State Your Business!

Overview

State-Owned Enterprise Challenges and World Bank Group Reforms

Purpose and Scope

This evaluation assesses the contribution of the World Bank Group’s three main institutions (World Bank, International Finance Corporation [IFC], and Multilateral Investment Guarantee Agency [MIGA]) to enhancing development outcomes through their support of state-owned enterprise (SOE) reform during fiscal years (FY)08–18. It looks at what works and what does not, the effectiveness of its various approaches, factors that explain success and failure, and the strengths and weaknesses of the Bank Group approach. It parallels efforts in the Bank Group to develop support to SOE reform that is more integrated and to empower staff with new frameworks and tools to address SOE challenges in client countries. To allow for an in-depth analysis, the evaluation’s scope focuses on two key sectors in developing economies where SOEs tend to play a substantial role: the financial sector and the energy sector.

SOEs play a major role in many developing and emerging economies, where governments use them to achieve economic, social, and political objectives: to deliver and extend access to services, fill gaps in markets, develop key sectors or regions, and provide employment. As of late 2020, SOEs accounted for 71 percent of the Morgan Stanley Capital International (MSCI) Emerging Market Index in utilities, 56 percent in energy, and 39 percent in the financial sector. Although state ownership in commercial banks had declined globally, SOEs often retain a dominant role in banking in emerging markets, such as China and India. For example, India relied primarily on state-owned financial institutions to implement its Jan Dhan Yojana program, under which more than 300 million basic accounts were opened in less than four years (2014–18). In Kenya, the Kenya Power and Lighting Company was the main vehicle for the government’s drive for universal electricity access, achieving more than 1 million new connections a year. Some SOEs have been run well, and they have made important contributions to economies. Singapore used SOEs successfully to drive development and industrialization after its independence in 1965, with effective efforts in diverse fields, including shipbuilding, oil refining and petrochemicals, and development finance. As highlighted by the coronavirus crisis, SOEs can be a useful vehicle for governments to channel resources to adversely affected firms and households (for example, through bank loans or power utility payment suspension).

However, SOEs’ mixed institutional mandates and their political importance often pose performance and governance challenges. SOEs may reflect the desire of the state or political groups to exert political influence over economic outcomes and resource allocation. SOEs may be asked to carry out financially unsustainable functions alongside commercial ones. They may experience political interference or competing mandates, which may reduce their transparency and accountability and make their oversight and regulation difficult, thus complicating their reform efforts. Although many SOEs are run well, many suffer from low productivity and efficiency, which have a detrimental impact on growth and consumer access to services. Poor financial performance and management practices can generate substantial public fiscal losses (or contingent liabilities). SOEs can also impose barriers to private participation in sectors where their dominant presence enables anticompetitive behavior, often with government protection or subsidy.

Where, Why, and How the Bank Group Supports SOE Reforms

From FY08 through FY18, the Bank Group implemented 1,008 projects with 2,185 components (interventions) that supported the reform of SOEs in the financial and energy sectors, with an estimated combined value of $71.5 billion in financing (table O.1). This involved financial, technical, analytic, and advisory support for both policy and institutional reforms (upstream) and enterprise-level activities (downstream). Upstream (policy and institutional) support was more frequent in upper-middle-income countries, and support for lower-middle-income countries focused more on downstream (enterprise-level) reforms. World Bank lending predominated, constituting more than 90 percent of the Bank Group SOE reform portfolio’s value in the energy and finance sectors (table O.1). IFC investment and MIGA guarantees, making up 9 percent of Bank Group commitments, are oriented primarily toward SOEs’ enterprise-level business and operational aspects. IFC advisory engages both upstream and downstream. MIGA is primarily engaged in the power sector.

Table O.1. Projects and Commitments by Institution

|

Institution |

Projects Approved FY08–18 (no.) |

Share of Projects (%) |

SOE Reform est. Volume ($, millions) |

Share of Volume (%) |

|

World Bank lending |

285 |

28 |

64,832 |

90.6 |

|

IFC IS |

61 |

6 |

3,765 |

5.3 |

|

IFC AS |

59 |

6 |

51 |

0.1 |

|

MIGA |

17 |

2 |

2,788 |

3.9 |

|

World Bank ASA |

587 |

58 |

104 |

0.1 |

|

Total |

1,008 |

100 |

71,540 |

100 |

Source: Independent Evaluation Group portfolio review and analysis.

