The World Bank Group in Bangladesh

Chapter 5 | Special Topics: Jobs Agenda and Clean Energy

Highlights

World Bank Group support for the jobs agenda was largely through support for improving the business environment and education (higher education and skills training). More recently, Bank Group support for the jobs agenda has been more direct and explicit, including through the three-operation Programmatic Jobs development policy credit series (fiscal years 2019–21), which has not, however, produced significant results.

The Bank Group has supported Bangladesh in its transition to clean energy since 2002. Its contribution to developing clean renewable energy and extending access to underserviced areas has been significant. But challenges to the country’s clean energy transition remain due to problems in attracting private sector investment and reforming tariffs.

This chapter assesses the Bank Group’s contributions to support two IDA priorities: the creation of more and higher productivity jobs (jobs agenda) and climate change mitigation through support for clean and renewable energy. The Bank Group’s contribution to the jobs agenda is assessed through the lens of investment climate and education and skills training.

World Bank Group Contributions to the Jobs Agenda

Noting that Bangladesh’s labor force had been growing by an average of 3.1 percent per year and 21 million people are expected to join the working-age population over the next decade, the 2015 SCD identified the creation of “more and better jobs” as a fundamental challenge to Bangladesh’s continued growth and poverty reduction (World Bank 2015a). Before the SCD, Bank Group support for the jobs agenda was indirect, taking place via the business environment and education reforms. Following the SCD, the Bank Group was more explicit in its support for the jobs agenda. The CPF stated that it would refocus the Bank Group’s strategic directions on removing stubborn impediments to job creation and growth, including underinvestment in key infrastructure such as transport and energy.

