The World Bank Group’s 2018 Capital Increase Package

Chapter 2 | Priority Area 1: Differentiating Support across Client Segments

Highlights

The International Bank for Reconstruction and Development has fully implemented all of its commitments and is on track to achieve most of its targets for differentiating support across client segments.

This priority area has led to increased lending to countries below the graduation discussion income level; stable, but below-target, lending volumes to countries above the graduation discussion income level; and average lending volumes, including increased concessional lending, to small states.

The International Finance Corporation has made limited progress in this priority area. The International Finance Corporation’s financing volumes for low-income and fragile countries are not currently on track to meet their ambitious targets.

The International Finance Corporation has a well-defined approach to additionality in upper-middle-income countries, but it has not employed knowledge and innovation additionalities to a greater extent in upper-middle-income countries than in lower-middle-income countries.

The CIP’s serving all clients priority area, to differentiate the Bank Group’s support across client segments, is well aligned with the Forward Look’s objectives. The CIP’s policy measures capture all the key dimensions of the Forward Look’s objectives, including the Bank Group’s need to engage a wide range of clients in ways that respond to their diverse development challenges.

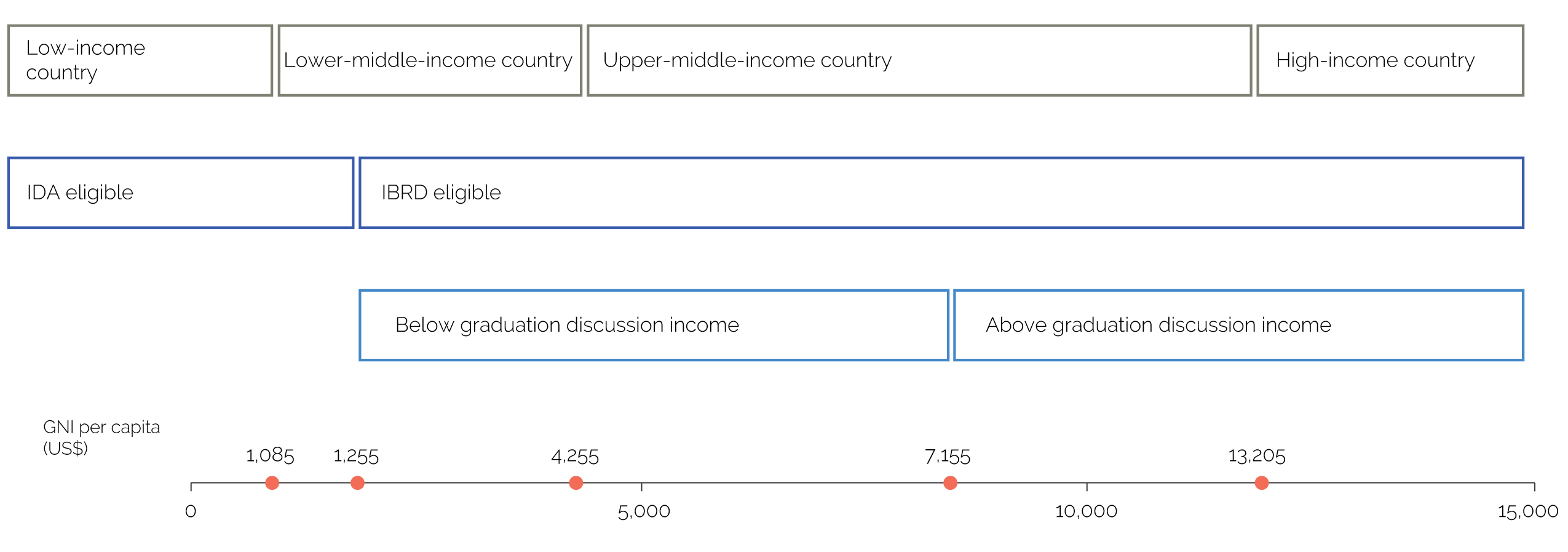

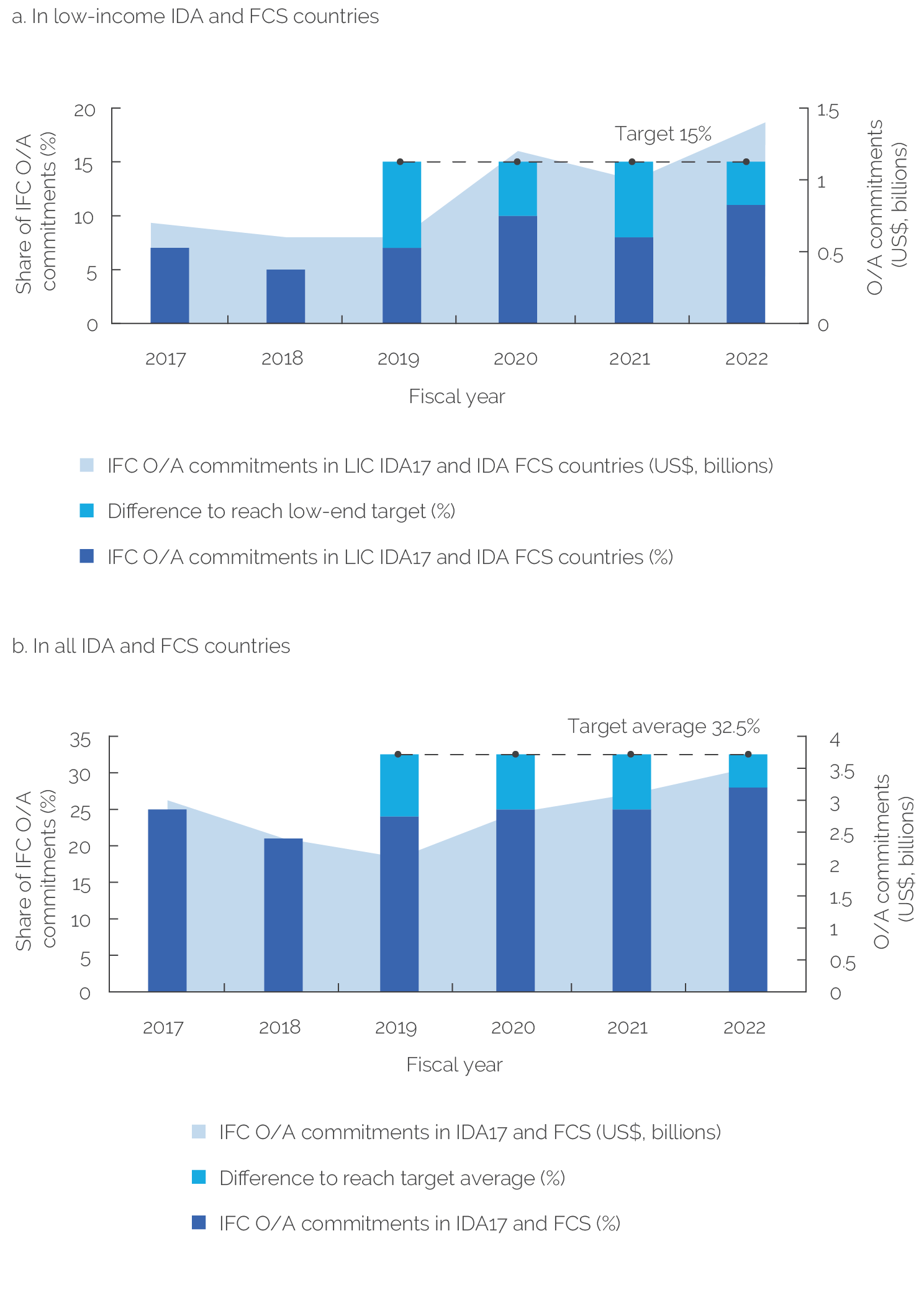

This priority area has 13 policy measures organized into three different country clusters (tables 2.1–2.4). IBRD’s country clusters include (i) low- and middle-income countries below the per capita GDI of $7,155, (ii) upper-middle-income countries (UMICs) with a per capita income above the GDI, and (iii) small states with populations below 1.5 million. (See figure 2.1 for income thresholds for these country groupings.) IFC’s policy measures were originally organized around the same country clusters, but with an additional distinction of IDA and FCS countries. However, starting in 2020, IBRD and IFC management implemented a reporting matrix that clarified the key commitments and targets, in consultation with Executive Directors. Starting with the 2020 annual implementation update, the annual CIP updates included CIP implementation status tables that reported on a subset of the original commitments and targets. The largest difference between the commitments in the original CIP Development Committee paper and those reported in the annual CIP updates is for IFC in the serving all clients priority area. Here, the simplified reporting matrix clarified that IFC’s implementation was to be tracked for IDA and FCS countries, rather than using the above- and below-GDI distinction. The revisions aligned IFC’s commitments in this priority area with its IFC 3.0 creating markets strategy, which focused more on IDA and FCS countries. IFC also revamped its CSC to align with the capital increase commitments as captured in the simplified reporting matrix. Accounting for the simplified reporting matrix’s revision, the validation identified 11 indicators, of which 4 are quantitative, to monitor these 13 policy measures.

