the public pension system. The World Bank’s objectives were highly relevant to country conditions and key social protection issues. Albania was and still is among the poorest countries in the Europe and Central Asia Region, and after the global and euro area crises, sluggish growth and increased unemployment heightened household vulnerability. The poorest lacked access to social assistance programs because of weak management, poor targeting, and inefficient resource allocation. Regarding pensions, demographic shifts, declining labor force participation, a growing informal sector, and ad hoc policy changes had undermined fiscal sustainability, fairness, and pension system incentives. The World Bank’s objectives aligned closely with both national development and social protection strategies on the need to reform the two key social assistance programs—Ndihma Ekonomike (or Solidarity Albania) and Disability Allowance—and the pension system.

The World Bank’s social protection program consisted of a well-sequenced and balanced mix of ASA and lending. Multiyear World Bank ASA provided crucial insights on the key issues facing existing social assistance programs and social care services. This included governance and management, targeting, and benefits administration. The ASA program was designed to build ownership of the reform agenda, strengthen the capacity of key social protection agencies, and provide a sequenced road map for implementation. A subregional study helped benchmark the Ndihma Ekonomike in relation to other Western Balkans programs. World Bank support to the implementation of the LSMS was essential for designing a proxy means test based on the targeting mechanism for the Ndihma Ekonomike program. World Bank analytical work on pensions—sustained over a long period—was also critical for diagnosing key challenges in the system and developing a comprehensive approach to policy reform, including defining priority areas for reform and quantifying their fiscal impact. Second, a project approved in 2001 (the Social Service Delivery Project) served both to establish the foundations of social assistance and pension reforms and enable the World Bank to help prepare the new social assistance targeting methodology and revisions to the legal framework. Regarding pensions, the project supported the Social Insurance Institute’s administrative reform (including development of the central registry of contributors and beneficiaries), helped improve public understanding of the pension system, and strengthened the Social Insurance Institute’s capacity for pension policy development.

Steady World Bank financing supported ambitious social assistance reforms. During the CPS, the Social Sector Reform Development Policy Operation focused on policy and legislative changes to improve the equity and efficiency of social assistance programs. These policies represented a fundamental shift, transferring decision-making on Ndihma Ekonomike eligibility from local governments to a centrally defined mechanism based on specific poverty criteria managed by the Ministry of Labor and Social Affairs that eliminated discretionary beneficiary selection. The follow-up operation—the FY12 Social Assistance Modernization Project (SAMP)—sought to help implement the policy changes and improve transparency through proactive communications, modernized information systems, and increased clarity on rules, roles, and controls. Best practice design features included indicative implementation road maps sketching the key results chains for improving the equity and efficiency of the Ndihma Ekonomike and Disability Allowance programs, and the use of pilots to learn the best way to adapt new mechanisms and systems before national rollout. During the CPF, additional financing for the SAMP operation (FY18) sought to scale up the geographical scope of Disability Allowance reform activities, improve physical accessibility to regional social security offices for people with disabilities, and develop a graduation and activation strategy for Ndihma Ekonomike beneficiaries.

Two World Bank operations supported an important pension reform. During the CPS, FY09 additional financing for an IPF operation approved before the evaluation period funded multiyear technical assistance. This support aimed to strengthen government institutional capacity for pension administration and pension reform design and implementation, and to enhance public understanding of the pension system. A series of two public finance development policy operations supported the enactment of a new pensions strategy and law, which strengthened the contributory program to reduce fiscal costs over time by more closely linking benefits to contributions and time in the labor market, increased the retirement age (notably to reduce gender inequality), introduced a social pension program to protect poor elderly people without pension rights, and capped budget transfers to the pension system.

The World Bank contributed to significant legal, regulatory, and capacity improvements in Albania’s pension system. With World Bank support, extensive outreach and communication strategies garnered critical public support for pension reform. The reform successfully reduced the fiscal burden of pensions, and the number of workers contributing to the system has increased.25 Pension administration has significantly improved, moving from a paper-based to an electronic system. However, challenges to the pension system’s sustainability that still need to be addressed include overoptimistic demographic and growth projection and the need to reform rural pensions.

