World Bank Support for Public Financial and Debt Management in IDA-Eligible Countries

Chapter 2 | The Public Financial and Debt Management Portfolio

This chapter describes the PFDM portfolio of lending and nonlending activities for IDA-eligible countries during the evaluation period. Much World Bank PFDM support was provided to IDA-eligible countries after, or in parallel with, the HIPC Initiative and the MDRI. Given the need to ensure that resources freed up from debt service were channeled to productive social sector spending and to avoid the reaccumulation of large debt burdens, the World Bank and its development partners provided extensive support to debt relief beneficiaries to improve PEM and debt management capacity, with much of the latter provided through the multidonor DMF. Appendix C describes the portfolio selection process for this evaluation and contains a more thorough analysis of the PFDM portfolio.

Investment Lending

Investment lending formed a significant part of the World Bank’s support for PFDM in IDA-eligible countries (figure 2.1). Between FY08 and FY17, the World Bank supported IDA-eligible clients in building their PFDM capacity through 126 investment loans valued at $6.8 billion.1 This included both investment project financing and Program-for-Results lending that supported 55 countries in total (table 2.1). Most of these countries were World Bank clients in Africa and South Asia. PFDM support through investment lending was not assessed because of data limitations.

Figure 2.1. PFDM Investment Lending in IDA-Eligible Countries (FY08–17)

Source: Independent Evaluation Group, World Bank Business Intelligence.

Note: IDA = International Development Association; IPF = investment project financing; PFDM = public financial and debt management; PforR = Program-for-Results.

Table 2.1. PFDM Interventions in IDA-Eligible Countries (FY08–17)

|

Public Finance Theme |

Investment Loans for PFDMa (no.) |

Lending for PFDM ($, billions) |

DPOs with at Least One PFDM-Related Prior Action |

|

|

(no.)b |

($, billions)c |

|||

|

PFM |

117 |

6.6 |

254 |

18.3 |

|

PDM |

11 |

0.5 |

82 |

7.2 |

|

Totald |

126 |

6.8 |

260 |

19.4 |

Source: Independent Evaluation Group; World Bank Business Intelligence.

Note: DPO = development policy operation; FY = fiscal year; IDA = International Development Association; PDM = public debt management; PFDM = public financial and debt management; PFM = public financial management.a. Investment loans include Programs-for-Results.b. Loans in a programmatic DPO series are each treated as an individual project.c. The lending amount of DPOs with at least one public finance prior action is the total amount of the DPO. d. As projects are coded with more than one theme, the total number of lending commitments is greater than the total number of PFDM commitments.

Program-for-Results financing made up a relatively small portion of the PFDM portfolio. Reasons for the limited use of Program-for-Results include the following: (i) the instrument was only introduced in 2012, halfway through the evaluation period; (ii) the program began with a cap of 5 percent of aggregate IBRD and IDA commitments to test the new instrument; and (iii) the Program-for-Results instrument requires stringent fiduciary controls that some IDA clients have difficultly achieving. Of the eight PFDM-related Programs-for-Results during the evaluation period, only three have closed; all three have received satisfactory outcome ratings by IEG, but it is premature to draw conclusions until more cases can be analyzed.2