Figure 2.1. IBRD Country Groupings

Figure 2.1. IBRD Country Groupings

Source: Independent Evaluation Group.

Note: GNI = gross national income; IBRD = International Bank for Reconstruction and Development; IDA = International Development Association.

The remainder of this chapter discusses, first, IBRD’s reporting on this priority area; second, its implementation of the priority area’s policy measures for below-GDI countries, above-GDI countries, and small states; and, third, IFC’s reporting and implementation on the priority area. The report finds that IBRD’s implementation was excellent and adequately reported, in part because its commitments were specific, achievable, and measurable. IFC has so far made more limited implementation progress, in part because its CIP commitments in this priority area were highly ambitious and the global environment has not been conducive to growing IFC’s investments in low-income and fragile countries.

Reporting

Whenever commitments and indicators in this priority area were specific, reporting has been satisfactory. Most of IBRD’s CIP commitments were specific and had clear and measurable indicators, its reporting covered most commitments, and the 11 reporting indicators were clearly linked to the commitments’ underlying objectives. Indicators focus on lending volume and do not assess qualitative aspects, such as the World Bank’s support for countries’ sustainable IDA graduation or enhanced coordination across Bank Group institutions. IFC’s monitoring and reporting, however, has some shortfalls. For example, IFC has reported on an indicator related to IFC additionality in above-GDI countries, but the indicator was not precisely formulated and did not do a good job of capturing progress toward the intended outcome. Similarly, IFC reported its commitment to promote a regional investment approach in middle- to upper-income small states as fulfilled but has not provided any further details.

IBRD Implementation for Countries below Graduation Discussion Income

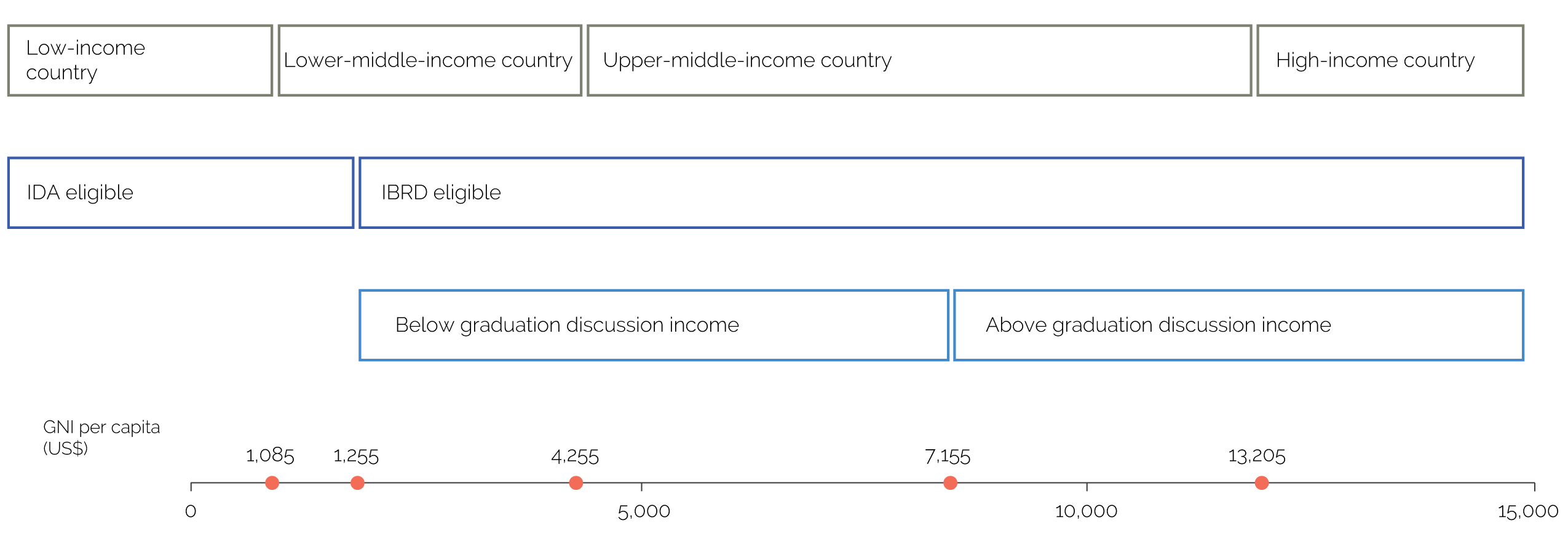

IBRD committed to increasing its financing to below-GDI countries. As shown in table 2.1, it has committed to a gradual and linear rise in its share of noncrisis lending to below-GDI countries to reach 70 percent by FY30. Its focus on noncrisis lending has meant that, during crisis situations, IBRD would have the flexibility to expand lending to above-GDI countries without breaking this commitment. IBRD has also targeted reaching a 67 percent lending share for noncrisis lending to below-GDI countries over the FY19–30 period, implying that under noncrisis circumstances, IBRD should lend relatively more to below-GDI countries and relatively less to above-GDI countries. However, when the lending terms of IBRD’s crisis buffer became the same as those for regular short-term lending,1 IBRD stopped separately tracking crisis and noncrisis lending volumes. As a result, progress on the originally defined indicator could not be validated. To achieve this commitment more generally, IBRD implemented differentiated loan pricing and single borrower limits on July 1, 2018, offering price discounts to below-GDI countries but no exemptions or discounts to above-GDI countries. Small states, FCS, and IDA-blend countries were exempted from this price increase.

