Results and Performance of the World Bank Group 2023

Chapter 3 | International Finance Corporation Results and Performance

International Finance Corporation (IFC) investment projects included in the calendar year (CY)20–22 Results and Performance of the World Bank Group cohort were moderately or minimally affected by COVID-19 (as assessed by IFC at the time of sampling). These investment projects were exposed to the pandemic for 24 percent of their project lives. As such, it is too early to assess the full impact of COVID-19 on IFC investment projects. That said, COVID-19–related lockdowns and economic slowdowns contributed to a more challenging operating environment for the CY20–22 cohort.

Along with COVID-19, IFC investment projects were negatively affected by unfavorable economic issues, high business risks, and high competition. IFC has no formal procedures for modifying the original development objectives, indicators, and targets to adapt to changing market conditions.

Notwithstanding the challenging environment and the inability of IFC to restructure project objectives and targets, IFC’s investment project development outcome success ratings declined only slightly from 53 percent in CY19–21 to 50 percent in CY20–22. IFC’s Expanded Project Supervision Report self-ratings also showed a decline.

Private sector sponsors and clients reacted quickly to the changing economic landscape during the pandemic. The strong ability and technical expertise of sponsors contributed to adaptive management and were the factor that most positively affected investment project performance.

This Results and Performance of the World Bank Group confirms that IFC investment project objectives were highly outcome oriented, with all projects pursuing project-level outcomes and a majority (74 percent) also pursuing market-level outcomes beyond the project. However, IFC investment projects’ outcome achievement rates were relatively low, and a lack of appropriate results indicators and evidence constrained some outcome measurements. Investment projects with high outcome achievement rates had higher development outcome ratings.

IFC advisory projects’ development effectiveness ratings slightly declined from 60 percent in the fiscal years (FY)19–21 to 54 percent in FY20–22. IFC’s Project Completion Report self-ratings also showed a decline. The challenging operating environment and weaknesses in advisory project preparation and monitoring and evaluation contributed to the ratings slide.

This chapter presents trends and patterns of IFC’s investment and advisory project performance.1,2 It describes the context of IFC’s operating environment, including how the markets test IFC private sector projects’ efficiency and competitiveness. The chapter also explores IFC investment projects’ development outcomes and key factors influencing project implementation and performance.

Project Exposure to the COVID-19 Pandemic and Sample Selection Bias

It is too early to assess the full impact of COVID-19 on IFC investment projects. IFC’s RAP cohort includes investment projects that were approved during CY12–17 and evaluated in CY20–22, when they achieved their early operating maturity stages;3 75 percent of IFC investment projects in the RAP cohort were still active. The cohort projects’ average exposure to COVID-19 was 24 percent of their active project lives—a larger percentage than for the World Bank’s RAP cohort. However, IFC’s RAP cohort did not include investment projects that were severely affected by the pandemic because IEG agreed that IFC could defer the project evaluations for these projects.4,5 These changes in the sampling processes influenced the profile of CY20–22 investment projects, creating a sample selection bias in which only projects moderately or minimally affected by COVID-19 were included. As such, the RAP’s analysis provides only preliminary insights into how the pandemic affected IFC investment project implementation and performance.

Preliminary findings suggest that COVID-19 undermined the implementation of CY20–22 investment projects. COVID-19 caused lockdowns, supply chain disruptions, asset quality issues, and an economic slowdown—all of which affected investment project implementation. The lockdowns particularly affected investment projects in the real sector, shutting down or limiting the operations of hotels, hospitals, transportation companies, manufacturing facilities, and tertiary education providers. In addition, the lockdowns, combined with the overall economic downturn, led to reduced demand for products and services in most sectors and for most IFC clients.

IFC has no formal procedures for modifying investment projects’ development objectives to adapt to changing market conditions subsequent to the Board approval of a project. By their nature, private sector projects must be financially sustainable and survive in a competitive market to be viable. Moreover, all IFC investment projects are also required to comply with IFC’s environmental and social performance standards. If needed, IFC can restructure the terms of investment financing agreements with clients and reschedule loan repayment schedules, and clients can adapt their products and services to changing market conditions, such as those caused by the COVID-19 pandemic. However, the original development objectives, indicators, and targets cannot be changed to reflect the changes in market conditions since neither IFC processes nor the Anticipated Impact Measurement and Monitoring (AIMM) framework consider formal changes of development objectives or targets after Board approval.

