Addressing Country-Level Fiscal and Financial Sector Vulnerabilities

Chapter 3 | Bank Group Support for Reducing Vulnerabilities

Highlights

World Bank Group support to country clients to help reduce fiscal and financial sector vulnerabilities (as outlined in country strategies and lending and knowledge instruments) was generally well aligned with the findings of diagnostics.

The World Bank’s support for reducing financial sector vulnerabilities was significant, with considerable technical assistance to central banks, deposit insurance funds, and financial regulators. Bank Group support for more ambitious reform was more prevalent in countries in the midst of crises.

Outside the context of a full-blown crisis, the World Bank was less effective in persuading countries to undertake the longer-term institutional reforms needed to tighten regulations and strengthen institutional capacity for crisis prevention and management.

Close partnership and coordination with the International Monetary Fund and other partners (usually in the context of a crisis when both institutions were providing significant support) enhanced the effectiveness of Bank Group support.

Although progress has been made to set up and strengthen social protection delivery systems and social safety net programs, important challenges remain, with social safety net adaptability and flexibility across the seven case study countries varying significantly.

Bank Group Support to Clients in Addressing Vulnerabilities

The quality of Bank Group support to client countries to reduce their fiscal and financial sector vulnerabilities and strengthen and adapt social safety nets is evaluated through the lens of (i) coherence with identified vulnerabilities, (ii) complementarity of the Bank Group’s response across its agencies and instruments, and (iii) collaboration with the IMF and other partners.

In all case study countries, a review of diagnostic work and subsequent World Bank–supported country strategies indicates that identified vulnerabilities usually informed Bank Group lending and subsequent ASA. The scale and nature of the Bank Group’s support differed across and within countries and over time, depending on government commitment and resistance from vested interests.

In countries where commitment to reform was weak or vested interests strong—as was the case in Ukraine throughout much of the early evaluation period, in Bangladesh (particularly in the financial sector), and in Tajikistan—the World Bank emphasized ongoing monitoring and analytical work to stay abreast of developments and conditions in anticipation of a more favorable climate for reform. In Ukraine, the World Bank and IFC supported a strong analytical and advisory program (including through programmatic technical assistance) in close collaboration with other development partners. Collaboration with partners was strong in Ukraine, where the Bank Group, the IMF, the European Bank of Reconstruction and Development, the UK Department for International Development, and the US Agency for International Development maintained particularly close coordination. This created a good basis from which to proceed with reforms to strengthen financial sector resilience when the political climate became more supportive of reform after 2014. However, in subsequent years, despite rigorous identification of vulnerabilities, vested interests in the parliament and the private sector blocked key financial sector legislation and policies, leaving reforms seriously incomplete. In Tajikistan, the 2015 FSAP identified vulnerabilities in the financial sector related to interconnected lending, bank resolution frameworks, and the governance of state banks. The Bank Group engaged with various shorter-term funding options, such as funding from the FIRST Initiative, to finance needed follow-up technical assistance.

Where ownership of reforms was strong, as in Jamaica, the World Bank responded with intensive dialogue and budget support in close coordination with the IMF. Based on the earlier identified debt vulnerabilities and a policy agenda outlined in a comprehensive CEM, the World Bank provided three successive budget support operations from 2013–17, focusing on fiscal consolidation and investment climate reform in conjunction with a large, three-year IMF-supported arrangement and budget support from the Inter-American Development Bank. These efforts sought to reverse adverse debt dynamics, rebuild fiscal space to finance critical services, and remove constraints to the recovery of investment and growth.

Coherence between identified vulnerabilities and Bank Group support to address them varied across countries, between moderate and high (table 3.1). The degree of coherence fluctuated more on the fiscal side than it did for financial sector support. This may reflect the more political nature of the engagement in the fiscal area, where World Bank support often required significant changes in budget planning, execution, and practices, as well as in transparency and accountability, especially in the relationship between the budget and state-owned banks and enterprises, which often ran counter to vested interests.

