Results and Performance of the World Bank Group 2022

Chapter 2 | World Bank Project Portfolio Performance

Highlights

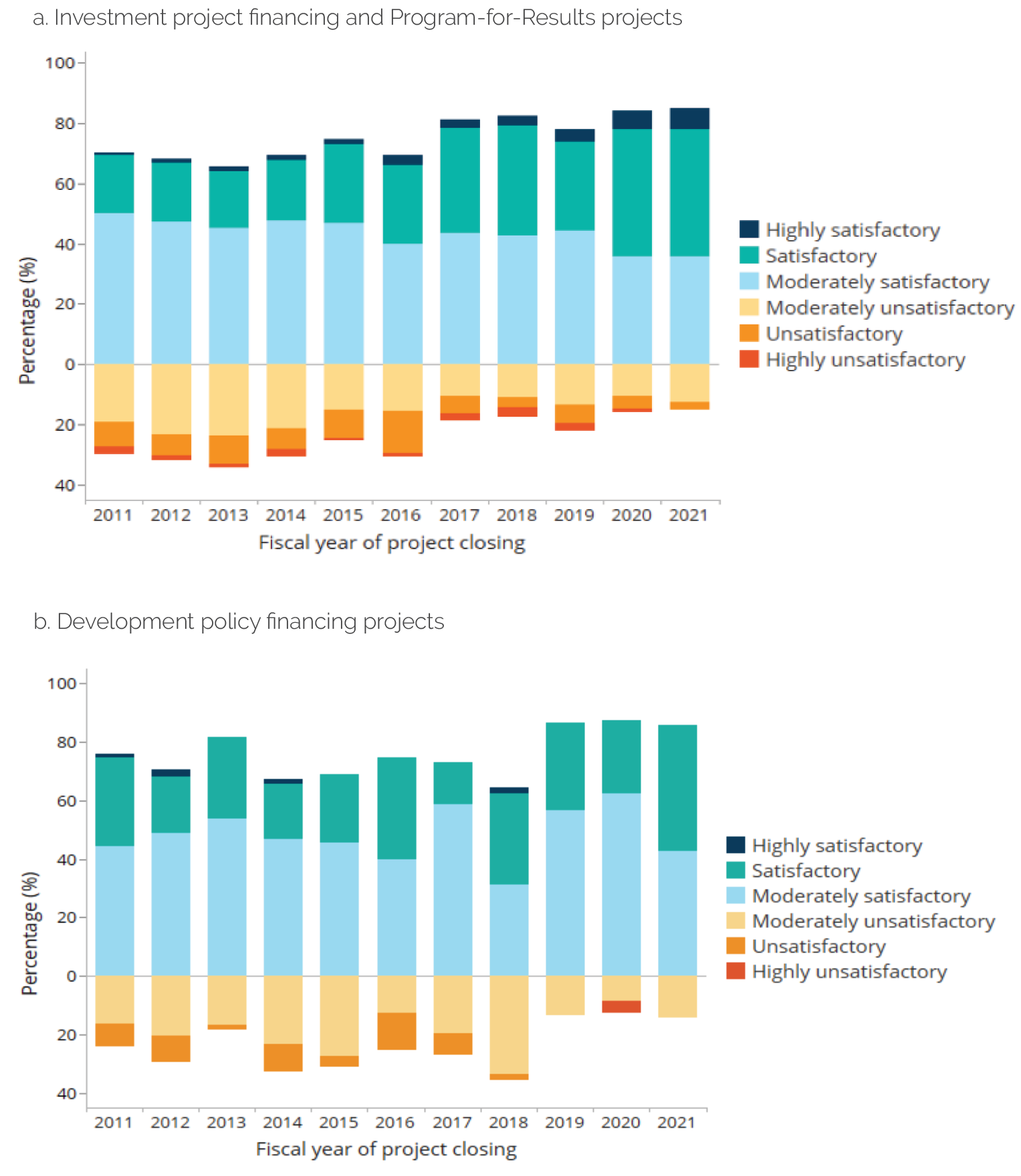

Project outcome ratings in fiscal year [FY]21 rose marginally to 85 percent of projects rated moderately satisfactory or higher, compared with 84 percent in FY20. No decline is observed in the outcome ratings for World Bank projects that closed during the COVID-19 pandemic (FY20 and FY21).

At the time of the 2021 Results and Performance of the World Bank Group (RAP), 88 percent of projects had a rating of moderately satisfactory or higher. However, since more projects that closed in FY20 have been reviewed after publication of the 2021 RAP, that figure is now 84 percent.

The percentage of projects in fragile and conflict-affected situations rated moderately satisfactory or higher for outcome in FY21 was 74 percent, compared with 82 percent in FY20.

