Main Findings: Responding to Needs and Priorities and Market and Regulatory Challenges

The World Bank Group was successful in mobilizing a total of US$4.73 billion (US$4.4 billion in trust funds and the rest with International Finance Corporation [IFC] resources), and was generally responsive to changes in market and regulatory systems and the needs and priorities of its country clients, including Low Income Countries as shown by targeted initiatives such as the Community Development Carbon Fund and the Carbon Initiative for Development, and the share of the carbon finance portfolio. In addition, MIGA provided guarantees for CDM projects with gross exposure of US$2.25 billion. The World Bank, through its deep expertise and closer engagement with client countries and global stakeholders, was innovative in anticipating needs, developing new initiatives and instruments, filling in gaps in carbon markets, and addressing underserved sectors, such as forests and landscapes. The World Bank Group also varied and tailored its interventions in different phases in response to the prevailing risks and uncertainties in markets and the underlying global climate change policies and regulatory challenges.

However, the significant growth in carbon finance and increased responsiveness of the World Bank Group was accompanied by the fragmentation and proliferation of carbon funds and facilities resulting in internal and external coordination challenges. The governance arrangements and monitoring and evaluation frameworks across the multiple carbon funds and facilities remain uneven. Despite the effort to cover diverse sectors, CF has also been concentrated in a few sectors (energy efficiency, renewable energy, industrial gases and waste management). Transport and agriculture were underrepresented.

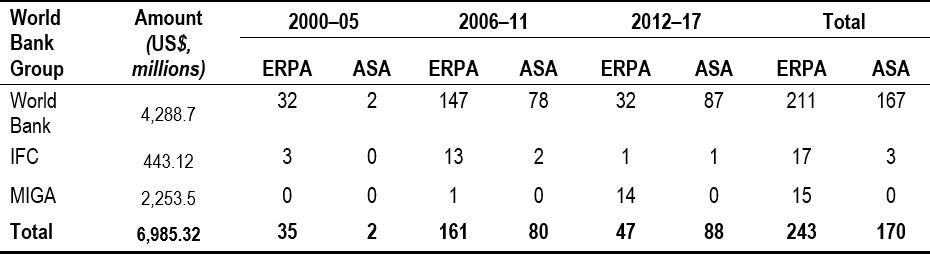

World Bank Group Engagement in Carbon Finance: Kyoto to Paris (calendar year)

|

World Bank Group |

Amount |

2000–05 |

2006–11 |

2012–17 |

Total |

||||

|

ERPA |

ASA |

ERPA |

ASA |

ERPA |

ASA |

ERPA |

ASA |

||

|

World Bank |

4,288.7 |

32 |

2 |

147 |

78 |

32 |

87 |

211 |

167 |

|

IFC |

443.12 |

3 |

0 |

13 |

2 |

1 |

1 |

17 |

3 |

|

MIGA |

2,253.5 |

0 |

0 |

1 |

0 |

14 |

0 |

15 |

0 |

|

Total |

6,985.32 |

35 |

2 |

161 |

80 |

47 |

88 |

243 |

170 |

|

Source: Independent Evaluation Group portfolio review and Carbon Finance Unit data. |

|||||||||

Source: Independent Evaluation Group portfolio review and Carbon Finance Unit data.

Note: ASA includes capacity building and work such as technical assistance, training and analytical studies. The amount shown for MIGA is the value of the gross exposure for the guarantees.

Read More in Chapter 2: Changing Needs, Priorities, and Regulatory Challenges in Carbon Markets

Main Findings: Catalyzing and Developing Markets for Climate Mitigation

The World Bank Group acted proactively, conceptualized and catalyzed carbon markets, developed pioneering models, tested the “proof of concept” and demonstrated the potential of markets for low-cost Global Greenhouse Gas emission reductions. The World Bank Group was one of the first movers into carbon finance, providing a timely and relevant contribution. It took risks at the global level and drove the process of creating the global carbon market