Development Policy Lending

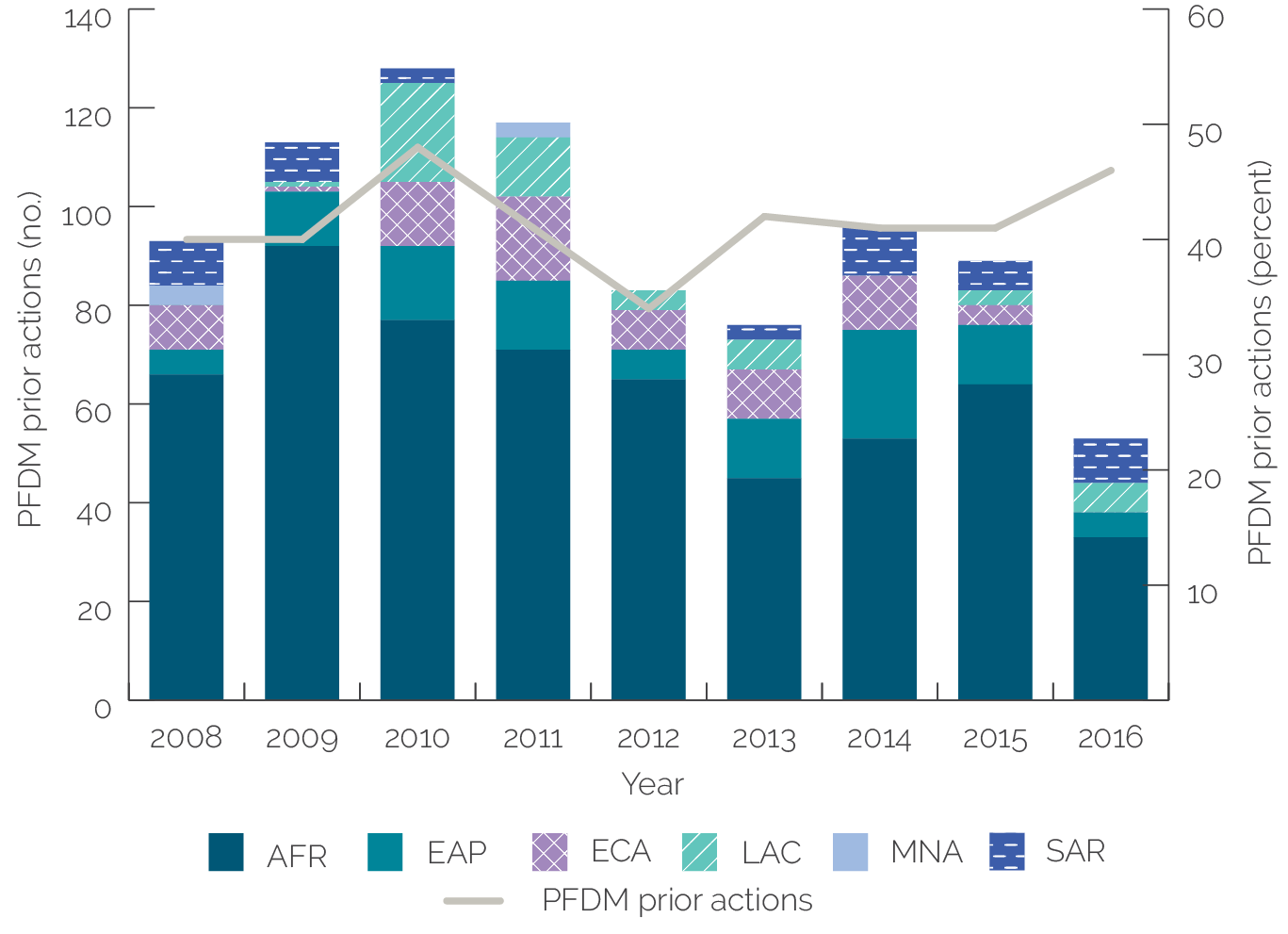

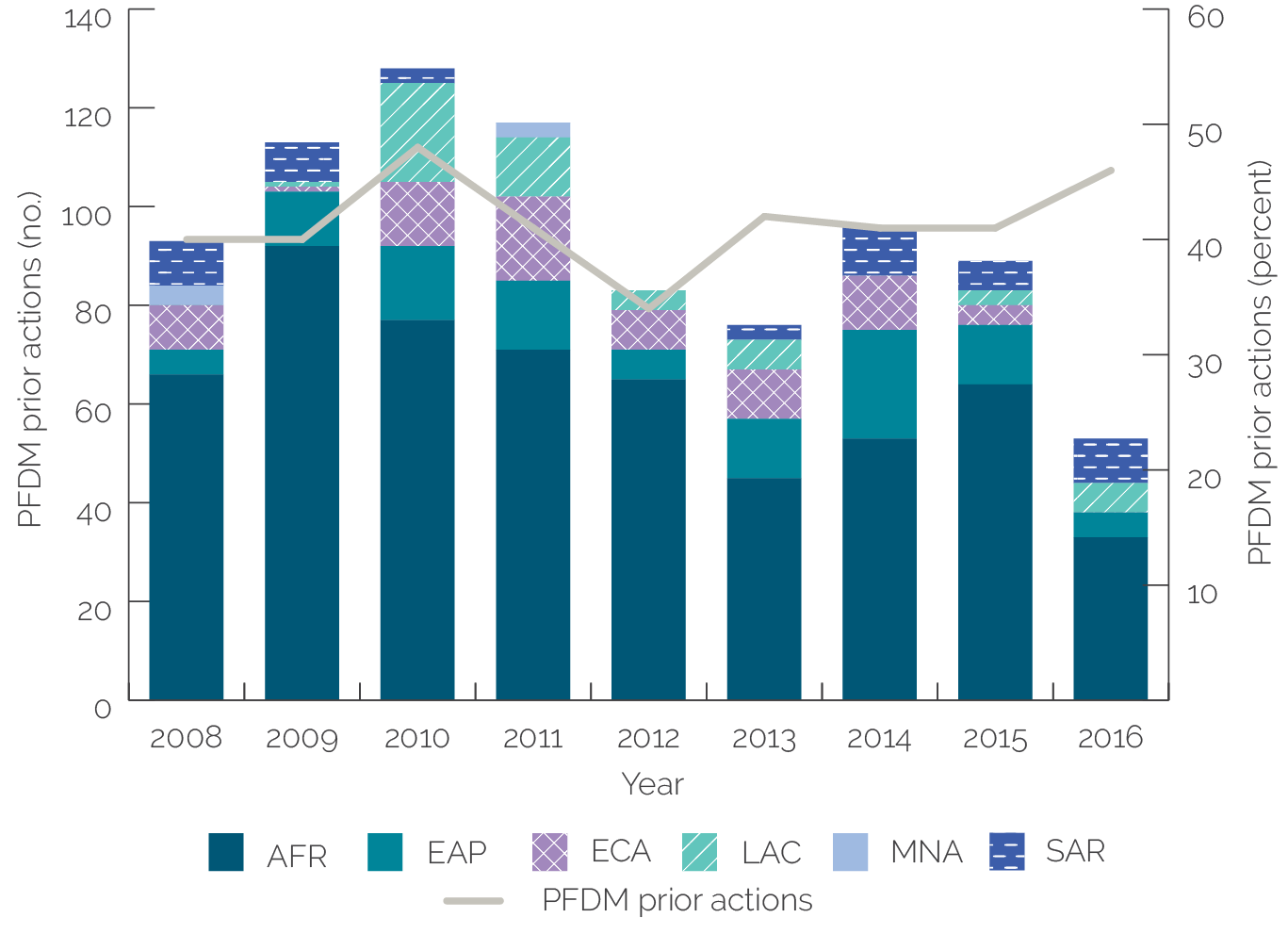

Over the evaluation period, there were 714 PFDM-related prior actions in 260 DPOs in 57 IDA-eligible client countries, totaling $19.4 billion. Operations in higher-income IDA-eligible countries were more likely to have PFDM prior actions, and operations in the Africa Region had more on average (figure 2.2).3 Of the DPOs rated by IEG, 32 percent had outcomes rated satisfactory and 41 percent had outcomes rated moderately satisfactory.

Figure 2.2. PFDM Prior Actions and Their Share of DPO Prior Actions for IDA-Eligible Countries

Source: Independent Evaluation Group, Operations Policy and Country Services

Note: AFR = Africa; DPO = development policy operation; EAP = East Asia and Pacific; ECA = Europe and Central Asia; IDA = International Development Association; LAC = Latin America and the Caribbean; MNA = Middle East and North Africa; PFDM = public financial and debt management; SAR = South Asia.

Nonlending Activities

Nonlending PFDM support included 598 ASA activities in 76 countries.4 Annual ASA delivery for PFDM increased from 50 activities on average over FY08–12 to 84 over FY13–17 (table 2.2). Diagnostic reports—largely DeMPAs and PEFA assessments—made up a fifth of PFM ASA activities and 15 percent of PDM ASA activities. Also included in the portfolio were 14 Medium-Term Debt Management Strategy (MTDS) reports and 89 nonsectoral public expenditure reviews. South Asia had the highest number of PFM ASA activities delivered (8.9) on average per country, followed by Europe and Central Asia with 4.8. The number of ASA activities delivered declined sharply in FY12 before rebounding in FY14 (table 2.3), with substantial increases for Africa and for East Asia and Pacific.

Table 2.2. Nonlending Support for PFDM in IDA-Eligible Countries (FY08–17)

|

Theme Code |

ASA Activities (no.) |

Share of PFDM ASA Activities (%) |

|

PFM |

345 |

58 |

|

PDM |

253 |

42 |

|

Other public finance theme code |

121 |

— |

|

Total, PFM and PDM |

598 |

100 |

Source: Independent Evaluation Group; World Bank Business Intelligence.