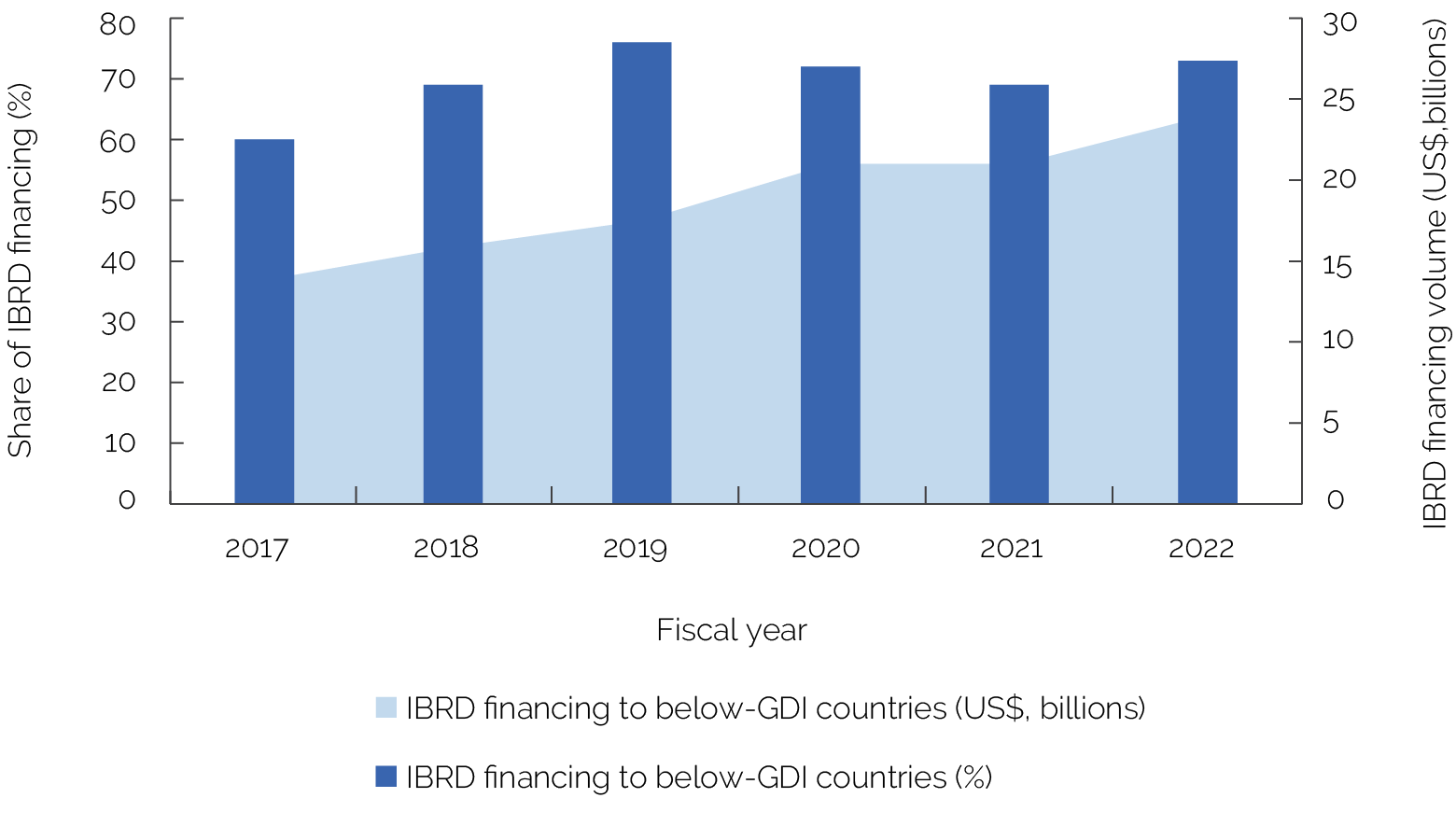

As a result of its CIP commitment, IBRD’s portfolio in below-GDI countries has grown steadily. It’s financing share for these countries grew from 60 percent in FY17 to 76 percent in FY19 and has remained above the target average of 67 percent in each of the past five years. Moreover, the cumulative financing for below-GDI countries remains on track to meet IBRD’s illustrative CIP target of $260 billion over the FY19–30 period (figure 2.2).

Table 2.1. CIP Policy Measures for IBRD for Countries below GDI

|

IBRD Policy Measures (below GDI) |

Commitments |

Indicators |

Targets |

|

IBRD will prioritize support to IDA graduates and new blends, aiming to make available resources to fully replace IDA financing for graduates. |

Prioritize IBRD support to IDA graduates and new blends aiming to make available resources to fully replace IDA financing for graduates. CIP main text. Underlined and in annex summary of the capital package. |

IBRD financing for recent IDA graduates relative to IDA financing before graduation. Limited reporting. |

100% replacement of IDA financing for IDA graduates. |

|

IBRD will increase noncrisis lending to MICs below GDI. |

Aim for a gradual and linear rise in IBRD share of noncrisis lending to countries below GDI. CIP main text. Underlined and in annex summary of the capital package. |

Percent of financing to countries below GDI. |

70% by FY30; average share of 67% over FY19–30. |

|

Increase cumulative IBRD financing to below-GDI countries. |

$260 billion cumulative IBRD financing to below-GDI countries over FY19–30 in nominal terms, $110 billion, or 70%, more than if no package. CIP main text. Not underlined but listed in annex summary of the capital package as “illustrative dollar numbers.” |

No indicator in CIP implementation status table. Reported in implementation updates narrative. |

$260 billion over FY19–30 in nominal terms. |

|

Higher SBL increase for countries below GDI. |

Higher SBL increase for countries below the GDI. CIP main text. Underlined and in annex summary of the capital package. |

Higher SBL increase for below-GDI than above-GDI countries introduced. |

Implemented (yes/no). |

|

Price discount for below-GDI countries, with blends and recent IDA graduates exempted from the price increase. |

Price discount for below-GDI countries and exemptions for blends and recent IDA graduates from the price increase. CIP main text. Underlined and in annex summary of the capital package. |

Price discount for below-GDI countries and exemptions for blends and recent IDA graduates implemented. |

Complete (yes/no). |

Source: Independent Evaluation Group.

Note: The bold text in the table was underlined in the CIP document to show that these were formal commitments. CIP = capital increase package; FY = fiscal year; GDI = graduation discussion income; IBRD = International Bank for Reconstruction and Development; IDA = International Development Association; MIC = middle-income country; SBL = single borrower limit.

Country-level data suggest that IDA graduation has not led to a decline in total World Bank lending for most IDA-blend and graduate countries. IBRD has committed to supporting IDA graduates and new IDA-blend countries by replacing 100 percent of their IDA financing with IBRD resources. IBRD used an aggregate indicator—IBRD financing for recent IDA graduates relative to IDA financing before graduation—to monitor progress on this commitment. The indicator, and this validation’s review of country-level data, indicates that IBRD lending has replaced IDA after most countries graduated from IDA, and if it was not replaced, it was mainly because (for various reasons) those graduate countries did not demand IBRD financing at the same volume that they had previously borrowed from IDA.

Figure 2.2. IBRD Financing to Countries below GDI

Source: Independent Evaluation Group.

Note: GDI = graduation discussion income; IBRD = International Bank for Reconstruction and Development.