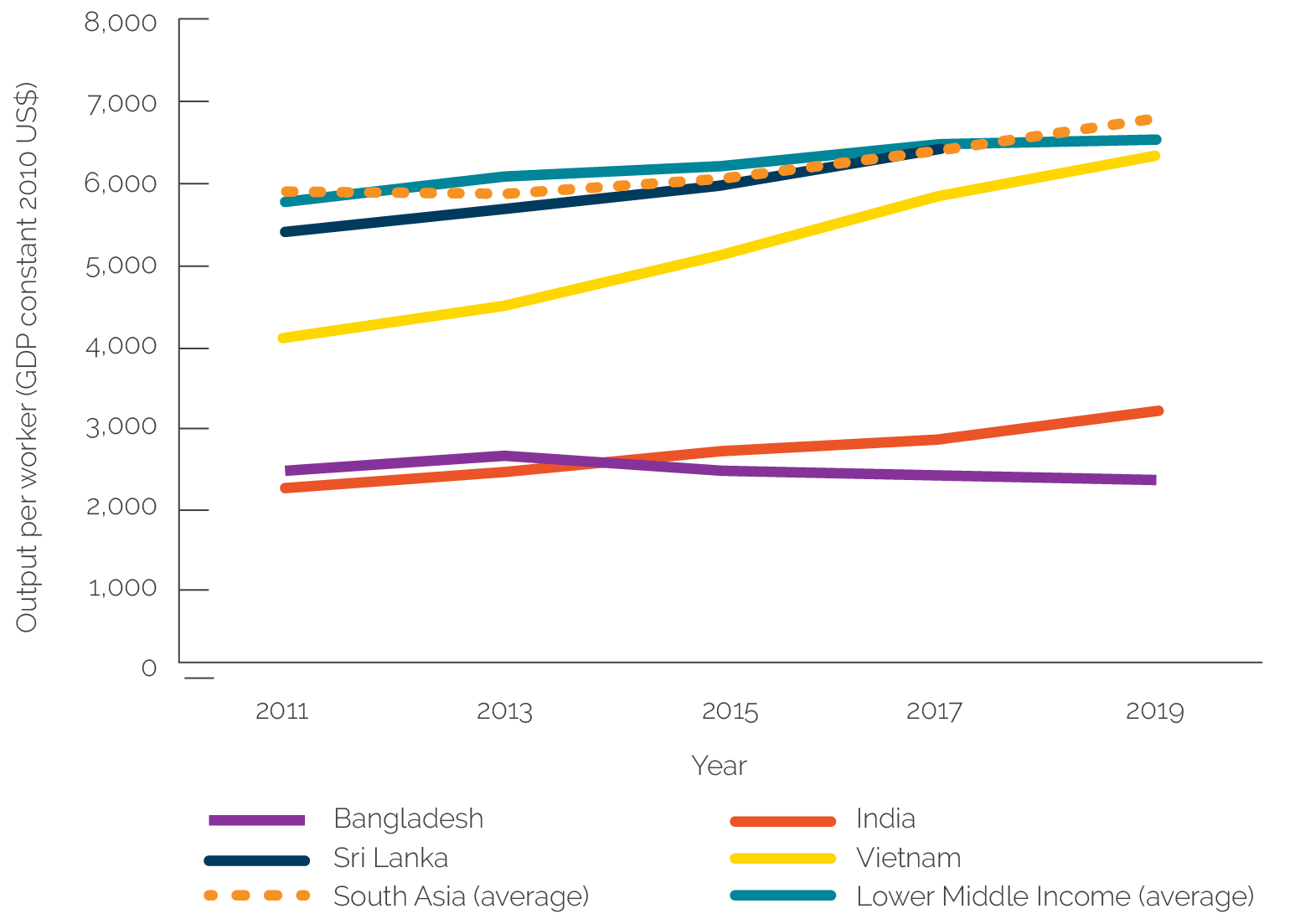

Despite the increase in manufacturing employment in Bangladesh in recent decades, job quality remains weak, with half of workers employed in subsistence agriculture and the informal sector. The pace of job creation in the formal sector, especially in the RMG sector, has slowed over the past decade. Bangladesh’s labor productivity is below that of its peer countries and the averages of South Asia, lower- middle-income countries, and upper-middle-income countries (figure 5.1).

Bangladesh’s workforce has very low educational attainment, with less than half of youth entering the workforce having completed secondary education (Country Private Sector Diagnostic; IFC 2021). Bangladesh’s Human Capital Index score (at 0.46) is on par with Guatemala, Lao People’s Democratic Republic, and Gabon, and it compares unfavorably to peer countries such as

Figure 5.1. Labor Productivity of Bangladesh, Peer Countries, South Asia, and Lower-Middle-Income Countries

Source: ILOSTAT (database), International Labour Organization, Geneva, Switzerland (last updated November 7, 2021).

Note: GDP = gross domestic product.

Vietnam (0.63), Thailand (0.61), and Sri Lanka (0.60). Productivity is undermined by shortcomings in education and health, where Bangladesh also compares unfavorably to peer countries. The female labor force participation rate (at 34.8 percent) is less than half the rate for men (83.6 percent).

Following the 2015 SCD, the Bank Group produced a series of analytical pieces to better understand Bangladesh’s jobs, business environment, and human capital constraints (appendix C). The 2017 Jobs Diagnostic (Farole et al. 2017) identified several reform pathways including (i) investment climate and trade and urbanization infrastructure and amenities to increase the pace and diversification of job creation; (ii) firm-level quality and productivity and pensions to raise job quality, and (iii) youth and women labor market transitions and international migration to improve access to jobs for vulnerable groups.

The Programmatic Jobs DPC series 1–3 (FY19–21) was the Bank Group’s main instrument for directly supporting policy reforms for the jobs agenda and contained prior actions related to trade, business environment, worker protection, and access to jobs for vulnerable populations. The Programmatic Jobs DPC series was designed in relation to the three objectives outlined in the 2017 Jobs Diagnostic and included reforms related to (i) trade and investment environment, (ii) workers’ protection (through pension reforms and labor laws); and (iii) improved access to jobs for vulnerable populations (women, youth, and migrant workers). The DPC series was complemented by several investment lending operations (see table 5.1).

