Paying for Results - Does Results-Based Lending Work?

What do we know about the effectiveness of the Program-for-Results (PforR) instrument in direct support of government programs?

What do we know about the effectiveness of the Program-for-Results (PforR) instrument in direct support of government programs?

By: Caroline HeiderIsmail Arslan

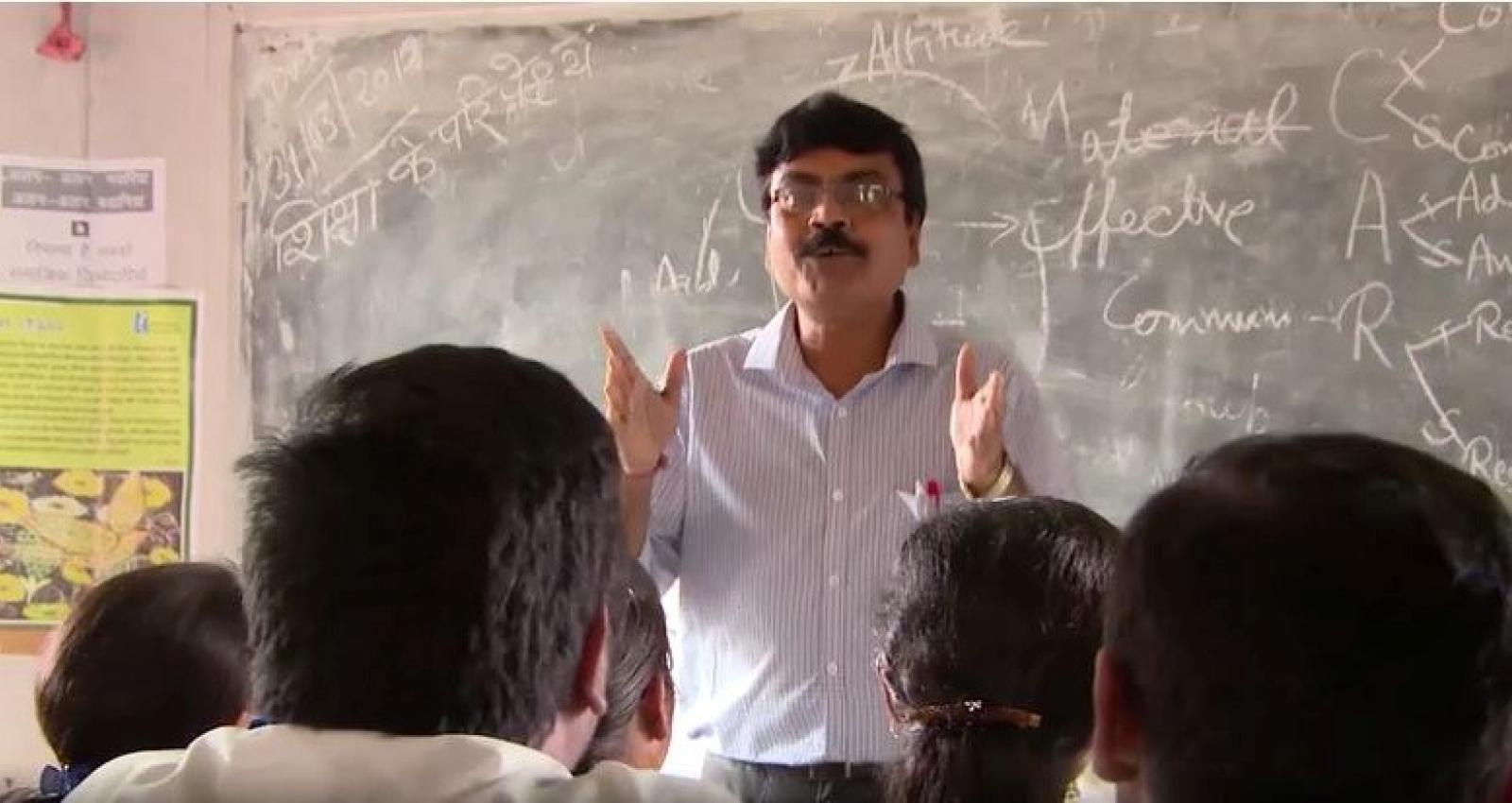

Since the early 2000’s, and at different stages, the Bank has experimented to various degrees with the use of results-based mechanisms in its programs and projects, particularly in the areas of health, nutrition, population, education, and social protection.