Project Performance Rating Trends

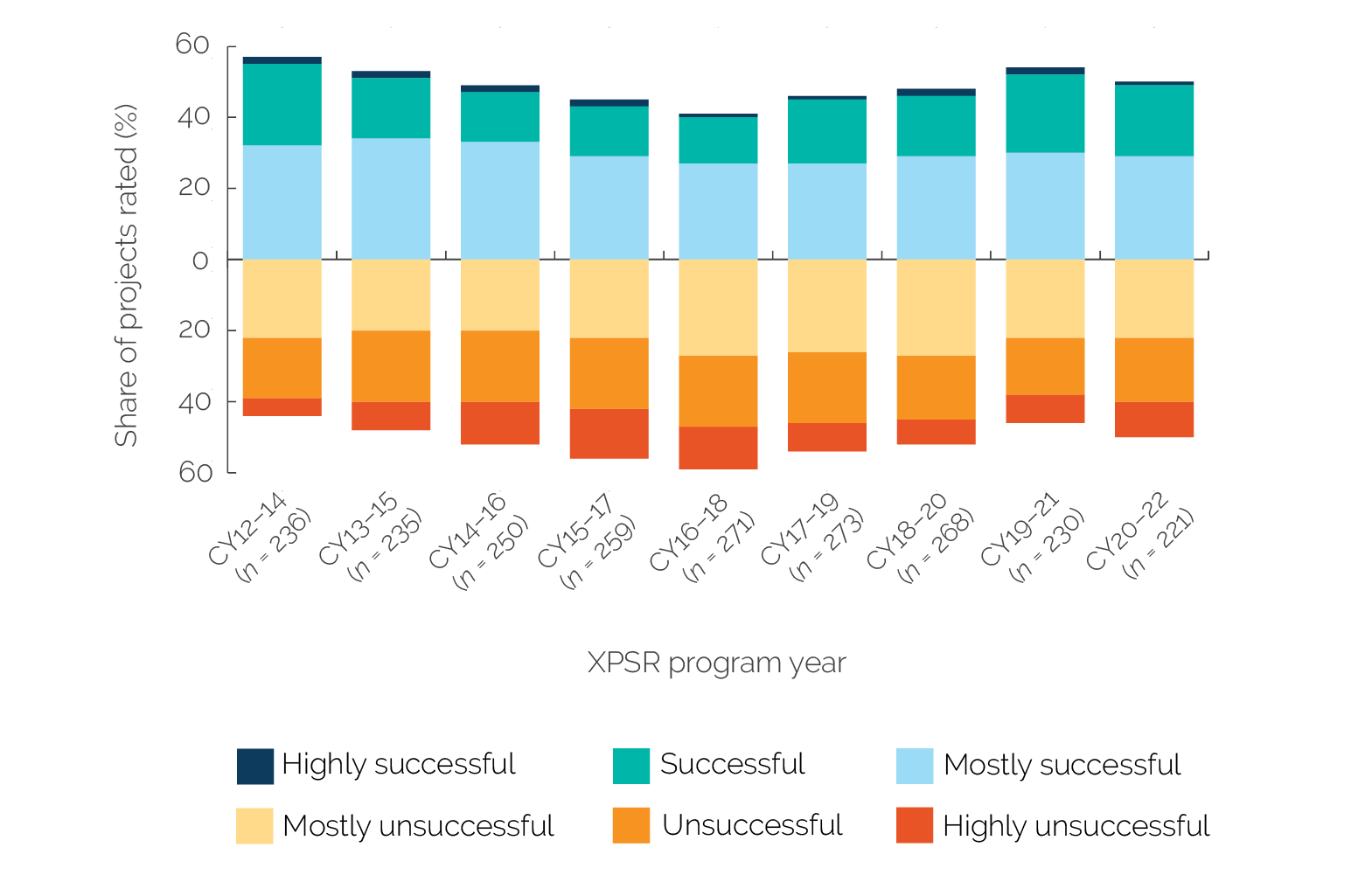

Development outcome success ratings for IFC investment projects declined only slightly in CY20–22 despite the difficult operating environment. The share of IFC investment projects with outcomes rated mostly successful or better had been increasing since CY16–18 but declined slightly from 53 percent in CY19–21 to 50 percent in CY20–22. IFC’s XPSR self-ratings also showed a decline. The decline was driven by the lower performance of CY22 investment projects, where the success rates dropped from 59 percent in CY21 to 50 percent in CY22. This decline in development outcome ratings mainly reflected lower average ratings across most project subgroups. Changes in the evaluated portfolio shares of different project subgroups did not have a significant effect on the overall decline (see the decomposition analysis in appendix E). On a granular basis, the share of projects with unsuccessful and highly unsuccessful ratings increased, the share of projects with mostly unsuccessful ratings remained the same, and the share of projects with mostly successful, successful, or highly successful ratings shrank (see figure 3.1).

Figure 3.1. IFC Investment Project Development Outcome Ratings

Source: Independent Evaluation Group, XPSR database.

Note: CY = calendar year; IFC = International Finance Corporation; XPSR = Expanded Project Supervision Report.

The development outcome ratings of investment projects in African, FCS, and IDA and blend countries were substantially low. The shares of African, FCS, and IDA and blend investment projects rated mostly successful or better for development outcome were 27 percent, 11 percent, and 36 percent in CY20–22, respectively. This was mainly driven by adverse macroeconomic factors, the pandemic’s effects, high business risks, and low sponsor or client management quality. Continued low performance in these markets would undermine the IFC 3.0 strategy, which aims to address conflict, fragility, and forced displacement by increasing operations in FCS and IDA and blend countries. Indeed, the share of investments in IDA and blend countries in IFC’s overall portfolio increased from 27 percent to 32 percent between 2019 and 2022, whereas the share of investments in FCS countries grew from 7 percent to 10 percent during the same period.

IFC investments, unlike World Bank projects in the public sector, must overcome hurdles unique to the private sector to be successful. IFC is a minority investor in projects alongside private sector sponsors and, therefore, shares risks, including commercial risks, with these other investors. In FCS and IDA and blend countries, IFC investment projects are often constrained by the limited number of potential sponsors with adequate capacity, resources, and relevant experience to undertake such investment projects. The private sector often faces difficult investment climates and regulatory environments in such countries. As such, investment projects could continue to deteriorate without up-front and upstream efforts to improve the business environment, reduce investment risks, attract private investors, and build sponsor capacity in these countries.