Table 5.1. Operations Supporting the Jobs Agenda

|

Operation |

Description |

|

Private Sector Development Project (FY11) and AF (FY17) |

Facilitate private investment and job creation and promote compliance with institutional quality standards in economic zones supported by the project. |

|

College Education Development Project (FY16): $100 million |

Strengthen strategic planning and management capacity of the college education subsector and improve the teaching and learning environment of participating colleges. |

|

Export Competitiveness for Jobs Project (FY17): $100 million |

Contribute to export diversification and more and better jobs in targeted sectors. |

|

Jobs DPC series 1–3 (FY19–21): $750 million ($250 million per operation) |

Support program of reforms to (i) modernize the trade and investment environment; (ii) strengthen systems that protect workers and build resilience; and (iii) improve policies and programs that enhance access to jobs for vulnerable populations. |

|

Private Investment and Digital Entrepreneurship Project (FY20): $500 million (Scale-Up Facility) |

Promote private investment, job creation, and environmental sustainability in participating economic zones and software technology parks in Bangladesh. |

|

Accelerating and Strengthening Skills for Economic Transformation (FY20): $300 million |

Equip Bangladeshi youth and workers, including women and the disadvantaged, with skills demanded for the future of work and improved employment prospects. |

Source: Independent Evaluation Group.

Note: AF = additional financing; DPC = development policy credit; FY = fiscal year.

Progress in advancing key reforms supported by policy-based lending has been less than hoped for. The DPC programmatic series started with strong prior actions and indicative triggers (appendix D). For example, pillar A (modernizing the trade and investment environment) supported establishment of a One Stop Service for investment, the new Companies Act, the Customs Act, and bonded warehouses, including for non-RMG sectors. But by the end of the series, the focus had been diluted when the second operation in the series was brought forward by several months to help the government address the fiscal impacts of COVID-19 and several actions were diluted (World Bank, 2021c.

Although the One Stop Service was enacted by parliament and published in the Bangladesh Gazette, it has not been fully operationalized (only 35 streamlined regulatory services are available, out of more than 150). The enactment of the new Companies Act was an indicative trigger for DPC 2, but it did not materialize into a prior action and was replaced by a weaker prior action (approval by the cabinet of the draft amendment to the new Companies Act). The IFC’s (2021) Country Private Sector Diagnostic noted that passage of a new Companies Act would be a game changer, as Bangladesh is one of the world’s most difficult environments for the private sector to operate in because of its archaic business processes. Parliament approved the establishment and governance structure of the Single Window but not its operationalization or financing.

Progress on other reforms supported under pillars B (workers’ protections and resilience) and C (access to jobs for vulnerable populations) was also watered down. Although the Labour Act was enacted and a new cash transfer program was established for informal workers, the cash program was not expanded to poor people in urban areas as envisaged. The comprehensive pension strategy, which was a trigger for DPC 2, was replaced by a financing scheme for export industry workers.

The Bank Group’s investment projects sought to increase foreign direct investment by developing export processing zones to address constraints to land access and infrastructure availability (see chapter 3). This was achieved through infrastructure investments in targeted economic zones and technical assistance and building capacity for economic zone–related institutions. Although the interventions made progress in generating foreign direct investment to the zones (to an estimated $3.2 billion by 2020), countrywide foreign direct investment remained low relative to comparators, raising questions about the additionality of the Bank Group–supported interventions in terms of foreign direct investment.

The Bank Group support to higher education and skills development was concentrated in the second half of the evaluation period. Two operations focused on institutional strengthening and capacity building and creating a better learning environment to produce more qualified and employable graduates: Higher Education Quality Enhancement (FY09) and Skills and Training Enhancement (FY10). Both closed in FY19, and IEG’s outcome ratings were satisfactory and highly satisfactory, respectively.

