A Focused Assessment of the International Development Association’s Private Sector Window

Chapter 1 | Background and Context

The Private Sector Window (PSW) is a blended finance mechanism that the World Bank Group introduced in 2017 to jumpstart private investment in International Development Association (IDA) countries and fragile and conflict-affected situations.

By partially mitigating the risks of the two agencies of the Bank Group that provide investment and insurance services to the private sector—the International Finance Corporation (IFC) and the Multilateral Investment Guarantee Agency (MIGA)—the PSW makes IFC and MIGA transactions possible in IDA countries and fragile and conflict-affected situations.

Key features of PSW projects—concessionality and financial and nonfinancial additionality—are expected to enable PSW transactions to materialize and to create the conditions for market development.

The evaluation answers two main sets of questions. The first inquires about IFC’s and MIGA’s usage of the PSW and early evidence on its potential market development effects. The second asks whether concessionality and financial and nonfinancial additionality have enabled PSW transactions to take place and have potential market development effects, whether the IDA capital is adequately leveraged, and whether financial reporting on the PSW is adequate for decision-making purposes. The evaluation examines PSW projects from fiscal years 2018 to 2023.

We triangulated data from qualitative and quantitative sources to answer the evaluation questions. The evaluation methods include a literature review; PSW portfolio analysis; an analysis of concessionality, capital provisioning, and financial reporting; semistructured interviews with IDA, IFC, and MIGA staff, experts, and clients; econometric work; and four country case studies. The evaluation aims to update the Independent Evaluation Group’s 2021 early-stage assessment of the PSW and to complement the 20th Replenishment of IDA PSW Mid-Term Review. It is part of the Independent Evaluation Group’s Maximizing Finance for Development workstream and complements related Independent Evaluation Group evaluations.

This evaluation has limitations. Because only 20 (out of 220) PSW projects have closed, it is based on a mix of ex ante and (limited) ex post evidence. We assess intermediate outcomes of the PSW, such as the impact of the PSW on IFC and MIGA’s ability to enter new markets and sectors, but we do not assess the final outcomes or impacts of PSW projects.

The private sector creates jobs and prosperity in the poorest countries, but developing it is challenging. The private sector plays a substantial role in countries eligible for the Private Sector Window (PSW): International Development Association (IDA) countries and fragile and conflict-affected situations (FCS) in IDA. It provides 90 percent of jobs and is the largest source of income for people living in IDA countries, in turn contributing to poverty reduction (World Bank 2017). However, attracting private capital and developing the private sector in low-income and fragile countries is challenging (World Bank 2016). In many PSW-eligible countries, the domestic private sector is small, informal, and constrained by a weak macroeconomic and regulatory environment, infrastructure bottlenecks, and a limited skilled labor force. High country risks and capital flight concerns make domestic and international investors reluctant to engage, particularly in FCS, which also experience security risks. As a result, the ability of PSW-eligible countries to attract private investment and grow the local private sector remains limited, constraining their development.

Blended finance, which mixes public development resources with private funds, can help attract private investment and grow the local private sector in developing countries, in turn giving them an opportunity to reach several Sustainable Development Goals (SDGs). Blended finance was created with the assumption that concessional finance for private sector projects is a valuable tool that development finance institutions (DFIs)—in cooperation with donors and other development partners—can use to implement the Addis Ababa Action Agenda for financing development, including addressing the SDGs and climate commitments under the Paris Agreement. Meeting these goals requires substantially more financing than official development assistance and multilateral development banks can provide. The development community needed to design approaches that would significantly increase private capital mobilization and the scale of sustainable private sector activity. In that context, blended finance emerged as a technique for deploying public development resources to improve the risk-return profile of individual DFI investments in developing countries. The goal was to “blend” these investments with commercial, private financing to show the viability of projects and build markets that could, over time, attract further commercial capital for development (OECD 2018).