In Tajikistan, although the World Bank correctly identified key fiscal vulnerabilities, it struggled to agree with the government on how to support efforts to address those vulnerabilities. In 2016, the World Bank began preparing a series of DPLs to help the government address fiscal issues but, in the end, decided to drop the series before approval, over concerns with the direction of reform, the quality of fiscal management, and transparency. In this environment, the World Bank continued monitoring and keeping abreast of fiscal issues but refrained from significant operational (that is, lending) engagement. By contrast, the World Bank was able to provide considerable support to the central bank through technical assistance and loans, which were viewed by the client as less controversial from the government’s viewpoint, given their more technical nature. In 2019, the World Bank began providing technical assistance to the financial sector to address concerns with financial stability, NPLs, bank resolution tools, payment system oversight, consumer protection, and corporate governance in the financial sector.

In Benin, support to reduce fiscal and financial sector vulnerabilities was relatively limited, the latter in part because the counterparts for financial sector dialogue were in the regional monetary authority, with which the World Bank had limited contacts and dialogue (and with which the IMF took the lead). In areas where there was confluence of interest and ownership, however, the World Bank responded with significant support.

Table 3.1. Coherence between Vulnerabilities and World Bank Group Support

|

Country |

Key Vulnerabilities |

Response |

Degree of Coherence |

|

Bangladesh |

SOEs, contingent liabilities, SOCBs |

Limited policy lending to address fiscal vulnerabilities, but extensive technical assistance addressing financial vulnerabilities. Since 2018, a Program-for-Results, Public Financial Management Program to Enhance Service Delivery Project, is supporting the SOEs in increasing debt transparency and profitability, as well as macro forecasting. |

Moderate |

|

Benin |

Public debt, domestic revenue mobilization, NPLs |

Policy-based guarantee focused on fiscal space but limited engagement in financial sector. |

Moderate |

|

Jamaica |

Public debt, fiscal space, NPLs, banking system concentration, access to finance |

Three DPLs targeting reduction of public debt and increase in fiscal space; financial sector DPLs. |

High |

|

Morocco |

Public sector governance and transparency, commercial bank oversight and regulation, and exposure to foreign markets |

DPL series targeting governance and transparency; technical assistance to financial sector resolution framework, overseeing systemic financial market infrastructures, creating a market for NPL management, and greening the financial system. |

High |

|

Mozambique |

Unsustainable debt; poor debt recording and monitoring; data transparency; central bank supervision, regulation, and resolution framework |

Three PRSCs targeting fiscal, debt management, and transparency; extensive technical assistance to financial sector. |

High |

|

Tajikistan |

Dependence of liquidity on remittances, debt management, SOBs, bank supervision and regulation, resolution frameworks, energy subsidies |

Policy-based lending targeting fiscal issues dropped. Technical assistance to financial sector including bank supervision, NPL resolution, deposit insurance strengthening, bank corporate governance, and remittances. |

Low to moderate |

|

Ukraine |

Debt management capacity, energy subsidies; supervision and regulation of commercial banks, bank resolution frameworks, NPLs, corruption and connected lending |

DPL series targeting fiscal vulnerabilities, separate financial sector DPF, extensive technical assistance on financial sector. |

High |

Source: Independent Evaluation Group.

Note: DPF = development policy financing; DPL = development policy loan; NPL = nonperforming loan; PRSC = Poverty Reduction Support Credit; SOB = state-owned bank; SOCB = state-owned commercial bank; SOE = state-owned enterprise.

The Bank Group drew on complementarity among its agencies, particularly where IFC had a substantial presence. IFC responded to identified vulnerabilities in the financial sector and by providing direct project and advisory support that was broadly complementary to that of the World Bank. This was common in the agriculture sector, which often had significant links to budgets and financial sectors, implying vulnerabilities through commodity price and credit risk and bank exposure to the sector. IFC support included developing innovative farmer crop receipt mechanisms to reduce the impact on farmer income of volatile commodity prices (Ukraine), consumer protection, and financial literacy (Tajikistan). IFC also provided direct investment and advisory support to banks focused on raising corporate standards and improving governance and risk management (Bangladesh).

These interventions complemented the World Bank’s engagement in the financial sector. The IFC benefited from the World Bank’s analytical work. World Bank and IFC staff worked well together in Mozambique through the IDA Private Sector Window. However, evidence from field visits indicates that IFC’s capacity to respond in some cases was constrained by a limited staff presence in the field (for example, in Benin).

