International Finance Corporation Additionality in Middle-Income Countries

Overview

Introduction

Additionality is a core feature of International Finance Corporation (IFC) development finance, which is integral to IFC’s mission. Additionality refers to the unique contribution that IFC (or other multilateral development banks) brings to a private investment project that is not offered by commercial sources of finance. The core idea is that the investment project should add value without crowding out private sector activity.

There are two types of additionality: financial and nonfinancial. Financial additionality can be realized through features such as the financing structure (for example, a long loan tenor or financing in local currency) and innovative financing (such as through derivatives or green bonds). Nonfinancial additionality encompasses other unique contributions such as the deployment of knowledge and standards or protection against noncommercial risk.

The concept of additionality is different from that of development impact, but additionality contributes to development impact. Where IFC provides unique support to a developmentally significant project that may not otherwise proceed, it is more likely to contribute to IFC’s goals of creating markets and mobilizing capital at scale in service of higher-level aims embodied in the Sustainable Development Goals. Projects may exhibit different types and combinations of additionality based on country income, sector, market, client, and other aspects of project context.

This evaluation distinguishes between anticipated and realized additionality. At the outset of a project, when it is being designed and appraised, IFC identifies the additionality it believes will be associated with its support. This is the project’s anticipated additionality. Once a project is complete or terminated, it may be evaluated to determine whether the anticipated additionality actually occurred—that is, whether IFC delivered a unique contribution to the client or partner consistent with its expectation. This is realized additionality. Additionality cannot be quantified, but evidence can be provided as to whether it was present or not present—for example, whether the tenor of the loan was or was not available from another provider.

Properly identifying and articulating project additionality are important in middle-income countries (MICs), especially in upper-middle-income countries (UMICs). In these countries, financial markets are more developed, and private investment far exceeds official development assistance. These conditions create a special challenge for IFC additionality because its reliance on traditional financial additionalities is weaker in the context of competition from private financiers. Innovative financing and nonfinancial additionalities can be particularly important to ensure that IFC adds unique value and does not crowd out private finance in this context.

This evaluation examines the relevance and effectiveness of IFC’s approach to additionality in MICs and seeks to explain the factors that contribute to or constrain its realization. Although the main focus is on project-level additionality, the evaluation also applies the lens of country and sector context to add to its learning value. Thus, it considers whether additionality can occur beyond the level of a single project—for example, at the country and sector level. Both at the project level and beyond the project, we derive lessons on how IFC can further strengthen its additionality.

In assessing additionality, the evaluation sought to answer three main questions:

1.Relevance. To what extent does IFC’s anticipated additionality in lower-middle-income countries (LMICs) and UMICs vary, and what explains variance according to country and industry or sector context, IFC instrument type, and the presence and role of other providers of finance and services in the same industry, sector, or country?

2.Effectiveness. To what extent was IFC’s anticipated financial and nonfinancial additionality realized in MICs, and to what extent was it plausibly linked to enhanced development outcomes and impact at the project, industry or sector, and country level?

3.Learning. How can IFC strengthen its additionality at the country, industry or sector, and project or instrument level?

Our findings are based on mixed methods. They include the following:

- A review and analysis of 579 projects evaluated between 2011 and 2022 and additional projects that were not evaluated but were initiated during this period

- Statistical and econometric analysis of the portfolio using both data from project evaluations and external variables to relate the successful attainment of financial and nonfinancial additionality to a variety of explanatory factors

- Nine country case studies, each with two nested sector studies, in countries selected to reflect a range of LMIC and UMIC experiences: Bangladesh, China, Colombia, the Arab Republic of Egypt, Indonesia, Mexico, Nigeria, South Africa, and Türkiye; sectors covered included electric power (traditional and renewable), commercial banking, microfinance, chemicals and fertilizers, and agroindustry

- A structured literature review of a very limited academic literature on development finance institutions (DFIs) financial and nonfinancial additionality for private sector operations, including on links of additionality to development outcomes

- Semistructured interviews of 21 IFC experts on aspects of IFC’s additionality and IFC practices and experience relating to them

- Deep dive input papers on DFI additionality in MICs and the additionality features of IFC’s financing instruments in MICs

The approach used by the Independent Evaluation Group (IEG) has several acknowledged limitations. First, it treats additionality and its types only as defined in IFC’s framework. Second, it is not an evaluation of IFC’s development effectiveness. Third, it does not treat the additionality of IFC advisory services projects because IFC has not consistently identified and assessed such additionality. Fourth, because IFC’s enhanced additionality framework was activated only in fiscal year 2019, there were few evaluated projects approved under the new framework. Next, although IEG applies country and sector lenses to additionality for learning purposes, it does not aggregate additionality at this level (as agreed in the Approach Paper). Finally, this evaluation focuses only on IFC’s work in MICs.

Relevance

Several factors make IFC a leader among DFIs in identifying and articulating additionality at the time of approval. IFC’s additionality framework and accompanying guidelines for staff provide the basis for clarity and rigor in articulating additionality in investment project approval documents. Furthermore, its internal review process enhances the quality of additionality claims. IFC does not apply a parallel process to its advisory services projects.