Since the early 2000’s, and at different stages, the Bank has experimented to various degrees with the use of results-based mechanisms in its programs and projects, particularly in the areas of health, nutrition, population, education, and social protection.

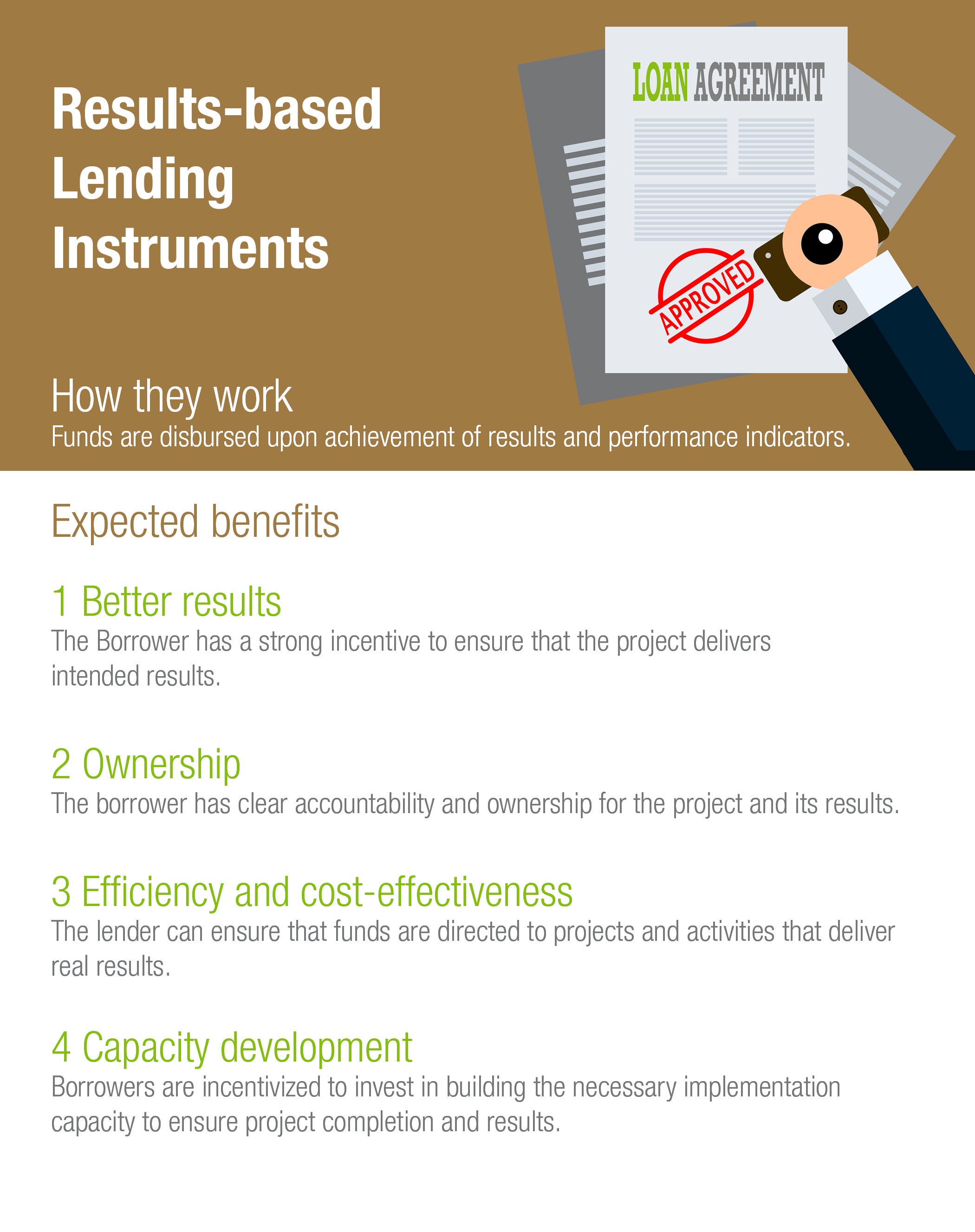

As part of a larger trend within the development community, the World Bank has in recent years sought to expand its use of results-based financing. In 2012, the Bank launched the Program-for-Results (PforR) instrument in direct support of government programs, tying disbursements to achievement of intended program results. Initially up to 5 percent of Bank-lending could go towards these programs; in 2015, this aggregate limit was raised to 15 percent.

The Bank is not alone in this regard. Only last week, the UK’s Department of International Development announced plans to expand the use of results-based development aid to cover up to 30 percent of its funding, following a comprehensive review that assessed the performance of DFID’s main multilateral and bilateral development aid partners. Other donors such as the USAID and the Asian Development Bank are also in the process of implementing similar results-based financing models.

So what do we know about the effectiveness of this new approach, relative to other more traditional development aid approaches?

In a recent IEG evaluation, we assessed the early World Bank’s experience with the program-for-results instrument. While it’s still too early to draw any definite conclusions, there are some important lessons and insights that could inform the work of the World Bank, other development partners and governments looking to use the ‘pay-for-results’ model.