Among projects rated moderately satisfactory or higher on outcome, the proportion rated satisfactory or highly satisfactory increased from 54 percent in FY20 to 58 percent in FY21, implying a decline in the share of projects rated moderately satisfactory.

Projects in two of the four Practice Groups (Human Development and Sustainable Development) averaged higher outcome ratings in FY21 than in FY20, but ratings declined in the Infrastructure and the Equitable Growth, Finance, and Institutions Practice Groups.

Four of the seven Regions (Eastern and Southern Africa, East Asia and Pacific, Europe and Central Asia, and South Asia) received higher project outcome ratings in FY21 than in FY20.

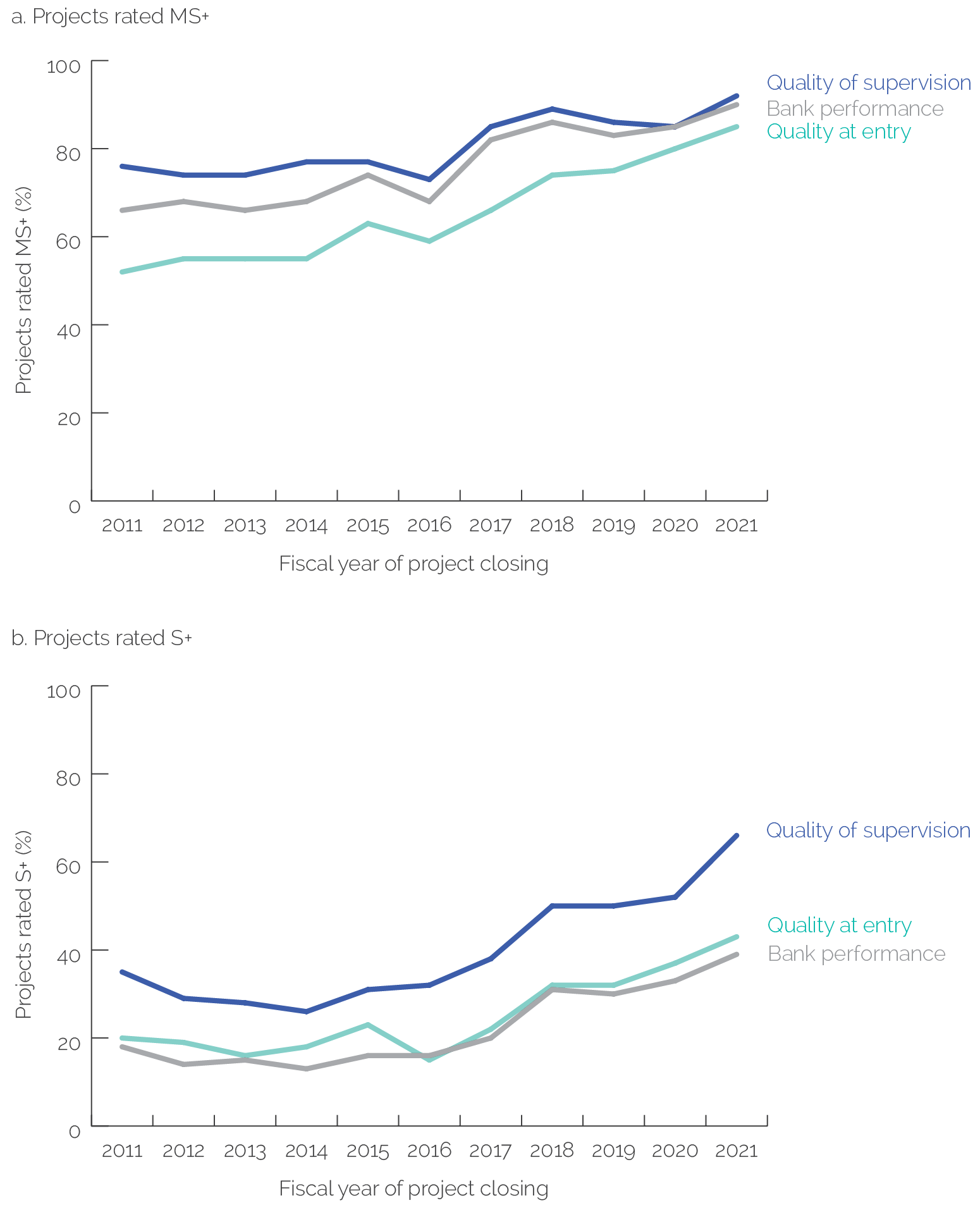

Bank performance continued to be strong, with performance in 91 percent of projects rated moderately satisfactory or higher in FY21, up from 86 percent in FY20, among which the proportion of projects rated satisfactory or highly satisfactory rose from 41 percent to 45 percent.

