The World Bank Group’s 2018 Capital Increase Package

Chapter 4 | Priority Area 3: Mobilizing Capital and Creating Markets

Highlights

The International Bank for Reconstruction and Development (IBRD) has made limited progress in mobilizing public and private capital. IBRD’s average annual private capital mobilization from fiscal year 2019 to fiscal year 2022 was 7.4 percent, well under its target of 25 percent.

The International Finance Corporation’s core mobilization ratio has been 94 percent averaged over the capital increase package period, exceeding the target of 80 percent of own-account commitments.

The World Bank Group’s implementation of the creating markets agenda and the Cascade approach has not been systematic and has lacked oversight, metrics, and targets.

IBRD intensified its domestic revenue mobilization work since 2018, but this work showed weak strategic coherence, and, internally, IBRD did not collaborate effectively.

This chapter covers the two clusters under the CIP’s mobilization and creating markets priority area. These include (i) creating markets and PCM and (ii) domestic revenue mobilization (DRM), which is how the Bank Group engages the public sector on taxes and other revenue sources.

Creating Markets and Private Capital Mobilization

The CIP’s creating markets and PCM cluster had five policy measures. These included two formal commitments that were monitored through one quantitative and one qualitative indicator (see table 4.1), which capture the progress toward a part of the intended outcomes (namely, mobilization) and do not fully capture the newer concept of creating markets.

Table 4.1. World Bank Group’s CIP Policy Measures for Creating Markets and Private Capital Mobilization

|

World Bank Group Policy Measures (PCM) |

Commitments |

Indicators |

Targets |

|

Adopting a systematic approach to creating markets across the World Bank Group by linking policy reform, advisory, investment, and mobilization to deliver solutions packages and using the Cascade approach as the operating system to MFD. From diagnostics to investments, the Bank Group instruments will be leveraged to crowd in the private sector. |

Adopting a systematic approach to creating markets across the Bank Group using the Cascade approach as the operating system to MFD. CIP main text. Not underlined but listed in annex summary of the capital package. |

No indicator in CIP implementation status table. Limited reporting in implementation updates narrative. |

No target. |

|

The Bank Group—Growing use of private sector solutions and mobilization of private finance with annual Bank Group mobilization by IBRD and IFC 1.7 times higher in FY30 than in no-capital increase scenario. |

CIP main text. Not underlined but listed in annex summary of the capital package. |

No indicator in CIP implementation status table. Limited reporting in implementation updates narrative. |

No target. |

|

IBRD aims to increase its mobilization ratios to 25% on average over FY19–30. |

IBRD will increase its mobilization ratio to 25% on average over FY19–30. CIP main text. Underlined and in annex summary of the capital package. |

IBRD private mobilization ratio. |

25% on average over FY19–30. |

|

IFC aims to increase its mobilization ratios to 90% by 2030 and reach 80% on average over FY19–30. |

Not underlined in CIP and not listed in annex summary of the capital package. |

No indicator in CIP implementation status table. Reported in implementation updates narrative. |

No target. |

|

The Bank Group continues to implement many important processes and tools to deliver this agenda, focusing on Bank Group coordination, upstream sector prioritization and project development, improved metrics to assess and anticipate the potential for market development, and new tools for supporting high-risk private sector projects and to enhance mobilization. To implement IFC 3.0, IFC has also put in place a new management structure and developed a set of new tools to enhance delivery. |

IBRD—Supporting policy reforms to unlock opportunities for private sector investment. IFC—Scaling up private sector solutions by

CIP main text. Not underlined but listed in annex summary of the capital package. |

Pipeline of upstream projects. Reported in CIP implementation status table and implementation updates narrative. |

No target. |

Source: Independent Evaluation Group.

Note: The bold text in the table was underlined in the CIP document to show that these were formal commitments. CIP = capital increase package; FY = fiscal year; IBRD = International Bank for Reconstruction and Development; IFC = International Finance Corporation; MFD = Maximizing Finance for Development; PCM = private capital mobilization.

