Addressing Country-Level Fiscal and Financial Sector Vulnerabilities

Chapter 1 | Background and Context

Context

Shocks come in all shapes and sizes, often without warning, and with potentially devastating impacts on economies, livelihoods, and populations. Reducing vulnerabilities to help cushion the impact of shocks and help economies recover more quickly is therefore a priority for policy makers.

Lessons from previous crises make clear that identifying and addressing country-specific vulnerabilities before a shock provides the opportunity to adopt policies that enhance resilience.

This evaluation assesses World Bank Group support to client countries to enhance their preparedness for shocks through the systematic identification of fiscal and financial sector vulnerabilities, as well as support to address these weaknesses. Previous Independent Evaluation Group evaluations have assessed the Bank Group’s contribution to building resilience to natural disasters.

The massive 2020 global economic crisis caused by the coronavirus (COVID-19) pandemic highlighted why preparedness is so critical. Immense global public health, demand, and supply shocks hit all countries hard and at nearly the same time. The result was the deepest peacetime global economic crisis since the Great Depression. To a significant extent, the depth of the economic and social impact was a function of each country’s preexisting fiscal and financial vulnerabilities; the strength of their fiscal and financial sector policies and institutions; and the size, flexibility, and adaptability of their social safety nets.

Previous crises have underscored this point.1 A clear lesson in the wake of the 2008 global financial crisis was the importance of identifying and addressing country-specific vulnerabilities ex ante to provide the opportunity for policy makers to enhance resilience to potential shocks. More than a decade has passed since then, giving the Independent Evaluation Group (IEG) the opportunity to assess the extent to which the World Bank Group has helped its client countries internalize the importance of proactive efforts to build resilience to domestic and external shocks.

This evaluation focuses on fiscal and financial sector vulnerabilities. Given their macroeconomic relevance, fiscal and financial sector weaknesses, when combined with major shocks, can also have significant social impact (Claessens et al. 2010; IMF 2011). The channels of impact are numerous. Weak institutional capacity can undermine efforts to understand and manage the fiscal and financial sector impacts of shocks. As economies are increasingly integrated into global trade, capital markets, and supply chains, integration itself can heighten vulnerabilities when external conditions take a turn for the worse. Crises and vulnerabilities can be, and have been, self-inflicted through poor domestic policies. This has led to growing awareness of the need to shift from a reliance on reactive, ad hoc, and ex post responses to shocks to an approach characterized by proactive risk identification and reduction (World Bank 2013).2 Failure to adopt policies ex ante to reduce vulnerabilities can turn an exogenous shock into a full-blown crisis. Such policies should support adequate macroeconomic buffers, strengthen financial sector balance sheets, enhance the ability to implement timely countercyclical policy, establish frameworks and institutions to facilitate crisis management, and put in place flexible and adequate social protection systems. Taking this into account, the focus of this evaluation is on crisis preparedness and not crisis response. (See box 1.1, which provides definitions of key concepts used in this evaluation.)