Blended finance is expected to support development, crowd in commercial funds over time, address challenges that the private sector faces in poor countries, and promote governance, environmental, and social standards. According to the DFI Working Group on Blended Concessional Finance for Private Sector Projects (DFI Working Group 2021), blended finance should be structured around five guiding principles. The first principle (rationale) is that using blended concessional financing should make a contribution beyond what is available in the market. The second (crowding in and minimum concessionality) is that DFI support should contribute to catalyzing market development and mobilizing private sector resources while minimizing the use of concessional resources. The third principle (commercial sustainability) is that the interventions must be sustainable, contribute to commercial viability, and revisit the level of concessionality over time. The fourth (reinforcing markets) is that projects should be structured to effectively and efficiently address market failures and minimize the risk of market distortion or crowding out of private finance. The fifth principle (promoting high standards) is that DFIs should promote high standards in their clients, including in the areas of corporate governance, environmental impact, and social inclusion.

The IDA Private Sector Window

To jumpstart private investment and growth in IDA countries, the Board directed IDA, the International Finance Corporation (IFC), and the Multilateral Investment Guarantee Agency (MIGA) to introduce the IDA PSW. In PSW-eligible countries, the private sector is reluctant to invest because of high risk, which is driven by several constraints, including (i) limited financing, particularly long-term and local currency financing; (ii) disruptions caused by exogenous factors, such as the trade disruptions triggered by the COVID-19 pandemic; and (iii) unfavorable business environments created by difficult macroeconomic conditions and regulatory constraints on investing or operating a business. IDA, IFC, and MIGA, as well as other development partners, aim to address these constraints by supporting policy changes to (among other things) stabilize the macro conditions, improve the business environment, and develop capital markets. The IDA PSW was conceived as an additional tool that the World Bank Group could deploy to help address these challenges, with a specific focus on partially mitigating the risks and potential losses of IFC and MIGA when they conduct high-risk transactions in IDA and FCS countries. One feature of PSW projects—concessionality—enables PSW transactions to materialize. Two additional features—financial and nonfinancial additionality—are expected to create the conditions for market development. The PSW was created in recognition that expanding support to the private sector is critical for helping IDA, IFC, and MIGA advance the IDA special themes—climate change; fragility, conflict, and violence; gender; governance and institutions; and jobs and economic transformation.1

The PSW comprises four facilities. These are the Blended Finance Facility (BFF), the Local Currency Facility (LCF), the MIGA Guarantee Facility, and the Risk Mitigation Facility (RMF). Table 1.1 provides a brief description of the facilities and their objectives, the instruments they use, and how the PSW works under each facility. Although each facility has its own design and focus, they are managed collectively by IDA using a portfolio approach to reflect the overall objectives of the PSW; each investment is assessed and approved based on its contribution to broader annual objectives rather than on a stand-alone basis (World Bank 2017). Individual projects under the BFF, LCF, and RMF are managed by IFC, whereas MIGA manages the MIGA Guarantee Facility.

The selection of PSW projects has three eligibility criteria, including the blended finance principles. The first eligibility criterion is that PSW resources are limited to (i) IDA only, (ii) fragile or conflict-affected IDA gap and blend countries, and (iii) select subnational areas in countries experiencing fragility (World Bank 2017). Temporary and transition eligibility was later granted to select IDA countries. (Appendix A lists the PSW-eligible countries.) The second eligibility criterion is that PSW-supported activities need to be aligned with IDA’s poverty focus and special themes, the Bank Group’s country strategies, and the Bank Group’s approach to supporting private sector investments and creating markets. The third eligibility criterion is that projects that use PSW funds (and blended finance projects more broadly) should aim at maximizing additionality and market sustainability while minimizing concessionality, by following the five blended finance principles outlined in chapter 1.