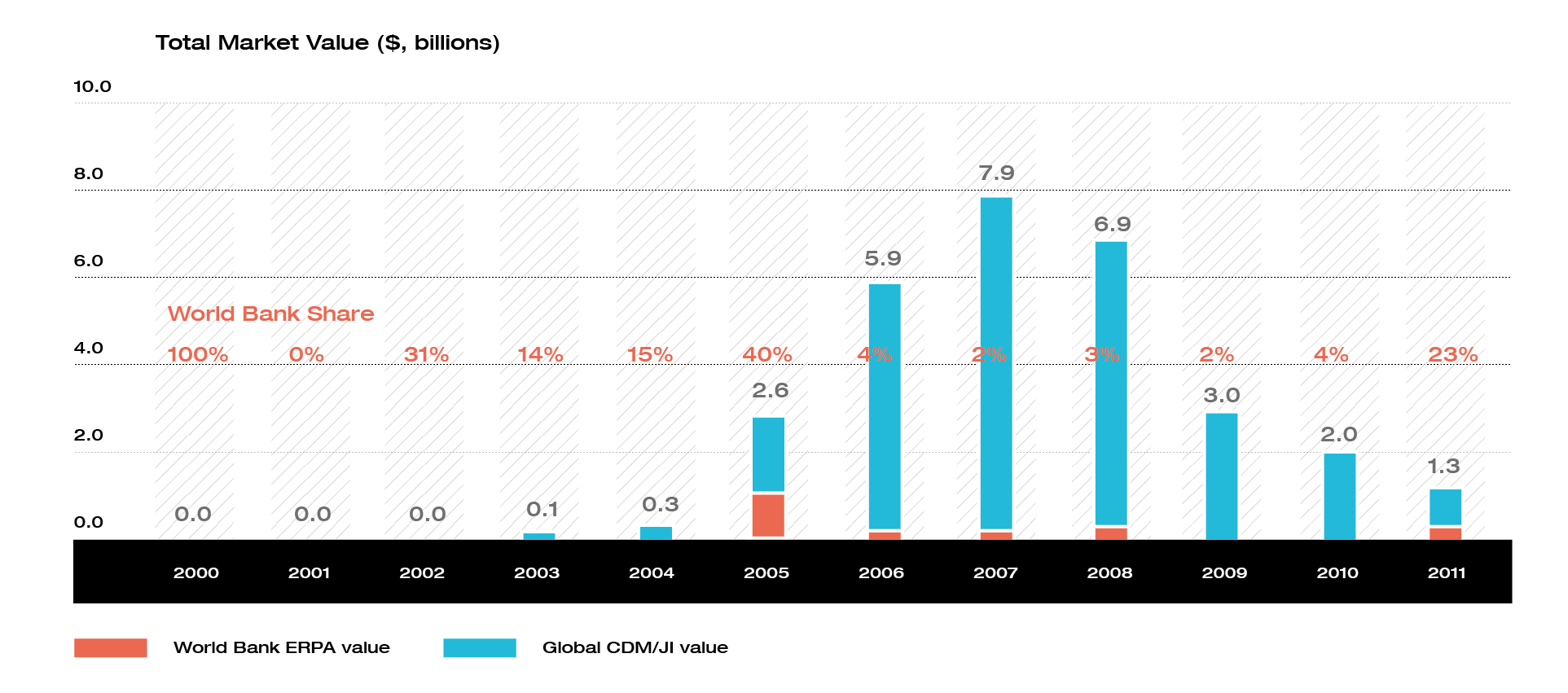

The World Bank Group’s effort to “build, expand and sustain markets” progressively led to significant growth in the carbon markets. The annual global primary CDM and Joint Implementation market grew from US$2.47 million in 2000 to US$7.9 billion at its height in 2007, while the World Bank Group’s market share declined from 100 percent in 2000 to 2 percent in 2007 (see figure below).