Note: ASA = advisory services and analytics; FY = fiscal year; IDA = International Development Association; PDM = public debt management; PFDM = public financial and debt management; PFM = public financial management.

Table 2.3. PFDM-Related ASA Activities by Region (FY08–17) (number)

|

FY of Delivery |

Region |

Total |

|||||

|

AFR |

EAP |

ECA |

LAC |

MNA |

SAR |

||

|

2008 |

29 |

5 |

9 |

2 |

1 |

16 |

62 |

|

2009 |

28 |

3 |

3 |

0 |

1 |

12 |

47 |

|

2010 |

28 |

9 |

3 |

6 |

2 |

8 |

56 |

|

2011 |

28 |

7 |

4 |

0 |

1 |

9 |

49 |

|

2012 |

9 |

1 |

4 |

0 |

0 |

6 |

20 |

|

2013 |

22 |

2 |

4 |

2 |

0 |

4 |

34 |

|

2014 |

41 |

6 |

15 |

2 |

1 |

17 |

82 |

|

2015 |

55 |

10 |

7 |

4 |

0 |

10 |

86 |

|

2016 |

42 |

15 |

7 |

3 |

0 |

12 |

79 |

|

2017 |

47 |

11 |

6 |

1 |

2 |

16 |

83 |

|

Total |

329 |

69 |

62 |

20 |

8 |

110 |

598 |

|

Average per country |

8.2 |

4.3 |

6.9 |

2.2 |

2.7 |

13.8 |

7.0 |

Source: DataMart, Independent Evaluation Group.

Note: ASA = advisory services and analytics; AFR = Africa; EAP = East Asia and Pacific; ECA = Europe and Central Asia; FY = fiscal year; LAC = Latin America and the Caribbean; MNA = Middle East and North Africa; PFDM = public financial and debt management; SAR = South Asia.