Table 1.1. PSW Facilities

|

PSW Facility |

Instruments |

PSW Objectives |

Example of How the PSW Works |

|

Blended Finance Facility |

Guarantees, equity, and senior and subordinated loans alongside IFC investments. |

Support IFC-led, high-impact pioneering investments across sectors, such as SME finance and agribusiness—and possibly pioneering investments in other key sectors, such as manufacturing, social sectors, energy access, distributed power generation, and telecommunications and technology—and local entrepreneurship through funds. |

In the case of guarantee instruments, the Blended Finance Facility provides IFC with loss protection up to an amount agreed on for each transaction or pool of transactions. For example, on a 40% pooled first-loss guarantee, IDA will take all losses up to 40% of the amount of the portfolio on a pool of loans to banks and microfinance institutions in multiple countries that on-lend to MSMEs at market rates. If the banks or microfinance institutions default on their repayment obligations to IFC, IFC will call on the IDA guarantee, and IDA will transfer funds to IFC. The IDA guarantee can continue to be called until losses exceed 40% of the pooled portfolio. After that, all losses are on IFC’s account. The loss absorption by IDA enables IFC to reduce its loss given default and, in turn, to reduce its prices to clients. |

|

Local Currency Facility |

Provides hedging for local currency IFC loan exposures. |

Allows IFC to provide financing in local currency in PSW-eligible countries where local currency solutions are underdeveloped or missing, targeted to markets in which currency hedging options are absent or very limited. |

IFC converts US dollars into local currency at the spot rate and lends this amount to its client. The client repays the loan in local currency, and IFC converts the repayments into US dollars at the spot rate at the time the payment is received and remits that US dollar amount in exchange for the preagreed US dollar payment from IDA. This arrangement removes all foreign exchange risk for IFC. IDA meanwhile retains this foreign exchange risk on its balance sheet. |

|

MIGA Guarantee Facility |

First-loss guarantees or risk-sharing agreements with IDA. |

Bridge gaps in the availability of coverage for MIGA-eligible noncommercial risks to crowd in private investment in PSW-eligible countries. |

IDA provides either a first-loss guarantee or risk sharing that reduces the amount of risk that MIGA is insuring (moving the risk from MIGA to the IDA balance sheet). This reduces the price of MIGA insurance to its clients and also reduces the risk for reinsurers (because IDA is now covering part of the risk), allowing MIGA to reinsure a larger percentage of project risks in IDA-only countries. |

|

Risk Mitigation Facility |

Political risk insurance and liquidity support guarantee. |

Project-based guarantees to crowd in private investment in infrastructure projects. |

We have not observed a substantial enough market for this product to be able to see how it works in practice (only one project has been approved to date under this facility). |

Sources: Independent Evaluation Group; World Bank 2021.

Note: IDA = International Development Association; IFC = International Finance Corporation; MIGA = Multilateral Investment Guarantee Agency; MSME = micro, small, and medium enterprise; PSW = Private Sector Window; SME = small and medium enterprise.

The PSW project approval process is consistent with IFC’s and MIGA’s approval processes with the addition of IDA representatives. IDA houses a PSW Secretariat that provides support during all stages of project approval (including concept review and internal approvals). A PSW Oversight Committee, consisting of a vice president each from IDA, IFC, and MIGA, provides strategic oversight on the use of the IDA PSW funds and addresses any controversial issues that might emerge at the project level.

The PSW is consistent with IFC’s and MIGA’s strategies and aims to help them achieve their transaction targets in PSW-eligible countries and to contribute to achieving the outcomes of the IDA special themes. The IFC 3.0 strategy encompasses tackling private sector challenges by creating markets and mobilizing private capital, including a commitment as part of the capital increase package to deliver 40 percent of IFC’s overall transactions in IDA countries and FCS and 15–20 percent in low-income IDA and FCS countries by fiscal year (FY)30 (IFC 2023). MIGA’s FY21–23 strategy has a target to increase the share of MIGA guarantees in IDA countries and FCS to an average of 30–33 percent. IFC and MIGA consider the PSW an important tool that, together with other IFC and MIGA instruments and with Bank Group support for policy reforms, can contribute to creating markets and help IFC and MIGA meet their targets in IDA countries and FCS.