Note: All projects and commitments approved between FY08 and FY18 are projected to the population based on sample size. Advisory services and analytics projects and expenditures are also projected to the population. ASA = advisory services and analytics; FY = fiscal year; IFC AS = International Finance Corporation advisory services; IFC IS = International Finance Corporation investment services; MIGA = Multilateral Investment Guarantee Agency; SOE = state-owned enterprise.

The Independent Evaluation Group (IEG) identified relevant SOE advisory services and analytics reform support activities in 142 countries and all other Bank Group SOE reform support in 119 countries. In IEG’s sample, Sub-Saharan Africa was the Region with the highest number of financing projects approved (114), but East Asia and Pacific had a higher average per country (5.3). Bank Group support to reform SOEs has been relatively more focused on lower-middle-income countries (46 percent, excluding advisory services and analytics) and low-income countries (29 percent), followed by upper-middle-income countries (23 percent).

This evaluation reviewed these projects, focusing on five major types of SOE reforms (figure O.1):

- Corporate governance improvements, which aim to enhance the transparency and accountability of SOEs, including by separating SOEs’ ownership and management and improving corporate disclosure (the timely release of accurate financial and business information).

- Business and operation reforms at the enterprise level, which aim to improve performance and service delivery, including through enhancement of physical infrastructure, human resource management, product quality, operational efficiency, and organizational structure.

- Strengthening competition and regulation in SOE markets, which aims to foster a level playing field among SOEs and private companies and allow private entry under equitable rules. Regulatory reforms compose the majority in this area.

- Privatization and other ownership reform, which aims to improve SOE performance by allowing or introducing private ownership of all or some SOE activities. It includes privatization and measures to increase the role of the private sector through public-private partnerships (PPPs) and other means.

- Macrofiscal, and public financial management reforms, which aim to limit SOEs’ possible negative impact on fiscal soundness or stability through subsidy reforms for and improved debt management of SOEs.