Bank performance ratings for fragile and conflict-affected situations declined marginally to 81 percent of projects rated moderately satisfactory or higher in FY21 (from 82 percent in FY20).

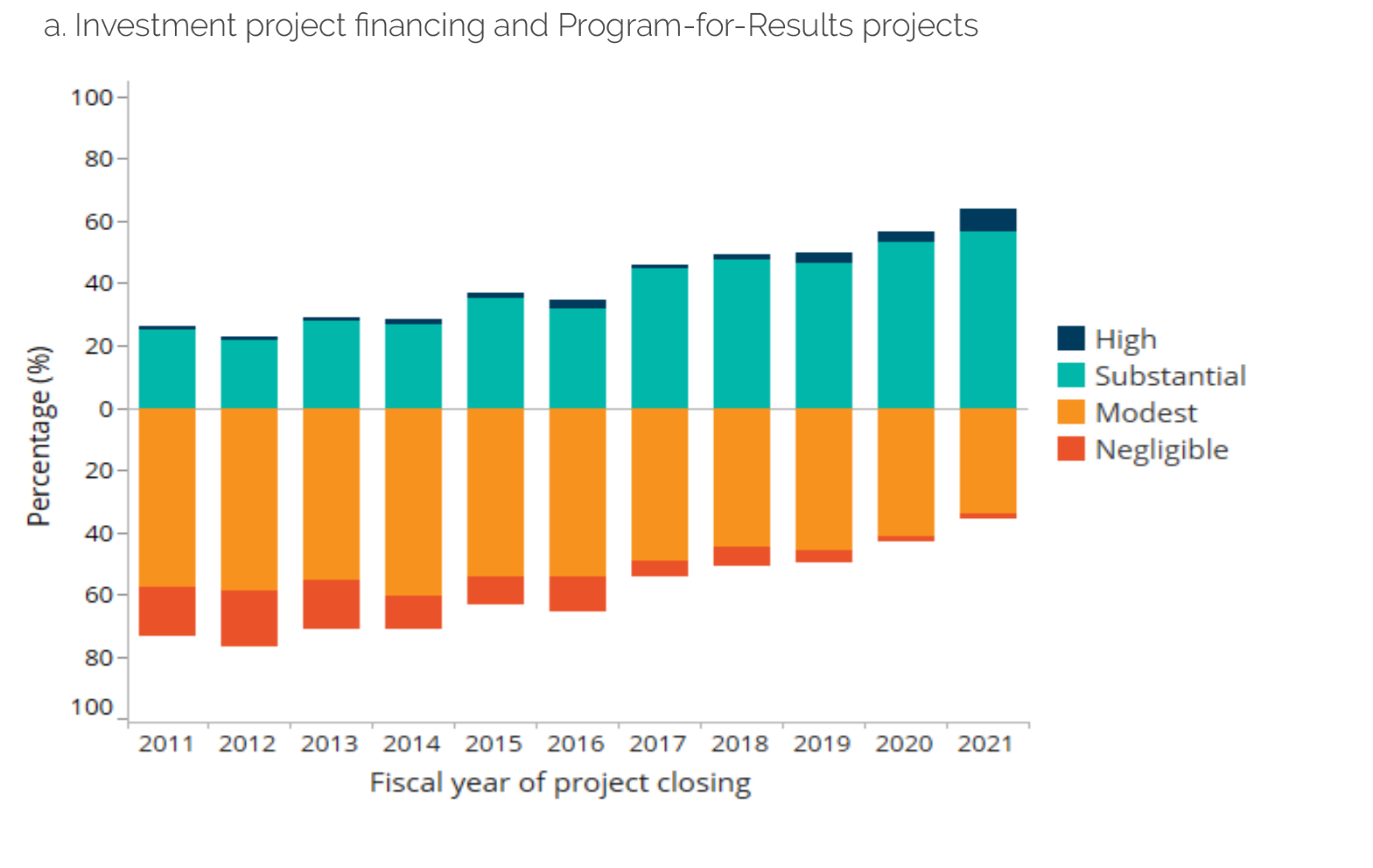

Monitoring and evaluation quality registered a clear improvement: the share of projects rated high or substantial increased from 57 percent in FY20 to 64 percent in FY21.