The degree of coordination and complementarity of World Bank and IMF support to help reduce fiscal and financial sector vulnerabilities varied across countries and sectors and depending on whether there was a crisis under way. In response to major crises in Jamaica, starting in 2013, and in Ukraine, starting in 2014, the World Bank and IMF contributed to highly coordinated, large-scale, and well-integrated stabilization programs accompanied by technical assistance. In the wake of the Arab spring, Morocco benefited from World Bank budget support in areas of governance and accountability that indirectly addressed some underlying fiscal vulnerabilities, whereas the IMF took the lead on macroeconomic policy dialogue and the provision of contingency financing to limit external contagion. At the other end of the spectrum, in Tajikistan the World Bank and IMF did not have strong coordination or integration to address fiscal and financial sector vulnerabilities, although the teams met periodically to discuss financial sector issues. In Bangladesh, Benin, and Mozambique, coordination with the IMF was more limited in scope and intensity.

Impact of Bank Group Support in Reducing Country-Level Vulnerabilities

The effectiveness of the Bank Group’s support in reducing vulnerabilities is assessed taking into account observed changes in vulnerability indicators over the evaluation period, given the nature of the Bank Group contribution. In-depth country case study assessments indicate that the Bank Group contributed significantly to reducing vulnerabilities in Jamaica and Ukraine starting from (and perhaps in part because of) the presence of a major crisis, alongside strong government ownership and large-scale World Bank support, complementary to and well coordinated with the IMF, and internally across Bank Group agencies. Still, despite substantial contributions, outcomes in Jamaica stood out, as government ownership has been sustained, including through the broad stakeholder consensus engendered by its economic and policy monitoring committee. By contrast, ownership in Ukraine waned and progress in reducing vulnerabilities slowed. At the other end of the effectiveness spectrum were countries with limited institutional capacity or substantial internal opposition to reforms and debt transparency (Bangladesh, Mozambique, and Tajikistan), which limited the effectiveness of the Bank Group’s contribution (table 3.2).

Table 3.2. Assessment of World Bank Group Effectiveness in Reducing Vulnerabilities and Improving Internal Coordination

|

Country |

Change in Vulnerabilities from 2010 to 2019 |

Bank Group Contribution |

Bank Group Internal Coordination |

|

Bangladesh Benin Jamaica Morocco Mozambique Tajikistan Ukraine |

Moderate to high High to very high Very high to moderate Moderate to low or moderate Moderate to very high High to high High to moderate |

Moderate Low or moderate High Moderate Low Low High |

Moderate Moderate High High Moderate Low High |

Source: Independent Evaluation Group evaluation team assessment.

In Ukraine, World Bank–supported reform resulted in a large cleanup of the banking system with about half the country’s 180 banks being declared insolvent and sent for resolution. Most large banks returned to minimum capital adequacy requirements, and the institutional capacity of the National Bank of Ukraine and Deposit Guarantee Fund were strengthened significantly. However, a number of key banking reform laws and regulations were blocked in parliament, drawing into question the implementability of reforms. Results have been particularly modest in dealing with the challenges in state-owned banks. Despite periods in which progress was difficult, the World Bank and IFC worked well together in Ukraine, with the World Bank focusing on policy, regulatory, and resolution frameworks and reform initiatives, and IFC on transactions (for example, bank privatization). IFC also achieved results in improving NPL management, bad asset resolution, operational risk, financial risk, and building the market for distressed assets.1

In contrast, in Mozambique, despite concerns from the earlier DeMPA about weaknesses in debt reporting and recording, the issue received little attention from the World Bank or the government before the eruption of the hidden debt crisis. In Tajikistan, the restructuring and resolution of state-owned banks was postponed indefinitely, despite clear risks to fiscal and financial sector stability. Because of low uptake, however, advice did not translate into a reduction of vulnerabilities. Debt buildup continued unabated.

Box 3.1. From Debt Sustainability to Debt Tolerance

The traditional approach to debt sustainability incorporated a relatively narrow menu of shocks (typically, growth and interest rate shocks).