IFC’s additionality has become more diverse over time to include both financial and nonfinancial attributes. This shift can be understood to arise in part in response to (i) the increased availability of private financing, which weakens IFC’s claims to financial additionality, and (ii) the increased scrutiny of additionality in projects in UMICs by IFC’s Board of Directors and management. The majority of projects (82 percent) anticipate both financial and nonfinancial additionality.

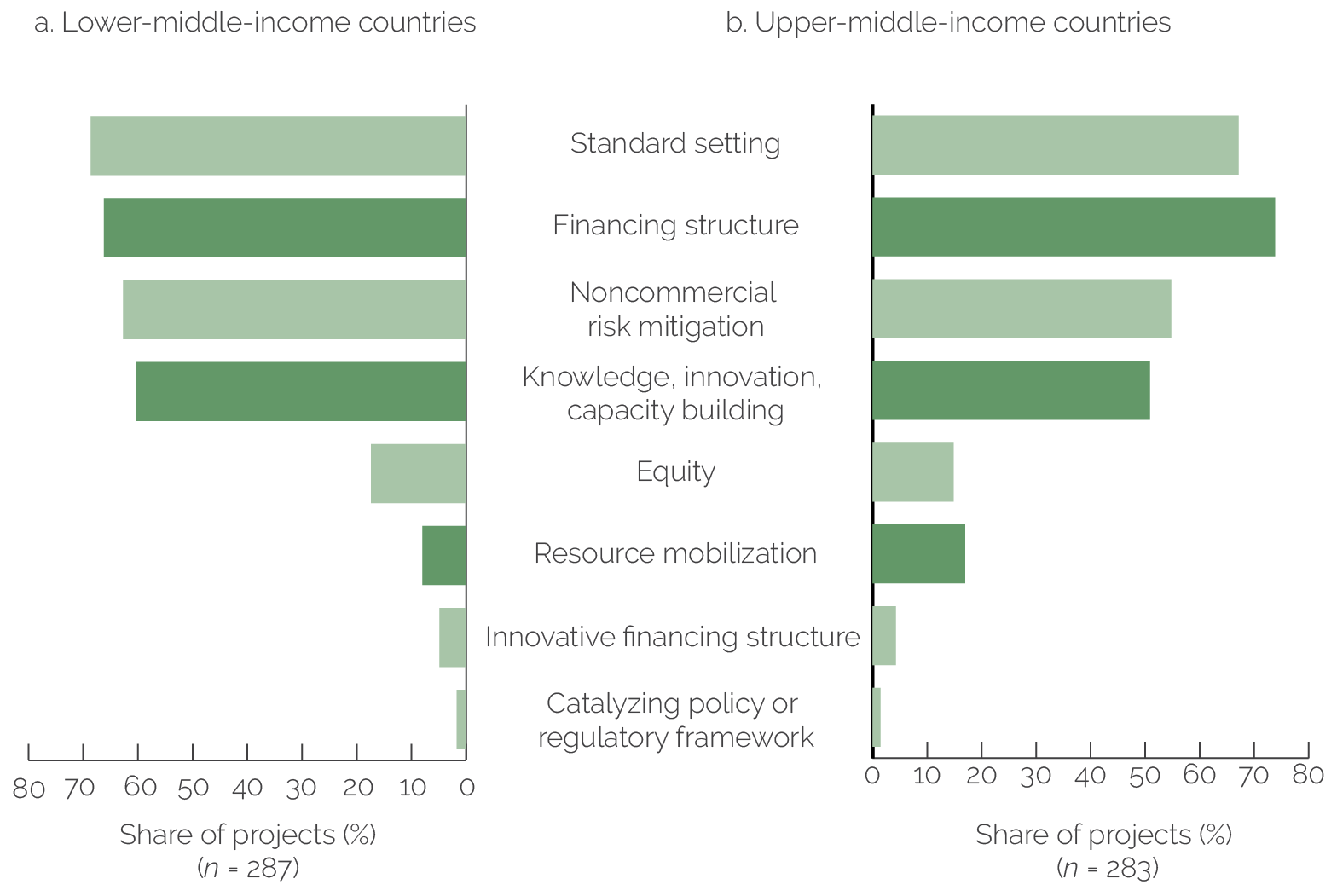

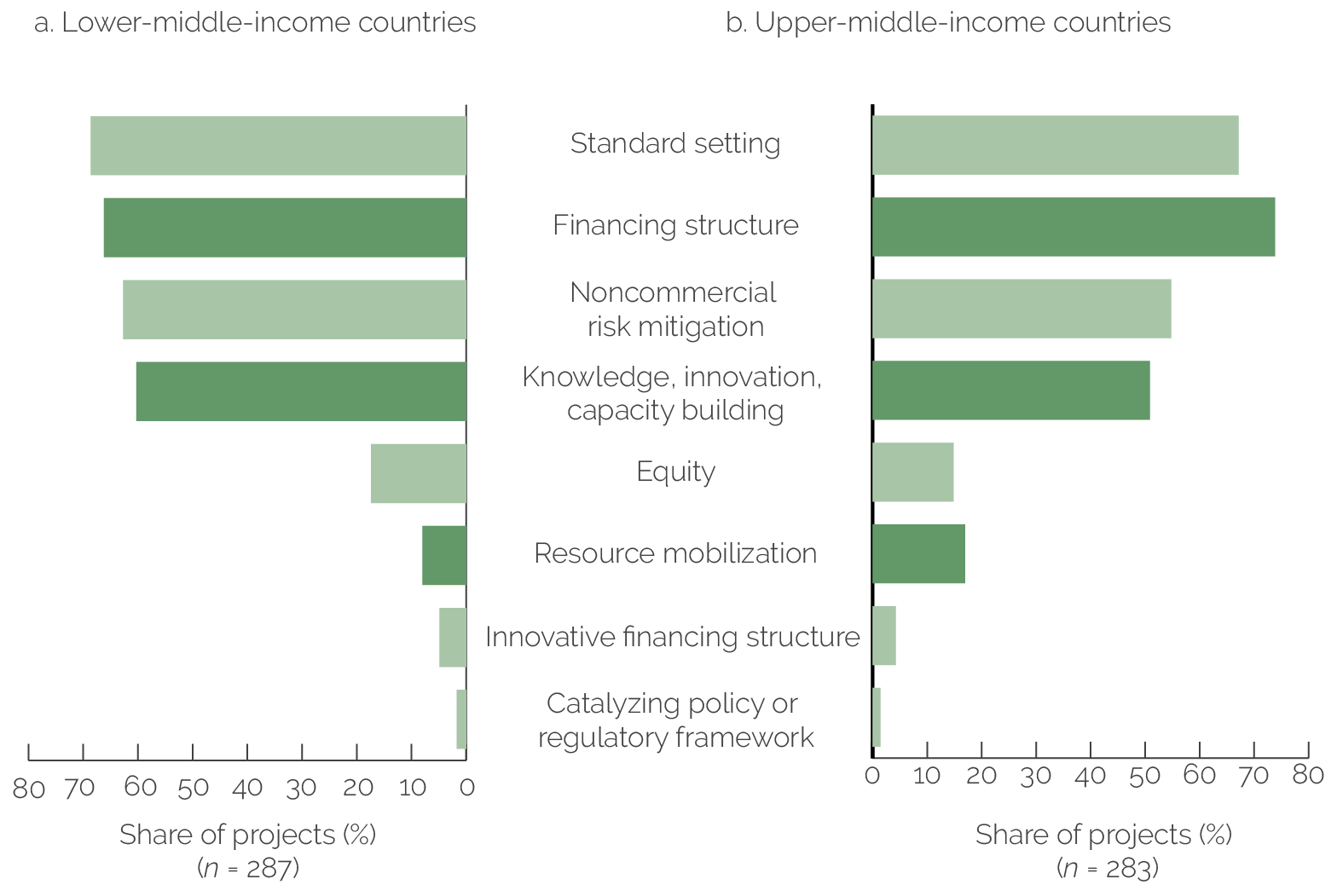

The patterns of anticipated additionality present in IFC’s portfolio do not match IFC’s assumptions about how additionality varies based on country income. IFC’s corporate strategies indicate that, as country income rises, IFC will rely more on additionality types based on innovation (financial and nonfinancial) and deployment of knowledge. However, the portfolio tells a different story. IFC has not employed knowledge and innovation additionalities to a greater extent in UMICs than in LMICs. In practice, IFC has a significantly greater proportion of anticipated financial additionalities in UMICs than in LMICs and a significantly greater proportion of anticipated nonfinancial additionalities in LMICs than in UMICs (figure O.1).

The types of additionalities IFC anticipates also differ by sector. The pattern of additionality in infrastructure is different from those in financial markets and manufacturing and services. This points to the importance of considering sector characteristics when planning for additionality. The stage of sector development also influences the types of additionalities provided, which can evolve over time as markets grow in sophistication.

Figure O.1. Incidence of Additionality Subtypes, Lower-Middle-Income Countries Compared with Upper-Middle-Income Countries

Source: Independent Evaluation Group.

Note: Dark green indicates additionality types for which differences between upper-middle-income countries and lower-middle-income countries are statistically significant at 95 percent.

The additionality of IFC’s financing instruments is determined not only by their features but also by the context in which they are applied. The additionality of loans and equity is a function of country, sector, and client risk, and of the stage of market development. Context matters. For example, some short-term financing instruments that may not offer a unique contribution in normal times may offer substantial additionality during crises when liquidity is scarce.

Although IFC has committed only to treating additionality at the project level, the evaluation finds promising examples where IFC considers additionality beyond the project level. For example, some country and sector strategy documents consider additionality. Such instances point to the potential for IFC to strategically add unique value at the country or sector level.

