World Bank Support for Public Financial and Debt Management in IDA-Eligible Countries

Chapter 4 | Building Public Investment Management Capacity to Improve Quality and Impact

This chapter analyzes World Bank support to IDA-eligible countries to improve PIM. Most of the World Bank’s support was in the form of ASA activities or through budget support operations. Despite the importance of longer-term capacity building to PIM, there was very little support through investment lending. This chapter also discusses links between the quality of PIM and debt sustainability, and details World Bank support to IDA-eligible countries over the evaluation period and to IDA-eligible countries now facing increasing debt distress.

World Bank Support of Public Investment Management

Relatively few IDA-eligible countries that are currently at risk of or in debt distress had PIM-related prior actions in their PFDM-related DPOs. The World Bank supported PIM through 59 prior actions in 44 DPOs in 24 IDA-eligible countries. Relative to the number of countries with PFDM-related DPOs, a disproportionate share of PIM-related prior actions was concentrated in East Asia and Pacific and in Europe and Central Asia; relatively few were in IDA-eligible countries that are currently at risk of or in debt distress. Just under half of the PIM prior actions were for DPOs in HIPCs (47.5 percent). Of the 30 IDA-eligible countries either at high risk of or in debt distress at the 2017 year-end, only 7 had DPO support with PIM-related prior actions during the evaluation period: Afghanistan, Cabo Verde, Ghana, Haiti, the Lao People’s Democratic Republic, and Mauritania (at high risk of debt distress), and Mozambique (in distress).

Prior actions in the 44 DPOs tended to support the establishment of PIM systems or the passage of enabling or supporting laws or oversight bodies. Several prior actions supported rationalization of, and improvements in, public investment programs or processes and their relationship to budget laws. This was the case for operations in Angola, the Comoros, Georgia, Kosovo, Mongolia, and Lagos State (Nigeria). Other prior actions sought to ensure the adoption of a methodology and a legal framework to appraise, select, and approve projects above a defined monetary value; this was the case for Ghana, Mozambique, Sierra Leone, and Vietnam. In some cases, the prior action was related to the establishment of a directorate of public investment (Haiti) or the establishment of a selection committee for public investment projects (Mali).

IEG evaluations of many of these policy operations concluded that, although the operations were necessary steps to improving PIM, they were not sufficient. Also needed to achieve meaningful results was investment support for the establishment of PIM offices and development of their institutional capacity; linking of public investment programs with investment budgets and project selection; ex ante and ex post evaluation tools and methodologies; and project management and monitoring manuals. Sequencing of actions was also important to the success of PIM support. As an illustrative example, box 4.1 summarizes findings from DPO support for PIM in Georgia and highlights the importance of establishing a long-term vision to ensure sustained PIM reforms.

Box 4.1. Example of World Bank PIM Support: Georgia’s Development Policy Operations I, II, and III

Georgia’s development policy operation programmatic series established a long-term vision for public investment management reforms that informed seven prior actions over three operations covering 2009 to 2012:

- In the first operation (2009), the three prior actions related to the preparation of a multiyear public investment program: (i) revising the budget circular to include proposals on nonfinancial assets, (ii) introducing a training program on capital budgeting in budget departments to strengthen project management, and (iii) piloting the preparation of the public investment program summary for spending units based on the 2009 budget.

- In the second operation (2010), the three prior actions related to the development of a public investment program, including issuing guidelines for project evaluation, submission, and selection, and publishing the public investment program as an annex to the budget law.

- In the third operation (2011), the one prior action required submission to parliament of a public investment program including time profiles of projects, summary justifications, and physical monitoring indicators covering most projects and including public reporting on actual versus planned implementation for 2010.

Although several weaknesses in the programmatic series were noted, the multiyear public investment program reform moved the public investment management agenda forward in Georgia. Additionally, reforms have been further deepened by subsequent World Bank development policy operations and advisory services and analytics activities.

The Implementation Completion and Results Report Review rated the series outcome as satisfactory. Georgia’s public investment program witnessed increased transparency, as reflected in the inclusion of an information annex to the budget, with a complete time profile of project financial information, summary project justifications, and physical monitoring indicators. However, overall progress in the sector was incomplete because accountability achievements were limited to only two ministries that reported on actual versus planned project implementation in 2011.

It should be noted that future development policy operations and capacity-building activities have continued this agenda.

Source: World Bank 2016c, 2018e.

Note: PIM = public investment management.