The more recent International Monetary Fund–World Bank Debt Sustainability Framework (DSF) guidance and tool kit, however, emphasizes the concept of debt tolerance. It recognizes that stabilizing the debt ratio may not be enough to avoid a debt crisis, depending on the level at which debt is stabilized and the kinds of shocks to which it is exposed. The new DSF, therefore, aims to identify different tolerance levels for debt so that an “early warning signal” can be provided to fiscal and debt policy. The DSF tool kit now contains a wider menu of shocks that are taken into account, including contingent liabilities such as public sector guarantees or state-owned enterprises. However, in practice, at the country level, fully accounting for these shocks outside of central government budget operations is proving difficult because of data constraints. The revised International Monetary Fund–World Bank Debt Sustainability Framework for Low-Income Countries, therefore, offers greater potential for standardized contingent liability shocks.

Source: Independent Evaluation Group team assessment.

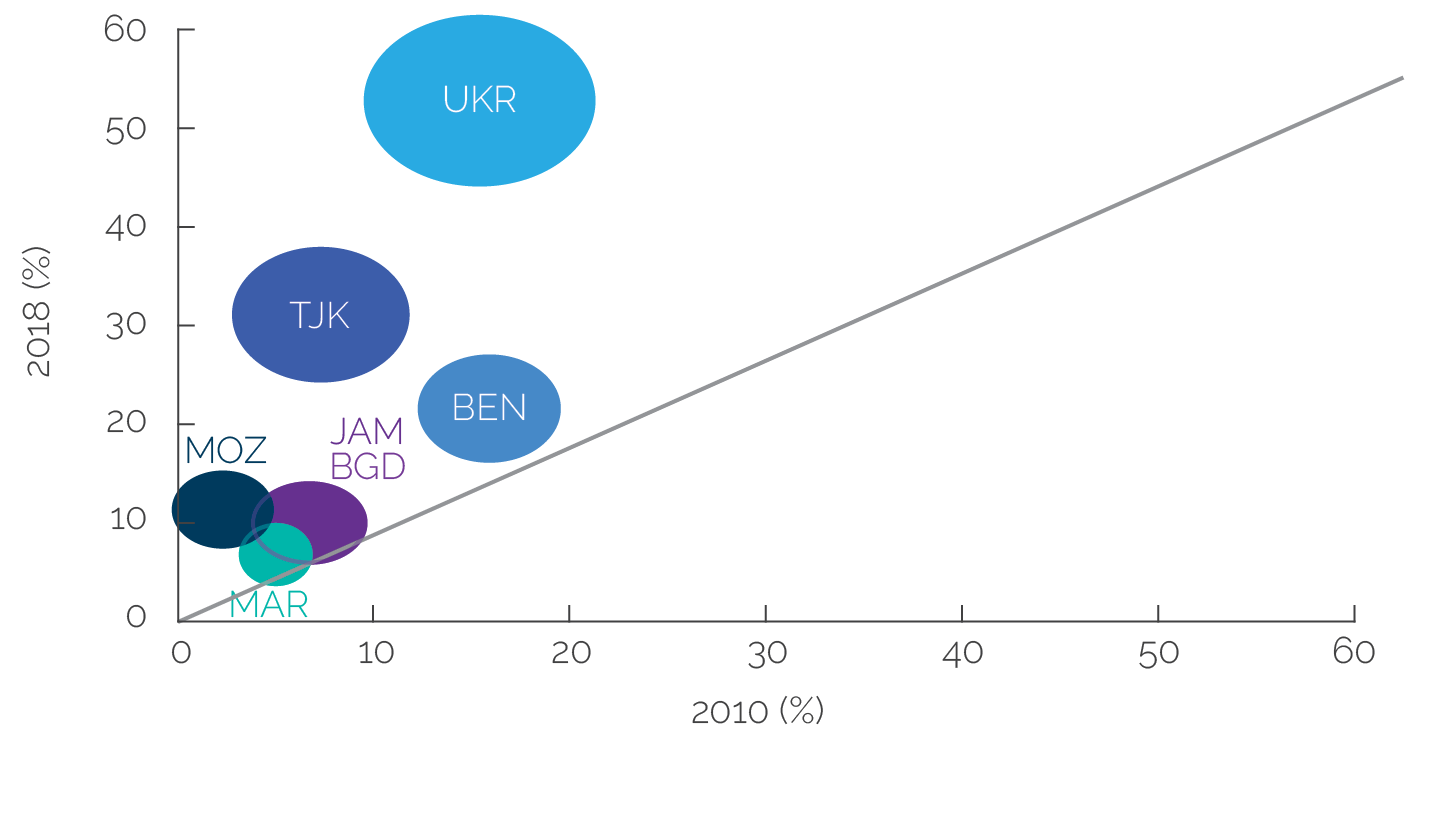

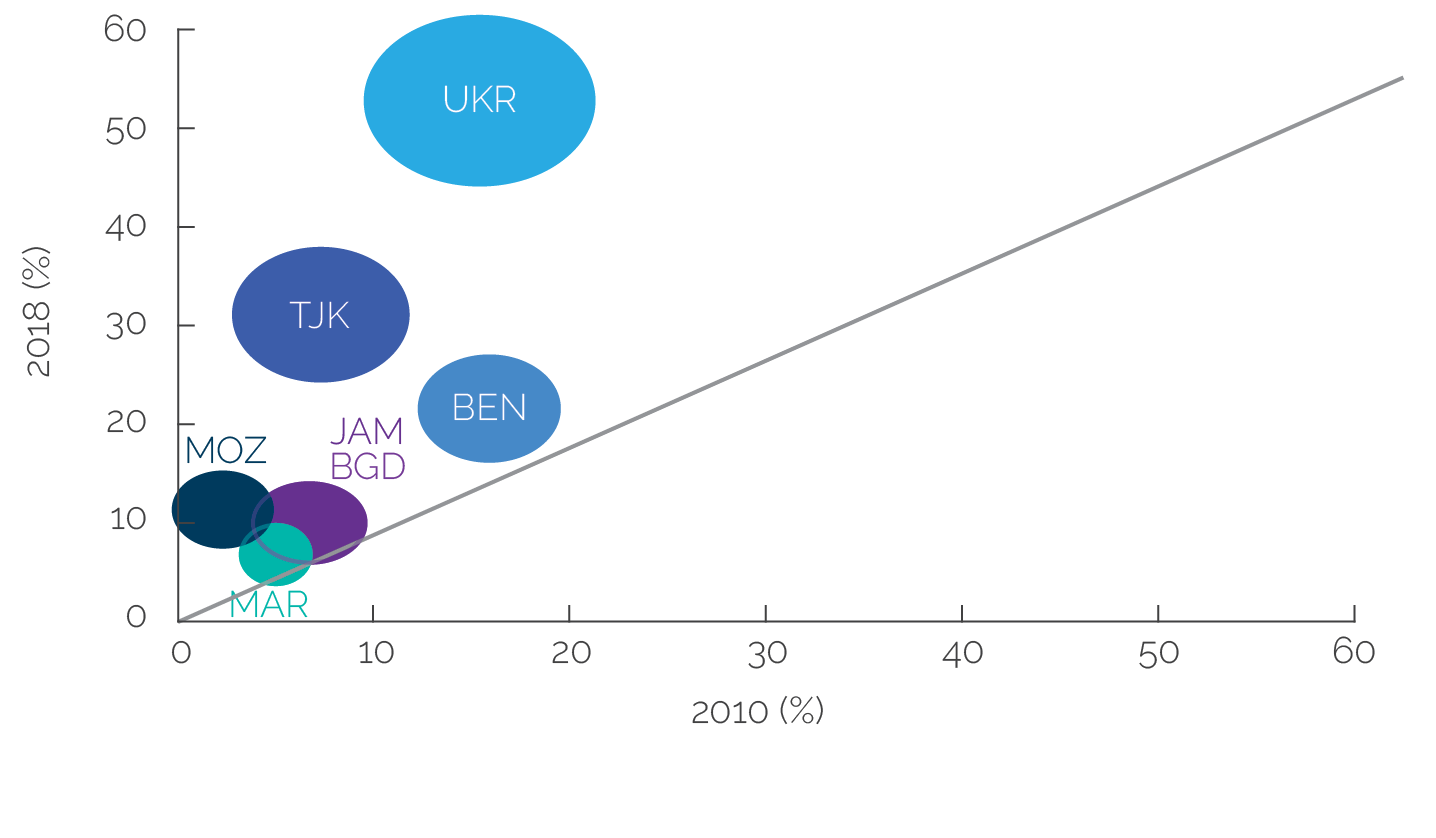

In the financial sector, the Bank Group had a mixed record of success during the evaluation period. Figure 3.1 illustrates the change in NPL ratios in case study countries during the evaluation period, reflecting unrecognized NPLs from the previous period in some countries.