Effectiveness

Nearly all IFC investment projects in MICs (96 percent) realize some additionality. However, many projects realize only part of the additionality anticipated. Thus, although 82 percent of projects anticipate both financial and nonfinancial additionality, only 60 percent deliver both. Although 87 percent of anticipated financial additionalities were realized, only 63 percent of anticipated nonfinancial additionalities were realized. The overall additionality success rates in LMICs (61 percent) and UMICs (63 percent) are very similar. IFC sometimes realizes additionality it did not anticipate, particularly with regard to standard setting and noncommercial risk mitigation.

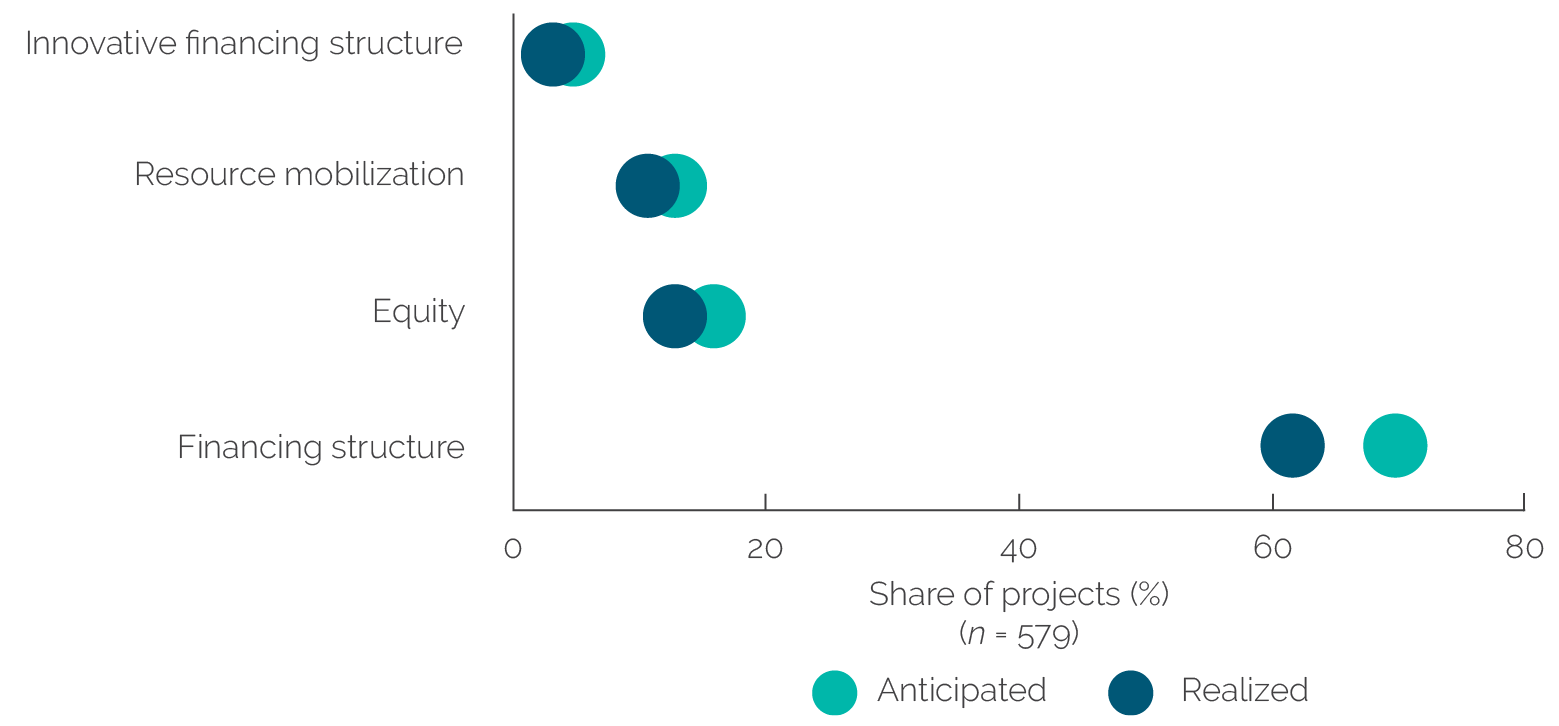

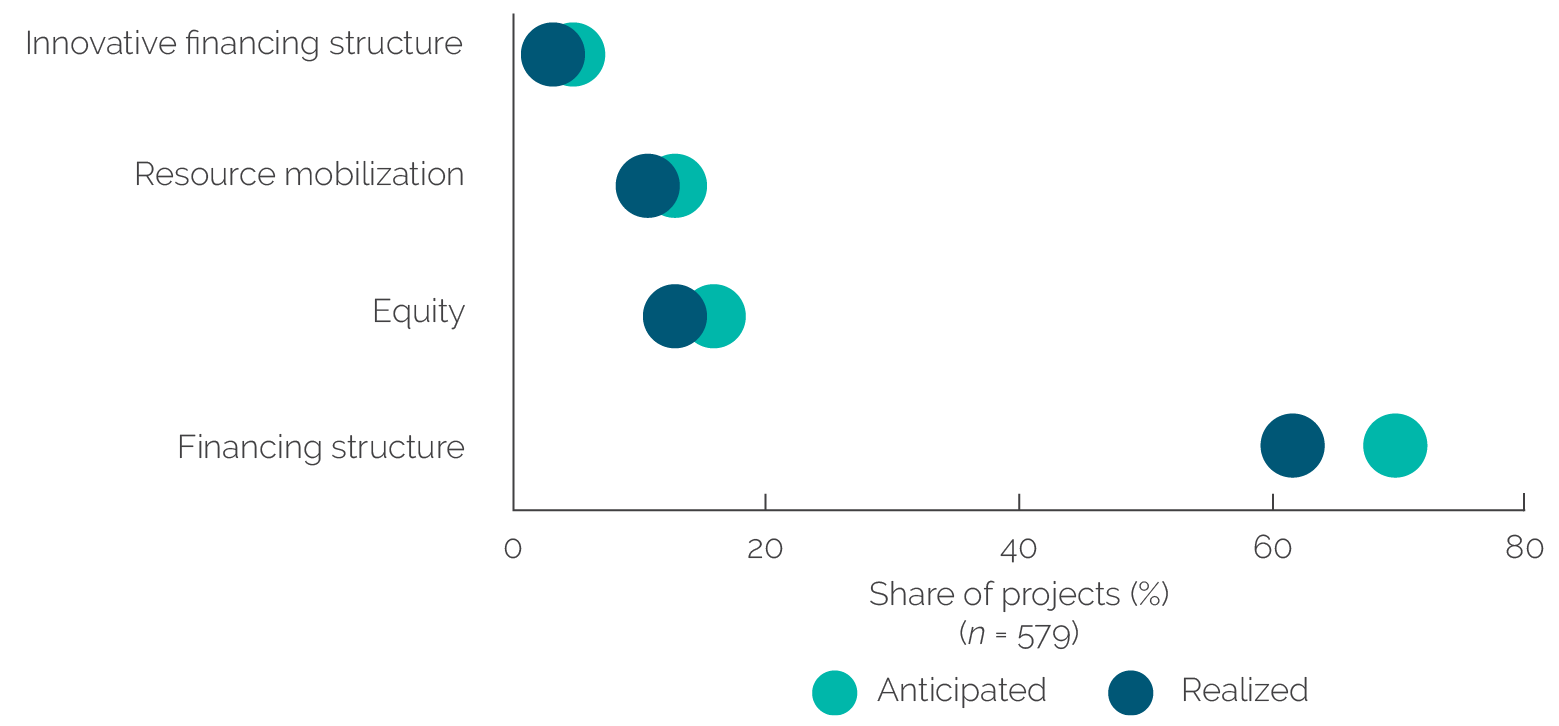

IFC is generally successful in realizing financial additionality. Overall, 86.7 percent of financial additionalities were realized. Financing structure additionality is the most common type of financial additionality. Equity and resource mobilization are less common, and innovative financing structure is only rarely identified as an additionality (figure O.2). Yet, IFC has a relatively high rate of realizing all these subtypes of additionality as anticipated. Several projects in country case studies realized innovative financing structures without anticipating them. IFC’s tool kit of financial instruments suggests different levels of success with different instruments, with loans offering the highest success rate and guarantees the lowest.

Figure O.2. Comparison of Anticipated and Realized Financial Additionality

Source: Independent Evaluation Group portfolio analysis of International Finance Corporation investment services projects evaluated 2011–21.