The PSW follows the One World Bank Group approach and, in its design, reinforces the importance of collaboration by combining the three institutions’ respective comparative advantages. The 2016 Forward Look and the 2018 International Bank for Reconstruction and Development and IFC Capital Packages underscored the importance of the Bank Group institutions working as “One World Bank Group.” This is operationalized through the Cascade approach, which urges the three Bank Group institutions to help countries maximize their development resources by using private financing and sustainable solutions from the private sector. IDA, the International Bank for Reconstruction and Development, IFC, and MIGA tackle constraints on private sector development from different perspectives based on their respective comparative advantages. In general, IDA provides sector knowledge, policy dialogue, and financial strength. In low-income countries, IDA provides a central platform for Bank Group support to the private sector through its work on improving regulatory quality, strengthening macroeconomic and structural policies, providing quality infrastructure, and improving labor market and skills policies (World Bank 2021). IDA can also directly support the private sector through lines of credit and guarantees backstopping government or state-owned enterprise payment and performance obligations. IFC provides direct investment in the form of equity, debt, and credit guarantees on commercial credit risks, as well as advisory services. In addition, IFC offers capabilities in project development, structuring, and mobilization platforms, along with its global client relationships (World Bank 2018). MIGA provides guarantees in the form of political risk insurance and credit enhancement to cover noncommercial risks. Furthermore, MIGA provides expertise in political risk, structuring, underwriting, pricing, claims management, reinsurance, and client relationships. All three institutions aim at direct financing (on the public or private side) and capital mobilization.

Evaluation Questions, Scope, and Methods

The evaluation answers two main sets of questions. The first inquires about the usage of the PSW funds and about early evidence of its potential market development effects. The second asks about the PSW’s enabling factors: concessionality (which enables projects to occur in the first place) and financial and nonfinancial additionality (which enable projects to create the conditions for market development).

- Usage and market development. Has the usage of the PSW enabled IFC and MIGA to adequately address challenges to private sector investment and increase the scope and scale of their portfolios in PSW-eligible countries? Is there any early evidence that PSW-supported investments are (or are not) creating the conditions that lead to market development?

- Enabling factors. Has concessionality enabled usage of the PSW? To what extent have the PSW subsidies followed the minimum concessionality principle (that is, the concessionality embedded in a financing package should not be greater than necessary to induce the intended investment)? Is IDA PSW capital adequately leveraged to increase usage? Is financial reporting on the PSW adequate for decision-making purposes? What types of financial and nonfinancial additionality features do PSW projects include? Have these features created the conditions for PSW transactions to have potential market development effects?

The evaluation looks at IDA PSW projects from FY18 to FY23. The evaluation assesses the PSW across three IDA cycles: the 18th Replenishment of IDA (IDA18), which covers FY18–20; IDA19, which was originally designed to cover FY21–23 but was revised after the start of the COVID-19 pandemic to cover only FY21–22; and IDA20, which was advanced by one year because of various crises and covers FY23–25. The evaluation covers both IFC and MIGA (because these two institutions originate the projects) and IDA, which provides the concessional support.