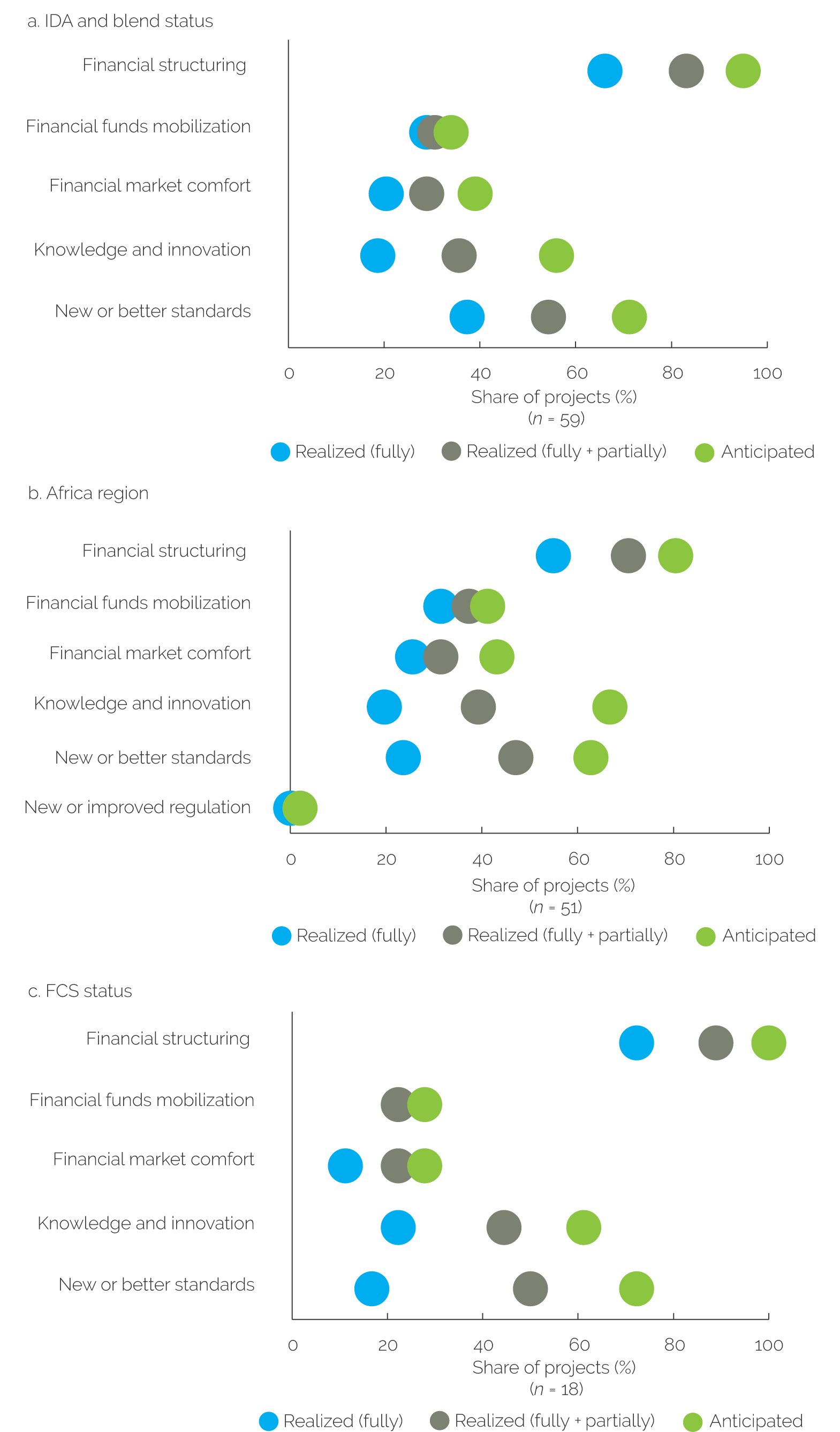

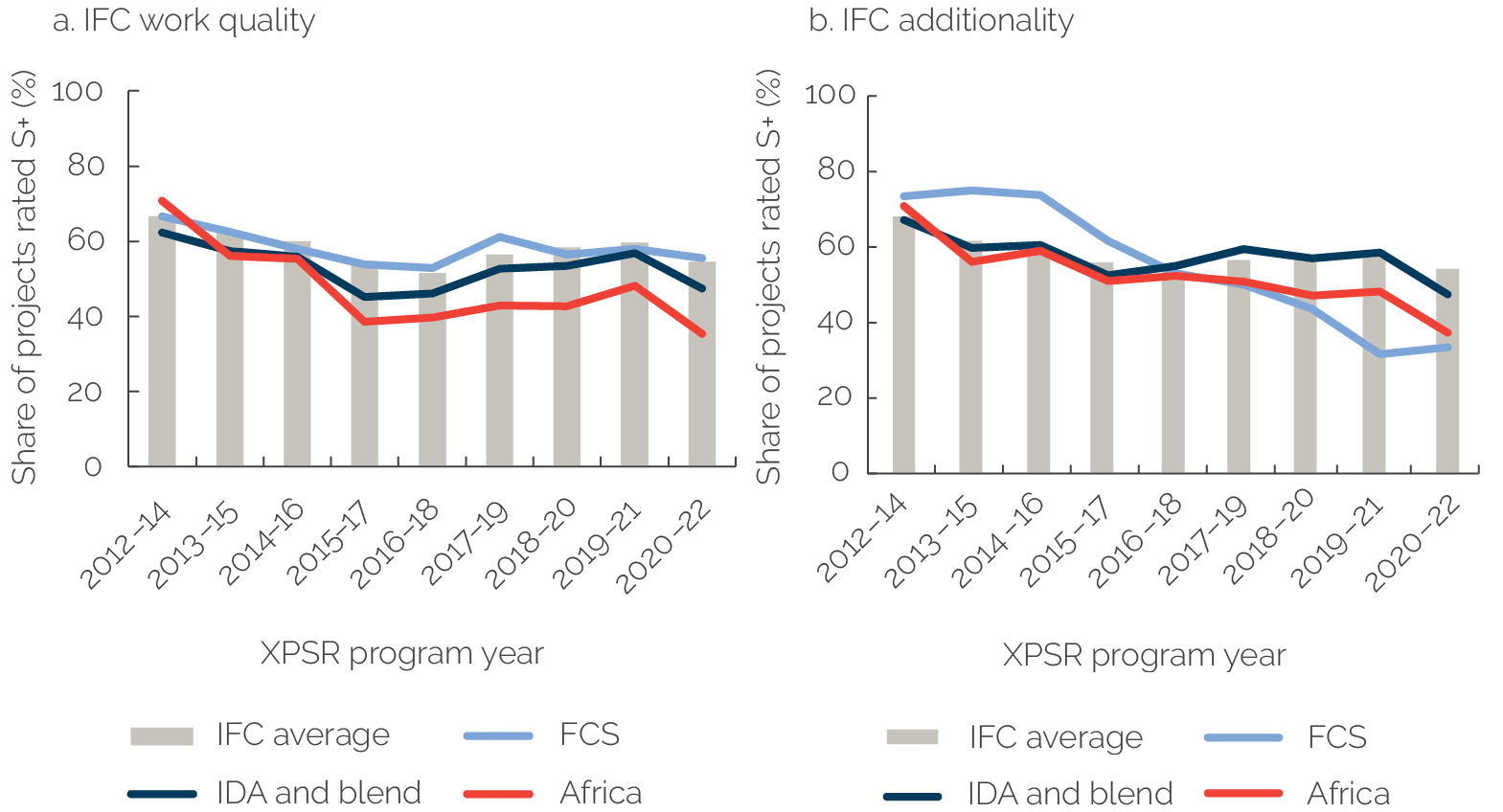

IFC work quality, which is important for overcoming these hurdles, weakened in CY20–22. Overall, the share of IFC investment projects with satisfactory or better IFC work quality ratings was 55 percent in CY20–22 (down from 60 percent in CY19–21).6 The share of investment projects with high project preparation work quality ratings decreased from 59 percent to 54 percent between CY19–21 and CY20–22, whereas high supervision work quality ratings stayed at approximately 70 percent during the same period. The decline in IFC work quality ratings was more pronounced in projects in African and IDA and blend countries compared with other country types (figure 3.2, panel a). IFC work quality ratings in FCS investment projects were on par with those of non-FCS investment projects. The challenging environment in African, IDA and blend, and FCS countries compels IFC to conduct more thorough due diligence, risk mitigation, and investment structuring at project preparation and provide enhanced implementation support during supervision. As in previous RAPs, RAP 2023 confirmed that IFC work quality ratings, particularly for project preparation, are positively and strongly associated with development outcome ratings.7 For example, RAP 2022 stated that there is a strong association between IFC work quality both at the front end and at implementation and the development outcome ratings (World Bank 2022b, 17). RAP 2021 and RAP 2020 both had similar findings.

Figure 3.2. IFC Investment Project Work Quality and Additionality Ratings

Source: Independent Evaluation Group, XPSR database.

Note: FCS = fragile and conflict-affected situation; IDA = International Development Association; IFC = International Finance Corporation; S+ = satisfactory or better; XPSR = Expanded Project Supervision Report.

