Findings by Region, Sector, and Instrument

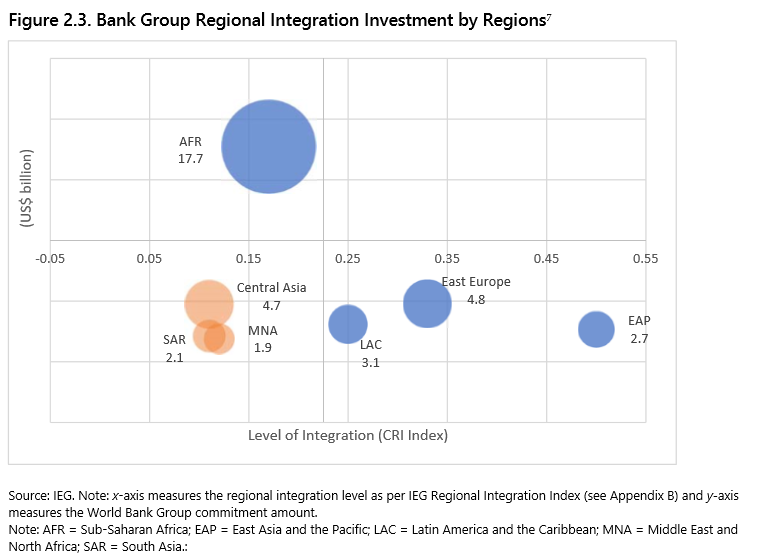

Spanning 867 projects with a combined commitment volume of $37+ billion during the 15-year evaluation period, the regional integration lending portfolio includes a wide spectrum of practice areas, multiple instruments, regional institutions, and sectoral approaches.

This upstream support at the local, national, subregional, and regional levels was evidenced in:

- enhanced capacity and client knowledge on regional integration;

- regional and cross-border policy, regulation, and harmonization of standards; and

- setting up new regional integration agencies and institutions.

The most promising outcomes were increased knowledge exchange and clients’ enhanced understanding of regional benefits and regional issues. The Bank Group contributed, to a lesser extent, to regional policy harmonization and formation of new regional institutions or functional agencies.

The performance of the regional integration portfolio across sectors is summarized as follows:

- Seventy percent of transport operations were successful in improving regional transport infrastructure, leading to reduced transit time and user costs. The Bank Group’s portfolio in other sectors has achieved mixed results;

- The Bank Group’s support for regional transport and trade integration projects had a weak, yet positive, effect on intraregional trade volumes.

- In the energy sector, the Bank Group was more successful in improving regional energy infrastructure and service reliability, whereas developing regional energy markets for improved trade remains unfinished business.

- In the information communications technology (ICT) sector, the Bank Group has been successful in developing regional infrastructure and increasing the region’s access to services.

- Beyond such sectoral efforts, there is little evidence on the wider economic benefits of the spillover effects of Bank Group interventions at the subregional or regional level to foster economic integration.

Read more about the World Bank Group’s Regional Integration Engagement and Achievements

Note: The Composite Regional Integration (CRI) analysis should not be viewed as a unique or exhaustive assessment of potential regional integration outcomes. The CRI index is just one option to assess regional integration. The analysis presented in this report represents work in progress subject to further review.

Comparative Advantages and Challenges

Stakeholder consensus analysis, and effectiveness analysis of its support to fostering regional integration reveal the Bank Group’s comparative advantage in:

- global knowledge: coverage that facilitates knowledge exchange and the transfer of good practices and lessons from one region to another;

- breadth of financial instruments: for example, Development Policy Loans focusing on policy and institutional actions are also potentially useful tools to prompt regional policy coordination and harmonization, which is usually the most difficult part of regional integration;

- synergies derived from the strength of three Bank Group institutions (IBRD/IDA, IFC and MIGA): this gives the Bank Group the ability to catalyze finance and draw on synergies among its institutions for regional initiatives that cannot be entirely supported through its own balance sheet

- convening power: resulting from its apolitical approach and neutral position during difficult conversations with clients on regional integration issues, which makes it possible to mobilize global expertise to strengthen regional public goods (RPG).

Yet, these advantages have not been fully utilized because of internal and external challenges, including:

- the confluence of the Bank Group’s single-country business model;

- lack of strategic prioritization of, accountability and incentive for pursuing regional integration interventions; and

- sub-optimal collaboration and partnership efforts with key stakeholders such as the Regional Economic Communities, the private sector, regional development banks, and other development partners.

If the Bank Group would like to fully use its comparative advantages, then it needs to address these challenges.

IDA Regional Window’s complementarity and challenges.

The IDA Regional Window has been a key source of co-financing, complementing the Bank Group’s comparative advantage in fostering regional integration, but its additionality beyond co-financing is not evident. The portfolio review and frontier analysis indicate that projects supported by the IDA Regional Window did not perform significantly better than those without this support. Further, Regional Window efforts suggest that there are challenges in targeting those regions and subregions with the most needs and demands. Finally, there is a lack of evidence that projects supported by the IDA Regional Window generated positive spillover effects, an important criterion for its use.

Read more about the World Bank Group’s Comparative Advantages and Challenges

Note: The Composite Regional Integration (CRI) analysis should not be viewed as a unique or exhaustive assessment of potential regional integration outcomes. The CRI index is just one option to assess regional integration. The analysis presented in this report represents work in progress subject to further review.

Recommendations

If the Bank Group institutions want to prioritize their regional integration engagements, the evaluation offers the following six recommendations to address key barriers and support clients’ regional integration aspirations:

1. Initiate high-level, strategic commitments to regional integration in all operational regions in addition to Sub-Saharan Africa, with tailored approaches.

2. Realign the Bank Group’s business model to achieve managerial accountability both at country management unit and Global Practice levels, and create incentives for project teams.

3. Rebalance the Bank Group regional integration projects to emphasize regions with high integration potential, and regional public goods.

4. Create and promote universally accepted frameworks at the region and sector levels, and crowd-in new partners, most notably the private sector, international industry associations, and regional institutions.

5. Strengthen the design of projects supported by the IDA Regional Window, to improve the assessment of spillover effects and to generate evidence based on robust indicators.

6. Recalibrate the IDA Regional Window’s resource allocation to expand support for subregions with high untapped potential for integration.

Social Network Analysis

Also See

IDA Regional Window Program 2003-17

Lessons from IEG Evaluations

The main objective of this synthesis report is to inform policy decisions on the International Development Association (IDA) Regional Window Program in the context of the IDA18 midterm review and the IDA19 replenishment. The report contains information on (a) the achievements of the program, and (b) key findings and conclusions for the consideration of IDA Deputies. This synthesis is derived primarily from IEG’s thematic evaluation, Two to Tango: An IEG Independent Evaluation of World Bank Group Support to Fostering Regional Integration and is complemented by findings from other existing thematic evaluations such as Grow with the flow: World Bank Group support to Trade Facilitation, project‐level evaluations and validations, and project performance assessment reports.

Précis | An illustrated overview of the Evaluation of World Bank Group Support to Regional Integration