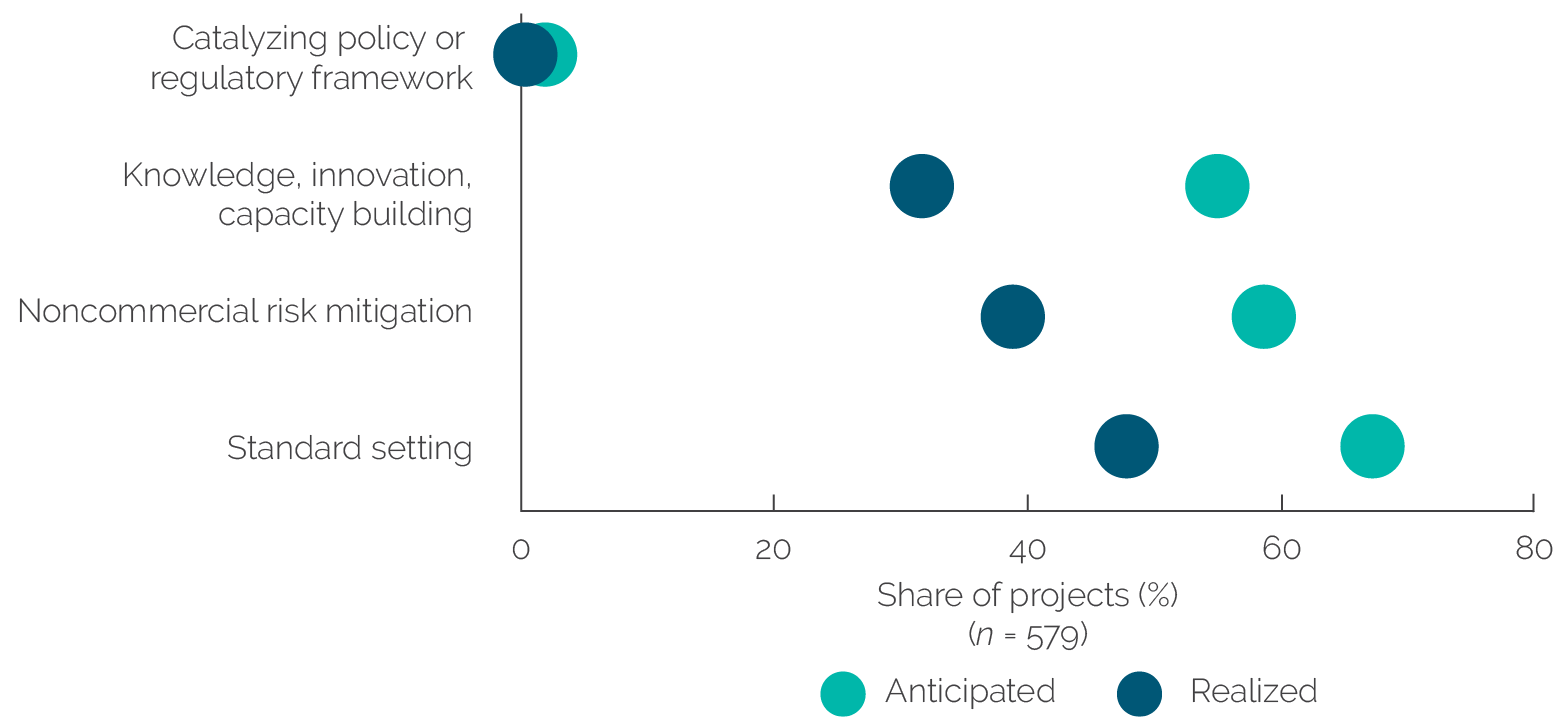

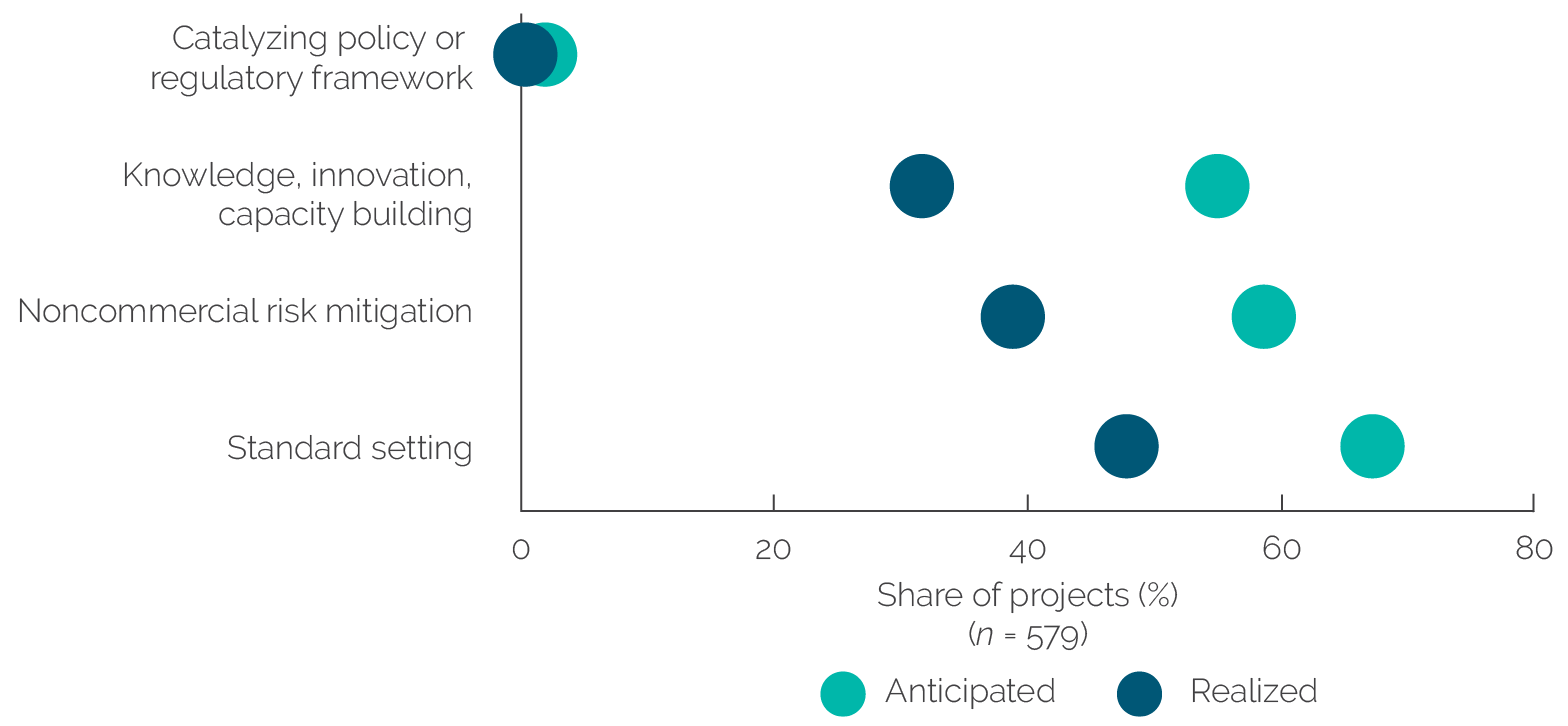

IFC is less successful at realizing nonfinancial additionality. Only 65 percent of anticipated nonfinancial additionalities were realized (figure O.3). Standard setting is the most common form of nonfinancial additionality. IFC is considered a leader among DFIs in its ability and willingness to monitor and enforce compliance with environmental and social standards, which often requires intensive, sustained client interaction. Corporate governance is the second-most common area of standard-setting additionality and another area where IFC is considered strong. Yet, this subtype of additionality is realized in only half of the projects where it is anticipated. IFC’s ability to add value through knowledge, innovation, and capacity building figures centrally in its value proposition in MICs; however, it has proved challenging to realize this form of additionality. Advisory services are a key instrument for nonfinancial additionality and are used more commonly in LMICs compared with UMICs. The advisory services actually materialized in only 57 percent of investment projects with nonfinancial additionality that anticipate complementary advisory services.

Figure O.3. Comparison of Anticipated and Realized Nonfinancial Additionality

Source: Independent Evaluation Group portfolio analysis of International Finance Corporation investment services projects evaluated 2011–21.

Realizing additionality is positively associated with both project development outcomes and project investment outcomes. IEG’s analysis of IFC’s evaluated portfolio indicates that 74 percent of projects with high additionality ratings have successful development outcomes. Furthermore, 81 percent of projects with low additionality ratings have low development outcome ratings.

Realizing nonfinancial additionality is particularly important for development outcomes. Projects that realize nonfinancial additionality are more likely to produce a variety of positive outcomes. For example, our econometric analysis finds that projects realizing knowledge, innovation, and capacity-building additionality are 25.3 percent more likely to have a positive development outcome rating and are 15.4 percent more likely to show positive project business performance.

IFC treats additionality primarily at the project level, but the country and sector lens affords a potentially valuable additional perspective. Approaching transactions individually (that is, focusing strictly on projects) can miss opportunities to realize greater additionality to clients, sectors, and countries. Thinking about additionality arising from sequenced or complementary activities may identify more opportunities for IFC to tap into regional or global programs and partnerships or to increase collaboration across the World Bank Group and with other DFIs.