IBRD Implementation for Countries above Graduation Discussion Income

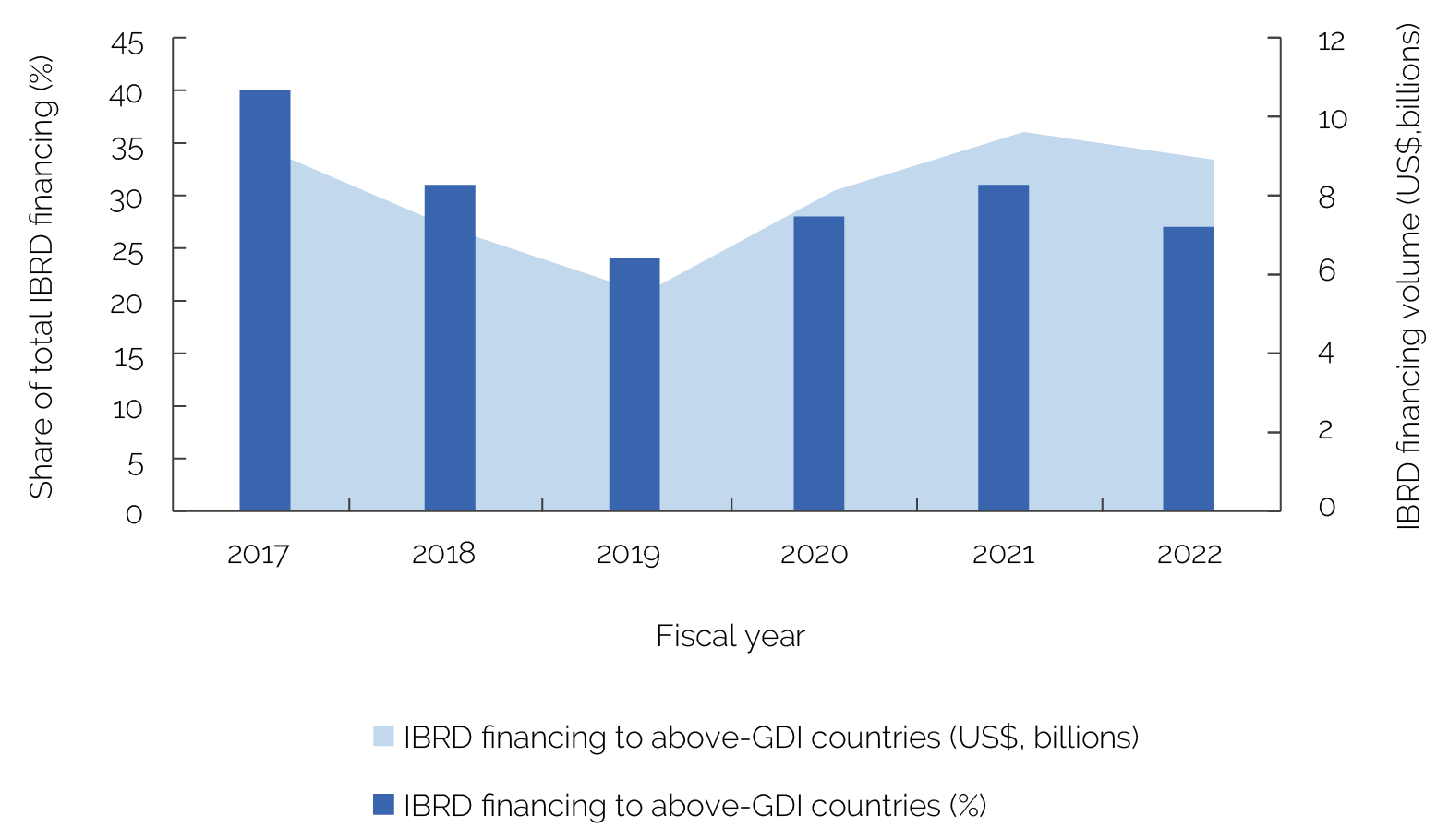

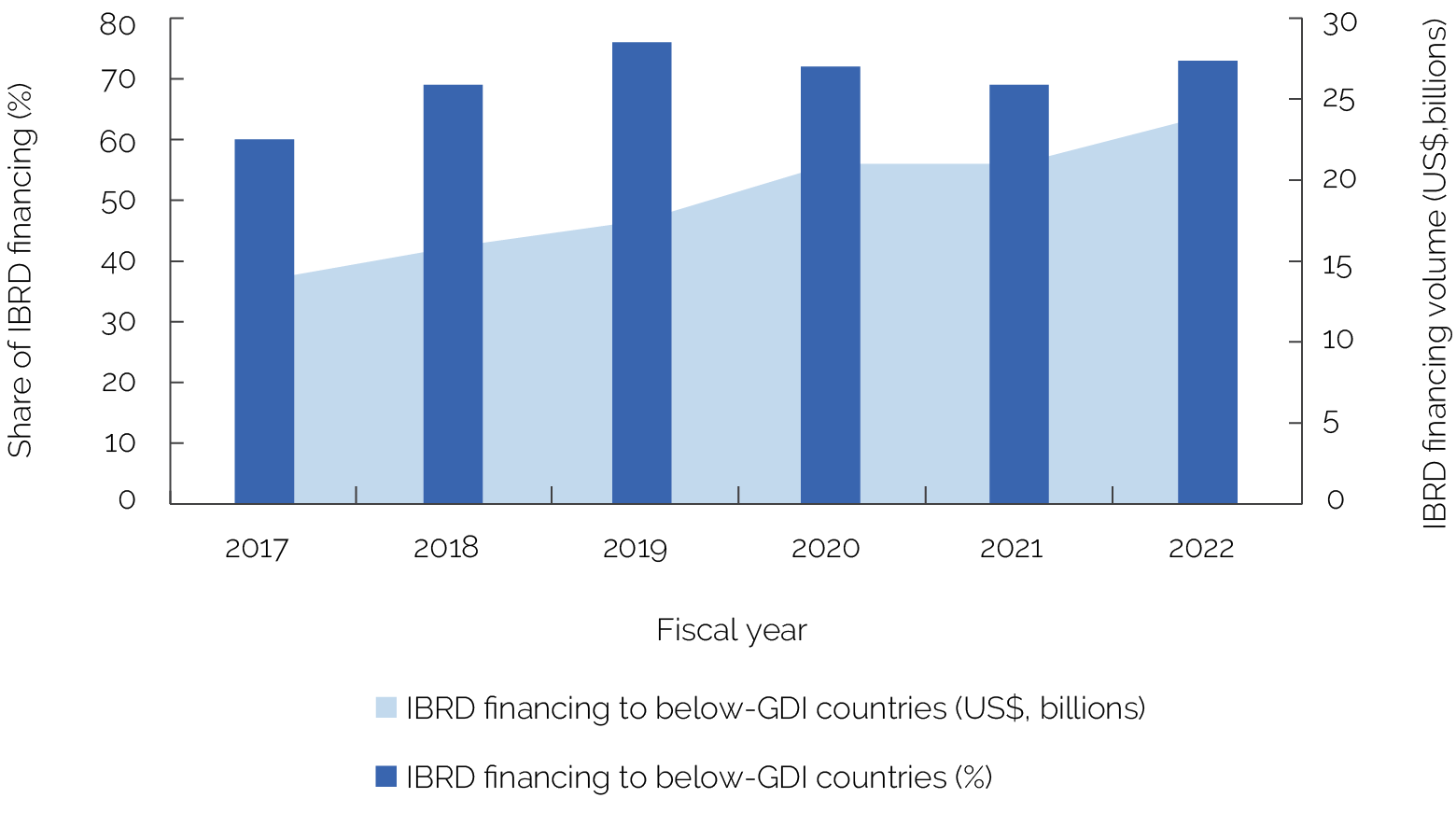

IBRD’s lending for UMICs, or above-GDI countries, has remained more or less stable, which is below the CIP’s indicative expectations. IBRD committed in the CIP to increase lending volumes for above-GDI countries and provided an indicative figure of $125 billion in cumulative noncrisis financing, in nominal terms, over the FY19–30 period (table 2.2). The main indicator used for this cluster, on updating Bank Group country engagement guidance, is insufficient to assess intended outcomes. As noted, IBRD has stopped distinguishing between crisis and noncrisis volumes; thus, it was not possible to validate this cluster’s result as it was originally defined. That being said, IBRD’s average total lending in the FY19–22 period has remained at $5.5–$9 billion, similar to the FY17–18 levels (figure 2.3). As such, its lending to above-GDI countries has not grown as expected by the CIP.

Table 2.2. CIP Policy Measures for IBRD Countries above GDI

|

IBRD Policy Measures (above GDI) |

Commitments |

Indicators |

Targets |

|

There will be a systematic analysis and assessment of the key elements of the IBRD graduation policy, reflected in CPFs and updated in Performance and Learning Reviews. |

Systematic analysis and assessment of the key elements of the IBRD graduation policy reflected in CPFs and updated in Performance and Learning Reviews of above-GDI countries. New IBRD activities will have a primary focus on interventions to strengthen policies and institutions required for sustainable IBRD graduation. Interventions will be focused on innovative solutions for boosting shared prosperity, delivering GPGs, and creating knowledge. CIP main text. Underlined and in annex summary of the capital package. |

SCD and country engagement guidance updated, and capital package agreement reflected in new CPFs for above-GDI countries. |

Implemented (yes/no). |

|

The policy package would enable IBRD to provide countries above the GDI $125 billion cumulative lending over FY19–30, or $40 billion (45%) more than without a package. It would also allow lending to the above-GDI countries for crisis response (which would be excluded from the lending share target). |

Provide countries above the GDI $125 billion cumulative lending over FY19–30 in nominal terms, or $40 billion (45%) more than without a package. CIP main text. Underlined and in annex summary of the capital package as “illustrative dollar numbers.” |

No indicator in CIP implementation status table. Not reported. |

$125 billion cumulative lending (noncrisis) over FY19–30 in nominal terms. $40 billion, or 45%, more than if no package. Combined with mobilization from private sector, the increase would reach $50 billion. |

Source: Independent Evaluation Group.