Very little of the World Bank’s PIM support to IDA-eligible countries was delivered through investment projects. In fact, investment lending to support improvements in PIM was limited to two projects. This is somewhat surprising given the conventional wisdom that PIM requires capacity building at an institutional level, which takes time to establish. The first project was Azerbaijan’s Public Investment Capacity Building Project, which was aimed at improving the quality and efficiency of preparation and implementation of investment projects in priority sectors, especially infrastructure. The project outcome received a moderately satisfactory rating from IEG, owing in large part to having successfully ensured that large investment projects in key sectors were first subject to economic appraisals; however, the average time for project implementation was not reduced as expected (World Bank 2017a). The Public Investment Management and Governance Support Project in Benin (an HIPC currently at moderate risk of debt distress) aimed to improve efficiency in PIM and enhance the performance of selected institutions of accountability through support to the legal framework; linking of planning and budgeting (annual and multiyear); and ex ante and ex post project selection, appraisal, and project management. The project is on track (project closure is projected for December 2021) to achieve its expected results of increasing the investment budget execution rate, reducing cost and time overruns, and reducing the backlog of administrative cases within the country’s PIM system (World Bank 2020a).

Public Investment Management Diagnostics

Given the importance of PIM to enhancing the effectiveness of public investment, the World Bank developed a PIM diagnostic tool in 2008 that is available to client countries on request. The tool assessed the effectiveness of processes and systems for selecting and implementing public investment projects (including in infrastructure), identifying eight “must-haves” for effective country systems (box 4.2). As a follow-up to the diagnostic engagement, and if requested by client countries, the World Bank would then initiate technical assistance with a focus on supporting improvements in PIM systems.1 Demand from client countries for this upstream diagnostic work, and for the support of operations, was high: World Bank PIM diagnostics have been undertaken by 67 countries to date, 35 of which were IDA eligible. However, IDA demand was concentrated among higher-income countries; of those 35 IDA-eligible countries, 12 were at high risk of external debt distress or in debt distress in 2013, a number that had fallen to 10 by 2018.

A more standardized PIM assessment was developed by the IMF in 2015 (IMF 2018). The IMF noted that improvement of the institutions for planning, allocating, and implementing public investments was needed to enhance the efficiency of public investment among low-income countries, as their efficiency was estimated to be 40 percent below levels in advanced economies. Fifteen institutional features were identified for the assessment tool, PIM Assessment (PIMA), and these features corresponded to the planning, allocation, and implementation of a PIM system (table 4.1; IMF 2015).

Table 4.1 Comparison of IMF and World Bank PIM Assessments

|

IMF PIMA (2015) |

World Bank Framework (2008) |

|

Planning sustainable levels of public investment |

Eight PIM “must haves” |

|

1. Fiscal principles or rules |

1. Investment guidance, project development, and preliminary screening |

|

2. National and sectoral planning |

2. Formal project appraisal |

|

3. Central-local coordination |

3. Independent review of appraisal |

|

4. Public-private partnerships |

4. Project selection and budgeting |

|

5. Regulation of infrastructure companies |

5. Project implementation |

|

Ensuring public investment is allocated to the right sectors and projects |

6. Project adjustment |

|

6. Multiyear budgeting |

7. Facility operation |

|

7. Budget comprehensiveness |

8. Basic completion review and evaluation |

|

8. Budget unity |

|

|

9. Project appraisal |

|

|

10. Project selection |

|

|

Implementing projects on time and on budget |

|

|

11. Protection of investment |

|

|

12. Availability of funding |

|

|

13. Transparency of budget execution |

|

|

14. Management of project implementation |

|

|

15. Monitoring of public assets |

Source: Independent Evaluation Group; International Monetary Fund 2018.

Note: IMF = International Monetary Fund; PIM = public investment management; PIMA = PIM Assessment.

The World Bank is now supporting the IMF in jointly delivering PIMA to client countries. Knowledge gained from comparative assessments performed using PIMA and lessons learned from the implementation of the PIM reform agenda are captured in the recently published Public Investment Management Reference Guide, which serves as a reference for PIM practitioners at the country level (Kim, Fallov, and Groom 2020). A desk review of five joint World Bank–IMF PIM assessments conducted by IEG for this evaluation synthesized findings and lessons (box 4.2).

Box 4.2. Synthesis of Recommendations from World Bank–IMF PIM Engagements (FY08–17)

The Independent Evaluation Group reviewed a sample of World Bank and joint World Bank–IMF PIM reports. Findings and recommendations for International Development Association–eligible countries include the need for:

Legislative Actions

- Establish and implement a unified legislative and regulation framework that includes all stages of the public investment management cycle.