Under the College Education Development Project (FY16), the Bank Group supported institutional strengthening and capacity of colleges (planning and management) and grant financing to improve the learning environment and training for college teachers in participating colleges. Under the Accelerating and Strengthening Skills for Economic Transformation Project (FY20), the Bank Group will provide grant financing for diploma and training institutes, and to teachers and management, to bring the quality standards of training programs in line with international standards. The Bank Group will also provide grant financing to industry groups to scale up enterprise-based training programs.

World Bank Group Contributions to Clean Energy and Sustainable Power

Bangladesh is extremely vulnerable to climate change. Mitigating the effects of climate change through reductions in greenhouse gas emissions is therefore a top priority for the country, a point made consistently in the government’s Vision 2021, the SCD, and both the CAS and CPF.1 Of Bangladesh’s total carbon dioxide emissions of 57.1 metric tons in 2011, the bulk came from the electricity sector (Sarkar et al. 2018). Emissions have continued to grow at a rapid rate: By 2019, fossil fuel–related emissions from the power sector had reached nearly 37 metric tons of carbon dioxide equivalent, and they are projected to increase to 41 metric tons of carbon dioxide equivalent by 2024 (Hasan and Chongbo 2020). The reliability of Bangladesh’s electricity supply is also the lowest among regional peers, reflecting transmission and distribution system bottlenecks.

There are several factors that constrain scale-up of renewable energy in Bangladesh. Potential is limited by land constraints (for solar photovoltaic) and climatic conditions (moderate resource availability for wind; World Bank 2015a, 79). Bangladesh imports power from India (which in turn imports hydropower from Bhutan), with very limited private sector participation. The cross border electricity trade multilateral trade involves (i) harmonization of regulations among participant countries to allow access to third-country markets through tripartite agreements and help address investor concerns regarding noncommercial risk and (ii) opening the market in a predictable, phased manner, potentially with sovereign assurances of open access to transmission infrastructure and each country’s national market.

The Bank Group has been supporting Bangladesh’s transition to clean energy and climate change mitigation through the dual pathways of (i) promoting green (renewable) energy and (ii) supporting more efficient use of conventional and traditional sources of energy (including a shift away from coal) and demand management. The effectiveness of Bank Group support has been significant. The main vehicle for maximizing the potential role for renewables was the Rural Electrification and Renewable Energy Development (RERED) project (approved in FY02, with additional financing in FY09 and FY12) and the successor project (RERED II, approved in FY13 with additional financing in FY14 and FY18; World Bank 2014c). Building on successful experience in Sri Lanka and lessons from other Asian countries, the World Bank supported a solar program using private vendors and a financial intermediary to provide consumers with access to finance and assurance of product quality to enhance access to power in underserviced areas in anticipation of grid rollout. Lessons included the following: (i) A vendor model of private sector–led renewable energy development (versus a fee-for-service model) could be successful if sufficient attention was paid to institutional arrangements, private participation, quality control, maintenance arrangements, and financial provisions to make solar home systems affordable to beneficiaries; and (ii) There was potential to scale up off-grid access to remote areas until such time as the grid would reach those locations, at which time off-grid schemes would be phased out.

The program achieved rapid rollout of nearly 4 million solar home systems by 2016 (with a target of 1.08 million by 2018), providing clean electricity to some 12 percent of the population (World Bank 2016d, 8–9). RERED operations also provided financial and technical support to minigrids (connecting households and businesses), solar irrigation pumps, and production of energy-efficient light bulbs as part of an effort to improve demand management (though the last initiative ran into quality problems when nearly one-third of the bulbs procured were found to be defective).