World Bank Market Share in Clean Development Mechanism and Joint Implementation Transactions

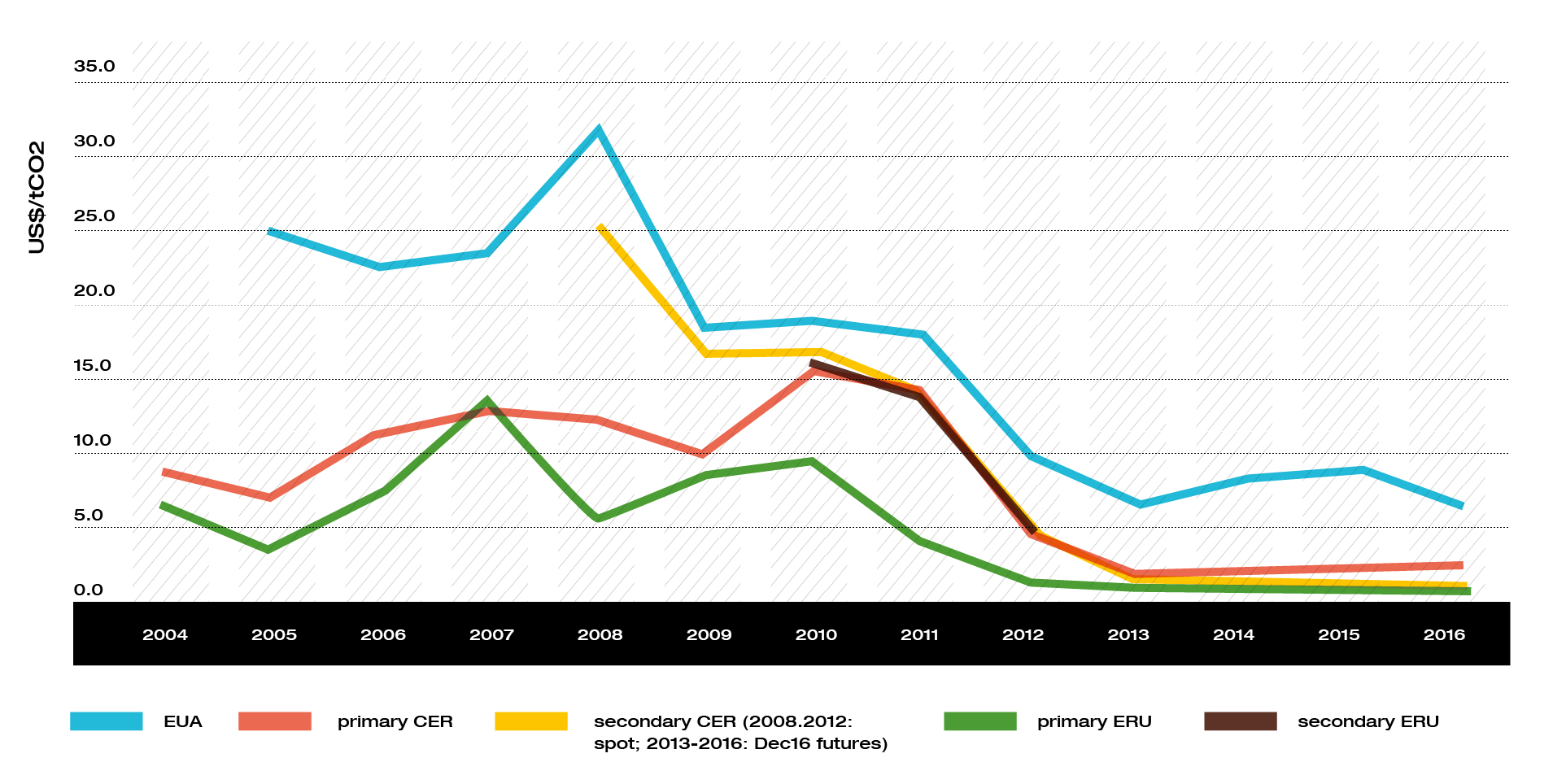

However, the strong success in catalyzing and developing carbon markets was not sustained due to external factors. Given the regulatory uncertainty beyond 2012, the World Bank Group’s effort was not enough to stem the decline and “save” the carbon market—credit prices collapsed in 2012 (see figure below). The post-2012 situation has undermined private sector interest and confidence in these markets although the signing of the Paris Agreement has re-ignited this interest. Nevertheless, the World Bank continued to support markets and sustained transactions at low level, often paying fixed prices and honoring existing contracts.