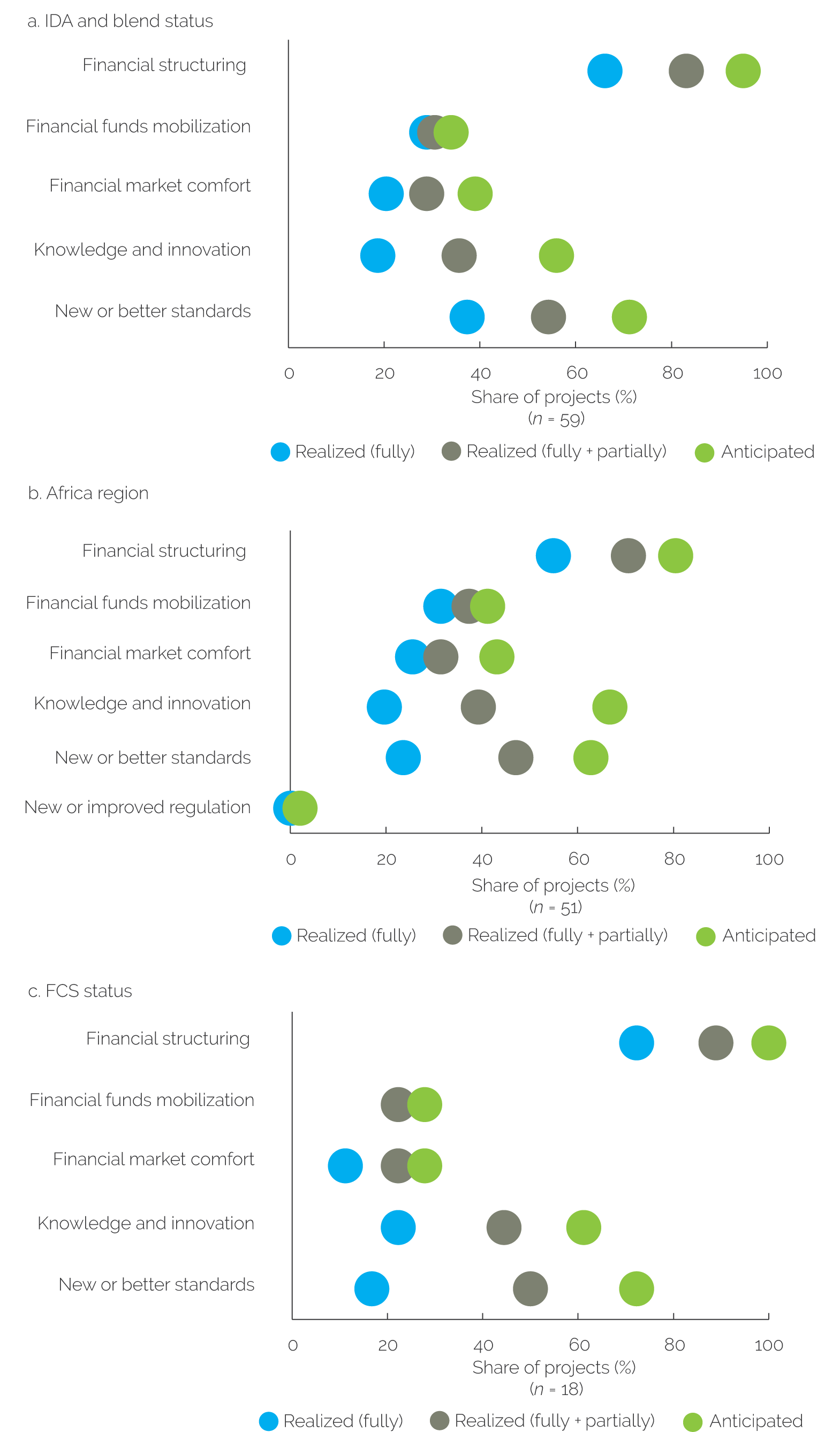

IFC additionality success ratings in challenging environments were lower than the IFC average. Overall, the share of IFC investment projects with high additionality ratings was 54 percent in CY20–22 (down from 59 percent in CY19–21). In challenging environments, such as FCS, African, and IDA and blend countries, IFC realized its anticipated additionality in 33 percent, 37 percent, and 47 percent of projects, respectively (figure 3.2, panel b). The gap between anticipated and realized additionality in these challenging markets was larger for nonfinancial additionality than for financial additionality. For example, the gap in provision of knowledge and innovation additionality was 27 percent in African, 20 percent in IDA and blend, and 17 percent in FCS countries.8 The gap in setting new or better standards, for example, in environmental and social and corporate governance practices was 16 percent in African, 17 percent in IDA and blend, and 22 percent in FCS countries (figure 3.3). IEG’s recent evaluation on IFC additionality in middle-income countries also found that IFC had the most difficulty with delivering nonfinancial additionality (World Bank 2023b), which requires more proactive supervision and implementation during an investment project’s life cycle. Within the RAP 2023 cohort, IFC additionality ratings were positively and strongly correlated with development outcome ratings.9 RAP 2022 also noted that IFC additionality was closely associated with development outcome ratings and that “IFC considers additionality essential to achieving development impact” (World Bank 2022a, xv).

Figure 3.3. Comparison of Anticipated and Realized Additionalities for Select Project Categories

Figure 3.3. Comparison of Anticipated and Realized Additionalities for Select Project Categories

Source: Independent Evaluation Group.

Note: The financial structuring, financial funds mobilization, and financial market comfort are the types of financial additionality. Conversely, knowledge and innovation, new or better standards, and new or improved regulation are the types of nonfinancial additionality. FCS = fragile and conflict-affected situation; IDA = International Development Association.

Overall, IFC investment outcome success ratings declined, although its equity performance remained stable. Financial sustainability is important for individual IFC project success and for IFC’s own sustainability as an investor and institution. IFC overall investment outcome ratings have been satisfactory or better in 60 percent of investment projects in CY20–22, which was slightly lower than 64 percent in CY19–21. This decline was caused by the slight decline in loan investment outcome ratings, some of which were caused by prepayments.10 In contrast, equity outcome ratings have remained stable, although only about a third of equity investments generated satisfactory returns. IFC achieved a “double bottom line” of high development outcome ratings and high investment returns in 42 percent of investment projects. The achievement of a double bottom line was lower in African, FCS, and IDA and blend countries, where a significant share of investment projects delivered neither positive development results nor satisfactory investment returns. Both IFC’s development and investment outcome ratings were low in 51 percent of African projects, 56 percent of FCS projects, and 39 percent of IDA and blend projects.

IFC advisory projects’ development effectiveness ratings declined slightly in the more challenging operating environment. The development effectiveness of IFC’s advisory projects has been improving since FY15–17, but the success ratings declined from 60 percent to 54 percent between FY19–21 and FY20–22 (figure 3.4). The overall ratings decline was mainly caused by a decrease in average ratings and not by changes in the evaluated portfolio’s composition (see the decomposition analysis in appendix E). IFC’s self-ratings in Project Completion Reports for advisory projects also declined. Fifty-four percent of advisory projects achieved satisfactory or better outcomes by the project’s completion date, despite 86 percent of projects delivering their outputs to the clients as expected. About a third of advisory projects had weak strategic relevance, whereas close to half had efficiency shortcomings. However, 23 percent of advisory projects managed to achieve longer-term impacts by the time of project completion. This is a positive achievement because advisory projects are not expected to achieve impacts by completion.

Figure 3.4. IFC Advisory Project Development Effectiveness Success Ratings

Source: Independent Evaluation Group, PCR database.

Note: IFC = International Finance Corporation; MS+ = mostly successful or better; PCR = Project Completion Report.