Box 1.1. Evaluation Scope

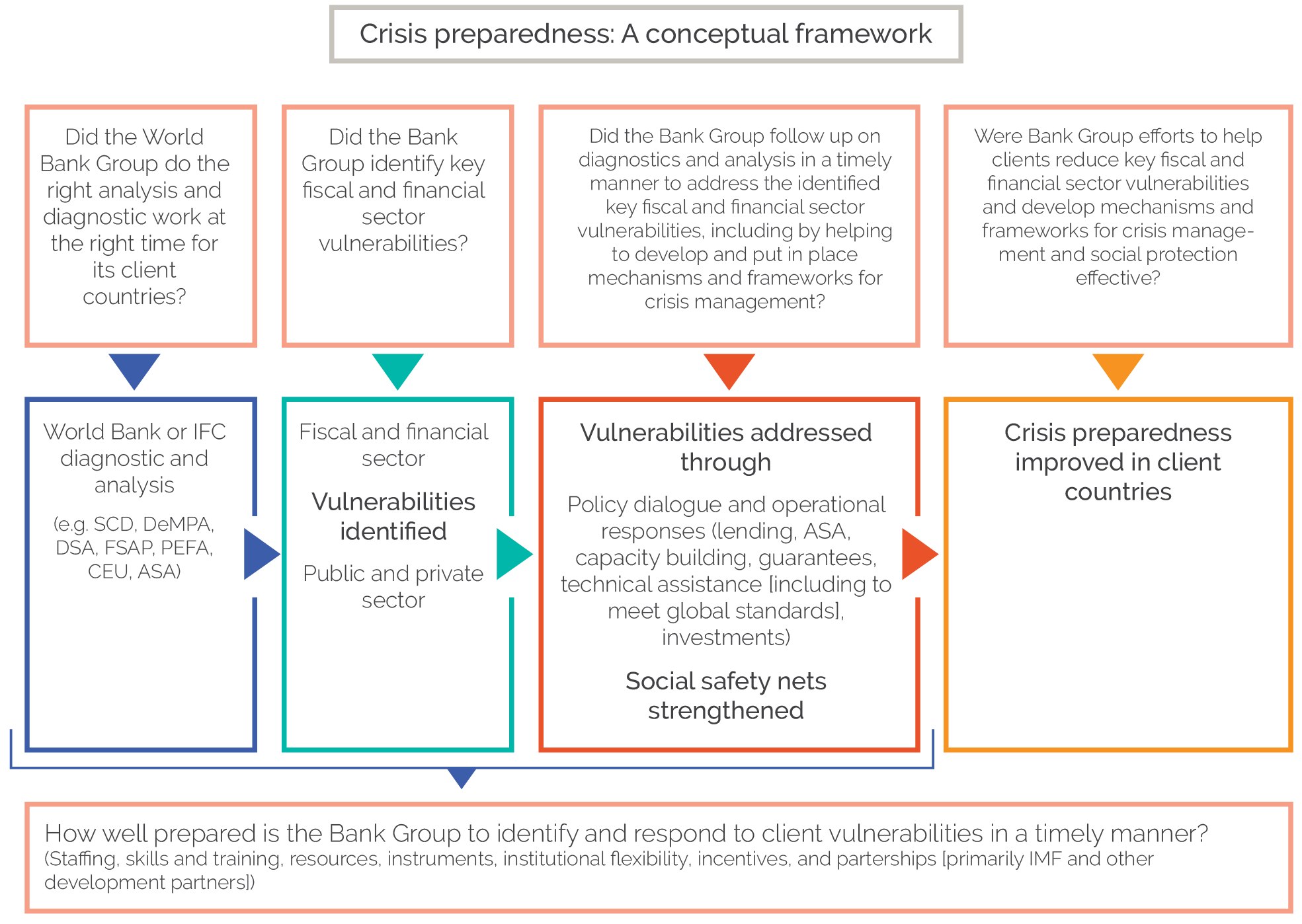

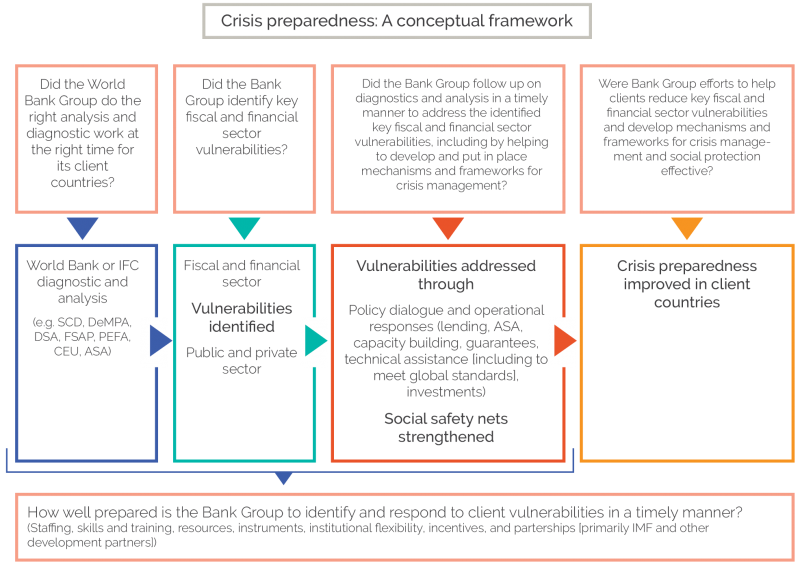

The focus of this evaluation is on whether the Bank Group has contributed to preparedness for macroeconomic shocks by identifying and helping clients reduce fiscal and financial sector vulnerabilities. The focus is on ex ante risk identification and preparedness, not on ex post crisis response and stabilization. Shocks can come from any source, but for the purposes of this evaluation, they are relevant only to the extent that they interact with fiscal and financial vulnerabilities. “Preparedness” can be reflected in institutions, policies, regulations, and balance sheets that help (i) identify fiscal and financial sector vulnerabilities, (ii) reduce key vulnerabilities to minimize their economic impact, (iii) improve the adaptability of social protection systems to shocks, and (iv) expedite recovery.