Read More in Chapter 4: Effectiveness of World Bank Group Roles

Main Findings: Effectiveness in Reducing Emissions

Despite the uncertain global regulatory framework, the World Bank Group has contributed in supporting projects to reduce emissions. The World Bank Group operated a complex architecture under the Kyoto Protocol’s requirement that each project activity must show that the emission reductions it produces are additional to what would have happened without the project. The Clean Development Mechanism and joint implementation have globally generated over 1.9 billion Certified Emission Reductions (CERs) and 0.9 billion ERUs to date. Based on emission reduction issuances up to August 2017, a total of 210 million tons of carbon dioxide equivalent verified units were produced by World Bank (97 percent) and IFC (3 percent). This constitutes 80 percent of the planned emission reduction targets for the World Bank and 32 percent for IFC, and 76 percent jointly for the World Bank Group. The evaluation evidence shows that registered World Bank Group projects produced higher Certified Emission Reductions and had higher likelihood of positive issuance compared with other Clean Development Mechanism projects.

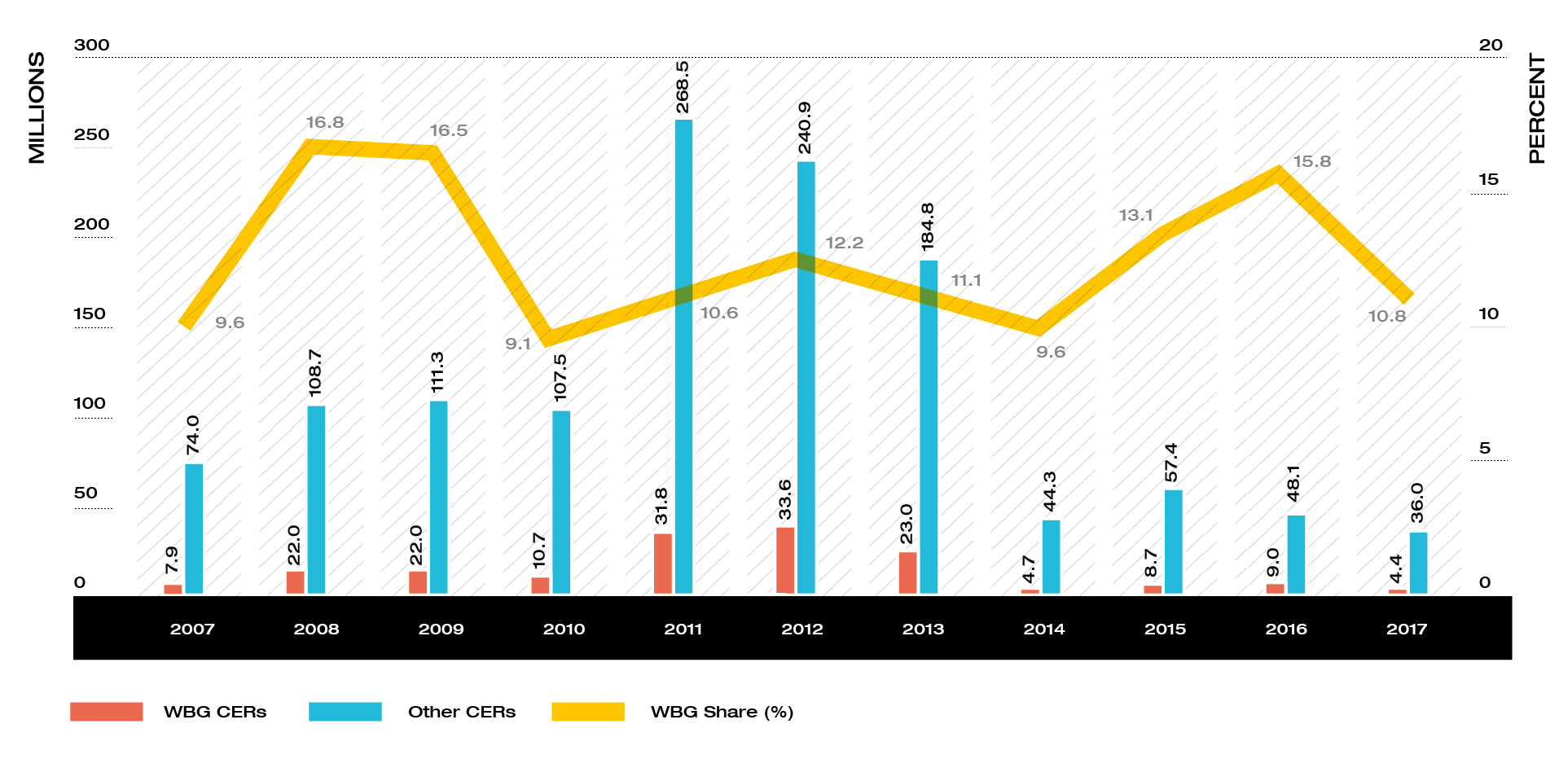

The emission reductions declined significantly after the expiration of the first commitment period of the KP in 2012, continuing the trend of prior years. The CDM carbon market decline was evident in traded volumes and issued CERs (see figure below) as well as registered projects and PoAs at the global level. The total CER issuance for CDM declined from 300 million in 2011 to about 40 million tCO2e in 2017.

In addition, a few sectors dominate the supply of emission reductions: industrial gases (58 percent), energy efficiency (16 percent), and renewable energy (12 percent). Agriculture, forestry and transport sectors jointly account for less than 5 percent. In addition, the share of the Low Income Countries in the emission reduction issuances remains less than 1 percent mainly because many of the projects are small and some are still ongoing (see figure below).

|

Achieved ERs (tCO2e) by Technology and Host Country Income Group |

|

|

a. ERs achieved by technology up to 2017 |

b. ERs achieved by income group up to 2017 |

Read More in Chapter 4: Effectiveness of World Bank Group Roles

Other Main Findings

Effectiveness in Generating Local Co-benefits for Sustainable Development

-

The World Bank Group has been less successful in generating sustainable development co-benefits and faced challenges in documenting development results from its carbon finance activities. The Clean Development Mechanism was launched with the dual objective of reducing the cost of compliance with Kyoto targets and contributing to sustainable development in developing countries. The World Bank Group designed carbon finance projects to meet these dual objectives of the Clean Development Mechanism, but there was significant variability in generating development benefits, and in some cases climate mitigation was achieved without clear local level social and economic development outcomes (for example, some hydropower, industrial energy efficiency and industrial gases).