Figure 3.1. Indicators of Financial Sector Vulnerability: Ratio of Nonperforming Loans to Total Loans (percentage)

Source: International Monetary Fund Article IV consultation.

Note: Area of circles represents the percentage of nonperforming loans to total loans for 2018. BEN = Benin; BGD = Bangladesh; JAM = Jamaica; MAR = Morocco; MOZ = Mozambique; TJK = Tajikistan; UKR = Ukraine.

Effectiveness was particularly low in Bangladesh, with the authorities canceling a major World Bank operation aimed at improving the governance of the banking sector after it had been approved by the World Bank Board. In Morocco, despite the fact that financial sector vulnerabilities were low, the Bank Group provided effective assistance to enhance financial system soundness and efficiency, including risk management procedures for banks; the supervisory framework; bank resolution procedures; access to credit; and development of the capital market. The two DPLs in support of micro, small, and medium enterprise (MSME) and capital market development helped strengthen the institutional and regulatory framework of the financial sector, extending the program of credit guarantees to MSMEs to facilitate higher access of MSMEs to finance and supporting capital market development though strengthening the organization, instruments, and supervision of the capital market. With the advice of the World Bank and the IMF, the new banking law extended the central bank’s regulatory and supervisory power to financial conglomerates, microfinance institutions, and offshore banks. The law also aims at improving cross-border supervision and tightening rules for consolidated risk management. IFC supported both the strengthening of the public credit bureau and the setting up of private credit bureaus. In Mozambique, after sustained engagement through two financial sector DPLs, the central bank raised banks’ minimum capital requirement and the minimum capital adequacy ratio from 8 percent to 12 percent, and crisis management arrangements were tested through a simulation exercise. The government has also passed a law aligning the national crisis management framework with the Financial Stability Board’s key attributes of effective resolution regimes for financial institutions.

In Ukraine, the Bank Group, working with the IMF, provided assistance for the massive restructuring of the banking sector after the 2014 crisis. Quantitative and qualitative indicators of banking system soundness show corresponding improvements (appendix C) over this period. However, efforts to support longer-term institutional reform to improve sector governance and prevent a reemergence of crisis conditions were less successful, as critical legislation became stuck in various parts of the legislative process. At the same time, the Bank Group was able to support capacity building in the central bank and the successful establishment of a deposit guarantee fund. IFC introduced a previously nonexistent crop receipts mechanism to farmers, which improved risk management, thereby helping limit government and financial sector contingent liabilities (box 3.2). The World Bank Treasury also provided technical assistance and advisory support to the Central Bank of Ukraine on risk management, hedging, and reserve management, as well as for the development of the local currency debt market (box 3.3, which includes examples of World Bank Treasury assistance to other countries).

Client feedback suggests that technical assistance and advisory support to the central bank and related bank reform (for example, bank resolution frameworks) has been especially valued. Clients valued Bank Group support for the establishment and development of credit bureaus and other activities that help strengthen bank lending practices. Evidence from IEG validations of World Bank staff self-evaluations indicate that, in countries with strong ownership and intensive Bank Group engagement closely coordinated with the IMF and other development partners, project outcomes were generally rated higher with a smaller variance than in countries with weak ownership and less intensive engagements, for example Benin and Mozambique (table 3.3).

Box 3.2. International Finance Corporation’s Innovative Assistance for Crop Receipts

The International Finance Corporation (IFC) crop receipt program is an innovative financial instrument to expand access to finance for small farmers. By reducing financing risks for farmers, the instrument contributes to reducing fiscal and financial sector vulnerabilities that may arise from crop failure and large swings in crop prices. Crop receipts are a preharvest financial instrument that allows farmers to use future harvests as collateral, enabling them to purchase high-quality seeds and other essentials. This instrument can help ease collateral constraints in the rural economy by providing financiers with additional security. IFC, through its Ukraine Crop Receipts Project implemented in partnership with the State Secretariat for Economic Affairs of Switzerland, introduced crop receipts in 2015. As of April 2020, small farmers have issued 4,000 crop receipts to receive $1 billion in financing (for details, see Emerging Europe [2018]). The crop receipts program is addressing the market failure of commercial banks not lending to small farmers because agricultural land used by small farmers is rented and therefore cannot be used as collateral. There is minimal foreign exchange risk because 95 percent of the loans to small farmers in this program are in local currency. One of IFC’s major clients in the crop receipts program is OTP bank, a Hungarian bank and currently one of the top three banks in Ukraine. OTP has a crop receipt portfolio of 260 clients (about $60 million in financing). The interest rate offered by OTP to small farmers is 22 percent, above the average market rate of 17 percent.