Source: Independent Evaluation Group.

Purpose of the Evaluation

The purpose of this evaluation is to assess Bank Group support to client countries to enhance their preparedness for shocks through the systematic identification of fiscal and financial sector vulnerabilities as well as Bank Group support in addressing those vulnerabilities. The evaluation also aims to assess the extent to which the Bank Group has proactively supported improvements in client country safety nets so that they can be effectively and efficiently expanded in a crisis. It focuses on the period between 2010 and 2019 and aims to inform the design of future Bank Group strategies, operations, diagnostics, and knowledge products.

The evaluation covers the International Bank for Reconstruction and Development, the International Development Association (IDA), the International Finance Corporation (IFC), and the Multilateral Investment Guarantee Agency and asks five questions. Given the criticality of country context for macrofinancial country preparedness, these questions will be answered in large part drawing on carefully selected, designed, and implemented case studies within a broader conceptual framework (figure 1.1), a detailed theory of change, reviews of relevant project and knowledge product portfolios, existing project-level and country-level evaluative evidence, and a targeted literature review. The literature review included past IEG and International Monetary Fund (IMF) evaluations related to macroeconomic crises; a review of relevant World Bank diagnostics; and corporate- and country-level semistructured interviews with World Bank, IFC, Multilateral Investment Guarantee Agency, and IMF staff, and other development partners as appropriate (appendix B).

The report is organized as follows: Chapters 2–4 present the main findings on identifying vulnerabilities, reducing vulnerabilities, adapting social safety nets for future crises, and preparing the World Bank for future crises. Chapter 5 provides concluding remarks and resulting lessons.

The following list groups the key questions asked by this evaluation.

- Identifying vulnerabilities:

- Did the Bank Group undertake the right analysis and diagnostic work on client countries at the right time to identify major fiscal and financial sector vulnerabilities?

- Did the Bank Group clearly and candidly identify key country-specific fiscal and financial sector vulnerabilities and needed reforms to social safety nets to improve responsiveness in its analytical work and policy dialogue?

- Responding to vulnerabilities: How did the Bank Group follow up to help client countries address identified fiscal and financial sector vulnerabilities?

- Reducing vulnerabilities: Were Bank Group efforts to help clients reduce key fiscal and financial sector vulnerabilities and develop mechanisms and frameworks for crisis management and social protection successful? In providing support, did the Bank Group coordinate effectively with key development partners, particularly the IMF?

- Preparing the Bank Group for crises: How well prepared was the Bank Group (in terms of staffing and incentives) to identify key fiscal and financial sector vulnerabilities and help clients address them promptly?

Figure 1.1. Conceptual Framework Guiding the Evaluation

Note: ASA = advisory services and analytics; DeMPA = Debt Management Performance Assessment; DSA = Debt Sustainability Analysis; FSAP = Financial Sector Assessment Program; IFC = International Finance Corporation; PEFA = Public Expenditure and Financial Accountability; SCD = Systematic Country Diagnostic.

The evaluation employed mixed methods. The main approach was case study analysis, including cross-cutting syntheses of thematic or sector issues and findings from individual case studies. Seven field-based case studies were conducted of Bank Group client countries, reflecting diverse country circumstances, country vulnerabilities, and experience with exogenous shocks, and diversity by region and income level. The countries selected were Bangladesh, Benin, Jamaica, Morocco, Mozambique, Tajikistan, and Ukraine. The evaluation draws on evidence from multiple sources: extensive document reviews, existing evaluative evidence, semistructured interviews with more than 200 stakeholders, and analysis of quantitative data (for more on methods, see appendix A and IEG 2019).

- This applies to small states vulnerable to natural disasters and low-income countries that meet a frequency criterion (two disasters every three years) and economic loss criterion (above 5 percent of GDP per year), based on the EM-DAT database for the period 1950–2015.

- The global financial crisis reduced the long-run growth path of many countries by between 4 and 8 percent and increased the number of poor people by 64 million (Chen and Ravallion 2009; World Bank 2010b), rolling back earlier gains on growth and poverty reduction. Banking crises alone resulted in an average increase in unemployment of 7 percentage points, an average drop in output of more than 9 percent (Reinhart and Rogoff 2009), and a decline in the incomes of poor people of more than 10 percent, while currency crises have had detrimental impacts on the income of poor people of about 15 percent (Rewilak 2018).

- World Development Report 2014, on risk, emphasizes the importance of preparedness, which includes intelligence, protection, and insurance (World Bank 2013).