Project Rating Trends and Patterns

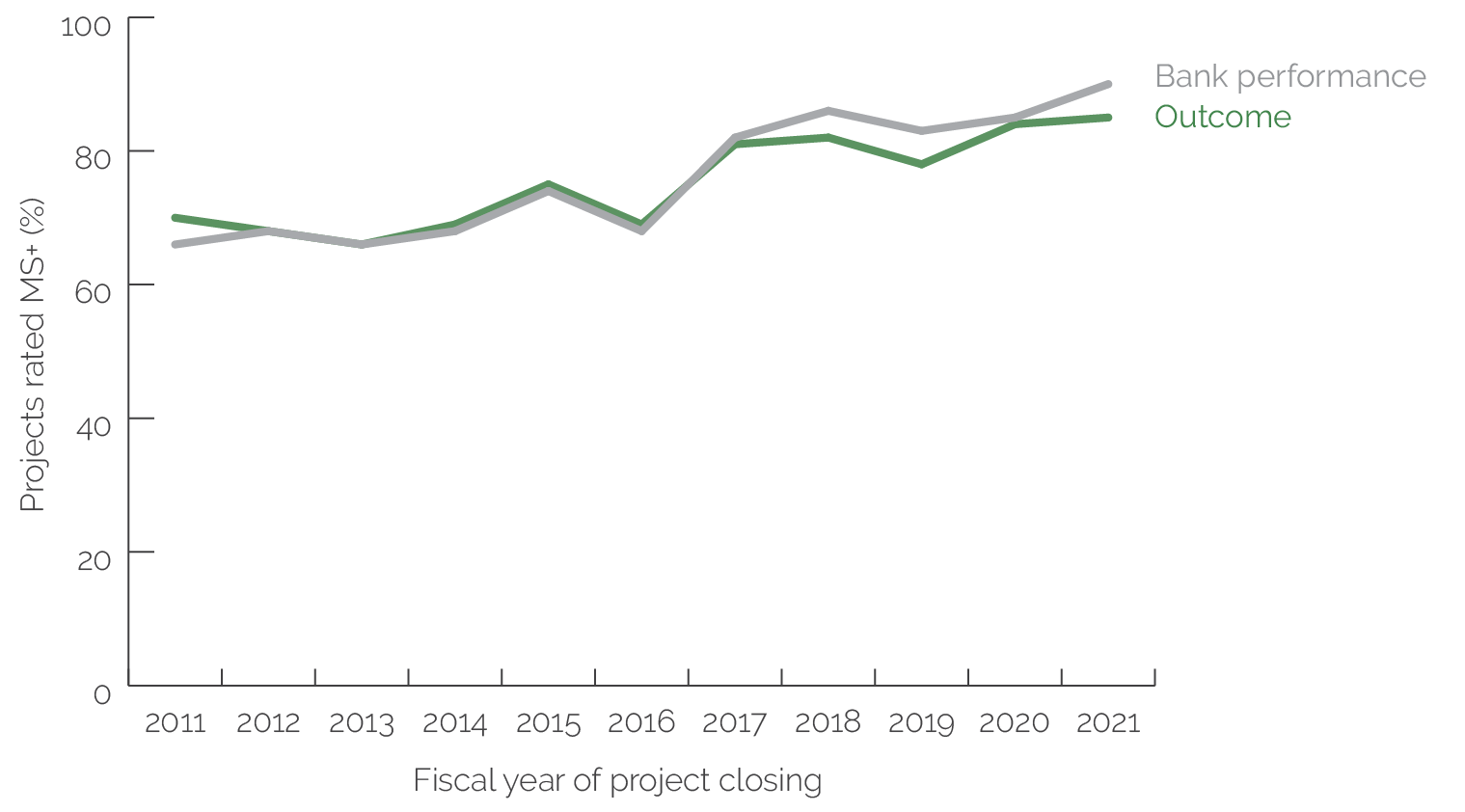

This RAP updates the project ratings, building on previous RAPs. The lending project outcome ratings remained high in FY21 after the increase in FY20. Among investment project financing (IPF) and Program-for-Results (P4R) projects closed in FY21, 85 percent were rated moderately satisfactory or higher, the highest since FY11 (figure 2.1, panel a). The average outcome rating is 4.4 on a six-point scale, compared with 4.3 in FY20.