World Bank support helped Albania revamp its social assistance policies to improve coverage, targeting, and efficiency. Under the DPL, the World Bank supported key policy measures, including creating a unified registry of social assistance beneficiaries by changing mechanisms to allocate resources and select beneficiaries for the Ndihma Ekonomike and Disability Allowance, and changing the Disability Allowance’s indexation formula, which curtailed the program’s ballooning costs. The Unified Scoring Formula was piloted for two years as part of the World Bank’s SAMP, after which the legal framework was amended to take into account lessons from the pilot. Extensive communication strategies were critical to inform local governments, beneficiaries, and the public about the reform objectives. Rollout on a national scale was delayed and began in 2018 with SAMP support. The Unified Scoring Formula is also being used to determine eligibility for other social assistance programs, including the energy cash benefit (designed to mitigate the impact of electricity tariff increases under the energy sector reform). The development and nationwide implementation of an electronic management information system for the Ndihma Ekonomike program has improved efficiency by allowing cross-checking of individual requests with other government databases and reducing the time needed to determine eligibility for benefits by 80 percent.26 Progress on Disability Allowance reform has been slower—the reform has been designed and piloted in just two districts.

Reform implementation has faced significant challenges. Experience to date with the Unified Scoring Formula has shown significant errors of exclusion, which have been addressed by returning some discretionary power to municipal governments on Ndihma Ekonomike eligibility—a practical, short-term fix, but not a substitute for updated household welfare data. The national rollout of both Ndihma Ekonomike and Disability Allowance has been slower than the World Bank anticipated because of the reforms’ complexity and political sensitivity, frequent ministerial changes, institutional restructuring, and major delays in government decision-making during the period before and after the 2017 election.

Given the lack of comparable household survey data, it is difficult to measure the extent to which the coverage, equity, and efficiency of social protection services has improved. Available information based on the social assistance reform pilot in three regions covering half of the country’s population indicates that targeting of the Ndihma Ekonomike programs has improved significantly.27 However, this is impossible to confirm due to the lack of comparable household data, as discussed in chapter 2.

The achievement of objectives in social protection warrants a moderately satisfactory rating. The World Bank contributed to significant improvements in Albania’s social assistance system by supporting legal and regulatory change and the development of institutional capacity in the Ndihma Ekonomike and Disability Allowance programs. However, implementation challenges entailed delays in scaling up the system nationally. Administrative data indicate some improvement in coverage, targeting, and efficiency in pilot areas, but household data to confirm these results are missing. The World Bank contributed to significant improvements in pension system solvency and participation.

Access to and Quality of Water and Sanitation Services

Objectives in urban water supply and sanitation broadened over the evaluation period. CPS and CPF objectives were well aligned with the government’s development priorities for urban infrastructure improvement, institutional reforms in the water sector, and improving livelihoods. The CPS focused on sewerage improvements as part of a broader goal of improving critical public environmental and municipal services. The CPF sought enhanced coverage of water and sanitation services, with infrastructure investments in a single city (Durres, a key coastal tourism hub) as the primary vehicle for achieving the objective. Results frameworks were adequate, but outcome indicators were too focused on outputs. Strategic objectives responded well to Albania’s EU accession goal—for example, accession directives and progress reports explicitly cited Albania’s need to invest more in wastewater management and improve water utility administration and service delivery. One hundred percent of the wastewater generated in the beach area (an important tourism destination) is now channeled to the wastewater treatment plant, benefiting about 150,000 residents.

Good progress was made toward the World Bank’s sewerage infrastructure development and service improvement targets. World Bank investments in wastewater collection and management in Saranda and Himara were completed in 2012, but the slow implementation of parallel investments supported by other financiers hindered the favorable impact. For example, the sewerage treatment system in Saranda was not fully operational until 2018. Good progress is being made on improving wastewater treatment in Durres and expanding connections. Sewer connections are nearly on target to be achieved by project completion (more than 2,900 new connections versus a target of 3,000), while targets for the volume of wastewater treated have been exceeded (2.2 million cubic meters versus a target of 1.8 million).

Water supply services in Durres have improved, though with some delays, but the water utility’s institutional capacity continues to be a challenge. The water supply component of the Water Resources and Irrigation Project, which involves developing a new water source for Durres and constructing a new main feeder pipeline, suffered from significant delays partly because of unclear property rights.28 Implementation of the water supply component is now accelerating. Before the project, the Durres water supply utility was near collapse. The development of a new water source and related improvements to the water network have resulted in improved water quality and supply duration. Water service duration has increased to 8 hours per day compared with 1–2 hours per day before the project started, but they remain below the end-of-project target of 12 hours per day. The central government continues to manage the project, given the water utility’s weak capacity.