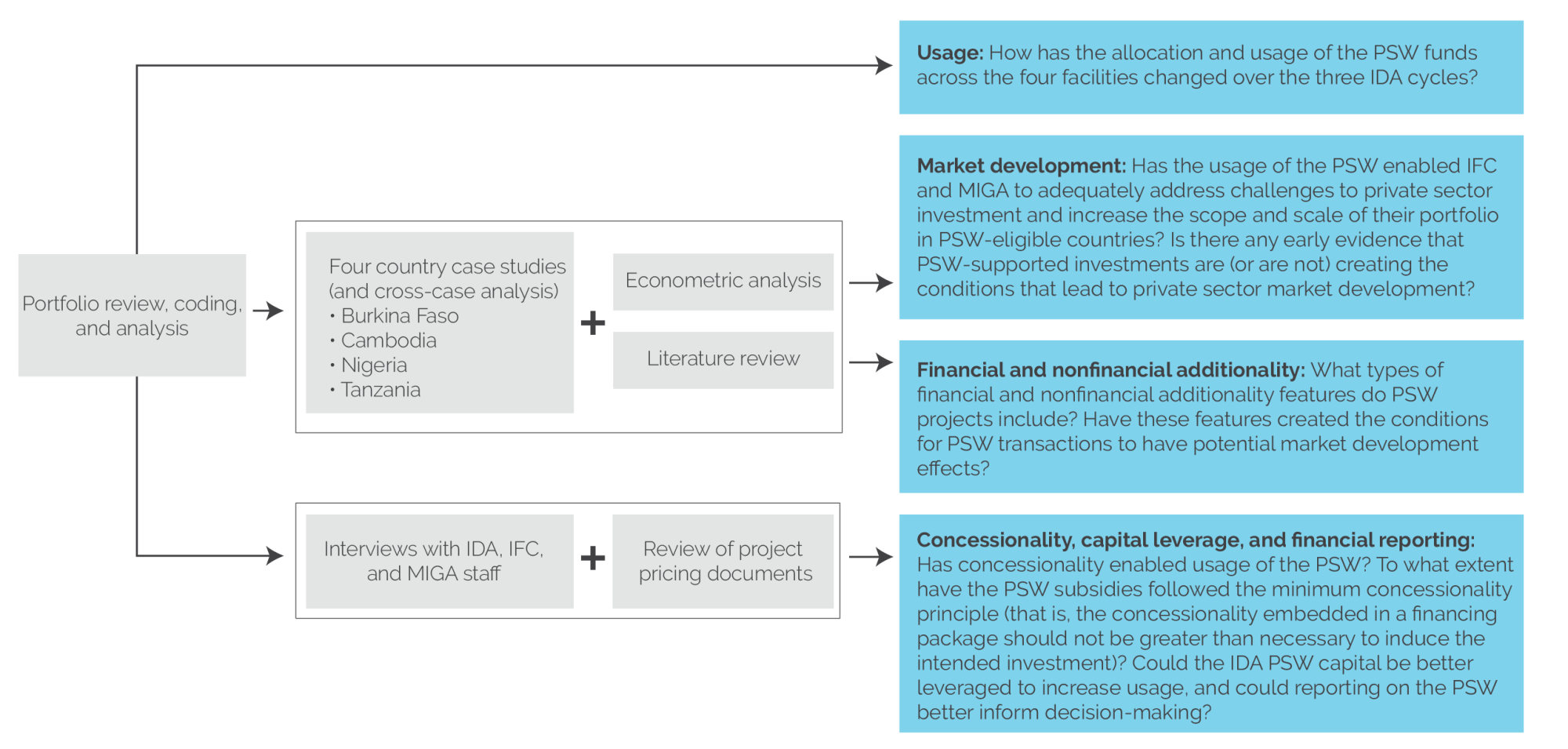

The evaluation used a mixed methods approach. The evaluation team triangulated data from both qualitative and quantitative sources to answer the evaluation questions. The evaluation methods include synthesizing findings from blended finance literature and internal document review, including pricing documents; PSW portfolio identification, review, and analysis; and semistructured interviews with staff, experts, and clients. The evaluation also includes econometric work, such as staggered difference-in-difference analysis and regressions on a one-to-many mapping of PSW and non-PSW projects, controlling for sectors and countries. The team also conducted four virtual country case studies (Burkina Faso, Cambodia, Nigeria, and Tanzania) to gauge how well the PSW projects fit within the overall country needs and whether they have resulted in addressing challenges to private sector investment. The portfolio analysis, econometric work, and analysis of concessionality provided quantitative insights into the PSW engagement, whereas the interviews, literature, and document reviews produced mostly qualitative insights. Figure 1.1 summarizes the methods used to answer the evaluation questions. Appendix B provides more details.