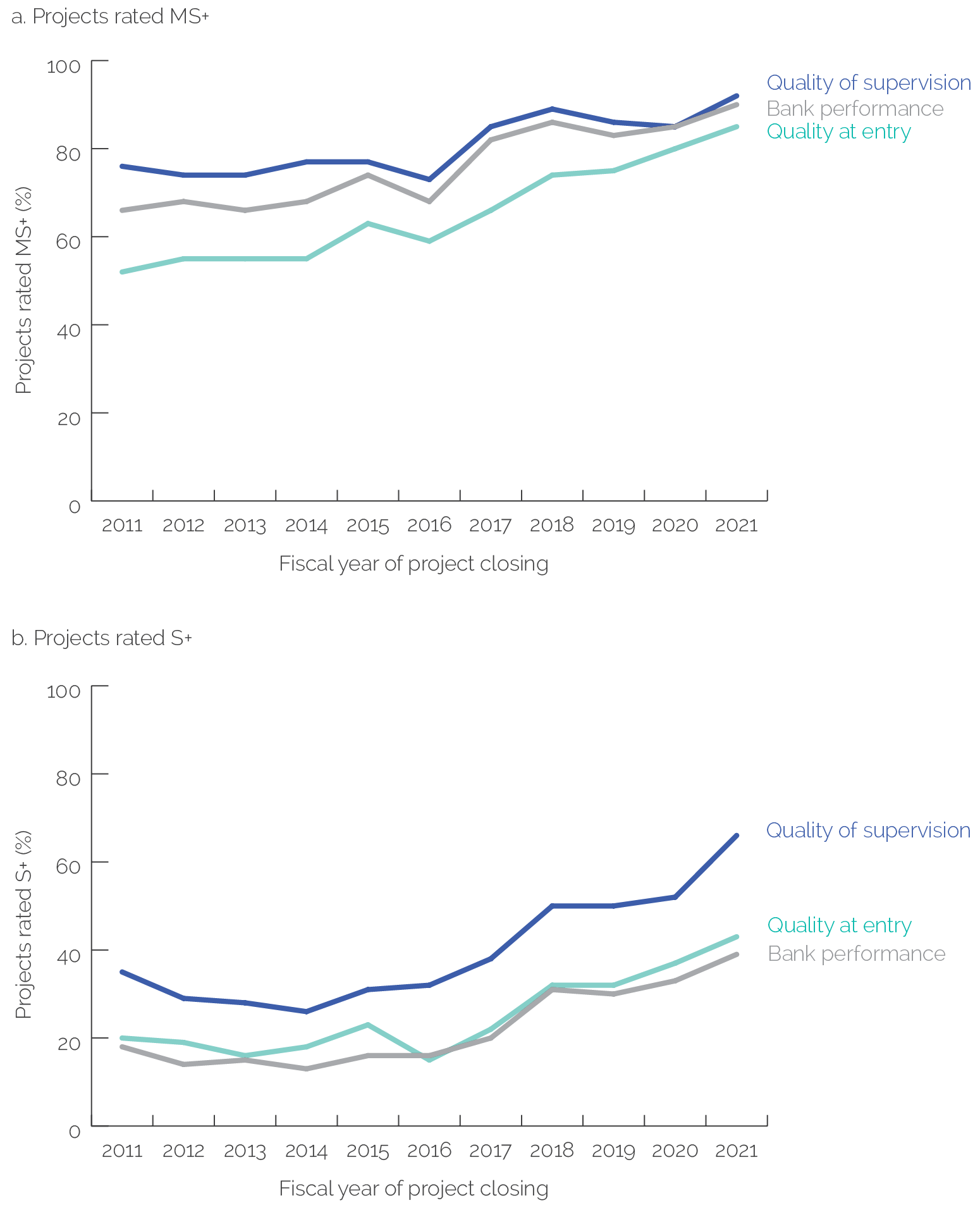

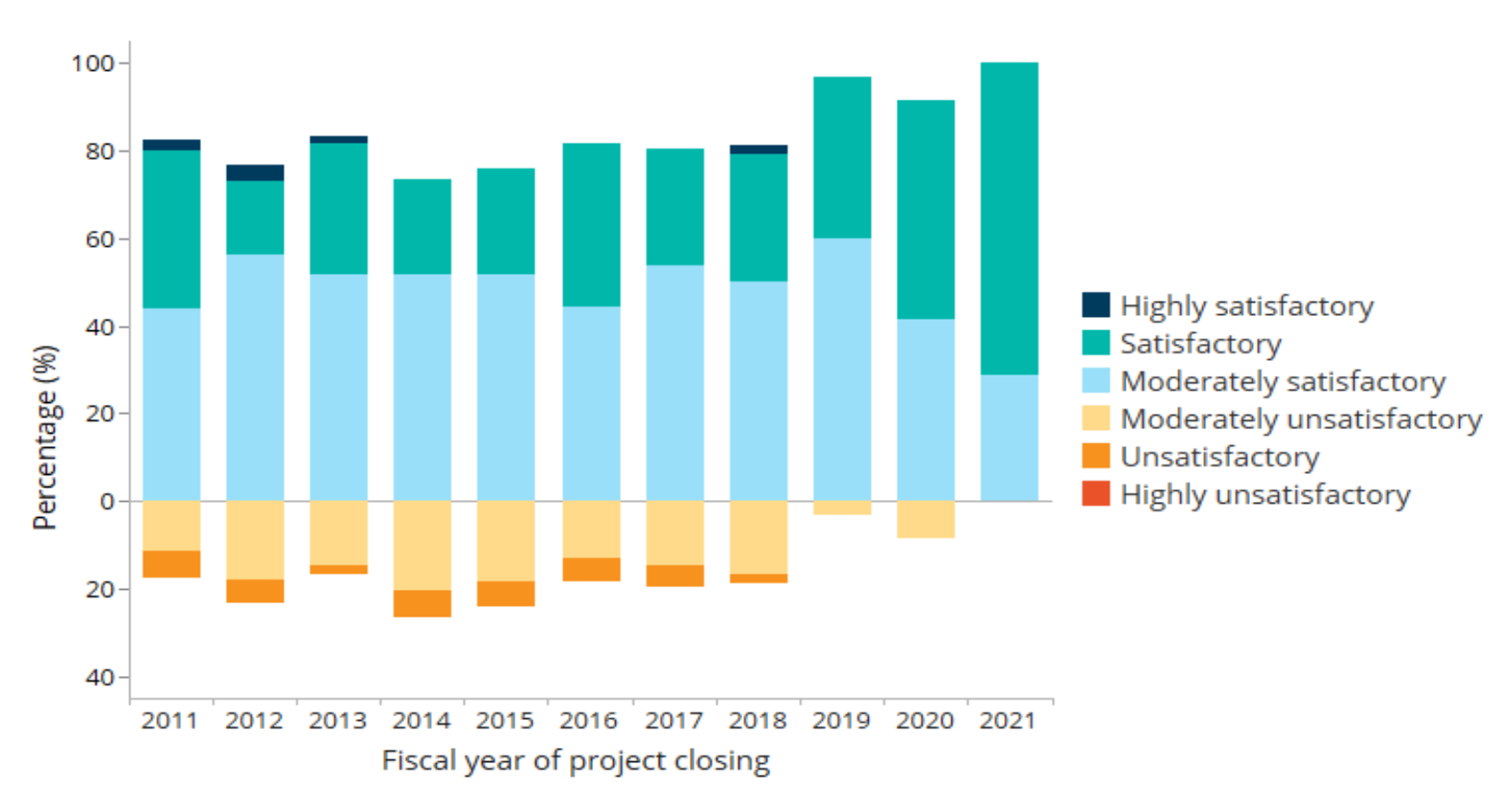

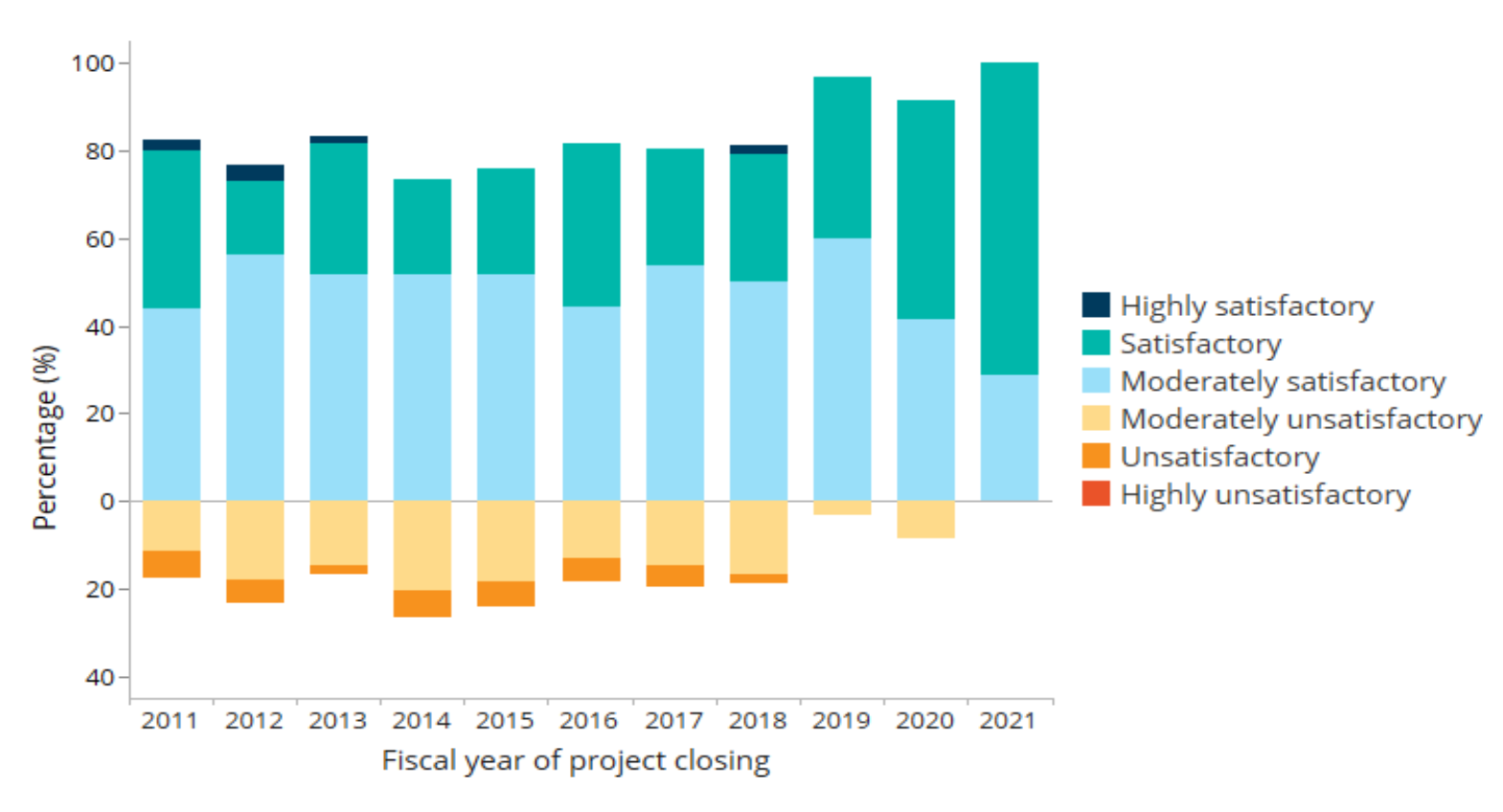

There are more fluctuations in development policy financing (DPF) project ratings, with the average rating improving from 4.0 in FY20 to 4.3 in FY21 and the percentage rated moderately satisfactory or higher declining from 88 percent in FY20 to 86 percent in FY21 (figure 2.1, panel b). However, such shifts are unlikely to be stable, given the small number of DPF projects in both periods (24 projects in FY20 and 7 in FY21). A more detailed presentation of project outcome ratings can be found in appendix D. Bank performance ratings, including both quality at entry and quality of supervision, maintained their upward trend. Between FY20 and FY21, the percentage of IPF and P4R projects with moderately satisfactory or higher ratings