-

In addition, many of the World Bank Group’s interventions were small prototypes and not integrated with the development investments in client countries.

-

Furthermore, the World Bank Group did not systematically monitor the sustainable development outcomes and the social and environmental benefits—a stark contrast from environmental integrity and additionality which were routinely checked through the CDM process. However, the World Bank Group could build on examples of transformational (but small) and innovative initiatives that contributed to both mitigation and local economic development, especially in the LICs (for example, Carbon Initiative for Development, Community Development Carbon Fund).

Effectiveness of Innovation and Capacity Building for Clients

-

The World Bank Group has been largely effective in innovating carbon finance and in building capacity for its clients. The World Bank developed multiple methodologies and financial instruments which helped to expand and deepen markets and reduce delivery and price risks. The IFC developed new financing instruments but was unable to scale up owing to the market collapse which led it to exit the carbon market. The Multilateral Investment Guarantee Agency (MIGA) provided the first risk guarantees for CDM projects against political risks, demonstrating that such cover could work for carbon finance projects although uptake has been limited.

-

The World Bank has increasingly reoriented its capacity building support toward domestic carbon pricing and readiness plans for forests and landscapes. The recent launch of the world’s largest domestic emissions trading system in China demonstrated the significant potential of national market initiatives for transformative change.

-

In the future, further innovation and capacity development is needed to address underserved sectors (for example, agriculture, transport and urban development). There is also a growing need to scale up mitigation efforts in response to the ambitious targets of the Paris Agreement. The green funds (FCPF and BioCF ISFL) are moving in this direction for piloting upscaled and jurisdictional initiatives in forests and landscapes. Continued success will require more fine-tuned, integrated and country-led approaches.

Effectiveness in Thought Leadership and Convening for Carbon Pricing

-

The World Bank has been generally effective in thought leadership and convening for carbon pricing. The World Bank has been a key thought leader and convener in carbon finance, and playing this role, it has been more dynamic and flexible than playing other roles. The World Bank has catalyzed new forms of partnerships and initiatives and has stimulated global and national dialogue on carbon pricing instruments. This has allowed developing countries to experiment with their own carbon pricing instruments and identify relevant mitigation opportunities.