More generally, Albania’s water and sanitation utilities continue to underperform in the context of weaknesses in the policy framework, although there has been some recent performance improvement from a low base.29 Services and performance standards remain far below what is required for EU accession, and most utilities are heavily subsidized.30 Rural communities, which make up more than 20 percent of the population, remain largely unserved because of the capacity limitations of the municipal utilities responsible for serving them. The evolving integrated water management policy has been yet to prove effective in improving utilities’ performance except in municipalities receiving long-term donor support.

The achievement of objectives for access to water and sanitation is rated moderately satisfactory. World Bank lending in the sector focused on infrastructure development and provided some support for institutional capacity building. The World Bank has expressed concern to government about the way the integrated water management policy is being operationalized, although this has had limited impact so far. The two ASA interventions during the evaluation period were widely acknowledged to have made very effective contributions to strengthening urban water supply and sanitation services, although the World Bank has yet to develop a comprehensive ASA program in the sector to help determine a more desirable reform path.31

- By 2014, the fiscal balance had deteriorated to −5.9 percent of gross domestic product (GDP) from −3.6 percent in 2011, and public debt had risen to 72 percent of GDP from 60 percent in 2011.

- Supported by the development policy loan, the government has made substantial progress in reorganizing the tax administration to better focus on large taxpayers and publishing its first tax expenditure review in December 2019.

- The World Bank also helped the government adopt a local government solvency bylaw, which monitors local government arrears and prescribes action plans through the technical assistance.

- By 2014, nonperforming loans had risen to almost 23 percent of total loans (among the highest in the region), which seriously threatened financial stability and contributed to the stagnation of credit to the private sector.

- The development effectiveness rating was mostly successful.

- According to the data obtained from the Port of Saranda in 2019, ship traffic is increasing steadily, with 130 cruise ships using the port in 2018. The number of foreign citizens arriving in Albania increased from 3.7 million in 2014 to 5.9 million in 2018 (INSTAT 2019c).

- Accurate, efficient, and transparent land administration records and procedures are important conditions for EU accession. For example, the European Commission noted in 2018 that progress has yet to be made toward improving the legal framework for registration, expropriation, and compensation; the 2012–20 strategy on property rights has yet to be updated; and institutional coordination should be improved. However, it also notes that an Integrated Land Management Secretariat has been established (EC 2018).

- These projects were implemented over a period coinciding with major political changes and economic stresses in Albania and a major Inspection Panel case concerning informal settlements that involved the Integrated Coastal Zone Management and Cleanup Project.

- The restructuring entailed scaling back much of the urban planning component and partially replacing it with emergency flood relief investment to accommodate disaster mitigation needs that arose during project implementation.

- The Immovable Property Registration Office was responsible for the land registration and cadaster; the Agency for Legalisation, Urbanisation, and Integration of Informal Areas and Buildings was responsible for the legalization of properties; and the Restitution Agency was responsible for the restitution of land belonging to former owners—all subordinate to different ministries.

- For example, the credit line with Credins Bank was drawn on only to a very limited extent. The International Finance Corporation has facilitated much larger investment by the private sector into the renewable energy sector through its Balkan Renewable Energy Program (advisory services).

- The privatization of the Albanian Power Corporation, supported by a partial risk guarantee through the power sector generation and restructuring project (fiscal years [FY]04–11), failed because of both inadequate investment by the private operator and government inaction on tariff adjustments and controlling electricity theft.

- The project contributed to the strengthening of the capacities of selected municipalities, which are now legally responsible for managing irrigation and drainage systems.

- The strategy focused on disaster management preparedness rather than disaster risk mitigation. The EU and other donors were emphasizing mitigation, for which the EU has substantial grant funding. The government decided to focus on mitigation rather than preparedness as the core of the national disaster risk management strategy.

- The project has made credible contributions to modernizing the Water Resources Management Information System through, for example, installation of groundwater monitoring equipment and preparation and online launching of a water cadaster.

- In the early 2000s, Albanians attained only 8.6 years of schooling on average (almost six years less than peers in the EU), and the country scored among the lowest in the Europe and Central Asia Region on the Organisation for Economic Co-operation and Development’s Program for International Student Assessment (PISA), a set of standardized achievement tests for language, math, and science.

- The Bologna Process is a series of agreements in higher education reached by 48 European countries (including Albania) to ensure compatibility in the quality and standards of higher education.