Institutional Actions

- Set up and render functional a dedicated directorate in charge of public investment, including the selection and ex ante evaluation processes of public investment projects.

- Clarify the roles, responsibilities, and interactions of actors in charge of public investment planning and budgeting.

Processes and Procedures

- Prepare, implement, and publish a multiannual public investment program plan.

- Implement processes for the selection, review, and implementation of public investment projects supported by public-private partnerships.

- Professionalize the management and supervision of the project portfolio to monitor, drive, and facilitate subsequent programming.

- Strengthen the efficiency of the implementation and ex post evaluation management of major public investment projects and make the monitoring of public assets more reliable.

Project Management

- Define and adopt, on the basis of an inventory of needs, a capacity-building plan for all stakeholders to enable them to obtain the necessary skills to manage public investment.

- Design and implement an information technology strategy to map and interface with existing and future investment project management applications, provide stakeholders with high-performance applications, and empower users.

Source: Independent Evaluation Group.

Note: FY = fiscal year; IMF = International Monetary Fund; PIM = public investment management.

The World Bank undertook 53 PIM-related ASA activities (including both diagnostic and nondiagnostic work) in IDA-eligible countries; just over a third of the activities were in HIPCs. However, there is currently no systematic and comprehensive tracking of World Bank nonlending support to PIM. This is partly the result of limitations arising from incomplete and inconsistent coding of ASA activities using the World Bank theme taxonomy. This, and other limitations of the World Bank’s knowledge management, makes a more definitive assessment of PIM work difficult. For instance, when IEG cross-checked the 53 coded PIM ASA activities with data from World Bank PIM practitioners in the Governance Global Practice, it found 20 PIM assessments that were not properly coded in accordance with the World Bank’s theme taxonomy.

Few IDA-eligible countries that have been or are now at high levels of debt distress received analytical support to improve PIM. The accurately coded PIM ASA activities (both diagnostic and nondiagnostic analyses) show that the World Bank supported (i) 8 HIPCs with 12 PIM ASA activities;2 (ii) 9 of the 35 IDA-eligible countries that were fragile and conflict affected at some point during the evaluation period with one PIM ASA activity each; and (iii) 5 of the 30 IDA-eligible countries at high risk of external debt distress or in distress at the end of the evaluation period—Burundi, Ghana, Haiti, and Tajikistan (high risk), and Mozambique (in distress)—with 8 PIM ASA activities.3 What these (albeit incomplete) data suggest is that IDA-eligible countries that have been or are now at high levels of debt distress do not appear to have received a proportionate share of analytical support to improve PIM.

PIM support often drew on complementarity between lending and nonlending activities. IEG evaluation of specific operations shows that diagnostic ASA activities have often been important in shaping PIM-related prior actions in DPOs. For example, Vietnam’s Public Investment Reform 1 and 2, a programmatic DPO series that focused on PIM reforms, drew on recommendations developed from rigorous analytical work (World Bank 2013a, 2016a). Such work included Vietnam Development Report: Capital Matters, a published ASA activity focused on the challenge of improving national investment efficiency in the context of the global financial crisis (World Bank 2009), as well as a PEFA assessment, poverty and social impact analyses, and an earlier public expenditure review.4 Many of the analytical recommendations to improve PIM in Vietnam featured prominently in the country’s public investment reform DPOs (and in Poverty Reduction Support Credit 7 and 8).5

Public Investment Management and Debt Sustainability

Rigorous PIM is critical for sound PFDM, given the amount of resources borrowed each year by governments to finance public investment. Because of the scarcity of public resources for development in IDA-eligible countries, weak PIM can have a large cost in foregone growth, development, debt sustainability, and poverty reduction. Improving PIM helps countries select projects with sufficient economic and development potential at the lowest cost. It plays an important role in reducing waste and corruption, which is important given the high cost of many capital investments, particularly in infrastructure (Flyvbjerg, Skamris Holm, and Buhl 2002; World Bank 2011). To this end, there are significant benefits to introducing greater transparency and rigor into the identification and implementation of debt-financed public investment.

