Creating an Enabling Environment for Private Sector Climate Action

Chapter 1 | Background and Context

Climate change caused by the emission of greenhouse gases (GHGs) is an urgent challenge, putting the Sustainable Development Goals further out of reach. On the world’s current trajectory of GHG emissions, the global temperature will increase by up to 2.7°C by 2100. This is more than the previously envisaged 1.5°C, which has been considered a critical threshold for limiting the most severe effects of climate change (IPCC 2018; UN 2021; UNEP 2021b). According to the Intergovernmental Panel on Climate Change, this temperature rise will have devastating effects not only on ecosystems but also on human health and well-being, water, agriculture, cities, settlements, and infrastructure (IPCC 2022). The poorest communities are likely to be hit hardest.

The private sector is a critical stakeholder in fighting climate change through both mitigation and adaptation interventions. Private sector climate action can play a leading role in climate change mitigation by reducing the GHG emissions of its operations using or developing low- or zero-emitting processes and technologies. The private sector can play a role in climate change adaptation by building climate resilience into its operations and investments. The private sector can also provide the finance to support investments in mitigation and adaptation.

Private sector financing is needed to achieve the world’s climate targets. Climate-related investments need to increase by more than 10 times by 2030 to satisfy the global investment needs in mitigation and adaptation. Recent assessments suggest that total climate finance flows need to reach at least $5 trillion per year by 2030 and be sustained at this level through 2050 (IEA 2021; IPCC 2018; OECD 2017b; UNEP 2016, 2021a). According to the Climate Policy Initiative, total global climate finance flows reached only $665 billion in 2020. Private sector finance is critical to meeting climate investment needs, particularly given constraints on public sector financing in the context of the global pandemic and high public indebtedness. However, contributions from the private sector have been modest to date ($333 billion in 2020; Naran et al. 2022) and mostly directed to high-income countries.

Most countries lack a conducive enabling environment for the private sector to engage in climate action. The private sector operates in a context influenced by the public sector through policies, regulations, and incentives; changes in these are necessary to catalyze and increase private sector participation in climate action. In many countries, legal and regulatory frameworks are insufficient for creating the conditions for attracting low-carbon technologies. Regulations that level the playing field by correcting price externalities so that actors bear the cost or benefits of their actions to others help create the conditions for private sector investments (BCG and GFMA 2020; Bhattacharya et al. 2020; Boehm et al. 2021; Kivimaa and Kern 2016; OECD 2017a; Rosenbloom, Meadowcroft, and Cashore 2019). Investments for climate adaptation will likely remain particularly low in the absence of a compensation mechanism for the positive social externalities that they generate.

Purpose and Scope of the Evaluation

This evaluation assesses the World Bank Group’s efforts to improve the enabling environment for private sector climate action (EEPSCA). The evaluation defines the private sector enabling environment for climate action as the set of policies (laws and regulations), incentives, standards, information, and institutions that encourage or facilitate the private sector to invest or behave in ways that reduce GHG emissions or adapt to the current or anticipated impacts of climate change. A private sector enabling environment for climate action exists in the contexts of country macroeconomic conditions and broader private sector enabling environments, which may also constrain private investment in climate action. The private sector includes large, medium, and small firms; domestic and international financiers; and smallholder farmers or other producers.