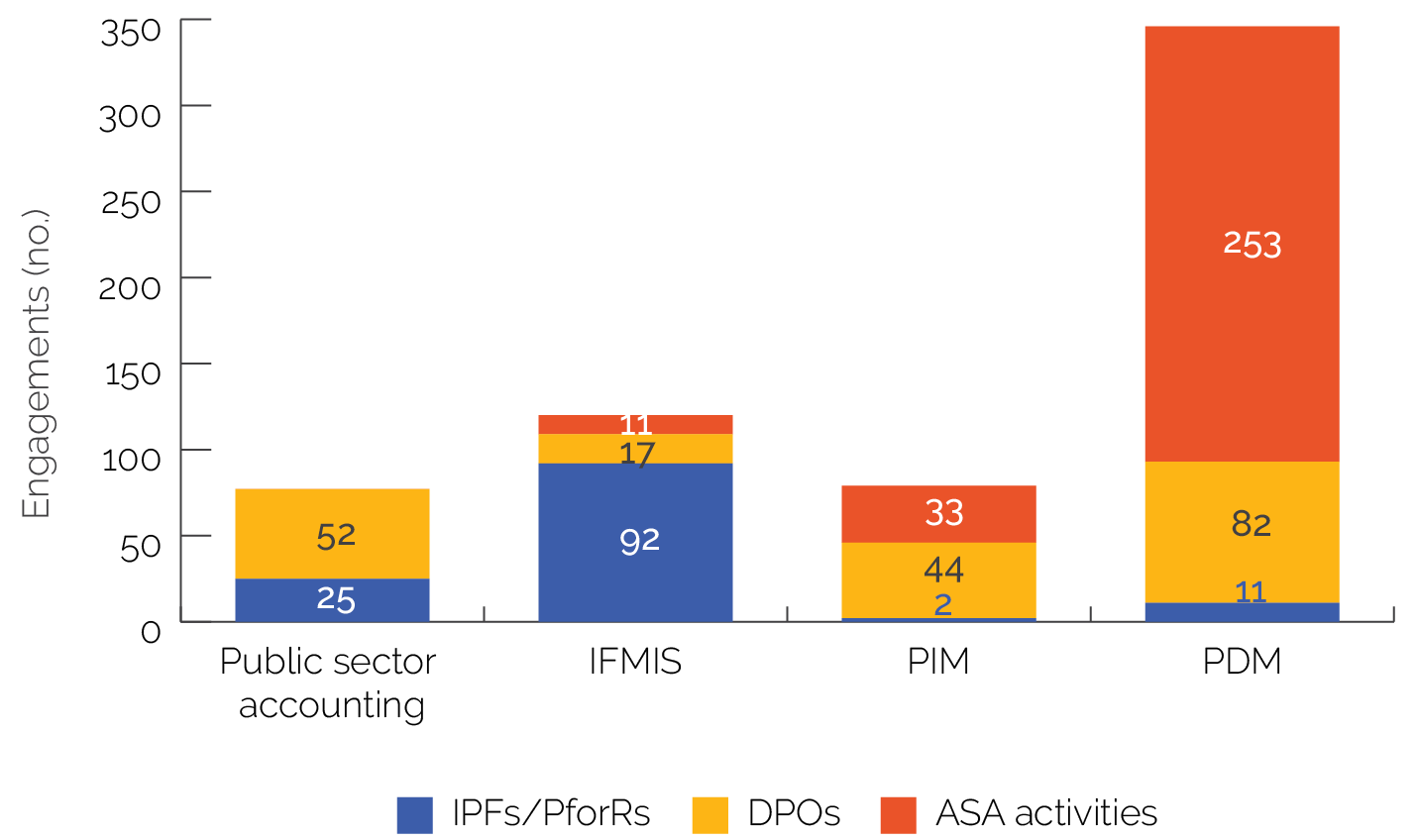

The next four chapters evaluate the World Bank’s support for four subthemes of PFDM in IDA-eligible countries: PEM (including budget preparation and execution, expenditure data management, and public sector accounting), PIM, IFMIS, and PDM. Figure 2.3 breaks down the portfolio by these subthemes.

Figure 2.3. Breakdown of World Bank PFDM Support to IDA-Eligible Countries by PFDM Subtheme

Source: Independent Evaluation Group.

Note: In public sector accounting, only one of three sub-subthemes for public expenditure management is displayed. The Independent Evaluation Group was unable to separately measure support for budget preparation and execution activities from the rest of the World Bank’s support for public financial management, as virtually all public finance management projects had at least one related activity in the subarea of budget preparation and execution. Data for BOOST are not available because most World Bank support for BOOST during the evaluation period was delivered through a global trust fund, as opposed to country-specific advisory services and analytics activities. ASA = advisory services and analytics; DPO = development policy operation; IDA = International Development Association; IFMIS = integrated financial management information system; IPF = investment project financing; PDM = public debt management; PFDM = public financial and debt management; PIM = public investment management; PforR = Program-for-Results.

- This does not capture the totality of public financial and debt management engagements as the evaluation does not include public financial and debt management support from the World Bank delivered by sectoral Global Practices, such as Health or Education. Although important, such interventions are significantly smaller in volume than those supported by the Governance and Macroeconomics, Trade, and Investment Global Practices.

- The two Programs-for-Results rated by Independent Evaluation Group can be found in World Bank (2020c, 2020d, 2020e).

- The denominator includes only those countries within the evaluation universe with development policy operations: 30 in Africa, 9 in East Asia and Pacific, 6 each in Europe and Central Asia and in South Asia, 5 in Latin America and the Caribbean, and 1 in Middle East and North Africa.

- For the purposes of this report, nonlending support and advisory services and analytics are used interchangeably.

- Although outside the scope of this evaluation, while establishing a clear relationship between strengthening PFM and achieving improved service delivery has proven elusive (see, for example, World Bank 2012a), there is growing momentum to rethink PFM support as a more “open” system that interacts fluidly with public policy and to better understand how PFM matters for service delivery (International Working Group 2020).

- Other exogenous shocks that affected the fiscal and debt outcomes of many International Development Association–eligible countries included the international oil and commodity price shock of 2014 and the Ebola outbreak in West Africa that same year.

- This does not capture the totality of public financial and debt management engagements as the evaluation does not include public financial and debt management support from the World Bank delivered by sectoral Global Practices, such as Health or Education. Although important, such interventions are significantly smaller in volume than those supported by the Governance and Macroeconomics, Trade, and Investment Global Practices.

- The two Programs-for-Results rated by Independent Evaluation Group can be found in World Bank (2020c, 2020d, 2020e).