There is an important link between the quality of PIM and debt sustainability. Weak PIM can increase the amount of debt incurred to pay for projects while reducing the impact projects have on growth, thereby increasing the ratio of debt to GDP. In the early to mid-2000s, as the HIPC Initiative was under implementation and fiscal space was being opened up for many low-income countries, World Bank client countries were increasingly undertaking growth-enabling public investment, including in infrastructure. World Bank analyses recognized that investments that promote growth might also enhance domestic resource mobilization, supporting increases in “pro-poor” spending.6 However, this effect required efficient and carefully selected public investment to ensure the investments achieved economic benefits that would justify their (often significant) costs. This required a well-functioning system for PIM, without which the case for growth-enhancing public investment is undermined. It is therefore of concern that public investment in low-income countries is estimated to be, on average, 40 percent less efficient than in the best-performing countries (IMF 2015).

A country’s ability to service borrowing for public investment depends, in part, on the extent to which those investments support longer-term economic growth. Debt sustainability is a function of the difference between the real interest rate and growth in output. It is therefore important that countries get value for money for their debt-financed investments. Good PIM can help with the selection of investments with adequate return. When less economically beneficial projects are selected, and higher-than-necessary costs are incurred (through either corruption or inefficient implementation), a country’s debt burden can increase rapidly and unsustainably.

An increasing number of IDA-eligible countries are currently in, or are at high risk of, debt distress. For many of these countries—a number of which had previously received significant bilateral and multilateral debt relief—a key contributor may have been debt-financed public investments that failed to generate expected or promised growth. Partly because of this result, the World Bank and its partners are now paying increasing attention to the reemergence of high indebtedness among client countries, including in the context of the most recent IDA Replenishment, the joint IMF–World Bank MPA (Multipronged Approach to Address Emerging Debt Vulnerabilities), and the new Sustainable Development Finance Policy, the first pillar of which seeks to promote more transparent and sustainable borrowing and investment practices in IDA countries, particularly the most heavily debt-stressed ones (IDA 2020c).7