Factors of Success and Failure

For IFC to realize additionality, a chain of events must take place. They include identifying anticipated additionality, deploying tools or support to transform anticipated additionality into realized additionality, assessing whether the anticipated additionality is being realized, and addressing it if it is not being realized. Internal and external factors influence these events, both at the project level and at the country and sector levels.

Project-level internal factors include IFC’s work quality, staff capabilities, and internal procedures. Work quality is the leading internal factor, although it has a larger influence on nonfinancial additionality than on financial additionality. Work quality during monitoring and supervision is especially important for nonfinancial additionality because nonfinancial additionality tends to be realized over the life of a project rather than at disbursement of financing (table O.1). Staff capabilities (expertise, experience, and local presence) are a second important internal factor noted prominently in case studies and interviews. Finally, IFC procedures (including safeguards, quality reviews, and systems for tracking additionality) and staff incentives both enhance and constrain the realization of additionality.

Internal procedures to assess additionality are incomplete. Although procedures at project identification and appraisal and at evaluation are well developed, practices related to monitoring and aggregate reporting are not. According to IFC’s guidelines, once a project is approved, IFC teams are expected to enter additionality information and related additionality milestones and indicators into a new additionality database and provide regular updates and evidence of when and how additionality was delivered during project implementation. However, the envisioned additionality database is not yet operational, and little monitoring of additionality is currently being done under the old system—the Development Outcome Tracking System. In addition, despite IFC’s guideline stating that, at the portfolio level, “IFC will provide annual reporting on achievement of additionality as part of development impact reporting,” (IFC 2018, 11), it does not do so.

Source: Independent Evaluation Group econometric analysis of evaluated International Finance Corporation investment projects.

Note: Relationships statistically significant above a 95 percent confidence level are indicated. The analysis controls for project tier, country income category, region, International Finance Corporation industry group, client and project characteristics, time period, and ratings of country political stability, government effectiveness, control of corruption, and domestic private sector credit depth.