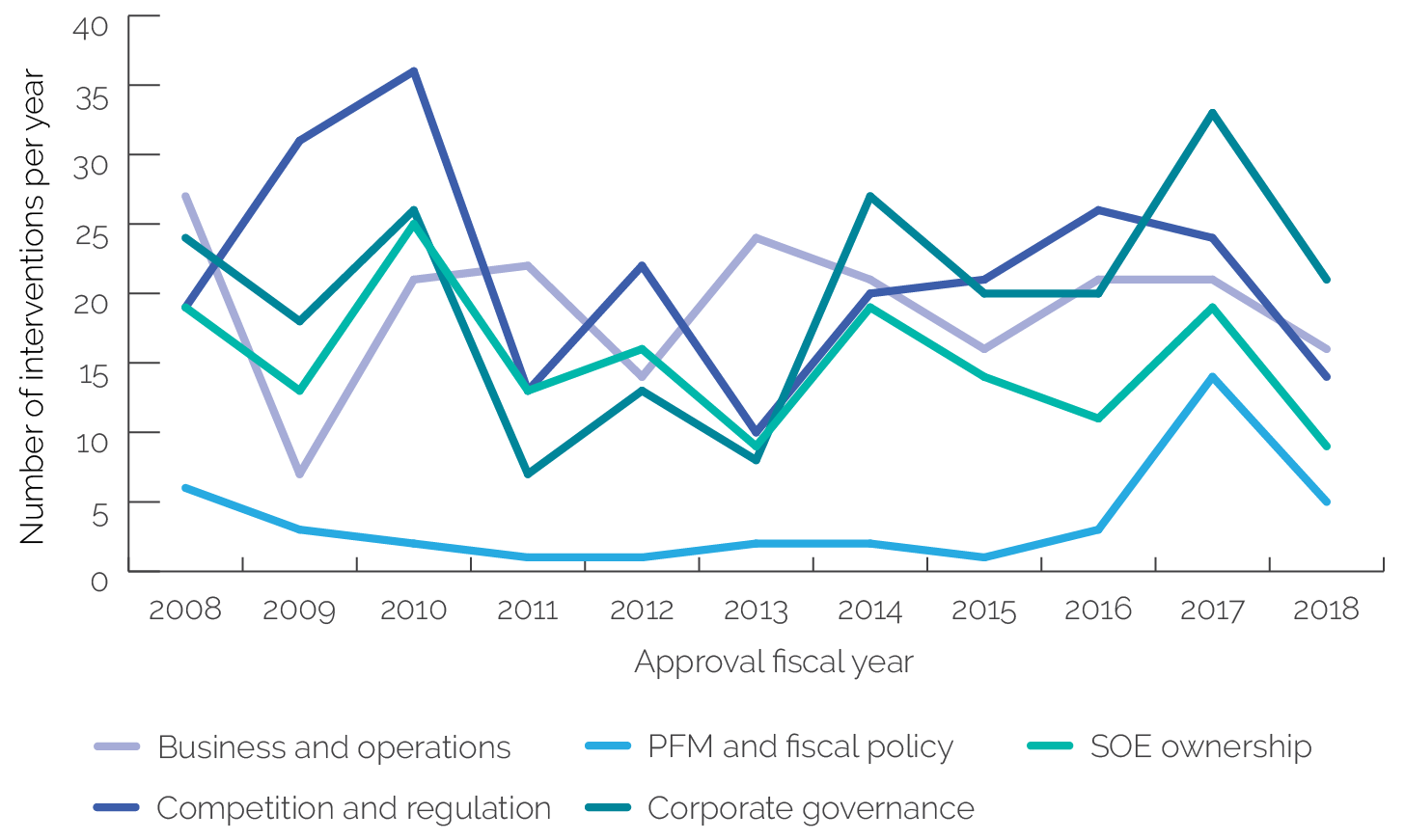

Over time, emphasis on corporate governance and business and operations has remained relatively high, as has work on strengthening sector regulation and competition, but there has been a low and declining emphasis on privatization. Corporate governance, business and operations, and competition and regulation represent more than 75 percent of the Bank Group portfolio in the evaluation period. Bank Group activity in the macrofiscal, and public financial management areas focusing explicitly on SOEs has remained low (figure O.1). However, the portfolio review is likely to underestimate the level of activity in the macrofiscal, and public financial management areas because much of this work influences SOEs as publicly financed entities without necessarily identifying them as an objective. Privatization represents a small and declining share of the portfolio (at less than 6 percent throughout the evaluation period), even though interviews suggest that after a period of client disinterest and political sensitivity, demand for privatization support has been growing. Even though privatization (and PPPs) is not part of the Equitable Growth, Finance, and Institutions’ new Integrated SOE Framework (intended to provide holistic guidance on SOE reform), the evaluation identified a gap between the high incidence of recommendations on privatization and ownership reform in various Bank Group diagnostic work (for example, Financial Sector Assessment Programs, sector work on energy, and Country Private Sector Diagnostic [CPSDs]) and the low incidence of these topics in the lending portfolio. The Bank Group’s FY18 corporate strategic statement on Maximizing Finance for Development (MFD) and the embedded Cascade approach state a preference for reliance on private finance and private sector solutions and financing, which could provide the framework for future Bank Group work on SOE privatization and ownership reforms.

Figure O.1. World Bank Group SOE Reform Support by Type, FY08–18 (no ASA)

Source: Independent Evaluation Group portfolio review and analysis.

Note: The figure shows that 217 interventions supported SOEs’ corporate governance reform; 210 supported business and operation reform; 236 sought to improve competition and regulation (of which 126 supported regulation); 167 supported SOE ownership reforms (of which 49 supported privatization); and 40 supported macrofiscal policy, public financial management, and debt. ASA = advisory services and analytics; FY = fiscal year; PFM = public financial management; SOE = state-owned enterprise.

Effectiveness of Bank Group Support to SOE Reforms

Portfolio Performance and Literature

On average, the SOE reform portfolio in the financial and energy sectors met the World Bank and IFC corporate targets for project success. Overall, World Bank lending achieved a success rate of 78 percent against a target of 75 percent. Development policy lending achieved a success rate of 85 percent versus the investment project finance’s success rate of 67 percent, but the two instruments focused on tackling different SOE reform challenges. Policy lending was more focused upstream, seeking to improve public finances; accountability, transparency, and oversight; or sector competition and productivity. Investment lending was more focused downstream, aiming to strengthen enterprise operational and financial performance as well as service delivery and quality. IFC achieved a success rate of 73 percent for investment services and 56 percent for advisory services against an overall target of 65 percent. Two evaluated MIGA guarantees both achieved their outcomes. Across reform types, evaluated privatization and corporate governance reforms showed the highest success rates. In the financial sector, the Bank Group overall engages far more with state-owned commercial banks than with state-owned development banks. The success rate for development bank SOE reform interventions (77 percent) exceeded that for commercial bank interventions (69 percent). In the power sector, SOE reforms in the transmission and distribution subsectors were the most effective, followed by power generation. SOE reform interventions dealing with extractive industries (petroleum, gas, and mining) were successful only half the time.