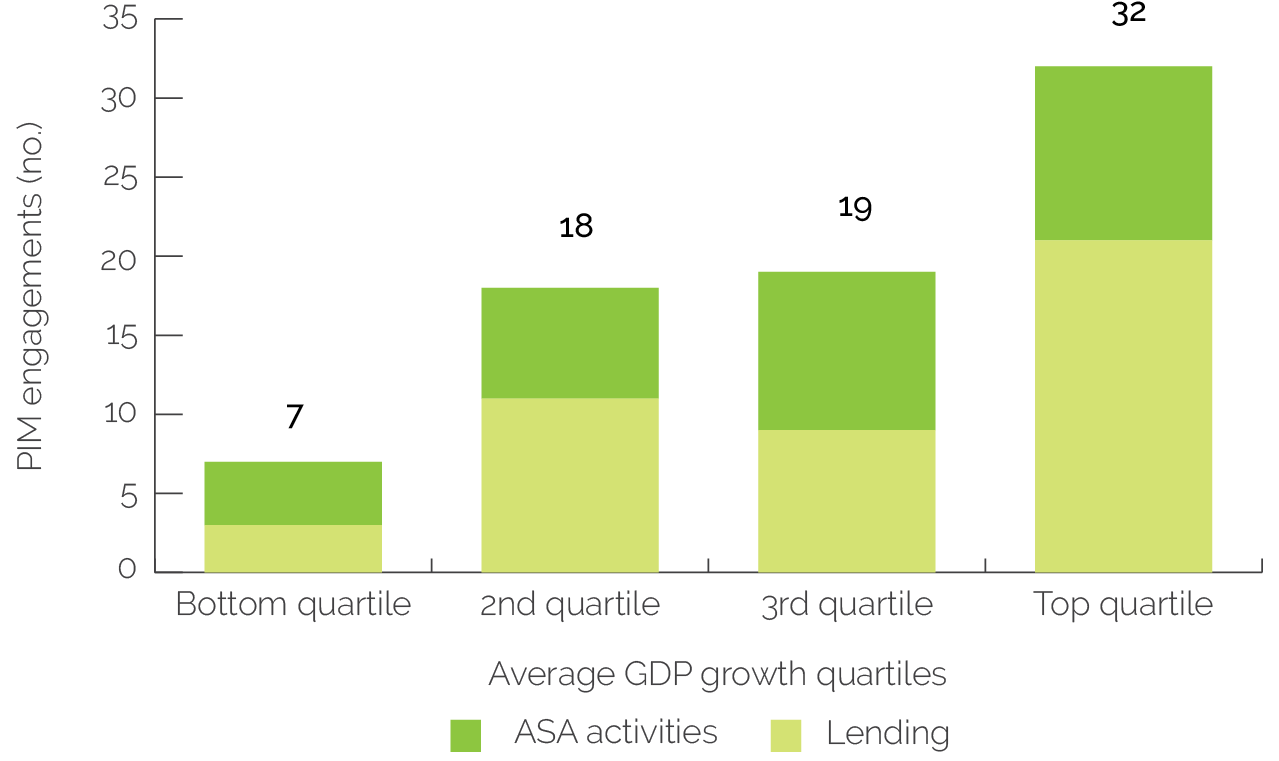

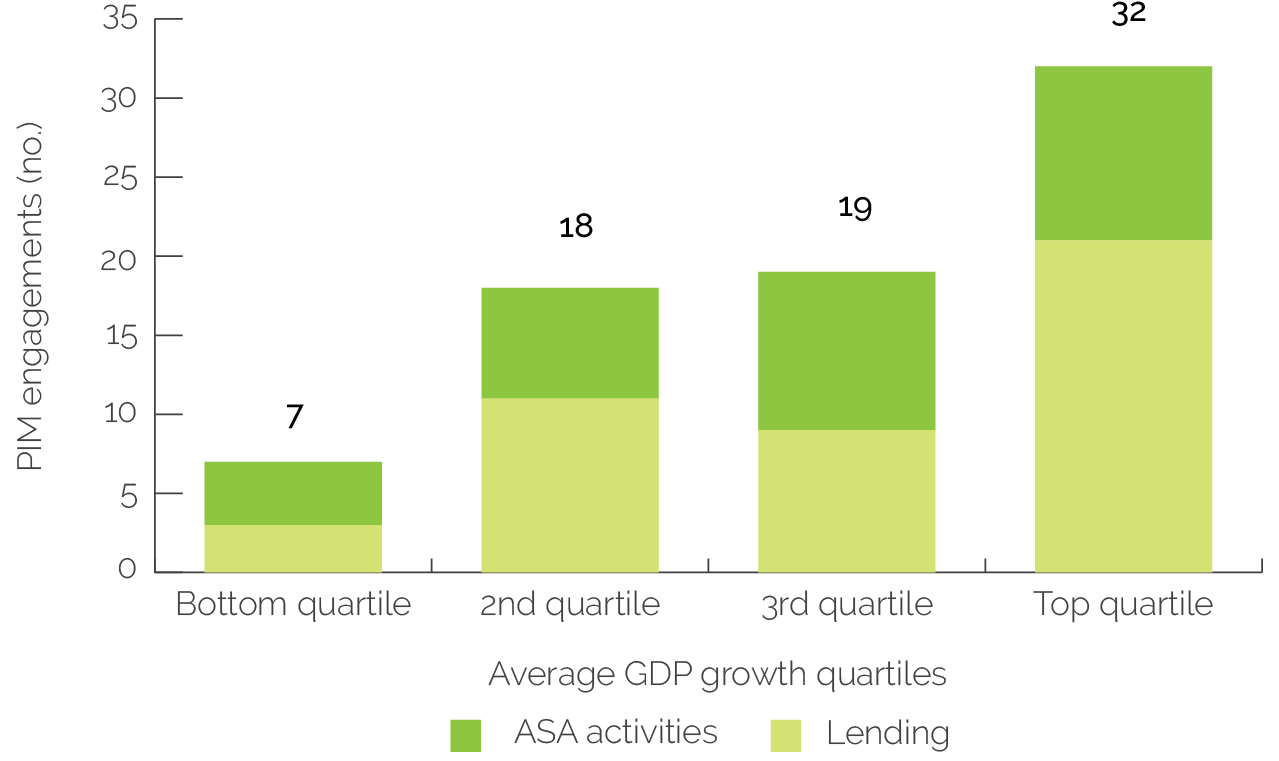

At the same time, available data suggest that lending from the World Bank to IDA-eligible countries to improve PIM was modest, was not focused on longer-term capacity building, and did not reach many “at-risk” countries. As indicated above, the World Bank supported 46 lending operations with a PIM focus during the evaluation in IDA-eligible countries, almost equally divided between those that were HIPC at one time and those that were not. This includes 44 DPOs (30 of which were part of eight programmatic series) with 59 prior actions related to PIM.8 Of the 32 IDA-eligible countries that were at high risk of debt distress or in debt distress as of FY18, only 10 had received PIM support over the previous decade: Afghanistan, Burundi, Cabo Verde, Ghana, Haiti, Lao People’s Democratic Republic, Mauritania, Mozambique, Sudan, and Tajikistan. This support consisted of 8 ASA activities (of which 2 were PIM diagnostics) and 10 DPOs, compared with 36 ASA activities for the 37 IDA-eligible countries that were in low or moderate risk of debt distress, and 25 for the 16 countries that were not rated.9 In effect, countries that ended the decade at high levels of debt distress were less likely to have benefited from World Bank support for PIM (figure 4.1) than those that did not end the decade at high levels of debt distress. Moreover, and although not establishing causality, faster-growing countries were more likely to have received PIM support from the World Bank (figure 4.2).