Figure 1.1. Methodological Overview—Evaluation Questions and Methods

Source: Independent Evaluation Group.

Note: IDA = International Development Association; IFC = International Finance Corporation; MIGA = Multilateral Investment Guarantee Agency; PSW = Private Sector Window.

The portfolio review and analysis are based on a portfolio of 220 Board-approved IFC and MIGA projects that PSW has supported since its inception. Of these, 189 have been committed or executed. This portfolio comprises 181 Board-approved IFC projects (161 committed) and 39 Board-approved MIGA guarantees (29 executed). In addition to this PSW portfolio, which the evaluation team obtained directly from IDA, IFC, and MIGA, the team also independently identified a portfolio of comparable non-PSW projects. This comparative portfolio was identified by matching PSW projects committed in a sector in a country with all non-PSW projects that were committed in the same sector of the same country in the period since the IDA PSW became operational. This matching technique was used only for the IFC PSW portfolio because the size of the MIGA PSW portfolio was too small for multivariate statistical analysis. Overall, 97 PSW-supported IFC projects matched 231 non-PSW IFC projects. (The comparative analysis is described in chapter 2, and further details on the matching methodology are available in appendix B.)

The evaluation has several limitations. Because only 20 (out of 220) PSW projects have closed, and none have been independently evaluated or validated by the Independent Evaluation Group (IEG), the evaluation is based on a mix of ex ante and (when available) ex post evidence. Ex post evidence is partial because it is based on case studies, portfolio supervision documents, and interviews. Our analysis of development outcomes is limited to intermediate outcomes. We have been able to assess, for example, the impact of the PSW on IFC’s and MIGA’s ability to enter new markets and sectors, expand their presence in existing markets, and mobilize third-party capital. We were, however, unable to assess the development outcomes and impacts of the PSW projects, which limits the scope of the analysis. Country case studies, which were selected based on several criteria, such as a high number of PSW projects (35 PSW projects in total in the four case study countries were reviewed) and the presence of comparator projects (appendix B provides further details), offer only some insights into the early impacts of PSW projects. We triangulated the country case studies with other evidence so we could generalize some of the findings to the entire portfolio. Our findings on scope and scale and the mobilization of third-party capital (chapter 2) are based primarily on ex post data. In contrast, our findings on the expected alignment with IDA special themes (detailed in chapter 2) are based on ex ante data. The concessionality analysis in chapter 3 is based on ex post data, whereas the findings on financial and nonfinancial additionality are based mostly on ex ante data. The econometric analysis also has limitations related to its technical aspects (such as not all PSW projects having a counterfactual match), but they do not affect the findings of the analysis (see appendix B).

Complementary Assessments: IEG’s 2021 PSW Early-Stage Assessment and the IDA20 PSW Mid-Term Review

This evaluation is preceded by a 2021 IEG early-stage assessment of the PSW and has been developed in parallel with the IDA20 PSW Mid-Term Review. IEG’s July 2021 report, The World Bank Group’s Experience with the IDA Private Sector Window: An Early-Stage Assessment (World Bank 2021), provided the first assessment of the PSW. It focused on the PSW pilot in the IDA18 cycle and covered the period FY18–20. The report assessed four dimensions of the PSW. The first was usage (funds committed for clients). The second was scope and scale—creating or developing new markets or sectors (scope) and increasing business in PSW-eligible countries and sectors with existing presence (scale). The third was concessionality, which is needed to make a PSW-supported investment commercially viable. The fourth was governance (the decision-making process used for the approval of PSW projects and for the PSW’s overall strategy). The IDA team has also recently completed the IDA20 PSW Mid-Term Review (DFCII 2023), which covers the IDA18, IDA19, and IDA20 cycles. The IDA20 PSW Mid-Term Review examines the PSW’s usage, scope and scale additionality, subsidy levels (concessionality), and lessons for operational enhancement (governance) of the PSW.