IFC’s advisory project development effectiveness ratings varied across regions and primary business areas. The decline in performance was more pronounced in the Financial Institutions Group; Public-Private Partnership; Manufacturing, Agribusiness, and Services; and Environment, Social, and Governance projects (which represented 61 percent of projects in IFC’s portfolio). Advisory projects in these primary business areas had weaknesses in project preparation and design and in M&E. External factors such as political conflicts, force majeure events, COVID-19–related disruptions, and client commitment issues also negatively affected the more recent projects in this RAP cohort and contributed to their low development effectiveness ratings.

The development effectiveness ratings of advisory projects were highly correlated with IFC work quality ratings, particularly for project preparation and design work quality. The relationship between IFC work quality ratings and development effectiveness ratings in IFC advisory projects has been established in previous RAPs and the 2017 joint IEG-IFC work quality study. They were correlated in 79 percent of advisory projects in the RAP cohort. IFC overall work quality ratings were satisfactory in 59 percent of advisory projects in FY20–22. However, IFC’s preparation and design work quality ratings were satisfactory or better in fewer than half of projects in FY20–22. The implementation and supervision work quality success ratings of advisory projects marginally declined in FY20–22, although 61 percent of these projects exhibited high work quality. Project design and preparation ratings were lower than the IFC average in advisory projects in the Africa region, with the success rate of 43 percent in FY20–22. Supervision and administration work quality success ratings continued to weaken in the Africa region and in IDA and blend countries. The share of African advisory projects with high implementation and supervision work quality ratings decreased from 58 percent in FY19–21 to 49 percent in FY20–22, while IDA and blend advisory projects saw a decline from 67 percent to 61 percent during the same period. Only 15 percent of the African advisory projects and 21 percent of IDA and blend projects with low IFC work quality achieved high development effectiveness ratings.

Factors Affecting Project Implementation and Performance

Several factors besides COVID-19 also negatively affected IFC’s investment project performance. This RAP conducted a deep-dive analysis of 170 IFC investment projects from the RAP cohort to find common factors affecting performance. The analysis identified the top three factors, among 5 categories and 51 subcategories, affecting performance for each project. These factors could have either a negative or positive influence on project performance (see appendix A for definition of different factors). We found that about a quarter of IFC investment projects in CY20–22 were negatively affected by unfavorable economic factors. These factors reduced demand for IFC client products and services and lowered the project companies’ operational and financial performance compared with the projections at the Board approval stage. The second-most common negative factor was high business risks, which affected the performance of 17 percent of investment projects. Many financial sector projects moved away from lending to riskier segments, such as micro, small, and medium enterprises and affordable housing finance, because of the economic slowdown and increased credit risks. This risk management was needed to help preserve capital; however, the consequence was that the development impact of these projects was reduced, since the lending targets to key beneficiaries were not met. Among real sector projects, adverse business factors related to cyclicality, a downturn in the markets, or untested and flawed business models affected investment project performance. The third-most common negative factor was higher- than-expected competition, which affected the performance of 14 percent of projects. This led to investment projects missing operational targets and contributed to reduced operating margins and profitability. The fourth-most common adverse factor was the limited technical expertise and track record of sponsors and clients, affecting 13 percent of investment projects (see box 3.1 for examples by industry group).

Investment projects that accumulated several negative factors had lower development outcome ratings. The accumulation of several negative factors within one project created significant risks, which many projects were unable to overcome. The RAP team observed this for many investment projects in the Africa region, which had relatively low development outcome ratings. These investment projects were affected by adverse economic factors, high business risks, and low ability of sponsors and clients. These three factors were also the most common negative factors for investment projects in IDA and blend, and FCS countries.

Many private sector sponsors and clients reacted quickly to the changing economic landscape, showing remarkable resilience and adaptability during the pandemic. In the financial sector, most IFC clients contracted their loan portfolio and focused on asset quality issues. Many real sector project companies implemented cost-saving initiatives to increase efficiency and shore up margins. Others invested quickly in information technology solutions to facilitate remote work. Many companies rolled out online versions of their business lines, particularly companies in the higher education and food and consumer retail sectors. In a few cases, the pandemic increased the demand for clients’ goods and services. For example, in the health care sector, investment project companies began manufacturing COVID-19 tests and vaccines, while project hospitals began treating COVID-19–affected patients.

The RAP team identified sponsor or client ability and technical expertise as a common factor that enabled proactive management to adapt quickly to the challenging environment. Strong sponsor and client ability and technical expertise contributed to better development outcomes. This factor positively influenced the performance of 30 percent of investment projects and was common for projects across all industry groups. Many sponsors can perform well in conducive operating environments, but strong and experienced sponsors can navigate challenging operating environments and identify mitigants to help projects survive. Indeed, strong sponsors were the decisive factor between investment projects on the borderline between mostly unsuccessful or mostly successful development outcome ratings. The main difference was that mostly successful investment projects relied on strong sponsors or clients to adapt to challenges.

There were other factors that supported investment project performance. Competitive business aspects supported the performance of 9 percent of investment projects, whereas favorable technology choices boosted the performance of 6 percent of projects. These two factors were most prevalent in real sector investment projects. Projects with clients that were market leaders or that increased their market share posted better operational and financial performance in 7 percent of the cohort. Strong financial capacity, capitalization, and leverage of sponsors aided the performance of 5 percent of projects. Collaboration and coordination among IFC investment and advisory teams, for example, by IFC providing technical assistance to sponsors, enhanced the performance of 5 percent of investment projects, particularly in the financial sector.

Box 3.1. Examples of Supporting and Constraining Factors Affecting IFC Investment Project Performance, by Industry Group

Financial Institutions Group Projects

Supporting factors. Technical expertise and track record as a positive factor meant that the management of financial institutions was experienced and the financial institution had a historical strong performance in terms of earnings, asset quality, and risk management. Market share typically meant that the financial institution was the leader in the respective market (for example, banking, small and medium enterprise lending, microfinance, and housing), which gave it an edge over the competition. “Collaboration and coordination within the International Finance Corporation: advisory services and investment services” typically referred to joint International Finance Corporation investment services and advisory projects that helped improve the capacity of financial institutions, especially in the area of micro, small, and medium enterprise lending.

Constraining factors. Business factors meant that the financial institutions experienced declining performance of the targeted beneficiaries and moved away from lending to them (for example, micro, small, and medium enterprises; agribusiness; and affordable housing) as a result of the higher-risk profile. In a more adverse environment, the financial institutions turned toward making less risky loans to corporations or investing in government securities, which reduced development impact. Asset quality could mean that the financial institution did not sufficiently provision for bad loans or had deficiencies in credit risk management. Legal or regulatory factors meant that the regulatory environment became more adverse during project implementation, with interest rate caps or new policy requirements on financial institutions.

Infrastructure and Natural Resources Projects

Supporting factors. Legal or regulatory factors meant that the projects benefited from effective structuring of concession agreements and supportive government policies and initiatives. Technology meant that the projects benefited from technically and commercially viable technology, with an edge over inefficient or costlier options. Pricing meant that the projects benefited from favorable tariffs or upward trends in market prices of their products.