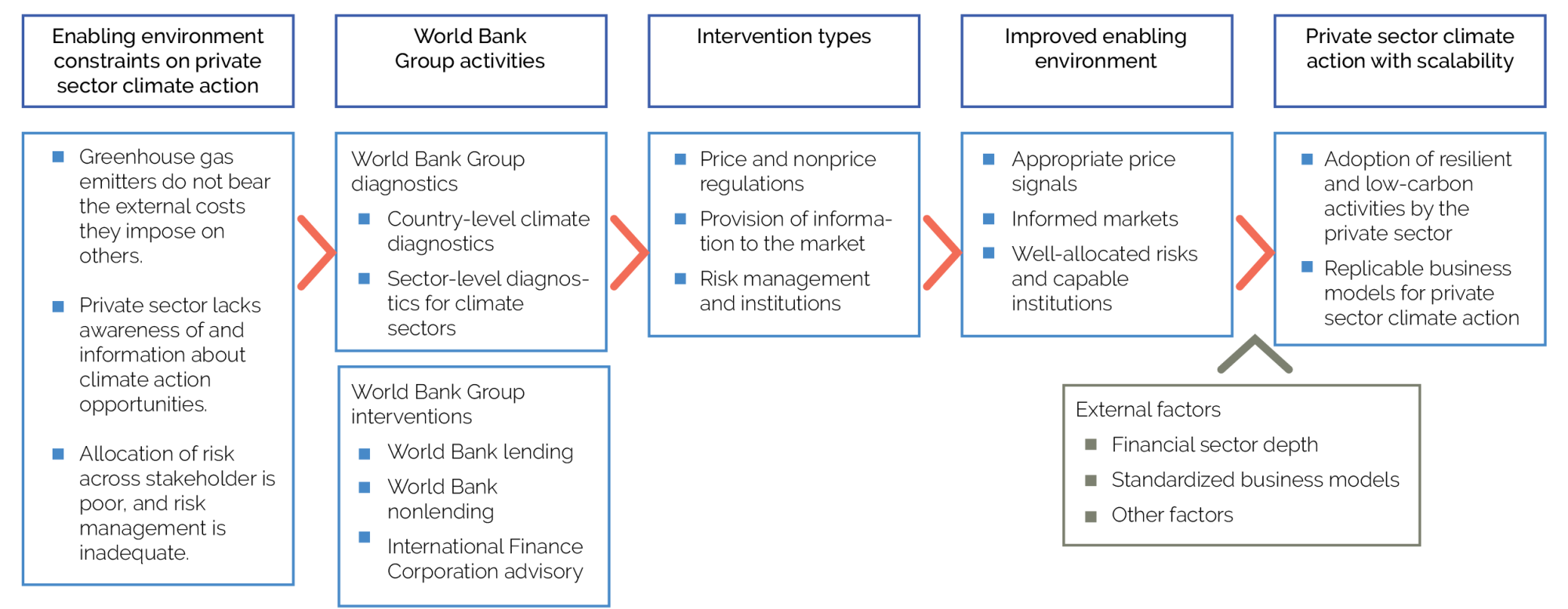

The evaluation tests if and how Bank Group enabling environment interventions are addressing the challenges that the private sector is facing when taking climate action. Figure 1.1 describes the logical framework for the evaluation. First, it describes the enabling environment constraints that the private sector is facing to undertaking climate action. The private sector does not have sufficient incentive to undertake climate action because it does not capture the external climate costs or benefits of its actions. The private sector may lack awareness or information on climate activities or investment opportunities. The private sector may be deterred from investing due to poorly allocated risks between government and the private sector and inadequate public institutions to mitigate or transfer those risks. Second, it looks at how Bank Group work aims to address these constraints. It analyzes Bank Group country diagnostics, such as Country Climate and Development Reports (CCDRs) and Financial Sector Assessment Programs (FSAPs) that identify priority actions across sectors. It also analyzes sectoral diagnostics that identify the specific constraints to achieving a particular private sector climate action (such as investment in solar power, more resilient buildings, or improved industrial energy efficiency). Based in part on these diagnostics and on client demand, the Bank Group develops lending and nonlending activities that seek to address the most important enabling environment constraints. If successful, these will lead to an improved enabling environment and eventually to climate action by the private sector. This action needs to be feasible at scale to have the impact needed to meet country climate goals. The ability of the enabling environment to contribute to private sector climate action may depend on external factors, including the strength of the domestic financial sector or the presence of standardized business models. This evaluation considers business models as private sector profit-making activities and their financing, governed by permitting and regulation. Standardizing business model means providing a template of contract terms, procurement processes, and financing models, among others, which can be replicated across projects.

The evaluation covers the Bank Group’s efforts to improve the climate change enabling environment in client countries. These include both efforts to improve upstream policies and midstream efforts to help build a pipeline of bankable projects. The evaluation excludes both higher-level macro issues and the general private sector enabling environment, as well as downstream effects of direct project financing or guarantees, including through indirect pathways, such as demonstration effects or market creation. It also excludes global work of the Bank Group. Although the evaluation does not cover climate finance or private capital mobilization issues, it indirectly addresses some of the challenges for financing the climate agenda. Achieving climate goals will also require actions by high-income countries, but Bank Group activities engaging these (nonclient) countries through global convening work are not covered by the evaluation. Although included in the portfolio, the evaluation places less attention on energy efficiency interventions, which are covered by a separate evaluation (World Bank 2023c). The evaluation covers Bank Group efforts to improve the EEPSCA through World Bank lending and nonlending activities, and International Finance Corporation (IFC) advisory services (AS), but does not cover other World Bank Group climate change activities. The evaluation covers IFC AS that support enabling environment activities, targeted to the government or industry level; it does not cover the majority of IFC AS that are targeted to specific firms and so do not address enabling environment. The evaluation does not include IFC investment services, which generally do not support enabling environment activities but may have done in some cases. Since the Multilateral Investment Guarantee Agency did not support activities on the creation of an enabling environment during the evaluation period, it is excluded from the evaluation. The evaluation covers operations approved during fiscal years (FY)13–22.

The purpose of this evaluation is to derive lessons from Bank Group experience in improving the EEPSCA. The evaluation assesses the relevance and effectiveness of Bank Group support to EEPSCA and aims to identify lessons applicable to the World Bank and IFC to inform implementation of the Bank Group Climate Change Action Plan 2021 and subsequent Bank Group activities. The evaluation also aims to inform discussions on the evolution road map, which considers further increasing the prominence of the role the Bank Group plays on supporting global public goods, such as climate change.

Figure 1.1. Evaluation Logical Framework

Source: Independent Evaluation Group.

Evaluation Questions and Methods

This evaluation answers the following questions: (i) How relevant has the Bank Group’s support been to creating an enabling environment for private sector participation in climate mitigation and adaptation in client countries? (ii) How effectively has the Bank Group supported creating an enabling environment in client countries to allow the private sector to engage in climate mitigation and adaptation?

To answer the first question, the evaluation assesses three aspects of relevance. First, it conducted a structured literature review to identify key enabling environment constraints on private sector climate action and conducted a systematic portfolio mapping to assess the alignment of the Bank Group portfolio with those key constraints. Second, it conducted a global data analysis to identify the sectors and countries with the highest GHG emissions and the countries with the highest needs for climate adaptation and conducted a systematic portfolio mapping to assess the alignment of the Bank Group portfolio with those sectors and countries. Third, it assessed the extent to which the Bank Group identified and acted on the most important enabling environment constraints at a country level using a structured qualitative review of key Bank Group country diagnostics and using explanatory case analysis.

To answer the second question, the evaluation assessed effectiveness in three ways. First, it conducted an effectiveness review and indicator analysis on project evaluations for completed projects. Second, it conducted a deep dive on the effectiveness of enabling environment interventions in the renewable energy sector using econometric analysis. Third, it identified factors that helped or hindered effectiveness using explanatory case analysis.