-

However, carbon pricing by itself will not be sufficient to increase mitigation to meet the Paris targets. In addition, the World Bank has been both ‘proactive’ in anticipating and responding to identified needs and priorities and ‘reactive’ to address observed conditions ex post. Experts and stakeholders interviewed for the evaluation stress the need to move from small projects supporting low-cost mitigation for compliance to integrated programs linking climate and development goals, catalyze partnerships that create space for other market actors (especially the private sector) and work at scale. In addition, given the current global policy landscape of low carbon prices, carbon pricing by itself is unlikely to provide the solution to scale mitigation and increase ambition unless it is supported by other complementary nonmarket efforts and domestic policy reforms.

Read more the World Bank’s contributions and effectiveness

Key Issues to Consider for the Future of Carbon Finance

Based on this experience and looking forward, this evaluation also identifies four timely and relevant issues which provide insights for the future of carbon finance and the World Bank Group’s strategic direction in its potential support for the next generation of market-based climate mitigation.

Programmatic Integration and Scaling Up

Greater programmatic integration and catalytic use of carbon finance with development and climate finance is pertinent under the framework of the Paris Agreement. Carbon Finance has largely remained a trust-funded, project-focused and small-scale activity with limited integration with World Bank Group financing operations.

Attracting and Leveraging Private Investments

As part of Maximizing Finance for Development, attracting and leveraging private investments will be key. Looking forward, greater participation of the private sector is required as the World Bank Group moves toward large-scale and sectoral crediting approaches. The incentives for the private sector are stronger when carbon finance improves returns and bankability of the investment, especially when frontloading of carbon revenues is possible or when the ERPA helps in securing financial closure. However, the potential for frontloading is often affected by the higher perceived risks for carbon projects. Along with blended finance and de-risking instruments, creating financial products that go beyond ex post payments and help address the bankability and upfront financing issues would be pertinent.

Global Positioning of the World Bank Group and its Comparative Advantages

The World Bank Group has certain advantages in carbon finance which distinguish it from other institutions. Relative to other actors, the World Bank Group has deep expertise in carbon finance and retained its technical and operational capacity over the years. The strength of the World Bank Group in translating donor support into results in the field, its ability to integrate finance with technical know-how, and its institutional memory are also seen as an advantage. Its convening power, thought leadership and ground-level global presence also enhance its ability to play the bridging and catalytic function. However, the World Bank Group is also seen in some cases as being too rigid and procedure and instrument driven and tending toward being public sector driven. With its reduced engagement at the country level after 2012, institutional capacity and experience are being lost. The opportunity for the future would be to leverage its strength to build and cement new forms of effective partnerships, and to create sufficient space for the private sector and other players.

The New Framework to Revitalize Carbon Markets

A key strategic challenge for World Bank Group is the possibility to contribute to building the next generation of carbon markets under the new framework of the Paris Agreement. The Nationally Determined Contribution (NDCs) of many countries call for markets and/or carbon pricing mechanisms, including emissions trading system and carbon taxes, as a tool for meeting their NDC commitments. International trade can lower the costs of implementing NDCs and help countries meet their commitments or even increase their ambition. However, such gains are not guaranteed. The future of carbon finance will be built on a different foundation and policy environment from the past. A global approach to carbon markets requires a coherent long-term strategy.

Recommendations

The following recommendations suggest a series of decisions that the World Bank Group could take to further enhance performance in its CF support in future, including the potential to scale up mitigation.

Recommendation 1. The World Bank Group should further strengthen coordination among its different carbon finance initiatives and instruments to enhance complementarity, avoid fragmentation, and harmonize their results frameworks. The World Bank Group should strive for complementarity between the relevant instruments and emphasize development of fewer, more harmonized, and consolidated carbon vehicles with shared vision, common governance systems, simpler rules, and well-functioning and consistent results frameworks for enhanced accountability and learning. For IFC, it should deepen its coordination and complementarity where and when it engages in carbon finance (e.g. coordinate Forests Bonds with FCPF, BioCF ISFL), just as MIGA can strengthen complementarity of any relevant guarantees. Learning from the Kyoto experience, this may require donors and other stakeholders to support such harmonization and consolidation to avoid proliferation of carbon funds and facilities under the new framework of the Paris Agreement.