The CIP’s creating markets agenda involved a solutions package and the Cascade approach. These components comprise the overall narrative of MFD and are aligned with the broader directions expressed in the 2030 Agenda and From Billions to Trillions: Transforming Development Finance Post-2015 Financing for Development: Multilateral Development Finance (AfDB et al. 2015; UN 2015). The concept of a solutions package implies the use of a combination of tools in a mutually reinforcing way to crowd in private resources. Similarly, the Cascade approach encourages Bank Group teams to use private financing and limit the use of concessional funds (which frees up public resources for where they are most necessary). The CIP’s PCM cluster includes a quantitative indicator of private capital mobilized, which is a subset of the market creation agenda. Although it includes a formal target for IBRD mobilization, it does not include any commitments from IFC. The cluster does not contain indicators or targets for solutions packages, nor does it systematically track the use of individual market creation tools.

This cluster’s solutions packages combine new and established Bank Group instruments to create markets and mobilize private capital. Established instruments include the World Bank’s analytical and lending support for private sector reforms; the Bank Group’s diagnostic and strategic country engagement products, such as Systematic Country Diagnostics and CPFs; and IFC’s investment and advisory operations. IFC has an extensive suite of new instruments that include the Bank Group’s CPSDs and IFC’s industry deep dives, both of which are mechanisms to systematically integrate private sector concerns into the Bank Group’s diagnostic and strategy work. IFC’s Creating Markets Advisory Window—another new instrument—builds local capacity, makes regulatory improvements, and supports upstream advisory work to prepare the enabling environment for PCM and develop bankable projects. The IDA PSW and other blended finance instruments also help create markets by making small amounts of concessional finance available and de-risking projects until they are attractive to the private sector. IFC’s new Anticipated Impact Measurement and Monitoring (AIMM) system (also discussed in chapter 5) assesses the likely impacts of projects on markets.

Reporting

The CIP only made a PCM commitment for IBRD and provided illustrative projections of IFC’s PCM. The World Bank’s and IFC’s CSCs, CIP implementation updates, IFC’s Strategy and Business Outlooks, and the Bank Group’s annual reports regularly report PCM data based on a common MDB methodology for standardized reporting of PCM. For IFC, the CIP provides figures of $175 billion in cumulative core mobilization from FY19 to FY30 alongside $220 billion in cumulative own-account investments for illustrative purpose. The CIP’s main text refers to IFC reaching a mobilization ratio of 90 percent of its own-account commitments by FY30 and averaging 80 percent over the CIP’s implementation period (World Bank Group 2018b).