Constraining factors. Business factors meant that the projects had flawed, untested, or fragile business models or experienced slowdown in market growth. Legal or regulatory factors meant that the projects were affected by failure to obtain the required licenses, an unexpected government decision to withhold value-added tax reimbursements, and disputes between the government and project company regarding the curtailment of fuel supply. Political factors meant the issues related to illiquid public sector offtaker with payment dependence on the government, inability of the government to meet its obligations in terms of fuel supply and offtake payments, delay in the commissioning attributed to the government, and regulatory changes because of the government's suspension of the privatization program.

Manufacturing, Agribusiness, and Services Projects

Supporting factors. Expansion meant that a project company benefited from expansion and market consolidation through acquisitions or organic growth, driving cost efficiencies and economies of scale. It could also mean that they had higher capital expenses or larger project scope than expected because of more investment. Relationship management meant that the project was a repeat deal with the same sponsors and gained from previous experience, or the International Finance Corporation had an active portfolio management and was flexible by helping the clients address their pressing needs in a more depressed market environment. Business factor as a favorable factor meant that the project gained from the increased market opportunity or its business model provided an edge over the competition.

Constraining factors. Environment and sustainability meant that the project had material shortcomings in meeting environmental and social requirements or that the client did not have in place some of the required important corporate policies. Business factors meant that the project company had shortcomings in the business model or suffered from unfavorable business and operating environment or industry cyclicality.

Disruptive Technologies and Funds Projects

Supporting factors. Technical expertise and track record as a positive factor meant fund managers with strong capacity or relevant experience. The environment and sustainability as a favorable factor meant the investment fund had high environmental and social and corporate governance standards.

Constraining factors. Project size meant that the fund was unable to reach its target size. This could be due to the fund manager’s lack of experience or mean that the fund’s investment thesis was too risky. Technical expertise and track record as an adverse factor typically meant that the fund manager lacked experience in private equity investing, in the specific fund target segment, or in emerging markets. Customers typically meant that the fund deviated from its investment strategy and invested in different types of portfolio companies than intended at approval. For example, the fund may have invested in developed countries rather than in emerging markets.

Source: Independent Evaluation Group.

Note: IFC = International Finance Corporation.

Performance factors could be divided into those within the control of IFC or its sponsors and those outside of their control. For example, an economic recession, the pandemic, or sudden changes in government regulations are out of the control of IFC and the project sponsors. However, sponsor ability, a client’s market share, business factors, and IFC investment–advisory services collaboration can be within IFC and the project sponsors’ control. Indeed, these controllable factors, which support project performance, featured more prominently in high-performing projects. Table 3.1 presents examples of potential measures that could be taken by IFC to mitigate adverse performance factors. For example, IFC or sponsors could mitigate adverse factors by conducting sound market analyses, enhancing the screening of sponsors, better assessing economic and business risks, providing advisory projects to strengthen sponsors’ skills and capacity, and improving the delivery of additionality during implementation.

Table 3.1. Examples of Potential Mitigation Measures for IFC Investment Projects, by Industry Group

|

Adverse Performance Factor |

Potential Mitigation Measures |

|

Financial Institutions Group projects |

|

|

Business factors: Refers to a financial institution moving away from lending to the target beneficiaries (for example, micro, small, and medium enterprises; agribusiness; affordable housing; and so on) because of a more adverse environment, which will reduce development impact. |

Mitigant: Provide technical assistance to the financial institution either before or during the implementation to enhance its capacity to increase or maintain lending to risky but highly developmental segments. |

|

Integrity, transparency, fairness, and reputation: Refers to internal integrity due diligence issues with the sponsor affecting the project. |

Mitigant: Conduct ongoing integrity due diligence to ensure that issues do not materialize. Proper supervision could help project teams react quickly to try to mitigate any adverse integrity due diligence issues during project implementation in a timely manner. |

|

Loan factors: Refers to the entire facility not being drawn down or disbursed due to a change in the financial institution‘s strategy. It also refers to the loan tenor not being appropriate for the project or loan covenants not being appropriate or followed. |

Mitigant: Carefully assess the financial institution’s strategy and capacity at appraisal to ensure commitment to the project’s development objectives (for example, micro, small, and medium enterprise lending). Ensure that the loan is properly priced or appropriate for the financial institution’s purposes. |

|

Infrastructure and Natural Resources projects |

|

|

Business factors: Refers to flawed, untested, or fragile business models or a slowdown in market growth. |

Mitigant: Assess the viability of the business model during appraisal. Decline to invest when the business model is flawed. Provide additionality to assist the client in improving operations and practices. |

|

Technical expertise and track record: Refers to the sponsors not measuring up to what the project was aiming to achieve without adequate operational and financial capacity, depth of management, and relevant experience. |

Mitigant: Closely examine the sponsor’s financial capacity, management depth, and relevant experience at appraisal. Provide additionality and active portfolio supervision if the sponsor decides to invest. |

|

Manufacturing, Agribusiness, and Services projects |

|

|

Environment and sustainability: Refers to the project having material shortcomings in meeting environmental and social requirements or the client not putting in place required corporate policies. |

Mitigant: In case of corporate financing investments, ensure that the client has in place all required corporate policies and that all its businesses comply with environmental and social performance standards. The cost of environmental and social improvements needs to be estimated at appraisal and included in the project cost if needed. Provide additionality to improve the client’s environmental and social practices. |

|

Business factors: Refers to shortcomings in the business model or unfavorable business and operating environment or industry cyclicality. |

Mitigant: Assess the viability of the business model during appraisal. Provide additionality to clients in improving their operations and practices. |

|

Disruptive Technologies and Funds projects |

|

|

Project size: Refers to a fund not reaching its target size, potentially due to fund manager’s lack of experience or riskiness of investment thesis. |

Mitigant: Provide additionality by assisting fund manager in fundraising. Conversely, decline to invest in the fund if the fund is unable to reach the minimum capital. |

|

Technical expertise and track record: Typically refers to a fund manager lacking experience in private equity investing, in the specific fund target segment, or in emerging markets. |

Mitigant: Provide additionality through technical assistance to both the fund manager and the downstream portfolio companies to help make the fund successful. |

|

Customers: Typically refers to fund deviation from its investment strategy and investing in different types of portfolio companies than intended at approval. |

Mitigant: Through position on the advisory committee, voice objections to any unnecessary deviations in the fund strategy or decline to participate in investments that are not in line with the investment thesis as presented at approval. |

Source: Independent Evaluation Group.

Note: IFC = International Finance Corporation.