Definitive causality is difficult to assert between the quality of PIM and the economic growth needed for countries to avoid debt distress. Would PIM support—had it been received—have had a positive impact on countries in or now approaching debt distress? Or was the lack of demand for PIM support from the World Bank indicative of other factors that contributed to rising debt distress? Country-specific counterfactuals are beyond the reach of this evaluation, and data are relatively scarce on the efficacy of World Bank–provided PIM support in enhancing growth and reducing the costs of public investment. IEG ratings are of limited use in answering this question as the small sample of investment project financing for PIM and the methodology used to assess the impact of DPOs (that is, assigning the same outcome rating to all prior actions, including those unrelated to PIM) make it challenging to interpolate. Moreover, given methodological limitations, the World Bank does not undertake systematic evaluation of the impact of its ASA activities. Nevertheless, theory would suggest that there may be a relationship between poor PIM practices and rising debt distress.10

Figure 4.1. Public Investment Management Engagements by Level of Debt

Source: Independent Evaluation Group; International Development Association 2019.

Note: Within the evaluation universe, 9 countries were in debt distress, 23 were at high risk of debt distress, 25 were at moderate risk, 12 were at low risk, and 16 were not rated (because they were either inactive or no longer low income). ASA = advisory services and analytics; DPF = development policy financing; PIM = public investment management.

Figure 4.2. World Bank Support to PIM by Average GDP Growth Quartile (2008–18)

Source: Independent Evaluation Group; World Development Indicators database (accessed May 28, 2020).

Note: ASA = advisory services and analytics; GDP = gross domestic product; PIM = public investment management.

- Knowledge gained from the application of this methodology was synthesized in Rajaram et al. (2010).

- Benin, Burundi, the Comoros, Ghana, Haiti, Liberia, Sierra Leone, and Uganda (out of 39 in the evaluation universe).

- See International Development Association (IDA 2018). The International Monetary Fund conducted 63 assessments overall using the Public Investment Management Assessment tool (37 for IDA-eligible countries), 4 of which were in countries at a high risk of external debt distress or in distress at the end of the evaluation period: Cameroon, Ghana, Mozambique, and Zambia. The Gambia, Kiribati, Maldives, and Mauritania were assessed using the Public Investment Management Assessment in 2018 or 2019, after the evaluation period.

- Recommendations were also influenced by Rajaram et al. (2010). This study was the starting point for the design of the public investment development policy operation series’ results framework. The design of public investment management–specific development policy operations was informed by the 2009 Vietnam Development Report (World Bank 2009).

- Objectives included improved commitment control over capital expenditures, the establishment of clear criteria for project selection and monitoring, market price–based estimation of investment costs, strengthened state-owned enterprises, better financial management of public investments, and a law to reject late procurement bids on public investment projects.

- See World Bank (2006, 2007). These publications articulated a growth-oriented approach to fiscal policy, incorporating revenue, aid, borrowing, and expenditure to identify, among other things, “fiscal space” and required public finance reforms. The approach stressed the importance of improved expenditure efficiency to create fiscal space for new policy priorities, such as public investment.

- The Sustainable Development Finance Policy builds on IDA’s Non-Concessional Borrowing Policy, approved in 2006, to further strengthen the focus on debt sustainability and debt transparency.

- Either coded public assets and investment management (435) or some combination of public investment or public investment management in the text of the prior action (compared with the 602 public financial management prior actions during the evaluation period).

- Only low-income countries are assessed by the debt sustainability analysis. The evaluation universe includes countries that were IDA-eligible for at least two years during the evaluation period; 14 countries are no longer low income. Additionally, Fiji recently became low income, so does not yet have a debt sustainability analysis assessment, and the Syrian Arab Republic has not been assessed for debt sustainability since its lending category became inactive.

- World Bank and IMF (2017) notes the complementarities between public investment management and public debt management. It explains that public investment management focuses on the need to ensure that all costs—including debt service costs—associated with investment projects are published.