IEG’s in-depth literature reviews yield evidence of SOE reform success in three of the five reform types: privatization, corporate governance reform, and competition. The literature consistently finds superior performance of private and privatized companies over public ones in both the energy and financial sectors and has especially negative findings about state-owned commercial banks. Rigorous national studies also yield evidence of the benefits of corporate governance reform for SOEs. There is strong evidence that competition improves SOE performance in both the power and financial sectors and augments the effectiveness of both privatization and regulatory reforms. The World Bank is aware of these benefits through the competitive neutrality framework it applies analytically. IFC also has a policy to focus financing on SOEs where there is a level playing field for private competition. MIGA’s policy is different.

The Bank Group recognizes the importance of competition and competitive neutrality, but analytics on competition have been limited, as has been the application of competitive neutrality in IFC projects. The Markets and Competition Policy Assessment Tool, which is the Bank Group’s main diagnostic on competition, has been applied to only nine countries and one subregion during the evaluation period. In addition, only a small number of CPSDs to date have deployed the tool’s framework. IFC policies demand verification that a level playing field for competition exists before engaging with an SOE, but attention to competitive neutrality in project documentation is weak and uneven. MIGA policy emphasizes competitive conditions much less than IFC policy does.

Factors of Success and Failure

One country characteristic and several project factors are predictive of SOE reform intervention success. Some factors are within the Bank Group’s control, and some are outside of it. Econometric analysis of evaluated projects confirmed the country characteristic and the project factors (originally emerging from IEG case studies, portfolio review, and the economic literature) as significantly predictive of success.

Control of corruption is a country characteristic strongly associated with SOE reform success. Other things being equal, a country with high control of corruption is more than twice as likely to see SOE reform interventions succeed as one with low control of corruption. In conditions of low control of corruption, all five major types of SOE reform are less likely to succeed, and it is more difficult to strengthen the governance, regulation, or performance of public enterprises. Overall, 26 percent of the SOE reform portfolio is in countries with low control of corruption.

The marginal effect of weak control of corruption is large, but in practice several factors mitigate its negative influence on SOE reform success, including selectivity for clients that display commitment, stronger supervision, and good project design and sequencing. In the evaluated portfolio, the success rate for countries with low control of corruption is about 67 percent, but it is 76 percent for those with high control of corruption. The contrast is more striking in low- and lower-middle-income countries—a 67 percent success rate where there is low control of corruption and an 85 percent success rate where control of corruption is high.

Five project factors not directly controlled by the Bank Group (though potentially influenced by it) are strongly associated with the success of SOE reform interventions:

- Client commitment to the reforms and reform activities. This underpinned success in multiple countries, including sustained power sector reforms motivated by government commitment to improving electricity supply and access.

- Coordination among donors and other stakeholders. This generally contributes to effectiveness, but it can be difficult to sustain. It can allow donors to work in complementary support of reform, leveraging one another’s resources and influence.

- Client institutional capacity and coordination. High institutional capacity often appeared as a factor of success, but weak coordination among client agencies hindered several reforms.

- Political economy. This can work for or against reforms, but vested interests often frustrate them. Political economy factors influencing projects included shifts in commitment arising from political considerations, opposition from vested interests, and a variety of political difficulties caused by electoral cycles and regime change.

- External shocks. Whether natural or human made, these can create opportunity by compelling action, but they can also disrupt reform progress.

Four other project-level factors that the Bank Group controls directly are strongly associated with successful SOE reform interventions:

- Project design, including appropriate choice of instrument, adaptation to local conditions, and simplicity (versus complexity).

- Supervision, including having in-country expertise during project implementation (especially for investment projects).

- A strong results framework with active monitoring and evaluation.

- Sequencing and complementarity of interventions, including the link of activities to prior analytic work and internal collaboration.