Recommendation 2. The World Bank Group should increase its use of carbon finance instruments to attract and mobilize finance that supports transformational activities and leverages private investments. The World Bank Group should identify new ways to use CF as catalytic funding for enabling transformational approaches (low-carbon technologies and policies) which may not otherwise be feasible or commercially viable under ‘business as usual’ conditions (for example, innovative low-carbon investments in technologies currently limited by bankability and other barriers). Through its selective and catalytic use of CF for climate mitigation to support such transformational interventions that meet the relevant ‘additionality’ criteria (under the Kyoto or Paris mechanisms), the World Bank Group should also continue to use CF to crowd-in or leverage private sector finance (for example, by packaging CF with climate finance to provide some upfront financing or mitigate risks), where possible, in line with Mobilizing Finance for Development objectives and the Cascade Approach, seeking private sector solutions and minimizing the use of scarce public finance resources. If and when IFC re-engages in carbon markets, it should build on its recent (e.g. Forests Bonds) and prior experience to leverage private finance and investments. MIGA should identify opportunities to enhance demand for its guarantees to support transformational projects.

Recommendation 3. The World Bank Group should strengthen the client country focus of its carbon finance activities, integrating them with country programs, in accordance with client demand and international agreements, enhancing their economic development benefits in client countries, and especially promoting poverty reduction co-benefits in Low Income Countries. This is consistent with both the continuing commitment of the Paris Agreement to development co-benefits and the World Bank Group’s own developmental goals. CF must be host country client-driven and increasingly streamlined into country programs and financing operations, with a vision towards bundling or packaging of all CF activities in host countries with other relevant World Bank Group operations. The design for integrating CF into country development programs and operations should be flexible, consider unique features of CF operations and associated legal commitments and risks, engage the private sector for scaling up successful pilots, and ensure delivery of development results, especially in LICs. Sustainable social and economic development co-benefits should be systematically targeted and promoted. Conditional on client demand, this would also apply to future IFC activities, if and when it re-engages in CF activities with the private sector in client countries, and MIGA guarantees, to strengthen support for climate mitigation and development efforts in client countries.

Recommendation 4. The World Bank Group should identify complementary and country-specific interventions that enhance the Global Greenhouse Gas emission reduction impact of carbon pricing solutions, consistent with countries’ Nationally Determined Contributions (NDCs). Many client countries are unlikely to implement carbon prices that will be high enough to provide strong price signals to bring significant changes in emissions soon. At the country level, low carbon prices mandate identification and structuring of complementary and synergistic programs, policy and institutional reforms and instruments (for example, removal of fossil fuel subsidies, energy efficiency standards, and so on.) closely aligned or synchronized with carbon pricing approaches (for example, carbon taxes, emission trading schemes). Initiatives to remove any binding constraints at the country, market, or sector level offers the potential to improve the efficiency and effectiveness of the carbon pricing approaches and create an enabling environment for private sector solutions. Where relevant and when they are active, IFC, through its engagement with the private sector under the WBG’s Carbon Pricing Leadership Coalition (CPLC), and MIGA should coordinate in the identification of constraints and complementary approaches to carbon pricing in client countries.

Recommendation 5. The World Bank Group should continue to pilot new market-based and scalable approaches for reducing Global Greenhouse Gas emissions, including those that focus on underutilized sectors and underserved countries. To do so the World Bank Group should further sharpen the focus of its capacity building, technical assistance and innovation on scalable approaches that contribute to raising the mitigation ambition. This includes piloting of new and scalable financial products as well as programmatic, sectoral and policy crediting approaches that are useful to support the transition to the new market mechanisms under the Paris framework. IFC and MIGA could also pilot scalable business models and de-risking instruments to support upscaled crediting approaches. The World Bank Group should identify and upscale innovative crediting approaches for carbon assets from forests, agriculture, and land use and transport, and urban building infrastructure.