The findings of IEG’s 2021 early-stage assessment of the PSW (World Bank 2021) were mixed. The assessment found that, during the IDA18 cycle, the use of the PSW was $1.4 billion, well below the originally allocated amount of $2.5 billion, and that much of it was driven by the Bank Group’s COVID-19 response. It also found that IFC commitments and MIGA guarantees in PSW-eligible countries remained relatively stable compared with levels before the introduction of the PSW but that the PSW had some positive effects in allowing the two institutions to enter new markets and sectors. The concessionality assessment did not analyze whether the subsidies provided to PSW-funded projects were appropriate or distorted the markets. The analysis focused on the internal processes to review and approve the subsidies and found them appropriate (that is, the relevant units were involved in reviewing and approving the subsidies). Finally, the early-stage assessment found that the PSW’s distinct governance structure had not limited the usage of the PSW under IDA18 but recommended continuous monitoring of processing time and costs. (Appendix C includes a more detailed summary of the findings of the 2021 IEG assessment.)

The IDA20 PSW Mid-Term Review (DFCII 2023) provides an overall positive assessment of the PSW from its inception to 2023. The IDA20 PSW Mid-Term Review finds that the pace of PSW approvals has consistently grown since IDA18. Over the five years it has existed, the PSW has supported the expansion of IFC’s and MIGA’s activities, including entering frontier markets and sectors and encouraging and supporting economic transformation. PSW-supported transactions are generating jobs in PSW-eligible countries. Further, lessons learned continue to inform the implementation of the PSW, and the IDA PSW Mid-Term Review requests IDA Deputies’ views on operational enhancements to facilitate further realization of the PSW’s potential for development impact.

This evaluation aims to update IEG’s 2021 early-stage assessment and to complement both the 2021 IEG assessment and the IDA20 PSW Mid-Term Review. The evaluation updates IEG’s 2021 assessment by looking at the IDA19 and IDA20 cycles. It complements the IEG 2021 assessment and the IDA20 PSW Mid-Term Review by (i) looking at the potential for creating the conditions for market development of the PSW, (ii) providing counterfactual analysis to test some of the findings of the other two studies on usage and private capital mobilization (among others), (iii) providing an in-depth assessment of concessionality, and (iv) adding an analysis of financial and nonfinancial additionality.

This evaluation is part of IEG’s Maximizing Finance for Development workstream and complements other IEG evaluations in this area of work. These include “Creating Markets” to Leverage the Private Sector for Sustainable Development and Growth: An Evaluation of the World Bank Group’s Experience through 16 Case Studies (World Bank 2019), The World Bank Group’s Approach to the Mobilization of Private Capital for Development (World Bank 2020), and The International Finance Corporation’s and Multilateral Investment Guarantee Agency’s Support for Private Investment in Fragile and Conflict-Affected Situations, Fiscal Years 2010–21 (World Bank 2022c), as well as ongoing and upcoming evaluations on IFC Country Diagnostics, the Cascade approach, IFC platforms, and private capital facilitation.

The rest of the report addresses the two evaluation questions and provides recommendations. Chapter 2 focuses on the usage of the PSW, its potential to address constraints on private investment in target countries, and its potential market development (question 1 on usage and market development). Chapter 3 assesses how concessionality and financial and nonfinancial additionality influence the usage of the PSW, including potential market development effects (question 2 on enabling factors). Finally, chapter 4 concludes, provides recommendations, and suggests some areas for future analysis.

- For the 20th Replenishment of the International Development Association (IDA20) cycle, Human Development was added, the Governance and Institutions special theme was dropped (and governance became a cross-cutting issue), and the other four special themes remained the same. We did not analyze the Human Development theme, which was added only for IDA20, because only one year has passed in this cycle.