Note: The bold text in the table was underlined in the CIP document to show that these were formal commitments. CIP = capital increase package; CPF = Country Partnership Framework; FY = fiscal year; GDI = graduation discussion income; GPG = global public good; IBRD = International Bank for Reconstruction and Development; SCD = Systematic Country Diagnostic.

Figure 2.3. IBRD Financing to Countries above GDI

Source: Independent Evaluation Group.

Note: GDI = graduation discussion income; IBRD = International Bank for Reconstruction and Development.

Country engagement documents for above-GDI countries did not systematically focus on strengthening policies and institutions. IBRD committed in the CIP to systematically analyze and reflect on key elements of its graduation policy in country engagement documents for countries that reach the GDI. According to the CIP, new IBRD activities in above-GDI countries should focus on strengthening the policies and institutions needed to graduate from IBRD borrower status. To fulfill this commitment, the Bank Group updated its country engagement guidance in September 2018 and again in July 2021. This validation reviewed 15 country engagement documents approved since July 2021 for above-GDI countries and found that these documents did discuss strengthening policies and institutions, but not consistently or systematically (which might have been expected because of the CIP commitment and revised guidance). For example, most country engagement documents analyzed the country’s institutional challenges separately rather than as a cross-cutting issue pertinent to all thematic areas. An exception to this general trend was Uruguay’s Country Partnership Framework (CPF) for the period FY23–27. This CPF’s design emerged as a best practice because it used a cross-cutting institution-building lens to inform the country engagement’s three proposed high-level objectives. For instance, one of these objectives—to increase environmental outcomes and resilience to shocks—was informed by recent assessments on the country’s institutional capacity to meet its national and international climate change commitments.

CPFs in above-GDI countries did not consistently focus on innovation and knowledge creation. The capital package emphasized the need to create knowledge and provide focused and innovative solutions to the complex development challenges of above-GDI countries. In fact, drawing knowledge from operational experiences in above-GDI countries and other UMICs to share with other countries is a core element of the Bank Group’s value proposition. However, IBRD has not reported on this policy measure with indicators or qualitative narratives. This validation’s review of the 15 above-GDI country engagement documents found that these countries’ CPFs have limited emphasis on innovation, knowledge creation, and demonstration effects. Thus, there is limited explicit evidence that IBRD programs in these countries have made the recommended shift.