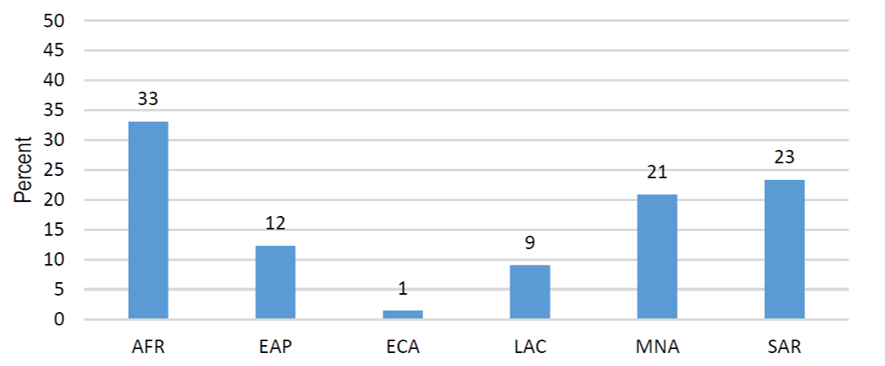

As of March 31, 2016, the World Bank had approved a total of 39 PforR operations, providing $9.4 billion of Bank financing to support a total of $49.9 billion in government programs, with an additional 21 operations under preparation (having completed the concept stage), totaling US$5.4 billion in expected Bank financing.

Given that none of the operations in the Bank’s PforR portfolio has closed, it would have been premature to try and assess their development outcomes. However, in terms of program design, strengthening results frameworks, ensuring borrower ownership, capacity building, partnering with other donors, and improving upfront program preparation quality, PforR programs compare favorably against the World Bank’s other instruments.

Based on the experience so far, PfoR operations cost about the same as other lending instruments to prepare, and they cost significantly more to supervise. These costs may well come down over time, as Bank staff and government counterparts gain more experience with the instrument.

The PforR Portfolio (percent of operations)

By Region (By amount as of March 31, 2016)

IEG’s evaluation identifies a number of opportunities to strengthen further the performance of PforR operations, based on the World Bank’s early experience with its PforR instrument. We highlight three of them below.

Add new comment