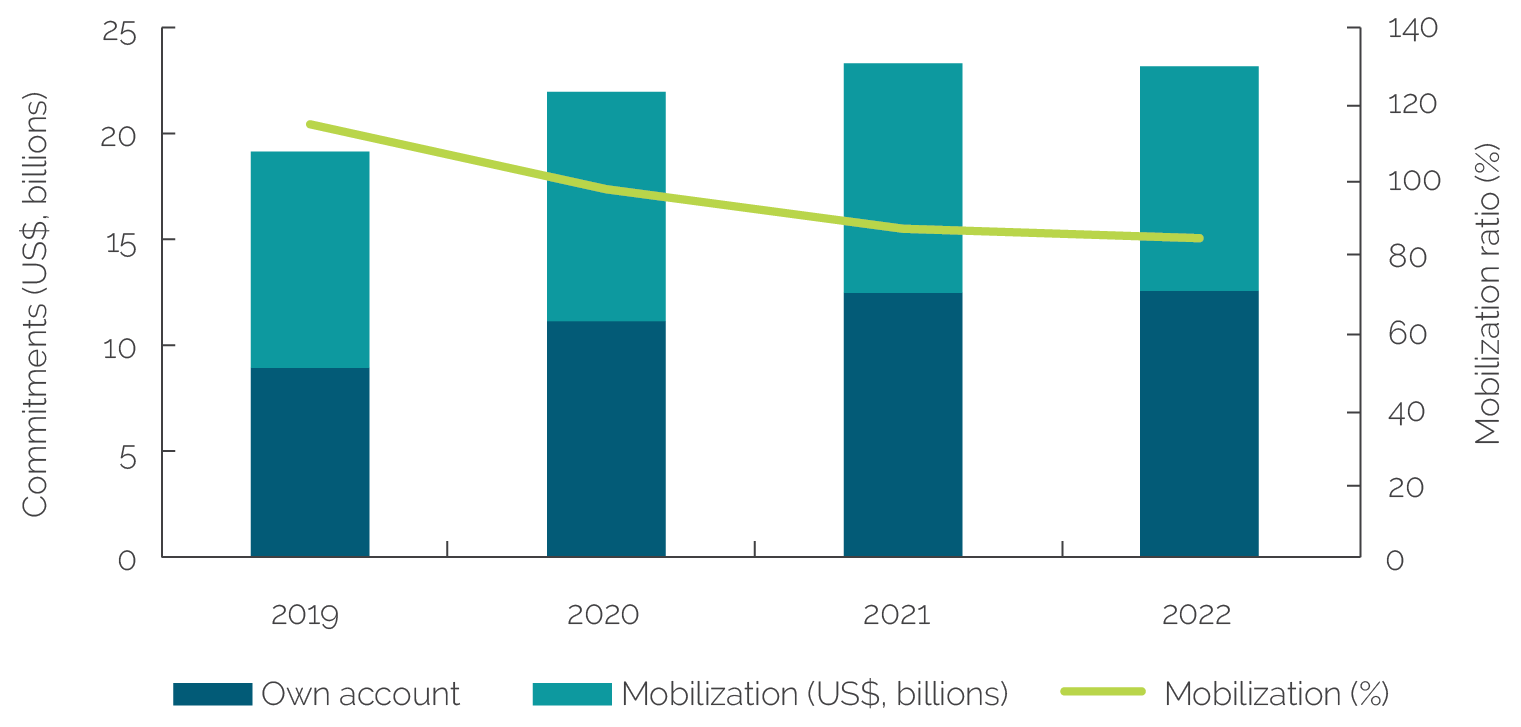

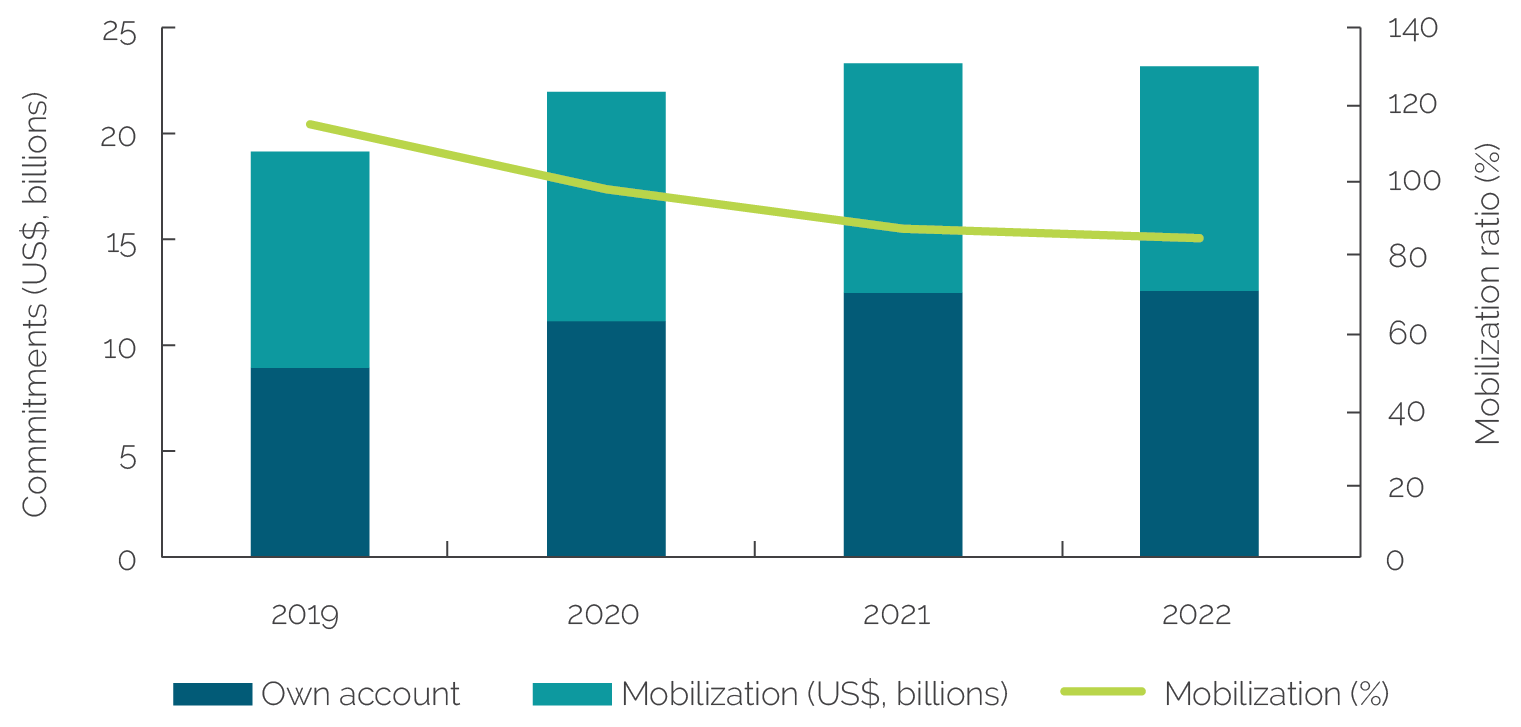

IFC has exceeded the illustrative projections for mobilization. Its own-account commitments have grown from $8.9 billion in FY19 to $12.6 billion in FY22, exceeding the growth of its mobilization totals, which increased from $10.2 billion in FY19 to $10.5 billion in FY22 (figure 4.1). IFC’s mobilization ratio has averaged 94 percent over the period, exceeding the 80 percent average indicated in the CIP for 2030. To meet the FY30 illustrative projections of $220 billion own-account investment and a 90 percent mobilization ratio at the end of the CIP period, IFC will need to continue to increase its own-account commitments and mobilization.

IBRD has not yet met its PCM target and has emphasized data in its reporting in an inconsistent manner. IBRD reported either annual PCM ratios or multiyear PCM averages, focusing on average figures in years when PCM ratios were low. This inconsistent emphasis in reporting approach dilutes accountability. Following the capital increase in FY18, IBRD’s PCM ratio of mobilization to own-account financing decreased from 16 percent to 3 percent in FY21 but then rebounded to 9 percent in FY22, resulting in an average annual PCM of 7.4 percent between FY19 and FY22, compared with a target of average 25 percent mobilization ratio between FY19–30. Only in 2017, before the CIP, did IBRD meet its 25 percent mobilization target.

Source: Independent Evaluation Group based on International Finance Corporation’s reported data.

Note: IFC = International Finance Corporation.

The CIP’s market creation objectives were never fully articulated, and reporting relied on individual examples. At the time of approval, the CIP did not articulate a framework on how the Bank Group should create markets. IFC’s FY20–22 Strategy and Business Outlook stated that cross–Bank Group working groups are working to develop a comprehensive MFD Results Measurement Framework (IFC 2019), which would presumably include market creation, but subsequent reporting made no further reference to the framework. A 2020 Assurance Review by GIA found that the Cascade approach to creating markets “is not systematically monitored and reviewed across Bank Group institutions” and that the approach has no “measurable metrics and milestones.” Without such clarity, CIP reporting on market creation policies has been vague and relied on limited case examples. This reporting was usually