IBRD Implementation for Small States

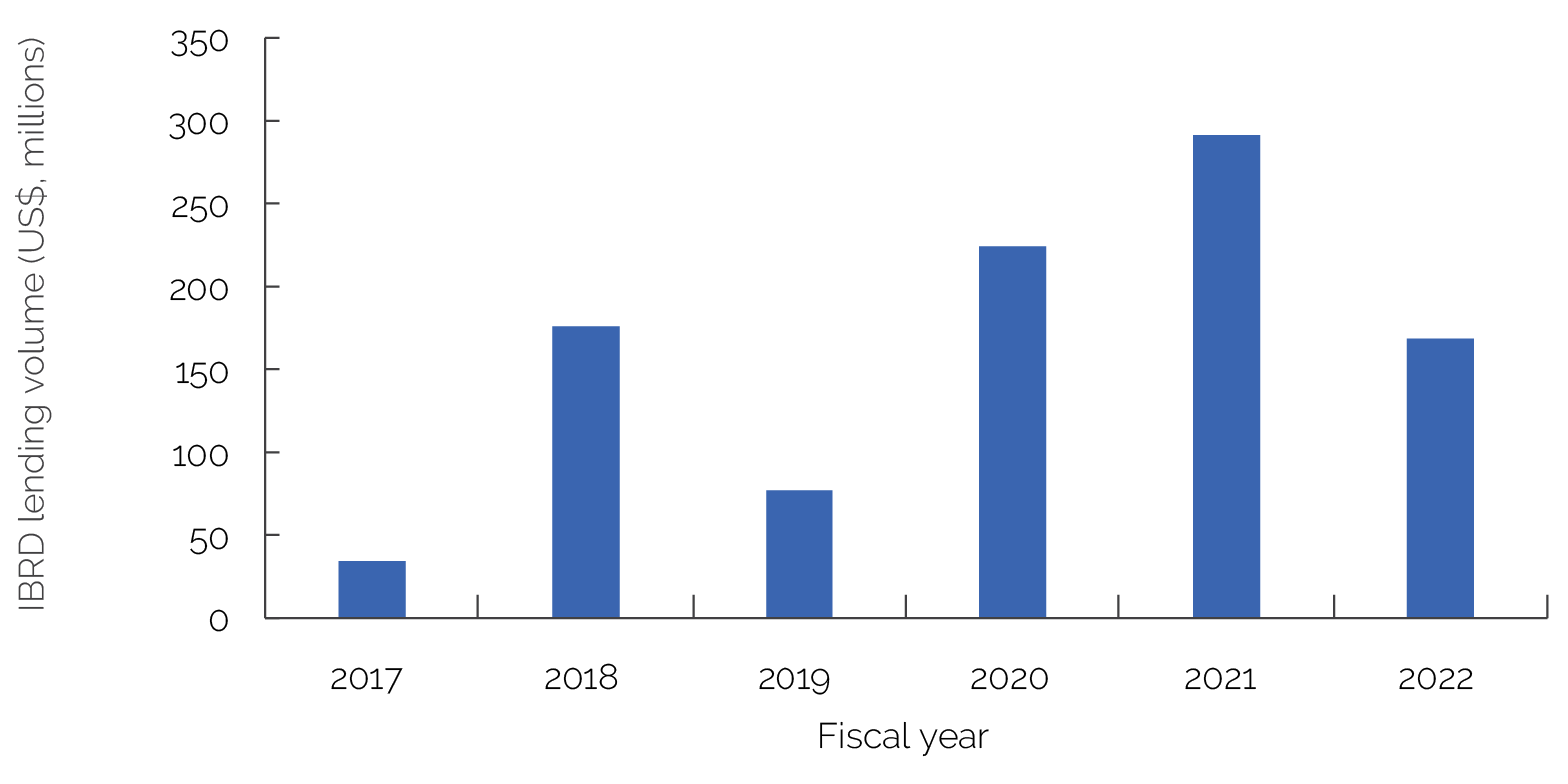

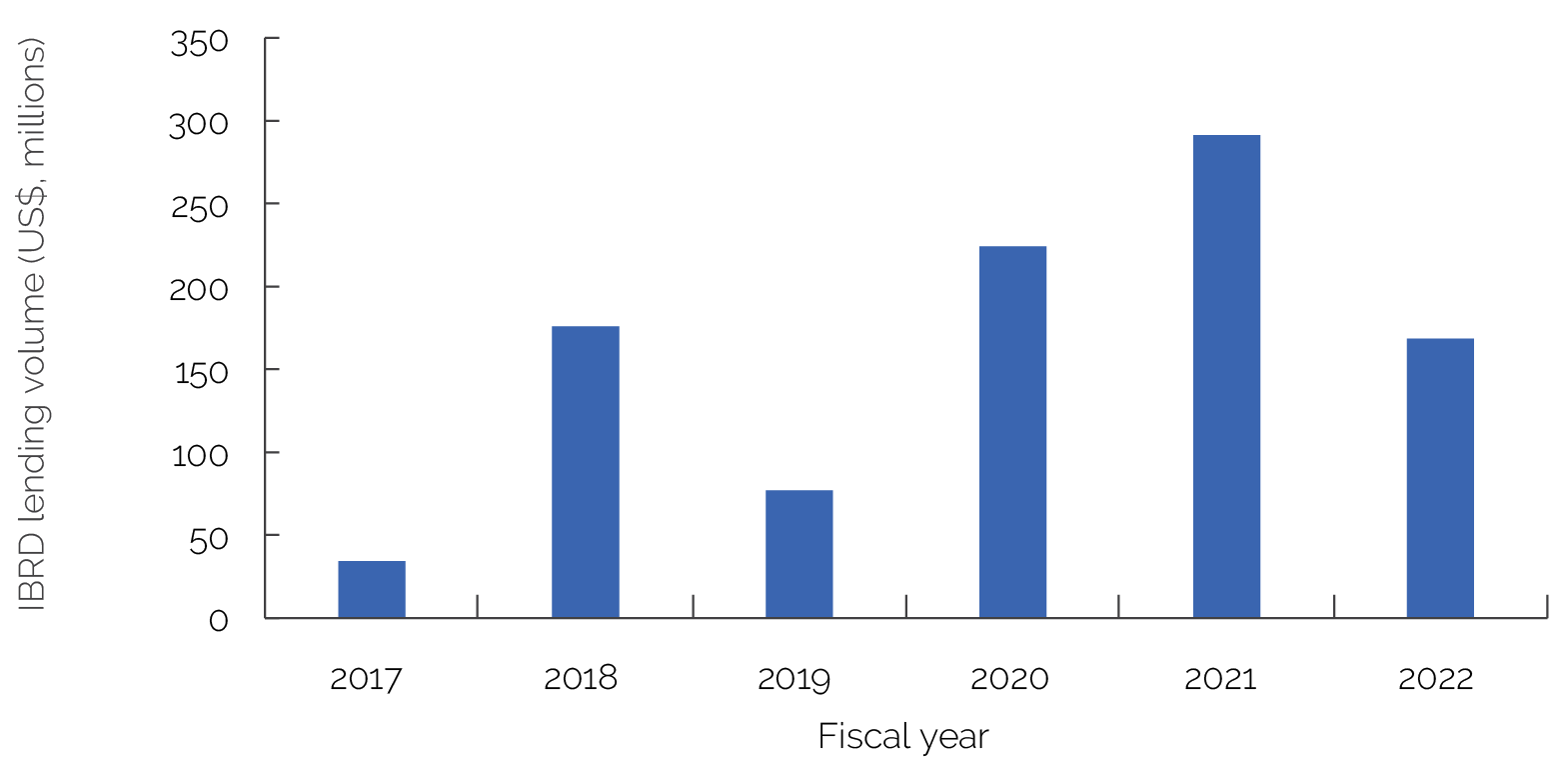

IBRD has met its CIP commitments to small states. The CIP included two very specific policy measures to enhance IBRD’s support to small states, including an increase in the base funding allocation to these countries and a waiver from IBRD’s price increase for these countries (table 2.3). These measures, which went into effect in FY19, increased IBRD’s concessionality for small states and recognized these countries’ vulnerabilities and unique development challenges. These changes led to an increase in average lending volumes for small states (figure 2.4). In fact, they were so effective that they compelled some small states that had stopped borrowing from IBRD to resume borrowing.

Table 2.3. CIP Policy Measures for IBRD Lending to Small States

|

IBRD Policy Measures for Small States |

Commitments |

Indicators |

Targets |

|

IBRD base allocation for small states will be doubled, subject to prudential limits. |

Double IBRD base allocation for small states, subject to prudential limits. CIP main text. Underlined and in annex summary of the capital package. |

Base allocation for small states doubled. Reporting inconsistency. Initially, results were reported aggregated by IDA cycle, and since fiscal year 2020, annual lending volumes were reported. |

Complete (yes/no). |

|

Small states will be exempted from the proposed maturity premium increase. |

Exempt small states from the IBRD price increase. CIP main text. Underlined and in annex summary of the capital package. |

Small states are exempt from capital package pricing increase. |

Complete (yes/no). |

Source: Independent Evaluation Group.

Note: The bold text in the table was underlined in the CIP document to show that these were formal commitments. CIP = capital increase package; IBRD = International Bank for Reconstruction and Development; IDA = International Development Association.

Figure 2.4. IBRD Lending to Small States

Source: Independent Evaluation Group.