Bank Group efforts to strengthen institutional capacity in the renewable energy sector have been modestly successful. Significant technical assistance was provided by the World Bank to both the Rural Electrification Board and the Infrastructure Development Company Limited through the RERED project and its additional financing to help build administrative and project implementation capacity. The impact of this support was demonstrated by the Infrastructure Development Company Limited’s successful management of the growing renewable program (World Bank 2014c). Technical assistance was also provided through the Siddhirganj Power Project to three implementing agencies (Electricity Generation Company of Bangladesh, Power Grid Company of Bangladesh, and Gas Transmission Company Limited) to support core management information systems and assist in the preparation of bidding documents and bid evaluation (World Bank 2021b). Support under the Power Sector Development Technical Assistance Project was successful in building capacity within the Bangladesh Energy Regulatory Commission as an independent regulatory authority agency. However, as reported by IEG, the commission’s ability to fulfill its key role in fostering fair competition in the sector was undermined by the government’s actions to set tariffs below cost-recovery levels, and by its multiplicity of roles and lack of independence as a regulatory body (World Bank 2014c).

Public entities still have limited capacity to undertake competitive Renewable Energy auctions, the regulatory framework remains underdeveloped, power infrastructure is inadequate, long-term domestic financing is lacking for projects, and institutional capacity is insufficient to negotiate power purchase agreements with independent power producers (World Bank 2020c. As a result, and despite government commitment to increasing generation of renewable energy, progress has been slow. By June 2020, only 311 megawatts of installed renewable energy capacity on-grid and 317 megawatts off-grid were coming from solar energy, and 230 megawatts came from hydro energy. Hence, the focus of Bank Group support has been on projects that will improve the efficiency of existing gas-fired power plants.

Bank Group efforts to help improve the efficiency of traditional (grid-based) operations have been largely successful. The Siddhirganj Power Project, which closed in December 2019, successfully contributed to an increase in supply of low-cost electricity, based on combined-cycle operation, while helping to strengthen the capacity of implementing agencies. Ongoing operations, such as the Rural Electricity Transmission and Distribution Project, are helping the country build new transmission and distribution lines and reduce technical electricity losses. Combined-cycle gas-fired power plants—such as Sembcorp’s 414 megawatt Sirajganj Unit 4 combined-cycle gas turbine plant, which is supported jointly by IFC and MIGA and went into full commercial operation in 2019—are expected to operate significantly more efficiently via repowering than single-cycle plants. However, the Ghorashal Unit 4 Repowering Project (closing in 2022), which aimed to increase capacity and efficiency of generation, is off track due to technical problems (). The reduction in greenhouse gas emissions from World Bank–financed projects is estimated at between 2.4 and 3.18 metric tons of carbon dioxide equivalent per year.

The Bank Group’s ASA had a strong focus on renewables, with assessments of the impact of solar home systems, support for the Sustainable and Renewable Energy Development Authority’s preparation of its investment plan, and other analytical work designed to build up a better understanding of sector issues. Analytical work contributed to the design of the Power System Reliability and Efficiency Improvement Project. Advisory work played a more limited role. For instance, despite undertaking analytical work on the impact of electricity price increases on the economy, the Bank Group had limited engagement with the Ministry of Power, Energy and Mineral Resources on tariff and subsidy reform despite its relevance to the financial viability of the sector.

IFC’s advisory work in the sector was relatively limited and had less-than-successful results. IFC had four advisory assignments during the period. Two of these (Lighting Asia and Waste-to-Energy) were rated unsuccessful. In both cases, private investors were unwilling to take commercial risks and make long-term commitments. One of the remaining assignments (BD Solar), a transaction advisory, did not advance from phase 1 mode. The Low Carbon Initiative was deemed successful form of approval of Low Carbon Roadmap and Guidelines, and the raising of awareness in academia.

- See chapter 8, Government of Bangladesh (2012).The Bank Group–supported Nationally Determined Contribution Support Facility is helping countries like Bangladesh address barriers to lowering their carbon footprint in their power sectors, which currently account for a significant portion of their greenhouse gas emissions.