in CIP implementation updates, which provided examples of internal collaboration, institutional changes, and market creation products. The updates also reported on the delivery of new diagnostics and strategies, such as the number of CPSDs finalized. These examples illustrate the efforts that the Bank Group has made to create markets but have a limited use for judging the Bank Group’s aggregate progress.

Implementation

Bank Group management took steps toward implementing MFD through the Cascade approach, but implementation was not systematic. GIA’s Assurance Review and the CIP’s implementation updates report several steps the Bank Group took in implementing the Cascade approach, including issuing guidance notes to incorporate the approach in country engagement products, providing communication and training materials, and establishing working groups. In 2020, the Bank Group established three World Bank–IFC working groups at the vice-presidential level to implement the Cascade approach focused on incentives, country programs, and operations. The Cascade approach lacked oversight and clear metrics and milestones, which hampered its implementation. For example, most of its oversight committees, which were established in FY17, had still not met by FY19, diminishing the working groups’ momentum. More generally, GIA found that in the absence of systematic monitoring, “most projects had no evidence of the analysis carried out by project teams in deciding not to consider private solutions to maximize developmental impact.”

IFC made organizational changes, and the Bank Group strengthened analytical capacity; however, despite IFC’s annual reporting there is little evidence that this led to systematic operational work to create markets. IFC created global and regional upstream units to get involved much earlier in the sector and project development process (IFC 2020a). In addition, IFC’s Economics Vice Presidential Unit created a series of analytic tools, such as CPSDs, which identify opportunities for market creation at the country level, and Sector Deep Dives, which present systematic overviews of sectors and subsectors that have the potential for PCM and market creation. However, in the absence of a monitoring framework, there was no evidence that these efforts were systematic or successful. The GIA’s Assurance Review reached the conclusion that Bank Group diagnostics work is robust but was not clearly translated into subsequent operational actions.