Note: IBRD = International Bank for Reconstruction and Development.

IFC Implementation

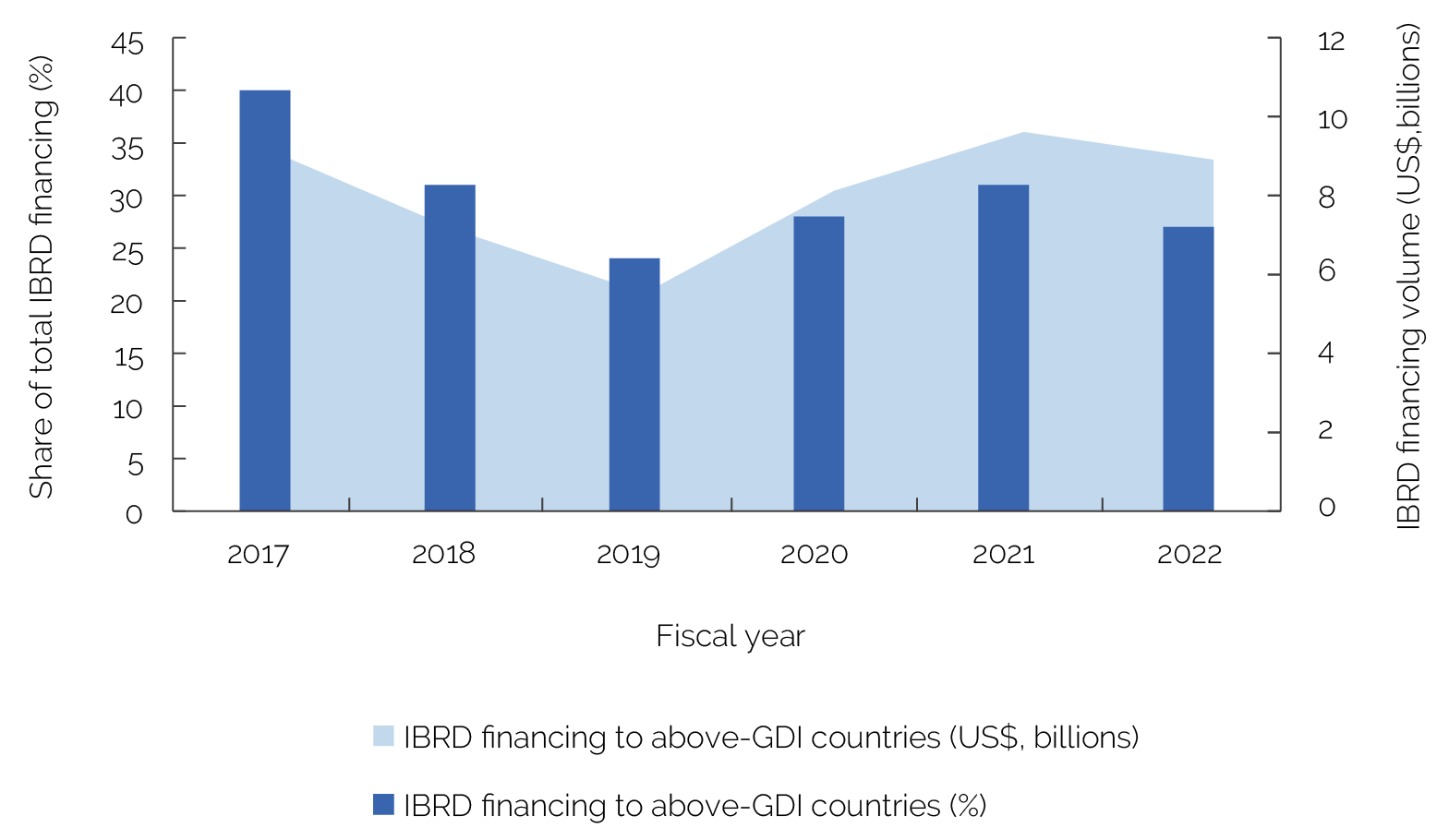

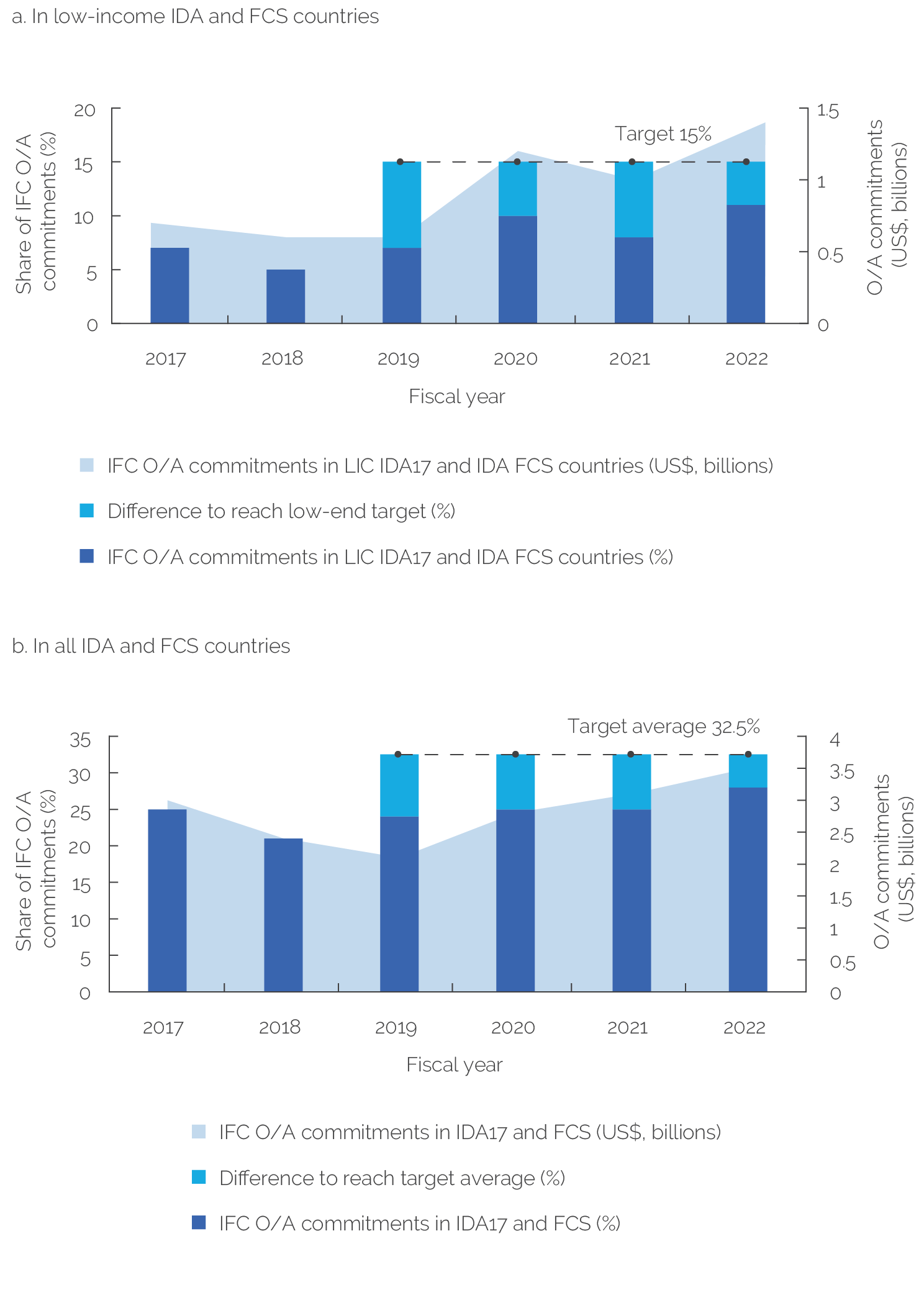

IFC investment shares in IDA and FCS countries have not grown as expected, despite IFC’s efforts to increase financing to these countries. Table 2.4 shows IFC’s commitments and targets. IFC’s financing to low-income countries in the 17th Replenishment of IDA and IDA FCS countries has fluctuated around an upward trend since FY19 but averaged 9 percent as a share of its long-term own-account financing, which is below its low-end target for FY26 of 15 percent (figure 2.5, panel a). This means that to reach its lower-end target by 2026, IFC investments in these countries would have to increase by one percentage point annually. IFC has also made less than expected progress on increasing its share of long-term finance from own-account in the 17th Replenishment of IDA and FCS countries to on average 32.5 percent over the FY19–30 period (figure 2.5, panel b). However, despite IFC’s efforts to increase this financing, as discussed in later chapters, its average share of financing for the 17th Replenishment of IDA and FCS countries over the last four years was only 25.5 percent, compared with its FY18 value of 21 percent.

IFC has increased its investments in IDA and FCS countries, although not at the rate needed to meet its targets, despite the availability of IDA Private Sector Window (PSW) resources. IFC committed to using IDA PSW resources to increase its share of investments in IDA and FCS countries. It has reported in CIP updates on its use of blended finance facilities and other sources of external funding, such as the PSW, to increase the financial viability of projects in IDA countries. However, as discussed in chapter 3, it has proved challenging for various reasons for IFC to increase its investments as intended in PSW-eligible countries.

Table 2.4. CIP Policy Measures for IFC for Differentiating Support across Client Segments

|

IFC Policy Measures |

Commitments |

Indicators |

Targets |

|

Expand commitments in IDA and FCS countries. |

Expand commitments in IDA and FCS countries. Not underlined in CIP but listed in annex summary of the capital package. |

Percent of own-account commitments in IDA17 FCS countries. |

40% of all commitments by FY30, averaging 32.5% over FY19–30. |

|

Use the IDA PSW to substantially increase own-account annual commitments in LIC IDA17 and IDA FCS countries. |

Use replenished PSW resources to increase share of IFC commitments in low-income IDA and IDA FCS countries. CIP main text. Underlined and in annex summary of the capital package. |

Percent of total annual commitments to low-income IDA17 and FCS countries. |

15–18% by FY26; 15–20% by FY30. |

|

Selective private sector investments in UMICs by IFC, with rigorous additionality assessment and focus on regional partnerships, frontier regions, financial stability, and global public goods. |

Selective private sector investments in UMICs following a rigorous approach to additionality. Not underlined but recognized as commitment in CIP implementation status tables. |

Adoption of new additionality framework.

|

Complete (yes/no). |

|

Promote a regional approach to investments in middle- to upper-middle-income small states and aim to leverage the use of de-risking tools for the lower-income and FCV ones. |

Promotion of regional approach to IFC investments in middle- to upper-middle-income small states and leveraging of de-risking tools for the lower-income and FCV ones. CIP main text. Underlined and in annex summary of the capital package. |

New approach incorporated in relevant papers and reports. |

Complete (yes/no). |

Source: Independent Evaluation Group.

Note: The bold text in the table was underlined in the CIP document to show that these were formal commitments. CIP = capital increase package; FCS = fragile and conflict-affected situation; FCV = fragility, conflict, and violence; FY = fiscal year; GDI = graduation discussion income; IDA = International Development Association; IDA17 = 17th Replenishment of IDA; IFC = International Finance Corporation; LIC = low-income country; PSW = Private Sector Window; UMIC = upper-middle-income country.