Investment projects from the CY20–22 cohort operated in more challenging country and market conditions than did prepandemic projects. This RAP compared performance factors of CY20–22 investment projects with those of CY17–19 projects (see appendix A and the report by Bravo et al. 2023 for the methodological details of applying supervised machine learning to the analysis of CY17–19 projects). Except for the pandemic and related effects, the key factors affecting CY20–22 investment project performance were broadly the same as those affecting CY17–19 project performance. That said, the investment projects in the RAP cohort were more negatively affected by (i) adverse economic factors; (ii) high business risks; (iii) unforeseen epidemics, including COVID-19; and (iv) higher-than-expected competition. The environment and sustainability factor was also more prevalent in CY20–22 investment projects. In contrast, M&E issues and unfavorable market pricing were more prevalent negative factors for the prepandemic investment projects (figure 3.5). However, strong client or sponsor ability, technical expertise, and experience aided the performance of investment projects in the RAP cohort. This factor was also prevalent in high-performing investment projects from CY20–22, demonstrating that strong clients and sponsors were able to effectively cope with challenges posed by the pandemic.

Figure 3.5. Factors Affecting IFC Investment Project Performance: The Prepandemic Cohort Compared with the RAP 2023 Cohort

Source: Independent Evaluation Group.

Note: The factor identification for calendar years 2020–22 projects was based on human thinking, whereas for calendar years 2019–21 prepandemic projects, it was based on machine learning. Positive = the identified factor aided the project performance. Negative = the identified factor constrained the project performance. AS = advisory services; IFC = International Finance Corporation; IS = investment services; RAP = Results and Performance of the World Bank Group.

Outcome Types of International Finance Corporation Investment Projects

This RAP built on RAP 2021 outcome type analysis with a deep-dive analysis and found that IFC investment project objectives were highly outcome oriented. The deep dive examined the intended outcomes from 170 IFC investment projects in the RAP cohort. The deep dive identified 848 outcomes across 13 different outcome types (see appendix A for the outcome typology). IFC’s investment project outcomes fall into two broad categories: project-level outcomes and market-level outcomes. Project-level outcomes are those with direct and indirect effects on stakeholders, the economy, and the environment. Market-level outcomes are derived effects, or those that catalyze systemic changes beyond the project’s effects.11 Projects reviewed in the deep dive pursued an average of 5 different outcomes, consisting of 4 project-level outcomes and 1 market-level outcome (see box 3.2 for examples of project- and market-level outcomes by industry group). Overall, all reviewed IFC investment projects pursued project-level outcomes, and 74 percent pursued market-level outcomes, confirming the RAP’s hypothesis that IFC investment projects were focused on higher-level outcomes such as market-level outcomes. Every IFC project pursued the project-level outcome type of improved access to goods and services. Other prevalent project-level outcomes were increased employment and quality and affordability of goods and services. The most common market-level outcome—competition in the market—was prevalent in 58 percent of projects, whereas sustainability in the market (which refers to clients’ adoption of climate-friendly and environmentally and socially sustainable products, practices, and technologies) was the second most prevalent market-level outcome.

Box 3.2. Examples of IFC Investment Project-Level and Market-Level Outcomes, by Industry Group

Financial Institutions Group

Project-level outcome: Increase in outstanding small and medium enterprise loans, increase in share of microfinance loans, and reduction in nonperforming loans ratio.

Market-level outcome: Demonstration of the viability of lending to microborrowers or small and medium enterprises, deepening of financial markets, and fostering increased competition in the banking sector.

Infrastructure and Natural Resources

Project-level outcome: Increase in renewable energy generation, improvement in information technology infrastructure, increase in access and use of mobile telecommunication services, and number of passengers with access to the road.

Market-level outcome: Diversification of energy mix and increased competition in the information and communication technology sector.

Manufacturing, Agribusiness, and Services

Project-level outcome: Increase in affordable housing supply, increase in purchases from domestic suppliers, increase in quality or affordability of health care services, and increase in tax payments.

Market-level outcome: Demonstration effect on the local agribusiness industry; demonstration of viability of green buildings and promotion of replication; enhanced environmental, social, and governance standards to serve as a corporate role model.

Disruptive Technologies and Funds

Project-level outcome: Percentage of fund investee companies with growth in revenue and returns, increase in job creation at investee companies, and increase in access to information and communication technology services.

Market-level outcome: Demonstration effect through raising of follow-on fund and facilitation of investee companies’ emergence as regional players.

Source: Independent Evaluation Group.

Note: IFC = International Finance Corporation.

Outcome achievement rates were relatively low. IFC fully achieved 45 percent of its 693 stated project-level outcomes and partially achieved 22 percent. The highest achievement rate among common project-level outcomes was improved sales and profitability of enterprises, which was fully achieved 67 percent of the time. Other common project-level outcomes with high full achievement rates were greenhouse gas reductions at 63 percent, enhanced capacity of final beneficiaries at 57 percent, and enhanced environmental and social standards of the client at 52 percent. IFC fully achieved 43 percent of its 155 stated market-level outcomes and partially achieved 21 percent. Among these, resilience in the market had the highest full achievement rate at 47 percent, whereas competition in the market, which was the most common market-level outcome in projects, had a full achievement rate of 45 percent (see table 3.2 for achievement rates by outcome type).