Source: Independent Evaluation Group.

Box 3.3. World Bank Treasury Assistance for Risk Management, Hedging, Reserve Management, and Support for Local Currency Debt Markets

The World Bank Treasury has supported risk reduction in a number of countries through integrated risk management projects, hedging operations, and advice on reserve management. These activities have helped countries strengthen overall macroeconomic management and improve buffers against risks. The Treasury has been active in all seven case study countries, but most effectively in Jamaica and Morocco. The Treasury assisted Morocco in 2019 to secure reinsurance of catastrophic risk until 2023. It also sold call options to Morocco to hedge butane price risk in 2019.

The Treasury assisted Caribbean Catastrophe Risk Insurance Facility member countries, including Jamaica, to issue catastrophe bonds (catbonds) to insure against major disasters without creating new public sector debt. The bonds transferred natural disaster risks to capital markets and eased the need to build up large budget reserves. The countries benefited from Treasury support throughout the preparation and market execution of the bonds. The Treasury is currently working with the IMF on incorporating a “hurricane clause” into Paris Club regulations, allowing the debt to be restructured in case of a hurricane.

The Treasury has served as an intermediary in swap transactions to assist countries in hedging against exchange rate risk and commodity price fluctuations, aligning the currency composition of borrowed resources with their international trade and improving the currency profile of their debt. The intermediary role of the Treasury in these operations reduces service costs compared with a direct commercial swap and obviates the need for collateral. Morocco is a notable beneficiary of these operations. In 2012, its dollar-denominated bonds were swapped with euro-denominated loans, facilitating Morocco’s international payments, which are mainly in euros. The Treasury also assisted the government to buy a call option to protect against increases in prices of butane, the main commodity benefiting from a price subsidy.

Through its Reserve Assets Management Program, the Treasury has also improved the management of country foreign exchange reserves to conform to international best practices. The program has been especially effective in Jamaica, assisting the central bank in establishing separate management strategies for working capital, which is used to smooth out exchange rate fluctuations; a liquidity tranche used for debt payment; and an investment tranche of longer-dated assets.

Finally, the Treasury assisted the Moroccan Treasury in revising the strategy for managing the central government debt. This included technical assistance support to Moroccan authorities for borrowing in local currency and on other issues related to the currency composition and the role of the domestic debt market within the context of the Medium-Term Debt Management Strategy.

Source: Independent Evaluation Group.

Note: ICRR rating scale runs from 1 (highly unsatisfactory) to 6 (highly satisfactory).

Table 3.3. Outcomes of Projects and Development Policy Financing Focused on Fiscal and Financial Vulnerabilities

|

Country |

Average ICRR Rating |

Average ICRR Outcome |

Variance |

Projects and DPL Programmatic Series (no.) |

|

Bangladesh |

3.8 |

Moderately satisfactory |

2.0 |

6 |

|

Benin |

3.2 |

Moderately unsatisfactory |

0.1 |

6 |

|

Jamaica |

4.0 |

Moderately satisfactory |

0.0 |

6 |

|

Morocco |

4.1 |

Moderately satisfactory |

0.1 |

7 |

|

Mozambique |

3.9 |

Moderately satisfactory |

0.8 |

7 |

|

Tajikistan |

4.0 |

Moderately satisfactory |

0.0 |

3 |

|

Ukraine |

5.0 |

Satisfactory |

0.2 |

6 |

Source: Independent Evaluation Group ICRR database.

Note: DPL = development policy loan; ICRR = Implementation Completion and Results Report Review.

- The International Finance Corporation Crisis Management Services Project was evaluated by the Independent Evaluation Group in 2013 and found positive results, albeit in small banks accounting for about 2.5 percent of total financial sector assets.