IFC made organizational changes that constrained or reversed earlier organizational changes that were enacted to create markets. IFC’s upstream operating model was launched in 2020 and envisaged a strong role for global units in creating markets. However, in 2022, IFC carried out additional organizational changes that moved most staff from these global upstream units to regional upstream units and further merged upstream and advisory teams. There was no clear or substantive explanation for this change, except for IFC’s need for “organizational simplification” and “being closer to the client.”1 Findings by IEG and others have established that market creation tends to have gestation periods of a half-decade or longer. This calls into question the rationale for the 2022 changes, which went into effect less than three years after the initial reforms—much too short of a period to derive meaningful lessons from the 2020 changes. Similarly, the discontinuation of joint World Bank–IFC Global Practices appears at odds with the Bank Group’s emphasis on collaboration, which is particularly important for creating markets. In general, frequent institutional changes, such as these, undermined the Bank Group’s ability to apply lessons from complex initiatives with long gestation periods and diluted accountability for delivering results.

The Bank Group’s Cascade approach for creating markets was at odds with internal staff incentives. A primary area of concern in institutional evaluations is how to incentivize market creation activities because of the Bank Group’s broader staff incentive structure. Staff incentives, including promotions, often favor sector- and unit-specific goals over corporate goals, such as creating markets or the Cascade approach. Furthermore, staff are incentivized to deliver results over a medium-time horizon, which is shorter than the long implementation times for market creation initiatives. IEG’s evaluation on creating markets established that “most reform efforts studied lasted more than 10 years” (World Bank 2019a, 47). It found that investment may be possible while reforms are being implemented but that there are minimum legal and regulatory requirements that need to be met. Volume and process efficiency targets focusing on the short-term disincentivize staff from focusing on market creation because of its longer lead times and a higher risk of financing not being approved or committed.

Current measurements of capital mobilization are generally effective, but they only capture part of IBRD’s contribution to private capital flows. A 2020 IEG evaluation, World Bank Group Approaches to Mobilize Private Capital for Development, found that the Bank Group’s approach to PCM is relevant to clients and mostly effective in mobilizing private capital (World Bank 2020a). The evaluation made recommendations on how to increase IBRD’s PCM, such as improving how incentives cascade down to organizational units. In addition, MDBs, including the Bank Group, have discussed developing a complementary framework to track “facilitated” or “enabled” private financing, which would capture a broader range of the MDBs’ PCM activities (AfDB et al. 2017). There is no clear indication as to when this framework will be finalized or rolled out.

Domestic Revenue Mobilization

DRM has become an important part of the global development agenda. High fiscal deficits and high and rising debt levels in lower-income countries make DRM an urgent priority in those economies (World Bank 2023d). DRM requires improving the public sector’s spending effectiveness and resource mobilization. As a result, DRM was an important theme at the 2015 International Conference on Financing for Development in Addis Ababa. It was also a prominent theme in successive IDA replenishments. Not surprisingly, then, both the Forward Look and the CIP have discussed the Bank Group’s role in DRM. However, as table 4.2 shows, the CIP DRM cluster’s two policy measures were vague, were written as broad statements of intent, and lacked indicators and targets, which made reporting difficult. The CIP document also mentioned illicit financial flows, but this validation did not identify any policy measures or reporting on this issue.

Table 4.2. CIP DRM Policy Measures for IBRD and IFC

|

World Bank Group Policy Measures (DRM) |

Commitments |

Indicators |

Targets |

|

The World Bank has created a Global Tax Team charged with broadening and deepening the tax base of client countries, working closely with IMF. |

Not underlined in CIP and not listed in annex summary of the capital package. |

No indicator in CIP implementation status table. Limited reporting in implementation updates narrative. |

No target. |

|

IFC aims to support DRM by investing in local capital market players (such as insurance companies and fund managers, and so on) and deploying innovative solutions to develop the local capital markets (including bond issuance, partial credit guarantees, and securitizations). |

Not underlined in CIP and not listed in annex summary of the capital package. |

No indicator in CIP implementation status table. Not reported. |

No target. |

Source: Independent Evaluation Group.