improved from 85 to 90 percent for Bank performance, 80 to 85 percent for quality at entry, and 85 to 92 percent for quality of supervision (figure 2.2). A similar increase was seen in ratings for projects in the Human Development and Sustainable Development Practice Groups, the Eastern and Southern Africa Region, and non–fragile and conflict-affected situations (FCS); there was a similar decline for projects in the Infrastructure and Equitable Growth, Finance, and Institutions Practice Groups, the Middle East and North Africa Region, and FCS. Bank performance ratings also improved among DPF projects, from 92 percent rated moderately satisfactory or higher in FY20 to 100 percent in FY21 (figure 2.3). Project outcome and Bank performance show a strong positive correlation, with both trending upward (figure 2.4). Meanwhile, there are a few outliers. For example, in Western and Central Africa, the percentage of projects with Bank performance rated moderately satisfactory or higher increased from 80 percent in FY20 to 83 percent in FY21, while the outcome decreased from 84 to 81 percent.

Figure 2.1. Distribution of the World Bank’s Project Outcome Ratings

Source: Independent Evaluation Group data.

Figure 2.2. Bank Performance, Quality at Entry, and Quality of Supervision for World Bank Projects: Investment Project Financing and Program-for-Results Projects

Source: Independent Evaluation Group data.

Note: MS+ = moderately satisfactory or higher; S+ = satisfactory or higher.

Figure 2.3. Bank Performance Ratings for World Bank Projects: Development Policy Financing

Source: Independent Evaluation Group data.

Source: Independent Evaluation Group data.

Note: MS+ = moderately satisfactory or higher.