Figure 2.5 IFC Own-Account Commitments

Source: Independent Evaluation Group.

Note: Panel a: The target for this commitment was to increase the share of IFC investments in low-income IDA and IDA FCS countries to 15–18 percent by 2026 and 15–20 percent by 2030. The low end of the target for FY26 is 15 percent. Panel b: IFC aimed to expand commitments in IDA and FCS countries and reach up to 40 percent of IFC commitments by 2030 and an average of 32.5 percent over fiscal years 2019–30. FCS = fragile and conflict-affected situation; IDA = International Development Association; IDA17 = 17th Replenishment of IDA; IFC = International Finance Corporation; LIC = low-income country; O/A = own account.

IFC has a well-defined approach to additionality in UMICs. Its ability to add value through financial features (for example, financing structure, innovative financing instruments, and resource mobilization) and nonfinancial features (for example, noncommercial risk mitigation, knowledge, innovation, and capacity building) is central to its value proposition in UMICs. To ensure that this value is realized, the CIP committed IFC to following a rigorous approach to additionality for private sector investments in UMICs (table 2.4). Additionality refers to the unique contributions that IFC brings to investment projects that are not offered by commercial sources of finance, thereby ensuring that IFC’s investment adds value without crowding out private sector activity. IFC’s corporate strategies indicate that as country income rises, IFC will rely more on additionality types based on both financial and nonfinancial innovation and deployment of knowledge. A recent IEG evaluation found that IFC does pay closer attention to documenting additionality in UMICs but does not differentiate the type of additionality it anticipates between UMICs and lower-middle-income countries, and, in practice, the type of additionality it anticipates in UMICs is not different from other client groups (World Bank 2023a). The evaluation also found that, contrary to its strategic expectations, IFC did not realize knowledge and innovation additionalities to a greater extent in UMICs than in lower-middle-income countries. According to IFC, the financing needs of middle-income countries remain large and exceed the supply of commercial sources of financing.

IFC’s small states commitment was not precisely defined and could not be validated. IFC is committed to a regional approach for investing in middle- to upper-income small states and to leveraging blended finance and other tools to limit investment risks in fragile and lower-income small states. The indicator that IFC uses to measure its small states commitment was vaguely defined as a “new approach incorporated in relevant papers and reports” (World Bank Group 2020a, 21). CIP updates have subsequently reported this commitment as complete since FY21 without corroborating evidence. As with other commitments, the weaknesses in the indicator and reporting mean that the commitment could not be validated; IFC may still have focused on small states.

There are several reasons for the differences in IBRD’s and IFC’s achievement of CIP targets for the differentiated support across the client segment priority area. First, IFC’s targets for IDA and FCS were more ambitious than IBRD’s targets for this cluster. Second, IBRD’s instruments made it easier to deliver. For example, IBRD could stimulate borrowing from certain countries by exempting them from rate increases, whereas IFC needs to set loan charges commensurate with these countries’ commercial risks. Third, low growth and a difficult macroeconomic environment in IDA and FCS countries in recent years have limited IFC’s investment opportunities. Tight credit in many countries during the COVID-19 pandemic also shifted demand for IFC’s investments to short-term and trade-related finance.

- The crisis buffer includes additional International Bank for Reconstruction and Development funds that can be activated to cover financing surges during crises.