Note: CIP = capital increase package; DRM = domestic revenue mobilization; IBRD = International Bank for Reconstruction and Development; IFC = International Finance Corporation; IMF = International Monetary Fund.

Reporting

IBRD and IFC’s CIP reporting on DRM has been unsatisfactory. The CIP has no formal DRM commitments and no indicators to measure DRM, and the CIP’s annual reporting has only described the World Bank’s DRM work in cursory fashion. The CIP’s lack of explicit commitments and indicators on DRM, and its broad wording of DRM policy measures create monitoring challenges, and reduce management’s accountability for acting on the CIP’s DRM policy measures. More complete indicators on DRM and tax equity are feasible and are, in fact, used in the results measurement system for the 20th Replenishment of IDA. Other non-CIP reporting to the Board on the World Bank’s DRM work started only in FY22 (World Bank Group 2021c). More specifically, this validation did not find evidence that IFC reported explicitly on the CIP measure to support DRM by investing in local capital market players and deploying innovative solutions to develop the local capital markets, although IFC did report on its development of mobilization platforms.

Implementation

The World Bank has intensified its DRM work since 2018 and pivoted toward tax policy. IEG’s 2023 evaluation of the World Bank’s DRM work finds that the World Bank’s support was greatest in countries with low revenue-to-GDP ratios, such as those in Sub-Saharan Africa and IDA-eligible countries (World Bank 2023d). The Global Tax Program, established by the World Bank and various donor countries in June 2018, has provided trust fund resources to increase the scale and quality of the World Bank’s DRM engagements in client countries. Separately, the World Bank also increased its use of development policy operations to support DRM during the FY16–19 period relative to the FY12–15 period. Management data suggest that IBRD gave increased attention to DRM and tax policy and increasingly used development policy financing (World Bank 2023d).

World Bank client governments have reversed many of the tax policies supported by development policy financing loans. IEG case studies show that governments frequently reintroduced tax exemptions that development policy financing prior actions had sought to eliminate (World Bank 2023d). Reasons for these policy reversals occurred because of corruption, elite capture, political protests, opposition from vested national interests, and so on.

The World Bank has shown limited internal collaboration and policy coherence on DRM. Two evaluations uncovered weaknesses in the World Bank’s internal collaboration and planning related to DRM, which included weak links between its diagnostic work and its operational work on tax reforms (SEO Amsterdam Economics 2023; World Bank 2023d). This weak link occurs partly because not all World Bank teams see taxation as an important development tool (SEO Amsterdam Economics 2023) but also because of the World Bank’s limited internal capacity on taxation. Interviews suggest that donor priorities in the donor-funded Global Tax Program have sometimes shaped the World Bank’s DRM work. Moreover, IEG’s DRM evaluation and the interviews for this validation show that the Bank Group’s direction and strategic coherence on DRM have varied because key managers have championed different DRM approaches, internal responsibility for tax issues has repeatedly shifted between departments, and senior management’s support has not been as visible and concerted for DRM as it has been for other CIP priority areas (World Bank 2023d). The World Bank’s Equitable Growth, Finance, and Institutions Global Practice listed its DRM priority areas and approaches, including its position on redistributive fiscal policies, progressive tax systems, and fiscal policies for climate action in a 2021 presentation to the Board of Executive Directors (World Bank Group 2021c). However, this presentation has not yet been accompanied by an action plan.

At the same time, the Bank Group’s collaboration with external partners on DRM has improved. For example, the Bank Group and the International Monetary Fund collaborate well on DRM, according to IEG’s DRM evaluation. The Platform for Collaboration on Tax, with its secretariat located at the World Bank, has contributed to this improved collaboration (SEO Amsterdam Economics 2023; World Bank 2023d).

The Bank Group updated its policy on intermediary jurisdictions in July 2022 to align with leading international standards. The policy regulates IFC’s due diligence on its investee companies’ taxation in operations that use intermediary jurisdictions in their holding structure. The policy is meant to curb tax avoidance and illicit financial flows in IFC projects and ensure investee companies’ compliance with national legal standards.

- See https://worldbankgroup.sharepoint.com/sites/ifcupstream/SitePages/Implementation-of-organizational-changes-impacting-Upstream-and-Advisory-teams.aspx (internal document).