The evaluation found that collaboration among Bank Group institutions, though relatively rare, can provide complementary support that aids SOE reform success through both diagnostics and operations. Sequential analytical and operational engagements built institutional and physical capacity, and the trust of underlying relationships carried reform momentum through difficult periods. Engagements that were more comprehensive involved both sequencing and complementarity of multiple interventions. For example, the CPSDs produced jointly by IFC and the World Bank consistently address SOE reform and feed into Systematic Country Diagnostics and Country Partnership Frameworks. Institutional collaboration to mobilize private financing is a key expectation raised in the MFD agenda and the Cascade approach, but neither approach spells out its implications (nor do sector strategies) regarding how Bank Group institutions can work together to support SOE reform. Although rare, experiences in several countries show the operational promise of applying a Cascade approach in power generation. However, collaboration requires a balancing of benefits and costs. Recent IEG work suggests that such collaboration works best when the roles, division of labor, and responsibilities among the different Bank Group institutions and respective project teams are clear (World Bank, 2017f).

Recommendations to Address Outstanding Challenges in SOE Reform

The Bank Group can build on successful features of SOE reform in the financial and energy sectors by enhancing selectivity and mitigation of risk factors and by applying the MFD and its embedded Cascade approach to SOE reform.

Enhancing selectivity by addressing corruption and competition. The evaluative evidence indicates that better SOE reform outcomes occur in the context of better control of corruption at the country level and competitive conditions at the sector and enterprise level. Both can be incorporated into approaches to selectivity and mitigation of risks when planning for SOE reforms.

Although the Bank Group SOE reform portfolio is concentrated in countries with stronger control of corruption, where reform is more likely to succeed, a substantial minority (26 percent) of interventions are in countries with weak control of corruption, where all types of SOE reform support are less likely to succeed. Regarding competitive conditions, the Bank Group recognizes the importance of competition and competitive neutrality principles, but it has not addressed these issues systematically enough and at scale through diagnostic or project work.

Recommendation 1: The World Bank Group should apply a selectivity framework for SOE reform support that considers country governance conditions, control of corruption, and sector and enterprise-level competition. First, the Bank Group should adopt a more selective approach toward SOE engagement in countries with weak control of corruption, giving full attention to internal and external factors of success. Findings suggest that the Bank Group could ramp up engagement with clients where success is more likely. In conditions of weak control of corruption, one option would be to engage first in addressing overall governance quality before attempting SOE reform. Where disengagement on SOE reform is not possible or desirable, close attention is needed to the factors that may mitigate corruption’s negative influence on SOE reform success, including selectivity toward clients who display commitment, stronger supervision, good (and simple) project design, and sequencing of activities. Next, the Bank Group should gear up capacity to conduct competition analysis at both the sector and project levels. The importance of competitive neutrality, especially considering IFC and (to a far lesser extent) MIGA policy requirements, indicates a need to ramp up project-level analysis by carrying out competition assessment systematically and by applying substantial up-front analytic capability to project-specific work on competitive neutrality. This would allow for greater selectivity toward competitive conditions that enhance SOE performance and for establishing up-front mitigating measures if competitive conditions were not conducive to success.

Improving Internal Coordination and Support Options by Applying MFD to SOE Reform

This evaluation generally finds positive experiences when the Bank Group collaborates internally on SOE reform. Institutional collaboration to mobilize private financing and capabilities is a key expectation of the MFD agenda and the Cascade approach. However, at the corporate level, there is room to spell out the implications of MFD and the Cascade approach for SOE reform and to ensure that the new Integrated SOE Framework diagnostic treats privatization and PPPs as part of a comprehensive Bank Group approach.

Recommendation 2: The World Bank Group should apply the MFD and its embedded Cascade approach for SOE reform. This would enhance internal coordination and mobilize private financing and capacity, especially for ownership reforms. First, the Bank Group should further develop and harmonize its diagnostic frameworks applied to SOE reform. This requires developing shared framing tools such as an Integrated SOE Framework and CPSD modules treating private sector options, including privatization and PPPs, for addressing SOE performance challenges. Second, the Bank Group could apply the Cascade approach in offering clients options for SOE reform that mobilize private financing and capacity through privatization and ownership reform. Along with recommendation 1, given appropriate country and sector conditions, there is greater room to apply the Cascade approach through a greater degree of and more routine World Bank, IFC, and MIGA coordination that builds on their respective comparative advantages. This can be piloted as a sequential process, with upstream interventions focusing on any needed policy and regulatory reforms to create a level playing field for private entry and investment, combined with downstream use of Bank Group instruments to catalyze and mobilize private financing. With careful monitoring and evaluation, such a pilot could inform future efforts to realize the Cascade more fully as a systematic approach to SOE reform.