Project-level external factors include client capacity and commitment, the political and policy environment, and competition and collaboration with other financiers. Realization of additionality is higher for repeat clients, especially in LMICs, perhaps because there is selection for clients with commitment and capacity. A supportive policy, regulatory, and political environment is vital for IFC to realize additionality, whereas unfavorable policies toward private sector solutions can impede its realization. Finally, the presence of other financiers creates fertile ground for collaboration but may also induce competition if the flow of bankable deals is limited or private finance is abundant.

Through a learning lens, we also note that some factors affect additionality beyond the project level. One is IFC’s long-term presence and engagement in particular sectors within a country. Long-term presence affords knowledge of the market, familiarity with potential clients, and the flexibility to respond quickly to changing conditions and priorities. A second factor that affects additionality beyond the project level is strategic planning tailored for engagement in the sector in a specific country context. IFC can have a larger impact in sectors where it can engage early in market development; apply multiple instruments in a sequential or complementary manner; collaborate with Bank Group institutions or other DFIs, financiers, and sponsors; and work at both upstream and downstream levels. A third factor is collaboration with the World Bank and the Multilateral Investment Guarantee Agency, which can enhance IFC additionality to clients and its impact on sectors. Finally, each of the external factors described above influences additionality not only at the project level but also at the country or sector level.

Recommendations to Enhance International Finance Corporation Additionality in Middle-Income Countries

Based on the preceding evidence-based analysis, we offer three recommendations to enhance IFC additionality in MICs.

Recommendation 1. To enhance institutional accountability, learning, and transparency, address gaps in internal systems related to monitoring, supervision, and reporting of additionality at the project and portfolio level.

IFC should update its internal additionality project-level tracking system, currently still hosted in the Development Outcome Tracking System platform. In addition, at the project level, IFC should systematically monitor whether necessary support is delivered within the stipulated timeline for anticipated additionalities that are to be fulfilled over the course of a project’s life. This should be followed up by a final assessment of whether additionality was realized or not and why. Proactive monitoring and supervision at the project level could enhance the realization of anticipated nonfinancial additionality claims.

IFC should introduce reporting of additionality at the portfolio level to enhance learning about patterns of additionality. Portfolio additionality ratings and information on additionality types (anticipated and realized) should be included in regular internal reports (for example, country- or sector-level portfolio reviews, scorecards) and considered in strategy discussions. Disclosure of anticipated additionality at the project level should continue, and external reporting of realized additionality at the portfolio level could follow the same approach as taken for development impact information.

Recommendation 2. To enhance commitment to and fulfillment of IFC’s strategic objectives, IFC should bring its strategy for additionality in MICs and its pattern of activity in MICs into closer alignment.

This evaluation showed that IFC’s stated strategy for MICs is not tightly linked to its actual patterns of anticipated and realized additionality. For example, IFC’s activities in UMICs do not systematically show greater innovation or reliance on knowledge compared with its activities in LMICs. Because strategy serves to guide staff, management, and the Board of Executive Directors (the Board) regarding what to expect in IFC’s approach, a closer alignment would enhance commitment to and fulfillment of IFC’s strategic objectives. Given the intuitive logic of IFC’s strategic statements on additionality, IFC could work to evolve its project design to better align with the stated strategy, with a stronger emphasis on innovation and nonfinancial additionality in UMICs. Doing so may require providing additional attention and resources to innovation and knowledge additionality, including at appraisal and supervision. This strengthened emphasis on innovation and knowledge additionality should include support for delivery of complementary advisory services. The alternative would be for IFC to offer the Board a revised strategy explaining how its additionality adapts to country and sector conditions, reflecting its actual practices in MICs, for example, adapting to the level of sector development.

Recommendation 3. To enhance its strategic approach to proactive creation of markets and mobilization of private capital to provide a critical contribution to the Sustainable Development Goals, IFC should incorporate its additionality approach into its country strategies and sector deep dives.

IFC 3.0 is about being proactive to create markets and mobilize private capital at significant scale to increase development impact. IEG’s observation of IFC’s good practices in identifying and realizing additionality at the sector and country levels suggests an opportunity to more deliberately envision and articulate additionality beyond the project level. Given the new tools for strategic engagement at the country and sector levels that IFC introduced under IFC 3.0, there is a clear opportunity to increase the distinctive value that IFC adds in specific country and sector contexts. This opportunity raises the possibility of several potential enhancements to IFC additionality with greater benefits for creating sectoral markets and mobilizing capital at scale. As good practices discussed in this evaluation suggest, strengthening IFC’s strategies by applying the additionality lens may open the door to realizing additionality from strategic planning for the explicit complementarity and sequencing of projects, combining projects that work upstream and downstream, and coordinating collaboration and distribution of responsibilities across the Bank Group. The recent China country strategy points to the potency of identifying sector-specific additionality within a country context—an approach that could be extended to other MIC country strategies. IFC’s sector deep dives on housing and financial technology (fintech) provide a good-practice example of the potential benefits of a systematic consideration of IFC’s unique potential to add value at the sector level. IFC clearly has the capacity to use the additionality lens more routinely in both its country strategies and its sector deep dives.