Table 3.2. IFC Outcome-Type Performance: Achievement Rate

|

Outcome Type |

Outcomes (no.) |

Outcome Achieved (fully; %) |

Outcome Achieved (partially; %) |

Outcome Achieved (fully + partially; %) |

|

Project-level outcomes |

||||

|

1.1 - Access to goods and services |

242 |

44 |

30 |

74 |

|

1.1.1 - Access to goods and services (MSME) |

50 |

46 |

22 |

68 |

|

1.1.2 - Access to goods and services (female) |

13 |

62 |

15 |

77 |

|

1.1.3 - Access to goods and services (customers) |

88 |

43 |

32 |

75 |

|

1.1.4 - Access to goods and services (miscellaneous) |

66 |

39 |

33 |

72 |

|

1.1.5 - Access to goods and services (direct client level) |

25 |

44 |

36 |

80 |

|

1.2 - Quality and affordability of goods and services |

104 |

47 |

14 |

61 |

|

1.2.1 - Quality of goods and services |

37 |

46 |

14 |

60 |

|

1.2.2 - Affordability of goods and services |

53 |

47 |

13 |

60 |

|

1.2.3 - Improved productivity and efficiency of the direct client |

14 |

50 |

21 |

71 |

|

1.3 - Enhanced capacity of final beneficiaries |

23 |

57 |

13 |

70 |

|

1.4 - Improved living standards (earnings) of individuals |

5 |

0 |

0 |

0 |

|

1.5 - Improved sales and profitability of enterprises |

15 |

67 |

27 |

94 |

|

2.1 – Suppliers and distributors reached |

12 |

50 |

25 |

75 |

|

2.2 - Improved capacity of suppliers and distributors |

5 |

40 |

20 |

60 |

|

2.3 - Improved sales and profitability of suppliers and distributors |

28 |

39 |

32 |

71 |

|

3.1 - Increased employment |

94 |

40 |

23 |

63 |

|

3.2 - Improved capacity and skills |

11 |

45 |

27 |

72 |

|

3.3 - Improved earning of employees |

0 |

n.a. |

n.a. |

n.a. |

|

4.1 - Increased transfers to the government |

32 |

31 |

28 |

59 |

|

5.1 - Increased money spent and transfer to the communities |

5 |

60 |

0 |

60 |

|

6.1 - Enhanced E&S standards of the client |

54 |

52 |

17 |

69 |

|

6.2 - Greenhouse gas reduction |

32 |

63 |

6 |

69 |

|

6.3 - Efficient use of resources |

11 |

55 |

9 |

64 |

|

7.1 - Gross value added |

5 |

40 |

60 |

100 |

|

7.2 - Induced or indirect employment |

8 |

25 |

0 |

25 |

|

7.3 - Export sales |

4 |

50 |

0 |

50 |

|

8.1 - Governance |

3 |

67 |

0 |

67 |

|

Total project-level outcomes |

693 |

45 |

23 |

68 |

|

Market-level outcomes |

||||

|

9 - Competition in the market |

98 |

45 |

20 |

65 |

|

10 - Resilience in the market |

17 |

47 |

29 |

76 |

|

11 - Integration in the market |

12 |

33 |

25 |

58 |

|

12 - Inclusiveness in the market |

8 |

38 |

13 |

50 |

|

13 - Sustainability in the market |

20 |

40 |

20 |

60 |

|

Total market-level outcomes |

155 |

43 |

21 |

65 |

|

Total outcomes |

848 |

45 |

22 |

67 |

Source: Independent Evaluation Group.

Note: Of project-level outcomes, 8 percent were considered not achieved because the results could not be verified. Of market-level outcomes, 7 percent were considered not achieved because their results could not be verified. E&S = environmental and social; IFC = International Finance Corporation; MSME = micro, small, and medium enterprise; n.a. = not applicable.

The achievement of market-level outcomes was almost as high as the achievement of project-level outcomes. These results did not fully confirm this RAP’s hypothesis that market-level outcomes were more difficult to achieve than project-level outcomes. This hypothesis was supported by findings from RAP 2021, which found that market-level outcomes are more difficult to achieve “because the success of market-level outcomes depends on the broader market environment and external factors such as market changes and actions by external actors” (World Bank 2021, 51). However, this RAP shows (see table 3.2) that reviewed investment projects fully achieved project-level outcomes only 2 percent more often than they achieved market-level outcomes (45 percent compared with 43 percent).

Monitoring data were not available for a significant number of total outcomes. This confirms the RAP’s hypothesis that IFC’s result measurement indicators are not fully adequate to measure outcome achievement. This is consistent with RAP 2021, which states that “market-level outcomes are also difficult to measure because they materialize over the long term and few indicators can measure a project’s contributions with certainty” (World Bank 2021, xv). Most of the investment projects in the RAP 2023 cohort were not subject to an AIMM assessment at their approval and continued to be monitored in the Development Outcome Tracking System. In many cases, IFC or IEG used other information sources, where available, to validate project outcome claims.

Some outcomes could not be verified because of a lack of appropriate results measurement indicators and evidence, which depressed outcome achievement rates. Eight percent of total outcomes could not be verified because of a lack of evidence and were coded as “cannot be verified,” including 8 percent of project-level outcomes and 7 percent of market-level outcomes. Of the 65 outcomes that could not be verified, 91 percent were not tracked by IFC in any monitoring system. Some of the most common reasons an outcome could not be verified were as follows: (i) the project did not have an indicator to track the outcome, (ii) the client did not report relevant information, (iii) there was insufficient evidence to measure achievement, (iv) there was no clarity in how to measure the outcome, (v) the result could not be attributed to the project, or (vi) it was too early to tell.

Relationship between Outcomes and Project Performance Ratings

Investment project development outcome ratings were related to the achievement rates of project- and market-level outcomes. According to the XPSR guidelines, development outcome ratings of IFC investment projects are assigned at the project level and subdimension level but not at the project outcome level. Therefore, this RAP expanded the RAP 2021 outcome type analysis by comparing outcome achievement to individual project development outcome ratings. This analysis showed that IFC investment projects that achieved more of their outcomes also had higher development outcome ratings. This relationship was particularly strong for market-level outcomes (table 3.3). For the RAP 2023 cohort of 170 investment projects, development outcome ratings decreased, along with lower outcome achievement rates, for both project- and market-level outcomes. Highly successful projects achieved 100 percent of their project- and market-level outcomes. Development outcome ratings declined in tandem with lower outcome achievement. Highly unsuccessful projects achieved only 8 percent of their outcomes. This indicates a clear link between outcome achievement levels, especially for market-level outcomes, and development outcome rating (see appendix F for details on outcome type analysis). Project business performance (PBP) and environmental and social effects are components of development outcome; therefore, lower PBP and environmental and social performance were also associated with lower investment project development outcome ratings.

Table 3.3. IFC Investment Project Development Outcome Ratings and Underlying Outcome Achievement Rates

|

Development Outcome Rating |

Total Projects (no.) |

Total Outcomes (no.) |

Overall Weighted Achievement Rate (%) |

Project-Level Outcome Weighted Achievement Rate (%) |

Market-Level Outcome Weighted Achievement Rate (%) |

Project Business Performance Average Rating |

Environmental and Social Effects Average Rating |

|

Highly successful |

3 |

18 |

100 |

100 |

100 |

4.0 |

3.0 |

|

Successful |

35 |

161 |

87 |

86 |

90 |

3.4 |

3.0 |

|

Mostly successful |

46 |

250 |

73 |

75 |

68 |

2.8 |

2.8 |

|

Mostly unsuccessful |

39 |

198 |

49 |

50 |

45 |

2.2 |

2.5 |

|

Unsuccessful |

32 |

139 |

23 |

25 |

9 |

1.4 |

2.5 |

|

Highly unsuccessful |

15 |

82 |

8 |

8 |

8 |

1.1 |

1.8 |

Source: Independent Evaluation Group.

Note: Outcome achievements in projects are measured with the following weights: outcome achieved = 1, partially achieved = 0.5, not achieved = 0, and cannot verify = 0. Project business performance and environmental and social effects ratings’ numerical values are as follows: excellent = 4, satisfactory = 3, partly unsatisfactory = 2, and unsatisfactory = 1. IFC = International Finance Corporation.

An investment project’s level of outcome achievement was the main difference in influencing the development outcome rating for borderline projects. As table 3.3 shows, the weighted outcome achievement rate of investment projects rated mostly successful was 73 percent compared with only 49 percent for investment projects rated mostly unsuccessful. Investment projects rated mostly successful achieved 68 percent of market-level outcomes compared with only 45 percent for investment projects rated mostly unsuccessful. Financial performance was also an important factor for borderline projects as the difference in their PBP rating was one full rating difference (satisfactory versus partly unsatisfactory). Investment projects rated mostly successful had an average PBP rating of 2.8 (closer to satisfactory than partly unsatisfactory), whereas investment projects rated mostly unsuccessful had an average PBP rating of 2.2 (closer to partly unsatisfactory than satisfactory).