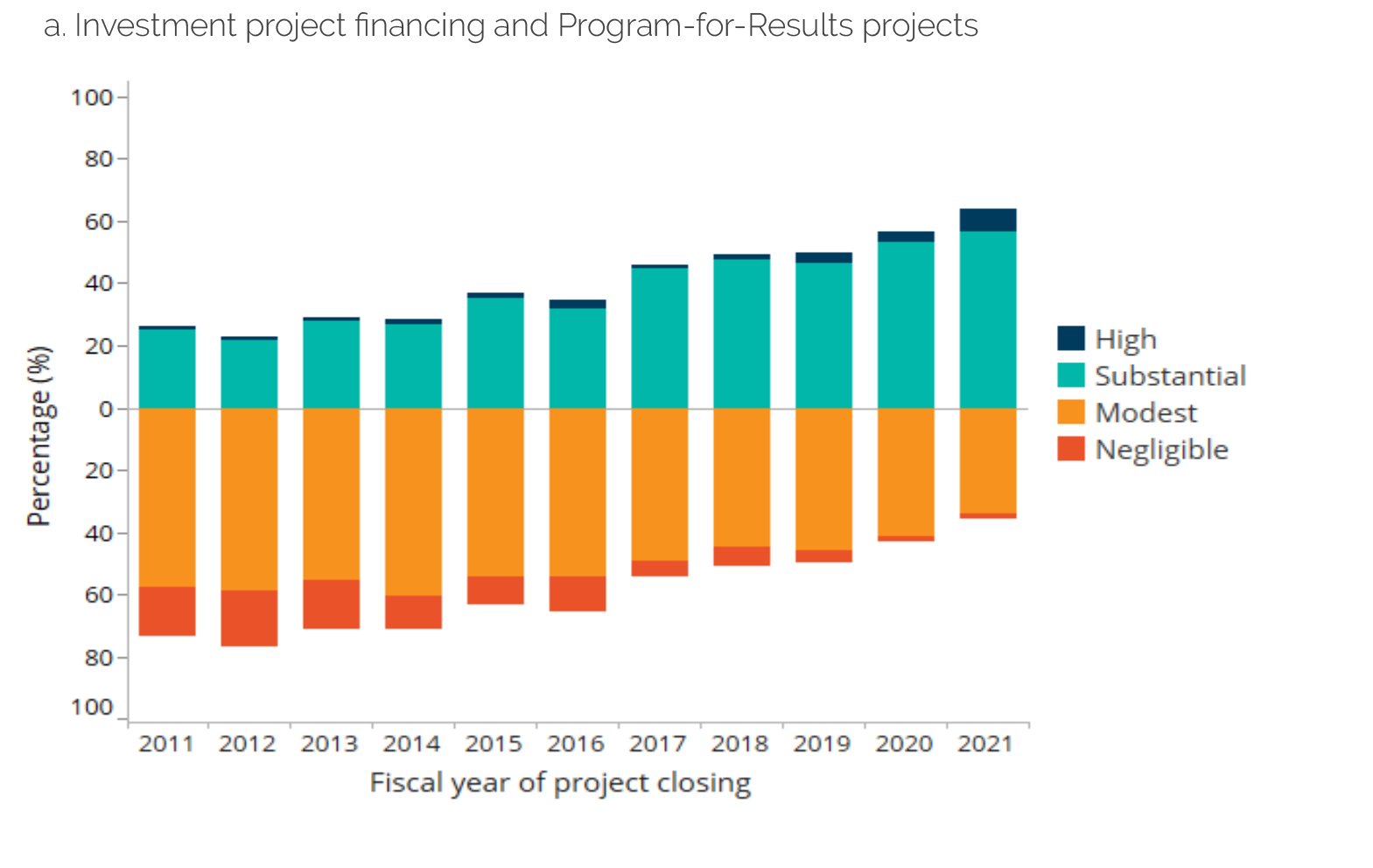

Among IPF and P4R projects, the steadily upward march in monitoring and evaluation (M&E) quality ratings continued. The percentage of projects with M&E quality ratings of high or substantial increased from 57 percent in FY20 to 64 percent in FY21 (figure 2.5), but the increase is driven by only two Practice Groups: Human Development (up from 76 to 97 percent) and Sustainable Development (up from 51 to 62 percent). A significant increase in M&E quality ratings is also found in projects of $25–100 million and in non-FCS. All Regions experienced the improvement except for Latin America and the Caribbean, where the percentage of projects rated high or substantial on M&E quality plummeted from 63 percent in FY20 to 46 percent in FY21, with 24 projects rated in both fiscal years. East Asia and Pacific had the most pronounced increase in percentage of projects with the higher ratings (rising from 54 percent in FY20 to 74 percent in FY21). Despite the decrease in outcome rating, the percentage of projects rated high or substantial on M&E quality in Western and Central Africa increased from 59 percent in FY20 to 69 percent in FY21.

Figure 2.5. Distribution of the World Bank’s Project Monitoring and Evaluation Quality Ratings

Source: Independent Evaluation Group data.

Note: There are no development policy financing projects with monitoring and evaluation quality ratings in 2021.

Project Performance during the COVID-19 Pandemic

Among the projects rated by IEG, just 10 projects were identified as responding to COVID-19, of which 7 received satisfactory outcome ratings and 3 received a moderately satisfactory outcome rating (appendix D). The RAP also found that the pre–COVID-19 CLR Review ratings are a good predictor of project performance during the COVID-19 time period (appendix D).